Since the coronavirus breakdown, manufacturers from the food & beverages (F&B) industry are targeting on the production of various CBD (Cannabidiol) products for pain and anxiety relief. Cannabis-infused products or CBD edibles are helpful to consumers in many ways due to their remarkable medicinal benefits. Available in a variety of forms and flavors, these CBD edibles release hemp-based chemical or cannabis into the body for relief from stress and depression. Apart from inevitable financial losses due to the coronavirus pandemic, several people are also facing fear and anxiety issues. CBD edibles are found to be beneficial due to their therapeutic properties during the ongoing COVID-19 outbreak. CBD edibles market stakeholders are effortlessly contributing to set their businesses to keep the economies running amid the ongoing pandemic. Their thoughtful and data-driven decisions are responsible for the increasing demand for CBD edibles from all over the world. Market players are investing in new regions to increase the production of hemp and marijuana plants, thus driving the CBD edibles market.

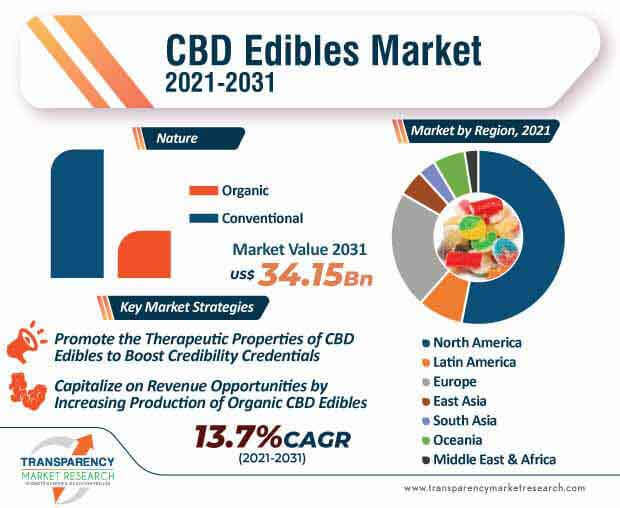

The CBD edibles market is expected to expand at a CAGR of 13.7% during the forecast period. The CBD edibles market is projected to reach the valuation of US$ 34.15 Bn by 2031. CBD edibles are gaining popularity due to their health benefits for reducing stress and chronic pain. Companies in the CBD edibles market are anticipated to join forces with researchers to develop various products in order to cater healthcare and pharmaceutical industries at a global level.

CBD is found to be effective for cancer treatments, anxiety, and relaxation. CBDs are helpful in reducing inflammation to a great extent and in chronic pain relief. People are consciously taking efforts to stay fit and healthy during the pandemic. Increasing government expenditure on healthcare supports the rising popularity and awareness of edible CBD products across the world. Small and medium scale manufacturers in the food & beverages industry are taking advantage of the situation to establish their brands in the market by introducing innovative products to cater the demands from consumers.

There are lucrative revenue opportunities for food practitioners, and manufacturers in the CBD edibles market to grow their businesses. Global acceptance and legalization of consumption of hemp and cannabis for health benefits is augmenting product manufacturers to increase the production of high-quality CBD edibles. Many countries are now making it legal to use CBD edibles since the past few years. There has been a tremendous growth in the consumption of CBD edibles after the coronavirus breakdown. Due to awareness of antioxidant and anti-aging properties of CBD & hemp products, consumers across the globe are focusing on purchasing tasty and flavorful CBD gummies, cannabis-infused chocolate bars, candies, etc. Consuming Keto-friendly CBDs, sugar-free CBD edibles, and CBDs with different fruit flavors are also a part of daily routine of many people at a global level. Little THC (Tetrahydrocannabinol) concentration (0.3%) drastically eliminates psychoactive effects and increases the usage of CBD edibles in pharmaceutical & healthcare applications.

High costs and stringent government rules & regulations on consuming CBD edibles are some of the major challenges manufacturers are facing. These products are having healing properties and can be used in chronic pain relief. Cannabis-derived products are expensive, and this factor can affect the global market. The challenge is to make them available in affordable prices so that everyone can experience their benefits. Government should focus on promotional activities in underdeveloped countries to spread awareness about CBD edibles. The rising usage of CBD edibles as dietary supplements is helping to boost production of CBD edibles.

