Manufacturers in the cholesterol lowering drugs market are increasing research activities to include bempedoic acid for the development of new drugs. For instance, in May 2019, Esperion - a U.S. pharmaceutical company, announced the FDA approval for new drug applications (NDAs) involving the bempedoic acid.

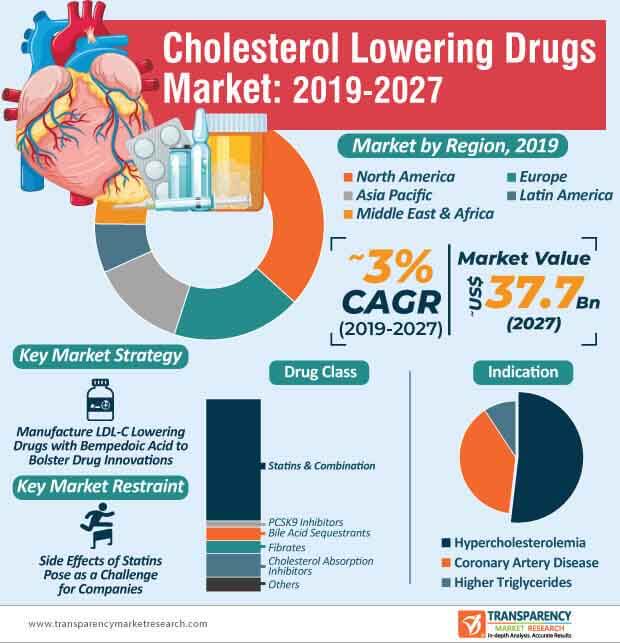

Companies are harnessing the advantages of bempedoic acid to treat a host of health conditions such as hypercholesterolemia and to treat patients with high cardiovascular risks. As such, the hypercholesterolemia indication segment of the cholesterol lowering drugs market is projected to reach a value of ~US$ 19.6 Bn by 2027. Hence, healthcare providers in the market for cholesterol lowering drugs are recommending the intake of bempedoic acid with statins to lower complications of LDL (Low-density Lipoproteins) associated with hypercholesterolemia.

Growing awareness about bad cholesterol is one of the key drivers that is triggering the growth of the cholesterol lowering drugs market. Companies are referring investigational studies to understand which drugs are well-tolerated in patients and make improvements according to the results.

In order to improve cardiovascular risk assessment, companies are increasingly adopting the ‘personalized’ approach to achieve better outcomes in patients. This trend has led to the concept of precision medicine in the market for cholesterol lowering drugs. The coronary artery disease indication segment of the cholesterol lowering drugs market is estimated to reach a value of ~US$ 14.9 Bn by 2027. Hence, manufacturers are increasing clinical trials that show promising outcomes of PCSK9 inhibitor monoclonal antibodies for the treatment of coronary artery diseases.

Companies in the cholesterol lowering drugs market are increasing their production capacities to manufacture Evolocumab used by high-risk patients. They are also tapping into opportunities to manufacture Canakinumbab, an effective antibody that leads to significant decline in cardiovascular events. Manufacturers are developing improved PCSK9 inhibitors to treat hyperchoesterolaemia. They are focusing on secondary prevention statins to lower LDL-C in patients. Improved outcomes associated with CPSK9 inhibitors are translating into revenue sources for companies in the market for cholesterol lowering drugs.

Various clinical trials have concluded that bile acid biosynthesis helps in reverse cholesterol transport (RCT). In a research published in MDPI, an open access publishing platform for scholarly research studies, reveals that RCT helps in reducing cholesterol via its conversion into bile acids in patients. On the other hand, companies are entering into licensing agreements to bolster their credibility credentials in the global cholesterol lowering drugs market. For instance, in January 2019, global pharmaceutical company Daiichi Sankyo Europe announced its European licensing agreement with Esperion, to market bempedoic acid and Ezetimibe combination tablet for cholesterol patients.

