The use of clinical chemistry analyzers has increased at a rapid pace over the past few decades, owing to significant advancements in technology and rising requirements of the healthcare industry. Clinical chemistry primarily focuses on the analysis of internal fluids within the body and offers accurate diagnostic insights. Conventional manual laboratory tests have laid a strong foundation for modern-day clinical chemistry. However, testing methods have evolved with advancements in technology and at present, several tests can be performed in automated laboratories using advanced instruments such as chemical analyzers.

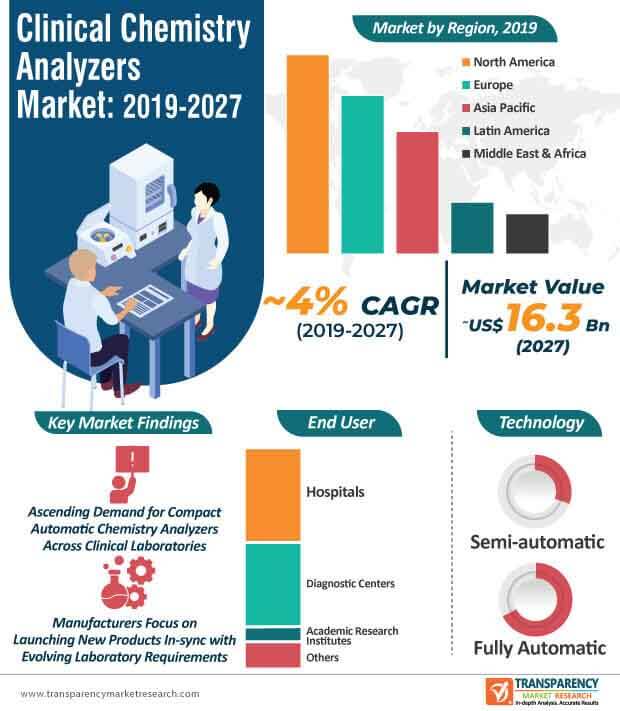

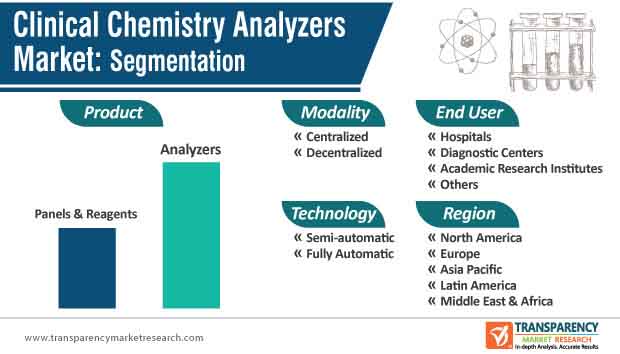

Significant developments in the design of modern-day clinical chemistry analyzers are expected to define the path of the clinical chemistry analyzers market, which is poised expected to reach a value of ~US$ 16.3 Bn by 2027. Groundbreaking technological advancements, improved production techniques, and entry of cutting-edge software are some of the factors that are projected to accelerate the growth of the clinical chemistry analyzers market during the forecast period (2019-2027). Hospitals, point of care diagnostic centers, research laboratories are the most prominent end users in the clinical chemistry analyzers market.

Computer technology has played a pivotal role in transforming the clinical chemistry segment, which, at present, is adopting informatics and automation. Automation in clinical chemistry has improved throughput to enable significantly higher testing volumes and efficiency, and minimizing human error. Moreover, automated clinical chemistry analyzers have proven their efficacy in minimizing cross-contamination and offer a high degree of safety from biohazard. The demand for automated chemistry analyzers has thus witnessed substantial growth in recent years and the trend is anticipated to continue during the forecast period. Fully automatic clinical chemistry analyzers are projected to account for ~64% share of the clinical chemistry analyzers market. This technology segment is expected to reach a value of ~US$ 10.4 Bn by 2027. The adoption of automated chemistry analyzers is expected to grow, as stakeholders in the clinical chemistry analyzers market value chain are leveraging favorable reimbursement policies and technologies to develop flexible instruments that offer superior performance than previous product types.

The clinical chemistry analyzers market has continually witnessed innovations predominantly driven by the evolution of technology. Ongoing R&D activities, coupled with integration of advanced software technologies in clinical laboratories are expected to shape the future of clinical chemistry analyzers. Furthermore, stakeholders are likely to develop new products that are in-sync with the requirements of laboratories. Participants operating in the clinical chemistry analyzers market are engaged in the development of customized analyzers for small-scale laboratories. Additionally, manufacturers in the clinical chemistry analyzers market are increasingly developing downsized clinical chemistry analyzers that open the floodgates for improved testing capabilities. The next generation of clinical chemistry analyzers will further improve the workflow efficiencies in hospitals, point-of-care diagnostic centers, and research laboratories. Significant efforts are in store to integrate molecular diagnostics instruments and mass spectrometry with clinical chemistry systems.

