The coronavirus pandemic has brought research labs and healthcare institutions under great scrutiny for accelerating the clinical trials for COVID-19 vaccines. As such, the success in these clinical trials has led to global recognition of India for supplying several lack of free doses to Brazil, Bangladesh, Algeria, and South Africa. Countries such as Sri Lanka are following suit whilst creating incremental opportunities for stakeholders in the clinical trials market.

The Food & Drug Administration (FDA) is creating awareness about Coronavirus Treatment Acceleration Program (CTAP) in order to bring economies to normal. Companies in the clinical trials market are taking advantage of this program to make new treatments available to patients as quickly as possible.

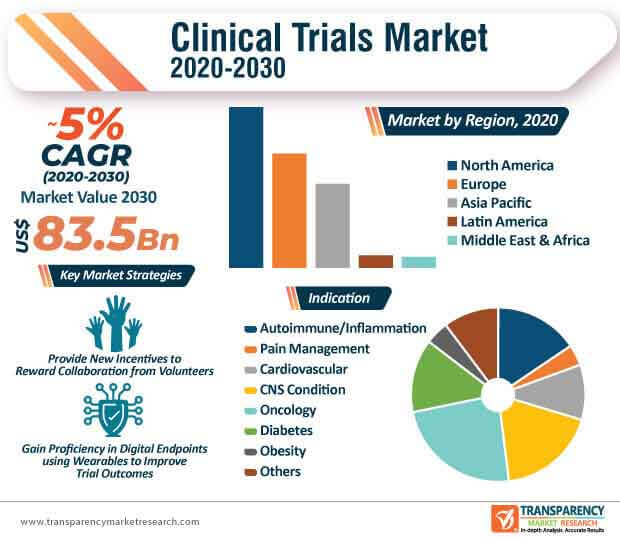

The clinical trials market is estimated to cross US$ 83.5 Bn by the end of 2030. However, finding the right patients is one of the most important pieces of the puzzle with respect to conducting clinical trials. Hence, stakeholders are working with experts at clinical trial recruitment companies to match patients with the right trials.

Slow recruitment is another challenge faced by companies in the market. Hence, companies are becoming aware about scrutinizing existing patient data to anticipate potential recruitment challenges in the long run. Clinical trial innovations are anticipated to bolster participation from volunteers.

Companies in the market are following guidelines of the FDA to advance in processes. They are referring to FDA guidance about Severely Debilitating or Life-Threatening Hematologic Disorders (SDLTHDs) in patients. Companies are increasing efforts to fill in the gap between scientific and technical complexities of clinical trials. Thus, companies are investing in improving the academia and are developing new incentives that reward collaboration from volunteers.

Companies in the market are taking additional efforts to develop networks that enable procedures at a patient’s home or at their private doctor’s clinic. This has led to innovations in sensor devices, patient reported outcomes on their computers, and flash pictures of their lesions from their cellphones that contribute toward processes.

Compliance with protocols is one of the key trends followed by stakeholders in the clinical trials market. Clinical trials supervised by Principal Investigators are gaining prominence in the market landscape. Continued positive cases for coronavirus have increased relevancy and role of stakeholders in the market. This shift has pushed clinical trials to go virtual.

Stakeholders in the market are teaming up with virtual clinical trial experts to capitalize on business opportunities during the ongoing pandemic. Even regulatory authorities have released guidelines to assist sponsors and patients via telemedicine and virtual trial tools to create viable solutions for current operational problems.

The proliferation of digital innovations with the help of wearables and sensors is translating into value grab opportunities for companies in the clinical trials market. ICON plc— a clinical research organization company is researching how digital endpoints, including digital biomarkers can improve trial outcomes. This has led to the adoption of digital health technologies that enable appropriate device selection and data strategies.

Digital health innovations hold promising potentials to better manage chronic diseases and improve patient access to healthcare services. Stakeholders and sponsors are taking efforts to improve adherence to medications and prevent its complications in patients. The Internet of Medical Things (IoMT) has the potential to enhance clinical development programs involving med-tech and pharmaceutical companies.

Analysts’ Viewpoint

There is a need for trial innovations since recently several volunteers were given wrong dose of the late stage clinical trial of the Oxford/AstraZeneca Covid-19 vaccine.

