Global Cloud Service Brokerage Market: Snapshot

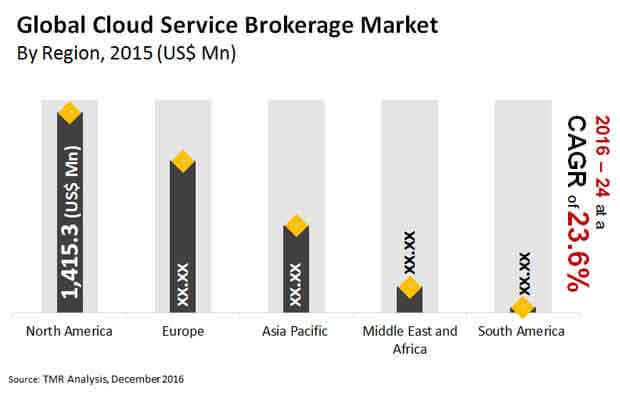

Cloud service brokers act as the middlemen or the link between cloud service providers and consumers. These are organizations that assist the users with selecting the appropriate services that meet their requirements on a long-term basis. In recent years, the global cloud service brokerage market has been facing soaring demand due to the relentless uptake of cloud services by several industrial verticals. The research report states that the global cloud service brokerage market is expected to be worth US$22.4 bn by the end of 2024 as compared to US$3.3 bn in 2015. Between the forecast years of 2016 and 2024, the global market is expected to progress at a CAGR of 23.6%.

Pressing Need to Manage Data Effectively Encourages Uptake of Services Offered by Cloud Service Brokers

Analysts anticipate that the global cloud service brokerage market is likely to grow against the backdrop of the pressing need for better cloud service providers and integrators to achieve cost-effectiveness in business operations. Furthermore, the growing requirements of simplified deployment and troubleshooting are also expected to boost the market’s growth in the coming years. The only roadblock in the development of the global market is the fact that the global market is still in its nascent stage, which means fewer users are aware of the advantages it can offer.

North America to Remain at Forefront as Region Embraces Technological Advancements

On the basis of regions, the global cloud service brokerage market is segmented into North America, South America, the Middle East and Africa, Asia Pacific, and Europe. Of these, North America is expected to dominate the global market in the coming years due to the strong presence of a large number of cloud service brokers and the existing data centers in the region. The rapid adoption of cloud services in the region due to notable advancements in technology is expected to keep North America at the forefront in the global market.

Europe too is expected to make a significant mark in the global cloud service brokerage market due to increasing awareness about the benefits of deploying cloud services and using cloud service brokers in various organizations. Thus, the demand for cloud services and data centers in the region in expected to create a positive outlook for this regional market.

Telecom and IT Sector becomes Key Contributor to Rising Revenue of Global Market

The various end users of cloud service brokers are sectors such as the healthcare, telecom and IT, retail, government, energy, and BFSI among others, Out of these, the telecom and IT segment was the key contributor to the rising revenue of the global market in 2015. This segment is expected to show steady growth in the coming years due to the accelerated adoption of cloud services. The increasing complexity and volume of data and the need to manage it efficiently are also driving the telecom and IT segment to use services offered by cloud service brokers. In the coming years, the BFSI segment will follow the IT and telecom segment’s lead as the sector will look for ways to minimize costs of data handling.

The key players operating in the global cloud services brokerage market are Capgemini S.A., Jamcracker, Inc., ComputeNext Inc., Accenture plc, Cognizant Technology Solutions Corporation, Nephos Technologies Ltd, NEC Corporation, Green Cloud Technologies, LLC, Appirio, Inc., Blue Wolf Group LLC, Dell Inc., and Cloud Sherpas, Inc. Currently, the market faces a high degree of competition due to the presence of several large players in the market.

Cloud Service Brokerage Market to Rise Remarkably Owing to Increasing Interest for Processed Utilization of Innovation

Cloud service representatives go about as the agents or the connection between cloud service suppliers and customers. These are associations that help the clients with choosing the proper services that meet their prerequisites on a drawn out premise. Lately, the worldwide cloud service brokerage market has been confronting taking off request because of the tenacious take-up of cloud services by a few modern verticals.

