Analysts’ Viewpoint

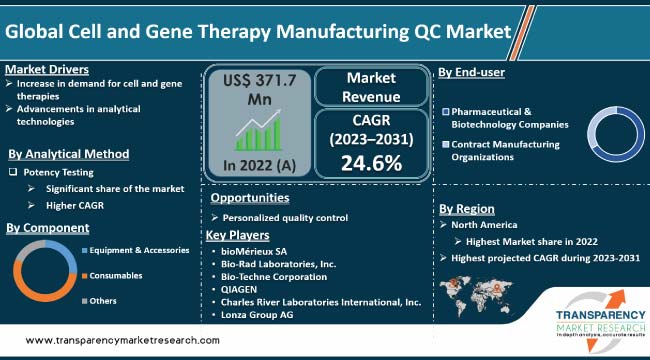

Expansion of the pharmaceutical and biotechnology industries is driving the global cell and gene therapy manufacturing QC market. Rapid development and adoption of cell & gene therapies are propelling demand for quality control measures. Surge in need to ensure safety, efficacy, and consistency of these therapies is fueling market expansion. Furthermore, stringent regulatory requirements to meet regulatory compliance and approval are expected to bolster the global cell and gene therapy manufacturing QC market size.

Technological advancements in analytical methods and testing techniques offer lucrative opportunities to market players. Companies are focusing on increasing investment in research and development in order to develop safer and more efficient cell & gene therapies.

Cell and gene therapies hold immense potential in revolutionizing the treatment of various diseases, including genetic disorders, cancer, and autoimmune conditions. As these therapies advance from the research phase to commercialization, ensuring the safety, efficacy, and consistency of the manufactured products becomes crucial. This is driving demand for quality control measures.

The market is highly competitive, with several companies specializing in providing quality control services and technologies. These companies offer a range of solutions, such as analytical testing services, quality control software, and consulting services, to support cell and gene therapy manufacturers. Additionally, collaborations and partnerships between industry players, research institutions, and regulatory bodies contribute to the expansion of the market.

Demand for cell and gene therapies is fueled by factors that highlight their potential to revolutionize disease treatment. One key factor is the concept of personalized medicine, where therapies can be customized based on an individual's specific genetic makeup and disease characteristics. This approach holds great promise in delivering more targeted and effective treatments, particularly for complex and challenging conditions.

Cell and gene therapies have demonstrated remarkable clinical breakthroughs in previously incurable diseases. For instance, CAR-T cell therapies have shown unprecedented success in treating certain types of leukemia and lymphoma, with high response rates and long-lasting remissions.

These success stories have generated significant excitement among patients, healthcare providers, and investors, thereby driving the demand for further advancements and research in the field.

Surge in demand for cell and gene therapies is also influenced by the support and recognition from regulatory agencies and healthcare systems. Regulatory bodies such as the FDA and EMA have established expedited approval pathways and frameworks specifically designed to accommodate the unique characteristics of these therapies. This regulatory support has encouraged investment and development in the field, subsequently boosting demand for manufacturing and quality control services to ensure the safety and efficacy of these therapies.

Advancements in analytical technologies have played a crucial role in propelling global cell and gene therapy manufacturing QC market growth. These technological advancements have significantly enhanced the capacity to analyze, characterize, and guarantee the quality of cell and gene therapy products.

Development and implementation of cutting-edge analytical techniques, including next-generation sequencing (NGS), mass spectrometry, flow cytometry, and imaging technologies, have revolutionized quality control practices in the field of cell and gene therapies. These advanced technologies offer improved sensitivity, resolution, and throughput, enabling a more comprehensive and precise assessment of various critical parameters.

For instance, NGS enables comprehensive profiling of the genomic and transcriptomic characteristics of cells and vectors used in cell and gene therapies. It facilitates the detection of genetic modifications, identification of potential off-target effects, and evaluation of vector integrity and stability. The valuable information obtained through NGS aids in ensuring the consistency and quality of therapeutic products.

