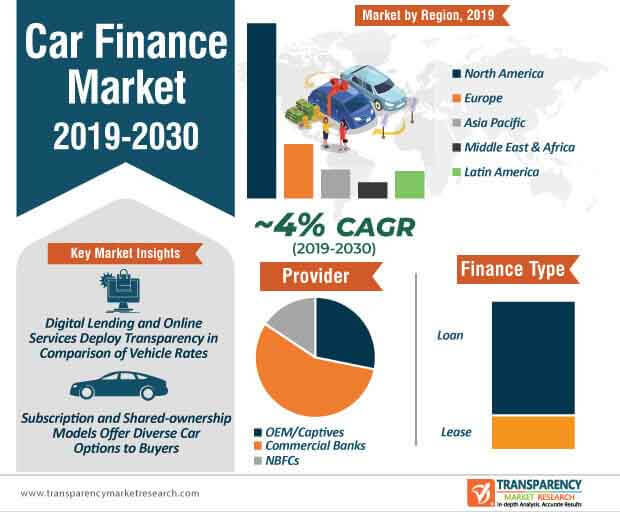

The car finance market has experienced considerable developments in the past decade, primarily driven by new business models, rising competition, and the onset of new technologies. The fluctuating sales of automotive vehicles across the world continue to define the course of the global car finance market. The sales of new cars across the world have witnessed a slight decline due to a host of demographic, technical, and economic factors since 2017. In addition, as the inventory of used cars continues to grow, the demand for new cars is decreasing. In addition, amidst the growing environmental concerns and calls to minimize carbon emission, car-pooling, the usage of electric bikes and bicycles has increased across the urban regions of the world. Current trends also indicate that more number of consumers are opting to purchase second-hand cars due to surging prices of new automotive cars due to which, the banking sector around the world is paying more attention to second-hand car financing.

Players operating in the current car finance market are increasingly focusing on simplifying the car finance process and make it customer friendly. In addition, market players are also expected to cater to the growing consumer demand for simpler loan applications and swift credit decisions. Advancements in car finance technologies in the past few years are expected to address these challenges due to which, the car finance market is expected to witness steady growth during the forecast period. The entry of cloud-based lending models and portfolio optimization is driven by data analytics that are expected to play an imperative role in the expansion of the car finance market. At the back of these factors, the global car finance market is expected to attain a market value of ~US$ 3 Trn by the end of 2030.

Advancements in cloud technology are expected to trigger the growth of the global car finance market during the assessment period. As consumer demand for a hassle-free lending experience continues to grow at a rapid pace, stakeholders in the car finance market are projected to leverage cloud technology to cater to these demands. Some of the potential benefits of deploying cloud include swift implementation, cost savings, and efficient delivery of new functions– an important factor that is anticipated to improve the overall lending experience. Cloud-based lending solutions are gradually making inroads in the global car finance market and as per current trends, the market share of on-premise legacy lending systems is projected to decline over the course of the forecast period.

Another significant development within the car finance market is the optimization of the loan portfolio. As data analytics continues to glide through the automotive space, stakeholders operating in the car finance market are increasingly relying on data analytics software to detect the trends and consumer patterns across the lending process of various portfolios. While automotive companies have utilized data for several years for optimum maintenance, data analytics is likely to establish a strong presence in the car finance market during the forecast period. Market participants are increasingly leaning toward using data analytics software to enhance customer experience and streamline the overall data governance structures.

The COVID-19 pandemic has put the brakes on the growth of several industries worldwide and the car finance market is treading through a similar path. Players operating in the current car finance market landscape are estimated to address various challenges, including dwindling consumer confidence and declining sales of new cars in the upcoming years to establish a strong foothold in the market. Due to the unpredicted turn of events, car sales around the world are likely to witness a major slump in 2020 and potentially, the first half of 2021. In their bid to establish a substantial market share, market players are expected to focus on servicing activities, such as refinancing and extensions by leveraging digital tools to accelerate the process remotely. Several companies are also expected to offer payment relief such as deferred lease payments and extensions to existing borrowers that are affected by the COVID-19 virus. Companies are projected to switch to digital lending solutions to ensure business continuity during the ongoing health crisis.