Internationally the interest for cloud services has developed massively on the grounds that there is remarkable ascent in the interest for innovation based services. Territories like IT and telecom, banking and funds, medical care, retail, energy, and government area are currently utilizing trend setting innovations at an enormous degree. Along these lines, a cloud service brokerage association helps clients or the clients to pick right services and give customization among different services and programming. Cloud services are profoundly alluring as they aid customization of cloud services, sending, and mix of different cloud services according to the requirement. The developing interest for half breed cloud model has likewise fuelled interest for cloud service brokerage around the world.

Alternately, the absence of mindfulness about advantages of utilizing cloud services may restrict the market's direction. As the market is in its incipient stage the employments of the cloud services is as yet unclear. Individuals actually really like to work customarily particularly in immature locales, which may remain as a barricade for the market to develop at its maximum capacity. Notwithstanding, augmenting infiltration of web and progressed utilization of innovation will decrease the impact of these restrictions. Low capital use and ease are likewise driving the interest for cloud service brokerage market.

The need to discover new cloud services suppliers and integrators, alongside the requirement for help, investigating, and improved on organization has contributed fundamentally towards the cloud service brokerage market as cloud service brokerage tends to these worries. Coordinating cloud-based arrangements with big business processing foundation is slowly getting mind boggling. This is prompting a developing interest in appropriation of cloud service brokerage for little, medium, and huge undertakings as cloud service brokerage aids the simple acknowledgment of the cloud in ventures with thorough information insurance needs. Notwithstanding, inferable from the beginning condition of the cloud service brokerage market, there is an absence of mindfulness among little and medium measured ventures with respect to the presence and advantages of the market. This is required to prevent the development of the cloud service brokerage market during the estimate time frame.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Cloud Brokerage Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Key Trends

4.4. Global Cloud Brokerage Market Analysis and Forecasts, 2014 – 2024

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

4.6. Eco-System Analysis

4.7. Market Outlook

5. Global Cloud Brokerage Market Analysis and Forecast, by Enterprise Size

5.1. Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size Forecast by Enterprise Size, 2014 - 2024 (US$ Mn)

5.4.1. Small and Medium Enterprises (SMEs)

5.4.2. Large Enterprises

5.5. Enterprise size comparison matrix

5.6. Market Attractiveness by Enterprise Size

6. Global Cloud Brokerage Market Analysis and Forecast, by Services

6.1. Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size Forecast by Services, 2014 - 2024 (US$ Mn)

6.4.1. Cloud Service Aggregation

6.4.2. Cloud Service Integration

6.4.3. Cloud Service Customization

6.5. Services comparison matrix

6.6. Market Attractiveness By Services

7. Global Cloud Brokerage Market Analysis and Forecast, by Solution

7.1. Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Size Forecast by Solution, 2014 - 2024 (US$ Mn)

7.4.1. Technology Enablement

7.4.2. Service

7.4.2.1. By Enabler

7.4.2.2. By Provider

7.5. Solution comparison matrix

7.6. Market Attractiveness by solution

8. Global Cloud Brokerage Market Analysis and Forecast, By End-use Industry

8.1. Definition

8.2. Key Findings / Developments

8.3. Key Trends

8.4. Market Size Forecast by End-use Vertical, 2014 - 2024 (US$ Mn)

8.4.1. BFSI

8.4.2. Telecom and IT

8.4.3. Health care

8.4.4. Retail

8.4.5. Government

8.4.6. Energy

8.4.7. Others

8.5. End- use Vertical comparison matrix

8.6. Market Attractiveness By End-use Vertical

9. Global Cloud Brokerage Market Analysis and Forecast, By Region

9.1. Key Findings / Developments

9.2. Key Trends

9.3. Market Size Forecast by Region, 2014 – 2024 (US$ Mn)

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Middle East and Africa

9.3.5. South America

9.4. Market Attractiveness By Region

10. North America Cloud Brokerage Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Market Size Forecast by Enterprise Size, 2014 - 2024 (US$ Mn)

