Analysts’ Viewpoint on Commercial Seaweed Market Scenario

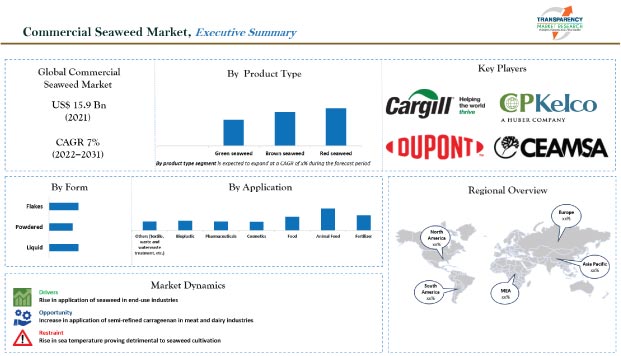

Commercial seaweed is a rich source of vitamins and minerals that can be found in various foods, cosmetics, and healthcare products. Rise in demand for seaweed-based culinary items and growing popularity of seaweed extracts, such as carrageenan and agar, are driving the global commercial seaweed market. Increase in application of commercial seaweed in various end-use industries, such as pharmaceuticals, food & beverage, and cosmetics, is also estimated to propel the market. Asia Pacific is likely to be a rapidly growing market for commercial seaweed in the near future. China, South Korea, Japan, and Indonesia are among the leading growers of seaweed across the globe.

Commercial seaweed is a form of microalgae, which is either taken directly or used as a hydrocolloid in food. This seaweed is also used in fertilizers, pharmaceuticals, cosmetics, and personal care items, as it is a rich source of minerals and vitamins. Commercial seaweed offers numerous health benefits. It is used significantly in pharmaceutical and personal care industries due to the high mineral and folic acid content. Players in the commercial seaweed market are increasingly cultivating sustainable seaweeds to meet the rising demand across the globe.

Increase in demand for seaweed in the pharmaceutical industry can be ascribed to its higher nutrient content and relatively low calories. Farmed seaweeds are available in a variety of colors and shapes. High concentration of vitamins and minerals, such as folic acid and vitamin K, provides numerous health benefits such as improved cardiovascular and immune system performance. This is driving the demand for red and black seaweed across the globe. Alginate, carrageenan, and agar are the three major seaweed derivatives. These seaweeds are derived from hydrocolloids and have strong biochemical properties, which make them useful in the pharmaceutical industry. These hydrocolloids are commonly used as excipients in pill form. Increasing usage of alginate seaweed in the pharmaceutical industry – it is used as dressing for wounds and a way to encapsulate cells and medicine – is further driving the demand for commercial seaweeds across the globe.

Commercial seaweed is extensively used in the cosmetic industry to make essential oils, creams, face masks, shampoos, bath salts, and other skin care products due to the high concentration of bioactive components. Anti-oxidant properties of commercial seaweeds provide anti-inflammatory and anti-aging effects, making them more useful in skin care, skin treatment, and hair care products. Applications of seaweed in the food & beverage industry are rising, specifically for particle suspension, emulsification, protein stabilization, thickening, and stabilization, in various processed foods such as dairy products, chocolate milk, sour cream, ice cream, and salad dressings. This is driving the demand for commercial seaweed in the food & beverage industry. Seaweed food and seaweed drinks are also popular among health-conscious consumers. The usage of commercial seaweeds in vegan/vegetarian gelatin-based food and beverage products, particularly among vegans because of its rich content in vitamins, minerals, and antioxidants, is further propelling the global demand for commercial seaweed.

Based on product type, the global commercial seaweed market has been classified into red seaweed, brown seaweed, and green seaweed. The red seaweed segment is estimated to dominate the commercial seaweed market, as red seaweeds are a good source of hydrocolloids, agar, and kappa carrageenan, which are often used in food preparations. Apart from the food industry, red seaweeds are also used in various skincare and personal care products. Growth of the commercial seaweed market can be ascribed to the rising application of red seaweed in various end-use industries.

The powdered form of commercial seaweed is expected to dominate the market during the forecast period, as it is easy to use and can be stored for a longer time. The powered form is also widely used in the food industry. However, demand for liquid and flake forms of seaweed is expected to rise significantly during the forecasted period.

The commercial seaweed market in Asia Pacific is estimated to grow at a notable pace during the forecast period. This can be ascribed to the increase in demand for and plentiful seaweed production in countries such as China, South Korea, Japan, and Indonesia. Furthermore, rise in usage of commercial seaweeds, particularly in food, pharmaceuticals, personal care products, gels, and adhesives, is fueling the market in the region. Key players in Asia Pacific are focusing on efficient commercial seaweed farming methods to create growth opportunities.

