Analysts’ Viewpoint

Technical advancements in the production of novel components with high energy efficiency are driving the circuit breaker market size. Circuit breaker is designed to close or open an electrical circuit. It protects electrical systems from damage. Rise in demand for electricity has made circuit breakers crucial in electrical systems.

Surge in focus on electrical safety is expected to augment market development during the forecast period. Circuit breakers are necessary safety devices for every structure that uses electricity. They serve as neutral third parties or arbitrators within intricate and potentially risky electrical wiring systems. Market vendors are investing significantly in the manufacture of novel Earth Leakage Circuit Breakers (ELCBs) and vacuum circuit breakers to expand their product portfolio.

Circuit breakers are mechanical devices, which disturb the flow of high-magnitude current. They are primarily designed to close or open an electrical circuit. Circuit breakers are used in utilities, energy generation, renewable energy applications, and energy distribution substations in urban areas to guarantee the safety and dependability of the entire energy distribution network. They stop and securely resume an interrupted current flow to regulate and safeguard electrical systems.

Low-voltage circuit breakers, medium-voltage circuit breakers, SF6/vacuum circuit breakers, and high-voltage circuit breakers are various types of circuit breakers used in industries. High-voltage circuit breakers can carry a high load without excessive heating. They have the ability to withstand thermal and mechanical effects caused by the maximum short circuit current that flows through the circuit. Circuit breakers are employed to switch different kinds of load in industries, buildings, commercial complexes, and hotels.

Ongoing push toward electrification has resulted in high demand for technologies that integrate Distributed Energy Resources (DERs) into power grids. Governments of countries across the globe are investing significantly to boost the capacity and efficiency of transmission and distribution systems in order to meet the surge in demand for electricity.

According to the International Energy Agency (IEA), the annual global energy investment was set to rise to US$ 1.9 Trn in 2021, rebounding nearly 10.0% from that in 2020 and bringing the total volume of investment back to pre-crisis levels. However, the composition has shifted to power and end-use sectors - and away from traditional fuel production. This shift in energy transition from traditional to renewable is anticipated to propel circuit breaker market expansion in the next few years.

Increase in usage of electricity across residential, commercial, and industrial sectors has led to a surge in demand for electrical components. The risk of electrical overload and short circuits is particularly high in residential and functional buildings, where installed electrical equipment and systems are not inspected regularly.

Growth in number of household appliances fuels electrical overload, thereby boosting the demand for Miniature Circuit Breakers (MCBs). An average household uses well over 50 electrical appliances. Decentralized energy producers, such as photovoltaic systems or electric vehicle charging, place completely new demands on electrical systems, thereby requiring extensive protective measures. Circuit breakers safely cut the connected circuit in the event of an overload or a short circuit. Thus, increase in consumption of electricity is likely to drive market progress during the forecast period.

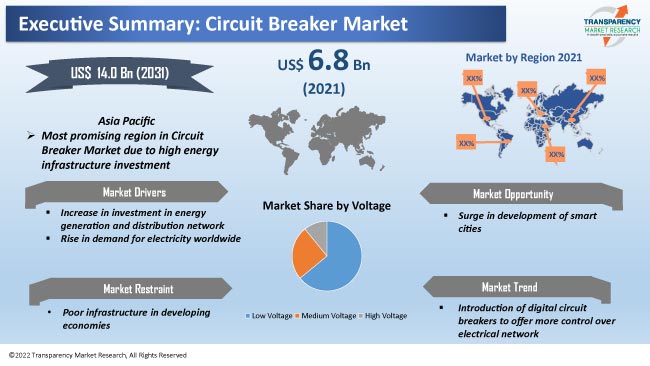

Circuit breakers are on the eve of a digital overhaul. New solid-state switches that combine computing power and wireless connectivity could become the center of smart, energy-efficient buildings of the future.

Solid-state digital circuit breakers offer several advantages to residential customers. Once a digital circuit breaker is installed, there is no need to rewire a home's electrical system to install multiple distribution boards and circuit breakers to accommodate DERs. The operator can view loads and sources, and control energy consumption from anywhere and anytime using a mobile device. The ability to manage power remotely allows owners to make real-time changes based on their current needs. This process helps maximize energy efficiency, reduce energy waste, and save money through utility-sponsored programs.

