Analysts’ Viewpoint on Market Scenario

Rise in demand for electronic devices and advancements in automotive and industrial automation are expected to propel the global chip resistor market development during the forecast period. The trend toward miniaturization and increase in use of Internet of Things (IoT) devices are driving demand for smaller and more precise chip resistors that can be used in a wide range of applications.

Manufacturers are investing in research and development to improve the quality and performance of their chip resistors and to develop new products that meet the evolving needs of customers. They are also offering competitive pricing to attract customers, especially in price-sensitive markets.

Chip resistor is a passive electronic component that restricts the flow of direct and alternating current. It can lower the voltage or keep the current constant in an electronic circuit. Chip resistors are available in either square or rectangular chip packages. They can be used to safeguard, power, or control circuits. Resistors, as passive components, can only reduce voltage or current signals and cannot increase them.

Surface-mount resistors are widely employed in electronic circuits to limit or control the flow of electrical current. They are utilized to set the bias of transistors, control the gain of amplifiers, and act as pull-up or pull-down resistors in digital circuits. Surface-mount resistors are commonly found in a wide range of electronic devices, including smartphones, tablets, laptops, televisions, and automotive electronics, among others.

Consumer electronics is one of the prominent sectors worldwide. According to the India Brand Equity Foundation, in 2022, exports of computer hardware and peripherals stood at US$ 284.26 Mn and that of consumer electronics stood at US$ 258.94 million, in India. Thus, growth in the consumer electronics sector is projected to augment the demand for chip resistors in the near future.

Chip resistors are essential components in manufacturing smartphones, tablets, laptops, cameras, and other electronic components. They are used to regulate the flow of electrical current in various parts of these devices, such as the display, audio system, and charging circuit.

Miniaturization of consumer electronics is likely to spur the chip resistor market growth in the next few years. Demand for chip resistors that can fit into these smaller spaces while still providing high levels of precision and performance is increasing, as electronic devices continue to become smaller and more compact. The trend toward miniaturization is driven by factors such as portability, convenience, and improved functionality.

Use of advanced materials and manufacturing techniques is expected to improve the performance and stability of electronic components. Major smartphone and tablet manufacturers, such as Apple, Samsung, and Huawei, rely on chip resistors to ensure reliability and high-quality performance of their products.

Electronic systems and components, such as infotainment systems, Advanced Driver Assistance Systems (ADAS), powertrain control systems, and communication systems, are gaining traction in the automotive sector. Integration of these components offers new features and capabilities such as hands-free navigation, traffic and weather updates, collision avoidance systems, and improved fuel efficiency. Therefore, increase in the integration of electronics in automobiles is projected to boost market expansion in the near future.

Chip resistors are commonly used to control electric current in circuits, set specific voltages, and reduce or eliminate interference in signals. They can be found in various automotive systems such as engine management, audio, climate control, and lighting.

Components employed in the automotive sector must be highly reliable, durable, and resistant to high temperatures. Chip resistors actively meet these requirements, as they are typically made from materials that can withstand high temperatures and harsh operating conditions, including high humidity and vibration. Additionally, these resistors are compact and lightweight, making them a good choice for usage in tight spaces where weight is a concern, such as in electric and hybrid vehicles.

According to the latest chip resistor market trends, the thick film resistor type segment held largest share of 52.0% in 2022. Growth of the segment can be ascribed to increase in demand for miniaturized and high-performance electronic devices. Thick film chip resistors offer a high degree of precision, stability, and reliability, making them suitable for use in consumer electronics. They are cost-effective and easy to integrate into electronic circuits. Surge in the popularity of IoT devices is also augmenting the demand for thick film resistors.

The thin film resistor segment is anticipated to grow at a significant pace due to rise in adoption of wearable devices and a paradigm shift toward miniaturization and multifunctionality of electronic devices.

The industrial end-use industry segment is projected to hold largest share during the forecast period. Chip resistors are suitable for a wide range of industrial applications, including power supplies, motor controls, and high-frequency circuits, due to their compact size and ability to handle high power in a small package.

