Analysts’ Viewpoint

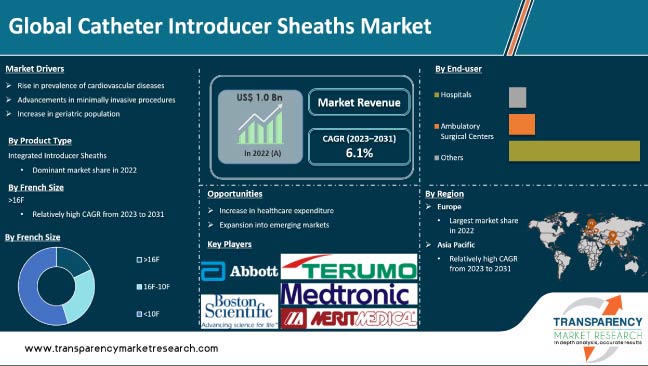

Rise in prevalence of cardiovascular diseases, technological advancements, shift toward minimally invasive procedures, and expanding healthcare infrastructure are expected to drive the global catheter introducer sheaths market in the next few years. These medical devices play a crucial role in various cardiovascular procedures, such as angiography, angioplasty, and stenting. Surge in the geriatric population is another major factor likely to propel demand for catheter introducer sheaths. Furthermore, increase in incidence of heart-related conditions is likely to drive the need for catheter-based interventions, which, in turn, is anticipated to bolster market growth.

Technological advancements in catheter introducer sheaths offers lucrative opportunities to market players. Manufacturers are focusing on designing sheaths with enhanced flexibility, better hemostasis capabilities, and reduced vascular complications.

However, availability of alternative treatment options and stringent regulatory guidelines are expected to hamper market growth to some extent.

Catheter introducer sheaths, also known as vascular introducer sheaths, are medical devices used in various interventional procedures to provide access to blood vessels. These sheaths are typically inserted into a blood vessel to facilitate the introduction of catheters or other devices into the cardiovascular system. These play a crucial role in minimizing trauma to the vessel and ensuring smooth passage of instruments during procedures.

Catheter introducer sheaths are available in different sizes, lengths, and configurations to accommodate various clinical needs and anatomical considerations. These are commonly used in procedures such as cardiac catheterization, angiography, angioplasty, and stenting.

Made from medical-grade plastics and engineered to be flexible and kink-resistant, the catheter introducer sheath guarantees durability and ease of use. Its tapered or dilating tip facilitates smooth insertion, while the materials used are biocompatible, ensuring compatibility with the human body.

In addition to its guiding function, catheter introducer sheath often features a side port or valve for fluid injection. This allows for the delivery of contrast media or medications directly to the target area, enhancing visualization or enabling targeted treatment.

Cardiovascular diseases are a group of disorders that affect the heart and blood vessels. These conditions could include coronary artery disease, heart failure, arrhythmias, valvular heart diseases, and more. Risk factors for cardiovascular diseases include high blood pressure, high cholesterol, smoking, obesity, diabetes, a sedentary lifestyle, and a family history of heart disease.

Catheter introducer sheaths are commonly used in various cardiovascular procedures, such as cardiac catheterization, percutaneous coronary interventions, and electrophysiological studies. These sheaths are inserted into a blood vessel, usually in the groin or wrist, to provide access for introducing catheters or other medical devices into the cardiovascular system. These allow physicians to perform diagnostic and therapeutic procedures without the need for open-heart surgery.

As per the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally. Around 17.9 million people succumbed to cardiovascular diseases in 2019, which represented 32% of global deaths. Of these, 85% were due to heart attack and stroke. Thus, increase in the number of cardiovascular patients are fueling global catheter introducer sheaths market growth.

Advancements in minimally invasive procedures related to catheter introducer sheaths have revolutionized various medical fields, including interventional cardiology, radiology, and vascular surgery. The combination of smaller diameter sheaths, improved flexibility & trackability, hydrophilic coatings, hemostatic properties, and closure devices has significantly improved patient outcomes, reduced complications, and enhanced the overall efficiency of these procedures.

One notable advancement is the development of catheter introducer sheaths with smaller diameters. These thinner sheaths offer less invasive access to blood vessels, reducing trauma to surrounding tissues and lowering the risk of complications. Moreover, their smaller size enables access to narrower blood vessels that were previously challenging to reach.

