Analysts’ Viewpoint on Market Scenario

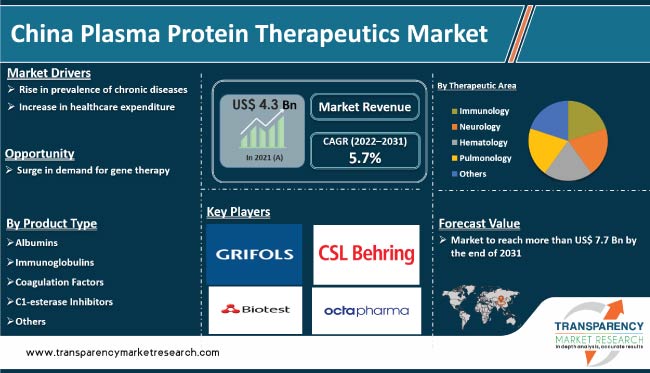

The China plasma protein therapeutics market size is expected to grow at a significant pace in the next few years due to increase in the prevalence of chronic diseases. Plasma protein therapies are used for the treatment and management of various autoimmune disorders.

Rise in healthcare expenditure is anticipated to augment market progress during the forecast period. The Government of China is focused on improving the diagnosis and treatment of rare diseases. Surge in demand for gene therapy is likely to offer lucrative growth opportunities for vendors in the industry. Vendors are engaged in the approval and launch of new products to increase their China plasma protein therapeutics market share.

Plasma protein therapeutics are proteins derived from human plasma. They are employed for the treatment of various medical conditions. Plasma protein therapeutics can be used for the treatment of blood disorders such as congenital fibrinogen deficiency, hemophilia A, Von Willebrand disease, and Disseminated Intravascular Coagulation (DIC). These disorders are caused by a deficiency or dysfunction of proteins involved in the blood clotting process. Plasma protein therapies help restore normal levels of these proteins in the body.

Plasma protein therapeutics can be utilized for the treatment of immune disorders such as primary immunodeficiency, autoimmune diseases, and certain infectious diseases. These disorders are caused by malfunctions in the immune system. Plasma protein therapies, such as Intravenous Immunoglobulin (IVIg) and anti-D immunoglobulin, can help boost the immune system.

Plasma protein therapeutics are used for the treatment of various chronic diseases such as cancer, cardiovascular diseases, and autoimmune diseases. Several factors contribute to the rise in cases of chronic diseases in China. Rapid industrialization has led to significant changes in people's lifestyles.

Rise in usage of motorized transportation and increase in the consumption of processed and high-calorie food products boost the risk of lifestyle disorders among the populace. Thus, surge in the incidence of chronic diseases is projected to contribute to China plasma protein therapeutics market growth in the next few years.

China is witnessing a gradual increase in the geriatric population, environmental pollution, and genetic predisposition. The proportion of people over the age of 65 years is expected to reach 20% of the overall population by 2035. This, in turn, is likely to boost the China plasma protein therapeutics market development in the near future.

Public awareness regarding plasma protein therapies is increasing due to high prevalence of various chronic diseases. Plasma protein therapies increase life expectancy and the enhance quality of life. These therapies also reduce life-threatening complications in people suffering from plasma protein deficiencies.

Plasma protein therapeutics are expensive. This could lead to market limitations. However, surge in healthcare expenditure is estimated to drive the China plasma protein therapeutics market expansion in the next few years. The Government of China has invested significantly in the healthcare sector in the past few years. According to the World Bank, healthcare expenditure in China as a percentage of GDP has increased from around 4% in 2000 to nearly 9% in 2020.

According to the latest China plasma protein therapeutics market analysis, the immunoglobulins product type segment accounted for largest share in 2021. Growth in the incidence of immune-mediated diseases, such as autoimmune disorders, allergies, and immune deficiency disorders, is augmenting demand for immunoglobulin protein therapeutics.

R&D in protein engineering and manufacturing technologies is expected to offer more effective and safer immunoglobulin protein therapeutics. Presence of favorable reimbursement policies for immunoglobulin protein therapeutics also positively impacts segment growth.

As per the latest China plasma protein therapeutics market insights, the immunology therapeutic area segment dominated the industry in 2021. Increase in the incidence of immune disorders is boosting the segment. Rheumatoid arthritis, systemic lupus erythematosus, Inflammatory Bowel Disease (IBD), and Multiple Sclerosis (MS) are some of the most common autoimmune disorders. Psoriatic, rheumatoid arthritis, and ankylosing spondylitis are the diseases with the highest number of cases in China.

The China plasma protein therapeutics market research report concludes with the company profiles section that includes key information such as product portfolio, recent developments, financial overview, company overview, strategies, and segments. Most companies focus on strategies such as new product launches, mergers & acquisitions, partnerships, and collaborations to compete in the marketplace.