10.3.1. Small and Medium Enterprises

10.3.2. Large Enterprises

10.4. Market Size Forecast by Services, 2014 - 2024 (US$ Mn)

10.4.1. Cloud Service Aggregation

10.4.2. Cloud Service Integration

10.4.3. Cloud Service Customization

10.5. Market Size Forecast by Solution, 2014 - 2024 (US$ Mn)

10.5.1. Technology Enablement

10.5.2. Service

10.5.2.1. By Enabler

10.5.2.2. By Provider

10.6. Market Size Forecast by End-use Industry, 2014 - 2024 (US$ Mn)

10.6.1. BFSI

10.6.2. Telecom and IT

10.6.3. Health care

10.6.4. Retail

10.6.5. Government

10.6.6. Energy

10.6.7. Others

10.7. Market Size Forecast by Country, 2014 – 2024 (US$ Mn)

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Enterprise Size

10.8.2. By Service Type

10.8.3. By Solution

10.8.4. By End-use Industry

10.8.5. By Country

11. Europe Cloud Brokerage Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Market Size Forecast by Enterprise Size, 2014 - 2024 (US$ Mn)

11.3.1. Small and Medium Enterprises (SMEs)

11.3.2. Large Enterprises

11.4. Market Size Forecast by Services, 2014 - 2024 (US$ Mn)

11.4.1. Cloud Service Aggregation

11.4.2. Cloud Service Integration

11.4.3. Cloud Service Customization

11.5. Market Size Forecast by Solution, 2014 - 2024 (US$ Mn)

11.5.1. Technology Enablement

11.5.2. Service

11.5.2.1. By Enabler

11.5.2.2. By Provider

11.6. Market Size Forecast by End-use Industry, 2014 - 2024 (US$ Mn)

11.6.1. BFSI

11.6.2. Telecom and IT

11.6.3. Health care

11.6.4. Retail

11.6.5. Government

11.6.6. Energy

11.6.7. Others

11.7. Market Size Forecast by Country, 2014 – 2024 (US$ Mn)

11.7.1. The U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Italy

11.7.5. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Enterprise Size

11.8.2. By Service Type

11.8.3. By Solution

11.8.4. By End-use Industry

11.8.5. By Country

12. Asia Pacific Cloud Brokerage Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Market Size Forecast by Enterprise Size, 2014 - 2024 (US$ Mn)

12.3.1. Small and Medium Enterprises (SMEs)

12.3.2. Large Enterprises

12.4. Market Size Forecast by Services, 2014 - 2024 (US$ Mn)

12.4.1. Cloud Service Aggregation

12.4.2. Cloud Service Integration

12.4.3. Cloud Service Customization

12.5. Market Size Forecast by Solution, 2014 - 2024 (US$ Mn)

12.5.1. Technology Enablement

12.5.2. Service

12.5.2.1. By Enabler

12.5.2.2. By Provider

12.6. Market Size Forecast by End-use Industry, 2014 - 2024 (US$ Mn)

12.6.1. BFSI

12.6.2. Telecom and IT

12.6.3. Health care

12.6.4. Retail

12.6.5. Government

12.6.6. Energy

12.6.7. Others

12.7. Market Size Forecast Market Size Forecast by Country, 2014 – 2024 (US$ Mn)

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Enterprise Size

12.8.2. By Service Type

12.8.3. By Solution

12.8.4. By End-use Industry

12.8.5. By Country

13. Middle East and Africa (MEA) Cloud Brokerage Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Market Size Forecast by Enterprise Size, 2014 - 2024 (US$ Mn)