Industrial applications often require precise resistance values and stability over a wide range of temperatures. Chip resistors are available in different types, such as thin film and thick film, each with unique properties. Thin film chip resistors offer high precision, stability, and low thermal coefficient of resistance. They are commonly employed in precision circuits such as instrumentation and control systems. Thick film chip resistors are known for their high power handling capabilities and are commonly used in power supplies, motor controls, and power electronics.

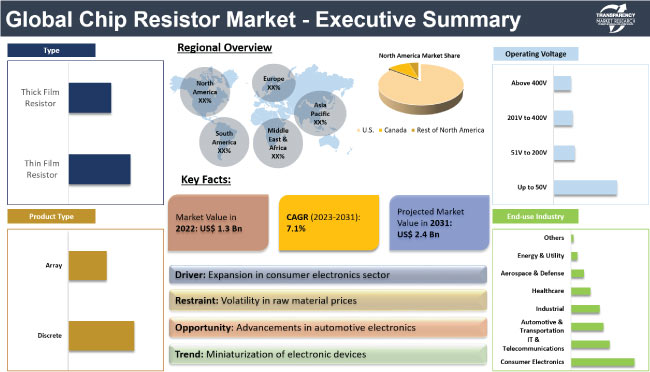

Asia Pacific held largest share of 33.0% in 2022. The region is anticipated to dominate the industry from 2023 to 2031, as per the latest chip resistor market forecast. Expansion in the consumer electronics sector and rise in digitalization in end-use industries are augmenting market statistics in the region.

North America is one of the significant regions in the global industry and is driven by growth in demand for automotive electronics. Middle East & Africa is a larger consumer of chip resistors than South America. However, the industry in South America is estimated to grow at a rapid pace compared to that in Middle East & Africa, in the near future.

The global industry is fragmented, with a small number of medium to large-scale vendors controlling the market share. AVX Corporation, Bourns, Inc., CTS Corporation, Hong Kong Resistors Manufactory, Kusum Enterprises Pvt. Ltd., Panasonic Corporation, ROHM Semiconductors, Samsung Electro-Mechanics, Susumu International, Synton-Tech Corporation, TE Connectivity, Tecdia Inc., Vishay Intertechnology, Inc., and YAGEO Group are key entities operating in this industry.

Key players have been profiled in the chip resistor market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Chip resistor manufacturers are developing smaller and more precise resistors that can meet the requirements of the latest electronic devices. They are also launching new products to increase their chip resistor market share. In January 2023, Bourns, Inc., a manufacturer of electronic components, expanded its line of high-power thick film resistors with the launch of four new AEC-Q200 compliant product series including Bourns Model CRM-Q, CRS-Q, CMP-Q, and CHP-Q Series.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 2.4 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.3 Bn in 2022

It is expected to grow at a CAGR of 7.1% from 2023 to 2031

It is projected to reach US$ 2.4 Bn by the end of 2031

Expansion in consumer electronics sector and rise in integration of electronics into automobiles

The thick film resistor type segment held approximately 52.0% share in 2022

Asia Pacific is more lucrative for vendors

The U.S. recorded 16.0% share in 2022

AVX Corporation, Bourns, Inc., CTS Corporation, Hong Kong Resistors Manufactory, Kusum Enterprises Pvt. Ltd., Panasonic Corporation, ROHM Semiconductors, Samsung Electro-Mechanics, Susumu International, Synton-Tech Corporation, TE Connectivity, Tecdia Inc., Vishay Intertechnology, Inc., and YAGEO Group

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Chip Resistor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Passive Devices Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Chip Resistor Market Analysis, by Type

5.1. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Thin Film Resistor

5.1.2. Thick Film Resistor

5.2. Market Attractiveness Analysis, by Type

6. Chip Resistor Market Analysis, by Product Type

6.1. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Product Type, 2017–2031

6.1.1. Discrete

6.1.2. Array

6.2. Market Attractiveness Analysis, by Product Type

7. Chip Resistor Market Analysis, by Operating Voltage

7.1. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Operating Voltage, 2017–2031

