Analysts’ Viewpoint on Market Scenario

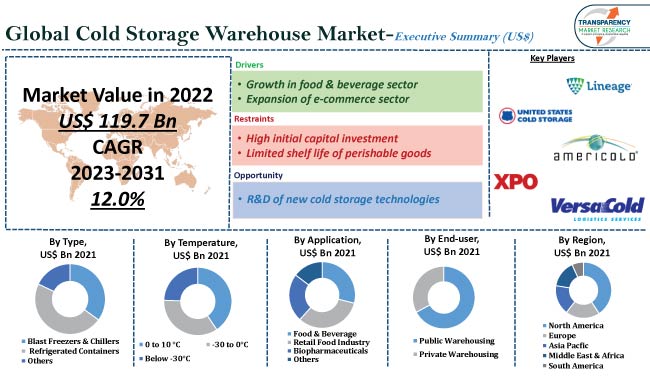

The cold storage warehouse market size is expected to grow at a rapid pace in the near future due to expansion in the food & beverage sector. Growth of the e-commerce sector is also projected to fuel market progress in the next few years. Cold storage warehouses are widely employed in various end-use industries such as food & beverage, pharmaceuticals, and chemicals.

Surge in consumption of packaged food products is likely to offer lucrative opportunities to vendors in the global cold storage warehouse industry. Furthermore, government measures to modernize the cold chain supply are also supporting cold storage warehouse market growth. Vendors are offering smart, sustainable, and energy-efficient cold storage warehouse solutions to increase their cold storage warehouse market share.

Cold storage warehouse is a structure or facility that is built to maintain specific environmental conditions to keep temperature-sensitive items safe. Cold storage warehousing generally falls into two categories dictated by the required temperature. The categories are bifurcated into refrigerated controlled temperatures ranging from 0°C to 10°C and fully frozen with temperature control between -30°C to 0°C.

The global food & beverage sector is growing at a rapid pace, with an emphasis on convenience and ready-to-eat meals. This has led to a surge in demand for cold storage facilities to keep raw materials, ingredients, and final goods at regulated temperatures in order to assure food safety and extend shelf life.

Rise in consumption of perishable products and fresh produce is projected to boost the usage of cold storage, thereby augmenting cold storage warehouse market value.

Consumers are becoming more health-conscious and are increasingly looking for items that are fresh, organic, and locally sourced. These goods are often required to be refrigerated in order to keep their freshness and nutritional worth. This, in turn, is boosting the demand for frozen warehouses.

According to the U.S. Department of Agriculture, the foodservice and food retailing industries in the U.S. supplied around US$ 2.12 Trn in food in 2021. Foodservice facilities contributed US$ 1.17 Trn to this total.

Food & beverage is one of the key industries in the EU, with a turnover of €1.1 Trn, according to the European Commission.

E-commerce is more popular than ever. Whether it is a fashionable item of apparel or the latest gadget, internet customers want their purchases to arrive at their homes as quickly as possible. The same holds true with their groceries.

As a result, demand for cold storage warehousing is increasing at a time when cold chain operations are growing more complicated. Hence, expansion in the e-commerce sector is driving market expansion.

By 2023, online retail sales are projected to reach US$ 6.17 Trn, with e-commerce websites accounting for 22.3% share of all retail sales. China is likely to dominate the global e-commerce market with 52.1% of all retail e-commerce sales globally and just over US$ 2 Trn in total online sales in 2021.

Major businesses are collaborating with online stores and developing their e-portals to reach a bigger audience. Thus, increase in number of online portals is estimated to bolster the cold storage warehouse market statistics in the near future.

According to the latest cold storage warehouse market trends, the refrigerated containers segment is expected to account for the largest share from 2023 to 2031, followed by the blast freezers & chillers segment.

The refrigerated cargo segment relies significantly on consistency from predictable delivery schedules to maintain the temperature at a predetermined constant level during cargo transportation.

According to the latest cold storage warehouse market analysis, the retail food industry end-user segment is anticipated to dominate the global landscape during the forecast period. Growth of the segment can be ascribed to expansion in the retail food sector and rise in adoption of cold storage warehouses in supermarkets, hypermarkets, convenience stores, and other retail stores, particularly in developed markets such as Europe and North America.

Growth in the retail chain in developing countries, including India, Brazil, Argentina, the UAE, and Saudi Arabia, is also augmenting the segment.

According to the latest cold storage warehouse market forecast, North America is estimated to constitute the largest share from 2023 to 2031. The region accounted for highest value share in 2022.

