Since the start of the COVID-19 crisis, the global automotive industry has witnessed a series of blows and surprises. However, mass inoculation programs and a significant drop in coronavirus cases is anticipated to revive growth of the automotive industry and car powertrain market. Together with integrated digitization and surging interest in electric vehicles (EVs) is anticipated to generate future revenue opportunities for stakeholders in the car powertrain market.

Automotive industries should improve supply chains using machine learning (ML) tools and Big Data analysis, which will ensure the continuity in supply chains. Automotive brands and dealers will likely continue to provide incentives such as reduced rate of interests, discounts, and other lucrative offers to boost car sales.

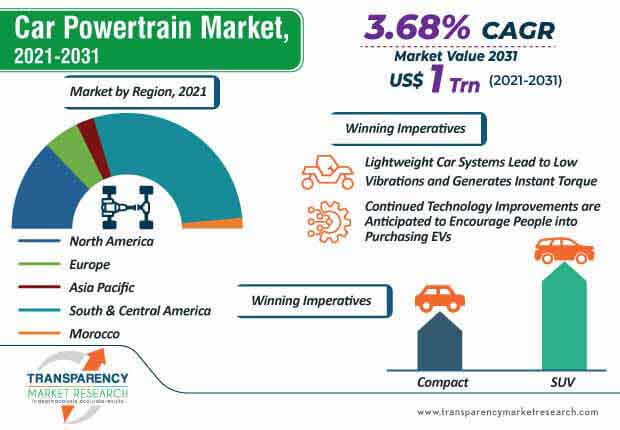

The car powertrain market is expected to clock a CAGR of 3.68% during the forecast period. Vehicle cost, charging infrastructure, and range anxiety are cited as some of the biggest barriers to purchasing EVs. Such findings are affecting growth of the market. Technologies to reduce charging are limited, owing to inherent challenges with lithium-ion technologies. These challenges are associated with thermal degradation at fast charging stations. Hence, companies in the car powertrain market should increase R&D in new battery chemistries and other technologies to align EVs with fast charging infrastructures.

Continued improvement in technology and low cost is anticipated to encourage people into purchasing battery electric vehicles (BEVs). Moreover, European countries are pushing toward aggressive CO2 targets and outright bans of ICE (Internal Combustion Engine) technology. Artificial intelligence (AI) techniques in engineering simulation and design software are being used to improve powertrains in EVs.

The car powertrain market is expected to surpass the value of US$ 1 Trn by 2031. A significant challenge with EVs remains the setting up of a new manufacturing facility. Ongoing innovations are emerging to inculcate changes to existing systems to produce EVs on the same assembly lines as conventional vehicles. This has led to the popularity of Daimler AG - a German multinational automotive corporation, which recently published an Indian patent that talks about an EV platform to convert a conventional semi-tractor or truck into an EV. Such trends are evident since public transport is very prominent in India.

High-power electric motors are gaining prominence in EVs. e-Powertrain by Nissan Motor Corporation is being publicized for its lightweight, compact, and high efficiency attributes for EVs. Next-gen e-Powertrains are eliminating the need for an internal combustion engine. Lightweight and compact systems lead to extremely low vibrations and generates instant torque. Companies in the car powertrain market are boosting production for systems that thrive in a range of environments whilst displaying high performance and durability.

Powertrains in EVs typically consist of motor, inverter, reduction drive, and power delivery module (PDM), among others. Companies in the car powertrain market are increasing the production of e-Powertrains with motors that generate the power for moving and regenerative braking power during deceleration.

Analysts’ Viewpoint

Companies in the car powertrain market are increasing R&D of autonomous vehicles, as people are conscious about social distancing owing to the COVID-19 outbreak. Due to stringent gas emission limits, manufacturers are increasing R&D in EVs. However, issues such as thermal degradation are being associated with lithium-ion battery technologies in EVs. Hence, companies should increase R&D in new battery chemistries and other technologies to help align EVs with future fast charging infrastructures. Moreover, in response to the need to reduce CO2 emissions, several countries have announced targets for eliminating ICE powertrains. Supportive government initiatives are creating revenue opportunities for automotive companies.