7.1.1. Up to 50V

7.1.2. 51V to 200V

7.1.3. 201V to 400V

7.1.4. Above 400V

7.2. Market Attractiveness Analysis, by Operating Voltage

8. Chip Resistor Market Analysis, by End-use Industry

8.1. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

8.1.1. Consumer Electronics

8.1.2. IT & Telecommunications

8.1.3. Automotive & Transportation

8.1.4. Industrial

8.1.5. Healthcare

8.1.6. Aerospace & Defense

8.1.7. Energy & Utility

8.1.8. Others (Oil & Gas, Media & Entertainment, etc.)

8.2. Market Attractiveness Analysis, by End-use Industry

9. Chip Resistor Market Analysis and Forecast, by Region

9.1. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Chip Resistor Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Thin Film Resistor

10.3.2. Thick Film Resistor

10.4. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Product Type, 2017–2031

10.4.1. Discrete

10.4.2. Array

10.5. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Operating Voltage, 2017–2031

10.5.1. Up to 50V

10.5.2. 51V to 200V

10.5.3. 201V to 400V

10.5.4. Above 400V

10.6. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.6.1. Consumer Electronics

10.6.2. IT & Telecommunications

10.6.3. Automotive & Transportation

10.6.4. Industrial

10.6.5. Healthcare

10.6.6. Aerospace & Defense

10.6.7. Energy & Utility

10.6.8. Others (Oil & Gas, Media & Entertainment, etc.)

10.7. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. by Type

10.8.2. by Product Type

10.8.3. by Operating Voltage

10.8.4. by End-use Industry

10.8.5. by Country/Sub-region

11. Europe Chip Resistor Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Thin Film Resistor

11.3.2. Thick Film Resistor

11.4. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Product Type, 2017–2031

11.4.1. Discrete

11.4.2. Array

11.5. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Operating Voltage, 2017–2031

11.5.1. Up to 50V

11.5.2. 51V to 200V

11.5.3. 201V to 400V

11.5.4. Above 400V

11.6. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.6.1. Consumer Electronics

11.6.2. IT & Telecommunications

11.6.3. Automotive & Transportation

11.6.4. Industrial

11.6.5. Healthcare

11.6.6. Aerospace & Defense

11.6.7. Energy & Utility

11.6.8. Others (Oil & Gas, Media & Entertainment, etc.)

11.7. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. by Type

11.8.2. by Product Type

11.8.3. by Operating Voltage

11.8.4. by End-use Industry

11.8.5. by Country/Sub-region

12. Asia Pacific Chip Resistor Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Thin Film Resistor

12.3.2. Thick Film Resistor

12.4. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Product Type, 2017–2031

12.4.1. Discrete

12.4.2. Array

12.5. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Operating Voltage, 2017–2031

12.5.1. Up to 50V

12.5.2. 51V to 200V

12.5.3. 201V to 400V

12.5.4. Above 400V

12.6. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.6.1. Consumer Electronics

12.6.2. IT & Telecommunications

12.6.3. Automotive & Transportation

12.6.4. Industrial

12.6.5. Healthcare

12.6.6. Aerospace & Defense

12.6.7. Energy & Utility

12.6.8. Others (Oil & Gas, Media & Entertainment, etc.)

12.7. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. by Type

12.8.2. by Product Type

12.8.3. by Operating Voltage

12.8.4. by End-use Industry

12.8.5. by Country/Sub-region

13. Middle East & Africa Chip Resistor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.3.1. Thin Film Resistor

13.3.2. Thick Film Resistor

13.4. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Product Type, 2017–2031

13.4.1. Discrete

13.4.2. Array

13.5. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Operating Voltage, 2017–2031

