Analysts’ Viewpoint

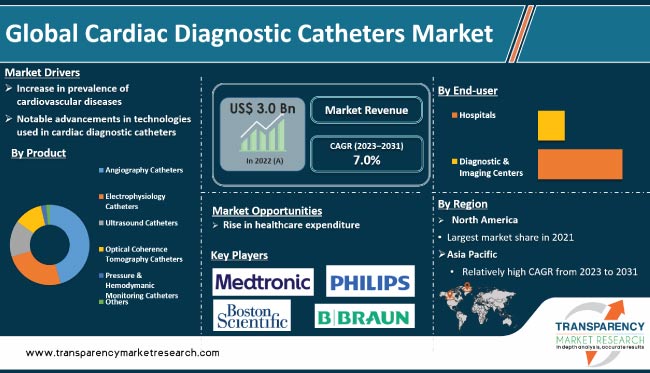

Increase in prevalence of cardiovascular diseases is a significant factor fueling cardiac diagnostic catheters market development. Moreover, technological advancements in catheters, surge in healthcare spending, and rise in awareness about the benefits of early detection and treatment for heart disease are also key factors that are expected to contribute to the cardiac diagnostic catheters market growth during the forecast period. Moreover, rise in number of older individuals who are more prone to developing heart disease is further augmenting market statistics.

Cardiac diagnostic catheters market companies are focusing on the introduction of new products based on advanced technology to grab business opportunities. Prominent market players are also making significant investment in R&D activities to develop innovative diagnostic cardiac catheters.

Cardiac diagnostic catheters are medical devices that are used to diagnose and monitor various heart conditions. They are thin, flexible tubes (catheters) that are inserted into a patient's blood vessels and guided to the heart. The catheters are equipped with sensors and electrodes that measure various cardiac parameters, such as electrical activity and blood flow, and obtain images of the heart's anatomy. These diagnostic catheters are used in various procedures, including electrophysiology studies, diagnostic angiography, and arrhythmia mapping.

They play a crucial role in the diagnosis and management of heart diseases, and are increasingly being used in place of more invasive diagnostic procedures. Cardiac diagnostic catheters are inserted through a small incision in the skin, reducing the risk of complications and providing a quicker recovery as compared to invasive procedures. All these factors are likely to positively impact the global cardiac diagnostic catheters market dynamics during the forecast period.

Several types of cardiac diagnostic catheters, such as electrophysiology (EP) catheters, coronary catheters, mapping catheters, etc., are available in the market. Coronary catheters utilize X-ray imaging to visualize coronary arteries and diagnose conditions such as coronary artery disease. Mapping catheters are used to create detailed maps of the electrical pathways of the heart, which can help diagnose arrhythmias.

Rise in incidence of heart diseases across the globe is driving the demand for diagnostic catheters for accurate diagnosis. These catheters are considered as a safe and non-invasive alternative to traditional diagnostic methods. There is an increase in need for cardiac catheterization as heart diseases become more common. Diagnostic catheters are becoming an increasingly popular choice to diagnose and monitor heart diseases due to their ability to provide real-time monitoring, improved accuracy, and reduced invasiveness.

According to the World Health Organization (WHO), cardiovascular diseases is among the leading causes of death globally. As per estimation, around 17.9 million people died due to CVDs in the year 2019, which represents 32.0% of deaths globally. Moreover, 85.0% deaths occurred due to strokes and heart attacks.

Significant technology advancements in cardiac diagnostic catheters have been witnessed in the last few years. These advancements have led to the development of new and improved catheter designs that enable for more precise and accurate diagnoses of cardiac conditions. Some of the most notable advancements include better imaging capabilities, improved sensing technologies, and better data analysis.

Advanced imaging technologies such as fluoroscopy, intravascular ultrasound, and optical coherence tomography have been integrated into diagnostic catheters, providing real-time images of the heart and surrounding vessels. Sensing technologies such as pressure sensors, accelerometers, and impedance sensors have been integrated into diagnostic catheters, allowing for more accurate measurements of cardiac function. Furthermore, improved data analysis algorithms allow for more accurate and automated analysis of diagnostic data, reducing the need for manual interpretation and increasing diagnostic accuracy.

In terms of product, the global market has been classified into angiography catheters, electrophysiology catheters, ultrasound catheters, optical coherence tomography catheters, pressure & hemodynamic monitoring catheters, and others. The electrophysiology catheters segment is projected to dominate the global market in the next few years.