The clinical trials market is predicted to advance at a modest CAGR of 5.4% during the forecast period. This is evident since stakeholders need to address challenges pertaining to site management and compliance in order to improve trial outcomes. Hence, companies are developing clinical trial timelines to avoid delays, and are increasing transparency with their sponsors to offer them a 360 degree view of the processes happening at development centers. IoMT is acting as a key driver for the market.

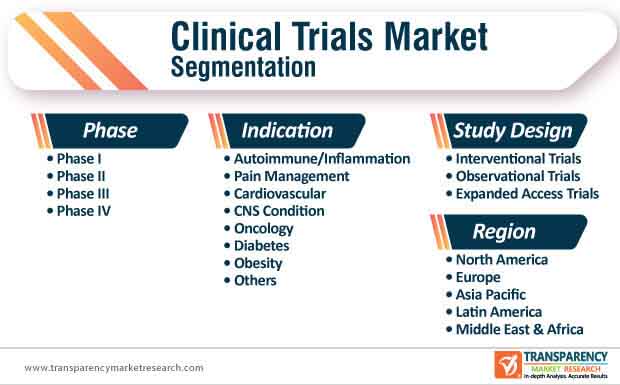

Clinical Trials Market – Segmentation

| Phase |

|

| Study Design |

|

| Indication |

|

| Region |

|

It is projected to reach a value of US$ 83.5 Bn by the end of 2030

The CAGR is anticipated to be 5% from 2020 to 2030.

North America is expected to account for leading share during the forecast period.

High prevalence and increase in incidence rate of chronic diseases, and rise in R&D activities in biotechnology & pharmaceuticals industries are anticipated to drive the global market.

Laboratory Corporation of America Holdings, IQVIA, Inc., Syneos Health, Parexel International Corporation, PRA Health Sciences, Inc., PPD, Inc., Icon plc, Charles River Laboratories, Inc., WuXi AppTec, and Medpace Holdings, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Clinical Trials Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Clinical Trials Market Analysis and Forecast, 2018–2030

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Number of Clinical Trials

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry

6. Global Clinical Trials Market Analysis and Forecast, by Phase

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Phase, 2018–2030

6.3.1. Phase I

6.3.2. Phase II

6.3.3. Phase III

6.3.4. Phase IV

6.4. Market Attractiveness Analysis, by Phase

7. Global Clinical Trials Market Analysis and Forecast, by Study Design

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Study Design, 2018–2030

7.3.1. Interventional Trials

7.3.2. Observational Trials

7.3.3. Expanded Access Trials

7.4. Market Attractiveness Analysis, by Study Design

8. Global Clinical Trials Market Analysis and Forecast, by Indication

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Indication, 2018–2030

8.3.1. Autoimmune/Inflammation

8.3.2. Pain Management

8.3.3. Cardiovascular

8.3.4. CNS Condition

8.3.5. Oncology

8.3.6. Diabetes

8.3.7. Obesity

8.3.8. Others

8.4. Market Attractiveness Analysis, by Indication

9. Global Clinical Trials Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Country/Region

10. North America Clinical Trials Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Phase, 2018–2030

10.2.1. Phase I

10.2.2. Phase II

10.2.3. Phase III

10.2.4. Phase IV

10.3. Market Value Forecast, by Study Design, 2018–2030

10.3.1. Interventional Trials

10.3.2. Observational Trials

10.3.3. Expanded Access Trials

10.4. Market Value Forecast, by Indication, 2018–2030

10.4.1. Autoimmune/Inflammation

10.4.2. Pain Management

10.4.3. Cardiovascular

10.4.4. CNS Condition

10.4.5. Oncology

10.4.6. Diabetes

10.4.7. Obesity

10.4.8. Others

10.5. Market Value Forecast, by Country, 2018–2030

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Phase

10.6.2. By Study Design

10.6.3. By Indication

10.6.4. By Country

11. Europe Clinical Trials Market Analysis and Forecast

11.1.Introduction

11.1.1. Key Findings

11.2.Market Value Forecast, by Phase, 2018–2030

11.2.1. Phase I

11.2.2. Phase II

11.2.3. Phase III

11.2.4. Phase IV

11.3.Market Value Forecast, by Study Design, 2018–2030

11.3.1. Interventional Trials

11.3.2. Observational Trials

11.3.3. Expanded Access Trials

11.4.Market Value Forecast, by Indication, 2018–2030

11.4.1. Autoimmune/Inflammation

11.4.2. Pain Management

11.4.3. Cardiovascular

11.4.4. CNS Condition

11.4.5. Oncology

11.4.6. Diabetes

11.4.7. Obesity

11.4.8. Others

11.5.Market Value Forecast, by Country/Sub-region, 2018–2030

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6.Market Attractiveness Analysis

