Analysts’ Viewpoint

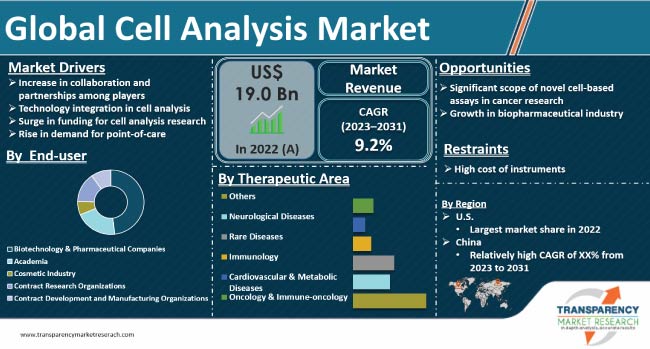

Rise in demand for personalized medicine, technological advancements, expanding applications, and emergence of new regional markets are expected to drive the global cell analysis industry growth during the forecast period. Continuous evolution of cell analysis technologies and their integration into diverse research & clinical settings are likely to propel market expansion. This in turn would facilitate deeper insights into cellular biology and revolutionizing the diagnosis and treatment of various diseases.

Increase in healthcare expenditure and rise in research activities, especially in emerging economies, offer lucrative opportunities to market players. Companies are focusing on developing efficient and affordable personalized medicines using cell analysis in order to increase market share and presence.

The cell analysis industry encompasses a range of technologies, instruments, and software used for studying and analyzing cells. It plays a crucial role in various scientific and medical disciplines, enabling researchers and clinicians to gain insights into cellular behavior, functions, and interactions. The field of cell analysis has witnessed significant advancements in the past few years, driven by technological innovations and growing demand for more comprehensive cellular analysis.

Applications of cell analysis are diverse and span across multiple fields. In basic research, cell analysis helps unravel the intricacies of cellular biology, aiding in the understanding of fundamental cellular processes and mechanisms. It also plays a crucial role in drug discovery and development by facilitating target identification and validation, as well as assessing drug efficacy and toxicity.

Technology integration is a key driver of the cell analysis market growth. New technologies can be integrated with existing ones to create more powerful and accurate tools for researchers and healthcare professionals. Hence, there has been an increasing adoption of technology integration in cell analysis by players.

In May 2023, Deepcell, a company specializing in artificial intelligence (AI)-powered single cell analysis, launched the REM-I Platform, which includes benchtop instruments, the Axon data suite and the Human Foundation Model. This high-dimensional cell morphology analysis and sorting platform combines single cell sorting, imaging, and analysis to catalyze new approaches to discovery in fields such as developmental biology, stem cell biology, cancer biology, gene therapy, and functional screening. According to the company, their AI-powered approach to cellular analysis is anticipated to develop biological research, ushering in a new era of discovery.

In January 2023, Axion BioSystems expanded its Omni live-cell imaging product family with the introduction of the Omni Pro 12 platform. The new platform is equipped with integrated robotics and a multiplate design compatible with any standard incubator, providing scientists and drug developers with increased flexibility and efficiency for live-cell imaging experiments. The platform offers a valuable tool in advancing research in areas such as oncology, immunology, and stem cell biology. The technology has the potential to facilitate the development of novel drugs and therapeutics.

Technology integration enables researchers and healthcare professionals to collect and analyze cell data more efficiently and accurately, leading to improved diagnostic and therapeutic outcomes. It can also assist companies in optimizing profits through product development mergers.

Collaboration and partnerships have a significant impact on the cell analysis market dynamics. By working together, companies and organizations pool their resources, expertise, and technologies to develop new and innovative cell analysis tools and services. The synergy is likely to give a competitive edge to the players.

Several players enter into collaborations for product development or regional expansion in order to tap the lucrative cell analysis market opportunities. For instance, in February 2023, Ultima Genomics, Inc. partnered with 10x Genomics to integrate the use of 10x Genomics Chromium Single Cell Gene Expression offerings with Ultima's sequencing systems. This collaboration, as part of the 10x Compatible Partner Program, aims to provide researchers with more efficient, cost-effective workflows for studying gene expression in single cells at a larger scale. By leveraging 10x Genomics' Single Cell offerings, researchers can gain a deeper understanding of the intricacies of biology on a cellular level through various applications.