In terms of component, the global consumables segment accounted for the largest global cell and gene therapy manufacturing QC market share in 2022. Consumables play a critical role in the quality control process, as these are essential for sample collection, preparation, and analysis.

These consumables include various items such as reagents, test kits, assay plates, pipettes, and tubes. Consistent demand for consumables is ascribed to the need to perform routine quality control testing throughout the cell and gene therapy manufacturing process. As the number of cell and gene therapy manufacturing facilities and research institutions increases, so does the demand for consumables.

The consumables segment is experiencing continuous growth due to recurring nature of quality control testing. Quality control is not a one-time event, but an ongoing process that ensures the safety, efficacy, and consistency of cell and gene therapies.

Regular testing is required to monitor the quality and integrity of raw materials, intermediates, and final products. This necessitates the constant supply and utilization of consumables, making it a fundamental component of the quality control process.

The segment benefits from the wide range and diversity of consumable products available in the market. Different types of consumables are required for various quality control tests, ranging from basic laboratory supplies to specialized reagents and assay kits. Availability of a comprehensive portfolio of consumables tailored for cell and gene therapy quality control applications drives the segment.

Based on the analytical method, the potency testing segment dominated the global cell and gene therapy manufacturing QC industry in 2022. Potency testing is a critical parameter in assessing the effectiveness and therapeutic potential of cell and gene therapies. It measures the biological activity or functional characteristics of the therapy, providing crucial insights into its efficacy. Potency testing helps ensure that the therapy meets the desired standards and delivers the intended therapeutic effect, making it a vital aspect of quality control.

Regulatory agencies emphasize the importance of potency testing in the evaluation and approval of cell and gene therapies. Potency is often a primary endpoint in clinical trials and is closely monitored during the manufacturing process. Regulatory guidelines provide specific requirements for potency testing, necessitating its implementation to demonstrate the therapeutic value and consistency of the therapies. This regulatory focus on potency testing drives the demand for analytical methods and expertise in this particular segment.

Potency testing methods have also witnessed significant advancements and innovations in the past few years. Development of robust and reliable analytical techniques, such as bioassays, molecular assays, and functional assays, has enhanced the accuracy, sensitivity, and specificity of potency testing. These sophisticated methods enable a more precise and comprehensive evaluation of the therapeutic potency, leading to improved quality control assessment.

In terms of end-user, the pharmaceutical & biotechnology companies segment held the leading share of the global cell and gene therapy manufacturing QC market demand in 2022. These companies are at the forefront of developing and manufacturing cell and gene therapies. They invest significantly in research and development to bring innovative therapies to the market. Hence, they have a substantial demand for quality control measures to ensure the safety, efficacy, and consistency of their products. Quality control is an integral part of their manufacturing processes, and they prioritize compliance with regulatory guidelines and industry standards.

Pharmaceutical & biotechnology companies have the resources and infrastructure to establish in-house quality control laboratories or collaborate with specialized quality control service providers. They have the expertise and personnel to perform complex analytical testing and interpretation of results. This allows them to have better control over the quality control process and ensure timely and accurate assessment of their cell and gene therapy products.

As per cell and gene therapy manufacturing QC market trends, North America dominated the global industry in 2022. The region is home to a robust and well-established pharmaceutical and biotechnology industry. North America houses numerous leading companies involved in cell and gene therapy research, development, and manufacturing. These companies invest significantly in quality control measures to ensure the safety, efficacy, and compliance of their products, driving demand for quality control services and technologies.

North America has a strong regulatory framework that supports the development and commercialization of cell and gene therapies. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have implemented clear guidelines and expedited approval pathways for these therapies.

According to cell and gene therapy manufacturing QC market research, Europe has a well-developed infrastructure for healthcare and life sciences, including state-of-the-art laboratories and research facilities. The region boasts advanced analytical technologies and expertise in quality control testing. This allows companies in Europe to perform comprehensive and accurate assessment of cell and gene therapy products, ensuring their quality and consistency.

