Analysts’ Viewpoint on Market Scenario

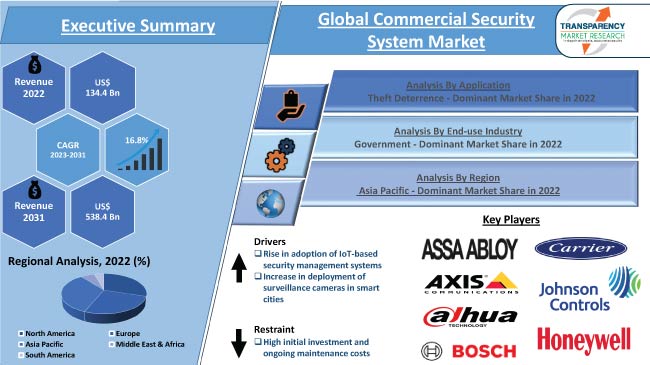

Rise in adoption of IoT-based security management systems is expected to propel the commercial security system market size in the near future. Increase in deployment of surveillance cameras in smart cities is also projected to augment market expansion during the forecast period. The need for security systems is growing significantly as crime rates are on the rise in many regions.

Businesses are focusing on protecting their assets, employees, and customers from theft, vandalism, and other criminal activities, which is likely to create lucrative opportunities for players in the global commercial security system industry. Vendors are adopting various growth strategies, such as collaborations with key players, mergers & acquisitions, product launches, and expansion of distribution network, to increase their commercial security system market share.

Commercial security systems are products and services designed to protect businesses, organizations, and commercial properties from various security threats. These systems include surveillance cameras, access control systems, intrusion detection systems, alarm systems, and security monitoring services. The specific components and features of a commercial surveillance system depend on the unique needs and requirements of the business or organization.

Many industries, such as government, BFSI, and military & defense, have to adhere to specific security regulations and compliance standards. This, in turn, leads to high demand for security systems that meet regulatory standards, thereby contributing to the commercial security system market growth.

Modern commercial intrusion detection systems offer remote monitoring capabilities that help security personnel or business owners receive alerts, access surveillance feeds, and control security systems remotely via computers or mobile devices. Rapid advancements in technology have made security systems more accessible, affordable, and effective. Innovations such as high-resolution surveillance cameras, cloud-based monitoring, and smart access control systems are driving the demand for upgraded security solutions.

IoT-based security systems leverage cloud-based storage and analytics platforms to store and process vast amounts of security-related data. This enables businesses to access and analyze data from multiple devices and locations, detect anomalies, and generate actionable insights for better security management.

According to Nasscom, in 2020, the IoT market in India reached US$ 9 Bn. IoT-enabled commercial security systems can integrate with other IoT devices and systems such as lighting control, HVAC systems, and alarm systems. This integration enables the automation of security actions based on predefined rules or triggers, enhancing overall security effectiveness and operational efficiency. Hence, increase in usage of IoT-based security management systems is propelling the commercial security system market revenue.

With IoT connectivity, commercial security systems can be remotely monitored and managed through web-based interfaces or mobile applications. This allows business owners or security personnel to access live video feeds, receive alerts, and control security settings from anywhere, improving flexibility and convenience.

Surveillance cameras play a crucial role in commercial security systems. Their integration with smart cities can further enhance overall security and public safety. Surveillance cameras provide real-time monitoring of commercial premises, streets, and public spaces within a smart city. By capturing video footage, these cameras help detect and respond to security incidents promptly. These advantages are boosting the deployment of surveillance cameras in smart cities, thereby augmenting the commercial security system market development.

Surveillance cameras can be used for traffic management in smart cities. By monitoring traffic flow, identifying congested areas, and detecting violations, cameras assist in optimizing traffic management strategies and enhancing public safety on roadways.

Key manufacturers in the market are launching advanced surveillance cameras to broaden their product portfolio. In March 2023, Irisity AB and Axis Communications collaborated to launch an advanced surveillance camera with AI-Powered Video Analytics. This advanced technology for proactive threat detection provides customers with a comprehensive and intelligent video security solution. Hence, development and launch of advanced products is contributing to the growth of the commercial security system industry.