13.3.1. Small and Medium Enterprises (SMEs)

13.3.2. Large Enterprises

13.4. Market Size Forecast by Services, 2014 - 2024 (US$ Mn)

13.4.1. Cloud Service Aggregation

13.4.2. Cloud Service Integration

13.4.3. Cloud Service Customization

13.5. Market Size Forecast by Solution, 2014 - 2024 (US$ Mn)

13.5.1. Technology Enablement

13.5.2. Service

13.5.2.1. By Enabler

13.5.2.2. By Provider

13.6. Market Size Forecast by End-use Industry, 2014 - 2024 (US$ Mn)

13.6.1. BFSI

13.6.2. Telecom and IT

13.6.3. Health care

13.6.4. Retail

13.6.5. Government

13.6.6. Energy

13.6.7. Others

13.7. Market Size Forecast by Country, 2014 – 2024 (US$ Mn)

13.7.1. UAE

13.7.2. South Africa

13.7.3. Rest of MEA

13.8. Market Attractiveness Analysis

13.8.1. By Enterprise Size

13.8.2. By Service Type

13.8.3. By Solution

13.8.4. By End-use Industry

13.8.5. By Country

14. South America Cloud Brokerage Market Analysis and Forecast

14.1. Key Findings

14.2. Key Trends

14.3. Market Size Forecast by Enterprise Size, 2014 - 2024 (US$ Mn)

14.3.1. Small and Medium Enterprises (SMEs)

14.3.2. Large Enterprises

14.4. Market Size Forecast by Services, 2014 - 2024 (US$ Mn)

14.4.1. Cloud Service Aggregation

14.4.2. Cloud Service Integration

14.4.3. Cloud Service Customization

14.5. Market Size Forecast by Solution, 2014 - 2024 (US$ Mn)

14.5.1. Technology Enablement

14.5.2. Service

14.5.2.1. By Enabler

14.5.2.2. By Provider

14.6. Market Size Forecast by End-use Industry, 2014 - 2024 (US$ Mn)

14.6.1. BFSI

14.6.2. Telecom and IT

14.6.3. Health care

14.6.4. Retail

14.6.5. Government

14.6.6. Energy

14.6.7. Others

14.7. Market Size Forecast by Country, 2014 – 2024 (US$ Mn)

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Enterprise Size

14.8.2. By Service Type

14.8.3. By Solution

14.8.4. By End-use Industry

14.8.5. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (by Tier and Size of companies)

15.2. Market Share Analysis by Company (2015)

15.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

15.3.1. CapGemini S.A

15.3.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.1.2. Company Description

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Jamcracker, Inc.

15.3.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.2.2. Company Description

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. ComputeNext Inc.

15.3.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.3.2. Company Description

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Accenture plc

15.3.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.4.2. Company Description

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Cognizant Technology Solutions Corporation

15.3.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.5.2. Company Description

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Nephos Technologies Ltd.

15.3.6.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.6.2. Company Description

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. NEC Corporation

15.3.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.7.2. Company Description

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Green Cloud Technologies, LLC

15.3.8.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.8.2. Company Description

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Appirio, Inc.

15.3.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.9.2. Company Description

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Blue Wolf Group LLC

15.3.10.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.10.2. Company Description

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Dell Inc.

15.3.11.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.11.2. Company Description

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. Cloud Sherpas, Inc.

15.3.12.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

15.3.12.2. Company Description

15.3.12.3. SWOT Analysis

15.3.12.4. Strategic Overview

16. Key Takeaways

List of Tables

Table 1 Global Cloud Service Brokerage Market Forecast, By Enterprise Size, 2014–2024 (US$ Mn)

Table 2 Global Cloud Service Brokerage Market Forecast, By Services, 2014–2024 (US$ Mn)

Table 3 Global Cloud Service Brokerage Market Forecast, By Solution, 2014–2024 (US$ Mn)

Table 4 Global Cloud Service Brokerage Market Forecast, By Service, 2014–2024 (US$ Mn)

Table 5 Global Cloud Service Brokerage Market Forecast, By End-use Vertical, 2014–2024 (US$ Mn)

