Analysts’ Viewpoint

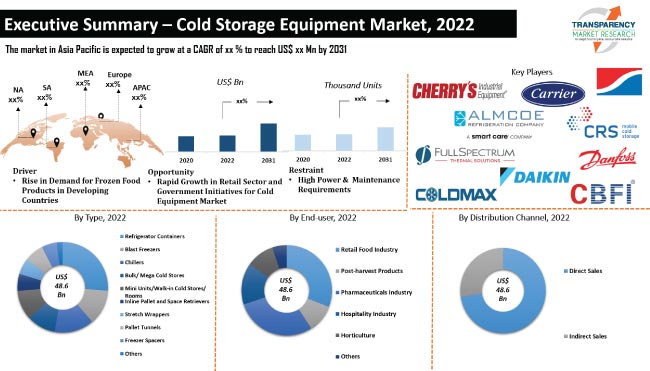

Surge in demand for frozen foods in emerging countries is a key factor driving the cold storage equipment market size. Growth in the medical industry, which needs to store a variety of laboratory samples, vaccines, and equipment, is also augmenting the demand for cold storage equipment.

Rise in government initiatives for cold chain development is projected to boost cold storage equipment business growth. Cold storage equipment companies are focusing on sustainability initiatives, smart warehousing, and Internet of Things (IOT) to increase their market share. They are expanding their presence in emerging markets, while continuing to focus on developed markets. Mergers and acquisitions, offering products at competitive prices, participating in trade shows and events, and B2B promotions are likely to further boost cold storage equipment business opportunities for key manufacturers.

Cold storage equipment is used to store perishable food products at low temperatures. These tools guard against food deterioration, cut down on waste, and guarantee adherence to food safety laws. The technique is also employed in high-tech electronics and petrochemical sectors due to the sensitivity of chemical reactions and metals to temperature changes.

Cold storage and temperature-controlled storage are used in lodging and dining establishments, the alcoholic beverage business, and forensic medical institutions. Cold storage equipment is available in different types such as commercial refrigerator containers, blast freezers, chiller, bulk/ mega cold stores, and cold rooms. Market statistics indicate that online purchase of refrigerated and frozen foods increased by 58% in 2021. Technological advancements in freezing equipment such as QFR (Quick Freezing Racks), RFID (wireless radio frequency identification), cross docking, and product picking have spurred market expansion.

Demand for cold storage has increased with population growth and demographic changes. Rise in demand for perishable foods such as fish, meat, and seafood in developing countries is a major factor boosting the demand for industrial refrigeration and freezing solutions. Furthermore, technological advancements in warehousing equipment, rise in health awareness among people, and high demand for specialty refrigeration units and temperature-controlled storage solutions for seafood, meat, and other perishable products are fueling market progress.

Energy-efficient cold storage solutions for perishable products such as food and medicine offer several benefits. They lower the deterioration rate of perishable foods and reduce the rate of chemical changes and growth of microorganism enzymes in foods. These storage solutions enable consumers to store food and medicine for extended periods of time for later use.

Ice boxes, blast freezers, chillers, warehouse refrigeration, and cold room shelving and storage systems are used to keep medicines and post-harvest produce as fresh as possible. Majority of refrigeration systems have settings to maintain optimal temperature. Seasonal fruits can only be grown for a limited number of months in a year. Cold storage technology helps these to last longer. These factors are leading to cold storage equipment market growth.

Surge in demand for cold storage equipment in the pharmaceutical sector can be ascribed to the importance of maintaining a certain temperature for drugs, whose efficiency can be disturbed by temperature fluctuations. Vaccines and medicines need to be stored at different temperatures. Cold storage warehouses have the capacity to meet these varied requirements. This is expected to fuel market development during the forecast period.

ULT (ultra-low temperature) freezers have become a necessity for organizations handling temperature-sensitive research specimens. Cold storage equipment helps safely preserve the cold supply chain for pharmaceutical, biotechnology, life sciences, and healthcare industries. Ultra-low temperature storage is critical to protect a broad range of biogenetic materials and biomolecules, such as cells and tissues, antibody proteins, and messenger RNA (mRNA), from denaturation and heat damage. Thus, technological advancements in the pharmaceutical sector are expected to create lucrative cold storage equipment market opportunities during the forecast period.