Canopy Growth Corporation, a specialist in diversified cannabis and CBD product manufacturing, is gaining recognition due to its newly developed CBD edible products that are attracting consumers. Products such as CBD supplements, tasty CBD gummies, wellness gummies, and CBD beverages are also equally popular among consumers across the world.

The increasing expenditure on healthcare and research & development activities in North America is expected to account for the largest share of the CBD edibles market. This can be attributed to technological advancements, changing lifestyles, awareness of CBD-infused products, and presence of other major market contributors in the region.

Due to rapid urbanization and presence of top market contributors, China is one of the fastest growing markets for the production of hemp-based product and CBD edibles. The rising demand and acceptance of CBD products in recent years is contributing to the growth of the China CBD edibles market. In addition, India is also one of the most important countries in the Asia Pacific to show satisfactory growth opportunities in the CBD edibles market. The high availability of raw materials required for producing CBD edibles, industrialization, and rapidly developing economy are some of the factors attributable to the fastest revenue growth in Asia Pacific.

Sales of hemp and CBD edibles have increased since the coronavirus pandemic. Increasing online vendors across the globe are selling their products fiercely due to legalization in many countries. Factors such as growing offline and online channels, development of eCommerce industry, and rapidly expanding online businesses are boosting the demand sentiments in the CBD edibles market. Companies in the CBD edibles market are developing innovative products to fulfill the demands of consumers. Competition is tough and market players are striving to top the business by using strategic approaches. Manufacturers in the CBD edibles market are increasing the availability of an innovative range of CBD products in a variety of different forms. Various ongoing research activities on cannabidiol and its impact on human body are helping to grow businesses exponentially. Manufacturers in the CBD edibles market are exploring opportunities in product creativity and design considerations. In order to boost credibility, companies are achieving high level of sophistication and performance in the CBD edibles market to meet consumer demands.

Analysts’ Viewpoint

Companies in the CBD edibles market are mainly focusing on the production of good quality CBD products that are safe to consume. The demand for such products after the coronavirus outbreak is on the rising side. However, it is necessary for manufacturing companies to work on a few disadvantages also. The overconsumption of CBD edibles is found to be dangerous to health. In some instances, complications such as psychiatric illness, sleepiness, paranoid delusions, etc., can also occur. Thus, to avoid the side-effects of CBD edibles, companies in the CBD edibles market are increasing awareness that CBD products should be consumed in moderation, and with the prescribed dosage. The high cost of CBD edible products is also one of the major negative factors to be taken into consideration. In order to overcome these challenges, there must be collaboration between manufacturers and scientists or researchers and to identify & resolve the issues related to safety for consumption of these products. Safety is of utmost importance, and thus governments and health practitioners should focus on awareness of consuming such products on a regular basis.

CBD Edibles Market: Overview

CBD Edibles: Market Frontrunners

CBD Edibles Market: Trends

CBD Edibles Market: Strategies

CBD Edibles Market: Key Players

CBD Edibles Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 9.46 Bn |

|

Market Forecast Value in 2031 |

US$ 34.15 Bn |

|

Growth Rate (CAGR) |

17.3% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

CBD Edibles Market is expected to Reach US$ 34.15 Bn By 2031

CBD Edibles Market is estimated to rise at a CAGR of 12.7% during forecast period

The demand for CBD as an ingredient in supplementary diets is increasing is expected to drive the CBD Edibles Market

North America is more attractive for vendors in the CBD Edibles Market

Key players of CBD Edibles Market are Pure Kana, CV Sciences, TIsodiol International, Elixinol Global Ltd, Charlottes Web Holdings Inc, Canopy Growth Corp, Medical Marijuana Inc, Aurora Cannabis Inc, MGC, Pharmaceuticals Ltd, Creso Pharma Ltd., Cronos Group Inc, Curaleaf Holdings Inc, Green Thumbs Industries Inc, Tilray Inc, TGOD Holdings Ltd, Ecofibre Ltd, Colorado Botanicals Inc, Zoetic International PLC, etc