Expansion in the food & beverage sector is driving market dynamics of North America. According to the U.S. Economic Development Commission's 2022 report, the food & beverage sector comprises approximately 27,000 organizations and employs approximately 1.5 million people. It is an integral part of the U.S. economy. Combined with agriculture, manufacturing, retail, and services, the sector accounts for about 5.0% of the country's GDP and 10.0% of employment.

Changes in food preferences, rise in health awareness, and increase in demand for natural and organic products are also augmenting the market revenue in North America.

The global landscape is consolidated, with a few large-scale vendors controlling majority of the market share. Most of the firms are investing significantly in R&D of new technologies to expand their product portfolio.

Lineage Logistics Holding, LLC, Americold Logistics, Inc., United States Cold Storage, DHL Group, XPO, Inc., VersaCold Logistics Services, Tippmann Group., GEODIS, NFI Industries, and Penske are prominent entities operating in this market.

Each of these players has been profiled in the cold storage warehouse market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 119.7 Bn |

|

Market Forecast Value in 2031 |

US$ 331.5 Bn |

|

Growth Rate (CAGR) |

12.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, and price trends, brand analysis and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 119.7 Bn in 2022

It is estimated to grow at a CAGR of 12.0% from 2023 to 2031

It is projected to reach US$ 331.5 Bn by 2031

Growth in the food & beverage sector and expansion of the e-commerce sector

The retail food industry application segment is anticipated to account for the largest share during the forecast period

North America is likely to record the highest demand from 2023 to 2031

Lineage Logistics Holding, LLC, Americold Logistics, Inc., United States Cold Storage, DHL Group, XPO, Inc., VersaCold Logistics Services, Tippmann Group., GEODIS, NFI Industries, and Penske

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Regional Snapshot

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Technological Overview Analysis

5.8. Regulatory Framework

5.9. Global Cold Storage Warehouse Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projection (US$ Bn)

5.9.2. Market Revenue Projection (Thousand Units)

6. Global Cold Storage Warehouse Market Analysis and Forecast, By Type

6.1. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Blast Freezers & Chillers

6.1.2. Refrigerated Containers

6.1.3. Others (Cold Rooms, Custom Cold Storage, etc.)

6.2. Incremental Opportunity, By Type

7. Global Cold Storage Warehouse Market Analysis and Forecast, By Temperature

7.1. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

7.1.1. 0 to 10 °C

7.1.2. -30 to 0°C

7.1.3. Below -30°C

7.2. Incremental Opportunity, By Temperature

8. Global Cold Storage Warehouse Market Analysis and Forecast, By Application

8.1. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Food & Beverage

8.1.2. Retail Food Industry

8.1.3. Biopharmaceuticals

8.1.4. Others (Chemicals, Botanicals, etc.)

8.2. Incremental Opportunity, By Application

9. Global Cold Storage Warehouse Market Analysis and Forecast, By End-user

9.1. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

9.1.1. Public Warehousing

9.1.2. Private Warehousing

9.2. Incremental Opportunity, By End-user

10. Global Cold Storage Warehouse Market Analysis and Forecast, by Region

10.1. Cold Storage Warehouse Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Cold Storage Warehouse Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side

11.3.2. Supply Side

11.4. Key Supplier Analysis

11.5. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

11.5.1. Blast Freezers & Chillers

11.5.2. Refrigerated Containers

11.5.3. Others (Cold Rooms, Custom Cold Storage, etc.)

11.6. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

11.6.1. 0 to 10 °C

11.6.2. -30 to 0°C

11.6.3. Below -30°C

11.7. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

11.7.1. Food & Beverage

11.7.2. Retail Food Industry

11.7.3. Biopharmaceuticals

11.7.4. Others (Chemicals, Botanicals, etc.)

11.8. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

11.8.1. Public Warehousing

11.8.2. Private Warehousing

11.9. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Cold Storage Warehouse Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Key Supplier Analysis

12.5. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

12.5.1. Blast Freezers & Chillers

12.5.2. Refrigerated Containers

12.5.3. Others (Cold Rooms, Custom Cold Storage, etc.)

12.6. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

12.6.1. 0 to 10 °C

12.6.2. -30 to 0°C

12.6.3. Below -30°C

12.7. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.7.1. Food & Beverage

12.7.2. Retail Food Industry

12.7.3. Biopharmaceuticals

12.7.4. Others (Chemicals, Botanicals, etc.)

12.8. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

12.8.1. Public Warehousing

12.8.2. Private Warehousing

12.9. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

12.9.1. Germany

12.9.2. U.K.

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Cold Storage Warehouse Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Key Supplier Analysis