Based on type, the refrigerator containers segment is estimated to dominate the global cold storage equipment industry in the next few years.

The refrigerated cargo industry relies heavily on consistency and a fixed delivery schedule to maintain the temperature at a predetermined constant level during cargo transportation. This is augmenting the refrigerator containers segment.

According to the cold storage equipment market forecast, the retail food industry segment is anticipated to dominate in terms of end-user. Cold storage equipment market development has historically been aided by the explosive rise of retail chains such as supermarkets, hypermarkets, and convenience stores, particularly in developed markets such as Europe and North America.

Significant expansion of retail chains in developing countries such as India, Brazil, Argentina, the United Arab Emirates, and Saudi Arabia is also expected to provide attractive opportunities for cold storage equipment market growth during the forecast period.

North America held the largest cold storage equipment market share in 2022. Mexico, in particular, is expected to witness exponential growth in the North American market due to strengthening of the warehouse network and investment in development of logistics infrastructure. Recent migration patterns have generated more food & beverage demand in states such as Florida, Arizona, and Texas. These would also serve as key factors stimulating the cold storage equipment market demand in North America.

Countries such as China are transitioning to a consumer-driven economy. Hence, the market in Asia Pacific is expected to witness significant growth in the next few years. Developments in warehousing and refrigerated shipping and availability of government subsidies to develop the cold chain industry enable service providers to tap into these emerging markets and utilize innovative solutions that can overcome the complexities associated with shipping.

The global cold storage equipment market is consolidated, with a few large-scale vendors controlling majority of the share. Most firms are spending significantly on research and development activities, primarily to develop environment-friendly products.

Expansion of product portfolios and mergers and acquisitions are the strategies adopted by key players. Almcoe Refrigeration Company, Carrier Global Corporation, Cascade Thermal Solutions Inc., Cherry's Industrial Equipment Corp, COLDMAX, Daikin Industries, Ltd., Danfoss, Guangzhou Icesource Co., Ltd., Henry Schein, Inc., and CRS Mobile Cold Storage are the prominent entities operating in this market.

Each of these players has been profiled in the cold storage equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 48.6 Bn |

|

Market Value in 2031 |

US$ 84.3 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, brand analysis, and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 48.6 Bn in 2022.

It is anticipated to grow at a CAGR of 6.6% during 2023 to 2031.

It is likely to reach US$ 84.3 Bn in 2031.

The retail food industry is expected to dominate the global landscape during the forecast period.

North America is expected to account for the leading share during the forecast period.

Rise in demand for frozen food products in developing countries.

Almcoe Refrigeration Company, Carrier Global Corporation, Cascade Thermal Solutions Inc., Cherry's Industrial Equipment Corp, COLDMAX, Daikin Industries, Ltd., Danfoss, Guangzhou Icesource Co., Ltd., Henry Schein, Inc., and CRS Mobile Cold Storage.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Cold Storage Market Overview

5.4. Industry SWOT Analysis

5.5. Technology Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Regulatory Framework

5.10. Global Cold Storage Equipment Market Analysis and Forecast,

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global Cold Storage Equipment Market Analysis and Forecast, by Type

6.1. Global Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

6.1.1. Refrigerator Containers

6.1.2. Blast Freezers

6.1.3. Chillers

6.1.4. Bulk/ Mega Cold Stores

6.1.5. Mini Units/Walk-in Cold Stores/ Rooms

6.1.6. Inline Pallet and Space Retrievers

6.1.7. Stretch Wrappers

6.1.8. Pallet Tunnels

6.1.9. Freezer Spacers

6.1.10. Others

6.2. Incremental Opportunity, by Type

7. Global Cold Storage Equipment Market Analysis and Forecast, by End-user

7.1. Global Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

7.1.1. Retail Food Industry

7.1.2. Post-harvest Products

7.1.3. Pharmaceuticals Industry

7.1.4. Hospitality Industry

7.1.5. Horticulture

7.1.6. Others

7.2. Incremental Opportunity, by End-user

8. Global Cold Storage Equipment Market Analysis and Forecast, by Distribution Channel

8.1. Global Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

8.1.1. Direct Sales

8.1.2. Indirect Sales

8.2. Incremental Opportunity, by Distribution Channel

9. Global Cold Storage Equipment Market Analysis and Forecast, by Region

9.1. Global Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Cold Storage Equipment Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Key Trends Analysis