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 680.85 Bn |

|

Market Forecast Value in 2031 |

US$ 1 Trn |

|

Growth Rate (CAGR) |

3.68% |

|

Forecast Period |

2021-2031 |

|

Historical Data Available for |

2016-2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Research Scope |

Research Scope Covers global Car Powertrain Market by car type, and category |

|

Report Coverage |

Market Dynamics, Key Trends, Porters Five Force, SWOT Analysis, Competitive Landscape, COVID-19 Analysis |

|

Format |

Electronic (PDF) or PPT |

|

Regions & Countries Covered |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

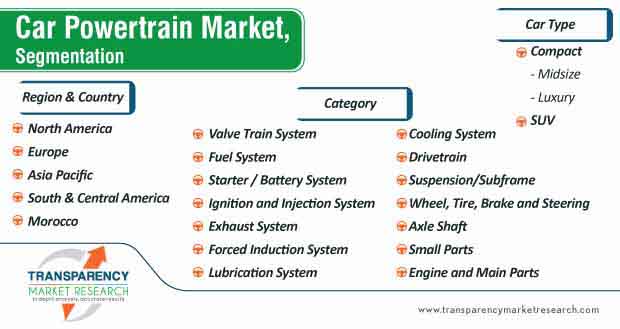

Market Segmentation |

Car Type |

|

Category |

|

|

Region & Country |

|

|

Companies Profiled |

MAHLE GmbH |

|

Robert Bosch |

|

|

Valeo SA |

|

|

Denso Corporation |

|

|

Magna International Inc. |

|

|

Continental AG |

|

|

Linamar |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The Car Powertrain Market is studied from 2021 - 2031.

The Car Powertrain Market is projected to reach the valuation US$ 11 Trn By 2031

The Car Powertrain Market is expected to grow at a CAGR of 3.68%.

American Axle & Manufacturing, Tenneco Inc., Linamar, ThyssenKrupp, Rheinmetall AGare a few of the key vendors in the Car Powertrain Market.

Increase in urbanization and surge in demand for transportation of population as well as consumer products are fueling the demand for vehicles.

