Key players in the global clinical trials management system market are engaged in technologically advanced processes, launch of new services, and acquisition & collaborative agreements with other companies. These strategies are likely to fuel the growth of the global clinical trials management system market. A few expansion strategies adopted by players operating in the global clinical trials management system market are:

The report on the global clinical trials management system market discussed individual strategies, followed by company profiles of manufacturers of clinical trials management system. The competitive landscape section has been included in the report to provide readers with a dashboard view and a company market share analysis of key players operating in the global clinical trials management system market.

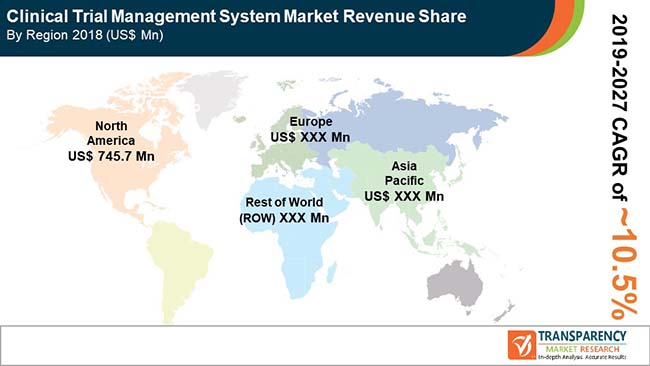

Clinical trial management system market is anticipated to grow at a CAGR of 10.5% during the forecast period

North America accounted for a major share of the global clinical trial management system market

The end-use segments in the clinical trial management system market are Pharmaceutical Industries, Contract Research Organizations, Health Care Providers

Rising demand for new therapies and increasing research and developmental activities to drive the global clinical trials management system market during the forecast period

Key players in the global clinical trial management system market include DataTRAK International Inc., Parexel International Corporation, Bio-Optronics, Inc., Dassault Systèmes SE, MedNet GmbH, and International Business Machines Corporation

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

1.3. Assumptions and Acronyms Used

2. Research Methodology

3. Executive Summary : Global Clinical Trial Management System Market

4. Market Overview

4.1. Introduction

4.1.1. Clinical Trial Management System Definition

4.1.2. Key Industry Evolutions/ Developments

4.2. Overview: Global Clinical Trial Management System (CTSM) Market

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Porter’s Five Force Analysis

4.5. Product Pipeline

4.6. Standards for data management in clinical trial study

5. Global Clinical Trial Management System (CTMS) Market Analysis, by Mode of Delivery

5.1. Introduction & Definition

5.2. Key Findings

5.3. Market Value Forecast By Mode of Delivery , 2017–2027

5.3.1. On-premise

5.3.2. Web-based

5.3.3. Cloud-based

5.4. Market Attractiveness By Mode of Delivery

6. Global Clinical Trial Management System (CTMS) Market Analysis, by Component

6.1. Introduction & Definition

6.2. Key Findings

6.3. Market Value Forecast By Component, 2017–2027

6.3.1. Software

6.3.2. Hardware

6.3.3. Services

6.4. Market Attractiveness By Components

7. Global Clinical Trial Management System (CTMS) Market Analysis, by Type

7.1. Introduction & Definition

7.2. Key Findings

7.3. Market Value Forecast By Type, 2017–2027

7.3.1. Enterprise-based

7.3.2. Site-based

7.4. Market Attractiveness By Type

8. Global Clinical Trial Management System (CTMS) Market Analysis, by End-user

8.1. Introduction & Definition

8.2. Key Findings

8.3. Market Value Forecast By End-user, 2017–2027

8.3.1. Pharmaceutical Industries

8.3.2. Contract Research Organizations

8.3.3. Healthcare Providers

8.3.4. Market Attractiveness By End-user

9. Global Clinical Trial Management System (CTMS) Market Analysis, by Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia

