Analyst Viewpoint

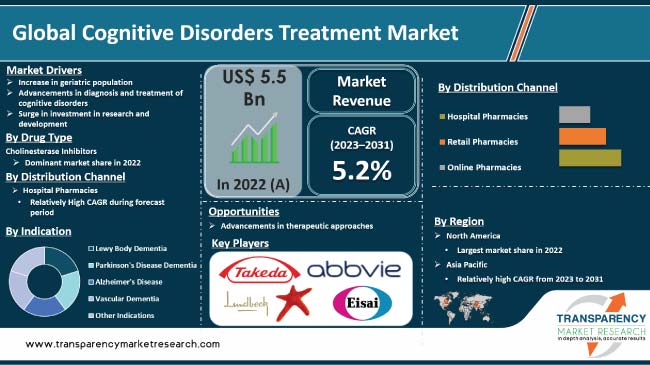

Technological advancements, increase in awareness, and evolving treatment modalities are driving the global market. Cognitive disorders encompass a spectrum of conditions affecting cognitive function, including but not limited to Alzheimer's disease, dementia, and attention-deficit/hyperactivity disorder (ADHD). Rise in the global geriatric population is another key factor driving market expansion. Furthermore, surge in investment in research and development is expected to bolster the global cognitive disorders treatment market size during the forecast period.

Advancements in therapeutic approaches offers lucrative opportunities to market players. Pharmaceutical companies are focusing on research & development to introduce novel cognitive disorder therapies in order to increase cognitive disorders treatment market share.

Cognitive disorders represent a spectrum of conditions characterized by impairment in cognitive functions, including memory, attention, language, and problem-solving. These disorders, such as Alzheimer's disease, Parkinson's disease, and vascular dementia, pose significant challenges to affected individuals and their caregivers.

The field of cognitive disorders treatment has witnessed a paradigm shift in the past few years, with a growing emphasis on multidisciplinary approaches and targeted interventions.

Pharmacological interventions are a cornerstone in the management of cognitive disorders. Advances in neuropharmacology have led to the development of medications targeting specific neurotransmitter systems implicated in cognitive function.

Cholinesterase inhibitors, such as donepezil, rivastigmine, and galantamine, have demonstrated efficacy in enhancing cognitive performance and mitigating symptom progression in Alzheimer's disease. Additionally, memantine, an NMDA receptor antagonist, has shown promise in managing moderate to severe cognitive impairment.

Ongoing research seeks to unravel the intricate neurobiological mechanisms underlying these disorders, paving the way for the development of novel therapeutic modalities. As the understanding of cognitive disorders deepens, integration of diverse treatment modalities offers hope for improving outcomes and enhancing the quality of life for individuals grappling with these challenging conditions.

Rise in prevalence of cognitive disorders has become a significant public health concern, with the geriatric population emerging as a pivotal driver of the global cognitive disorders treatment market demand.

As populations across the globe experience a demographic shift toward older age groups, the incidence of cognitive disorders, such as Alzheimer's disease and dementia, has witnessed a corresponding surge.

According to data from the World Health Organization (WHO), the global population aged 60 and above is projected to nearly double by 2050, reaching approximately 22% of the world's population. This demographic shift is particularly pronounced in developed nations, where aging is more rapid.

In the U.S., the Administration on Aging reports a substantial increase in the elderly population, with individuals aged 65 and older expected to comprise 21.7% of the population by 2040, up from 15.2% in 2016. This demographic segment is highly susceptible to cognitive disorders, with Alzheimer's disease affecting an estimated 5.8 million people in 2020.

In Europe, this pattern is mirrored, with Eurostat projecting that the percentage of people aged 65 and older is anticipated to reach 29.1% by 2050. Within this demographic cohort, the prevalence of dementia is anticipated to rise sharply, necessitating an intensified focus on cognitive disorder treatment and management.

These demographic shifts underline the imperative for sustained research and development in the cognitive disorders treatment market. As the aging population burgeons, innovative therapeutic interventions and pharmaceutical solutions, such as memory loss management and cognitive function enhancement, become paramount to address the escalating burden of cognitive disorders.

The landscape of cognitive disorders treatment has undergone a transformative shift, with advancements in diagnosis and treatment emerging as a pivotal driver of the market. Focus on precision medicine and technological innovations has ushered in a new era, fostering tailored therapeutic approaches for cognitive disorders, such as cognitive impairment therapy. This paradigm shift is not only reshaping patient outcomes, but also propelling the cognitive disorders treatment market demand.