10.3.1. Supply Side

10.3.2. Demand Side

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

10.5.1. Refrigerator Containers

10.5.2. Blast Freezers

10.5.3. Chillers

10.5.4. Bulk/ Mega Cold Stores

10.5.5. Mini Units/Walk-in Cold Stores/ Rooms

10.5.6. Inline Pallet and Space Retrievers

10.5.7. Stretch Wrappers

10.5.8. Pallet Tunnels

10.5.9. Freezer Spacers

10.5.10. Others

10.6. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

10.6.1. Retail Food Industry

10.6.2. Post-harvest Products

10.6.3. Pharmaceuticals Industry

10.6.4. Hospitality Industry

10.6.5. Horticulture

10.6.6. Others

10.7. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.7.1. Direct Sales

10.7.2. Indirect Sales

10.8. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Cold Storage Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply Side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

11.5.1. Refrigerator Containers

11.5.2. Blast Freezers

11.5.3. Chillers

11.5.4. Bulk/ Mega Cold Stores

11.5.5. Mini Units/Walk-in Cold Stores/ Rooms

11.5.6. Inline Pallet and Space Retrievers

11.5.7. Stretch Wrappers

11.5.8. Pallet Tunnels

11.5.9. Freezer Spacers

11.5.10. Others

11.6. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

11.6.1. Retail Food Industry

11.6.2. Post-harvest Products

11.6.3. Pharmaceuticals Industry

11.6.4. Hospitality Industry

11.6.5. Horticulture

11.6.6. Others

11.7. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

11.7.1. Direct Sales

11.7.2. Indirect Sales

11.8. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Cold Storage Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply Side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

12.5.1. Refrigerator Containers

12.5.2. Blast Freezers

12.5.3. Chillers

12.5.4. Bulk/ Mega Cold Stores

12.5.5. Mini Units/Walk-in Cold Stores/ Rooms

12.5.6. Inline Pallet and Space Retrievers

12.5.7. Stretch Wrappers

12.5.8. Pallet Tunnels

12.5.9. Freezer Spacers

12.5.10. Others

12.6. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

12.6.1. Retail Food Industry

12.6.2. Post-harvest Products

12.6.3. Pharmaceuticals Industry

12.6.4. Hospitality Industry

12.6.5. Horticulture

12.6.6. Others

12.7. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.7.1. Direct Sales

12.7.2. Indirect Sales

12.8. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Cold Storage Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

13.5.1. Refrigerator Containers

13.5.2. Blast Freezers

13.5.3. Chillers

13.5.4. Bulk/ Mega Cold Stores

13.5.5. Mini Units/Walk-in Cold Stores/ Rooms

13.5.6. Inline Pallet and Space Retrievers

13.5.7. Stretch Wrappers

13.5.8. Pallet Tunnels

13.5.9. Freezer Spacers

13.5.10. Others

13.6. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

13.6.1. Retail Food Industry

13.6.2. Post-harvest Products

13.6.3. Pharmaceuticals Industry

13.6.4. Hospitality Industry

13.6.5. Horticulture

13.6.6. Others

13.7. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.7.1. Direct Sales

13.7.2. Indirect Sales

13.8. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Cold Storage Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

14.5.1. Refrigerator Containers

14.5.2. Blast Freezers

14.5.3. Chillers

14.5.4. Bulk/ Mega Cold Stores

14.5.5. Mini Units/Walk-in Cold Stores/ Rooms

14.5.6. Inline Pallet and Space Retrievers

14.5.7. Stretch Wrappers

14.5.8. Pallet Tunnels

14.5.9. Freezer Spacers

14.5.10. Others

14.6. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

14.6.1. Retail Food Industry

14.6.2. Post-harvest Products

14.6.3. Pharmaceuticals Industry

14.6.4. Hospitality Industry

14.6.5. Horticulture

14.6.6. Others

14.7. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.7.1. Direct Sales

14.7.2. Indirect Sales

14.8. Cold Storage Equipment Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2021)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Distribution channel overview, Business Strategies / Recent Developments]