13.5. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.5.1. Blast Freezers & Chillers

13.5.2. Refrigerated Containers

13.5.3. Others (Cold Rooms, Custom Cold Storage, etc.)

13.6. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

13.6.1. 0 to 10 °C

13.6.2. -30 to 0°C

13.6.3. Below -30°C

13.7. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.7.1. Food & Beverage

13.7.2. Retail Food Industry

13.7.3. Biopharmaceuticals

13.7.4. Others (Chemicals, Botanicals, etc.)

13.8. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

13.8.1. Public Warehousing

13.8.2. Private Warehousing

13.9. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Cold Storage Warehouse Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Key Supplier Analysis

14.5. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.5.1. Blast Freezers & Chillers

14.5.2. Refrigerated Containers

14.5.3. Others (Cold Rooms, Custom Cold Storage, etc.)

14.6. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

14.6.1. 0 to 10 °C

14.6.2. -30 to 0°C

14.6.3. Below -30°C

14.7. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.7.1. Food & Beverage

14.7.2. Retail Food Industry

14.7.3. Biopharmaceuticals

14.7.4. Others (Chemicals, Botanicals, etc.)

14.8. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

14.8.1. Public Warehousing

14.8.2. Private Warehousing

14.9. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Cold Storage Warehouse Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trends Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Key Supplier Analysis

15.5. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

15.5.1. Blast Freezers & Chillers

15.5.2. Refrigerated Containers

15.5.3. Others (Cold Rooms, Custom Cold Storage, etc.)

15.6. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

15.6.1. 0 to 10 °C

15.6.2. -30 to 0°C

15.6.3. Below -30°C

15.7. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.7.1. Food & Beverage

15.7.2. Retail Food Industry

15.7.3. Biopharmaceuticals

15.7.4. Others (Chemicals, Botanicals, etc.)

15.8. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

15.8.1. Public Warehousing

15.8.2. Private Warehousing

15.9. Cold Storage Warehouse Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Revenue Share Analysis (%), By Company, (2022)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. LINEAGE LOGISTICS HOLDING, LLC

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Americold Logistics, Inc.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. United States Cold Storage

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. DHL Group

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. XPO, Inc.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. VersaCold Logistics Services

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Tippmann Group.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. GEODIS

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. NFI Industries

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Penske

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Others

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Prevailing Market Risks

List of Tables

Table 1: Global Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Table 2: Global Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Table 3: Global Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Table 4: Global Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Table 5: Global Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Table 6: Global Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Table 7: Global Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Table 8: Global Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Table 9: Global Cold Storage Warehouse Market Value, by Region, US$ Bn, 2017-2031

Table 10: Global Cold Storage Warehouse Market Volume, by Region, Thousand Units,2017-2031

Table 11: North America Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Table 12: North America Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Table 13: North America Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Table 14: North America Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Table 15: North America Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Table 16: North America Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Table 17: North America Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Table 18: North America Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Table 19: North America Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Table 20: North America Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Table 21: Europe Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Table 22: Europe Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Table 23: Europe Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Table 24: Europe Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Table 25: Europe Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Table 26: Europe Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Table 27: Europe Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Table 28: Europe Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Table 29: Europe Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Table 30: Europe Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Table 31: Asia Pacific Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Table 32: Asia Pacific Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Table 33: Asia Pacific Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Table 34: Asia Pacific Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Table 35: Asia Pacific Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Table 36: Asia Pacific Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Table 37: Asia Pacific Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Table 38: Asia Pacific Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Table 39: Asia Pacific Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Table 40: Asia Pacific Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Table 41: Middle East & Africa Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Table 42: Middle East & Africa Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Table 43: Middle East & Africa Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Table 44: Middle East & Africa Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Table 45: Middle East & Africa Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Table 46: Middle East & Africa Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Table 47: Middle East & Africa Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Table 48: Middle East & Africa Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Table 49: Middle East & Africa Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Table 50: Middle East & Africa Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Table 51: South America Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Table 52: South America Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Table 53: South America Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Table 54: South America Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Table 55: South America Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Table 56: South America Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Table 57: South America Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Table 58: South America Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Table 59: South America Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Table 60: South America Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

List of Figures

Figure 1: Global Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Figure 2: Global Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Figure 3: Global Cold Storage Warehouse Market Incremental Opportunity, by Type, 2021-2031

Figure 4: Global Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Figure 5: Global Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Figure 6: Global Cold Storage Warehouse Market Incremental Opportunity, by Temperature, 2021-2031

Figure 7: Global Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Figure 8: Global Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Figure 9: Global Cold Storage Warehouse Market Incremental Opportunity, by Application, 2021-2031