Table 6 Global Cloud Service Brokerage Market Forecast, By Region, 2014–2024 (US$ Mn)

Table 7 North America Cloud Service Brokerage Market Forecast, By Enterprise Size, 2014–2024 (US$ Mn)

Table 8 North America Cloud Service Brokerage Market Forecast, By Services, 2014–2024 (US$ Mn)

Table 9 North America Cloud Service Brokerage Market Forecast, By Solution, 2014–2024 (US$ Mn)

Table 10 North America Cloud Service Brokerage Market Forecast, By Service, 2014–2024 (US$ Mn)

Table 11 North America Cloud Service Brokerage Market Forecast, By End-use Vertical, 2014–2024 (US$ Mn)

Table 12 North America Cloud Service Brokerage Market Forecast, By Country, 2014–2024 (US$ Mn)

Table 13 Europe Cloud Service Brokerage Market Forecast, By Enterprise Size, 2014–2024 (US$ Mn)

Table 14 Europe Cloud Service Brokerage Market Forecast, By Services, 2014–2024 (US$ Mn)

Table 15 Europe Cloud Service Brokerage Market Forecast, By Solution, 2014–2024 (US$ Mn)

Table 16 Europe Cloud Service Brokerage Market Forecast, By Service, 2014–2024 (US$ Mn)

Table 17 Europe Cloud Service Brokerage Market Forecast, By End-use Vertical, 2014–2024 (US$ Mn)

Table 18 Europe Cloud Service Brokerage Market Forecast, By Country, 2014–2024 (US$ Mn)

Table 19 Asia Pacific Cloud Service Brokerage Market Forecast, By Enterprise Size, 2014–2024 (US$ Mn)

Table 20 Asia Pacific Cloud Service Brokerage Market Forecast, By Services, 2014–2024 (US$ Mn)

Table 21 Asia Pacific Cloud Service Brokerage Market Forecast, By Solution, 2014–2024 (US$ Mn)

Table 22 Asia Pacific Cloud Service Brokerage Market Forecast, By Service, 2014–2024 (US$ Mn)

Table 23 Asia Pacific Cloud Service Brokerage Market Forecast, By End-use Vertical, 2014–2024 (US$ Mn)

Table 24 Asia Pacific Cloud Service Brokerage Market Forecast, By Country, 2014–2024 (US$ Mn)

Table 25 MEA Cloud Service Brokerage Market Forecast, By Enterprise Size, 2014–2024 (US$ Mn)

Table 26 MEA Cloud Service Brokerage Market Forecast, By Services, 2014–2024 (US$ Mn)

Table 27 MEA Cloud Service Brokerage Market Forecast, By Solution, 2014–2024 (US$ Mn)

Table 28 MEA Cloud Service Brokerage Market Forecast, By Service, 2014–2024 (US$ Mn)

Table 29 MEA Cloud Service Brokerage Market Forecast, By End-use Vertical, 2014–2024 (US$ Mn)

Table 30 MEA Cloud Service Brokerage Market Forecast, By Country, 2014–2024 (US$ Mn)

Table 31 South America Cloud Service Brokerage Market Forecast, By Enterprise Size, 2014–2024 (US$ Mn)

Table 32 South America Cloud Service Brokerage Market Forecast, By Services, 2014–2024 (US$ Mn)

Table 33 South America Cloud Service Brokerage Market Forecast, By Solution, 2014–2024 (US$ Mn)

Table 34 South America Cloud Service Brokerage Market Forecast, By Service, 2014–2024 (US$ Mn)

Table 35 South America Cloud Service Brokerage Market Forecast, By End-use Vertical, 2014–2024 (US$ Mn)

Table 36 South America Cloud Service Brokerage Market Forecast, By Country, 2014–2024 (US$ Mn)

List of Figures

Figure 1 Market Revenue Projections, 2014 - 2024 (US$ Mn)

Figure 2 Eco-system Analysis

Figure 3 Market Value Share (Revenue) By Enterprise Size (2016)

