Analysts’ Viewpoint

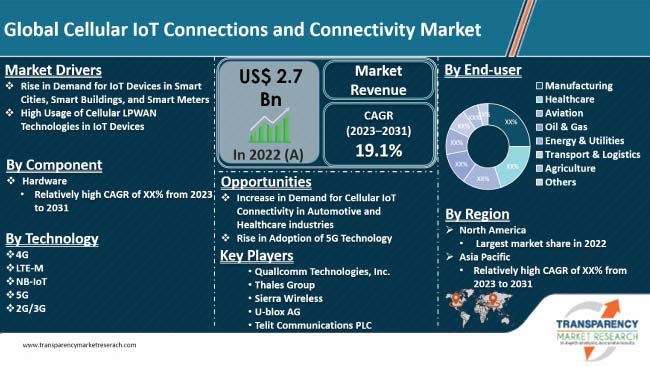

Cellular IoT connectivity is a way to connect Internet of Things (IoT) devices to the internet using cellular networks. It provides scalable and reliable connectivity for a diverse range of IoT deployments. Rising demand for IoT devices in various applications, such as smart cities, smart buildings and smart meters, is accelerating the cellular IoT connections and connectivity market demand. Moreover, high usage of cellular LPWAN in IoT devices is also playing a key role cellular IoT connections and connectivity market development. On the other hand, cybersecurity threats on cellular IoT connections and connectivity technologies can hinder market growth.

Meanwhile, increase in demand for cellular IoT in automotive and healthcare industries and rise in adoption of 5G technology are opening up cellular IoT connections and connectivity market opportunities. Cellular IoT connections market distributors are investing in R&D to be able to improve the performance of their services and develop new technologies for sensor integration.

Cellular IoT connections and connectivity is a complex network; a method of connecting physical things such as sensors to the internet. IoT cellular network is the mainstay of driving secure connections of different devices to the internet across different sectors. Cellular IoT connections and connectivity include many sub-categories of network technology such as 2G, 3G, 4G, Lte-M, NB-IoT and 5G. Long Term Evolution for Machines (LTE-M) and Narrowband-Internet of Things (NB-IoT) are the two main types of cellular IoT.

Cellular IoT connectivity has become more accessible, efficient, and cost-effective due to the deployment of 4G and the emergence of 5G networks, thereby making it an attractive choice for IoT deployments.

Internet of things (IoT) are currently being leveraged in majority of industries, and the adoption is expected to increase at a consistent pace. Moreover, there is a significant demand for IoT devices in smart city initiatives, smart buildings, and smart meters.

The number of smart cities initiatives has been increasing every year. These smart cities utilize IoT devices to collect data and improve efficiency and sustainability. IoT devices used in these smart cities are in the form of traffic sensors, noise sensors, water quality sensors, parking sensors, security cameras, streetlights and others.

These IoT devices are connected through cellular IoT technology. For instance, water leakage detection and automatic closing of the supplying pipes at the appropriate locations can be easily managed through a deployed NBIoT, which is a cellular IoT technology.

Cellular IoT is ideal for smart buildings, as it allows devices to be connected even in remote areas or where Wi-Fi is not available. Cellular IoT devices can be used to collect data on diverse building conditions, such as temperature, humidity, occupancy, and energy usage. This data can be used to improve building efficiency and sustainability. Cellular IoT can also be utilized to improve security and safety in buildings. For instance, sensors can be used to detect unauthorized entry or fire, and alarms can be sent to security personnel or occupants. According to memoori, the number of connected devices installed in commercial smart buildings was over 1.5 Bn in 2022.

Smart meters are devices that measure and track energy usage. They can be used to collect data on a variety of factors, such as electricity, gas, and water usage. This data can be used to improve energy efficiency and sustainability, as well as to provide better customer service. Cellular IoT can be used to connect smart meters to a central network. This allows meter data to be collected and analyzed in real time. This information can then be used to identify areas where energy can be saved, such as by turning off lights in unoccupied rooms or adjusting the temperature of HVAC systems.

Usage of IoT in the automotive industry, ranging from connected devices for cars to automated vehicles, has significantly impacted the sector. IoT has limitless potential for the automobile industry, and it can revolutionize how drivers interact and commute with their vehicles. CV2X (cellular vehicle to everything) is a platform that connects smart transport systems and vehicles with each other. These connected cars enable quicker data transmission and improved vehicle communication.