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Strategic Promotional Strategies

5. Global CBD Edibles Demand (in Value) Analysis 2016–2020 and Forecast, 2021–2031

5.1. Historical Market Value (US$ Mn) Analysis, 2016–2020

5.2. Current and Future Market Value (US$ Mn) Projections, 2021–2031

5.2.1. Y-o-Y Growth Trend Analysis

5.2.2. Absolute $ Opportunity Analysis

6. Market Background

6.1. Macro-Economic Factors

6.1.1. Global GDP Growth Outlook

6.1.2. Global Industry Value Added

6.1.3. Global Urbanization Growth Outlook

6.1.4. Global Food Security Index Outlook

6.1.5. Global Rank – Ease of Doing Business

6.1.6. Global Rank – Trading Across Borders

6.2. Impact of COVID-19 on CBD Market

6.2.1. Manufacturer/Processors

6.2.2. Supply Chain and Logistics

6.2.3. Wholesalers/Traders

6.2.4. Retailers

6.3. Impact of COVID-19 on Food & Beverage Industry

6.4. COVID-19 Risk Assessment/Impact

6.5. Global CBD Market Overview

6.6. Global Food & Beverage Industry Outlook

6.7. Perceived Benefits of CBD-Infused Product

6.8. Global CBD Edibles Production Outlook by Country

6.9. List of Potential Buyers by Region

6.10. Key Regulations by Region

6.11. Industry Value and Supply Chain Analysis

6.11.1. Profit Margin Analysis at each point of sales

6.11.2. List and Role of Key Participants

6.11.2.1. CBD Edibles Manufacturers

6.11.2.2. Distributors/Suppliers/Wholesalers

6.11.2.3. Traders/Retailers

6.11.2.4. End-Users

6.12. Market Dynamics

6.12.1. Drivers

6.12.2. Restraints

6.12.3. Opportunity Analysis

6.13. Forecast Factors - Relevance & Impact

7. Global CBD Edibles Analysis 2016–2020 and Forecast 2021–2031, By Nature

7.1. Introduction / Key Findings

7.2. Historical Market Size (US$ Mn) Analysis By Nature, 2016–2020

7.3. Current and Future Market Size (US$ Mn) and Forecast By Nature, 2021–2031

7.3.1. Organic

7.3.2. Conventional

7.4. Market Attractiveness Analysis By Nature

8. Global CBD Edibles Analysis 2016–2020 and Forecast 2021–2031, By Type

8.1. Introduction / Key Findings

8.2. Historical Market Size (US$ Mn) By Type, 2016–2020

8.3. Current and Future Market Size (US$ Mn) and Forecast By Type, 2021–2031

8.3.1. Chocolates & Candies

8.3.2. Gummies

8.3.3. Snacks

8.3.4. Supplements

8.3.5. Beverages

8.3.6. Others

8.4. Market Attractiveness Analysis By Type

9. Global CBD Edibles Analysis 2016–2020 and Forecast 2021–2031, By Sales Channel

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) By Sales Channel, 2016–2020