As the clinical chemistry analyzers market enters the automation era, manufacturers in the market are expected to focus on expanding their product portfolio by developing cutting-edge products according to current lab requirements. For instance, Trivitron Healthcare, an Indian health-tech company, launched a fully automated chemistry analyzer – ‘Nanolab 200’ in July 2019. The newly launched product is an automated benchtop chemistry analyzer that has a throughput of around 200 tests per hour. Integrated with cutting-edge liquid level detection technology, the newly launched product is expected to improve efficiency levels across clinical laboratories.

Companies are also focusing on opportunities in mid-sized laboratories wherein the integration of automated systems is a major challenge. Several manufacturers are launching compact analyzers with improved turn-around-time (TAT). For instance, in August 2019, the ERBA Group launched a new range of clinical chemistry analyzers, including XL 200 and XL 640 that are easier to operate and integrate with the advanced software version.

Analysts’ Viewpoint

The clinical chemistry analyzers market is expected to grow at a CAGR of ~4% during the forecast period. Automation will continue to fuel major developments in the clinical chemistry analyzer market. Companies operating in the current landscape should identify evolving requirements of clinical laboratories and develop new products with improved throughput. Research and development activities will continue to play a key role in the development of future generations of clinical laboratory instruments. Due to significant technological developments in North America and Europe, these regions will continue to remain the most prominent markets for clinical chemistry analyzers during the forecast period.

Clinical Chemistry Analyzers Market: Overview

Increase in Demand for Portable Devices and Point-of-Care Testing to Accelerate Clinical Chemistry Analyzers Market Growth

Large Target Patient Pool

High Cost of Automated Instruments to Hamper Clinical Chemistry Analyzers Market

Clinical Chemistry Analyzers Market: Competition Landscape

Clinical Chemistry Analyzers Market: Key Developments

Key players in the global clinical chemistry analyzers market are engaged in the development of new products and approvals, key mergers & acquisitions, and collaborations. Major developments by key players operating in clinical chemistry analyzers are likely to fuel the expansion of the global clinical chemistry analyzers market. Some of the growth strategies adopted by the players in the global clinical chemistry analyzers market are as follows:

The report on the global clinical chemistry analyzers market discusses individual strategies, followed by company profiles of manufacturers of clinical chemistry analyzers. The ‘Competition Landscape’ section has been included in the global clinical chemistry analyzers market report to provide readers with a dashboard view and a company market share analysis of key players operating in the global clinical chemistry analyzers market.

Clinical chemistry analyzers market is expected to reach a value of ~US$ 16.3 Bn by 2027

Clinical chemistry analyzers market to expand at a CAGR of ~4% from 2019 to 2027

Clinical chemistry analyzers market is driven by rise in prevalence of chronic diseases and adoption of point-of-care testing in diagnosis of various diseases

Asia Pacific accounted for a significant share of the global clinical chemistry analyzers market

Key players in the global clinical chemistry analyzers market include Ortho Clinical Diagnostics, F. Hoffmann-La Roche Ltd., Danaher Corporation, Randox Laboratories Ltd, Siemens Healthineers

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Clinical Chemistry Analyzers Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.4. Global Clinical Chemistry Analyzers Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Technological Advancements

5.2. Regulatory Scenario

6. Global Clinical Chemistry Analyzers Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

6.2.1. Panels & Reagents

6.2.2. Analyzers

6.3. Global Clinical Chemistry Analyzers Market Attractiveness, by Product

7. Global Clinical Chemistry Analyzers Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

7.2.1. Semi-automatic

7.2.2. Fully Automatic

7.3. Global Clinical Chemistry Analyzers Market Attractiveness, by Technology

8. Global Clinical Chemistry Analyzers Market Analysis and Forecast, by Modality

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Modality, 2017–2027

8.2.1. Centralized

8.2.2. Decentralized

8.3. Global Clinical Chemistry Analyzers Market Attractiveness, by Modality

9. Global Clinical Chemistry Analyzers Market Analysis and Forecast, by End User

9.1. Introduction & Definition

9.2. Global Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

9.2.1. Hospitals

9.2.2. Diagnostic Centers

9.2.3. Academic Research Institutes

9.2.4. Others

9.3. Global Clinical Chemistry Analyzers Market Attractiveness, by End User

10. Global Clinical Chemistry Analyzers Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Global Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Clinical Chemistry Analyzers Market Attractiveness, by region