Strategic agreements are helping manufacturers to expand their cardiovascular portfolio, since cholesterol increases risks of coronary heart diseases. Companies are eyeing business expansions in the U.K. and Switzerland. Patients are increasingly benefitting from the advantages of bempedoic-induced drugs, as novel drug help to reduce fatty acid synthesis in liver.

Statins & combination drug class segment of the cholesterol lowering drugs market is expected to reach a value of ~US$ 19.8 Bn by 2021. However, side effects associated with statins, such as muscle pain and undesired reactions with other medicines, act as a barrier for its adoption by patients. Hence, manufacturers are introducing new class of oral cholesterol lowering drugs that are well tolerated in patients.

Improved drug formulations in new oral drugs are being used as an alternative to statins. Manufacturers in the cholesterol lowering drugs market are increasing production capabilities to include bempedoic acid in new drug formulations. They are increasing efforts to obtain approvals for bempedoic-induced drugs in Europe.

Moreover, companies in the market for cholesterol lowering drugs are increasing research activities to develop drugs using bempedoic acid to reduce incidences of heart attack and stroke in patients. High prevalence of LDL cholesterol is another driver fueling the demand for cholesterol lowering drugs.

Analysts’ Viewpoint

Top medical innovations in the cholesterol lowering drugs market primarily involve bempedoic acid in drug formulations. Apart from North America and Europe, manufacturers are leveraging opportunities in Asia Pacific, since governments of rapidly developing countries are increasingly investing toward the strengthening of their healthcare infrastructure.

Though statins are projected for widespread adoption in the coming years, its side effects are a major concern for healthcare companies. Hence, companies in the cholesterol lowering drugs market should increase awareness about the intake of statins with Ezetimibe or PCSK9 inhibitors to reduce LDL-C and boost drug tolerance in patients. They should increase production of PCSK9 inhibitors, since these drugs are anticipated to witness high adoption during the forecast period.

Cholesterol lowering drugs market to reach a valuation of ~US$ 37.7 Bn by 2027

Cholesterol lowering drugs market is expected to expand at a CAGR of ~3% during the forecast period from 2019 to 2027

Cholesterol lowering drugs market is driven by increase in prevalence of coronary artery disease

North America accounted for a major share of the cholesterol lowering drugs market, and is projected to remain dominant during the forecast period

Key players in the cholesterol lowering drugs market include Sanofi, Pfizer, Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Cholesterol Lowering Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cholesterol Lowering Drugs Market Analysis and Forecasts, 2017–2027

5. Market Outlook

5.1. Pipeline Analysis

5.2. Key Drug Brand Analysis

5.3. Key Merger & Acquisitions

5.4. Pipeline Analysis

5.5. Global Prevalence of Cardiovascular Diseases

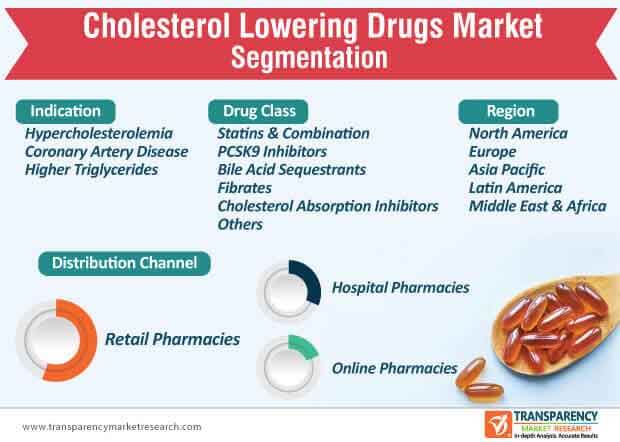

6. Global Cholesterol Lowering Drugs Market Analysis and Forecasts, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017–2027

6.3.1. Statins and Combination

6.3.2. PCSK9 Inhibitors

6.3.3. Bile Acid Sequestrants

6.3.4. Fibrates

6.3.5. Cholesterol Absorption Inhibitors

6.3.6. Others

6.4. Market Attractiveness, by Drug Class

7. Global Cholesterol Lowering Drugs Market Analysis and Forecasts, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017–2027