Electrophysiology (EP) catheters are medical devices used in the diagnosis and treatment of heart rhythm disorders. They consist of thin, flexible tubes that are inserted into the heart through a vein in the leg or neck. EP catheters are equipped with electrodes that allow physicians to measure the electrical activity of the heart, assess the location and cause of arrhythmias, and perform therapeutic procedures, such as ablation (destruction of problematic tissue) or implantation of pacemakers or defibrillators. The cardiac diagnostic catheters market size is anticipated to increase during the forecast period, owing to the rapid adoption of EP catheters in hospitals and diagnostic centers across the globe.

According to the global cardiac diagnostic catheters market analysis, based on end-user, the global industry has been bifurcated into hospitals and diagnostic & imaging centers. The hospitals segment held major share of the global market in 2021. People prefer hospitals for cardiovascular disease treatment than diagnostic & imaging centers. This is likely to augment the demand for cardiac diagnostic catheters in hospitals during the forecast period.

According to the global cardiac diagnostic catheters market research report, North America is likely to dominate the global market in the near future due to rise in prevalence of cardiovascular diseases in the region. Moreover, high adoption of diagnostic cardiac catheters in the region is positively impacting market statistics. According to Center for Disease Control and Prevention (CDC), one person dies every 34 seconds due to cardiovascular diseases in the U.S. This is fueling the demand for diagnostic catheterization.

The market for cardiac diagnostic catheters in Asia Pacific is estimated to expand at a rapid pace during the forecast period. According to the American Stroke Association, cardiovascular diseases are the leading cause of mortality in India. This is creating lucrative opportunities for diagnostic coronary catheters manufacturers in the region.

The global cardiac diagnostic catheters industry is consolidated, with the presence of a small number of large companies. Majority of the companies are making an investment in research and development activities, primarily to develop innovative products based on advanced technologies. Leading players are following the latest cardiac diagnostic catheters market trends and adopting several strategies to increase their revenue share. These include expansion of product portfolio and mergers & acquisitions.

Leading players in the global cardiac diagnostic catheters business are Abbott, Ares Medikal, B. Braun SE, BIOTRONIK SE & Co KG, BrosMed Medical Co., Ltd., Cascade Health Care, Cordis, Johnson & Johnson, Guangzhou Weili, Medical Equipment Co., Ltd., Medtronic, Boston Scientific Corporation, Koninklijke Philips N.V., Lepu Medical Technology (Beijing) Co., Ltd., Merit Medical Systems, Teleflex Incorporated, and VYAIRE.

Key players profiled in the cardiac diagnostic catheters market report have been analyzed on the basis of various parameters such as product portfolio, financial overview, recent developments, company overview, business segments, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 3.0 Bn |

|

Market Forecast Value in 2031 |

US$ 5.6 Bn |

|

Growth Rate (CAGR) |

7.0% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 3.0 Bn in 2022.

It is projected to reach a value of more than US$ 5.6 Bn by 2031.

The CAGR is anticipated to be 7.0% from 2023 to 2031.

Increase in prevalence of cardiovascular diseases and notable advancements in technologies used in cardiac diagnostic catheters.

North America is expected to account for major share during the forecast period.

Abbott, Ares Medikal, B. Braun SE, BIOTRONIK SE & Co KG, BrosMed Medical Co., Ltd., Cascade Health Care, Cordis, Guangzhou Weili, Medical Equipment Co., Ltd., Medtronic, Boston Scientific Corporation, Koninklijke Philips N.V., Lepu Medical Technology(Beijing)Co., Ltd., Merit Medical Systems, Teleflex Incorporated, and VYAIRE.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Cardiac Diagnostic Catheters Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cardiac Diagnostic Catheters Market Analysis and Forecasts, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario by Region/globally

5.3. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

5.4. Disease Prevalence & Incidence Rate globally with key countries

6. Global Cardiac Diagnostic Catheters Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Angiography Catheters

6.3.2. Electrophysiology Catheters

6.3.3. Ultrasound Catheters

6.3.4. Optical Coherence Tomography Catheters

6.3.5. Pressure & Hemodynamic Monitoring Catheters

6.3.6. Others

6.4. Market Attractiveness, by Product

7. Global Cardiac Diagnostic Catheters Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals

7.3.2. Diagnostic & Imaging Centers

7.4. Market Attractiveness, by End-user

8. Global Cardiac Diagnostic Catheters Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Country/Region

9. North America Cardiac Diagnostic Catheters Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017-2031

9.2.1. Angiography Catheters

9.2.2. Electrophysiology Catheters

9.2.3. Ultrasound Catheters

9.2.4. Optical Coherence Tomography Catheters

9.2.5. Pressure & Hemodynamic Monitoring Catheters

9.2.6. Others

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals

9.3.2. Diagnostic & Imaging Centers

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Cardiac Diagnostic Catheters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Angiography Catheters