9.2.4. Rest of the World

9.3. Market Attractiveness by Region

10. North America Clinical Trial Management System Analysis and Forecast

10.1. Key Findings

10.2. North America Clinical Trial Management System (CTMS) Market Overview

10.3. Market Value Share By Country/Sub-regions

10.3.1. U.S.

10.3.2. Canada

10.4. Market Value Share By Mode of Delivery

10.4.1. Cloud-based

10.4.2. Web-based

10.4.3. On-premise

10.5. Market Value Share By Component

10.5.1. Software

10.5.2. Hardware

10.5.3. Services

10.6. Market Value Share By Type

10.6.1. Enterprise-based

10.6.2. Site-based

10.7. Market Value Share By End-user

10.7.1. Pharmaceutical Industries

10.7.2. Contract Research Organizations

10.7.3. Healthcare Providers

10.8. Market Attractiveness Analysis

10.8.1. By Country/Sub-region

10.8.2. By Mode of Delivery

10.8.3. By Component

10.8.4. By Type

10.8.5. By End-user

11. Europe Clinical Trial Management System Analysis and Forecast

11.1. Key Findings

11.2. Europe Clinical Trial Management System (CTMS) Market Overview

11.3. Market Value Share By Country/Sub-regions

11.3.1. U.K.

11.3.2. France

11.3.3. Germany

11.3.4. Russia

11.3.5. Poland

11.3.6. Rest of Europe

11.4. Market Value Share By Mode of Delivery

11.4.1. Cloud-based

11.4.2. Web-based

11.4.3. On-premise

11.5. Market Value Share By Component

11.5.1. Software

11.5.2. Hardware

11.5.3. Services

11.6. Market Value Share By Type

11.6.1. Enterprise-based

11.6.2. Site-based

11.7. Market Value Share By End-user

11.7.1. Pharmaceutical Industries

11.7.2. Contract Research Organizations

11.7.3. Healthcare Providers

11.8. Market Attractiveness Analysis

11.8.1. By Country/Sub-region

11.8.2. By Mode of Delivery

11.8.3. By Component

11.8.4. By Type

11.8.5. By End-user

12. Asia Clinical Trial Management System Analysis and Forecast

12.1. Key Findings

12.2. Asia Clinical Trial Management System (CTMS) Market Overview

12.3. Market Value Share By Country/Sub-regions

12.3.1. China

12.3.2. South Korea

12.3.3. Taiwan

12.3.4. India

12.3.5. Rest of Asia

12.4. Market Value Share By Mode of Delivery

12.4.1. Cloud-based

12.4.2. Web-based

12.4.3. On-premise

12.5. Market Value Share By Component

12.5.1. Software

12.5.2. Hardware

12.5.3. Services

12.6. Market Value Share By Type

12.6.1. Enterprise-based

12.6.2. Site-based

12.7. Market Value Share By End-user

12.7.1. Pharmaceutical Industries

12.7.2. Contract Research Organizations

12.7.3. Healthcare Providers

12.8. Market Attractiveness Analysis

12.8.1. By Country/Sub-region

12.8.2. By Mode of Delivery

12.8.3. By Component

12.8.4. By Type

12.8.5. By End-user

13. Rest of World (ROW) Clinical Trial Management System Market Analysis and Forecast

13.1. Key Findings

13.2. ROW Clinical Trial Management System (CTMS) Market Overview

13.3. Market Value Share By Mode of Delivery

13.3.1. Cloud-based

13.3.2. Web-based

13.3.3. On-premise

13.4. Market Value Share By Component

13.4.1. Software

13.4.2. Hardware

13.4.3. Services

13.5. Market Value Share By Type

13.5.1. Enterprise-based

13.5.2. Site-based

13.6. Market Value Share By End-user

13.6.1. Pharmaceutical Industries

13.6.2. Contract Research Organizations

13.6.3. Healthcare Providers

13.7. Market Attractiveness Analysis

13.7.1. By Mode of Delivery

13.7.2. By Component

13.7.3. By Type

13.7.4. By End-user

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. .Market Share Analysis By Company (2018)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Oracle

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Dassault Système

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. PAREXEL International Corporation

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. IBM

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Cinven

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Mednet

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Microsoft

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Apple Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Bio-Optronics, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Cognizant

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. . Financial Overview

14.3.10.3. Product Portfolio

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. DSG, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Financial Overview

14.3.11.3. Product Portfolio

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Forte

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Financial Overview

14.3.12.3. Product Portfolio

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Veeva Systems

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Financial Overview

14.3.13.3. Product Portfolio

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. DATATRAK Int

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Financial Overview

14.3.14.3. Product Portfolio

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

List of Tables

Table 01: Global CTMS Market Size (US$ Mn) Forecast, by Mode of Delivery, 2017–2027

Table 02: Global CTMS Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table 03: Global CTMS Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 04: Global CTMS Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 05: Global CTMS Market (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Clinical Trial Management (CTMS) Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Mode of Delivery, 2017–2027

Table 08: North America Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table 09: North America Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 10: North America Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 11: Europe Clinical Trial Management (CTMS) Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Mode of Delivery, 2017–2027

