Analysts’ Viewpoint

The global cardiovascular monitoring & diagnostic devices market is driven by rise in prevalence of chronic cardiovascular diseases. Primary causes of cardiovascular disease are high salt intake in diet, increased tobacco use, rise in prevalence of smoking, and surge in alcohol consumption. Cardiovascular diseases can be effectively treated if detected early. Increase in demand for early diagnosis of cardiovascular diseases is likely to accelerate business expansion in the near future.

Launch of new products with novel features is another factor that is expected to boost demand for cardiovascular devices. The cardiovascular diagnostic & monitoring devices industry is expanding at a rapid pace due to rise in the demand for effective and cutting-edge devices to reduce cardiovascular disease-related deaths. Furthermore, incorporation of cutting-edge technologies such as artificial intelligence (AI) in cardiovascular devices improves patient care and reduces cardiac patient mortality.

Cardiac monitoring devices are important in cardiovascular care because these can be used to determine the frequency and severity of cardiac failure, as well as the efficacy of treatments such as drugs, surgeries, and device implants. Cardiovascular disease (CVD), which is preventable, is one of the leading causes of death worldwide. Majority of CVDs can be avoided with pre-monitoring and pre-diagnosis. Arrhythmias, or irregularities in the heartbeat, can be avoided with early detection. Cardiac monitoring products can assist patients who are at high risk of heart disease and help in diagnosis and monitoring of heart disease. This is projected to augment the demand for cardiovascular monitoring & diagnostic devices in the near future.

Doctors' and healthcare networks' adoption of electronic medical records and the integration of medical data with the ubiquitous mobile device have been slow. However, new wireless monitoring tools have emerged and are being used in the treatment of cardiac patients. Development of these wireless cardiac monitoring devices heralds a new era in medicine. It has also led to a shift from population-level health care to individualized medicine, in which qualified healthcare workers are equipped with cutting-edge biosensing, the data from which is prepared through algorithms to predict events before they occur.

Subcutaneous cardiac monitor devices (SCRMs) are a newer technology used to monitor known arrhythmias such as atrial fibrillation (AF) or to detect infrequent tachy and brady arrhythmias in patients at risk of sudden cardiac death. Cardiac diagnostic & monitoring devices is a rapidly expanding field that could go beyond electrocardiographic (ECG) and blood pressure measurements. To date, the primary focus of cardiac monitoring has been ambulatory ECG (AECG) monitoring. In this context, AECG monitoring has evolved into a diagnostic tool that physicians of various specialties use on a daily basis.

Majority of skin-mounted cardiovascular monitoring & diagnostic devices currently in use concentrate on the ECG. Nevertheless, in the past few years, devices that are implanted in the subcutaneous tissues or, in rare circumstances, other organs (such as the pulmonary arterial circulation), have become more prevalent. Phoenix Cardiac Devices' BACE (Basal Annuloplasty of the Cardio Externally) device received the CE mark in April 2021. Additionally, Philips purchased BioTelemetry, Inc. in December 2020. This acquisition is expected to enable the integration of BioTelemetry's cardiac diagnostics and monitoring services with Philips' patient monitoring services.

Cardiac monitoring devices help with continuous heart monitoring in order to detect chronic heart conditions such as stroke and heart failure. It should be possible to recognize and monitor the development of the disease by concentrating on structural and functional abnormalities of the heart and arteries.

According to the American Heart Association's 2017 Heart Diseases and Stroke Statistics update, the number of people with heart failure is rising, and is likely to increase by 46% by 2030, leading to more than 8 million people suffering from heart failure. Congestive heart failure affects 22 million people globally, and another 2 million cases are discovered every year. According to the American Heart Association, congestive heart failure, which kills 8.5% of the population of the U.S. each year, is one of the primary causes of death in the country.

Early detection, which leads to more accurate results using cardiovascular monitoring & diagnostic devices than external cardiac monitors, is projected to fuel market development. For instance, in April 2022, Biotricity announced it would formally soon begin selling its FDA-approved wireless wearable cardiac monitoring device, Biotres. Physicians, medical practices, hospitals, and individuals were allowed to pre-order the product since late February 2022.