High cost of solid-state breakers is one of the key market limitations. Digital breakers cost two to five times as much as mechanical breakers. However, the cost of silicon carbide technology is declining. Industrial customers are willing to pay high prices for smart, safe products that replace traditional components in a building's electrical system.

Smart cities are urban regions that are advanced in terms of overall infrastructure, transportation, communications, and market viability. Some aspects of the smart city concept include increased energy efficiency, smart water management, robust transportation system, smart grids, and advanced healthcare and education facilities.

Many utilities already offer networked energy management solutions, including remote building control. Municipal, regional, and national governments are launching smart city initiatives aimed at promoting technical innovation and systematic applications of Internet of Things (IoT) in urban landscapes. Utilities are working with cities and developers to implement sensor technologies as a part of integrated municipal energy and environmental planning. Thus, development in smart city infrastructure is expected to create robust opportunities for market expansion in the next few years.

According to the latest circuit breaker market forecast, Asia Pacific is anticipated to dominate the global business during 2022 to 2031. Expansion in energy infrastructure and high investment in smart city infrastructure are driving market statistics in the region. Additionally, rise in per capita income and growth in industrialization and urbanization are likely to fuel market revenue in the next few years.

Europe and North America possess significant growth opportunities due to the increase in investment in smart city infrastructure in these regions.

The industry is highly fragmented and involves various types of manufacturers, vendors, and suppliers. Several manufacturers are investing significantly in R&D of new products to enhance their circuit breaker market share.

The business is dominated by manufacturers such as ABB, Siemens AG, Schneider Electric, Eaton, Mitsubishi Electric Corporation, Toshiba, Corporation, Powell Industries, General Electric, Camsco Electric Co., Ltd., and Havells India Ltd.

These players have been profiled in the circuit breaker market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 6.8 Bn |

|

Market Forecast Value in 2031 |

US$ 14.0 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 6.8 Bn in 2021

It is estimated to grow at a CAGR of 7.4% during the forecast period

It is expected to reach US$ 14.0 Bn by 2031

Increase in investment in energy generation and distribution network and rise in demand for electricity worldwide

Asia Pacific is a highly lucrative region that accounted for around 41.2% share in 2021

ABB, Siemens AG, Schneider Electric, Eaton, Mitsubishi Electric Corporation, Toshiba, Corporation, Powell Industries, General Electric, Camsco Electric Co., Ltd., and Havells India Ltd.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Circuit Breaker Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Electrical Component Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Circuit Breaker Market Analysis by Insulation

5.1. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Insulation, 2017–2031

5.1.1. Air Circuit Breaker

5.1.2. Vacuum Circuit Breaker

5.1.3. Gas Circuit Breaker

5.1.4. Oil Circuit Breaker

5.2. Market Attractiveness Analysis, By Insulation

6. Global Circuit Breaker Market Analysis by Voltage

6.1. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Voltage, 2017–2031

6.1.1. Low Voltage

6.1.2. Medium Voltage

6.1.3. High Voltage

6.2. Market Attractiveness Analysis, By Voltage

7. Global Circuit Breaker Market Analysis by End-use Industry

7.1. Circuit Breaker Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

7.1.1. Commercial

7.1.2. Industrial

7.1.3. Residential

7.1.4. Utility Scale

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Circuit Breaker Market Analysis and Forecast by Region

8.1. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Circuit Breaker Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Insulation, 2017–2031

9.3.1. Air Circuit Breaker

9.3.2. Vacuum Circuit Breaker

9.3.3. Gas Circuit Breaker

9.3.4. Oil Circuit Breaker

9.4. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Voltage, 2017–2031

9.4.1. Low Voltage

9.4.2. Medium Voltage

9.4.3. High Voltage

9.5. Circuit Breaker Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

9.5.1. Commercial

9.5.2. Industrial

9.5.3. Residential

9.5.4. Utility Scale

9.6. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Insulation

9.7.2. By Voltage

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Circuit Breaker Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Insulation, 2017–2031