13.5.1. Up to 50V

13.5.2. 51V to 200V

13.5.3. 201V to 400V

13.5.4. Above 400V

13.6. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Consumer Electronics

13.6.2. IT & Telecommunications

13.6.3. Automotive & Transportation

13.6.4. Industrial

13.6.5. Healthcare

13.6.6. Aerospace & Defense

13.6.7. Energy & Utility

13.6.8. Others (Oil & Gas, Media & Entertainment, etc.)

13.7. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. by Type

13.8.2. by Product Type

13.8.3. by Operating Voltage

13.8.4. by End-use Industry

13.8.5. by Country/Sub-region

14. South America Chip Resistor Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

14.3.1. Thin Film Resistor

14.3.2. Thick Film Resistor

14.4. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Product Type, 2017–2031

14.4.1. Discrete

14.4.2. Array

14.5. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by Operating Voltage, 2017–2031

14.5.1. Up to 50V

14.5.2. 51V to 200V

14.5.3. 201V to 400V

14.5.4. Above 400V

14.6. Chip Resistor Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

14.6.1. Consumer Electronics

14.6.2. IT & Telecommunications

14.6.3. Automotive & Transportation

14.6.4. Industrial

14.6.5. Healthcare

14.6.6. Aerospace & Defense

14.6.7. Energy & Utility

14.6.8. Others (Oil & Gas, Media & Entertainment, etc.)

14.7. Chip Resistor Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. by Type

14.8.2. by Product Type

14.8.3. by Operating Voltage

14.8.4. by End-use Industry

14.8.5. by Country/Sub-region

15. Competition Assessment

15.1. Global Chip Resistor Market Competition Matrix - a Dashboard View

15.1.1. Global Chip Resistor Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. AVX Corporation

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Bourns, Inc.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. CTS Corporation

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Hong Kong Resistors Manufactory

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Kusum Enterprises Pvt. Ltd.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Panasonic Corporation

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. ROHM Semiconductors

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Samsung Electro-Mechanics

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Susumu International

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Synton-Tech Corporation

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. TE Connectivity

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Tecdia Inc.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Vishay Intertechnology, Inc.

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. YAGEO Group

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. by Type

17.1.2. by Product Type

17.1.3. by Operating Voltage

17.1.4. by End-use Industry

17.1.5. by Region

List of Tables

Table 1: Global Chip Resistor Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 2: Global Chip Resistor Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 3: Global Chip Resistor Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 4: Global Chip Resistor Market Size & Forecast, by Operating Voltage, Value (US$ Bn), 2017-2031

Table 5: Global Chip Resistor Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 6: Global Chip Resistor Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 7: Global Chip Resistor Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 8: North America Chip Resistor Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 9: North America Chip Resistor Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 10: North America Chip Resistor Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 11: North America Chip Resistor Market Size & Forecast, by Operating Voltage, Value (US$ Bn), 2017-2031

Table 12: North America Chip Resistor Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 13: North America Chip Resistor Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 14: North America Chip Resistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 15: Europe Chip Resistor Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 16: Europe Chip Resistor Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 17: Europe Chip Resistor Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 18: Europe Chip Resistor Market Size & Forecast, by Operating Voltage, Value (US$ Bn), 2017-2031

Table 19: Europe Chip Resistor Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 20: Europe Chip Resistor Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 21: Europe Chip Resistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 22: Asia Pacific Chip Resistor Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 23: Asia Pacific Chip Resistor Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 24: Asia Pacific Chip Resistor Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 25: Asia Pacific Chip Resistor Market Size & Forecast, by Operating Voltage, Value (US$ Bn), 2017-2031

Table 26: Asia Pacific Chip Resistor Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 27: Asia Pacific Chip Resistor Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 28: Asia Pacific Chip Resistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 29: Middle East & Africa Chip Resistor Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 30: Middle East & Africa Chip Resistor Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 31: Middle East & Africa Chip Resistor Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 32: Middle East & Africa Chip Resistor Market Size & Forecast, by Operating Voltage, Value (US$ Bn), 2017-2031

Table 33: Middle East & Africa Chip Resistor Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 34: Middle East & Africa Chip Resistor Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 35: Middle East & Africa Chip Resistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

Table 36: South America Chip Resistor Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 37: South America Chip Resistor Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 38: South America Chip Resistor Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 39: South America Chip Resistor Market Size & Forecast, by Operating Voltage, Value (US$ Bn), 2017-2031