Similarly, in March 2023, Becton Dickinson Holdings Pte. Ltd. (BD) announced an extension of its research partnership with the Agency for Science, Technology, and Research. The partnership aims to use spectral flow cytometry panels for deep immunophenotyping of human tissues, leveraging the latest advancements in technology, such as the BD FACSymphony A5 SE Cell Analyzer unit. The collaboration seeks to uncover new discoveries that can lead to improved healthcare outcomes by identifying novel insights through advanced immunophenotyping techniques.

Hence, collaboration and partnerships could drive innovation, accelerate development, and increase the impact of cell analysis growth by leveraging the strengths and resources of multiple companies and organizations.

In terms of end-user, the biotechnology & pharmaceutical companies segment is projected to account for the largest global cell analysis market share from 2023 to 2031.

Emergence of new treatments, advancements in medical devices, and innovations across various sectors offer significant market opportunities for cell analysis companies. Additionally, the shift in scientific focus toward addressing new diseases has contributed to the expansion of the segment. Moreover, governments and private organizations are investing significantly in research & development efforts to discover novel solutions.

Based on therapeutic area, the oncology & immune-oncology segment dominated the market in 2022. The nucleic acid-based drugs sub-segment of the oncology & immune-oncology segment is anticipated to expand at a high CAGR from 2023 to 2031.

Single-cell technologies of cell analysis are emerging as potent instruments in cancer research. These advanced tools allow molecular profiling of individual cells within a tumor, opening up new avenues for studying tumor heterogeneity, and the composition of cell types in the microenvironment. Rise in adoption of new technology for cell analysis is likely to increase the oncology & immune-oncology segment’s market share.

Based on technology, the flow cytometry segment is likely to account for leading share in 2022. Flow cytometry is a rapid technology used to analyze individual cells as it pass by one or numerous lasers while suspended in a buffered salt-based solution.

Availability of a greater variety of reagents in the past few years has resulted in exponential increase in the number of parameters used in experiments of flow cytometry. The market has witnessed significant rise in the use of fluorochromes, such as polymer dyes and tandem dyes, for conjugating monoclonal antibodies.

The cell analysis workplace plays a crucial role in each stage of the drug discovery and development process. By utilizing various cell analysis techniques, in vitro preclinical studies contribute to the understanding of drug candidates' efficacy, toxicity, MOA, and formulation, thus informing decision-making for further development and advancing the most promising candidates to in vivo preclinical and clinical studies. These advanced cell analysis techniques contribute to the efficiency and success of drug development efforts.

As per cell analysis market trends, the U.S. dominated the global industry, with largest share in 2022. The trend is projected to continue during the forecast period. This can be ascribed to growth in cell cycle analysis, strong presence of key players, and increase in demand for cell therapy.

In October 2022, Century Therapeutics and Bristol Myers Squibb announced a research collaboration and license agreement aimed at developing and commercializing up to four programs for hematologic malignancies and solid tumors. The collaboration brings together Century's leading iPSC-based allogeneic cell therapy platform and Bristol Myers Squibb's knowledge in cell therapy and oncology drug development.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 19.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 42.4 Bn |

|

Growth Rate (CAGR) |

9.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, and R&D overview. |

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 19.0 Bn in 2022

It is projected to reach US$ 42.4 Bn by 2031

It expanded at a CAGR of 10.9% from 2017 to 2022

It is likely to advance at a CAGR of 9.2% from 2023 to 2031

Increase in collaboration & partnerships among players, technology integration in cell analysis, surge in funding for cell analysis research, and rise in demand for point-of-care.

The biotechnology & pharmaceutical companies segment held around 48.0% share in 2022

The U.S. is expected to be highly lucrative region during the forecast period.