The market in North America and Europe is also likely to grow considerably during the forecast period, due to the rise in demand for plant-based and vegan products in these regions. The commercial seaweed market in Middle East & Africa is in the nascent phase. It is likely to grow at a rapid pace during the forecast period.

Key companies operating in the global commercial seaweed market are focusing on increasing their production capacities to meet the rising demand across the globe. Expansion of product portfolios and mergers and acquisitions are the prominent strategies adopted by key players. Cargill Corporation, E.I. Du Pont de Nemours and Company, CP Kelco, CEAMSA, Acadian Seaplants Ltd, Gelymar SA, Seasol International Pvt. Ltd, Brandt Agricultural Products Ltd, The Cornish Seaweed Company, and Leili Group are the prominent entities operating in the market.

Each of these players has been profiled in the commercial seaweed market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 15.9 Bn |

|

Market Forecast Value in 2031 |

US$ 31.1 Bn |

|

Growth Rate (CAGR) |

7.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

Market share analysis by the company (2021) Company profiles section includes an overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The commercial seaweed market stood at US$ 15.9 Bn in 2021.

The market is estimated to grow at a CAGR of 7.0% during 2022-2031.

The market is likely to reach US$ 31.1 Bn by 2031.

High demand for commercial seaweed in food, cosmetic, and pharmaceutical industries.

The food segment accounted for the largest share of the commercial seaweed market in 2021.

Asia Pacific is likely to be a highly lucrative market in the next few years.

Key players in the commercial seaweed market include Cargill Corporation, E.I. Du Pont de Nemours and Company, CP Kelco, CEAMSA, Acadian Seaplants Ltd, Gelymar SA, Seasol International Pvt. Ltd, Brandt Agricultural Products Ltd, The Cornish Seaweed Company, and Leili Group.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Regulations & Guidelines

5.5. Key Market Indicators

5.5.1. Overall Commercial Seaweed Market Overview

5.6. Raw Material Analysis

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Value Chain Analysis

5.10. Regulatory Framework

5.11. Covid-19 Impact Analysis

5.12. Global Commercial Seaweed Market Analysis and Forecast, 2017–2031

5.12.1. Market Value Projections (US$ Bn)

5.12.2. Market Volume Projections (Tons)

6. Global Commercial Seaweed Market Analysis and Forecast, by Product Type

6.1. Commercial Seaweed Market Size (US$ Bn and Tons) By Product Type, 2017–2031

6.1.1. Red seaweed

6.1.2. Brown seaweed

6.1.3. Green seaweed

6.2. Incremental Opportunity, by Product Type

7. Global Commercial Seaweed Market Analysis and Forecast, by Form

7.1. Commercial Seaweed Market Size (US$ Bn and Tons), by Form, 2017–2031

7.1.1. Liquid

7.1.2. Powdered

7.1.3. Flakes

7.2. Incremental Opportunity, by Form

8. Global Commercial Seaweed Market Analysis and Forecast, by Application

8.1. Commercial Seaweed Market Size (US$ Bn and Tons), by Application, 2017–2031

8.1.1. Fertilizer

8.1.2. Animal Feed

8.1.3. Food

8.1.4. Cosmetics

8.1.5. Pharmaceuticals

8.1.6. Bioplastic

8.1.7. Others (Textile, Waterwaste treatment, etc.)

8.2. Incremental Opportunity, by Region

9. Global Commercial Seaweed Market Analysis and Forecast, by Region

9.1. Commercial Seaweed Market Size (US$ Bn and Tons), by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. Latin America

9.2. Incremental Opportunity, by Region

10. North America Commercial Seaweed Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key supplier analysis

10.3. Covid-19 Impact Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Price

10.5. Key Trends Analysis

10.5.1. Demand Side

10.5.2. Supplier Side

10.6. Commercial Seaweed Market Size (US$ Bn and Tons), by Product Type, 2017–2031

10.6.1. Red seaweed

10.6.2. Brown seaweed

10.6.3. Green seaweed

10.7. Commercial Seaweed Market Size (US$ Bn and Tons), by Form, 2017–2031

10.7.1. Liquid

10.7.2. Powdered

10.7.3. Flakes

10.8. Commercial Seaweed Market Size (US$ Bn and Tons), by Application, 2017–2031

10.8.1. Fertilizer

10.8.2. Animal Feed

10.8.3. Food

10.8.4. Cosmetics

10.8.5. Pharmaceuticals

10.8.6. Bioplastic

10.8.7. Others (Textile, Waterwaste treatment, etc.)

10.9. Commercial Seaweed Market Size (US$ Bn and Tons), by Country, 2017–2031

10.9.1. U.S

10.9.2. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Commercial Seaweed Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key supplier analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Commercial Seaweed Market Size (US$ Bn and Tons), by Product Type, 2017–2031