Table 40: South America Chip Resistor Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 41: South America Chip Resistor Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 42: South America Chip Resistor Market Size & Forecast, by Country Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Chip Resistor Market Share Analysis, by Region

Figure 02:Global Chip Resistor Market, Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Chip Resistor Market, Value (US$ Bn), 2017-2031

Figure 04: Global Chip Resistor Market, Volume (Million Units), 2017-2031

Figure 05: Global Chip Resistor Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 06: Global Chip Resistor Market Share Analysis, by Type, 2022 and 2031

Figure 07: Global Chip Resistor Market Attractiveness, by Type, Value (US$ Bn), 2022-2031

Figure 08: Global Chip Resistor Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 09: Global Chip Resistor Market Share Analysis, by Product Type, 2022 and 2031

Figure 10: Global Chip Resistor Market Attractiveness, by Product Type, Value (US$ Bn), 2022-2031

Figure 11: Global Chip Resistor Market Size & Forecast, by Operating Voltage, Revenue (US$ Bn), 2017-2031

Figure 12: Global Chip Resistor Market Share Analysis, by Operating Voltage, 2022 and 2031

Figure 13: Global Chip Resistor Market Attractiveness, by Operating Voltage, Value (US$ Bn), 2022-2031

Figure 14: Global Chip Resistor Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 15: Global Chip Resistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 16: Global Chip Resistor Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022-2031

Figure 17: Global Chip Resistor Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 18: Global Chip Resistor Market Share Analysis, by Region, 2022 and 2031

Figure 19: Global Chip Resistor Market Attractiveness, by Region, Value (US$ Bn), 2022-2031

Figure 20: North America Chip Resistor Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 21: North America Chip Resistor Market Share Analysis, by Type, 2022 and 2031

Figure 22: North America Chip Resistor Market Attractiveness, by Type, Value (US$ Bn), 2022-2031

Figure 23: North America Chip Resistor Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 24: North America Chip Resistor Market Share Analysis, by Product Type, 2022 and 2031

Figure 25: North America Chip Resistor Market Attractiveness, by Product Type, Value (US$ Bn), 2022-2031

Figure 26: North America Chip Resistor Market Size & Forecast, by Operating Voltage, Revenue (US$ Bn), 2017-2031

Figure 27: North America Chip Resistor Market Share Analysis, by Operating Voltage, 2022 and 2031

Figure 28: North America Chip Resistor Market Attractiveness, by Operating Voltage, Value (US$ Bn), 2022-2031

Figure 29: North America Chip Resistor Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 30: North America Chip Resistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 31: North America Chip Resistor Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022-2031

Figure 32: North America Chip Resistor Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 33: North America Chip Resistor Market Share Analysis, by Country 2022 and 2031

Figure 34: North America Chip Resistor Market Attractiveness, by Country Value (US$ Bn), 2022-2031

Figure 35: Europe Chip Resistor Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 36: Europe Chip Resistor Market Share Analysis, by Type, 2022 and 2031

Figure 37: Europe Chip Resistor Market Attractiveness, by Type, Value (US$ Bn), 2022-2031

Figure 38: Europe Chip Resistor Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 39: Europe Chip Resistor Market Share Analysis, by Product Type, 2022 and 2031

Figure 40: Europe Chip Resistor Market Attractiveness, by Product Type, Value (US$ Bn), 2022-2031

Figure 41: Europe Chip Resistor Market Size & Forecast, by Operating Voltage, Revenue (US$ Bn), 2017-2031

Figure 42: Europe Chip Resistor Market Share Analysis, by Operating Voltage, 2022 and 2031

Figure 43: Europe Chip Resistor Market Attractiveness, by Operating Voltage, Value (US$ Bn), 2022-2031

Figure 44: Europe Chip Resistor Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 45: Europe Chip Resistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 46: Europe Chip Resistor Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022-2031

Figure 47: Europe Chip Resistor Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 48: Europe Chip Resistor Market Share Analysis, by Country 2022 and 2031

Figure 49: Europe Chip Resistor Market Attractiveness, by Country Value (US$ Bn), 2022-2031