In terms of type, the ECG devices segment is expected to grow at a rapid pace during the forecast period. An ECG (electrocardiogram) device records heartbeats using electric signals, which are then amplified and displayed on an ECG monitor. ECG devices are used to identify different heart diseases and arrhythmias in a person's body and aid in the selection of the best treatment.

The ECG test detects abnormal heart pattern, and is a non-invasive, painless procedure. Four different types of ECG device can be used to assess the body's heart activity during specific conditions or activities. This is anticipated to propel the ECG devices segment during the forecast period.

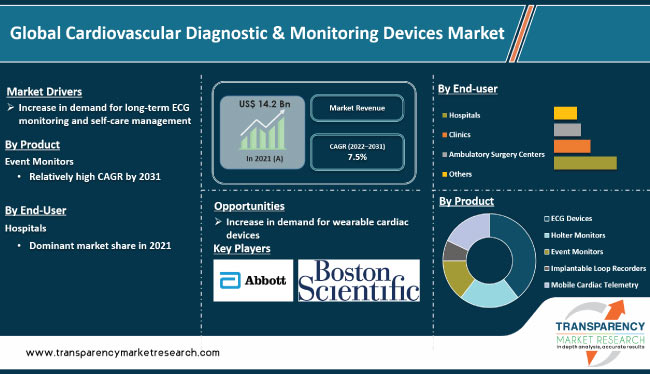

Based on end-user, the hospitals segment dominated the cardiovascular diagnostic & monitoring devices market in 2021. This is ascribed to higher rate of adoption and usage than in other healthcare facilities. Improved healthcare infrastructure in both developed & emerging countries and expansion of favorable reimbursement policies are propelling the hospitals segment.

Patients prefer hospitals that practice patient-centered care as they gain more knowledge about it. In other words, hospitals develop a reputation for providing patients with high-quality care, giving them a competitive advantage over organizations that still rely on antiquated procedures. The needs of patients and their families should be the driving force behind an effective hospital system. This entails using personnel and material resources as efficiently as possible in order to save time and money.

North America accounted for around 40.0% share of the global business in 2021. This is ascribed to well-established healthcare infrastructure and quick uptake of newer products. Around 5 million people in the U.S. have heart failure and could require ongoing monitoring via ICM, as well as the 4 million people who have recurrent arrhythmia.

The business is anticipated to grow significantly during the forecast period due to high prevalence of heart failure in the U.S. and high healthcare spending on treatment. The cardiovascular diagnostic & monitoring devices market in Canada is likely to witness strong growth between 2022 and 2031 due to developing health care infrastructure. It is likely to be supported by increasing demand for cardiovascular diagnostics & monitoring in North America.

The industry in Asia Pacific is expected to grow at the fastest pace during the forecast period. Developing health care infrastructure is likely to propel the demand between 2021 and 2031.

The cardiovascular monitoring & diagnostic devices market is highly competitive and dominated by a small group of companies. Key players are forming strategic alliances to increase sales and share. Other strategies used by participants to increase footprint include product line expansion, acquisitions, and mergers. Abbott Laboratories, Biotronik, Boston Scientific Corporation, GE Healthcare, Hill-Rom Holdings, Koninklijke Philips N.V., Medtronic, and Nihon Kohden Corporation are the prominent players in the industry.

Major players have been profiled in the report based on parameters such as financial overview, company overview, strategies, product portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 14.2 Bn |

|

Forecast (Value) in 2031 |

More than US$ 29.0 Bn |

|

Growth Rate (CAGR) for 2022–2031 |

7.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 14.2 Bn in 2021

It is projected to reach more than US$ 29.0 Bn by 2031

The CAGR is anticipated to be 7.5% from 2022 to 2031

Increase in demand for long-term ECG monitoring and self-care management.