Modern catheter introducer sheaths with enhanced flexibility and trackability are designed to be more maneuverable, allowing physicians to navigate through tortuous blood vessels or complex anatomy with greater ease. Improved trackability enables precise placement of the sheath, minimizing the chances of vessel damage and enhancing the overall success rate of the procedure.

Incorporation of hydrophilic coatings in several catheter introducer sheaths reduces friction during insertion, facilitating smooth gliding of the sheath through the blood vessels. By minimizing resistance, hydrophilic coatings decrease the force required for insertion, potentially reducing patient discomfort and vascular trauma.

Advancements in sheath materials and coatings have also led to the development of catheter introducer sheaths with hemostatic properties. Some sheaths now incorporate materials or coatings with inherent hemostatic properties, such as bio-absorbable polymers or hemostatic agents. These properties help seal the puncture site after the sheath is removed, reducing the risk of bleeding and improving patient outcomes.

Thus, advancements in minimally invasive procedures is expected to propel the global catheter introducer sheaths market size during the forecast period.

In terms of product type, the integrated introducer sheaths segment dominated the global catheter introducer sheaths market in 2023. This is ascribed to integrated introducer sheath’s advantages such as reduced procedural time, enhanced safety, and improved workflow efficiency.

The integration of multiple functionalities, such as hemostasis valves and guidewire compatibility, into a single device offers convenience to healthcare professionals, are driving the segment.

Integrated sheaths offer significant advantages in terms of workflow efficiency. They eliminate the need for manual assembly, saving valuable time during procedures and minimizing the potential for errors.

Integrated sheaths reduce the risk of air embolism, a serious complication associated with separate introducer sheaths. By providing a closed system, they offer enhanced patient safety.

Integrated sheaths promote patient comfort by minimizing the number of devices used. The streamlined design reduces bulkiness and discomfort for patients during the procedure, leading to higher patient satisfaction and compliance.

Based on French size, the <10F segment accounted for the largest global catheter introducer sheaths market share in 2022. This is ascribed to technological advancements that have led to the development of smaller and more flexible sheaths, allowing for easier and less invasive procedures. This has increased demand for smaller introducer sheaths, especially in minimally invasive surgeries and interventional procedures.

The <10F segment caters to a wide range of medical applications, including cardiology, urology, and neurology, further expanding its market dominance. Moreover, these smaller sheaths offer benefits such as reduced patient discomfort, faster recovery times, and lower risk of complications. As a result, healthcare professionals are increasingly opting for less than 10 French size sheaths.

Europe dominated the global market in 2022. This is ascribed to well-established healthcare infrastructure and high healthcare expenditure, allowing for the widespread adoption of advanced medical devices.

Europe has a large geriatric population, which often requires medical interventions that utilize catheter introducer sheaths. The region also has a strong focus on research & development, leading to continuous innovation and product advancements in the market.

Regulatory frameworks and reimbursement policies in Europe are favorable for medical device manufacturers, encouraging market growth. Overall, these factors contribute to the region's dominance of the global catheter introducer sheaths market.

The market in North America is experiencing significant growth due to rise in prevalence of cardiovascular diseases and increase in the geriatric population, which have led to rising demand for interventional procedures, including catheterization.

Advancements in medical technology, such as improved imaging techniques and minimally invasive procedures, have bolstered the adoption of catheter introducer sheaths. Additionally, North America's supportive regulatory environment, well-established healthcare infrastructure, and high healthcare expenditure contribute to the market's growth.

As per catheter introducer sheaths market trends, the industry in Asia Pacific is expected to grow at a faster pace during the forecast period. Large number of research institutions, academic organizations, and healthcare facilities in countries such as China, Japan, and India, and strong customer base are driving the market in the region.

This report provides profiles of leading players operating in the global catheter introducer sheaths industry. These include Abbott, Boston Scientific Corporation, Stryker Corporation, Teleflex Incorporated, Merit Medical Systems, Inc., Terumo Corporation, Medtronic plc, W. L. Gore & Associates, Inc., Lepu Medical Technology (Beijing) Co., Ltd., Becton, Dickinson, and Company (BD), Cardinal Health, Inc., B. Braun SE, ICU Medical, Inc., Cook Medical, and BIOTRONIK SE & Co KG.

These players engage in mergers & acquisitions, strategic collaborations, and new product launches to expand presence and increase market share.

The catheter introducer sheath industry research report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 1.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 1.7 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 1.0 Bn in 2022

It is projected to reach more than US$ 1.7 Bn by 2031

The CAGR is anticipated to be 6.1% from 2023 to 2031

The integrated introducer sheaths segment accounted for the largest share in 2022

Europe is expected to account for the leading share during the forecast period.