1. Preface

1.1. Market Definition and Scope

1.2. Key Research Objectives

2. Assumptions and Research Methodology

3. Market Overview

3.1. Overview

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Overview on R&D spending of major biotechnology and pharmaceutical companies by therapeutic area

3.3.1. Top 15 Origins of Pipeline Drugs

3.3.2. Biological versus non-biological drugs as a % of pipeline

3.3.3. Ongoing rise of gene and cell therapy

4. Global Cell Analysis Market Analysis and Forecast, by End-user

4.1. Introduction & Definition

4.2. Key Findings/Developments

4.3. Market Value Forecast, by End-user, 2017-2031

4.3.1. Biotechnology & Pharmaceutical Companies

4.3.2. Academia

4.3.3. Cosmetic Industry

4.3.4. Contract Research Organizations

4.3.5. Contract Development and Manufacturing Organizations

5. Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Analysis and Forecast, by Therapeutic Area

5.1. Introduction & Definition

5.2. Key Findings/Developments

5.3. Market Value Forecast, by Therapeutic Area, 2015-2031

5.3.1. Oncology & Immune-oncology

5.3.1.1. Small Molecules

5.3.1.2. Protein-based Therapeutics

5.3.1.3. Cell Therapy

5.3.1.4. Nucleic Acid-based Drugs

5.3.2. Cardiovascular & Metabolic Diseases

5.3.2.1. Small Molecules

5.3.2.2. Protein-based Therapeutics

5.3.2.3. Cell Therapy

5.3.2.4. Nucleic Acid-based Drugs

5.3.3. Immunology

5.3.3.1. Small Molecules

5.3.3.2. Protein-based Therapeutics

5.3.3.3. Cell Therapy

5.3.3.4. Nucleic Acid-based Drugs

5.3.4. Rare Diseases

5.3.4.1. Small Molecules

5.3.4.2. Protein-based Therapeutics

5.3.4.3. Cell Therapy

5.3.4.4. Nucleic Acid-based Drugs

5.3.5. Neurological Diseases

5.3.5.1. Small Molecules

5.3.5.2. Protein-based Therapeutics

5.3.5.3. Cell Therapy

5.3.5.4. Nucleic Acid-based Drugs

5.3.6. Others

5.3.6.1. Small Molecules

5.3.6.2. Protein-based Therapeutics

5.3.6.3. Cell Therapy

5.3.6.4. Nucleic Acid-based Drugs

6. Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Analysis and Forecast, by Technology

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Technology, 2017-2031

6.3.1. Flow Cytometry

6.3.2. Image-based Cytometry

6.3.3. Biochemical Assays

6.3.4. Mass Spectrometry

7. Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Analysis and Forecast, by Workplace

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Workplace, 2017-2031

7.3.1. Target Identification

7.3.2. Hit Generation & Lead Identification

7.3.3. Lead Optimization

7.3.4. In Vitro Preclinical Studies

7.3.5. In Vivo Preclinical Studies

7.3.6. Clinical Studies

8. Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Analysis and Forecast, by Country/Region

8.1. Key Findings

8.2. Market Value Forecast, by Country/Region, 2017-2031

8.2.1. U.S.

8.2.2. Europe

8.2.3. China

8.2.4. Rest of the World

9. U.S. Cell Analysis Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by End-user, 2017-2031

9.2.1. Biotechnology & Pharmaceutical Companies

9.2.2. Academia

9.2.3. Cosmetic Industry

9.2.4. Contract Research Organizations

9.2.5. Contract Development and Manufacturing Organizations

9.3. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Therapeutic Area, 2017-2031