According to the latest global commercial security system market trends, the theft deterrence application segment held 31.1% share in 2022. The segment is projected to maintain the status quo and advance at a CAGR of 17.6% during the forecast period. Commercial security systems are primarily employed to reduce theft in commercial locations. These systems employ various measures to deter theft and protect businesses from losses. These measures include surveillance cameras, access control, and alarm systems.

According to the latest global commercial security system market analysis, the government end-use industry segment accounted for 28.1% share in 2022. The segment is estimated to maintain the status quo and advance at a CAGR of 17.4% during the forecast period. Commercial security systems play an important role in supporting government initiatives and ensuring the security and safety of government facilities, operations, and personnel. Additionally, government agencies utilize commercial security systems to enhance public safety and support law enforcement efforts.

According to the latest global commercial security system market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. The region accounted for 33.1% share in 2022. Rapid urbanization and economic growth are major factors fueling market dynamics in Asia Pacific. Increase in number of smart cities and surge in adoption of robust security measures in the commercial sector are also augmenting market progress in the region.

The business in North America and Europe is driven by rise in investment in the R&D of new scalable commercial security systems for efficient management and presence of major players. The business in North America accounted for 30.1% share in 2022.

The global business is fragmented, with the presence of several commercial security system companies. Most vendors are investing significantly in the R&D of new products to expand their product portfolio.

Assa Abloy AB, Axis Communications AB, Bosch Sicherheitssysteme GmbH, Carrier Global Corporation, Dahua Technology Co., Ltd, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Johnson Controls International, Nortek Security & Control LLC, and Tyco International Ltd. are key entities operating in this sector.

Each of these players has been profiled in the commercial security system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 134.4 Bn |

|

Market Forecast Value in 2031 |

US$ 538.4 Bn |

|

Growth Rate (CAGR) |

16.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Billion Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 134.4 Bn in 2022

It is expected to be 16.8% from 2023 to 2031

Rise in adoption of IoT-based security management systems and increase in deployment of surveillance cameras in smart cities

Theft deterrence was the largest application segment with 31.1% share in 2022

Asia Pacific recorded the highest demand in 2022

The sector in China was valued at US$ 49.7 Bn in 2022

Assa Abloy AB, Axis Communications AB, Bosch Sicherheitssysteme GmbH, Carrier Global Corporation, Dahua Technology Co., Ltd, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Johnson Controls International, Nortek Security & Control LLC, and Tyco International Ltd.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Commercial Security System Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Automation Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Commercial Security System Market Analysis, By Offering

5.1. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

5.1.1. Hardware

5.1.1.1. Burglar Alarm Systems

5.1.1.2. Fire & Life Safety Devices

5.1.1.3. Security Cameras

5.1.1.4. Others (Keycard Access Systems, Intercom/Entrance Systems, etc.)

5.1.2. Software

5.1.3. Services

5.2. Market Attractiveness Analysis, By Offering

6. Global Commercial Security System Market Analysis, By Application

6.1. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

6.1.1. Indoor/Outdoor Surveillance

6.1.2. Flood Detection/Protection

6.1.3. Theft Deterrence

6.1.4. Occupancy & People Counting

6.1.5. Others (Queue Monitoring, Crowd Gathering, etc.)

6.2. Market Attractiveness Analysis, By Application

7. Global Commercial Security System Market Analysis, By End-use Industry

7.1. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

7.1.1. Government

7.1.2. Military and Defense

7.1.3. Transportation

7.1.4. Retail

7.1.5. BFSI

7.1.6. Sports and Leisure

7.1.7. Others (Education, Hotels, etc.)

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Commercial Security System Market Analysis and Forecast, By Region

8.1. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Commercial Security System Market Analysis and Forecast