The ECG devices segment held more than 41% share in 2021

Abbott Laboratories, Biotronik, Boston Scientific Corporation, GE Healthcare, Hill-Rom Holdings, Koninklijke Philips N.V., Medtronic, and Nihon Kohden Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cardiovascular Diagnostic & Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast, 2017–2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Disease Prevalence & Incidence Rate

5.2. Key Product/Brand Analysis

5.3. Smart wearable devices in cardiovascular care: where we are and how to move forward

5.4. Value Chain Analysis

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. ECG Devices

6.3.1.1. Resting ECG Devices

6.3.1.2. Stress ECG Devices

6.3.2. Holter Monitors

6.3.3. Event Monitors

6.3.4. Implantable Loop Recorders

6.3.5. Mobile Cardiac Telemetry

6.4. Market Attractiveness Analysis, by Product

7. Global Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Clinics

7.3.3. Ambulatory Surgery Centers

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. ECG Devices

9.2.1.1. Resting ECG Devices

9.2.1.2. Stress ECG Devices

9.2.2. Holter Monitors

9.2.3. Event Monitors

9.2.4. Implantable Loop Recorders

9.2.5. Mobile Cardiac Telemetry

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Clinics

9.3.3. Ambulatory Surgery Centers

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. ECG Devices

10.2.1.1. Resting ECG Devices

10.2.1.2. Stress ECG Devices

10.2.2. Holter Monitors

10.2.3. Event Monitors

10.2.4. Implantable Loop Recorders

10.2.5. Mobile Cardiac Telemetry

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Clinics

10.3.3. Ambulatory Surgery Centers

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. ECG Devices

11.2.1.1. Resting ECG Devices

11.2.1.2. Stress ECG Devices

11.2.2. Holter Monitors

11.2.3. Event Monitors

11.2.4. Implantable Loop Recorders

11.2.5. Mobile Cardiac Telemetry

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Clinics

11.3.3. Ambulatory Surgery Centers

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. ECG Devices

12.2.1.1. Resting ECG Devices

12.2.1.2. Stress ECG Devices

12.2.2. Holter Monitors

12.2.3. Event Monitors

12.2.4. Implantable Loop Recorders

12.2.5. Mobile Cardiac Telemetry

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Clinics

12.3.3. Ambulatory Surgery Centers

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. ECG Devices

13.2.1.1. Resting ECG Devices

13.2.1.2. Stress ECG Devices

13.2.2. Holter Monitors

13.2.3. Event Monitors

13.2.4. Implantable Loop Recorders

13.2.5. Mobile Cardiac Telemetry

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Clinics

13.3.3. Ambulatory Surgery Centers

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Competitive Business Strategies

14.4. Company Profiles

14.4.1. Abbott Laboratories

14.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.4.1.2. Company Financials

14.4.1.3. Growth Strategies

14.4.1.4. SWOT Analysis

14.4.2. Biotronik

14.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.4.2.2. Company Financials

14.4.2.3. Growth Strategies

14.4.2.4. SWOT Analysis

14.4.3. Boston Scientific Corporation

14.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.4.3.2. Company Financials

14.4.3.3. Growth Strategies

14.4.3.4. SWOT Analysis

14.4.4. GE Healthcare

14.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.4.4.2. Company Financials

14.4.4.3. Growth Strategies

14.4.4.4. SWOT Analysis

14.4.5. Medtronic

14.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.4.5.2. Company Financials

14.4.5.3. Growth Strategies

14.4.5.4. SWOT Analysis

14.4.6. Nihon Kohden Corporation

14.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.4.6.2. Company Financials

14.4.6.3. Growth Strategies

14.4.6.4. SWOT Analysis

List of Tables

Table 01: Global Stroke Incident Cases

Table 02: Global Prevalence of Heart Failure (2017)

Table 03: Status of Cardiac Surgeries in Countries in South Asia 2016–2017

Table 04: Status of Cardiac Surgeries in North America

Table 05: New Zealand all cardiac surgery patients in 2016: age and gender

Table 06: Europe Hospital discharge rates for in-patients with diseases of the cardiovascular system, 2016-2017

Table 07: Key Product/Brand Analysis of Implantable Loop Recorder

Table 08: Key Product/Brand Analysis of Holter Monitors

Table 09: Key Product/Brand Analysis of ECG

Table 10: Key Product/Brand Analysis of Event Monitors

Table 11: Key Product/Brand Analysis of Event Monitors

Table 12: Key Product/Brand Analysis of Mobile Cardiac Telemetry

Table 13: Ambulatory Cardiac Monitoring Devices Procedures performed till 2018

Table 14: Ambulatory Cardiac Monitoring Devices Procedures performed after January 2019