In 2021, there were around 250 million connected cars on the road. These cars use cellular IoT connectivity to connect with smart transport systems. Demand for these cars is rising consistently across the globe. As per Smartcar, 30 million connected vehicles were sold globally in 2020, out of which 13 million connected vehicles were sold in U.S. alone, accounting for 91% of total vehicles sold in the country.

Demand of IoT devices and solutions is increasing at rapid rate worldwide. Various healthcare applications leverage cellular IoT technologies through NB-IoT or 5G. For instance, 5G is quite effective for wearable sensors, such as heart monitors, as it offers low latency and transmits data at a quicker rate. Cellular IoT is also being used for emergency and alarm systems in the healthcare industry with the aim of providing help to patients as soon as possible.

Demand for IoT solutions in the healthcare industry is increasing at a rapid pace, and it is expected to continue to increase in the upcoming years. Increase in IoT devices and solutions is estimated to further fuel the demand for cellular IoT connectivity. Cellular connectivity provides wide range of networks, which is important for healthcare applications that need to be able to connect devices in remote areas or areas with poor WiFi signal. For instance, cellular IoT can be used to connect remote patient monitoring devices, such as heart rate and blood pressure monitors, which need to be able to transmit data to a central server even if the patient is not in a WiFi-connected area.

Growth of cellular IoT in automotive and healthcare industries in the next few years is likely to open up new opportunities in the cellular IoT connections and connectivity market.

According to the latest cellular IoT connections and connectivity industry research report, North America is anticipated to hold dominant share of the global industry during the forecast period. The region, especially the U.S., is at the forefront of technological advancements. This is due to the increase in adoption of cellular IoT connectivity in the automotive, transport and logistics, and wearable sectors in the region. Another reason is that major companies that engage in the market are based in the U.S.

Cellular IoT connections and connectivity industry growth in Asia Pacific is expected to be at a notable CAGR during the forecast period. Increasing smart city and smart infrastructure initiatives in countries such as China and India is expected to accelerate the cellular IoT connections and connectivity market growth in Asia Pacific.

The cellular IoT connections and connectivity market report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

ARM Limited, Huawei Technologies Co., Ltd, MediaTek Inc., Quallcomm Technologies, Inc., Telit Communications PLC, Sierra Wireless, Thales Group, Vodafone Limited, Telefonaktiebolaget LM Ericsson, U-blox AG, Zte Corporation and Sequans Communications are the key companies in cellular IoT connections and connectivity market.

Prominent providers are investing in R&D activities to introduce advanced edge computing and IoT solutions that can cater to the growing cellular IoT connections and connectivity market demand. These service providers are tapping into the latest cellular IoT connections and connectivity market trends to gain new opportunities and stay ahead of the competitive curve.

Key players in the cellular IoT connections and connectivity market forecast report have been profiled based on various parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 2.7 Bn |

|

Market Forecast Value in 2031 |

US$ 12.7 Bn |

|

Growth Rate (CAGR) |

19.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.7 Bn in 2022

It is anticipated to reach US$ 12.7 Bn by the end of 2031.

The CAGR is estimated to be 19.1% from 2023 to 2031.

Rise in demand for IoT devices in smart cities, smart buildings & smart meters and high usage of cellular LPWAN in IoT devices

North America accounted for the leading share in 2022

ARM Limited, Huawei Technologies Co., Ltd, MediaTek Inc., Quallcomm Technologies, Inc., Telit Communications PLC, Sierra Wireless, Thales Group, Vodafone Limited, Telefonaktiebolaget LM Ericsson, U-blox AG, Zte Corporation and Sequans Communications.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Cellular IoT Connections and Connectivity Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Cellular IoT Connections and Connectivity Market