9.1. Market Snapshot

9.2. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

9.2.1. Hardware

9.2.1.1. Burglar Alarm Systems

9.2.1.2. Fire & Life Safety Devices

9.2.1.3. Security Cameras

9.2.1.4. Others (Keycard Access Systems, Intercom/Entrance Systems, etc.)

9.2.2. Software

9.2.3. Services

9.3. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

9.3.1. Indoor/Outdoor Surveillance

9.3.2. Flood Detection/Protection

9.3.3. Theft Deterrence

9.3.4. Occupancy & People Counting

9.3.5. Others (Queue Monitoring, Crowd Gathering, etc.)

9.4. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

9.4.1. Government

9.4.2. Military and Defense

9.4.3. Transportation

9.4.4. Retail

9.4.5. BFSI

9.4.6. Sports and Leisure

9.4.7. Others (Education, Hotels, etc.)

9.5. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Offering

9.6.2. By Application

9.6.3. By End-use Industry

9.6.4. By Country/Sub-region

10. Europe Commercial Security System Market Analysis and Forecast

10.1. Market Snapshot

10.2. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

10.2.1. Hardware

10.2.1.1. Burglar Alarm Systems

10.2.1.2. Fire & Life Safety Devices

10.2.1.3. Security Cameras

10.2.1.4. Others (Keycard Access Systems, Intercom/Entrance Systems, etc.)

10.2.2. Software

10.2.3. Services

10.3. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

10.3.1. Indoor/Outdoor Surveillance

10.3.2. Flood Detection/Protection

10.3.3. Theft Deterrence

10.3.4. Occupancy & People Counting

10.3.5. Others (Queue Monitoring, Crowd Gathering, etc.)

10.4. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

10.4.1. Government

10.4.2. Military and Defense

10.4.3. Transportation

10.4.4. Retail

10.4.5. BFSI

10.4.6. Sports and Leisure

10.4.7. Others (Education, Hotels, etc.)

10.5. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Offering

10.6.2. By Application

10.6.3. By End-use Industry

10.6.4. By Country/Sub-region

11. Asia Pacific Commercial Security System Market Analysis and Forecast

11.1. Market Snapshot

11.2. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

11.2.1. Hardware

11.2.1.1. Burglar Alarm Systems

11.2.1.2. Fire & Life Safety Devices

11.2.1.3. Security Cameras

11.2.1.4. Others (Keycard Access Systems, Intercom/Entrance Systems, etc.)

11.2.2. Software

11.2.3. Services

11.3. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.3.1. Indoor/Outdoor Surveillance

11.3.2. Flood Detection/Protection

11.3.3. Theft Deterrence

11.3.4. Occupancy & People Counting

11.3.5. Others (Queue Monitoring, Crowd Gathering, etc.)

11.4. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

11.4.1. Government

11.4.2. Military and Defense

11.4.3. Transportation

11.4.4. Retail

11.4.5. BFSI

11.4.6. Sports and Leisure

11.4.7. Others (Education, Hotels, etc.)

11.5. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Offering

11.6.2. By Application

11.6.3. By End-use Industry

11.6.4. By Country/Sub-region

12. Middle East & Africa Commercial Security System Market Analysis and Forecast

12.1. Market Snapshot

12.2. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

12.2.1. Hardware

12.2.1.1. Burglar Alarm Systems

12.2.1.2. Fire & Life Safety Devices

12.2.1.3. Security Cameras

12.2.1.4. Others (Keycard Access Systems, Intercom/Entrance Systems, etc.)

12.2.2. Software

12.2.3. Services

12.3. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.3.1. Indoor/Outdoor Surveillance

12.3.2. Flood Detection/Protection

12.3.3. Theft Deterrence

12.3.4. Occupancy & People Counting

12.3.5. Others (Queue Monitoring, Crowd Gathering, etc.)

12.4. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

12.4.1. Government

12.4.2. Military and Defense

12.4.3. Transportation

12.4.4. Retail

12.4.5. BFSI

12.4.6. Sports and Leisure

12.4.7. Others (Education, Hotels, etc.)

12.5. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Offering

12.6.2. By Application

12.6.3. By End-use Industry

12.6.4. By Country/Sub-region

13. South America Commercial Security System Market Analysis and Forecast

13.1. Market Snapshot

13.2. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

13.2.1. Hardware

13.2.1.1. Burglar Alarm Systems

13.2.1.2. Fire & Life Safety Devices

13.2.1.3. Security Cameras

13.2.1.4. Others (Keycard Access Systems, Intercom/Entrance Systems, etc.)

13.2.2. Software

13.2.3. Services

13.3. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.3.1. Indoor/Outdoor Surveillance