11.6.1. By Phase

11.6.2. By Study Design

11.6.3. By Indication

11.6.4. By Country/Sub-region

12. Asia Pacific Clinical Trials Market Analysis and Forecast

12.1.Introduction

12.1.1. Key Findings

12.2.Market Value Forecast, by Phase, 2018–2030

12.2.1. Phase I

12.2.2. Phase II

12.2.3. Phase III

12.2.4. Phase IV

12.3.Market Value Forecast, by Study Design, 2018–2030

12.3.1. Interventional Trials

12.3.2. Observational Trials

12.3.3. Expanded Access Trials

12.4.Market Value Forecast, by Indication, 2018–2030

12.4.1. Autoimmune/Inflammation

12.4.2. Pain Management

12.4.3. Cardiovascular

12.4.4. CNS Condition

12.4.5. Oncology

12.4.6. Diabetes

12.4.7. Obesity

12.4.8. Others

12.5.Market Value Forecast, by Country/Sub-region, 2018–2030

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6.Market Attractiveness Analysis

12.6.1. By Phase

12.6.2. By Study Design

12.6.3. By Indication

12.6.4. By Country/Sub-region

13. Latin America Clinical Trials Market Analysis and Forecast

13.1.Introduction

13.1.1. Key Findings

13.2.Market Value Forecast, by Phase, 2018–2030

13.2.1. Phase I

13.2.2. Phase II

13.2.3. Phase III

13.2.4. Phase IV

13.3.Market Value Forecast, by Study Design, 2018–2030

13.3.1. Interventional Trials

13.3.2. Observational Trials

13.3.3. Expanded Access Trials

13.4.Market Value Forecast, by Indication, 2018–2030

13.4.1. Autoimmune/Inflammation

13.4.2. Pain Management

13.4.3. Cardiovascular

13.4.4. CNS Condition

13.4.5. Oncology

13.4.6. Diabetes

13.4.7. Obesity

13.4.8. Others

13.5.Market Value Forecast, by Country/Sub-region, 2018–2030

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6.Market Attractiveness Analysis

13.6.1. By Phase

13.6.2. By Study Design

13.6.3. By Indication

13.6.4. By Country/Sub-region

14. Middle East & Africa Clinical Trials Market Analysis and Forecast

14.1.Introduction

14.1.1. Key Findings

14.2.Market Value Forecast, by Phase, 2018–2030

14.2.1. Phase I

14.2.2. Phase II

14.2.3. Phase III

14.2.4. Phase IV

14.3.Market Value Forecast, by Study Design, 2018–2030

14.3.1. Interventional Trials

14.3.2. Observational Trials

14.3.3. Expanded Access Trials

14.4.Market Value Forecast, by Indication, 2018–2030

14.4.1. Autoimmune/Inflammation

14.4.2. Pain Management

14.4.3. Cardiovascular

14.4.4. CNS Condition

14.4.5. Oncology

14.4.6. Diabetes

14.4.7. Obesity

14.4.8. Others

14.5.Market Value Forecast, by Country/Sub-region, 2018–2030

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6.Market Attractiveness Analysis

14.6.1. By Phase

14.6.2. By Study Design

14.6.3. By Indication

14.6.4. By Country/Sub-region

15. Competitive Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2019

15.3. Company Profiles

15.3.1. Laboratory Corporation of America Holdings

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. IQVIA Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. Syneos Health

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Parexel International Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. PPD Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Icon plc

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. Charles River Laboratories, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.8. WuXi AppTec

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Medpace Holdings, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

List of Tables

Table 01: Global Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 02: Global Clinical Trials Market Value (US$ Mn) Forecast, by Study Design, 2018–2030

Table 03: Global Clinical Trials Market Value (US$ Mn) Forecast, by Indication, 2018–2030