As per cell and gene therapy manufacturing QC market analysis, Asia Pacific is home to a large population base, providing a significant market for cell and gene therapies. The region also faces a high burden of diseases that can potentially be treated with advanced therapies. Increase in demand for innovative treatment options has spurred the development and manufacturing of cell and gene therapies in the region. Quality control plays a crucial role in ensuring the safety, efficacy, and consistency of these therapies, making it a priority for companies operating in Asia Pacific.

The global cell and gene therapy manufacturing QC market is fragmented, with the presence of large number of players. Merger & acquisition and collaborations are the key strategies adopted by market players to increase market share.

bioMérieux SA, Bio-Rad Laboratories, Inc., Bio-Techne Corporation, QIAGEN, Charles River Laboratories International, Inc., Lonza Group AG, Merck KGaA, Intertek Group plc, Thermo Fisher Scientific, Inc., Eurofins Scientific S.E., and F. Hoffmann-La Roche Ltd. are the prominent players in the market.

Each of the prominent players has been profiled in the cell and gene therapy manufacturing QC market report scope based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 371.7 Mn |

| Forecast Value in 2031 | More than US$ 2.8 Bn |

| Growth Rate (CAGR ) | 24.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn/Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

It was valued at US$ 371.7 Mn in 2022

It is projected to reach more than US$ 2.8 Bn by 2031

The CAGR is anticipated to be 24.6% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

bioMérieux SA, Bio-Rad Laboratories, Inc., Bio-Techne Corporation, QIAGEN, Charles River Laboratories International, Inc., Lonza Group AG, Merck KGaA, Intertek Group plc, Thermo Fisher Scientific, Inc., Eurofins Scientific S.E., and F. Hoffmann-La Roche Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cell and Gene Therapy Manufacturing Quality Control (QC) Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. Regulatory Scenario by Region/Globally

5.4. Major Research Institutes Involved

5.5. COVID-19 Pandemic Impact on Industry

6. Global Cell and Gene Therapy Manufacturing QC Analysis and Forecast, by Component

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Component, 2017-2031

6.3.1. Equipment & Accessories

6.3.2. Consumables

6.3.3. Others

6.4. Market Attractiveness Analysis, by Component

7. Global Cell and Gene Therapy Manufacturing QC Analysis and Forecast, by Analytical Method

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Analytical Method, 2017-2031