Figure 10: Global Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Figure 11: Global Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Figure 12: Global Cold Storage Warehouse Market Incremental Opportunity, by End-user, 2021-2031

Figure 13: Global Cold Storage Warehouse Market Value, by Region, US$ Bn, 2017-2031

Figure 14: Global Cold Storage Warehouse Market Volume, by Region, Thousand Units,2017-2031

Figure 15: Global Cold Storage Warehouse Market Incremental Opportunity, by Region,2021-2031

Figure 16: North America Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Figure 17: North America Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Figure 18: North America Cold Storage Warehouse Market Incremental Opportunity, by Type, 2021-2031

Figure 19: North America Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Figure 20: North America Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Figure 21: North America Cold Storage Warehouse Market Incremental Opportunity, by Temperature, 2021-2031

Figure 22: North America Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Figure 23: North America Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Figure 24: North America Cold Storage Warehouse Market Incremental Opportunity, by Application, 2021-2031

Figure 25: North America Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Figure 26: North America Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Figure 27: North America Cold Storage Warehouse Market Incremental Opportunity, by End-user, 2021-2031

Figure 28: North America Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Figure 29: North America Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Figure 30: North America Cold Storage Warehouse Market Incremental Opportunity, by Country,2021-2031

Figure 31: Europe Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Figure 32: Europe Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Figure 33: Europe Cold Storage Warehouse Market Incremental Opportunity, by Type, 2021-2031

Figure 34: Europe Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Figure 35: Europe Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Figure 36: Europe Cold Storage Warehouse Market Incremental Opportunity, by Temperature, 2021-2031

Figure 37: Europe Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Figure 38: Europe Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Figure 39: Europe Cold Storage Warehouse Market Incremental Opportunity, by Application, 2021-2031

Figure 40: Europe Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Figure 41: Europe Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Figure 42: Europe Cold Storage Warehouse Market Incremental Opportunity, by End-user, 2021-2031

Figure 43: Europe Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Figure 44: Europe Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Figure 45: Europe Cold Storage Warehouse Market Incremental Opportunity, by Country,2021-2031

Figure 46: Middle East & Africa Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Figure 47: Middle East & Africa Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Figure 48: Middle East & Africa Cold Storage Warehouse Market Incremental Opportunity, by Type, 2021-2031

Figure 49: Middle East & Africa Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Figure 50: Middle East & Africa Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Figure 51: Middle East & Africa Cold Storage Warehouse Market Incremental Opportunity, by Temperature, 2021-2031

Figure 52: Middle East & Africa Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Figure 53: Middle East & Africa Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Figure 54: Middle East & Africa Cold Storage Warehouse Market Incremental Opportunity, by Application, 2021-2031

Figure 55: Middle East & Africa Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Figure 56: Middle East & Africa Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Figure 57: Middle East & Africa Cold Storage Warehouse Market Incremental Opportunity, by End-user, 2021-2031

Figure 58: Middle East & Africa Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Figure 59: Middle East & Africa Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Figure 60: Middle East & Africa Cold Storage Warehouse Market Incremental Opportunity, by Country,2021-2031

Figure 61: South America Cold Storage Warehouse Market Value, by Type, US$ Bn, 2017-2031

Figure 62: South America Cold Storage Warehouse Market Volume, by Type, Thousand Units,2017-2031

Figure 63: South America Cold Storage Warehouse Market Incremental Opportunity, by Type, 2021-2031

Figure 64: South America Cold Storage Warehouse Market Value, by Temperature, US$ Bn, 2017-2031

Figure 65: South America Cold Storage Warehouse Market Volume, by Temperature, Thousand Units,2017-2031

Figure 66: South America Cold Storage Warehouse Market Incremental Opportunity, by Temperature, 2021-2031

Figure 67: South America Cold Storage Warehouse Market Value, by Application, US$ Bn, 2017-2031

Figure 68: South America Cold Storage Warehouse Market Volume, by Application, Thousand Units,2017-2031

Figure 69: South America Cold Storage Warehouse Market Incremental Opportunity, by Application, 2021-2031

Figure 70: South America Cold Storage Warehouse Market Value, by End-user, US$ Bn, 2017-2031

Figure 71: South America Cold Storage Warehouse Market Volume, by End-user, Thousand Units,2017-2031

Figure 72: South America Cold Storage Warehouse Market Incremental Opportunity, by End-user, 2021-2031

Figure 73: South America Cold Storage Warehouse Market Value, by Country, US$ Bn, 2017-2031

Figure 74: South America Cold Storage Warehouse Market Volume, by Country, Thousand Units,2017-2031

Figure 75: South America Cold Storage Warehouse Market Incremental Opportunity, by Country,2021-2031