4.5. PEST Analysis

4.6. Porter’s Analysis

4.7. Market Opportunity Assessment - by Region (North America/ Europe/Asia Pacific/Middle East and Africa/South America)

4.7.1. By Component

4.7.2. By Technology

4.7.3. By End-user

5. Global Cellular IoT Connections and Connectivity Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

5.2. Pricing Model Analysis/Price Trend Analysis

6. Global Cellular IoT Connections and Connectivity Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.2. Software

6.3.3. Services

7. Global Cellular IoT Connections and Connectivity Market Analysis, by Technology

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Technology, 2018 - 2031

7.3.1. 2G/3G

7.3.2. 4G

7.3.3. LTE-M

7.3.4. NB-IoT

7.3.5. 5G

8. Global Cellular IoT Connections and Connectivity Market Analysis, by End-user

8.1. Key Segment Analysis

8.2. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

8.2.1. Agriculture

8.2.2. Aviation

8.2.3. Healthcare

8.2.4. Transportation & Logistics

8.2.5. Energy & Utilities

8.2.6. Manufacturing

8.2.7. Oil & Gas

8.2.8. Others

9. Global Cellular IoT Connections and Connectivity Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Cellular IoT Connections and Connectivity Market Analysis and Forecast

10.1. Regional Outlook

10.2. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Technology

10.2.3. By End-user

10.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Cellular IoT Connections and Connectivity Market Analysis and Forecast

11.1. Regional Outlook

11.2. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Technology

11.2.3. By End-user

11.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Cellular IoT Connections and Connectivity Market Analysis and Forecast

12.1. Regional Outlook

12.2. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Technology

12.2.3. By End-user

12.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Cellular IoT Connections and Connectivity Market Analysis and Forecast

13.1. Regional Outlook

13.2. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Technology

13.2.3. By End-user

13.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Cellular IoT Connections and Connectivity Market Analysis and Forecast

14.1. Regional Outlook

14.2. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Technology

14.2.3. By End-user

14.3. Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Competitive Landscape by Tier Structure of Companies

15.3. Scale of Competition, 2022

15.4. Scale of Competition at Regional Level, 2022

15.5. Market Revenue Share Analysis/Ranking, by Leading Players (2022)

15.6. List of Startups

15.7. Competition Evolution

15.8. Major Mergers & Acquisitions, Expansions, Partnership, Contracts, Deals, etc.

16. Company Profiles

16.1. ARM Limited

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Recent Developments

16.1.6. Impact of COVID-19

16.1.7. TMR View

16.1.8. Competitive Threats and Weakness

16.2. Huawei Technologies Co., Ltd

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Recent Developments

16.2.6. Impact of COVID-19

16.2.7. TMR View

16.2.8. Competitive Threats and Weakness

16.3. MediaTek Inc.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Recent Developments

16.3.6. Impact of COVID-19

16.3.7. TMR View

16.3.8. Competitive Threats and Weakness

16.4. Quallcomm Technologies, Inc.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Recent Developments

16.4.6. Impact of COVID-19

16.4.7. TMR View

16.4.8. Competitive Threats and Weakness

16.5. Telit Communications PLC

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Recent Developments

16.5.6. Impact of COVID-19

16.5.7. TMR View

16.5.8. Competitive Threats and Weakness

16.6. Sierra Wireless

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Recent Developments

16.6.6. Impact of COVID-19

16.6.7. TMR View

16.6.8. Competitive Threats and Weakness

16.7. Thales Group

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Recent Developments

16.7.6. Impact of COVID-19

16.7.7. TMR View

16.7.8. Competitive Threats and Weakness

16.8. Vodafone Limited

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Recent Developments

16.8.6. Impact of COVID-19

16.8.7. TMR View

16.8.8. Competitive Threats and Weakness

16.9. Telefonaktiebolaget LM Ericsson

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Recent Developments

16.9.6. Impact of COVID-19

16.9.7. TMR View

16.9.8. Competitive Threats and Weakness

16.10. U-blox AG

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Recent Developments

16.10.6. Impact of COVID-19

16.10.7. TMR View

16.10.8. Competitive Threats and Weakness

16.11. Zte Corporation

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Recent Developments

16.11.6. Impact of COVID-19

16.11.7. TMR View

16.11.8. Competitive Threats and Weakness

16.12. Sequans Communications

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Recent Developments

16.12.6. Impact of COVID-19

16.12.7. TMR View

16.12.8. Competitive Threats and Weakness

16.13. Others

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Recent Developments

16.13.6. Impact of COVID-19

16.13.7. TMR View

16.13.8. Competitive Threats and Weakness

17. Key Takeaways

List of Tables

Table 1. Acronyms Used in Cellular IoT Connections and Connectivity Market

Table 2. North America Cellular IoT Connections and Connectivity Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 3. Europe Cellular IoT Connections and Connectivity Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 4. Asia Pacific Cellular IoT Connections and Connectivity Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 5. Middle East & Africa Cellular IoT Connections and Connectivity Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 6. South America Cellular IoT Connections and Connectivity Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 7. Forecast Factors: Relevance and Impact (1/2)