7.3.1. Sterility Testing

7.3.2. Purity Testing

7.3.3. Potency Testing

7.3.4. Identity Testing

7.3.5. Others

7.4. Market Attractiveness Analysis, by Analytical Method

8. Global Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast, by Process

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Process, 2017-2031

8.3.1. Upstream Processes

8.3.2. Downstream Processes

8.3.3. Process Development

8.4. Market Attractiveness Analysis, by Process

9. Global Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Pharmaceutical & Biotechnology Companies

9.3.2. Contract Manufacturing Organizations (CMOs)

9.4. Market Attractiveness Analysis, by End-user

10. Global Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Component, 2017-2031

11.2.1. Equipment & Accessories

11.2.2. Consumables

11.2.3. Others

11.3. Market Value Forecast, by Analytical Method, 2017-2031

11.3.1. Sterility Testing

11.3.2. Purity Testing

11.3.3. Potency Testing

11.3.4. Identity Testing

11.3.5. Others

11.4. Market Value Forecast, by Process, 2017-2031

11.4.1. Upstream Processes

11.4.2. Downstream Processes

11.4.3. Process Development

11.5. Market Value Forecast, by End-user, 2017-2031

11.5.1. Pharmaceutical & Biotechnology Companies

11.5.2. Contract Manufacturing Organizations (CMOs)

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Analytical Method

11.7.3. By Process

11.7.4. By End-user

11.7.5. By Country

12. Europe Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Component, 2017-2031

12.2.1. Equipment & Accessories

12.2.2. Consumables

12.2.3. Others

12.3. Market Value Forecast, by Analytical Method, 2017-2031

12.3.1. Sterility Testing

12.3.2. Purity Testing

12.3.3. Potency Testing

12.3.4. Identity Testing

12.3.5. Others

12.4. Market Value Forecast, by Process, 2017-2031

12.4.1. Upstream Processes

12.4.2. Downstream Processes

12.4.3. Process Development

12.5. Market Value Forecast, by End-user, 2017-2031

12.5.1. Pharmaceutical & Biotechnology Companies

12.5.2. Contract Manufacturing Organizations (CMOs)

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Analytical Method

12.7.3. By Process

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Component, 2017-2031

13.2.1. Equipment & Accessories

13.2.2. Consumables

13.2.3. Others

13.3. Market Value Forecast, by Analytical Method, 2017-2031

13.3.1. Sterility Testing

13.3.2. Purity Testing

13.3.3. Potency Testing

13.3.4. Identity Testing

13.3.5. Others

13.4. Market Value Forecast, by Process, 2017-2031

13.4.1. Upstream Processes

13.4.2. Downstream Processes

13.4.3. Process Development

13.5. Market Value Forecast, by End-user, 2017-2031

13.5.1. Pharmaceutical & Biotechnology Companies

13.5.2. Contract Manufacturing Organizations (CMOs)

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Analytical Method

13.7.3. By Process

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Component, 2017-2031

14.2.1. Equipment & Accessories

14.2.2. Consumables

14.2.3. Others

14.3. Market Value Forecast, by Analytical Method, 2017-2031

14.3.1. Sterility Testing

14.3.2. Purity Testing

14.3.3. Potency Testing

14.3.4. Identity Testing

14.3.5. Others

14.4. Market Value Forecast, by Process, 2017-2031

14.4.1. Upstream Processes

14.4.2. Downstream Processes

14.4.3. Process Development

14.5. Market Value Forecast, by End-user, 2017-2031

14.5.1. Pharmaceutical & Biotechnology Companies

14.5.2. Contract Manufacturing Organizations (CMOs)

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Component

14.7.2. By Analytical Method

14.7.3. By Process

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Component, 2017-2031

15.2.1. Equipment & Accessories

15.2.2. Consumables

15.2.3. Others

15.3. Market Value Forecast, by Analytical Method, 2017-2031

15.3.1. Sterility Testing

15.3.2. Purity Testing

15.3.3. Potency Testing

15.3.4. Identity Testing

15.3.5. Others

15.4. Market Value Forecast, by Process , 2017-2031

15.4.1. Upstream Processes

15.4.2. Downstream Processes

15.4.3. Process Development

15.5. Market Value Forecast, by End-user, 2017-2031

15.5.1. Pharmaceutical & Biotechnology Companies

15.5.2. Contract Manufacturing Organizations (CMOs)

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Component

15.7.2. By Analytical Method

15.7.3. By Process

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2022

16.3. Company Profiles

16.3.1. bioMérieux SA

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. Bio-Rad Laboratories, Inc.

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Bio-Techne Corporation

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. QIAGEN

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Charles River Laboratories International, Inc.

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Lonza Group AG

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Merck KGaA

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. Intertek Group plc

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. Thermo Fisher Scientific Inc.

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. Eurofins Scientific S.E.

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. F. Hoffmann-La Roche Ltd.

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

List of Tables

Table 01: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 02: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Analytical Method, 2017-2031

Table 03: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 04: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 07: North America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Analytical Method, 2017-2031

Table 08: North America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 09: North America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 10: North America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 11: Europe Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 12: Europe Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Analytical Method, 2017-2031

Table 13: Europe Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 14: Europe Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Europe Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 17: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Analytical Method, 2017-2031

Table 18: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 19: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 20: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Latin America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 23: Latin America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Analytical Method, 2017-2031

Table 24: Latin America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 25: Latin America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 28: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Analytical Method, 2017-2031

Table 29: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 30: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Cell and Gene Therapy Manufacturing QC Market Value Share, by Component, 2022

Figure 03: Cell and Gene Therapy Manufacturing QC Market Value Share, by Product Type, 2022

Figure 04: Cell and Gene Therapy Manufacturing QC Market Value Share, by Process, 2022

Figure 05: Cell and Gene Therapy Manufacturing QC Market Value Share, by End-user, 2022