15.3.1. Almcoe Refrigeration Company

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information

15.3.1.4. (Subject to Data Availability)

15.3.1.5. Distribution channel overview

15.3.1.6. Business Strategies / Recent Developments

15.3.2. Carrier Global Corporation

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information

15.3.2.4. (Subject to Data Availability)

15.3.2.5. Distribution channel overview

15.3.2.6. Business Strategies / Recent Developments

15.3.3. Cascade Thermal Solutions Inc.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information

15.3.3.4. (Subject to Data Availability)

15.3.3.5. Distribution channel overview

15.3.3.6. Business Strategies / Recent Developments

15.3.4. Cherry's Industrial Equipment Corp

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information

15.3.4.4. (Subject to Data Availability)

15.3.4.5. Distribution channel overview

15.3.4.6. Business Strategies / Recent Developments

15.3.5. COLDMAX

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information

15.3.5.4. (Subject to Data Availability)

15.3.5.5. Distribution channel overview

15.3.5.6. Business Strategies / Recent Developments

15.3.6. CRS Mobile Cold Storage

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information

15.3.6.4. (Subject to Data Availability)

15.3.6.5. Distribution channel overview

15.3.6.6. Business Strategies / Recent Developments

15.3.7. Daikin Industries, Ltd.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information

15.3.7.4. (Subject to Data Availability)

15.3.7.5. Distribution channel overview

15.3.7.6. Business Strategies / Recent Developments

15.3.8. Danfoss

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information

15.3.8.4. (Subject to Data Availability)

15.3.8.5. Distribution channel overview

15.3.8.6. Business Strategies / Recent Developments

15.3.9. Guangzhou Icesource Co., Ltd.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information

15.3.9.4. (Subject to Data Availability)

15.3.9.5. Distribution channel overview

15.3.9.6. Business Strategies / Recent Developments

15.3.10. Henry Schein, Inc.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information

15.3.10.4. (Subject to Data Availability)

15.3.10.5. Distribution channel overview

15.3.10.6. Business Strategies / Recent Developments

15.3.11. Midwest Scientific Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financial Information

15.3.11.4. (Subject to Data Availability)

15.3.11.5. Distribution channel overview

15.3.11.6. Business Strategies / Recent Developments

15.3.12. Raytechs World Technical Services LLC

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. Financial Information

15.3.12.4. (Subject to Data Availability)

15.3.12.5. Distribution channel overview

15.3.12.6. Business Strategies / Recent Developments

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Type

16.1.2. By End-user

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Understanding the Procurement Process of End-users

16.3. Preferred Sales & Marketing Strategy

List of Table

Table 1: Global Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Table 2: Global Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Table 3: Global Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Table 4: Global Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Table 5: Global Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 6: Global Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 7: Global Cold Storage Equipment Market Value, by Region, US$ Mn, 2017-2031

Table 8: Global Cold Storage Equipment Market Volume, by Region, thousand Units,2017-2031

Table 9: North America Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Table 10: North America Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Table 11: North America Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Table 12: North America Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Table 13: North America Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 14: North America Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 15: North America Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Table 16: North America Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Table 17: Europe Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Table 18: Europe Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Table 19: Europe Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Table 20: Europe Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Table 21: Europe Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 22: Europe Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 23: Europe Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Table 24: Europe Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Table 25: Asia Pacific Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Table 26: Asia Pacific Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Table 27: Asia Pacific Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Table 28: Asia Pacific Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Table 29: Asia Pacific Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 30: Asia Pacific Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 31: Asia Pacific Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Table 32: Asia Pacific Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Table 33: Middle East & Africa Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Table 34: Middle East & Africa Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Table 35: Middle East & Africa Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Table 36: Middle East & Africa Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Table 37: Middle East & Africa Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 38: Middle East & Africa Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 39: Middle East & Africa Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Table 40: Middle East & Africa Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Table 41: South America Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Table 42: South America Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Table 43: South America Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Table 44: South America Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Table 45: South America Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 46: South America Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 47: South America Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Table 48: South America Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