13.3.2. Flood Detection/Protection

13.3.3. Theft Deterrence

13.3.4. Occupancy & People Counting

13.3.5. Others (Queue Monitoring, Crowd Gathering, etc.)

13.4. Commercial Security System Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

13.4.1. Government

13.4.2. Military and Defense

13.4.3. Transportation

13.4.4. Retail

13.4.5. BFSI

13.4.6. Sports and Leisure

13.4.7. Others (Education, Hotels, etc.)

13.5. Commercial Security System Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Offering

13.6.2. By Application

13.6.3. By End-use Industry

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Commercial Security System Market Competition Matrix - a Dashboard View

14.1.1. Global Commercial Security System Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Assa Abloy AB

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Axis Communications AB

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Bosch Sicherheitssysteme GmbH

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Carrier Global Corporation

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Dahua Technology Co., Ltd.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Hangzhou Hikvision Digital Technology Co., Ltd.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Honeywell International Inc.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Johnson Controls International

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Nortek Security & Control LLC

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Tyco International Ltd.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Other Key Players

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Commercial Security System Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 2: Global Commercial Security System Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 3: Global Commercial Security System Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 4: Global Commercial Security System Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 5: Global Commercial Security System Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 6: Global Commercial Security System Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 7: North America Commercial Security System Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 8: North America Commercial Security System Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 9: North America Commercial Security System Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 10: North America Commercial Security System Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 11: North America Commercial Security System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 12: North America Commercial Security System Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Europe Commercial Security System Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 14: Europe Commercial Security System Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 15: Europe Commercial Security System Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 16: Europe Commercial Security System Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 17: Europe Commercial Security System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 18: Europe Commercial Security System Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 19: Asia Pacific Commercial Security System Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 20: Asia Pacific Commercial Security System Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 21: Asia Pacific Commercial Security System Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 22: Asia Pacific Commercial Security System Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 23: Asia Pacific Commercial Security System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Asia Pacific Commercial Security System Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Middle East & Africa Commercial Security System Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 26: Middle East & Africa Commercial Security System Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 27: Middle East & Africa Commercial Security System Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 28: Middle East & Africa Commercial Security System Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 29: Middle East & Africa Commercial Security System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 30: Middle East & Africa Commercial Security System Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 31: South America Commercial Security System Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 32: South America Commercial Security System Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 33: South America Commercial Security System Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 34: South America Commercial Security System Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 35: South America Commercial Security System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 36: South America Commercial Security System Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Commercial Security System Market

Figure 02: Porter Five Forces Analysis - Global Commercial Security System Market

Figure 03: Technology Road Map - Global Commercial Security System Market

Figure 04: Global Commercial Security System Market, Value (US$ Bn), 2017-2031

Figure 05: Global Commercial Security System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 06: Global Commercial Security System Market Projections by Offering, Value (US$ Bn), 2017-2031

Figure 07: Global Commercial Security System Market, Incremental Opportunity, by Offering, 2023-2031

Figure 08: Global Commercial Security System Market Share Analysis, by Offering, 2023 and 2031

Figure 09: Global Commercial Security System Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 10: Global Commercial Security System Market, Incremental Opportunity, by Application, 2023-2031

Figure 11: Global Commercial Security System Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Commercial Security System Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 13: Global Commercial Security System Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 14: Global Commercial Security System Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 15: Global Commercial Security System Market Projections by Region, Value (US$ Bn), 2017-2031

Figure 16: Global Commercial Security System Market, Incremental Opportunity, by Region, 2023-2031

Figure 17: Global Commercial Security System Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Commercial Security System Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 19: North America Commercial Security System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 20: North America Commercial Security System Market Projections by Offering Value (US$ Bn), 2017-2031

Figure 21: North America Commercial Security System Market, Incremental Opportunity, by Offering, 2023-2031

Figure 22: North America Commercial Security System Market Share Analysis, by Offering, 2023 and 2031