Abbott, Boston Scientific Corporation, Stryker Corporation, Teleflex Incorporated, Merit Medical Systems, Inc., Terumo Corporation, Medtronic plc, W. L. Gore & Associates, Inc., Lepu Medical Technology (Beijing) Co., Ltd., Becton, Dickinson, and Company (BD), Cardinal Health, Inc., B. Braun SE, ICU Medical, Inc., Cook Medical, and BIOTRONIK SE & Co KG are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Catheter Introducer Sheath Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Catheter Introducer Sheath Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Porter’s Five Force Analysis

5.2. List of Major Brands of Large (>16F) Catheter Introducer Sheath and its Comparative Pricing

5.3. List of Major Large (>16F) Introducer Sheath Manufacturer/Suppliers

5.4. Key Countries Market Value (US$ Mn) for Large (>16F) Catheter Introducer Sheath, 2017-2031

6. Global Catheter Introducer Sheath Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Integrated Introducer Sheaths

6.3.2. Separate Introducer Sheaths

6.4. Market Attractiveness Analysis, by Product Type

7. Global Catheter Introducer Sheath Market Analysis and Forecast, by French Size

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by French Size, 2017-2031

7.3.1. > 16F

7.3.1.1. Cardiovascular

7.3.1.2. Peripheral Vascular

7.3.1.3. Neurovascular

7.3.1.4. Others

7.3.2. 16F-10F

7.3.2.1. Cardiovascular

7.3.2.2. Peripheral Vascular

7.3.2.3. Neurovascular

7.3.2.4. Others

7.3.3. <10F

7.3.3.1. Cardiovascular

7.3.3.2. Peripheral Vascular

7.3.3.3. Neurovascular

7.3.3.4. Others

7.4. Market Attractiveness Analysis, by French Size

8. Global Catheter Introducer Sheath Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Catheter Introducer Sheath Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Catheter Introducer Sheath Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Integrated Introducer Sheaths

10.2.2. Separate Introducer Sheaths

10.3. Market Value Forecast, by French Size, 2017-2031

10.3.1. > 16F

10.3.1.1. Cardiovascular

10.3.1.2. Peripheral Vascular

10.3.1.3. Neurovascular

10.3.1.4. Others

10.3.2. 16F-10F

10.3.2.1. Cardiovascular

10.3.2.2. Peripheral Vascular

10.3.2.3. Neurovascular

10.3.2.4. Others

10.3.3. <10F

10.3.3.1. Cardiovascular

10.3.3.2. Peripheral Vascular

10.3.3.3. Neurovascular

10.3.3.4. Others

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By French Size

10.6.3. By End-user

10.6.4. By Country

11. Europe Catheter Introducer Sheath Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Integrated Introducer Sheaths

11.2.2. Separate Introducer Sheaths

11.3. Market Value Forecast, by French Size, 2017-2031

11.3.1. > 16F

11.3.1.1. Cardiovascular

11.3.1.2. Peripheral Vascular

11.3.1.3. Neurovascular

11.3.1.4. Others

11.3.2. 16F-10F

11.3.2.1. Cardiovascular

11.3.2.2. Peripheral Vascular

11.3.2.3. Neurovascular

11.3.2.4. Others

11.3.3. <10F

11.3.3.1. Cardiovascular

11.3.3.2. Peripheral Vascular

11.3.3.3. Neurovascular

11.3.3.4. Others

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By French Size

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Catheter Introducer Sheath Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Integrated Introducer Sheaths

12.2.2. Separate Introducer Sheaths

12.3. Market Value Forecast, by French Size, 2017-2031

12.3.1. > 16F

12.3.1.1. Cardiovascular

12.3.1.2. Peripheral Vascular

12.3.1.3. Neurovascular

12.3.1.4. Others

12.3.2. 16F-10F

12.3.2.1. Cardiovascular

12.3.2.2. Peripheral Vascular

12.3.2.3. Neurovascular

12.3.2.4. Others

12.3.3. <10F

12.3.3.1. Cardiovascular

12.3.3.2. Peripheral Vascular

12.3.3.3. Neurovascular

12.3.3.4. Others

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By French Size

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Catheter Introducer Sheath Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Integrated Introducer Sheaths