Table 04: Global Clinical Trials Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 05: North America Clinical Trials Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 06: North America Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 07: North America Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 08: North America Clinical Trials Market Value (US$ Mn) Forecast, by Indication, 2018–2030

Table 09: Europe Clinical Trials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 10: Europe Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 11: Europe Clinical Trials Market Value (US$ Mn) Forecast, by Study Design, 2018–2030

Table 12: Europe Clinical Trials Market Value (US$ Mn) Forecast, by Indication, 2018–2030

Table 13: Asia Pacific Clinical Trials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 14: Asia Pacific Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 15: Asia Pacific Clinical Trials Market Value (US$ Mn) Forecast, by Study Design, 2018–2030

Table 16: Asia Pacific Clinical Trials Market Value (US$ Mn) Forecast, by Indication, 2018–2030

Table 17: Latin America Clinical Trials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 18: Latin America Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 19: Latin America Clinical Trials Market Value (US$ Mn) Forecast, by Study Design, 2018–2030

Table 20: Latin America Clinical Trials Market Value (US$ Mn) Forecast, by Indication, 2018–2030

Table 21: Middle East & Africa Clinical Trials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 22: Middle East & Africa Clinical Trials Market Value (US$ Mn) Forecast, by Phase, 2018–2030

Table 23: Middle East & Africa Clinical Trials Market Value (US$ Mn) Forecast, by Study Design, 2018–2030

Table 24: Middle East & Africa Clinical Trials Market Value (US$ Mn) Forecast, by Indication, 2018–2030

List of Figures

Figure 01: Global Clinical Trials Market Value (US$ Mn) Forecast, 2018–2030

Figure 02: Global Clinical Trials Market Value Share, by Phase, 2019

Figure 03: Global Clinical Trials Market Value Share, by Indication, 2019

Figure 04: Global Clinical Trials Market Value Share, by Study Design, 2019

Figure 05: Global Clinical Trials Market Value Share, by Region, 2019

Figure 06: Global Clinical Trials Market Value Share Analysis, by Phase, 2019 and 2030

Figure 07: Global Clinical Trials Market Value (US$ Mn), by Phase I, 2018–2030

Figure 08: Global Clinical Trials Market Value (US$ Mn), by Phase II, 2018–2030

Figure 09: Global Clinical Trials Market Value (US$ Mn), by Phase III, 2018–2030

Figure 10: Global Clinical Trials Market Value (US$ Mn), by Phase IV, 2018–2030

Figure 11: Global Clinical Trials Market Attractiveness Analysis, by Phase, 2020–2030

Figure 12: Global Clinical Trials Market Value Share Analysis, by Study Design, 2019 and 2030

Figure 13: Global Clinical Trials Market Value (US$ Mn), Interventional Trials, 2018–2030

Figure 14: Global Clinical Trials Market Value (US$ Mn), Observational Trials, 2018–2030

Figure 15: Global Clinical Trials Market Value (US$ Mn), Expanded Access Trials, 2018–2030

Figure 16: Global Clinical Trials Market Attractiveness Analysis, by Study Design, 2020–2030

Figure 17: Global Clinical Trials Market Value Share Analysis, by Indication, 2019 and 2030

Figure 18: Global Clinical Trials Market Value (US$ Mn), Autoimmune /Inflammation, 2018–2030

Figure 19: Global Clinical Trials Market Value (US$ Mn), Pain Management, 2018–2030

Figure 20: Global Clinical Trials Market Value (US$ Mn), Cardiovascular, 2018–2030

Figure 21: Global Clinical Trials Market Value (US$ Mn), CNS Condition, 2018–2030

Figure 22: Global Clinical Trials Market Value (US$ Mn), Oncology, 2018–2030

Figure 23: Global Clinical Trials Market Value (US$ Mn), Diabetes, 2018–2030

Figure 24: Global Clinical Trials Market Value (US$ Mn), Obesity, 2018–2030

Figure 25: Global Clinical Trials Market Value (US$ Mn), Others, 2018–2030

Figure 26: Global Clinical Trials Market Attractiveness Analysis, by Indication, 2020–2030

Figure 27: Global Clinical Trials Market Value Share Analysis, by Region, 2019 and 2030

Figure 28: Global Clinical Trials Market Attractiveness Analysis, by Region, 2020–2030