1. Executive Summary

1.1. Demand & Supply Side Trends

1.2. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Key Market Trends

2.3.1. Key Trends Impacting the Market

2.3.2. Product Innovation / Development Trends

2.4. Market Background

2.4.1. Macro-Economic Factors

2.4.1.1. Global GDP Growth Outlook

2.4.1.2. Global Industrial Growth Outlook

2.4.1.3. Global Urbanization Growth Outlook

2.4.1.4. Global Population Growth Outlook

2.4.1.5. Global Automotive Industry Growth Outlook

2.5. Forecast Factors - Relevance & Impact

2.5.1. Global Automotive Production Growth Outlook

2.5.2. Global Automotive Sales Growth Outlook

2.5.3. Global Vehicle Parc Outlook

2.6. PESTLE Analysis

2.7. Porter’s Five Forces Analysis

2.8. Value Chain Analysis

2.8.1. List of Suppliers

2.8.2. List of OEMs

2.8.3. Profitability Margins

2.9. Market Dynamics

2.9.1. Drivers

2.9.2. Restraints

2.9.3. Opportunity

2.10. Covid-19 Crisis – Impact Assessment

3. Global Car Powertrain Market Analysis and Forecast, by Car Type

3.1. Definition

3.2. Market Snapshot

3.3. Global Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

3.3.1. Compact

3.3.2. Midsize

3.3.3. Luxury

3.3.4. SUV

4. Global Car Powertrain Market Analysis and Forecast, by Category

4.1. Definition

4.2. Market Snapshot

4.3. Global Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

4.3.1. Engine and Main Parts

4.3.2. Valve Train System

4.3.3. Fuel System

4.3.4. Starter / Battery System

4.3.5. Ignition and Injection System

4.3.6. Exhaust System

4.3.7. Forced Induction System

4.3.8. Lubrication System

4.3.9. Cooling System

4.3.10. Drivetrain

4.3.11. Suspension/Subframe

4.3.12. Wheel, Tire, Brake and Steering

4.3.13. Axle Shaft

4.3.14. Small Parts

5. Global Car Powertrain Market Analysis and Forecast, by Region & Country

5.1. Market Snapshot

5.2. Global Car Powertrain Market Value (US$ Mn) Forecast, by Region & Country, 2017‒2031

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Central & South America

5.2.5. Morocco

6. North America Car Powertrain Market Value (US$ Mn) Forecast, 2017‒2031

6.1. Market Snapshot

6.2. North America Car Powertrain Market Value (US$ Mn) Forecast, by Car Type

6.2.1. Compact

6.2.2. Midsize

6.2.3. Luxury

6.2.4. SUV

6.3. North America Car Powertrain Market Value (US$ Mn) Forecast, by Category

6.3.1. Engine and Main Parts

6.3.2. Valve Train System

6.3.3. Fuel System

6.3.4. Starter / Battery System

6.3.5. Ignition and Injection System

6.3.6. Exhaust System

6.3.7. Forced Induction System

6.3.8. Lubrication System

6.3.9. Cooling System

6.3.10. Drivetrain

6.3.11. Suspension/Subframe

6.3.12. Wheel, Tire, Brake and Steering

6.3.13. Axle Shaft

6.3.14. Small Parts

6.4. North America Car Powertrain Market Value (US$ Mn) Forecast, by Country

6.4.1. U.S.

6.4.2. Canada

6.4.3. Mexico

7. Europe Car Powertrain Market Value (US$ Mn) Forecast, 2017‒2031

7.1. Market Snapshot

7.2. Europe Car Powertrain Market Value (US$ Mn) Forecast, by Car Type

7.2.1. Compact

7.2.2. Midsize

7.2.3. Luxury

7.2.4. SUV

7.3. Europe Car Powertrain Market Value (US$ Mn) Forecast, by Category

7.3.1. Engine and Main Parts

7.3.2. Valve Train System

7.3.3. Fuel System

7.3.4. Starter / Battery System

7.3.5. Ignition and Injection System

7.3.6. Exhaust System

7.3.7. Forced Induction System

7.3.8. Lubrication System

7.3.9. Cooling System

7.3.10. Drivetrain

7.3.11. Suspension/Subframe

7.3.12. Wheel, Tire, Brake and Steering

7.3.13. Axle Shaft

7.3.14. Small Parts

7.4. Europe Car Powertrain Market Value (US$ Mn) Forecast, by Country and Sub-region

7.4.1. UK

7.4.2. Germany

7.4.3. France

7.4.4. Italy

7.4.5. Spain

7.4.6. Austria

7.4.7. Belgium

7.4.8. Sweden

7.4.9. Portugal

7.4.10. Finland

7.4.11. Netherlands

7.4.12. Russia

7.4.13. Turkey

7.4.14. Czech Republic

7.4.15. Hungary

7.4.16. Ukraine

7.4.17. Poland

7.4.18. Slovakia

7.4.19. Romania

7.4.20. Slovenia

7.4.21. Serbia

8. Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, 2017‒2031

8.1. Market Snapshot

8.2. Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, by Car Type

8.2.1. Compact

8.2.2. Midsize

8.2.3. Luxury

8.2.4. SUV

8.3. Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, by Category

8.3.1. Engine and Main Parts

8.3.2. Valve Train System

8.3.3. Fuel System

8.3.4. Starter / Battery System

8.3.5. Ignition and Injection System

8.3.6. Exhaust System

8.3.7. Forced Induction System

8.3.8. Lubrication System

8.3.9. Cooling System

8.3.10. Drivetrain

8.3.11. Suspension/Subframe

8.3.12. Wheel, Tire, Brake and Steering

8.3.13. Axle Shaft

8.3.14. Small Parts

8.4. Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, by Country and Sub-region