Figure 23: North America Commercial Security System Market Projections by Application (US$ Bn), 2017-2031

Figure 24: North America Commercial Security System Market, Incremental Opportunity, by Application, 2023-2031

Figure 25: North America Commercial Security System Market Share Analysis, by Application, 2023 and 2031

Figure 26: North America Commercial Security System Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 27: North America Commercial Security System Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 28: North America Commercial Security System Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 29: North America Commercial Security System Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 30: North America Commercial Security System Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 31: North America Commercial Security System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 32: Europe Commercial Security System Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 33: Europe Commercial Security System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 34: Europe Commercial Security System Market Projections by Offering Value (US$ Bn), 2017-2031

Figure 35: Europe Commercial Security System Market, Incremental Opportunity, by Offering, 2023-2031

Figure 36: Europe Commercial Security System Market Share Analysis, by Offering, 2023 and 2031

Figure 37: Europe Commercial Security System Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 38: Europe Commercial Security System Market, Incremental Opportunity, by Application, 2023-2031

Figure 39: Europe Commercial Security System Market Share Analysis, by Application, 2023 and 2031

Figure 40: Europe Commercial Security System Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 41: Europe Commercial Security System Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 42: Europe Commercial Security System Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 43: Europe Commercial Security System Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 44: Europe Commercial Security System Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 45: Europe Commercial Security System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Commercial Security System Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 47: Asia Pacific Commercial Security System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 48: Asia Pacific Commercial Security System Market Projections by Offering Value (US$ Bn), 2017-2031

Figure 49: Asia Pacific Commercial Security System Market, Incremental Opportunity, by Offering, 2023-2031

Figure 50: Asia Pacific Commercial Security System Market Share Analysis, by Offering, 2023 and 2031

Figure 51: Asia Pacific Commercial Security System Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 52: Asia Pacific Commercial Security System Market, Incremental Opportunity, by Application, 2023-2031

Figure 53: Asia Pacific Commercial Security System Market Share Analysis, by Application, 2023 and 2031

Figure 54: Asia Pacific Commercial Security System Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 55: Asia Pacific Commercial Security System Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 56: Asia Pacific Commercial Security System Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 57: Asia Pacific Commercial Security System Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 58: Asia Pacific Commercial Security System Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 59: Asia Pacific Commercial Security System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Commercial Security System Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 61: Middle East & Africa Commercial Security System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 62: Middle East & Africa Commercial Security System Market Projections by Offering Value (US$ Bn), 2017-2031

Figure 63: Middle East & Africa Commercial Security System Market, Incremental Opportunity, by Offering, 2023-2031

Figure 64: Middle East & Africa Commercial Security System Market Share Analysis, by Offering, 2023 and 2031

Figure 65: Middle East & Africa Commercial Security System Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 66: Middle East & Africa Commercial Security System Market, Incremental Opportunity, by Application, 2023-2031

Figure 67: Middle East & Africa Commercial Security System Market Share Analysis, by Application, 2023 and 2031

Figure 68: Middle East & Africa Commercial Security System Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 69: Middle East & Africa Commercial Security System Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 70: Middle East & Africa Commercial Security System Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 71: Middle East & Africa Commercial Security System Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 72: Middle East & Africa Commercial Security System Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 73: Middle East & Africa Commercial Security System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America Commercial Security System Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 75: South America Commercial Security System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 76: South America Commercial Security System Market Projections by Offering Value (US$ Bn), 2017-2031

Figure 77: South America Commercial Security System Market, Incremental Opportunity, by Offering, 2023-2031

Figure 78: South America Commercial Security System Market Share Analysis, by Offering, 2023 and 2031

Figure 79: South America Commercial Security System Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 80: South America Commercial Security System Market, Incremental Opportunity, by Application, 2023-2031

Figure 81: South America Commercial Security System Market Share Analysis, by Application, 2023 and 2031

Figure 82: South America Commercial Security System Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 83: South America Commercial Security System Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 84: South America Commercial Security System Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 85: South America Commercial Security System Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 86: South America Commercial Security System Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 87: South America Commercial Security System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Commercial Security System Market Competition

Figure 89: Global Commercial Security System Market Company Share Analysis