9.3. Current and Future Market Size (US$ Mn) and Forecast By Sales Channel, 2021–2031

9.3.1. Hypermarkets/Supermarkets

9.3.2. Specialty Stores

9.3.3. Online Retail

9.3.4. Other Retail Formats

9.4. Market Attractiveness Analysis By Sales Channel

10. Global CBD Edibles Analysis 2016–2020 and Forecast 2021–2031, by Region

10.1. Introduction

10.2. Historical Market Size (US$ Mn) Analysis By Region, 2016–2020

10.3. Current Market Size (US$ Mn) and Forecast By Region, 2021–2031

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. East Asia

10.3.5. South Asia

10.3.6. Oceania

10.3.7. Middle East and Africa (MEA)

10.4. Market Attractiveness Analysis By Region

11. North America CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

11.1. Introduction

11.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

11.3. Market Size (US$ Mn) and Forecast By Market Taxonomy, 2021–2031

11.3.1. By Country

11.3.1.1. U.S.

11.3.1.2. Canada

11.3.2. By Nature

11.3.3. By Type

11.3.4. By Sales Channel

11.4. Market Attractiveness Analysis

11.4.1. By Country

11.4.2. By Nature

11.4.3. By Type

11.4.4. By Sales Channel

11.5. Drivers and Restraints - Impact Analysis

12. Latin America CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

12.1. Introduction

12.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

12.3. Market Size (US$ Mn) Forecast By Market Taxonomy, 2021–2031

12.3.1. By Country

12.3.1.1. Brazil

12.3.1.2. Mexico

12.3.1.3. Rest of Latin America

12.3.2. By Nature

12.3.3. By Type

12.3.4. By Sales Channel

12.4. Market Attractiveness Analysis

12.4.1. By Country

12.4.2. By Nature

12.4.3. By Type

12.4.4. By Sales Channel

12.5. Drivers and Restraints - Impact Analysis

13. Europe CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

13.1. Introduction

13.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

13.3. Market Size (US$ Mn) and Forecast By Market Taxonomy, 2021–2031

13.3.1. By Country

13.3.1.1. United Kingdom

13.3.1.2. Germany

13.3.1.3. Italy

13.3.1.4. France

13.3.1.5. Spain

13.3.1.6. BENELUX

13.3.1.7. Nordic

13.3.1.8. Russia

13.3.1.9. Poland

13.3.1.10. Rest of Europe

13.3.2. By Nature

13.3.3. By Type

13.3.4. By Sales Channel

13.4. Market Attractiveness Analysis

13.4.1. By Country

13.4.2. By Nature

13.4.3. By Type

13.4.4. By Sales Channel

13.5. Drivers and Restraints - Impact Analysis

14. South Asia CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

14.1. Introduction

14.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

14.3. Market Size (US$ Mn) and Forecast By Market Taxonomy, 2021–2031

14.3.1. By Country

14.3.1.1. India

14.3.1.2. Thailand

14.3.1.3. Indonesia

14.3.1.4. Malaysia

14.3.1.5. Rest of South Asia

14.3.2. By Nature

14.3.3. By Type

14.3.4. By Sales Channel

14.4. Market Attractiveness Analysis

14.4.1. By Country

14.4.2. By Nature

14.4.3. By Type

14.4.4. By Sales Channel

14.5. Drivers and Restraints - Impact Analysis

15. East Asia CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

15.1. Introduction

15.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

15.3. Market Size (US$ Mn) and Forecast By Market Taxonomy, 2021–2031

15.3.1. By Country

15.3.1.1. China

15.3.1.2. Japan

15.3.1.3. South Korea

15.3.2. By Nature

15.3.3. By Type

15.3.4. By Sales Channel

15.4. Market Attractiveness Analysis

15.4.1. By Country

15.4.2. By Nature

15.4.3. By Type

15.4.4. By Sales Channel

15.5. Drivers and Restraints - Impact Analysis

16. Oceania CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

16.1. Introduction

16.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

16.3. Market Size (US$ Mn) Forecast By Market Taxonomy, 2021–2031

16.3.1. By Country

16.3.1.1. Australia

16.3.1.2. New Zealand

16.3.2. By Nature

16.3.3. By Flavor

16.3.4. By Type

16.3.5. By Sales Channel

16.4. Market Attractiveness Analysis

16.4.1. By Country

16.4.2. By Nature

16.4.3. By Type

16.4.4. By Sales Channel

16.5. Drivers and Restraints - Impact Analysis

17. Middle East and Africa CBD Edibles Analysis 2016–2020 and Forecast 2021–2031

17.1. Introduction

17.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

17.3. Market Size (US$ Mn) and Forecast By Market Taxonomy, 2021–2031

17.3.1. By Country

17.3.1.1. GCC Countries

17.3.1.2. South Africa

17.3.1.3. Rest of Middle East and Africa

17.3.2. By Nature

17.3.3. By Type

17.3.4. By Sales Channel

17.4. Market Attractiveness Analysis

17.4.1. By Country

17.4.2. By Nature

17.4.3. By Type

17.4.4. By Sales Channel

17.5. Drivers and Restraints - Impact Analysis

18. Market Structure Analysis

18.1. Market Analysis by Tier of Companies

18.2. Market Concentration

18.3. Market Presence Analysis

19. Competition Analysis

19.1. Competition Dashboard

19.2. Competition Deep Dive

19.2.1. Pure Kana

19.2.1.1. Overview

19.2.1.2. Product Portfolio

19.2.1.3. Sales Footprint

19.2.1.4. Key Developments

19.2.1.5. Strategy Overview

19.2.2. CV Sciences

19.2.2.1. Overview

19.2.2.2. Product Portfolio

19.2.2.3. Sales Footprint

19.2.2.4. Key Developments

19.2.2.5. Strategy Overview

19.2.3. Isodiol International