Table 8. Forecast Factors: Relevance and Impact (2/2)

Table 9. Impact Analysis of Drivers & Restraints

Table 10. Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 11. Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 12. Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 13. Global Cellular IoT Connections and Connectivity Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 14. North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 15. North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 16. North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 17. North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 18. U.S. Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 19. Canada Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 20. Mexico Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 21. Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 22. Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 23. Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 24. Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 25. Germany Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 26. U.K. Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 27. France Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 28. Italy Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 29. Spain Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 30. Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 31. Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 32. Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 33. Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 34. China Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 35. India Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 36. Japan Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 37. ASEAN Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 38. Middle East & Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 39. Middle East & Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 40. Middle East & Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 41. Middle East & Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 42. Saudi Arabia Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 43. United Arab Emirates Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 44. South Africa Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 45. South America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 46. South America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 47. South America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 48. South America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 49. Brazil Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 50. Argentina Cellular IoT Connections and Connectivity Market Revenue CAGR Breakdown (%), by Growth Term

Table 51. Mergers & Acquisitions, Partnerships (1/2)

Table 52. Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1. Global Cellular IoT Connections and Connectivity Market Size (US$ Mn) Forecast, 2018-2031

Figure 2. Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3. Top Segment Analysis of Cellular IoT Connections and Connectivity Market

Figure 4. Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5. Global Cellular IoT Connections and Connectivity Market Attractiveness Assessment, by Component

Figure 6. Global Cellular IoT Connections and Connectivity Market Attractiveness Assessment, by Technology

Figure 7. Global Cellular IoT Connections and Connectivity Market Attractiveness Assessment, by End-user

Figure 8. Global Cellular IoT Connections and Connectivity Market Attractiveness Assessment, by Region

Figure 9. Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn) Historic Trends, 2017 - 2022

Figure 10. Global Cellular IoT Connections and Connectivity Market Revenue Opportunity (US$ Mn) Historic Trends, 2017 - 2022

Figure 11. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2023

Figure 12. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2031

Figure 13. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 14. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 15. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 16. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2023

Figure 17. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2031

Figure 18. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 2G/3G, 2023 - 2031

Figure 19. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 4G, 2023 - 2031

Figure 20. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by LTE-M, 2023 - 2031

Figure 21. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by NB-IoT, 2023 - 2031

Figure 22. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 5G,

Figure 23. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2023

Figure 24. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2031

Figure 25. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Agriculture, 2023 - 2031

Figure 26. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Aviation, 2023 - 2031

Figure 27. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 28. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Transportation & Logistics, 2023 - 2031

Figure 29. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2023 - 2031

Figure 30. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 31. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 32. Global Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 33. Global Cellular IoT Connections and Connectivity Market Opportunity (US$ Mn), by Region

Figure 34. Global Cellular IoT Connections and Connectivity Market Opportunity Share (%), by Region, 2023-2031

Figure 35. Global Cellular IoT Connections and Connectivity Market Size (US$ Mn), by Region, 2023 & 2031

Figure 36. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Region, 2023

Figure 37. Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Region, 2031

Figure 38. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 39. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 40. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 41. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 42. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 43. North America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Component

Figure 44. North America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Technology

Figure 45. North America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by End-user

Figure 46. North America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Country

Figure 47. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2023

Figure 48. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2031

Figure 49. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 50. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 51. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 52. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2023

Figure 53. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2031

Figure 54. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 2G/3G, 2023 - 2031

Figure 55. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 4G, 2023 - 2031

Figure 56. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by LTE-M, 2023 - 2031

Figure 57. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Data & NB-IoT, 2023 - 2031

Figure 58. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 5G, 2023 - 2031

Figure 59. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2023

Figure 60. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2031

Figure 61. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Agriculture, 2023 - 2031

Figure 62. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Aviation, 2023 - 2031

Figure 63. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 64. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Transportation & Logistics, 2023 - 2031

Figure 65. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2023 - 2031

Figure 66. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 67. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 68. North America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 69. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2023

Figure 70. North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2031

Figure 71. U.S. Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 72. Canada Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 73. Mexico Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 74. Europe Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Component