Table 13: Europe Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table 14: Europe Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 15: Europe Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 16: Asia Clinical Trial Management Systems (CTMS) Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Clinical Trial Management Systems (CTMS) Market Size (US$ Mn) Forecast, by Mode of Delivery, 2017–2027

Table 18: Asia Clinical Trial Management Systems (CTMS) Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table 19: Asia Clinical Trial Management Systems (CTMS) Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 20: Asia Clinical Trial Management Systems (CTMS) Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 21: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Mode of Delivery, 2017–2027

Table 22: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table 23: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 24: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 25: Market Footprint Analysis, by Region

List of Figure

Figure 1: Global Clinical Trial Management System Market Size ($ Million) and Distribution by Geography, 2018 and 2027

Figure 2: Global Clinical Trial Management System Market, by Component and Mode of Delivery

Figure 3: Global Clinical Trial Management System Market, by type and end-user

Figure 4: Market Share by Region, 2018

Figure 5: Global Clinical Trial Management System, Market Opportunity Map, by Mode of Delivery and Component

Figure 6: Global Clinical Trial Management System, Market Opportunity Map, by Type and End-user

Figure 7: Global Clinical Trial Management System (CTSM) Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 8: Global CTMS Market Value Share, by Mode of Delivery, 2018 and 2027

Figure 9: Global CTMS Market Attractiveness, by Mode of Delivery, 2019–2027

Figure 10: Cloud-based Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 11: Web-based Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 12: On-premise Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 13: Global CTMS Market Value Share, by Component, 2018 and 2027

Figure 14: Global CTMS Market Attractiveness, by Component, 2019–2027

Figure 15: Software Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 16: Hardware Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 17: Services Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 18: Global CTMS Market Value Share, by Type, 2018 and 2027

Figure 19: Global CTMS Market Attractiveness, by Type, 2019–2027

Figure 20: Enterprise based Clinical Trial Management System

Figure 21: Site based Clinical Trial Management System

Figure 22: Global CTMS Market Value Share, by End-user, 2018 and 2027

Figure 23: Global CTMS Market Attractiveness, by End-user, 2019–2027

Figure 24: Pharmaceutical Industries Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 25: Contract Research Organizations Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 26: Health Care Providers Clinical Trial Management System Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 27: Global CTMS Market Value Share, by Region, 2018 and 2027

Figure 28: Global CTMS Market Attractiveness, by Region, 2019–2027

Figure 29: North America Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 30: North America Clinical Trial Management System (CTMS) Market Value Share, by Country, 2018 and 2027

Figure 31: North America Clinical Trial Management System (CTMS) Market Attractiveness, by Mode of Delivery, 2019–2027

Figure 32: North America Clinical Trial Management System (CTMS) Market Value Share, by Component, 2018 and 2027

Figure 33: North America Clinical Trial Management System (CTMS) Attractiveness, by Component, 2019–2027

Figure 34: North America Clinical Trial Management System (CTMS) Market Value Share, by Type, 2018 and 2027

Figure 35: North America Clinical Trial Management System (CTMS) Attractiveness, by Type, 2019–2027

Figure 36: North America Clinical Trial Management System (CTMS) Value Share, by End-user, 2018 and 2027

Figure 37: North America Clinical Trial Management System (CTMS) Attractiveness, by End-user, 2019–2027

Figure 38: Europe Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 39: : Europe Clinical Trial Management System (CTMS) Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 40: Europe Clinical Trial Management System (CTMS) Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 41: Europe Clinical Trial Management System (CTMS) Market Value Share, by Mode of Delivery, 2018 and 2027

Figure 42: Europe Clinical Trial Management System (CTMS) Market Attractiveness, by Mode of Delivery, 2019–2027

Figure 43: Europe Clinical Trial Management System (CTMS) Market Value Share, by Component, 2018 and 2027

Figure 44: Europe Clinical Trial Management System (CTMS) Attractiveness, by Component, 2019–2027

Figure 45: Europe Clinical Trial Management System (CTMS) Market Value Share, by Type, 2018 and 2027

Figure 46: Europe Clinical Trial Management System (CTMS) Attractiveness, by Type, 2019–2027

Figure 47: Europe Clinical Trial Management System (CTMS) Value Share, by End-user, 2018 and 2027

Figure 48: Europe Clinical Trial Management System (CTMS) Attractiveness, by End-user, 2019–2027

Figure 49: Asia Clinical Trial Management Systems (CTMS) Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2019–2027

Figure 50: : Asia Clinical Trial Management Systems (CTMS) Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 51: Asia Clinical Trial Management Systems (CTMS) Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 52: Asia Clinical Trial Management Systems (CTMS) Market Value Share, by Mode of Delivery, 2018 and 2027