9.3.1. Oncology & Immune-oncology

9.3.1.1. Small Molecules

9.3.1.2. Protein-based Therapeutics

9.3.1.3. Cell Therapy

9.3.1.4. Nucleic Acid-based Drugs

9.3.2. Cardiovascular & Metabolic Diseases

9.3.2.1. Small Molecules

9.3.2.2. Protein-based Therapeutics

9.3.2.3. Cell Therapy

9.3.2.4. Nucleic Acid-based Drugs

9.3.3. Immunology

9.3.3.1. Small Molecules

9.3.3.2. Protein-based Therapeutics

9.3.3.3. Cell Therapy

9.3.3.4. Nucleic Acid-based Drugs

9.3.4. Rare Diseases

9.3.4.1. Small Molecules

9.3.4.2. Protein-based Therapeutics

9.3.4.3. Cell Therapy

9.3.4.4. Nucleic Acid-based Drugs

9.3.5. Neurological Diseases

9.3.5.1. Small Molecules

9.3.5.2. Protein-based Therapeutics

9.3.5.3. Cell Therapy

9.3.5.4. Nucleic Acid-based Drugs

9.3.6. Others

9.3.6.1. Small Molecules

9.3.6.2. Protein-based Therapeutics

9.3.6.3. Cell Therapy

9.3.6.4. Nucleic Acid-based Drugs

9.4. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Technology, 2017-2031

9.4.1. Flow Cytometry

9.4.2. Image-based Cytometry

9.4.3. Biochemical Assays

9.4.4. Mass Spectrometry

9.5. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Workplace, 2017-2031

9.5.1. Target Identification

9.5.2. Hit Generation & Lead Identification

9.5.3. Lead Optimization

9.5.4. In Vitro Preclinical Studies

9.5.5. In Vivo Preclinical Studies

9.5.6. Clinical Studies

10. Europe Cell Analysis Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by End-user, 2017-2031

10.2.1. Biotechnology & Pharmaceutical Companies

10.2.2. Academia

10.2.3. Cosmetic Industry

10.2.4. Contract Research Organizations

10.2.5. Contract Development and Manufacturing Organizations

10.3. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Therapeutic Area, 2017-2031

10.3.1. Oncology & Immune-oncology

10.3.1.1. Small Molecules

10.3.1.2. Protein-based Therapeutics

10.3.1.3. Cell Therapy

10.3.1.4. Nucleic Acid-based Drugs

10.3.2. Cardiovascular & Metabolic Diseases

10.3.2.1. Small Molecules

10.3.2.2. Protein-based Therapeutics

10.3.2.3. Cell Therapy

10.3.2.4. Nucleic Acid-based Drugs

10.3.3. Immunology

10.3.3.1. Small Molecules

10.3.3.2. Protein-based Therapeutics

10.3.3.3. Cell Therapy

10.3.3.4. Nucleic Acid-based Drugs

10.3.4. Rare Diseases

10.3.4.1. Small Molecules

10.3.4.2. Protein-based Therapeutics

10.3.4.3. Cell Therapy

10.3.4.4. Nucleic Acid-based Drugs

10.3.5. Neurological Diseases

10.3.5.1. Small Molecules

10.3.5.2. Protein-based Therapeutics

10.3.5.3. Cell Therapy

10.3.5.4. Nucleic Acid-based Drugs

10.3.6. Others

10.3.6.1. Small Molecules

10.3.6.2. Protein-based Therapeutics

10.3.6.3. Cell Therapy

10.3.6.4. Nucleic Acid-based Drugs

10.4. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Technology, 2017-2031

10.4.1. Flow Cytometry

10.4.2. Image-based Cytometry

10.4.3. Biochemical Assays

10.4.4. Mass Spectrometry

10.5. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Workplace, 2017-2031

10.5.1. Target Identification

10.5.2. Hit Generation & Lead Identification

10.5.3. Lead Optimization

10.5.4. In Vitro Preclinical Studies

10.5.5. In Vivo Preclinical Studies

10.5.6. Clinical Studies

10.6. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Country/Sub-region, 2017-2031

10.6.1. EU5

10.6.2. U.K.

10.6.3. Switzerland

10.6.4. Rest of Europe

11. China Cell Analysis Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by End-user, 2017-2031

11.2.1. Biotechnology & Pharmaceutical Companies

11.2.2. Academia

11.2.3. Cosmetic Industry

11.2.4. Contract Research Organizations

11.2.5. Contract Development and Manufacturing Organizations

11.3. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Therapeutic Area, 2017-2031