Figure 50: Asia Pacific Chip Resistor Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 51: Asia Pacific Chip Resistor Market Share Analysis, by Type, 2022 and 2031

Figure 52: Asia Pacific Chip Resistor Market Attractiveness, by Type, Value (US$ Bn), 2022-2031

Figure 53: Asia Pacific Chip Resistor Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 54: Asia Pacific Chip Resistor Market Share Analysis, by Product Type, 2022 and 2031

Figure 55: Asia Pacific Chip Resistor Market Attractiveness, by Product Type, Value (US$ Bn), 2022-2031

Figure 56: Asia Pacific Chip Resistor Market Size & Forecast, by Operating Voltage, Revenue (US$ Bn), 2017-2031

Figure 57: Asia Pacific Chip Resistor Market Share Analysis, by Operating Voltage, 2022 and 2031

Figure 58: Asia Pacific Chip Resistor Market Attractiveness, by Operating Voltage, Value (US$ Bn), 2022-2031

Figure 59: Asia Pacific Chip Resistor Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 60: Asia Pacific Chip Resistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 61: Asia Pacific Chip Resistor Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022-2031

Figure 62: Asia Pacific Chip Resistor Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 63: Asia Pacific Chip Resistor Market Share Analysis, by Country 2022 and 2031

Figure 64: Asia Pacific Chip Resistor Market Attractiveness, by Country Value (US$ Bn), 2022-2031

Figure 65: Middle East & Africa Chip Resistor Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 66: Middle East & Africa Chip Resistor Market Share Analysis, by Type, 2022 and 2031

Figure 67: Middle East & Africa Chip Resistor Market Attractiveness, by Type, Value (US$ Bn), 2022-2031

Figure 68: Middle East & Africa Chip Resistor Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 69: Middle East & Africa Chip Resistor Market Share Analysis, by Product Type, 2022 and 2031

Figure 70: Middle East & Africa Chip Resistor Market Attractiveness, by Product Type, Value (US$ Bn), 2022-2031

Figure 71: Middle East & Africa Chip Resistor Market Size & Forecast, by Operating Voltage, Revenue (US$ Bn), 2017-2031

Figure 72: Middle East & Africa Chip Resistor Market Share Analysis, by Operating Voltage, 2022 and 2031

Figure 73: Middle East & Africa Chip Resistor Market Attractiveness, by Operating Voltage, Value (US$ Bn), 2022-2031

Figure 74: Middle East & Africa Chip Resistor Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 75: Middle East & Africa Chip Resistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 76: Middle East & Africa Chip Resistor Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022-2031

Figure 77: Middle East & Africa Chip Resistor Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 78: Middle East & Africa Chip Resistor Market Share Analysis, by Country 2022 and 2031

Figure 79: Middle East & Africa Chip Resistor Market Attractiveness, by Country Value (US$ Bn), 2022-2031

Figure 80: South America Chip Resistor Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 81: South America Chip Resistor Market Share Analysis, by Type, 2022 and 2031

Figure 82: South America Chip Resistor Market Attractiveness, by Type, Value (US$ Bn), 2022-2031

Figure 83: South America Chip Resistor Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 84: South America Chip Resistor Market Share Analysis, by Product Type, 2022 and 2031

Figure 85: South America Chip Resistor Market Attractiveness, by Product Type, Value (US$ Bn), 2022-2031

Figure 86: South America Chip Resistor Market Size & Forecast, by Operating Voltage, Revenue (US$ Bn), 2017-2031

Figure 87: South America Chip Resistor Market Share Analysis, by Operating Voltage, 2022 and 2031

Figure 88: South America Chip Resistor Market Attractiveness, by Operating Voltage, Value (US$ Bn), 2022-2031

Figure 89: South America Chip Resistor Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 90: South America Chip Resistor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 91: South America Chip Resistor Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022-2031

Figure 92: South America Chip Resistor Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 93: South America Chip Resistor Market Share Analysis, by Country 2022 and 2031

Figure 94: South America Chip Resistor Market Attractiveness, by Country Value (US$ Bn), 2022-2031