Figure 06: Global Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Component, 2022 and 2031

Figure 07: Global Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Component, 2023-2031

Figure 08: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn), by Equipment & Accessories, 2017‒2031

Figure 09: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn), by Consumables, 2017‒2031

Figure 10: Global Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn), by Others, 2017‒2031

Figure 11: Global Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Analytical Method, 2022 and 2031

Figure 12: Global Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Analytical Method, 2023-2031

Figure 13: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Sterility Testing, 2017-2031

Figure 14: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Urological Surgery, 2017-2031

Figure 15: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Potency Testing, 2017-2031

Figure 16: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Identity Testing, 2017-2031

Figure 17: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Others, 2017-2031

Figure 18: Global Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Process, 2022 and 2031

Figure 19: Global Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Process, 2023-2031

Figure 20: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Upstream Processes, 2017-2031

Figure 21: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Downstream Processes, 2017-2031

Figure 22: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Process Development, 2017-2031

Figure 23: Global Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: Global Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by End-user, 2023-2031

Figure 25: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017-2031

Figure 26: Global Cell and Gene Therapy Manufacturing QC Market Revenue (US$ Mn), by Contract Manufacturing Organizations (CMOs), 2017-31

Figure 27: Global Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Region, 2022 and 2031

Figure 28: Global Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Region, 2023-2031

Figure 29: North America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, 2017-2031

Figure 30: North America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Country, 2022 and 2031

Figure 31: North America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Country, 2023-2031

Figure 32: North America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Component, 2022 and 2031

Figure 33: North America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Component 2023-2031

Figure 34: North America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Analytical Method, 2022 and 2031

Figure 35: North America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Analytical Method, 2023-2031

Figure 36: North America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Process, 2022 and 2031

Figure 37: North America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, Process, 2023-2031

Figure 38: North America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by End-user, 2022 and 2031

Figure 39: North America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by End-user, 2023-2031

Figure 40: Europe Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, 2017-2031

Figure 41: Europe Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Europe Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Europe Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Component, 2022 and 2031

Figure 44: Europe Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Component 2023-2031

Figure 45: Europe Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Analytical Method, 2022 and 2031

Figure 46: Europe Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Analytical Method, 2023-2031

Figure 47: Europe Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Process, 2022 and 2031

Figure 48: Europe Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, Process, 2023-2031

Figure 49: Europe Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by End-user, 2022 and 2031

Figure 50: Europe Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by End-user, 2023-2031

Figure 51: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, 2017-2031

Figure 52: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 53: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 54: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Component, 2022 and 2031

Figure 55: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Component 2023-2031

Figure 56: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Analytical Method, 2022 and 2031

Figure 57: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Analytical Method, 2023-2031

Figure 58: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Process, 2022 and 2031

Figure 59: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, Process, 2023-2031

Figure 60: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by End-user, 2022 and 2031

Figure 61: Asia Pacific Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by End-user, 2023-2031

Figure 62: Latin America Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, 2017-2031

Figure 63: Latin America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 64: Latin America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 65: Latin America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Component, 2022 and 2031

Figure 66: Latin America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Component 2023-2031

Figure 67: Latin America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Analytical Method, 2022 and 2031

Figure 68: Latin America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Analytical Method, 2023-2031

Figure 69: Latin America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Process, 2022 and 2031

Figure 70: Latin America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, Process, 2023-2031

Figure 71: Latin America Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by End-user, 2022 and 2031

Figure 72: Latin America Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by End-user, 2023-2031

Figure 73: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value (US$ Mn) Forecast, 2017-2031

Figure 74: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 75: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 76: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Component, 2022 and 2031

Figure 77: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Component 2023-2031

Figure 78: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Analytical Method, 2022 and 2031

Figure 79: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by Analytical Method, 2023-2031

Figure 80: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by Process, 2022 and 2031

Figure 81: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, Process, 2023-2031

Figure 82: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Value Share Analysis, by End-user, 2022 and 2031

Figure 83: Middle East & Africa Cell and Gene Therapy Manufacturing QC Market Attractiveness Analysis, by End-user, 2023-2031