11.3.1. Oncology & Immune-oncology

11.3.1.1. Small Molecules

11.3.1.2. Protein-based Therapeutics

11.3.1.3. Cell Therapy

11.3.1.4. Nucleic Acid-based Drugs

11.3.2. Cardiovascular & Metabolic Diseases

11.3.2.1. Small Molecules

11.3.2.2. Protein-based Therapeutics

11.3.2.3. Cell Therapy

11.3.2.4. Nucleic Acid-based Drugs

11.3.3. Immunology

11.3.3.1. Small Molecules

11.3.3.2. Protein-based Therapeutics

11.3.3.3. Cell Therapy

11.3.3.4. Nucleic Acid-based Drugs

11.3.4. Rare Diseases

11.3.4.1. Small Molecules

11.3.4.2. Protein-based Therapeutics

11.3.4.3. Cell Therapy

11.3.4.4. Nucleic Acid-based Drugs

11.3.5. Neurological Diseases

11.3.5.1. Small Molecules

11.3.5.2. Protein-based Therapeutics

11.3.5.3. Cell Therapy

11.3.5.4. Nucleic Acid-based Drugs

11.3.6. Others

11.3.6.1. Small Molecules

11.3.6.2. Protein-based Therapeutics

11.3.6.3. Cell Therapy

11.3.6.4. Nucleic Acid-based Drugs

11.4. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Technology, 2017-2031

11.4.1. Flow Cytometry

11.4.2. Image-based Cytometry

11.4.3. Biochemical Assays

11.4.4. Mass Spectrometry

11.5. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Workplace, 2017-2031

11.5.1. Target Identification

11.5.2. Hit Generation & Lead Identification

11.5.3. Lead Optimization

11.5.4. In Vitro Preclinical Studies

11.5.5. In Vivo Preclinical Studies

11.5.6. Clinical Studies

12. Rest of the World Cell Analysis Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by End-user, 2017-2031

12.2.1. Biotechnology & Pharmaceutical Companies

12.2.2. Academia

12.2.3. Cosmetic Industry

12.2.4. Contract Research Organizations

12.2.5. Contract Development and Manufacturing Organizations

12.3. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Therapeutic Area, 2017-2031

12.3.1. Oncology & Immune-oncology

12.3.1.1. Small Molecules

12.3.1.2. Protein-based Therapeutics

12.3.1.3. Cell Therapy

12.3.1.4. Nucleic Acid-based Drugs

12.3.2. Cardiovascular & Metabolic Diseases

12.3.2.1. Small Molecules

12.3.2.2. Protein-based Therapeutics

12.3.2.3. Cell Therapy

12.3.2.4. Nucleic Acid-based Drugs

12.3.3. Immunology

12.3.3.1. Small Molecules

12.3.3.2. Protein-based Therapeutics

12.3.3.3. Cell Therapy

12.3.3.4. Nucleic Acid-based Drugs

12.3.4. Rare Diseases

12.3.4.1. Small Molecules

12.3.4.2. Protein-based Therapeutics

12.3.4.3. Cell Therapy

12.3.4.4. Nucleic Acid-based Drugs

12.3.5. Neurological Diseases

12.3.5.1. Small Molecules

12.3.5.2. Protein-based Therapeutics

12.3.5.3. Cell Therapy

12.3.5.4. Nucleic Acid-based Drugs

12.3.6. Others

12.3.6.1. Small Molecules

12.3.6.2. Protein-based Therapeutics

12.3.6.3. Cell Therapy

12.3.6.4. Nucleic Acid-based Drugs

12.4. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Technology, 2017-2031

12.4.1. Flow Cytometry

12.4.2. Image-based Cytometry

12.4.3. Biochemical Assays

12.4.4. Mass Spectrometry

12.5. Biotechnology & Pharmaceutical Companies Market Value Forecast, by Workplace, 2017-2031

12.5.1. Target Identification

12.5.2. Hit Generation & Lead Identification

12.5.3. Lead Optimization

12.5.4. In Vitro Preclinical Studies

12.5.5. In Vivo Preclinical Studies

12.5.6. Clinical Studies

List of Tables

Table 01: Overview on R&D spending of major biotechnology and pharmaceutical companies, by therapeutic areas (1/4)