11. North America Clinical Chemistry Analyzers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. North America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

11.2.1. Panels & Reagents

11.2.2. Analyzers

11.3. North America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

11.3.1. Semi-automatic

11.3.2. Fully Automatic

11.4. North America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Modality, 2017–2027

11.4.1. Centralized

11.4.2. Decentralized

11.5. North America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

11.5.1. Hospitals

11.5.2. Diagnostic Centers

11.5.3. Academic Research Institutes

11.5.4. Others

11.6. North America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. North America Clinical Chemistry Analyzers Market Attractiveness

11.7.1. By Product

11.7.2. By Technology

11.7.3. By Modality

11.7.4. By End User

11.7.5. By Country

12. Europe Clinical Chemistry Analyzers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Europe Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

12.2.1. Panels & Reagents

12.2.2. Analyzers

12.3. Europe Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

12.3.1. Semi-automatic

12.3.2. Fully Automatic

12.4. Europe Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Modality, 2017–2027

12.4.1. Centralized

12.4.2. Decentralized

12.5. Europe Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

12.5.1. Hospitals

12.5.2. Diagnostic Centers

12.5.3. Academic Research Institutes

12.5.4. Others

12.6. Europe Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Europe Clinical Chemistry Analyzers Market Attractiveness

12.7.1. By Product

12.7.2. By Technology

12.7.3. By Modality

12.7.4. By End User

12.7.5. By Country/Sub-region

13. Asia Pacific Clinical Chemistry Analyzers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Asia Pacific Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

13.2.1. Panels & Reagents

13.2.2. Analyzers

13.3. Asia Pacific Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

13.3.1. Semi-automatic

13.3.2. Fully Automatic

13.4. Asia Pacific Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Modality, 2017–2027

13.4.1. Centralized

13.4.2. Decentralized

13.5. Asia Pacific Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

13.5.1. Hospitals

13.5.2. Diagnostic Centers

13.5.3. Academic Research Institutes

13.5.4. Others

13.6. Asia Pacific Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Clinical Chemistry Analyzers Market Attractiveness

13.7.1. By Product

13.7.2. By Technology

13.7.3. By Modality

13.7.4. By End User

13.7.5. By Country/Sub-region

14. Latin America Clinical Chemistry Analyzers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Latin America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

14.2.1. Panels & Reagents

14.2.2. Analyzers

14.3. Latin America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

14.3.1. Semi-automatic

14.3.2. Fully Automatic

14.4. Latin America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Modality, 2017–2027

14.4.1. Centralized

14.4.2. Decentralized

14.5. Latin America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

14.5.1. Hospitals

14.5.2. Diagnostic Centers

14.5.3. Academic Research Institutes

14.5.4. Others

14.6. Latin America Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Latin America Clinical Chemistry Analyzers Market Attractiveness

14.7.1. By Product

14.7.2. By Technology

14.7.3. By Modality

14.7.4. By End User

14.7.5. By Country/Sub-region

15. Middle East & Africa Clinical Chemistry Analyzers Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Middle East & Africa Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

15.2.1. Panels & Reagents

15.2.2. Analyzers

15.3. Middle East & Africa Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

15.3.1. Semi-automatic

15.3.2. Fully Automatic

15.4. Middle East & Africa Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Modality, 2017–2027

15.4.1. Centralized

15.4.2. Decentralized

15.5. Middle East & Africa Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

15.5.1. Hospitals

15.5.2. Diagnostic Centers

15.5.3. Academic Research Institutes

15.5.4. Others

15.6. Middle East & Africa Clinical Chemistry Analyzers Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Middle East & Africa Clinical Chemistry Analyzers Market Attractiveness