Analysts’ Viewpoint

The global car finance market is expected to grow at a steady pace during the forecast period. The market growth is driven by advancements in technology pertaining to the cloud and data analysis. A large number of car finance companies will rely on digital lending platforms during the ongoing COVID-19 pandemic and possibly, in the period beyond that. Digital tools will play a key role in the restructuring of the car finance market over the course of the forecast period. Market participants should focus on improving the overall lending experience and work toward simplifying the borrowing process for customers.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. Primary Research and List of Primary Sources

2.1.2. Secondary Research and Sources

2.2. Key assumptions for Data Modelling

3. Executive Summary : Global Car Finance Market

3.1. Global Car Finance Market Value (US$ Bn) Forecast, 2018?2030

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors

4.3. Industry Dynamics

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.4.4. Impact Analysis of Drivers and Restraints

4.5. Market Factor Analysis

4.5.1. Porter’s Five Force Analysis

4.5.2. PESTEL Analysis

4.5.3. Value Chain Analysis

4.5.3.1. List of Key Manufacturers

4.5.3.2. List of Customers

4.5.3.3. Level of Integration

4.5.4. SWOT Analysis

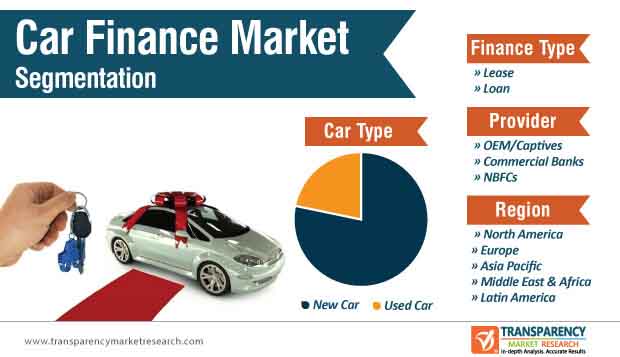

5. Global Car Finance Market Analysis and Forecast, by Car Type

5.1. Definition

5.2. Market Snapshot

5.3. Global Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

5.3.1. Used Car

5.3.2. New Car

6. Global Car Finance Market Analysis and Forecast, by Finance Type

6.1. Definition

6.2. Market Snapshot

6.3. Global Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

6.3.1. Lease

6.3.2. Loan

7. Global Car Finance Market Analysis and Forecast, by Provider

7.1. Definition

7.2. Market Snapshot

7.3. Global Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

7.3.1. OEM/ Captives

7.3.2. Commercial Banks

7.3.3. NBFCs

8. Global Car Finance Market Analysis and Forecast, by Region

8.1. Market Snapshot

8.2. Global Car Finance Market Value (US$ Bn) Forecast, by Region, 2018?2030

8.2.1. North America

8.2.2. Latin America

8.2.3. Europe

8.2.4. Asia Pacific

8.2.5. Middle East & Africa

9. North America Car Finance Market Value (US$ Bn) Forecast, 2018?2030

9.1. Market Snapshot

9.2. North America Car Finance Market Value (US$ Bn) Forecast, by Car Type

9.2.1. Used Cars

9.2.2. New Car

9.3. North America Car Finance Market Value (US$ Bn) Forecast, by Finance Type

9.3.1. Lease

9.3.2. Loan

9.4. North America Car Finance Market Value (US$ Bn) Forecast, by Provider

9.4.1. OEM/ Captives

9.4.2. Commercial Banks

9.4.3. NBFCs

9.5. North America Car Finance Market Value (US$ Bn) Forecast, by Country

9.5.1. U.S.

9.5.2. Canada

9.6. U.S. Car Finance Market Value (US$ Bn) Forecast, by Car Type

9.6.1. Used Car

9.6.2. New Car

9.7. U.S. Car Finance Market Value (US$ Bn) Forecast, by Finance Type

9.7.1. Lease

9.7.2. Loan

9.8. U.S. Car Finance Market Value (US$ Bn) Forecast, by Provider

9.8.1. OEM/ Captives

9.8.2. Commercial Banks

9.8.3. NBFCs

9.9. Canada Car Finance Market Value (US$ Bn) Forecast, by Car Type

9.9.1. Used Car

9.9.2. New Car

9.10. Canada Car Finance Market Value (US$ Bn) Forecast, by Finance Type

9.10.1. Lease

9.10.2. Loan

9.11. Canada Car Finance Market Value (US$ Bn) Forecast, by Provider

9.11.1. OEM/ Captives

9.11.2. Commercial Banks

9.11.3. NBFCs

9.12. North America Car Finance Market: PEST Analysis

10. Europe Car Finance Market Value (US$ Bn) Forecast, 2018?2030

10.1. Market Snapshot

10.2. Europe Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.2.1. Used Car

10.2.2. New Car

10.3. Europe Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.3.1. Lease

10.3.2. Loan

10.4. Europe Car Finance Market Value (US$ Bn) Forecast, by Provider

10.4.1. OEM/ Captives

10.4.2. Commercial Banks

10.4.3. NBFCs

10.5. Europe Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Nordic & Baltic

10.5.7. Russia

10.6. Germany Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.6.1. Used Car

10.6.2. New Car

10.7. Germany Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.7.1. Lease

10.7.2. Loan

10.8. Germany Car Finance Market Value (US$ Bn) Forecast, by Provider

10.8.1. OEM/ Captives

10.8.2. Commercial Banks