7.3.1. Hypercholesterolemia

7.3.2. Coronary Artery Disease

7.3.3. Higher Triglycerides

7.4. Market Attractiveness, by Indication

8. Global Cholesterol Lowering Drugs Market Analysis and Forecasts, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2027

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Distribution Channel

9. Global Cholesterol Lowering Drugs Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Cholesterol Lowering Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017–2027

10.2.1. Statins and Combination

10.2.2. PCSK9 Inhibitors

10.2.3. Bile Acid Sequestrants

10.2.4. Fibrates

10.2.5. Cholesterol Absorption Inhibitors

10.2.6. Others

10.3. Market Value Forecast, by Indication, 2017–2027

10.3.1. Hypercholesterolemia

10.3.2. Coronary Artery Disease

10.3.3. Higher Triglycerides

10.4. Market Value Forecast, by Distribution Channel, 2017–2027

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Indication

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Cholesterol Lowering Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2027

11.2.1. Statins and Combination

11.2.2. PCSK9 Inhibitors

11.2.3. Bile Acid Sequestrants

11.2.4. Fibrates

11.2.5. Cholesterol Absorption Inhibitors

11.2.6. Others

11.3. Market Value Forecast, by Indication, 2017–2027

11.3.1. Hypercholesterolemia

11.3.2. Coronary Artery Disease

11.3.3. Higher Triglycerides

11.4. Market Value Forecast, by Distribution Channel, 2017–2027

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Indication

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Cholesterol Lowering Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2027

12.2.1. Statins and Combination

12.2.2. PCSK9 Inhibitors

12.2.3. Bile Acid Sequestrants

12.2.4. Fibrates

12.2.5. Cholesterol Absorption Inhibitors

12.2.6. Others

12.3. Market Value Forecast, by Indication, 2017–2027

12.3.1. Hypercholesterolemia

12.3.2. Coronary Artery Disease

12.3.3. Higher Triglycerides

12.4. Market Value Forecast, by Distribution Channel, 2017–2027

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Indication

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Cholesterol Lowering Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017–2027

13.2.1. Statins and Combination

13.2.2. PCSK9 Inhibitors

13.2.3. Bile Acid Sequestrants

13.2.4. Fibrates

13.2.5. Cholesterol Absorption Inhibitors

13.2.6. Others

13.3. Market Value Forecast, by Indication, 2017–2027

13.3.1. Hypercholesterolemia

13.3.2. Coronary Artery Disease

13.3.3. Higher Triglycerides

13.4. Market Value Forecast, by Distribution Channel, 2017–2027

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Indication

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Cholesterol Lowering Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017–2027

14.2.1. Statins and Combination

14.2.2. PCSK9 Inhibitors

14.2.3. Bile Acid Sequestrants

14.2.4. Fibrates

14.2.5. Cholesterol Absorption Inhibitors

14.2.6. Others

14.3. Market Value Forecast, by Indication, 2017–2027

14.3.1. Hypercholesterolemia

14.3.2. Coronary Artery Disease

14.3.3. Higher Triglycerides

14.4. Market Value Forecast, by Distribution Channel, 2017–2027

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Indication

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis/Ranking, by Company (2018)

15.3. Company Profiles

15.3.1. Pfizer Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Sanofi

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. GlaxoSmithKline plc

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Company Financials

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. Novartis AG

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Company Financials

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. Merck & Co., Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Company Financials

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Amgen, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Company Financials

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. Takeda Pharmaceutical Company Limited

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Company Financials

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. Sun Pharmaceutical Industries Ltd.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Company Financials