19.2.3.1. Overview

19.2.3.2. Product Portfolio

19.2.3.3. Sales Footprint

19.2.3.4. Key Developments

19.2.3.5. Strategy Overview

19.2.4. Elixinol LLC

19.2.4.1. Overview

19.2.4.2. Product Portfolio

19.2.4.3. Sales Footprint

19.2.4.4. Key Developments

19.2.4.5. Strategy Overview

19.2.5. Charlottes Web Holdings Inc.

19.2.5.1. Overview

19.2.5.2. Product Portfolio

19.2.5.3. Sales Footprint

19.2.5.4. Key Developments

19.2.5.5. Strategy Overview

19.2.6. Canopy Growth Corp

19.2.6.1. Overview

19.2.6.2. Product Portfolio

19.2.6.3. Sales Footprint

19.2.6.4. Key Developments

19.2.6.5. Strategy Overview

19.2.7. Medical Marijuana Inc.

19.2.7.1. Overview

19.2.7.2. Product Portfolio

19.2.7.3. Sales Footprint

19.2.7.4. Key Developments

19.2.7.5. Strategy Overview

19.2.8. Aurora Cannabis Inc.

19.2.8.1. Overview

19.2.8.2. Product Portfolio

19.2.8.3. Sales Footprint

19.2.8.4. Key Developments

19.2.8.5. Strategy Overview

19.2.9. MGC Pharmaceuticals Ltd.

19.2.9.1. Overview

19.2.9.2. Product Portfolio

19.2.9.3. Sales Footprint

19.2.9.4. Key Developments

19.2.9.5. Strategy Overview

19.2.10. Creso Pharma Ltd.

19.2.10.1. Overview

19.2.10.2. Product Portfolio

19.2.10.3. Sales Footprint

19.2.10.4. Key Developments

19.2.10.5. Strategy Overview

19.2.11. Cronos Group Inc.

19.2.11.1. Overview

19.2.11.2. Product Portfolio

19.2.11.3. Sales Footprint

19.2.11.4. Key Developments

19.2.11.5. Strategy Overview

19.2.12. Curaleaf Holdings Inc.

19.2.12.1. Overview

19.2.12.2. Product Portfolio

19.2.12.3. Sales Footprint

19.2.12.4. Key Developments

19.2.12.5. Strategy Overview

19.2.13. Green Thumbs Industries Inc.

19.2.13.1. Overview

19.2.13.2. Product Portfolio

19.2.13.3. Sales Footprint

19.2.13.4. Key Developments

19.2.13.5. Strategy Overview

19.2.14. Tilray Inc.

19.2.14.1. Overview

19.2.14.2. Product Portfolio

19.2.14.3. Sales Footprint

19.2.14.4. Key Developments

19.2.14.5. Strategy Overview

19.2.15. The Green Organic Dutchman Holdings Ltd.

19.2.15.1. Overview

19.2.15.2. Product Portfolio

19.2.15.3. Sales Footprint

19.2.15.4. Key Developments

19.2.15.5. Strategy Overview

19.2.16. Ecofibre Ltd.

19.2.16.1. Overview

19.2.16.2. Product Portfolio

19.2.16.3. Sales Footprint

19.2.16.4. Key Developments

19.2.16.5. Strategy Overview

19.2.17. Colorado Botanicals

19.2.17.1. Overview

19.2.17.2. Product Portfolio

19.2.17.3. Sales Footprint

19.2.17.4. Key Developments

19.2.17.5. Strategy Overview

19.2.18. Zoetic International PLC

19.2.18.1. Overview

19.2.18.2. Product Portfolio

19.2.18.3. Sales Footprint

19.2.18.4. Key Developments

19.2.18.5. Strategy Overview

19.2.19. Others (On Additional Request)

20. Assumptions and Acronyms Used

21. Research Methodology

List of Tables

Table 01: Global CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 02: Global CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 03: Global CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 04: Global CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Region, 2016-2031

Table 05: North America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 06: North America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 07: North America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 08: North America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 09: Latin America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 10: Latin America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 11: Latin America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 12: Latin America CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 13: Europe CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 14: Europe CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 15: Europe CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 16: Europe CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 17: South Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 18: South Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 19: South Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 20: South Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 21: East Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 22: East Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 23: East Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 24: East Asia CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 25: Oceania CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 26: Oceania CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 27: Oceania CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 28: Oceania CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

Table 29: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 30: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 31: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2016-2031

Table 32: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis and Forecast by Country, 2016-2031

List of Figures

Figure 01: Global CBD Edibles Market Value (US$ Mn) Forecast, 2021–2031

Figure 02: Global CBD Edibles Market Value Share Analysis by Nature, 2021 E