List of Figures

Figure 1: Global Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Figure 2: Global Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Figure 3: Global Cold Storage Equipment Market Incremental Opportunity, by Type, 2021-2031

Figure 4: Global Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Figure 5: Global Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Figure 6: Global Cold Storage Equipment Market Incremental Opportunity, by End-user, 2021-2031

Figure 7: Global Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 8: Global Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 9: Global Cold Storage Equipment Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 10: Global Cold Storage Equipment Market Value, by Region, US$ Mn, 2017-2031

Figure 11: Global Cold Storage Equipment Market Volume, by Region, thousand Units,2017-2031

Figure 12: Global Cold Storage Equipment Market Incremental Opportunity, by Region,2021-2031

Figure 13: North America Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Figure 14: North America Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Figure 15: North America Cold Storage Equipment Market Incremental Opportunity, by Type, 2021-2031

Figure 16: North America Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Figure 17: North America Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Figure 18: North America Cold Storage Equipment Market Incremental Opportunity, by End-user, 2021-2031

Figure 19: North America Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 20: North America Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 21: North America Cold Storage Equipment Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 22: North America Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Figure 23: North America Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Figure 24: North America Cold Storage Equipment Market Incremental Opportunity, by Country,2021-2031

Figure 25: Europe Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Figure 26: Europe Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Figure 27: Europe Cold Storage Equipment Market Incremental Opportunity, by Type, 2021-2031

Figure 28: Europe Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Figure 29: Europe Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Figure 30: Europe Cold Storage Equipment Market Incremental Opportunity, by End-user, 2021-2031

Figure 31: Europe Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 32: Europe Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 33: Europe Cold Storage Equipment Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 34: Europe Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Figure 35: Europe Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Figure 36: Europe Cold Storage Equipment Market Incremental Opportunity, by Country,2021-2031

Figure 37: Asia Pacific Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Figure 38: Asia Pacific Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Figure 39: Asia Pacific Cold Storage Equipment Market Incremental Opportunity, by Type, 2021-2031

Figure 40: Asia Pacific Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Figure 41: Asia Pacific Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Figure 42: Asia Pacific Cold Storage Equipment Market Incremental Opportunity, by End-user, 2021-2031

Figure 43: Asia Pacific Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 44: Asia Pacific Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 45: Asia Pacific Cold Storage Equipment Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 46: Asia Pacific Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Figure 47: Asia Pacific Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Figure 48: Asia Pacific Cold Storage Equipment Market Incremental Opportunity, by Country,2021-2031

Figure 49: Middle East & Africa Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Figure 50: Middle East & Africa Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Figure 51: Middle East & Africa Cold Storage Equipment Market Incremental Opportunity, by Type, 2021-2031

Figure 52: Middle East & Africa Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Figure 53: Middle East & Africa Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Figure 54: Middle East & Africa Cold Storage Equipment Market Incremental Opportunity, by End-user, 2021-2031

Figure 55: Middle East & Africa Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 56: Middle East & Africa Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 57: Middle East & Africa Cold Storage Equipment Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 58: Middle East & Africa Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Figure 59: Middle East & Africa Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Figure 60: Middle East & Africa Cold Storage Equipment Market Incremental Opportunity, by Country,2021-2031

Figure 61: South America Cold Storage Equipment Market Value, by Type, US$ Mn, 2017-2031

Figure 62: South America Cold Storage Equipment Market Volume, by Type, Thousand Units,2017-2031

Figure 63: South America Cold Storage Equipment Market Incremental Opportunity, by Type, 2021-2031

Figure 64: South America Cold Storage Equipment Market Value, by End-user, US$ Mn, 2017-2031

Figure 65: South America Cold Storage Equipment Market Volume, by End-user, Thousand Units,2017-2031

Figure 66: South America Cold Storage Equipment Market Incremental Opportunity, by End-user, 2021-2031

Figure 67: South America Cold Storage Equipment Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 68: South America Cold Storage Equipment Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 69: South America Cold Storage Equipment Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 70: South America Cold Storage Equipment Market Value, by Country, US$ Mn, 2017-2031

Figure 71: South America Cold Storage Equipment Market Volume, by Country, Thousand Units,2017-2031

Figure 72: South America Cold Storage Equipment Market Incremental Opportunity, by Country,2021-2031