10.3.1. Air Circuit Breaker

10.3.2. Vacuum Circuit Breaker

10.3.3. Gas Circuit Breaker

10.3.4. Oil Circuit Breaker

10.4. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Voltage, 2017–2031

10.4.1. Low Voltage

10.4.2. Medium Voltage

10.4.3. High Voltage

10.5. Circuit Breaker Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

10.5.1. Commercial

10.5.2. Industrial

10.5.3. Residential

10.5.4. Utility Scale

10.6. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Insulation

10.7.2. By Sales Channel

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Circuit Breaker Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Insulation, 2017–2031

11.3.1. Air Circuit Breaker

11.3.2. Vacuum Circuit Breaker

11.3.3. Gas Circuit Breaker

11.3.4. Oil Circuit Breaker

11.4. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Voltage, 2017–2031

11.4.1. Low Voltage

11.4.2. Medium Voltage

11.4.3. High Voltage

11.5. Circuit Breaker Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.5.1. Commercial

11.5.2. Industrial

11.5.3. Residential

11.5.4. Utility Scale

11.6. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Insulation

11.7.2. By Voltage

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Circuit Breaker Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Insulation, 2017–2031

12.3.1. Air Circuit Breaker

12.3.2. Vacuum Circuit Breaker

12.3.3. Gas Circuit Breaker

12.3.4. Oil Circuit Breaker

12.4. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Voltage, 2017–2031

12.4.1. Low Voltage

12.4.2. Medium Voltage

12.4.3. High Voltage

12.5. Circuit Breaker Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.5.1. Commercial

12.5.2. Industrial

12.5.3. Residential

12.5.4. Utility Scale

12.6. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Insulation

12.7.2. By Voltage

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Circuit Breaker Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Insulation, 2017–2031

13.3.1. Air Circuit Breaker

13.3.2. Vacuum Circuit Breaker

13.3.3. Gas Circuit Breaker

13.3.4. Oil Circuit Breaker

13.4. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Voltage, 2017–2031

13.4.1. Low Voltage

13.4.2. Medium Voltage

13.4.3. High Voltage

13.5. Circuit Breaker Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.5.1. Commercial

13.5.2. Industrial

13.5.3. Residential

13.5.4. Utility Scale

13.6. Circuit Breaker Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Insulation

13.7.2. By Voltage

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Circuit Breaker Market Competition Matrix - a Dashboard View

14.1.1. Global Circuit Breaker Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Siemens AG

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Schneider Electric

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Eaton

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Mitsubishi Electric Corporation

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Toshiba Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Powell Industries

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. General Electric

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Camsco Electric Co., Ltd.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Havells India Ltd.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Insulation

16.1.2. By Voltage

16.1.3. By End-use Industry

16.1.4. By Region/Country/Sub-region

List of Tables

Table 1: Global Circuit Breaker Market Value (US$ Mn) & Forecast, by Insulation, 2017‒2031

Table 2: Global Circuit Breaker Market Volume (Million Units) & Forecast, by Insulation, 2017‒2031

Table 3: Global Circuit Breaker Market Value (US$ Mn) & Forecast, by Voltage, 2017‒2031

Table 4: Global Circuit Breaker Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 5: Global Circuit Breaker Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: Global Circuit Breaker Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 7: North America Circuit Breaker Market Value (US$ Mn) & Forecast, by Insulation, 2017‒2031

Table 8: North America Circuit Breaker Market Volume (Million Units) & Forecast, by Insulation, 2017‒2031

Table 9: North America Circuit Breaker Market Value (US$ Mn) & Forecast, by Voltage, 2017‒2031

Table 10: North America Circuit Breaker Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 11: North America Circuit Breaker Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 12: North America Circuit Breaker Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 13: Europe Circuit Breaker Market Value (US$ Mn) & Forecast, by Insulation, 2017‒2031

Table 14: Europe Circuit Breaker Market Volume (Million Units) & Forecast, by Insulation, 2017‒2031

Table 15: Europe Circuit Breaker Market Value (US$ Mn) & Forecast, by Voltage, 2017‒2031

Table 16: Europe Circuit Breaker Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 17: Europe Circuit Breaker Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 18: Europe Circuit Breaker Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 19: Asia Pacific Circuit Breaker Market Value (US$ Mn) & Forecast, by Insulation, 2017‒2031

Table 20: Asia Pacific Circuit Breaker Market Volume (Million Units) & Forecast, by Insulation, 2017‒2031

Table 21: Asia Pacific Circuit Breaker Market Value (US$ Mn) & Forecast, by Voltage, 2017‒2031