Figure 75. Europe Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Technology

Figure 76. Europe Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by End-user

Figure 77. Europe Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Country

Figure 78. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2023

Figure 79. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2031

Figure 80. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 81. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 82. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 83. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2023

Figure 84. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2031

Figure 85. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 2G/3G, 2023 - 2031

Figure 86. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 4G, 2023 - 2031

Figure 87. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by LTE-M, 2023 - 2031

Figure 88. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by NB-IoT, 2023 - 2031

Figure 89. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 5G, 2023 - 2031

Figure 90. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2023

Figure 91. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2031

Figure 92. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Agriculture, 2023 - 2031

Figure 93. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Aviation, 2023 - 2031

Figure 94. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 95. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Transportation & Logistics, 2023 - 2031

Figure 96. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2023 - 2031

Figure 97. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 98. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 99. Europe Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 100. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2023

Figure 101. Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2031

Figure 102. Germany Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 103. U.K. Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 104. France Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 105. Italy Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 106. Spain Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 107. Asia Pacific Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Component

Figure 108. Asia Pacific Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Technology

Figure 109. Asia Pacific Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by End-user

Figure 110. Asia Pacific Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Country

Figure 111. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2023

Figure 112. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2031

Figure 113. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 114. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 115. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 116. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2023

Figure 117. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2031

Figure 118. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 2G/3G, 2023 - 2031

Figure 119. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 4G, 2023 - 2031

Figure 120. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by LTE-M, 2023 - 2031

Figure 121. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by NB-IoT, 2023 - 2031

Figure 122. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 5G, 2023 - 2031

Figure 123. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2023

Figure 124. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2031

Figure 125. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Agriculture, 2023 - 2031

Figure 126. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Aviation, 2023 - 2031

Figure 127. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 128. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Transportation & Logistics, 2023 - 2031

Figure 129. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2023 - 2031

Figure 130. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 131. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 132. Asia Pacific Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 133. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2023

Figure 134. Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2031

Figure 135. China Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 136. India Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 137. Japan Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 138. ASEAN Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 139. Middle East & Africa Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Component

Figure 140. Middle East & Africa Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Technology

Figure 141. Middle East & Africa Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by End-user

Figure 142. Middle East & Africa Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Country

Figure 143. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2023

Figure 144. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2031

Figure 145. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 146. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 147. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 148. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2023

Figure 149. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2031

Figure 150. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 2G/3G, 2023 - 2031

Figure 151. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 4G, 2023 - 2031

Figure 152. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by LTE-M, 2023 - 2031

Figure 153. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by NB-IoT, 2023 - 2031

Figure 154. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 5G, 2023 - 2031

Figure 155. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2023

Figure 156. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2031

Figure 157. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Agriculture, 2023 - 2031

Figure 158. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Aviation, 2023 - 2031

Figure 159. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 160. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Transportation & Logistics, 2023 - 2031

Figure 161. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2023 - 2031

Figure 162. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 163. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 164. Middle East & Africa Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 165. Middle East & Africa East & Africa East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2023

Figure 166. Middle East & Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2031

Figure 167. Saudi Arabia Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 168. United Arab Emirates Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 169. South Africa Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 170. South America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Component

Figure 171. South America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Technology

Figure 172. South America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by End-user

Figure 173. South America Cellular IoT Connections and Connectivity Market Revenue Opportunity Share, by Country

Figure 174. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2023

Figure 175. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2031

Figure 176. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 177. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 178. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 179. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2023

Figure 180. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Technology, 2031

Figure 181. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 2G/3G, 2023 - 2031

Figure 182. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 4G, 2023 - 2031

Figure 183. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by LTE-M, 2023 - 2031

Figure 184. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by NB-IoT, 2023 - 2031

Figure 185. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by 5G, 2023 - 2031

Figure 186. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2023

Figure 187. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2031

Figure 188. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Agriculture, 2023 - 2031

Figure 189. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Aviation, 2023 - 2031

Figure 190. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 191. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Transportation & Logistics, 2023 - 2031

Figure 192. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Energy & Utilities, 2023 - 2031

Figure 193. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 194. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 195. South America Cellular IoT Connections and Connectivity Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 196. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2023

Figure 197. South America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country, 2031

Figure 198. Brazil Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 199. Argentina Cellular IoT Connections and Connectivity Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031