13.2.2. Separate Introducer Sheaths

13.3. Market Value Forecast, by French Size, 2017-2031

13.3.1. > 16F

13.3.1.1. Cardiovascular

13.3.1.2. Peripheral Vascular

13.3.1.3. Neurovascular

13.3.1.4. Others

13.3.2. 16F-10F

13.3.2.1. Cardiovascular

13.3.2.2. Peripheral Vascular

13.3.2.3. Neurovascular

13.3.2.4. Others

13.3.3. <10F

13.3.3.1. Cardiovascular

13.3.3.2. Peripheral Vascular

13.3.3.3. Neurovascular

13.3.3.4. Others

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By French Size

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Catheter Introducer Sheath Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017-2031

14.2.1. Integrated Introducer Sheaths

14.2.2. Separate Introducer Sheaths

14.3. Market Value Forecast, by French Size, 2017-2031

14.3.1. > 16F

14.3.1.1. Cardiovascular

14.3.1.2. Peripheral Vascular

14.3.1.3. Neurovascular

14.3.1.4. Others

14.3.2. 16F-10F

14.3.2.1. Cardiovascular

14.3.2.2. Peripheral Vascular

14.3.2.3. Neurovascular

14.3.2.4. Others

14.3.3. <10F

14.3.3.1. Cardiovascular

14.3.3.2. Peripheral Vascular

14.3.3.3. Neurovascular

14.3.3.4. Others

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of the MEA

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By French Size

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Boston Scientific Corporation

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Stryker Corporation

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Teleflex Incorporated

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Merit Medical Systems, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Terumo Corporation

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Medtronic plc

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. W. L. Gore & Associates, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Lepu Medical Technology (Beijing) Co., Ltd.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Becton, Dickinson, and Company (BD)

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Cardinal Health, Inc.

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. B. Braun SE

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. ICU Medical, Inc.

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. Cook Medical

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Product Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

15.3.15. BIOTRONIK SE & Co KG

15.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.15.2. Product Portfolio

15.3.15.3. Financial Overview

15.3.15.4. SWOT Analysis

15.3.15.5. Strategic Overview

List of Tables

Table 01: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by French Size, 2017-2031

Table 03: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by >16F, 2017-2031

Table 04: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by 16F-10F, 2017-2031

Table 05: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by <10F, 2017-2031

Table 06: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Global Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 08: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 09: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by French Size, 2017-2031

Table 10: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by >16F, 2017-2031

Table 11: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by 16F-10F, 2017-2031

Table 12: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by <10F, 2017-2031

Table 13: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 14: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 15: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 16: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by French Size, 2017-2031

Table 17: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by >16F, 2017-2031

Table 18: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by 16F-10F, 2017-2031

Table 19: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by <10F, 2017-2031

Table 20: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 23: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by French Size, 2017-2031

Table 24: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by >16F, 2017-2031

Table 25: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by 16F-10F, 2017-2031

Table 26: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by <10F, 2017-2031

Table 27: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 28: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 29: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 30: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by French Size, 2017-2031

Table 31: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by >16F, 2017-2031

Table 32: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by 16F-10F, 2017-2031

Table 33: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by <10F, 2017-2031

Table 34: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 35: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 36: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 37: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by French Size, 2017-2031

Table 38: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by >16F, 2017-2031

Table 39: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by 16F-10F, 2017-2031

Table 40: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by <10F, 2017-2031

Table 41: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 42: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Catheter Introducer Sheaths Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 02: Global Catheter Introducer Sheaths Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 03: Global Catheter Introducer Sheaths Market Value (US$ Mn), by Integrated Introducer Sheaths, 2017‒2031

Figure 04: Global Catheter Introducer Sheaths Market Value (US$ Mn), by Separate Introducer Sheaths, 2017‒2031

Figure 05: Global Catheter Introducer Sheaths Market Value Share Analysis, by French Size, 2022 and 2031

Figure 06: Global Catheter Introducer Sheaths Market Attractiveness Analysis, by French Size, 2023-2031

Figure 07: Global Catheter Introducer Sheaths Market Revenue (US$ Mn), by >16F, 2017-2031

Figure 08: Global Catheter Introducer Sheaths Market Revenue (US$ Mn), by 16F-10F, 2017-2031

Figure 09: Global Catheter Introducer Sheaths Market Revenue (US$ Mn), by <10F, 2017-2031

Figure 10: Global Catheter Introducer Sheaths Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global Catheter Introducer Sheaths Market Attractiveness Analysis, by End-user, 2023-2031

Figure 12: Global Catheter Introducer Sheaths Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 13: Global Catheter Introducer Sheaths Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017-2031