15.7.1. By Product

15.7.2. By Technology

15.7.3. By Modality

15.7.4. By End User

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Company Profiles

16.2.1. Ortho Clinical Diagnostics

16.2.1.1. Company Overview

16.2.1.2. Growth Strategies

16.2.1.3. SWOT Analysis

16.2.2. F. Hoffmann-La Roche Ltd.

16.2.2.1. Company Overview

16.2.2.2. Company Financials

16.2.2.3. Growth Strategies

16.2.2.4. SWOT Analysis

16.2.3. Danaher Corporation

16.2.3.1. Company Overview

16.2.3.2. Company Financials

16.2.3.3. Growth Strategies

16.2.3.4. SWOT Analysis

16.2.4. Randox Laboratories Ltd

16.2.4.1. Company Overview

16.2.4.2. Company Financials

16.2.4.3. Growth Strategies

16.2.4.4. SWOT Analysis

16.2.5. Siemens Healthineers

16.2.5.1. Company Overview

16.2.5.2. Company Financials

16.2.5.3. Growth Strategies

16.2.5.4. SWOT Analysis

16.2.6. Abbott Laboratories

16.2.6.1. Company Overview

16.2.6.2. Company Financials

16.2.6.3. Growth Strategies

16.2.6.4. SWOT Analysis

16.2.7. Thermo Fisher Scientific, Inc.

16.2.7.1. Company Overview

16.2.7.2. Company Financials

16.2.7.3. Growth Strategies

16.2.7.4. SWOT Analysis

16.2.8. Mindray Medical International Limited

16.2.8.1. Company Overview

16.2.8.2. Growth Strategies

16.2.8.3. SWOT Analysis

List of Tables

Table 01: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 03: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 04: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 05: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 08: North America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 09: North America Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 10: North America Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 11: Europe Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 13: Europe Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 14: Europe Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 15: Europe Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 16: Asia Pacific Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Pacific Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 18: Asia Pacific Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 19: Asia Pacific Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 20: Asia Pacific Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 21: Latin America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Latin America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 23: Latin America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 24: Latin America Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 25: Latin America Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 26: Middle East & Africa Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 27: Middle East & Africa Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 28: Middle East & Africa Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Technology, 2017–2027

Table 29: Middle East & Africa Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 30: Middle East & Africa Clinical Chemistry Analyzers market Value (US$ Mn) Forecast, by End User, 2017–2027

List of Figures

Figure 01: Global Clinical Chemistry Analyzers Market Value (US$ Mn) and Distribution (%), by Region, 2019 and 2027

Figure 02: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, 2017–2027

Figure 03: Global Clinical Chemistry Analyzers Market Value Share Analysis, by Product, 2018 and 2027

Figure 04: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Analyzers, 2017–2027

Figure 05: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Panels & Reagents, 2017–2027

Figure 06: Global Clinical Chemistry Analyzers Market Attractiveness, by Product, 2019?2027

Figure 07: Global Clinical Chemistry Analyzers Market Value Share Analysis, by Modality, 2018 and 2027

Figure 08: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Centralized, 2017–2027

Figure 09: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Decentralized, 2017–2027

Figure 10: Global Clinical Chemistry Analyzers Market Attractiveness, by Modality, 2019?2027

Figure 11: Global Clinical Chemistry Analyzers Market Value Share Analysis, by Technology, 2018 and 2027

Figure 12: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Semi-automatic, 2017–2027

Figure 13: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Fully Automatic, 2017–2027

Figure 14: Global Clinical Chemistry Analyzers Market Attractiveness, by Technology, 2019?2027

Figure 15: Global Clinical Chemistry Analyzers Market Value Share Analysis, by End User, 2018 and 2027

Figure 16: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Hospitals, 2017–2027

Figure 17: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Diagnostic Centers, 2017–2027

Figure 18: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Academic Research Institutes, 2017–2027

Figure 19: Global Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, by Others, 2017–2027

Figure 20: Global Clinical Chemistry Analyzers Market Attractiveness, by End User, 2019?2027

Figure 21: Global Clinical Chemistry Analyzers Market: Regional Outlook

Figure 22: Global Clinical Chemistry Analyzers Market Value Share Analysis, by Region, 2018 and 2027

Figure 23: Global Clinical Chemistry Analyzers Market Attractiveness Analysis, by Region, 2019–2027

Figure 24: North America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, 2017–2027

Figure 25: North America Clinical Chemistry Analyzers Market Value Share, by Country, 2018 and 2027

Figure 26: North America Clinical Chemistry Analyzers Market Attractiveness, by Country, 2019–2027

Figure 27: North America Clinical Chemistry Analyzers Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 28: North America Clinical Chemistry Analyzers Market Attractiveness Analysis, by Product Type, 2019?2027

Figure 29: North America Clinical Chemistry Analyzers Market Value Share Analysis, by Technology, 2018 and 2027

Figure 30: North America Clinical Chemistry Analyzers Market Attractiveness Analysis, by Technology, 2019?2027

Figure 31: North America Clinical Chemistry Analyzers Market Value Share Analysis, by Modality, 2018 and 2027

Figure 32: North America Clinical Chemistry Analyzers Market Attractiveness Analysis, by Modality, 2019?2027

Figure 33: North America Clinical Chemistry Analyzers market Value Share Analysis, by End User, 2018 and 2027