Biognosys AG, Biotest AG, Taibang Biological Group, CSL Behring (CSL), Grifols, S.A., Kedrion S.p.A., Octapharma AG, Takeda Pharmaceutical Company Limited, and Shanghai RAAS are key entities operating in the China plasma protein therapeutics market. Several international pharmaceutical companies have established production facilities in China, which has led to surge in the domestic production of plasma protein therapeutics. This trend is expected to continue as the Government of China continues to implement policies to encourage the expansion of the domestic pharmaceutical industry.

|

Attribute |

Detail |

|

Market Size in 2021 |

US$ 4.3 Bn |

|

Forecast Value in 2031 |

More than US$ 7.7 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Country Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 4.3 Bn in 2021

It is projected to reach more than US$ 7.7 Bn by 2031

It is anticipated to be 5.7% from 2022 to 2031

Rise in prevalence of chronic diseases and increase in healthcare expenditure

Biognosys AG, Biotest AG, Taibang Biological Group, CSL Behring (CSL), Grifols, S.A., Kedrion S.p.A., Octapharma AG, Takeda Pharmaceutical Company Limited, and Shanghai RAAS

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: China Plasma Protein Therapeutics Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

5. Key Insights

5.1. Albumin Overview

5.2. Supply Chain of Human Serum Albumin (HSA) Market

5.3. Annual Consumption of Human Albumin

5.4. Key Product/Brand Analysis

5.5. List of Customers & Distributors

5.6. Impact of COVID-19 Pandemic on Industry

6. China Plasma Protein Therapeutics Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Albumins

6.3.2. Immunoglobulins

6.3.3. Coagulation Factors

6.3.4. C1-esterase Inhibitors

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product Type

7. China Plasma Protein Therapeutics Market Analysis and Forecast, by Therapeutic Area

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Therapeutic Area, 2017–2031

7.3.1. Immunology

7.3.2. Neurology

7.3.3. Hematology

7.3.4. Pulmonology

7.3.5. Others

7.4. Market Attractiveness Analysis, by Therapeutic Area

8. Competition Landscape

8.1. Market Player – Competition Matrix (By Tier and Size of Companies)

8.2. Market Share Analysis, by Company (2021)

8.3. Company Profiles

8.3.1. Biognosys AG

8.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.1.2. Product Portfolio

8.3.1.3. SWOT Analysis

8.3.1.4. Strategic Overview

8.3.2. Biotest AG

8.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.2.2. Product Portfolio

8.3.2.3. SWOT Analysis

8.3.2.4. Strategic Overview

8.3.3. China Biologic Products Holdings, Inc.

8.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.3.2. Product Portfolio

8.3.3.3. SWOT Analysis

8.3.3.4. Strategic Overview

8.3.4. CSL Behring

8.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.4.2. Product Portfolio

8.3.4.3. SWOT Analysis

8.3.4.4. Strategic Overview

8.3.5. Grifols, S.A.

8.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.5.2. Product Portfolio

8.3.5.3. SWOT Analysis

8.3.5.4. Strategic Overview

8.3.6. Octapharma AG

8.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.6.2. Product Portfolio

8.3.6.3. SWOT Analysis

8.3.6.4. Strategic Overview

8.3.7. Shanghai RAAS

8.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.7.2. Product Portfolio

8.3.7.3. SWOT Analysis

8.3.7.4. Strategic Overview

8.3.8. Takeda Pharmaceutical Company Limited

8.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.8.2. Product Portfolio

8.3.8.3. SWOT Analysis

8.3.8.4. Strategic Overview

8.3.9. Kedrion S.p.A.

8.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.9.2. Product Portfolio

8.3.9.3. SWOT Analysis

8.3.9.4. Strategic Overview

List of Tables

Table 01: China Plasma Protein Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: China Plasma Protein Therapeutics Market Value (US$ Mn) Forecast, by Therapeutic Area, 2017–2031

List of Figures

Figure 01: China Plasma Protein Therapeutics Market, by Product Type, 2021 and 2031

Figure 02: China Plasma Protein Therapeutics Market Attractiveness Analysis, Product Type, 2022–2031

Figure 03: China Plasma Protein Therapeutics Market (US$ Mn), by Albumins, 2017–2031

Figure 04: China Plasma Protein Therapeutics Market (US$ Mn), by Immunoglobulins, 2017–2031

Figure 05: China Plasma Protein Therapeutics Market (US$ Mn), by Coagulation Factors, 2017–2031

Figure 06: China Plasma Protein Therapeutics Market (US$ Mn), by C1-esterase Inhibitors, 2017–2031

Figure 07: China Plasma Protein Therapeutics Market (US$ Mn), by Others, 2017–2031

Figure 08: China Plasma Protein Therapeutics Market, by Therapeutic Area, 2021 and 2031

Figure 09: China Plasma Protein Therapeutics Market Attractiveness Analysis, Therapeutic Area, 2022–2031

Figure 10: China Plasma Protein Therapeutics Market (US$ Mn), by Immunology, 2017–2031

Figure 11: China Plasma Protein Therapeutics Market (US$ Mn), by Neurology, 2017–2031

Figure 12: China Plasma Protein Therapeutics Market (US$ Mn), by Hematology, 2017–2031

Figure 13: China Plasma Protein Therapeutics Market (US$ Mn), by Pulmonology, 2017–2031

Figure 14: China Plasma Protein Therapeutics Market (US$ Mn), by Others, 2017–2031