15.3.8.3. Growth Strategies

15.3.8.4. SWOT Analysis

15.3.9. AbbVie, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Company Financials

15.3.9.3. Growth Strategies

15.3.9.4. SWOT Analysis

15.3.10. Mylan N.V.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Company Financials

15.3.10.3. Growth Strategies

15.3.10.4. SWOT Analysis

List of Tables

Table 01: Key Pipeline Analysis – Cholesterol Lowering Drugs Market

Table 02: Key Brand Sales Analysis – Cholesterol Lowering Drugs Market

Table 03: Key Mergers & Acquisition in the Cholesterol Lowering Drugs Market

Table 04: Global Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 05: Global Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 06: Global Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 07: Global Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08: North America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 09: North America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 10: North America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 11: North America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 12: Europe Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: Europe Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 14: Europe Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 15: Europe Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 16: Asia Pacific Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Pacific Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 18: Asia Pacific Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 19: Asia Pacific Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 20: Latin America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: Latin America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 22: Latin America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 23: Latin America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 24: Middle East & Africa Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 25: Middle East & Africa Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 26: Middle East & Africa Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 27: Middle East & Africa Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Cholesterol Lowering Drugs Market Value (US$ Mn), by Drug Class, 2018

Figure 03: Global Cholesterol Lowering Drugs Market Value Share Analysis, by Drug Class, 2018

Figure 04: Market Overview

Figure 05: Global Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast, 2017–2027

Figure 06: Global Cholesterol Lowering Drugs Market Value Share, by Drug Class, 2018

Figure 07: Global Cholesterol Lowering Drugs Market Value Share, by Indication, 2018

Figure 08: Global Cholesterol Lowering Drugs Market Value Share, by Distribution Channel, 2018

Figure 09: Global Cholesterol Lowering Drugs Market Value Share, by Region, 2018

Figure 10: Demographic Cardiovascular Death Statistics Globally-2017 (Millions)

Figure 11: Global Cholesterol Lowering Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 12: Global Cholesterol Lowering Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Statins & Combination, 2017-2027

Figure 13: Global Cholesterol Lowering Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by PCSK9 Inhibitors, 2017-2027

Figure 14: Global Cholesterol Lowering Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Bile Acid Sequestrants, 2017-2027

Figure 15: Global Cholesterol Lowering Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Fibrates, 2017-2027

Figure 16: Global Cholesterol Lowering Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cholesterol Absorption Inhibitors, 2017-2027

Figure 17: Global Cholesterol Lowering Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2027

Figure 18: Global Cholesterol Lowering Drugs Market Attractiveness, by Drug Class, 2019–2027

Figure 19: Global Cholesterol Lowering Drugs Market Value Share Analysis, by Indication, 2018 and 2027

Figure 20: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Y-o-Y Growth, by Hypercholesterolemia, 2017–2027

Figure 21: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Y-o-Y Growth, by Coronary Artery Disease, 2017–2027

Figure 22: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Y-o-Y Growth, by Higher Triglycerides, 2017–2027

Figure 23: Global Cholesterol Lowering Drugs Market Attractiveness Analysis, by Indication, 2019–2027

Figure 24: Global Cholesterol Lowering Drugs Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 25: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Y-o-Y Growth, by Hospital Pharmacies, 2017–2027

Figure 26: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Y-o-Y Growth, by Retail Pharmacies, 2017–2027

Figure 27: Global Cholesterol Lowering Drugs Market Value (US$ Mn) and Y-o-Y Growth, by Online Pharmacies, 2017–2027

Figure 28: Global Cholesterol Lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 29: Global Cholesterol Lowering Drugs Market Value Share Analysis, by Region, 2018 and 2027

Figure 30: Global Cholesterol Lowering Drugs Market Attractiveness Analysis, by Region, 2019–2027

Figure 31: North America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 32: North America Cholesterol Lowering Drugs Market Value Share, by Country, 2018 and 2027

Figure 33: North America Cholesterol Lowering Drugs Market Attractiveness, by Country, 2019–2027

Figure 34: North America Cholesterol Lowering Drugs Market Value Share, by Drug Class, 2018 and 2027

Figure 35: North America Cholesterol Lowering Drugs Market Attractiveness, by Drug Class, 2019–2027

Figure 36: North America Cholesterol Lowering Drugs Market Value Share, by Indication, 2018 and 2027