Table 22: Asia Pacific Circuit Breaker Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 23: Asia Pacific Circuit Breaker Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 24: Asia Pacific Circuit Breaker Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 25: Middle East & Africa Circuit Breaker Market Value (US$ Mn) & Forecast, by Insulation, 2017‒2031

Table 26: Middle East & Africa Circuit Breaker Market Volume (Million Units) & Forecast, by Insulation, 2017‒2031

Table 27: Middle East & Africa Circuit Breaker Market Value (US$ Mn) & Forecast, by Voltage, 2017‒2031

Table 28: Middle East & Africa Circuit Breaker Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 29: Middle East & Africa Circuit Breaker Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 30: Middle East & Africa Circuit Breaker Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 31: South America Circuit Breaker Market Value (US$ Mn) & Forecast, by Insulation, 2017‒2031

Table 32: South America Circuit Breaker Market Volume (Million Units) & Forecast, by Insulation, 2017‒2031

Table 33: South America Circuit Breaker Market Value (US$ Mn) & Forecast, by Voltage, 2017‒2031

Table 34: South America Circuit Breaker Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 35: South America Circuit Breaker Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 36: South America Circuit Breaker Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

List of Figures

Figure 01: Global Circuit Breaker Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 02: Global Circuit Breaker Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 03: Global Circuit Breaker Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 04: Global Circuit Breaker Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 05: Global Circuit Breaker Market Projections by Insulation, and Value (US$ Mn), 2017‒2031

Figure 06: Global Circuit Breaker Market Share Analysis, by Insulation, 2021 and 2031

Figure 07: Global Circuit Breaker Market, Incremental Opportunity, by Insulation, 2021‒2031

Figure 08: Global Circuit Breaker Market Projections by Voltage, and Value (US$ Mn), 2017‒2031

Figure 09: Global Circuit Breaker Market Share Analysis, by Voltage, 2021 and 2031

Figure 10: Global Circuit Breaker Market, Incremental Opportunity, by Voltage, 2021‒2031

Figure 11: Global Circuit Breaker Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 12: Global Circuit Breaker Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 13: Global Circuit Breaker Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 14: Global Circuit Breaker Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 15: Global Circuit Breaker Market Share Analysis, by Region 2021 and 2031

Figure 16: Global Circuit Breaker Market, Incremental Opportunity, by Region, 2021‒2031

Figure 17: North America Circuit Breaker Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 18: North America Circuit Breaker Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 19: North America Circuit Breaker Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 20: North America Circuit Breaker Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 21: North America Circuit Breaker Market Projections by Insulation, and Value (US$ Mn), 2017‒2031

Figure 22: North America Circuit Breaker Market Share Analysis, by Insulation, 2021 and 2031

Figure 23: North America Circuit Breaker Market, Incremental Opportunity, by Insulation, 2021‒2031

Figure 24: North America Circuit Breaker Market Projections by Voltage, and Value (US$ Mn), 2017‒2031

Figure 25: North America Circuit Breaker Market Share Analysis, by Voltage, 2021 and 2031

Figure 26: North America Circuit Breaker Market, Incremental Opportunity, by Voltage, 2021‒2031

Figure 27: North America Circuit Breaker Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 28: North America Circuit Breaker Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 29: North America Circuit Breaker Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 30: North America Circuit Breaker Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 31: North America Circuit Breaker Market Share Analysis, by Region 2021 and 2031

Figure 32: North America Circuit Breaker Market, Incremental Opportunity, by Region, 2021‒2031

Figure 33: Europe Circuit Breaker Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 34: Europe Circuit Breaker Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 35: Europe Circuit Breaker Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 36: Europe Circuit Breaker Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 37: Europe Circuit Breaker Market Projections by Insulation, and Value (US$ Mn), 2017‒2031

Figure 38: Europe Circuit Breaker Market Share Analysis, by Insulation, 2021 and 2031

Figure 39: Europe Circuit Breaker Market, Incremental Opportunity, by Insulation, 2021‒2031

Figure 40: Europe Circuit Breaker Market Projections by Voltage, and Value (US$ Mn), 2017‒2031

Figure 41: Europe Circuit Breaker Market Share Analysis, by Voltage, 2021 and 2031

Figure 42: Europe Circuit Breaker Market, Incremental Opportunity, by Voltage, 2021‒2031