Figure 5 Market Value Share (Revenue) By Services (2016)

Figure 4 Market Value Share (Revenue) By End-use Vertical (2016)

Figure 6 Market Value (Revenue) Share By Geography (2016)

Figure 7 Global Cloud Service Brokerage Market Value Share Analysis, By Enterprise Size, 2016 and 2024

Figure 8 SME Graph

Figure 9 Large Enterprise Graph

Figure 10 Cloud Service Brokerage Comparison Matrix, By Enterprise Size

Figure 11 Cloud Service Brokerage Market Attractiveness Analysis, By Enterprise Size

Figure 12 Global Cloud Service Brokerage Market Value Share Analysis, By Services, 2016 and 2024

Figure 13 Cloud Service Aggregation Graph

Figure 14 Cloud Service Integration Graph

Figure 15 Cloud Service Customization Graph

Figure 16 Cloud Service Brokerage Comparison Matrix, By Services

Figure 17 Cloud Service Brokerage Market Attractiveness Analysis, By Services

Figure 18 Global Cloud Service Brokerage Market Value Share Analysis, By Solution, 2016 and 2024

Figure 19 Technology Enablement Graph

Figure 20 Service Graph

Figure 21 Cloud Service Brokerage Comparison Matrix, By Solution

Figure 22 Cloud Service Brokerage Market Attractiveness Analysis, By Solution

Figure 23 Global Cloud Service Brokerage Market Value Share Analysis, By End-use Vertical, 2016 and 2024

Figure 24 BFSI Graph

Figure 25 Telecom & IT Graph

Figure 26 Healthcare Graph

Figure 27 Retail Graph

Figure 28 Government Graph

Figure 29 Energy Graph

Figure 30 Others Graph

Figure 31 Cloud Service Brokerage Comparison Matrix, By End-use Vertical

Figure 32 Cloud Service Brokerage Market Attractiveness Analysis, By End-use Vertical

Figure 33 Cloud Service Brokerage Market CAGR (2016 – 2024) Analysis, By Country

Figure 34 Cloud Service Brokerage Market Attractiveness Analysis, By Region

Figure 35 North America Cloud Service Brokerage Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2024

Figure 36 North America Cloud Service Brokerage Market Value Share Analysis, By Enterprise Size, 2016 and 2024

Figure 37 North America Cloud Service Brokerage Market Value Share Analysis, By Services, 2016 and 2024

Figure 38 North America Cloud Service Brokerage Market Value Share Analysis, By Solution, 2016 and 2024

Figure 39 North America Cloud Service Brokerage Market Value Share Analysis, By End-use Vertical, 2016 and 2024

Figure 40 North America Cloud Service Brokerage Market Value Share Analysis, By Country, 2016 and 2024

Figure 41 North America Cloud Service Brokerage Market Attractiveness Analysis, By Enterprise Size

Figure 42 North America Cloud Service Brokerage Market Attractiveness Analysis, By Services

Figure 43 North America Cloud Service Brokerage Market Attractiveness Analysis, By Solution

Figure 44 North America Cloud Service Brokerage Market Attractiveness Analysis, By Country

Figure 45 North America Cloud Service Brokerage Market Attractiveness Analysis, By End-use Vertical

Figure 46 Europe Cloud Service Brokerage Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2024

Figure 47 Europe Cloud Service Brokerage Market Value Share Analysis, By Enterprise Size, 2016 and 2024

Figure 48 Europe Cloud Service Brokerage Market Value Share Analysis, By Services, 2016 and 2024

Figure 49 Europe Cloud Service Brokerage Market Value Share Analysis, By Solution, 2016 and 2024

Figure 50 Europe Cloud Service Brokerage Market Value Share Analysis, By End-use Vertical, 2016 and 2024

Figure 51 Europe Cloud Service Brokerage Market Value Share Analysis, By Country, 2016 and 2024

Figure 52 Europe Cloud Service Brokerage Market Attractiveness Analysis, By Enterprise Size