Figure 37: North America Cholesterol Lowering Drugs Market Attractiveness, by Indication, 2019–2027

Figure 38: North America Cholesterol Lowering Drugs Market Value Share, by Distribution Channel, 2018 and 2027

Figure 39: North America Cholesterol Lowering Drugs Market Attractiveness, by Distribution Channel, 2019–2027

Figure 40: Europe Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 41: Europe Cholesterol Lowering Drugs Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 42: Europe Cholesterol Lowering Drugs Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 43: Europe Cholesterol Lowering Drugs Market Value Share, by Drug Class, 2018 and 2027

Figure 44: Europe Cholesterol Lowering Drugs Market Attractiveness, by Drug Class, 2019–2027

Figure 45: Europe Cholesterol Lowering Drugs Market Value Share, by Indication, 2018 and 2027

Figure 46: Europe Cholesterol Lowering Drugs Market Attractiveness, by Indication, 2019–2027

Figure 47: Europe Cholesterol Lowering Drugs Market Value Share, by Distribution Channel, 2018 and 2027

Figure 48: Europe Cholesterol Lowering Drugs Market Attractiveness, by Distribution Channel, 2019–2027

Figure 49: Asia Pacific Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 50: Asia Pacific Cholesterol Lowering Drugs Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 51: Asia Pacific Cholesterol Lowering Drugs Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 52: Asia Pacific Cholesterol Lowering Drugs Market Value Share, by Drug Class, 2018 and 2027

Figure 53: Asia Pacific Cholesterol Lowering Drugs Market Attractiveness, by Drug Class, 2019–2027

Figure 54: Asia Pacific Cholesterol Lowering Drugs Market Value Share, by Indication, 2018 and 2027

Figure 55: Asia Pacific Cholesterol Lowering Drugs Market Attractiveness, by Indication, 2019–2027

Figure 56: Asia Pacific Cholesterol Lowering Drugs Market Value Share, by Distribution Channel, 2018 and 2027

Figure 57: Asia Pacific Cholesterol Lowering Drugs Market Attractiveness, by Distribution Channel, 2019–2027

Figure 58: Latin America Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 59: Latin America Cholesterol Lowering Drugs Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 60: Latin America Cholesterol Lowering Drugs Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 61: Latin America Cholesterol Lowering Drugs Market Value Share, by Drug Class, 2018 and 2027

Figure 62: Latin America Cholesterol Lowering Drugs Market Attractiveness, by Drug Class, 2019–2027

Figure 63: Latin America Cholesterol Lowering Drugs Market Value Share, by Indication, 2018 and 2027

Figure 64: Latin America Cholesterol Lowering Drugs Market Attractiveness, by Indication, 2019–2027

Figure 65: Latin America Cholesterol Lowering Drugs Market Value Share, by Distribution Channel, 2018 and 2027

Figure 66: Latin America Cholesterol Lowering Drugs Market Attractiveness, by Distribution Channel, 2019–2027

Figure 67: Middle East & Africa Cholesterol Lowering Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 68: Middle East & Africa Cholesterol Lowering Drugs Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 69: Middle East & Africa Cholesterol Lowering Drugs Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 70: Middle East & Africa Cholesterol Lowering Drugs Market Value Share, by Drug Class, 2018 and 2027

Figure 71: Middle East & Africa Cholesterol Lowering Drugs Market Attractiveness, by Drug Class, 2019–2027

Figure 72: Middle East & Africa Cholesterol Lowering Drugs Market Value Share, by Indication, 2018 and 2027

Figure 73: Middle East & Africa Cholesterol Lowering Drugs Market Attractiveness, by Indication, 2019–2027

Figure 74: Middle East & Africa Cholesterol Lowering Drugs Market Value Share, by Distribution Channel, 2018 and 2027

Figure 75: Middle East & Africa Cholesterol Lowering Drugs Market Attractiveness, by Distribution Channel, 2019–2027

Figure 76: Market Position/Ranking Analysis, 2018, by Tier and Size of the Company