Table 02: Overview on R&D spending of major biotechnology and pharmaceutical companies, by therapeutic areas (2/4)

Table 03: Overview on R&D spending of major biotechnology and pharmaceutical companies, by therapeutic areas (2/3)

Table 04: Overview on R&D spending of major biotechnology and pharmaceutical companies, by therapeutic areas (4/4)

Table 05: Top 15 Origins of Pipeline Drugs

Table 06: Global Cell Analysis Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Therapeutic Area, 2017-2031

Table 08: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Oncology & Immune-oncology, 2017-2031

Table 09: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Cardiovascular & Metabolic Diseases, 2017-2031

Table 10: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Immunology, 2017-2031

Table 11: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Rare Diseases, 2017-2031

Table 12: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Neurological Diseases, 2017-2031

Table 13: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Others, 2017-2031

Table 14: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 15: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Workplace, 2017-2031

Table 16: Global Cell Analysis Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 17: U.S. Cell Analysis Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 18: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Therapeutic Area, 2017-2031

Table 19: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Oncology & Immune-oncology, 2017-2031

Table 20: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Cardiovascular & Metabolic Diseases, 2017-2031

Table 21: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Immunology, 2017-2031

Table 22: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Rare Diseases, 2017-2031

Table 23: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Neurological Diseases, 2017-2031

Table 24: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Others, 2017-2031

Table 25: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 26: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Workplace, 2017-2031

Table 27: Europe Cell Analysis Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 28: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Therapeutic Area, 2017-2031

Table 29: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Oncology & Immune-oncology, 2017-2031

Table 30: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Cardiovascular & Metabolic Diseases, 2017-2031

Table 31: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Immunology, 2017-2031

Table 32: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Rare Diseases, 2017-2031

Table 33: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Neurological Diseases, 2017-2031

Table 34: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Others, 2017-2031

Table 35: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 36: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Workplace, 2017-2031

Table 37: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 38: China Cell Analysis Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 39: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Therapeutic Area, 2017-2031

Table 40: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Oncology & Immune-oncology, 2017-2031

Table 41: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Cardiovascular & Metabolic Diseases, 2017-2031

Table 42: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Immunology, 2017-2031

Table 43: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Rare Diseases, 2017-2031

Table 44: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Neurological Diseases, 2017-2031

Table 45: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Others, 2017-2031

Table 46: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 47: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Workplace, 2017-2031

Table 48: Rest of the World Cell Analysis Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 49: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Therapeutic Area, 2017-2031

Table 50: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Oncology & Immune-oncology, 2017-2031

Table 51: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Cardiovascular & Metabolic Diseases, 2017-2031

Table 52: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Immunology, 2017-2031

Table 53: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Rare Diseases, 2017-2031

Table 54: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Neurological Diseases, 2017-2031

Table 55: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Others, 2017-2031

Table 56: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 57: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value (US$ Mn) Forecast, by Workplace, 2017-2031

List of Figures

Figure 01: Major R&D spending therapeutic areas, by companies

Figure 02: Biological versus non-biological drugs as a % of pipeline

Figure 03: Ongoing rise of gene and cell therapy

Figure 04: Global Cell Analysis Market Value Share Analysis, by End-user, 2022 and 2031

Figure 05: Global Cell Analysis Market Attractiveness Analysis, by End-user, 2023-2031

Figure 06: Global Cell Analysis Market (US$ Mn), by Biotechnology & Pharmaceutical Companies, 2017-2031

Figure 07: Global Cell Analysis Market (US$ Mn), by Academia, 2017-2031

Figure 08: Global Cell Analysis Market (US$ Mn), by Cosmetic Industry, 2017-2031

Figure 09: Global Cell Analysis Market (US$ Mn), by Contract Research Organizations, 2017-2031

Figure 10: Global Cell Analysis Market (US$ Mn), by Contract Development and Manufacturing Organizations, 2017-2031

Figure 11: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Therapeutic Area, 2022 and 2031

Figure 12: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Therapeutic Area, 2023-2031

Figure 13: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Oncology & Immune-oncology, 2017-2031