8.4.1. China

8.4.2. Rest of Asia Pacific

9. Central & South America Car Powertrain Market Value (US$ Mn) Forecast, 2017‒2031

9.1. Market Snapshot

9.2. Central & South America Car Powertrain Market Value (US$ Mn) Forecast, by Car Type

9.2.1. Compact

9.2.2. Midsize

9.2.3. Luxury

9.2.4. SUV

9.3. Central & South America Car Powertrain Market Value (US$ Mn) Forecast, by Category

9.3.1. Engine and Main Parts

9.3.2. Valve Train System

9.3.3. Fuel System

9.3.4. Starter / Battery System

9.3.5. Ignition and Injection System

9.3.6. Exhaust System

9.3.7. Forced Induction System

9.3.8. Lubrication System

9.3.9. Cooling System

9.3.10. Drivetrain

9.3.11. Suspension/Subframe

9.3.12. Wheel, Tire, Brake and Steering

9.3.13. Axle Shaft

9.3.14. Small Parts

10. Morocco Car Powertrain Market Value (US$ Mn) Forecast, 2017‒2031

10.1. Market Snapshot

10.2. Morocco Car Powertrain Market Value (US$ Mn) Forecast, by Car Type

10.2.1. Compact

10.2.2. Midsize

10.2.3. Luxury

10.2.4. SUV

10.3. Morocco Car Powertrain Market Value (US$ Mn) Forecast, by Category

10.3.1. Engine and Main Parts

10.3.2. Valve Train System

10.3.3. Fuel System

10.3.4. Starter / Battery System

10.3.5. Ignition and Injection System

10.3.6. Exhaust System

10.3.7. Forced Induction System

10.3.8. Lubrication System

10.3.9. Cooling System

10.3.10. Drivetrain

10.3.11. Suspension/Subframe

10.3.12. Wheel, Tire, Brake and Steering

10.3.13. Axle Shaft

10.3.14. Small Parts

11. Competition Landscape

11.1. Market Analysis By Company (2020)

11.2. Market Player – Competition Matrix (By Tier and Size of companies)

11.3. Key Market Players (Details – Overview, Recent Developments, Strategy)

11.3.1. Mahle GmbH,

11.3.1.1. Overview

11.3.1.2. Recent Developments

11.3.1.3. Strategy

11.3.2. American Axle & Manufacturing,

11.3.2.1. Overview

11.3.2.2. Recent Developments

11.3.2.3. Strategy

11.3.3. Tenneco Inc., Linamar,

11.3.3.1. Overview

11.3.3.2. Recent Developments

11.3.3.3. Strategy

11.3.4. ThyssenKrupp,

11.3.4.1. Overview

11.3.4.2. Recent Developments

11.3.4.3. Strategy

11.3.5. Rheinmetall AG,

11.3.5.1. Overview

11.3.5.2. Recent Developments

11.3.5.3. Strategy

11.3.6. Sanjo Machine Works,

11.3.6.1. Overview

11.3.6.2. Recent Developments

11.3.6.3. Strategy

11.3.7. Yasunaga, Bharat Forge,

11.3.7.1. Overview

11.3.7.2. Recent Developments

11.3.7.3. Strategy

11.3.8. Art Metal Mfg. Co., Ltd,

11.3.8.1. Overview

11.3.8.2. Recent Developments

11.3.8.3. Strategy

11.3.9. Continental AG,

11.3.9.1. Overview

11.3.9.2. Recent Developments

11.3.9.3. Strategy

11.3.10. Robert Bosch GmbH,

11.3.10.1. Overview

11.3.10.2. Recent Developments

11.3.10.3. Strategy

11.3.11. Denso Corporation,

11.3.11.1. Overview

11.3.11.2. Recent Developments

11.3.11.3. Strategy

11.3.12. ZF Friedrichshafen AG,

11.3.12.1. Overview

11.3.12.2. Recent Developments

11.3.12.3. Strategy

11.3.13. Magna International Inc.,

11.3.13.1. Overview

11.3.13.2. Recent Developments

11.3.13.3. Strategy

11.3.14. Bridgestone Corporation,

11.3.14.1. Overview

11.3.14.2. Recent Developments

11.3.14.3. Strategy

11.3.15. Michelin,

11.3.15.1. Overview

11.3.15.2. Recent Developments

11.3.15.3. Strategy

11.3.16. Faurecia,

11.3.16.1. Overview

11.3.16.2. Recent Developments

11.3.16.3. Strategy

11.3.17. Clarios,

11.3.17.1. Overview

11.3.17.2. Recent Developments

11.3.17.3. Strategy

11.3.18. Valeo SA

11.3.18.1. Overview

11.3.18.2. Recent Developments

11.3.18.3. Strategy

List of Tables

Table 1: Global Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 2: Global Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 3: Global Car Powertrain Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 4: Europe Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 5: Europe Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 6: Europe Car Powertrain Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 7: U.K. Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 8: U.K. Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 9: Germany Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 10: Germany Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 11: France Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 12: France Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 13: Italy Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 14: Italy Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 15: Spain Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 16: Spain Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 17: Austria Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 18: Austria Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 19: Belgium Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 20: Belgium Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 21: Sweden Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 22: Sweden Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 23: Portugal Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 24: Portugal Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 25: Finland Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 26: Finland Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 27: Netherlands Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 28: Netherlands Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 29: Russia Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 30: Russia Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 31: Turkey Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 32: Turkey Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 33: Czech Republic Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 34: Czech Republic Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 35: Hungary Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 36: Hungary Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 37: Ukraine Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 38: Ukraine Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 39: Poland Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 40: Poland Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 41: Slovakia Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 42: Slovakia Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 43: Romania Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 44: Romania Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 45: Slovenia Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 46: Slovenia Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 47: Serbia Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 48: Serbia Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 49: North America Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 50: North America Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 51: North America Car Powertrain Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 52: U.S. Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 53: U.S. Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 54: Canada Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 55: Canada Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 56: Mexico Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 57: Mexico Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 58: Central & South America Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 59: Central & South America Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 60: Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 61: Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 62: Asia Pacific Car Powertrain Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 63: China Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 64: China Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 65: Rest of APAC Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 66: Rest of APAC Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