In the past few years, breakthroughs in neuroimaging technologies have significantly enhanced diagnostic accuracy, allowing for early detection of cognitive disorders.

According to a report by the World Health Organization (WHO), advancements in brain imaging, such as positron emission tomography (PET) and functional magnetic resonance imaging (fMRI), have played a crucial role in unraveling the intricacies of cognitive disorders at a molecular and cellular level. This has enabled clinicians to make more informed treatment decisions, leading to improved patient outcomes.

The advent of biomarker discovery and analysis has further revolutionized the diagnostic landscape. Identification of specific biomarkers associated with cognitive disorders allows for early detection, enabling interventions at the pre-symptomatic stage.

Treatment modalities have also evolved in tandem with diagnostic advancements. Pharmaceutical interventions, including disease-modifying therapies, have witnessed a surge in development.

The shift toward advancements in diagnosis and treatment is driving global cognitive disorders treatment market growth. Integration of cutting-edge diagnostic technologies and development of targeted therapeutics underscore a promising trajectory for improving patient outcomes and advancing the overall landscape of cognitive disorders treatment.

The field of cognitive disorders treatment is witnessing profound transformation, attributed to increase in investment in research & development (R&D). The pivotal role of R&D in advancing therapeutic interventions for cognitive disorders has become a linchpin for market expansion and innovation.

Investment in R&D acts as a catalyst, propelling the global cognitive disorders treatment market by fostering a conducive environment for scientific exploration. These financial commitments are instrumental in supporting comprehensive research initiatives, ranging from the identification of novel biomarkers to the development of precision-targeted therapies.

The multifaceted nature of cognitive disorders necessitates a nuanced approach, and R&D investments empower researchers to explore diverse modalities, including pharmacological interventions, neuromodulation techniques, and cognitive rehabilitation strategies.

The growing investment landscape in R&D facilitates collaboration between academia, industry, and research institutions, fostering a robust ecosystem that accelerates the translation of scientific discoveries into tangible clinical applications.

This collaborative synergy not only expedites the drug development process, but also promotes the exploration of innovative diagnostic tools and personalized treatment approaches. The ripple effects of increased R&D investments are evident in the rapid expansion of the knowledge base surrounding cognitive disorders, enabling healthcare professionals to adopt more targeted and efficacious interventions.

North America accounted for the largest global cognitive disorders treatment market share in 2022. This is ascribed to robust research & development initiatives, led by leading pharmaceutical companies and academic institutions. The region's advanced healthcare infrastructure seamlessly integrates cutting-edge technologies, fostering efficient diagnosis and treatment.

Collaborations between industry giants and research entities facilitate knowledge exchange, driving accelerated advancements. High healthcare expenditure and increase in geriatric population are ascribed to North America’s market dominance.

According to cognitive disorders treatment market forecast, the industry in Asia Pacific is expected to grow at a rapid pace during the forecast period. This is ascribed to rise in prevalence of cognitive disorders among the geriatric population and increase in awareness and de-stigmatization of mental health issues.

Leading companies in the global cognitive disorders treatment market have adopted strategies such as merger & acquisition, collaborations, and new product launches in order to expand presence.

Eisai Co., Ltd., Novartis AG (Knight Therapeutics), Biogen, Inc., Takeda Pharmaceutical Company Limited, Dr. Reddy’s Laboratories Ltd., Adamas Pharmaceuticals, Inc., Allergan plc, Actavis plc, and H. Lundbeck A/S are the prominent players in the global cognitive disorders treatment market.

The cognitive disorders treatment market report profiles top players based on various factors such as company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 5.5 Bn |

| Forecast (Value) in 2031 | More than US$ 8.6 Bn |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.5 Bn in 2022

It is projected to reach more than US$ 8.6 Bn by 2031

The CAGR is anticipated to be 5.2% from 2023 to 2031

The Alzheimer's disease indication segment accounted for the largest share in 2022

North America is expected to a lucrative region during the forecast period.