Figure 34: North America Clinical Chemistry Analyzers market Attractiveness, by End User, 2019–2027

Figure 35: Europe Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, 2017–2027

Figure 36: Europe Clinical Chemistry Analyzers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 37: Europe Clinical Chemistry Analyzers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 38: Europe Clinical Chemistry Analyzers Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 39: Europe Clinical Chemistry Analyzers Market Attractiveness Analysis, by Product Type, 2019?2027

Figure 40: Europe Clinical Chemistry Analyzers Market Value Share Analysis, by Technology, 2018 and 2027

Figure 41: Europe Clinical Chemistry Analyzers Market Attractiveness Analysis, by Technology, 2019?2027

Figure 42: Europe Clinical Chemistry Analyzers Market Value Share Analysis, by Modality, 2018 and 2027

Figure 43: Europe Clinical Chemistry Analyzers Market Attractiveness Analysis, by Modality, 2019?2027

Figure 44: Europe Clinical Chemistry Analyzers market Value Share Analysis, by End User, 2018 and 2027

Figure 45: Europe Clinical Chemistry Analyzers market Attractiveness, by End User, 2019–2027

Figure 46: Asia Pacific Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, 2017–2027

Figure 47: Asia Pacific Clinical Chemistry Analyzers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 48: Asia Pacific Clinical Chemistry Analyzers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 49: Asia Pacific Clinical Chemistry Analyzers Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 50: Asia Pacific Clinical Chemistry Analyzers Market Attractiveness Analysis, by Product Type, 2019?2027

Figure 51: Asia Pacific Clinical Chemistry Analyzers Market Value Share Analysis, by Technology, 2018 and 2027

Figure 52: Asia Pacific Clinical Chemistry Analyzers Market Attractiveness Analysis, by Technology, 2019?2027

Figure 53: Asia Pacific Clinical Chemistry Analyzers Market Value Share Analysis, by Modality, 2018 and 2027

Figure 54: Asia Pacific Clinical Chemistry Analyzers Market Attractiveness Analysis, by Modality, 2019?2027

Figure 55: Asia Pacific Clinical Chemistry Analyzers market Value Share Analysis, by End User, 2018 and 2027

Figure 56: Asia Pacific Clinical Chemistry Analyzers market Attractiveness, by End User, 2019–2027

Figure 57: Latin America Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, 2017–2027

Figure 58: Latin America Clinical Chemistry Analyzers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 59: Latin America Clinical Chemistry Analyzers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 60: Latin America Clinical Chemistry Analyzers Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 61: Latin America Clinical Chemistry Analyzers Market Attractiveness Analysis, by Product Type, 2019?2027

Figure 62: Latin America Clinical Chemistry Analyzers Market Value Share Analysis, by Technology, 2018 and 2027

Figure 63: Latin America Clinical Chemistry Analyzers Market Attractiveness Analysis, by Technology, 2019?2027

Figure 64: Latin America Clinical Chemistry Analyzers Market Value Share Analysis, by Modality, 2018 and 2027

Figure 65: Latin America Clinical Chemistry Analyzers Market Attractiveness Analysis, by Modality, 2019?2027

Figure 66: Latin America Clinical Chemistry Analyzers market Value Share Analysis, by End User, 2018 and 2027

Figure 67: Latin America Clinical Chemistry Analyzers market Attractiveness, by End User, 2019–2027

Figure 68: Middle East & Africa Clinical Chemistry Analyzers Market Value (US$ Mn) Forecast, 2017–2027

Figure 69: Middle East & Africa Clinical Chemistry Analyzers Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 70: Middle East & Africa Clinical Chemistry Analyzers Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 71: Middle East & Africa Clinical Chemistry Analyzers Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 72: Middle East & Africa Clinical Chemistry Analyzers Market Attractiveness Analysis, by Product Type, 2019?2027

Figure 73: Middle East & Africa Clinical Chemistry Analyzers Market Value Share Analysis, by Technology, 2018 and 2027

Figure 74: Middle East & Africa Clinical Chemistry Analyzers Market Attractiveness Analysis, by Technology, 2019?2027

Figure 75: Middle East & Africa Clinical Chemistry Analyzers Market Value Share Analysis, by Modality, 2018 and 2027

Figure 76: Middle East & Africa Clinical Chemistry Analyzers Market Attractiveness Analysis, by Modality, 2019?2027

Figure 77: Middle East & Africa Clinical Chemistry Analyzers market Value Share Analysis, by End User, 2018 and 2027

Figure 78: Middle East & Africa Clinical Chemistry Analyzers market Attractiveness, by End User, 2019–2027