11.5.1. Red seaweed

11.5.2. Brown seaweed

11.5.3. Green seaweed

11.6. Commercial Seaweed Market Size (US$ Bn and Tons), by Form, 2017–2031

11.6.1. Liquid

11.6.2. Powdered

11.6.3. Flakes

11.7. Commercial Seaweed Market Size (US$ Bn and Tons), by Application, 2017–2031

11.7.1. Fertilizer

11.7.2. Animal Feed

11.7.3. Food

11.7.4. Cosmetics

11.7.5. Pharmaceuticals

11.7.6. Bioplastic

11.7.7. Others (Textile, Waterwaste treatment, etc.)

11.8. Commercial Seaweed Market Size (US$ Bn and Tons), by Country, 2017–2031

11.8.1. U.K

11.8.2. Germany

11.8.3. Spain

11.8.4. France

11.8.5. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Commercial Seaweed Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key supplier analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Commercial Seaweed Market Size (US$ Bn and Tons), by Product Type, 2017–2031

12.5.1. Red seaweed

12.5.2. Brown seaweed

12.5.3. Green seaweed

12.6. Commercial Seaweed Market Size (US$ Bn and Tons), by Form, 2017–2031

12.6.1. Liquid

12.6.2. Powdered

12.6.3. Flakes

12.7. Commercial Seaweed Market Size (US$ Bn and Tons), by Application, 2017–2031

12.7.1. Fertilizer

12.7.2. Animal Feed

12.7.3. Food

12.7.4. Cosmetics

12.7.5. Pharmaceuticals

12.7.6. Bioplastic

12.7.7. Others (Textile, Waterwaste treatment, etc.)

12.8. Commercial Seaweed Market Size (US$ Bn and Tons), by Country, 2017–2031

12.8.1. Japan

12.8.2. China

12.8.3. India

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East and Africa Commercial Seaweed Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key supplier analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Commercial Seaweed Market Size (US$ Bn and Tons), by Product Type, 2017–2031

13.5.1. Red seaweed

13.5.2. Brown seaweed

13.5.3. Green seaweed

13.6. Commercial Seaweed Market Size (US$ Bn and Tons), by Form, 2017–2031

13.6.1. Liquid

13.6.2. Powdered

13.6.3. Flakes

13.7. Commercial Seaweed Market Size (US$ Bn and Tons), by Application, 2017–2031

13.7.1. Fertilizer

13.7.2. Animal Feed

13.7.3. Food

13.7.4. Cosmetics

13.7.5. Pharmaceuticals

13.7.6. Bioplastic

13.7.7. Others (Textile, Waterwaste treatment, etc.)

13.8. Commercial Seaweed Market Size (US$ Bn and Tons), by Country, 2017–2031

13.8.1. UAE

13.8.2. South Africa

13.8.3. Rest of MEA

13.9. Incremental Opportunity Analysis

14. Latin America Commercial Seaweed Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key supplier analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Commercial Seaweed Market Size (US$ Bn and Tons), by Product Type, 2017–2031

14.5.1. Red seaweed

14.5.2. Brown seaweed

14.5.3. Green seaweed

14.6. Commercial Seaweed Market Size (US$ Bn and Tons), by Form, 2017–2031

14.6.1. Liquid

14.6.2. Powdered

14.6.3. Flakes

14.7. Commercial Seaweed Market Size (US$ Bn and Tons), by Application, 2017–2031

14.7.1. Fertilizer

14.7.2. Animal Feed

14.7.3. Food

14.7.4. Cosmetics

14.7.5. Pharmaceuticals

14.7.6. Bioplastic

14.7.7. Others (Textile, Waste and Waterwaste treatment, etc.)

14.8. Commercial Seaweed Market Size (US$ Bn and Tons), by Country, 2017–2031

14.8.1. Chile

14.8.2. Brazil

14.8.3. Rest of Latin America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%), by Company, (2021)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview

15.3.1. Cargill Corporation

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. E.I. Du Pont de Nemours and Company

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. CP Kelco

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. CEAMSA

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Acadian Seaplants Ltd.