Eisai Co., Ltd., Novartis AG (Knight Therapeutics), Biogen, Inc., Takeda Pharmaceutical Company Limited, Dr. Reddy’s Laboratories Ltd., Adamas Pharmaceuticals, Inc., Allergan plc, Actavis plc, and H. Lundbeck A/S.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cognitive Disorders Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cognitive Disorders Treatment Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Pipeline Analysis

5.3. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.4. COVID-19 Pandemic Impact on Industry

6. Global Cognitive Disorders Treatment Market Analysis and Forecast, By Indication

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Indication, 2017–2031

6.3.1. Lewy Body Dementia

6.3.2. Parkinson's Disease Dementia

6.3.3. Alzheimer's Disease

6.3.4. Vascular Dementia

6.3.5. Other indications

6.4. Market Attractiveness Analysis, By Indication

7. Global Cognitive Disorders Treatment Market Analysis and Forecast, By Drug Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Drug Type, 2017–2031

7.3.1. Cholinesterase Inhibitors

7.3.2. NMDA Antagonists & Combination Drugs

7.4. Market Attractiveness Analysis, By Drug Type

8. Global Cognitive Disorders Treatment Market Analysis and Forecast, By Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, By Distribution Channel

9. Global Cognitive Disorders Treatment Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, By Region

10. North America Cognitive Disorders Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Indication, 2017–2031

10.2.1. Lewy Body Dementia

10.2.2. Parkinson's Disease Dementia

10.2.3. Alzheimer's Disease

10.2.4. Vascular Dementia

10.2.5. Other Indications

10.3. Market Value Forecast, by Drug Type, 2017–2031

10.3.1. Cholinesterase Inhibitors

10.3.2. NMDA Antagonists & Combination Drugs

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Indication

10.6.2. By Drug Type

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Cognitive Disorders Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Indication, 2017–2031

11.2.1. Lewy Body Dementia

11.2.2. Parkinson's Disease Dementia

11.2.3. Alzheimer's Disease

11.2.4. Vascular Dementia

11.2.5. Other Indications

11.3. Market Value Forecast, by Drug Type, 2017–2031

11.3.1. Cholinesterase Inhibitors

11.3.2. NMDA Antagonists & Combination Drugs

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Indication

11.6.2. By Drug Type

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Cognitive Disorders Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Indication, 2017–2031

12.2.1. Lewy Body Dementia

12.2.2. Parkinson's Disease Dementia

12.2.3. Alzheimer's Disease

12.2.4. Vascular Dementia

12.2.5. Other Indications

12.3. Market Value Forecast, by Drug Type, 2017–2031

12.3.1. Cholinesterase Inhibitors

12.3.2. NMDA Antagonists & Combination Drugs

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Indication

12.6.2. By Drug Type

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Cognitive Disorders Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Indication, 2017–2031

13.2.1. Lewy Body Dementia

13.2.2. Parkinson's Disease Dementia

13.2.3. Alzheimer's Disease

13.2.4. Vascular Dementia

13.2.5. Other Indications

13.3. Market Value Forecast, by Drug Type, 2017–2031

13.3.1. Cholinesterase Inhibitors

13.3.2. NMDA Antagonists & Combination Drugs

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Indication

13.6.2. By Drug Type

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Cognitive Disorders Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Indication, 2017–2031

14.2.1. Lewy Body Dementia

14.2.2. Parkinson's Disease Dementia

14.2.3. Alzheimer's Disease

14.2.4. Vascular Dementia

14.2.5. Other Indications

14.3. Market Value Forecast, by Drug Type, 2017–2031

14.3.1. Cholinesterase Inhibitors

14.3.2. NMDA Antagonists & Combination Drugs

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Indication

14.6.2. By Drug Type

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Eisai Co., Ltd.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Novartis AG (Knight Therapeutics)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Biogen, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Takeda Pharmaceutical Company Limited

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Dr. Reddy’s Laboratories Ltd.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Adamas Pharmaceuticals, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Allergan plc

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Actavis plc

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. H. Lundbeck A/S

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

List of Tables

Table 01: Global Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017‒2031

Table 02: Global Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 03: Global Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017‒2031

Table 06: North America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, By Indication, 2017–2031

Table 07: North America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, By Distribution Channel, 2017–2031

Table 08: North America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017‒2031

Table 10: Europe Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, By Indication, 2017–2031

Table 11: Europe Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, By Distribution Channel, 2017–2031

Table 12: Europe Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017‒2031

Table 14: Asia Pacific Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Asia Pacific Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Asia Pacific Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017‒2031