Figure 43: Europe Circuit Breaker Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 44: Europe Circuit Breaker Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 45: Europe Circuit Breaker Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 46: Europe Circuit Breaker Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 47: Europe Circuit Breaker Market Share Analysis, by Region 2021 and 2031

Figure 48: Europe Circuit Breaker Market, Incremental Opportunity, by Region, 2021‒2031

Figure 49: Asia Pacific Circuit Breaker Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 50: Asia Pacific Circuit Breaker Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 51: Asia Pacific Circuit Breaker Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 52: Asia Pacific Circuit Breaker Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 53: Asia Pacific Circuit Breaker Market Projections by Insulation, and Value (US$ Mn), 2017‒2031

Figure 54: Asia Pacific Circuit Breaker Market Share Analysis, by Insulation, 2021 and 2031

Figure 55: Asia Pacific Circuit Breaker Market, Incremental Opportunity, by Insulation, 2021‒2031

Figure 56: Asia Pacific Circuit Breaker Market Projections by Voltage, and Value (US$ Mn), 2017‒2031

Figure 57: Asia Pacific Circuit Breaker Market Share Analysis, by Voltage, 2021 and 2031

Figure 58: Asia Pacific Circuit Breaker Market, Incremental Opportunity, by Voltage, 2021‒2031

Figure 59: Asia Pacific Circuit Breaker Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 60: Asia Pacific Circuit Breaker Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 61: Asia Pacific Circuit Breaker Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 62: Asia Pacific Circuit Breaker Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Circuit Breaker Market Share Analysis, by Region 2021 and 2031

Figure 64: Asia Pacific Circuit Breaker Market, Incremental Opportunity, by Region, 2021‒2031

Figure 65: Middle East & Africa Circuit Breaker Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa Circuit Breaker Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 67: Middle East & Africa Circuit Breaker Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 68: Middle East & Africa Circuit Breaker Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 69: Middle East & Africa Circuit Breaker Market Projections by Insulation, and Value (US$ Mn), 2017‒2031

Figure 70: Middle East & Africa Circuit Breaker Market Share Analysis, by Insulation, 2021 and 2031

Figure 71: Middle East & Africa Circuit Breaker Market, Incremental Opportunity, by Insulation, 2021‒2031

Figure 72: Middle East & Africa Circuit Breaker Market Projections by Voltage, and Value (US$ Mn), 2017‒2031

Figure 73: Middle East & Africa Circuit Breaker Market Share Analysis, by Voltage, 2021 and 2031

Figure 74: Middle East & Africa Circuit Breaker Market, Incremental Opportunity, by Voltage, 2021‒2031

Figure 75: Middle East & Africa Circuit Breaker Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 76: Middle East & Africa Circuit Breaker Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 77: Middle East & Africa Circuit Breaker Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 78: Middle East & Africa Circuit Breaker Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 79: Middle East & Africa Circuit Breaker Market Share Analysis, by Region 2021 and 2031

Figure 80: Middle East & Africa Circuit Breaker Market, Incremental Opportunity, by Region, 2021‒2031

Figure 81: South America Circuit Breaker Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 82: South America Circuit Breaker Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 83: South America Circuit Breaker Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 84: South America Circuit Breaker Market Size & Forecast, Y-o-Y, Volume (Million Units), 2017‒2031

Figure 85: South America Circuit Breaker Market Projections by Insulation, and Value (US$ Mn), 2017‒2031

Figure 86: South America Circuit Breaker Market Share Analysis, by Insulation, 2021 and 2031

Figure 87: South America Circuit Breaker Market, Incremental Opportunity, by Insulation, 2021‒2031

Figure 88: South America Circuit Breaker Market Projections by Voltage, and Value (US$ Mn), 2017‒2031

Figure 89: South America Circuit Breaker Market Share Analysis, by Voltage, 2021 and 2031

Figure 90: South America Circuit Breaker Market, Incremental Opportunity, by Voltage, 2021‒2031

Figure 91: South America Circuit Breaker Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 92: South America Circuit Breaker Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 93: South America Circuit Breaker Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 94: South America Circuit Breaker Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 95: South America Circuit Breaker Market Share Analysis, by Region 2021 and 2031

Figure 96: South America Circuit Breaker Market, Incremental Opportunity, by Region, 2021‒2031

Figure 97: Company Share Analysis (2021)