Figure 29: North America Clinical Trials Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 30: North America Clinical Trials Market Value Share (%), by Country, 2019 and 2030

Figure 31: North America Clinical Trials Market Attractiveness, by Country, 2020–2030

Figure 32: North America Clinical Trials Market Value Share Analysis, by Phase, 2019 and 2030

Figure 33: North America Clinical Trials Market Attractiveness Analysis, by Phase, 2020–2030

Figure 34: North America Clinical Trials Market Value Share Analysis, by Study Design, 2019 and 2030

Figure 35: North America Clinical Trials Market Attractiveness Analysis, by Study Design, 2020–2030

Figure 36: North America Clinical Trials Market Value Share Analysis, by Indication, 2019 and 2030

Figure 37: North America Clinical Trials Market Attractiveness Analysis, by Indication, 2020–2030

Figure 38: Europe Clinical Trials Market Value (US$ Mn) Forecast, 2018–2030

Figure 39: Europe Clinical Trials Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 40: Europe Clinical Trials Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 41: Europe Clinical Trials Market Value Share Analysis, by Phase, 2019 and 2030

Figure 42: Europe Clinical Trials Market Attractiveness Analysis, by Phase, 2020–2030

Figure 43: Europe Clinical Trials Market Value Share Analysis, by Study Design, 2019 and 2030

Figure 44: Europe Clinical Trials Market Attractiveness Analysis, by Study Design, 2020–2030

Figure 45: Europe Clinical Trials Market Value Share Analysis, by Indication, 2019 and 2030

Figure 46: Europe Clinical Trials Market Attractiveness Analysis, by Indication, 2020–2030

Figure 47: Asia Pacific Clinical Trials Market Value (US$ Mn) Forecast, 2018–2030

Figure 48: Asia Pacific Clinical Trials Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 49: Asia Pacific Clinical Trials Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 50: Asia Pacific Clinical Trials Market Value Share Analysis, by Phase, 2019 and 2030

Figure 51: Asia Pacific Clinical Trials Market Attractiveness Analysis, by Phase, 2020–2030

Figure 52: Asia Pacific Clinical Trials Market Value Share Analysis, by Study Design, 2019 and 2030

Figure 53: Asia Pacific Clinical Trials Market Attractiveness Analysis, by Study Design, 2020–2030

Figure 54: Asia Pacific Clinical Trials Market Value Share Analysis, by Indication, 2019 and 2030

Figure 55: Asia Pacific Clinical Trials Market Attractiveness Analysis, by Indication, 2020–2030

Figure 56: Latin America Clinical Trials Market Value (US$ Mn) Forecast, 2018–2030

Figure 57: Latin America Clinical Trials Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 58: Latin America Clinical Trials Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 59: Latin America Clinical Trials Market Value Share Analysis, by Phase, 2019 and 2030

Figure 60: Latin America Clinical Trials Market Attractiveness Analysis, by Phase, 2020–2030

Figure 61: Latin America Clinical Trials Market Value Share Analysis, by Study Design, 2019 and 2030

Figure 62: Latin America Clinical Trials Market Attractiveness Analysis, by Study Design, 2020–2030

Figure 63: Latin America Clinical Trials Market Value Share Analysis, by Indication, 2019 and 2030

Figure 64: Latin America Clinical Trials Market Attractiveness Analysis, by Indication, 2020–2030

Figure 65: Middle East & Africa Clinical Trials Market Value (US$ Mn) Forecast, 2018–2030

Figure 66: Middle East & Africa Clinical Trials Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 67: Middle East & Africa Clinical Trials Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 68: Middle East & Africa Clinical Trials Market Value Share Analysis, by Phase, 2019 and 2030

Figure 69: Middle East & Africa Clinical Trials Market Attractiveness Analysis, by Phase, 2020–2030

Figure 70: Middle East & Africa Clinical Trials Market Value Share Analysis, by Study Design, 2019 and 2030

Figure 71: Middle East & Africa Clinical Trials Market Attractiveness Analysis, by Study Design, 2020–2030

Figure 72: Middle East & Africa Clinical Trials Market Value Share Analysis, by Indication, 2019 and 2030

Figure 73: Middle East & Africa Clinical Trials Market Attractiveness Analysis, by Indication, 2020–2030

Figure 74: Global Clinical Trials Market Share Analysis, by Company, 2019