Figure 53 Europe Cloud Service Brokerage Market Attractiveness Analysis, By Services

Figure 54 Europe Cloud Service Brokerage Market Attractiveness Analysis, By Solution

Figure 55 Europe Cloud Service Brokerage Market Attractiveness Analysis, By Country

Figure 56 Europe Cloud Service Brokerage Market Attractiveness Analysis, By End-use Vertical

Figure 57 Asia Pacific Cloud Service Brokerage Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2024

Figure 58 Asia Pacific Cloud Service Brokerage Market Value Share Analysis, By Enterprise Size, 2016 and 2024

Figure 59 Asia Pacific Cloud Service Brokerage Market Value Share Analysis, By Services, 2016 and 2024

Figure 60 Asia Pacific Cloud Service Brokerage Market Value Share Analysis, By Solution, 2016 and 2024

Figure 61 Asia Pacific Cloud Service Brokerage Market Value Share Analysis, By End-use Vertical, 2016 and 2024

Figure 62 Asia Pacific Cloud Service Brokerage Market Value Share Analysis, By Country, 2016 and 2024

Figure 63 Asia Pacific Cloud Service Brokerage Market Attractiveness Analysis, By Enterprise Size

Figure 64 Asia Pacific Cloud Service Brokerage Market Attractiveness Analysis, By Services

Figure 65 Asia Pacific Cloud Service Brokerage Market Attractiveness Analysis, By Solution

Figure 66 Asia Pacific Cloud Service Brokerage Market Attractiveness Analysis, By Country

Figure 67 Asia Pacific Cloud Service Brokerage Market Attractiveness Analysis, By End-use Vertical

Figure 68 MEA Cloud Service Brokerage Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2024

Figure 69 MEA Cloud Service Brokerage Market Value Share Analysis, By Enterprise Size, 2016 and 2024

Figure 70 MEA Cloud Service Brokerage Market Value Share Analysis, By Services, 2016 and 2024

Figure 71 MEA Cloud Service Brokerage Market Value Share Analysis, By Solution, 2016 and 2024

Figure 72 MEA Cloud Service Brokerage Market Value Share Analysis, By End-use Vertical, 2016 and 2024

Figure 73 MEA Cloud Service Brokerage Market Value Share Analysis, By Country, 2016 and 2024

Figure 74 MEA Cloud Service Brokerage Market Attractiveness Analysis, By Enterprise Size

Figure 75 MEA Cloud Service Brokerage Market Attractiveness Analysis, By Services

Figure 76 MEA Cloud Service Brokerage Market Attractiveness Analysis, By Solution

Figure 77 MEA Cloud Service Brokerage Market Attractiveness Analysis, By Country

Figure 78 MEA Cloud Service Brokerage Market Attractiveness Analysis, By End-use Vertical

Figure 79 South America Cloud Service Brokerage Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2024

Figure 80 South America Cloud Service Brokerage Market Value Share Analysis, By Enterprise Size, 2016 and 2024

Figure 81 South America Cloud Service Brokerage Market Value Share Analysis, By Services, 2016 and 2024

Figure 82 South America Cloud Service Brokerage Market Value Share Analysis, By Solution, 2016 and 2024

Figure 83 South America Cloud Service Brokerage Market Value Share Analysis, By End-use Vertical, 2016 and 2024

Figure 84 South America Cloud Service Brokerage Market Value Share Analysis, By Country, 2016 and 2024

Figure 85 South America Cloud Service Brokerage Market Attractiveness Analysis, By Enterprise Size

Figure 86 South America Cloud Service Brokerage Market Attractiveness Analysis, By Services

Figure 87 South America Cloud Service Brokerage Market Attractiveness Analysis, By Solution

Figure 88 South America Cloud Service Brokerage Market Attractiveness Analysis, By Country

Figure 89 South America Cloud Service Brokerage Market Attractiveness Analysis, By End-use Vertical

Figure 90 Global Cloud Service Brokerage Market Share Analysis (2015)