Figure 53: Asia Clinical Trial Management Systems (CTMS) Market Attractiveness, by Mode of Delivery, 2019–2027

Figure 54: Asia Clinical Trial Management Systems (CTMS) Market Value Share, by Component, 2018 and 2027

Figure 55: Asia Clinical Trial Management Systems (CTMS) Market Attractiveness, by Component, 2019–2027

Figure 56: Asia Clinical Trial Management Systems (CTMS) Market Value Share, by Type, 2018 and 2027

Figure 57: Asia Clinical Trial Management Systems (CTMS) Market Attractiveness, by Type, 2019–2027

Figure 58: Asia Clinical Trial Management Systems (CTMS) Market Value Share, by End-user, 2018 and 2027

Figure 59: Asia Clinical Trial Management Systems (CTMS) Market Attractiveness, by End-user, 2019–2027

Figure 60: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 61: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Value Share, by Mode of Delivery, 2018 and 2027

Figure 62: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Attractiveness, by Mode of Delivery, 2019–2027

Figure 63: Rest of the World (RoW)Clinical Trial Management System (CTMS) Market Value Share, by Component, 2018 and 2027

Figure 64: Rest of the World (RoW)Clinical Trial Management System (CTMS) Attractiveness, by Component, 2019–2027

Figure 65: Rest of the World (RoW) Clinical Trial Management System (CTMS) Market Value Share, by Type, 2018 and 2027

Figure 66: Rest of the World (RoW) Clinical Trial Management System (CTMS) Attractiveness, by Type, 2019–2027

Figure 67: Rest of the World (RoW)Clinical Trial Management System (CTMS) Value Share, by End-user, 2018 and 2027

Figure 68: Rest of the World (RoW)Clinical Trial Management System (CTMS) Attractiveness, by End-user, 2019–2027

Figure 69: Global Clinical Trial Management System Market Share Analysis, by Key Players (2018)

Figure 70: Oracle’s Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 71: Breakdown of Oracle’s Revenue, by Region, 2018

Figure 72: Breakdown of Oracle’s Revenue, by Business Segment, 2018

Figure 73: Oracle’s Research & Development Expenditure (US$ Mn) and Intensity (%), 2018 and 2017

Figure 74: Dassault Système Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 75: Dassault Système Revenue(US$ Mn), by Subscription Business Segment, 2018

Figure 76: Dassault Système, Inc Revenue (US$ Mn), by Professional Services Business Segment, 2018

Figure 77: Dassault Système, Inc R&D Expenditure (US$ Mn), 2017–2018

Figure 78: PAREXEL International Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 79: PAREXEL International Corporation Revenue (US$ Mn), by Business Segment, 2018

Figure 80: PAREXEL International Corporation Revenue (US$ Mn), by Geography, 2018

Figure 81: PAREXEL International Corporation Selling, General and Administrative Expenditure (US$ Mn), 2017–2018

Figure 82: IBM Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 83: IBM Revenue (US$ Mn), by Subscription Business Segment, 2018

Figure 84: IBM S,G&A Expenditure (US$ Mn), 2018

Figure 85: IBM R&D Expenditure (US$ Mn), 2017–2018

Figure 86: Microsoft Revenue (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 87: Microsoft Gross Margin (Bn) and Y-o-Y Growth (%), 2016-2018

Figure 88: Microsoft Operating Income (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 89: Microsoft Assets (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 90: Apple Inc Revenue (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 91: Apple Inc Gross Margin (Bn) and Y-o-Y Growth (%), 2016-2018

Figure 92: Apple Inc Net Income (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 93: R&D Expense (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 94: Wipro Limited Revenue (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 95: Wipro Limited Gross Income (Bn) and Y-o-Y Growth (%), 2016-2018

Figure 96: Wipro Limited R&D Expenses (US$ Bn) and Y-o-Y Growth (%), 2017–2018

Figure 97: Cognizant Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 98: Cognizant Gross Income (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 99: Cognizant Revenue, by Business Segment, 2018

Figure 100: Cognizant Revenue, by Geography, 2018

Figure 101: Veeva Systems Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 102: Veeva Systems Gross Income (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 103: Veeva Systems SG&A Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2018

Figure 104: Veeva Systems R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2018

Figure 105: DATATRAK Int Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 106: DATATRAK INT Gross Income (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 107: DATATRAK Int SG&A Expenditure (US$ Mn), 2018

Figure 108: DATATRAK Int Research & Development Expenditure (US$ Mn), 2018 and 2017