Figure 14: Global Catheter Introducer Sheaths Market Revenue (US$ Mn), by Others (Research & Academic Institutes, etc.), 2017-2031

Figure 15: Global Catheter Introducer Sheaths Market Value Share Analysis, by Region, 2022 and 2031

Figure 16: Global Catheter Introducer Sheaths Market Attractiveness Analysis, by Region, 2023-2031

Figure 17: North America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, 2017-2031

Figure 18: North America Catheter Introducer Sheaths Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 19: North America Catheter Introducer Sheaths Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 20: North America Catheter Introducer Sheaths Market Value Share Analysis, by French Size, 2022 and 2031

Figure 21: North America Catheter Introducer Sheaths Market Attractiveness Analysis, by French Size, 2023-2031

Figure 22: North America Catheter Introducer Sheaths Market Value Share Analysis, by End-user, 2022 and 2031

Figure 23: North America Catheter Introducer Sheaths Market Attractiveness Analysis, by End-user, 2023-2031

Figure 24: North America Catheter Introducer Sheaths Market Value Share Analysis, by Country, 2022 and 2031

Figure 25: North America Catheter Introducer Sheaths Market Attractiveness Analysis, by Country, 2023-2031

Figure 26: Europe Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, 2017-2031

Figure 27: Europe Catheter Introducer Sheaths Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 28: Europe Catheter Introducer Sheaths Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 29: Europe Catheter Introducer Sheaths Market Value Share Analysis, by French Size, 2022 and 2031

Figure 30: Europe Catheter Introducer Sheaths Market Attractiveness Analysis, by French Size, 2023-2031

Figure 31: Europe Catheter Introducer Sheaths Market Value Share Analysis, by End-user, 2022 and 2031

Figure 32: Europe Catheter Introducer Sheaths Market Attractiveness Analysis, by End-user, 2023-2031

Figure 33: Europe Catheter Introducer Sheaths Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 34: Europe Catheter Introducer Sheaths Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 35: Asia Pacific Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, 2017-2031

Figure 36: Asia Pacific Catheter Introducer Sheaths Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 37: Asia Pacific Catheter Introducer Sheaths Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 38: Asia Pacific Catheter Introducer Sheaths Market Value Share Analysis, by French Size, 2022 and 2031

Figure 39: Asia Pacific Catheter Introducer Sheaths Market Attractiveness Analysis, by French Size, 2023-2031

Figure 40: Asia Pacific Catheter Introducer Sheaths Market Value Share Analysis, by End-user, 2022 and 2031

Figure 41: Asia Pacific Catheter Introducer Sheaths Market Attractiveness Analysis, by End-user, 2023-2031

Figure 42: Asia Pacific Catheter Introducer Sheaths Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 43: Asia Pacific Catheter Introducer Sheaths Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 44: Latin America Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, 2017-2031

Figure 45: Latin America Catheter Introducer Sheaths Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 46: Latin America Catheter Introducer Sheaths Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 47: Latin America Catheter Introducer Sheaths Market Value Share Analysis, by French Size, 2022 and 2031

Figure 48: Latin America Catheter Introducer Sheaths Market Attractiveness Analysis, by French Size, 2023-2031

Figure 49: Latin America Catheter Introducer Sheaths Market Value Share Analysis, by End-user, 2022 and 2031

Figure 50: Latin America Catheter Introducer Sheaths Market Attractiveness Analysis, by End-user, 2023-2031

Figure 51: Latin America Catheter Introducer Sheaths Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 52: Latin America Catheter Introducer Sheaths Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 53: Middle East & Africa Catheter Introducer Sheaths Market Value (US$ Mn) Forecast, 2017-2031

Figure 54: Middle East & Africa Catheter Introducer Sheaths Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 55: Middle East & Africa Catheter Introducer Sheaths Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 56: Middle East & Africa Catheter Introducer Sheaths Market Value Share Analysis, by French Size, 2022 and 2031

Figure 57: Middle East & Africa Catheter Introducer Sheaths Market Attractiveness Analysis, by French Size, 2023-2031

Figure 58: Middle East & Africa Catheter Introducer Sheaths Market Value Share Analysis, by End-user, 2022 and 2031

Figure 59: Middle East & Africa Catheter Introducer Sheaths Market Attractiveness Analysis, by End-user, 2023-2031

Figure 60: Middle East & Africa Catheter Introducer Sheaths Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 61: Middle East & Africa Catheter Introducer Sheaths Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 62: Catheters Introducer Sheaths Market Share Analysis, by Company, 2022