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Gelymar SA

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Seasol International Pvt. Ltd

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. Brandt Agricultural Products Ltd

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. The Cornish Seaweed Company

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Leili Group

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Product Type

16.1.2. By Form

16.1.3. By region

16.2. Understanding the Buying Process of the Customers

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Table 2: Global Commercial Seaweed Market, by Product Type, Tons 2017–2031

Table 3: Global Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Table 4: Global Commercial Seaweed Market, by Form, Tons 2017–2031

Table 5: Global Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Table 6: Global Commercial Seaweed Market, by Application, Tons 2017–2031

Table 7: Global Commercial Seaweed Market, by Region, US$ Bn, 2017–2031

Table 8: Global Commercial Seaweed Market, by Region, Tons 2017–2031

Table 9: North America Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Table 10: North America Commercial Seaweed Market, by Product Type, Tons 2017–2031

Table 11: North America Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Table 12: North America Commercial Seaweed Market, by Form, Tons 2017–2031

Table 13: North America Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Table 14: North America Commercial Seaweed Market, by Application, Tons 2017–2031

Table 15: North America Commercial Seaweed Market, by Country, US$ Bn, 2017–2031

Table 16: North America Commercial Seaweed Market, by Country, Tons 2017–2031

Table 17: Europe Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Table 18: Europe Commercial Seaweed Market, by Product Type, Tons 2017–2031

Table 19: Europe Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Table 20: Europe Commercial Seaweed Market, by Form, Tons 2017–2031

Table 21: Europe Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Table 22: Europe Commercial Seaweed Market, by Application, Tons 2017–2031

Table 23: Europe Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Table 24: Europe Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Table 25: Asia Pacific Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Table 26: Asia Pacific Commercial Seaweed Market, by Product Type, Tons 2017–2031

Table 27: Asia Pacific Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Table 28: Asia Pacific Commercial Seaweed Market, by Form, Tons 2017–2031

Table 29: Asia Pacific Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Table 30: Asia Pacific Commercial Seaweed Market, by Application, Tons 2017–2031

Table 31: Asia Pacific Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Table 32: Asia Pacific Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Table 33: Middle East & Africa Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Table 34: Middle East & Africa Commercial Seaweed Market, by Product Type, Tons 2017–2031

Table 35: Middle East & Africa Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Table 36: Middle East & Africa Commercial Seaweed Market, by Form, Tons 2017–2031

Table 37: Middle East & Africa Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Table 38: Middle East & Africa Commercial Seaweed Market, by Application, Tons 2017–2031

Table 39: Middle East & Africa Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Table 40: Middle East & Africa Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Table 41: Latin America Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Table 42: Latin America Commercial Seaweed Market, by Product Type, Tons 2017–2031

Table 43: Latin America Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Table 44: Latin America Commercial Seaweed Market, by Form, Tons 2017–2031

Table 45: Latin America Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Table 46: Latin America Commercial Seaweed Market, by Application, Tons 2017–2031

Table 47: Latin America Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Table 48: Latin America Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

List Of Figures

Figure 1: Global Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Figure 2: Global Commercial Seaweed Market, by Product Type, Tons 2017–2031

Figure 3: Global Commercial Seaweed Market by Product Type, Incremental Opportunity, 2022–2031

Figure 4: Global Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Figure 5: Global Commercial Seaweed Market, by Form, Tons 2017–2031

Figure 6: Global Commercial Seaweed Market by Form, Incremental Opportunity, 2022–2031

Figure 7: Global Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Figure 8: Global Commercial Seaweed Market, by Application, Tons 2017–2031

Figure 9: Global Commercial Seaweed Market by Application, Incremental Opportunity, 2022–2031

Figure 10: Global Commercial Seaweed Market, by Region, US$ Bn, 2017–2031

Figure 11: Global Commercial Seaweed Market, by Region, Tons 2017–2031

Figure 12: Global Commercial Seaweed Market by Region, Incremental Opportunity, 2022–2031

Figure 13: North America Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Figure 14: North America Commercial Seaweed Market, by Product Type, Tons 2017–2031

Figure 15: North America Commercial Seaweed Market by Product Type, Incremental Opportunity, 2022–2031

Figure 16: North America Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Figure 17: North America Commercial Seaweed Market, by Form, Tons 2017–2031

Figure 18: North America Commercial Seaweed Market by Form, Incremental Opportunity, 2022–2031