Table 67: Morocco Car Powertrain Market Value (US$ Mn) Forecast, by Category, 2017‒2031

Table 68: Morocco Car Powertrain Market Value (US$ Mn) Forecast, by Car Type, 2017‒2031

List of Figures

Figure 1: Global Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 2: Global Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 3: Global Car Powertrain Market Absolute $ Opportunity Analysis

Figure 4: Europe Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 5: Europe Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 6: Europe Car Powertrain Market Absolute $ Opportunity Analysis

Figure 7: U.K. Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 8: U.K. Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 9: U.K. Car Powertrain Market Absolute $ Opportunity Analysis

Figure 10: Germany Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 11: Germany Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 12: Germany Car Powertrain Market Absolute $ Opportunity Analysis

Figure 13: France Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 14: France Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 15: France Car Powertrain Market Absolute $ Opportunity Analysis

Figure 16: Italy Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 17: Italy Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 18: Italy Car Powertrain Market Absolute $ Opportunity Analysis

Figure 19: Spain Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 20: Spain Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 21: Spain Car Powertrain Market Absolute $ Opportunity Analysis

Figure 22: Austria Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 23: Austria Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 24: Austria Car Powertrain Market Absolute $ Opportunity Analysis

Figure 25: Belgium Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 26: Belgium Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 27: Belgium Car Powertrain Market Absolute $ Opportunity Analysis

Figure 28: Sweden Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 29: Sweden Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 30: Sweden Car Powertrain Market Absolute $ Opportunity Analysis

Figure 31: Portugal Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 32: Portugal Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 33: Portugal Car Powertrain Market Absolute $ Opportunity Analysis

Figure 34: Finland Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 35: Finland Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 36: Finland Car Powertrain Market Absolute $ Opportunity Analysis

Figure 37: Netherlands Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 38: Netherlands Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 39: Netherlands Car Powertrain Market Absolute $ Opportunity Analysis

Figure 40: Russia Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 41: Russia Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 42: Russia Car Powertrain Market Absolute $ Opportunity Analysis

Figure 43: Turkey Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 44: Turkey Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 45: Turkey Car Powertrain Market Absolute $ Opportunity Analysis

Figure 46: Czech Republic Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 47: Czech Republic Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 48: Czech Republic Car Powertrain Market Absolute $ Opportunity Analysis

Figure 49: Hungary Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 50: Hungary Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 51: Hungary Car Powertrain Market Absolute $ Opportunity Analysis

Figure 52: Ukraine Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 53: Ukraine Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 54: Ukraine Car Powertrain Market Absolute $ Opportunity Analysis

Figure 55: Poland Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 56: Poland Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 57: Poland Car Powertrain Market Absolute $ Opportunity Analysis

Figure 58: Slovakia Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 59: Slovakia Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 60: Slovakia Car Powertrain Market Absolute $ Opportunity Analysis

Figure 61: Romania Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 62: Romania Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 63: Romania Car Powertrain Market Absolute $ Opportunity Analysis

Figure 64: Slovenia Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 65: Slovenia Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 66: Slovenia Car Powertrain Market Absolute $ Opportunity Analysis

Figure 67: Serbia Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 68: Serbia Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 69: Serbia Car Powertrain Market Absolute $ Opportunity Analysis

Figure 70: North America Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 71: North America Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 72: North America Car Powertrain Market Absolute $ Opportunity Analysis

Figure 73: U.S. Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 74: U.S. Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 75: U.S. Car Powertrain Market Absolute $ Opportunity Analysis

Figure 76: Canada Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 77: Canada Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 78: Canada Car Powertrain Market Absolute $ Opportunity Analysis

Figure 79: Mexico Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 80: Mexico Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 81: Mexico Car Powertrain Market Absolute $ Opportunity Analysis

Figure 82: Central & South America Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 83: Central & South America Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 84: Central & South America Car Powertrain Market Absolute $ Opportunity Analysis

Figure 85: Asia Pacific Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 86: Asia Pacific Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 87: Asia Pacific Car Powertrain Market Absolute $ Opportunity Analysis

Figure 88: China Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 89: China Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 90: China Car Powertrain Market Absolute $ Opportunity Analysis

Figure 91: Rest of APAC Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 92: Rest of APAC Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 93: Rest of APAC Car Powertrain Market Absolute $ Opportunity Analysis

Figure 94: Morocco Car Powertrain Market Value (US$ Mn), 2017-2031

Figure 95: Morocco Car Powertrain Market Current and Future Value Projections, 2021–2031

Figure 96: Morocco Car Powertrain Market Absolute $ Opportunity Analysis