Figure 14: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Cardiovascular & Metabolic Diseases, 2017-2031

Figure 15: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Immunology, 2017-2031

Figure 16: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Rare Diseases, 2017-2031

Figure 17: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Neurological Diseases, 2017-2031

Figure 18: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Others, 2017-2031

Figure 19: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Technology, 2022 and 2031

Figure 20: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Technology, 2023-2031

Figure 21: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Flow Cytometry, 2017-2031

Figure 22: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Image-based Cytometry/Microscopy, 2017-2031

Figure 23: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Biochemical Assays, 2017-2031

Figure 24: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Mass Spectrometry, 2017-2031

Figure 25: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Analysis and Forecast, by Workplace, 2022 and 2031

Figure 26: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Workplace, 2023-2031

Figure 27: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Target Identification, 2017-2031

Figure 28: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Hit Generation & Lead Identification, 2017-2031

Figure 29: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Lead Optimization, 2017-2031

Figure 30: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by In Vitro Preclinical Studies, 2017-2031

Figure 31: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by In Vivo Preclinical Studies, 2017-2031

Figure 32: Global Biotechnology & Pharmaceutical Companies Cell Analysis Market (US$ Mn), by Clinical Studies, 2017-2031

Figure 33: Global Cell Analysis Market Value Share Analysis, by Region, 2022 and 2031

Figure 34: Global Cell Analysis Market Attractiveness Analysis, by Region, 2023-2031

Figure 35: U.S. Cell Analysis Market Value (US$ Mn) Forecast, 2017-2031

Figure 36: U.S. Cell Analysis Market Value Share Analysis, by End-user, 2022 and 2031

Figure 37: U.S. Cell Analysis Market Attractiveness Analysis, by End-user, 2023-2031

Figure 38: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Therapeutic Area, 2022 and 2031

Figure 39: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Therapeutic Area, 2023-2031

Figure 40: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Technology, 2022 and 2031

Figure 41: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Technology, 2023-2031

Figure 42: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Workplace, 2022 and 2031

Figure 43: U.S. Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Workplace, 2023-2031

Figure 44: Europe Cell Analysis Market Value (US$ Mn) Forecast, 2017-2031

Figure 45: Europe Cell Analysis Market Value Share Analysis, by End-user, 2022 and 2031

Figure 46: Europe Cell Analysis Market Attractiveness Analysis, by End-user, 2023-2031

Figure 47: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Therapeutic Area, 2022 and 2031

Figure 48: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Therapeutic Area, 2023-2031

Figure 49: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Technology, 2022 and 2031

Figure 50: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Technology, 2023-2031

Figure 51: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Workplace, 2022 and 2031

Figure 52: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Workplace, 2023-2031

Figure 53: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Europe Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 55: China Cell Analysis Market Value (US$ Mn) Forecast, 2017-2031

Figure 56: China Cell Analysis Market Value Share Analysis, by End-user, 2022 and 2031

Figure 57: China Cell Analysis Market Attractiveness Analysis, by End-user, 2023-2031

Figure 58: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Therapeutic Area, 2022 and 2031

Figure 59: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Therapeutic Area, 2023-2031

Figure 60: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Technology, 2022 and 2031

Figure 61: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Technology, 2023-2031

Figure 62: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Workplace, 2022 and 2031

Figure 63: China Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Workplace, 2023-2031

Figure 64: Rest of the World Cell Analysis Market Value (US$ Mn) Forecast, 2017-2031

Figure 65: Rest of the World Cell Analysis Market Value Share Analysis, by End-user, 2022 and 2031

Figure 66: Rest of the World Cell Analysis Market Attractiveness Analysis, by End-user, 2023-2031

Figure 67: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Therapeutic Area, 2022 and 2031

Figure 68: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Therapeutic Area, 2023-2031

Figure 69: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Technology, 2022 and 2031

Figure 70: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Technology, 2023-2031

Figure 71: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Value Share Analysis, by Workplace, 2022 and 2031

Figure 72: Rest of the World Biotechnology & Pharmaceutical Companies Cell Analysis Market Attractiveness Analysis, by Workplace, 2023-2031