Table 18: Latin America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, By Indication, 2017–2031

Table 19: Latin America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, By Distribution Channel, 2017–2031

Table 20: Latin America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017‒2031

Table 22: Middle East & Africa Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Middle East & Africa Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 24: Middle East & Africa Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Cognitive Disorders Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 02: Global Cognitive Disorders Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 03: Global Cognitive Disorders Treatment Market Value Share Analysis, By Indication, 2022 and 2031

Figure 04: Global Cognitive Disorders Treatment Market Attractiveness Analysis, By Indication, 2023–2031

Figure 05: Global Cognitive Disorders Treatment Market Value Share Analysis, By Distribution Channel, 2022 and 2031

Figure 06: Global Cognitive Disorders Treatment Market Attractiveness Analysis, By Distribution Channel, 2023–2031

Figure 07: Global Cognitive Disorders Treatment Market Value Share Analysis, by Region, 2022 and 2031

Figure 08: Global Cognitive Disorders Treatment Market Attractiveness Analysis, by Region, 2023–2031

Figure 09: North America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: North America Cognitive Disorders Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 11: North America Cognitive Disorders Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 12: North America Cognitive Disorders Treatment Market Value Share Analysis, By Indication, 2022 and 2031

Figure 13: North America Cognitive Disorders Treatment Market Attractiveness Analysis, By Indication, 2023–2031

Figure 14: North America Cognitive Disorders Treatment Market Value Share Analysis, By Distribution Channel, 2022 and 2031

Figure 15: North America Cognitive Disorders Treatment Market Attractiveness Analysis, By Distribution Channel, 2023–2031

Figure 16: North America Cognitive Disorders Treatment Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Cognitive Disorders Treatment Market Attractiveness Analysis, by Country, 2023–2031

Figure 18: Europe Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 19: Europe Cognitive Disorders Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 20: Europe Cognitive Disorders Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 21: Europe Cognitive Disorders Treatment Market Value Share Analysis, By Indication, 2022 and 2031

Figure 22: Europe Cognitive Disorders Treatment Market Attractiveness Analysis, By Indication, 2023–2031

Figure 23: Europe Cognitive Disorders Treatment Market Value Share Analysis, By Distribution Channel, 2022 and 2031

Figure 24: Europe Cognitive Disorders Treatment Market Attractiveness Analysis, By Distribution Channel, 2023–2031

Figure 25: Europe Cognitive Disorders Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Europe Cognitive Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Asia Pacific Cognitive Disorders Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 29: Asia Pacific Cognitive Disorders Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 30: Asia Pacific Cognitive Disorders Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 31: Asia Pacific Cognitive Disorders Treatment Market Attractiveness Analysis, by Indication, 2023–2031

Figure 32: Asia Pacific Cognitive Disorders Treatment Market Value Share Analysis, By Distribution Channel, 2022 and 2031

Figure 33: Asia Pacific Cognitive Disorders Treatment Market Attractiveness Analysis, By Distribution Channel, 2023–2031

Figure 34: Asia Pacific Cognitive Disorders Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Asia Pacific Cognitive Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Latin America Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Latin America Cognitive Disorders Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 38: Latin America Cognitive Disorders Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 39: Latin America Cognitive Disorders Treatment Market Value Share Analysis, By Indication, 2022 and 2031

Figure 40: Latin America Cognitive Disorders Treatment Market Attractiveness Analysis, By Indication, 2023–2031

Figure 41: Latin America Cognitive Disorders Treatment Market Value Share Analysis, By Distribution Channel, 2022 and 2031

Figure 42: Latin America Cognitive Disorders Treatment Market Attractiveness Analysis, By Distribution Channel, 2023–2031

Figure 43: Latin America Cognitive Disorders Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Latin America Cognitive Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Middle East & Africa Cognitive Disorders Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Middle East & Africa Cognitive Disorders Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 47: Middle East & Africa Cognitive Disorders Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 48: Middle East & Africa Cognitive Disorders Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 49: Middle East & Africa Cognitive Disorders Treatment Market Attractiveness Analysis, by Indication, 2023–2031

Figure 50: Middle East & Africa Cognitive Disorders Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 51: Middle East & Africa Cognitive Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 52: Middle East & Africa Cognitive Disorders Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 53: Middle East & Africa Cognitive Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Global Cognitive Disorders Treatment Market Share Analysis, by Company, 2022