Table 15: Global Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 16: Global Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 17: Global Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 18: Global Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 19: North America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 20: North America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 21: North America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 22: North America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 23: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 25: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 26: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 27: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 28: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 29: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 30: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 31: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 33: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 34: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 35: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 36: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 37: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 38: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 39: GE Healthcare Business Overview

Table 40: Koninklijke Philips N.V. Business Overview

Table 41: Medtronic plc Business Overview

Table 42: Abbott Laboratories Business Overview

Table 43: Boston Scientific Corporation Business Overview

Table 44: Hill-Rom Holdings, Inc. Business Overview

Table 45: Nihon Kohden Corporation Business Overview

Table 46: Asahi Kasei Medical Co., Ltd. Business Overview

List of Figures

Figure 01: Global Cardiovascular Diagnostic & Monitoring Devices Market Share, by Type

Figure 02: Global Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 03: Procedures performed in 2017 (New Zealand)

Figure 04: Procedures performed in 2017 (Australia)

Figure 05: Value Chain Analysis

Figure 06: Global Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 07: Global Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 08: Global Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 09: Global Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 10: Global Cardiovascular Diagnostic & Monitoring Devices Market Analysis, by Region

Figure 11: Global Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Region, 2020 and 2031

Figure 12: Global Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Region, 2021–2031

Figure 13: North America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 14: North America Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Country, 2020 and 2031

Figure 15: North America Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Country, 2021–2031

Figure 16: North America Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 17: North America Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 18: North America Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 19: North America Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 20: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 22: Europe Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 23: Europe Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 24: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 25: Europe Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 26: Europe Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 27: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 29: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 30: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 31: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 32: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 33: Asia Pacific Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 34: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 36: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 37: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 38: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 39: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 40: Latin America Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 41: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 42: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 43: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 44: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 45: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 46: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 47: Middle East & Africa Cardiovascular Diagnostic & Monitoring Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 48: GE Healthcare Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 49: GE Healthcare Breakdown of Net Sales (%), by Region/Country, 2019

Figure 50: GE Healthcare Breakdown of Net Sales (%), by Business Segment, 2019

Figure 51: GE Healthcare R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 52: Koninklijke Philips N.V. Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 53: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Region/Country, 2019

Figure 54: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Business Segment, 2019

Figure 55: Koninklijke Philips N.V. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 56: Medtronic plc Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 57: Medtronic plc Breakdown of Net Sales (%), by Region/Country, 2020

Figure 58: Medtronic plc Breakdown of Net Sales (%), by Business Segment, 2020

Figure 59: Medtronic plc R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 60: Abbott Laboratories Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 61: Abbott Laboratories Breakdown of Net Sales (%), by Region/Country, 2019

Figure 62: Abbott Laboratories Breakdown of Net Sales (%), by Business Segment, 2019

Figure 63: Abbott Laboratories R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 64: Boston Scientific Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 65: Boston Scientific Corporation Breakdown of Net Sales (%), by Region/Country, 2019

Figure 66: Boston Scientific Corporation Breakdown of Net Sales (%), by Business Segment, 2019

Figure 67: Boston Scientific Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 68: Hill-Rom Holdings, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 69: Hill-Rom Holdings, Inc. Breakdown of Net Sales (%), by Region/Country, 2020

Figure 70: Hill-Rom Holdings, Inc. Breakdown of Net Sales (%), by Business Segment, 2020

Figure 71: Hill-Rom Holdings, Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 72: Nihon Kohden Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 73: Nihon Kohden Corporation Breakdown of Net Sales (%), by Region/Country, 2019

Figure 74: Nihon Kohden Corporation Breakdown of Net Sales (%), by Business Segment, 2019

Figure 75: Nihon Kohden Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 76: Asahi Kasei Medical Co., Ltd. Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 77: Asahi Kasei Medical Co., Ltd. Breakdown of Net Sales (%), by Region/Country, 2019

Figure 78: Asahi Kasei Medical Co., Ltd. Breakdown of Net Sales (%), by Business Segment, 2019

Figure 79: Asahi Kasei Medical Co., Ltd. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019