Figure 03: Global CBD Edibles Market Y-o-Y Growth Rate by Nature, 2021-2031

Figure 04: Global CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 05: Global CBD Edibles Market Value Share Analysis by Type, 2021 E

Figure 06: Global CBD Edibles Market Y-o-Y Growth Rate by Type, 2021-2031

Figure 07: Global CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 08: Global CBD Edibles Market Value Share Analysis by Sales Channel, 2021 E

Figure 09: Global CBD Edibles Market Y-o-Y Growth Rate by Sales Channel, 2021-2031

Figure 10: Global CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 11: Global CBD Edibles Market Value Share Analysis by Region, 2021 E

Figure 12: Global CBD Edibles Market Y-o-Y Growth Rate by Region, 2021-2031

Figure 13: Global CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Region, 2021–2031

Figure 14: Global CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 15: Global CBD Edibles Market Attractiveness Analysis by Nature, 2021-2031

Figure 16: Global CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 17: Global CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 18: North America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 19: North America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 20: North America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 21: North America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 22: North America CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 23: North America CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 24: North America CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 25: North America CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 26: Latin America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 27: Latin America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 28: Latin America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 29: Latin America CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 30: Latin America CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 31: Latin America CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 32: Latin America CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 33: Latin America CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 34: Europe CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 35: Europe CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 36: Europe CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 37: Europe CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 38: Europe CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 39: Europe CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 40: Europe CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 41: Europe CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 42: South Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 43: South Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 44: South Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 45: South Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 46: South Asia CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 47: South Asia CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 48: South Asia CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 49: South Asia CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 50: East Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 51: East Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 52: East Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 53: East Asia CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 54: East Asia CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 55: East Asia CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 56: East Asia CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 57: East Asia CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 58: Oceania CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 59: Oceania CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 60: Oceania CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 61: Oceania CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 62: Oceania CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 63: Oceania CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 64: Oceania CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 65: Oceania CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031

Figure 66: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Nature, 2021–2031

Figure 67: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Type, 2021–2031

Figure 68: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2021–2031

Figure 69: Middle East & Africa CBD Edibles Market Value (US$ Mn) Analysis & Forecast by Country, 2021–2031

Figure 70: Middle East & Africa CBD Edibles Market Attractiveness Analysis by Region, 2021-2031

Figure 71: Middle East & Africa CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 72: Middle East & Africa CBD Edibles Market Attractiveness Analysis by Type, 2021-2031

Figure 73: Middle East & Africa CBD Edibles Market Attractiveness Analysis by Sales Channel, 2021-2031