Figure 19: North America Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Figure 20: North America Commercial Seaweed Market, by Application, Tons 2017–2031

Figure 21: North America Commercial Seaweed Market by Application, Incremental Opportunity, 2022–2031

Figure 22: North America Commercial Seaweed Market, by Country, US$ Bn, 2017–2031

Figure 23: North America Commercial Seaweed Market, by Country, Tons 2017–2031

Figure 24: North America Commercial Seaweed Market by Country, Incremental Opportunity, 2022–2031

Figure 25: Europe Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Figure 26: Europe Commercial Seaweed Market, by Product Type, Tons 2017–2031

Figure 27: Europe Commercial Seaweed Market, by Product Type, Incremental Opportunity, 2022–2031

Figure 28: Europe Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Figure 29: Europe Commercial Seaweed Market, by Form, Tons 2017–2031

Figure 30: Europe Commercial Seaweed Market, by Form, Incremental Opportunity, 2022–2031

Figure 31: Europe Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Figure 32: Europe Commercial Seaweed Market, by Application, Tons 2017–2031

Figure 33: Europe Commercial Seaweed Market, by Application, Incremental Opportunity, 2022–2031

Figure 34: Europe Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Figure 35: Europe Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Figure 36: Europe Commercial Seaweed Market, by Country and Sub-region, Incremental Opportunity, 2022–2031

Figure 37: Asia Pacific Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Figure 38: Asia Pacific Commercial Seaweed Market, by Product Type, Tons 2017–2031

Figure 39: Asia Pacific Commercial Seaweed Market, by Product Type, Incremental Opportunity, 2022–2031

Figure 40: Asia Pacific Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Figure 41: Asia Pacific Commercial Seaweed Market, by Form, Tons 2017–2031

Figure 42: Asia Pacific Commercial Seaweed Market, by Form, Incremental Opportunity, 2022–2031

Figure 43: Asia Pacific Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Figure 44: Asia Pacific Commercial Seaweed Market, by Application, Tons 2017–2031

Figure 45: Asia Pacific Commercial Seaweed Market, by Application, Incremental Opportunity, 2022–2031

Figure 46: Asia Pacific Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Figure 47: Asia Pacific Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Figure 48: Asia Pacific Commercial Seaweed Market, by Country and Sub-region, Incremental Opportunity, 2022–2031

Figure 49: Middle East & Africa Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Figure 50: Middle East & Africa Commercial Seaweed Market, by Product Type, Tons 2017–2031

Figure 51: Middle East & Africa Commercial Seaweed Market by Product Type, Incremental Opportunity, 2022–2031

Figure 52: Middle East & Africa Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Figure 53: Middle East & Africa Commercial Seaweed Market, by Form, Tons 2017–2031

Figure 54: Middle East & Africa Commercial Seaweed Market by Form, Incremental Opportunity, 2022–2031

Figure 55: Middle East & Africa Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Figure 56: Middle East & Africa Commercial Seaweed Market, by Application, Tons 2017–2031

Figure 57: Middle East & Africa Commercial Seaweed Market by Application, Incremental Opportunity, 2022–2031

Figure 58: Middle East & Africa Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Figure 59: Middle East & Africa Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Figure 60: Middle East & Africa Commercial Seaweed Market by Country and Sub-region, Incremental Opportunity, 2022–2031

Figure 61: Latin America Commercial Seaweed Market, by Product Type, US$ Bn, 2017–2031

Figure 62: Latin America Commercial Seaweed Market, by Product Type, Tons 2017–2031

Figure 63: Latin America Commercial Seaweed Market by Product Type, Incremental Opportunity, 2022–2031

Figure 64: Latin America Commercial Seaweed Market, by Form, US$ Bn, 2017–2031

Figure 65: Latin America Commercial Seaweed Market, by Form, Tons 2017–2031

Figure 66: Latin America Commercial Seaweed Market by Form, Incremental Opportunity, 2022–2031

Figure 67: Latin America Commercial Seaweed Market, by Application, US$ Bn, 2017–2031

Figure 68: Latin America Commercial Seaweed Market, by Application, Tons 2017–2031

Figure 69: Latin America Commercial Seaweed Market by Application, Incremental Opportunity, 2022–2031

Figure 70: Latin America Commercial Seaweed Market, by Country and Sub-region, US$ Bn, 2017–2031

Figure 71: Latin America Commercial Seaweed Market, by Country and Sub-region, Tons 2017–2031

Figure 72: Latin America Commercial Seaweed Market by Country and Sub-region, Incremental Opportunity, 2022–2031