10.2.2. Electrophysiology Catheters

10.2.3. Ultrasound Catheters

10.2.4. Optical Coherence Tomography Catheters

10.2.5. Pressure & Hemodynamic Monitoring Catheters

10.2.6. Others

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals

10.3.2. Diagnostic & Imaging Centers

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Cardiac Diagnostic Catheters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Angiography Catheters

11.2.2. Electrophysiology Catheters

11.2.3. Ultrasound Catheters

11.2.4. Optical Coherence Tomography Catheters

11.2.5. Pressure & Hemodynamic Monitoring Catheters

11.2.6. Others

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals

11.3.2. Diagnostic & Imaging Centers

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. Japan

11.4.2. China

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Cardiac Diagnostic Catheters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Angiography Catheters

12.2.2. Electrophysiology Catheters

12.2.3. Ultrasound Catheters

12.2.4. Optical Coherence Tomography Catheters

12.2.5. Pressure & Hemodynamic Monitoring Catheters

12.2.6. Others

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Hospitals

12.3.2. Diagnostic & Imaging Centers

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Cardiac Diagnostic Catheters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Angiography Catheters

13.2.2. Electrophysiology Catheters

13.2.3. Ultrasound Catheters

13.2.4. Optical Coherence Tomography Catheters

13.2.5. Pressure & Hemodynamic Monitoring Catheters

13.2.6. Others

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals

13.3.2. Diagnostic & Imaging Centers

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2022)

14.3. Company Profiles

14.3.1. Abbott

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. B. Braun SE

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Boston Scientific Corporation

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. BrosMed Medical Co., Ltd.

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. Cordis

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. Medical Equipment Co., Ltd.

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Medtronic

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Koninklijke Philips N.V.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. Lepu Medical Technology (Beijing) Co., Ltd.

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. Teleflex Incorporated

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

List of Tables

Table 01: Global Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: Global Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 03: Global Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 06: North America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 07: Europe Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table -08: Europe Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 09: Europe Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 10: Asia Pacific Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 12: Asia Pacific Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 13: Latin America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 15: Latin America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 18: Middle East & Africa Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user 2017–2031

List of Figures

Figure 01: Global Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Cardiac Diagnostic Catheters Market Value Share, by Product, 2022

Figure 03: Cardiac Diagnostic Catheters Market Value Share, by End-user, 2022

Figure 04: Cardiac Diagnostic Catheters Market Value Share, by Region, 2022

Figure 05: Global Cardiac Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 06: Global Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 07: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Angiography Catheters, 2017‒2031

Figure 08: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Anti-viral, 2017‒2031

Figure 09: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Electrophysiology Catheters, 2017‒2031

Figure 10: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Ultrasound Catheters, 2017‒2031

Figure 11: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Optical Coherence Tomography Catheters, 2017‒2031

Figure 12: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Pressure & Hemodynamic Monitoring Catheters, 2017‒2031

Figure 13: Global Cardiac Diagnostic Catheters Market Value (US$ Mn), by Others, 2017‒2031

Figure 14: Global Cardiac Diagnostic Catheters Market Value Share Analysis, by End-user 2022 and 2031

Figure 15: Global Cardiac Diagnostic Catheters Market Attractiveness Analysis, by End-user 2023–2031

Figure 16: Global Cardiac Diagnostic Catheters Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 17: Global Cardiac Diagnostic Catheters Market Revenue (US$ Mn), by Diagnostic & Imaging Centers, 2017–2031

Figure 18: Global Cardiac Diagnostic Catheters Market Value Share Analysis, by Region, 2022 and 2031

Figure 19: Global Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Region, 2023–2031

Figure 20: North America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: North America Cardiac Diagnostic Catheters Market Value Share Analysis, by Country, 2022 and 2031

Figure 22: North America Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Country, 2023–2031

Figure 23: North America Cardiac Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 24: North America Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Product 2023–2031

Figure 25: North America Cardiac Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: North America Cardiac Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Europe Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Europe Cardiac Diagnostic Catheters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 29: Europe Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 30: Europe Cardiac Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Europe Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 32: Europe Cardiac Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Cardiac Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 34: Asia Pacific Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: Asia Pacific Cardiac Diagnostic Catheters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Asia Pacific Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Asia Pacific Cardiac Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 38: Asia Pacific Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 39: Asia Pacific Cardiac Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Asia Pacific Cardiac Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 41: Latin America Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 42: Latin America Cardiac Diagnostic Catheters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 43: Latin America Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Latin America Cardiac Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 45: Latin America Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 46: Latin America Cardiac Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Latin America Cardiac Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 48: Middle East & Africa Cardiac Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 49: Middle East & Africa Cardiac Diagnostic Catheters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Middle East & Africa Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 51: Middle East & Africa Cardiac Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 52: Middle East & Africa Cardiac Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 53: Middle East & Africa Cardiac Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 54: Middle East & Africa Cardiac Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 55: Company Share Analysis (2022)