10.8.3. NBFCs

10.9. U.K. Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.9.1. Used Car

10.9.2. New Car

10.10. U.K. Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.10.1. Lease

10.10.2. Loan

10.11. U.K. Car Finance Market Value (US$ Bn) Forecast, by Provider

10.11.1. OEM/ Captives

10.11.2. Commercial Banks

10.11.3. NBFCs

10.12. France Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.12.1. Used Car

10.12.2. New Car

10.13. France Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.13.1. Lease

10.13.2. Loan

10.14. France Car Finance Market Value (US$ Bn) Forecast, by Provider

10.14.1. OEM/ Captives

10.14.2. Commercial Banks

10.14.3. NBFCs

10.15. Italy Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.15.1. Used Car

10.15.2. New Car

10.16. Italy Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.16.1. Lease

10.16.2. Loan

10.17. Italy Car Finance Market Value (US$ Bn) Forecast, by Provider

10.17.1. OEM/ Captives

10.17.2. Commercial Banks

10.17.3. NBFCs

10.18. Spain Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.18.1. Used Car

10.18.2. New Car

10.19. Spain Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.19.1. Lease

10.19.2. Loan

10.20. Spain Car Finance Market Value (US$ Bn) Forecast, by Provider

10.20.1. OEM/ Captives

10.20.2. Commercial Banks

10.20.3. NBFCs

10.20.4. Food & Beverage

10.21. Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.21.1. Used Car

10.21.2. New Car

10.22. Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.22.1. Lease

10.22.2. Loan

10.23. Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, by Provider

10.23.1. OEM/ Captives

10.23.2. Commercial Banks

10.23.3. NBFCs

10.24. Russia Car Finance Market Value (US$ Bn) Forecast, by Car Type

10.24.1. Used Car

10.24.2. New Car

10.25. Russia Car Finance Market Value (US$ Bn) Forecast, by Finance Type

10.25.1. Lease

10.25.2. Loan

10.26. Russia Car Finance Market Value (US$ Bn) Forecast, by Provider

10.26.1. OEM/ Captives

10.26.2. Commercial Banks

10.26.3. NBFCs

10.26.4. Food & Beverage

10.27. Europe Car Finance Market: PEST Analysis

11. Asia Pacific Car Finance Market Value (US$ Bn) Forecast, 2018?2030

11.1. Market Snapshot

11.2. Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Car Type

11.2.1. Used Car

11.2.2. New Car

11.3. Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Finance Type

11.3.1. Lease

11.3.2. Loan

11.4. Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Provider

11.4.1. OEM/ Captives

11.4.2. Commercial Banks

11.4.3. NBFCs

11.5. Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region

11.5.1. China

11.5.2. India

11.5.3. Japan

11.5.4. ANZ

11.5.5. ASEAN

11.6. China Car Finance Market Value (US$ Bn) Forecast, by Car Type

11.6.1. Used Car

11.6.2. New Car

11.7. China Car Finance Market Value (US$ Bn) Forecast, by Finance Type

11.7.1. Lease

11.7.2. Loan

11.8. China Car Finance Market Value (US$ Bn) Forecast, by Provider

11.8.1. OEM/ Captives

11.8.2. Commercial Banks

11.8.3. NBFCs

11.9. India Car Finance Market Value (US$ Bn) Forecast, by Car Type

11.9.1. Used Car

11.9.2. New Car

11.10. India Car Finance Market Value (US$ Bn) Forecast, by Finance Type

11.10.1. Lease

11.10.2. Loan

11.11. India Car Finance Market Value (US$ Bn) Forecast, by Provider

11.11.1. OEM/ Captives

11.11.2. Commercial Banks

11.11.3. NBFCs

11.12. Japan Car Finance Market Value (US$ Bn) Forecast, by Car Type

11.12.1. Used Car

11.12.2. New Car

11.13. Japan Car Finance Market Value (US$ Bn) Forecast, by Finance Type

11.13.1. Lease

11.13.2. Loan

11.14. Japan Car Finance Market Value (US$ Bn) Forecast, by Provider

11.14.1. OEM/ Captives

11.14.2. Commercial Banks

11.14.3. NBFCs

11.15. ANZ Car Finance Market Value (US$ Bn) Forecast, by Car Type

11.15.1. Used Car

11.15.2. New Car

11.16. ANZ Car Finance Market Value (US$ Bn) Forecast, by Finance Type

11.16.1. Lease

11.16.2. Loan

11.17. ANZ Car Finance Market Value (US$ Bn) Forecast, by Provider

11.17.1. OEM/ Captives

11.17.2. Commercial Banks

11.17.3. NBFCs

11.18. ASEAN Car Finance Market Value (US$ Bn) Forecast, by Car Type

11.18.1. Used Car

11.18.2. New Car

11.19. ASEAN Car Finance Market Value (US$ Bn) Forecast, by Finance Type

11.19.1. Lease

11.19.2. Loan

11.20. ASEAN Car Finance Market Value (US$ Bn) Forecast, by Provider

11.20.1. OEM/ Captives

11.20.2. Commercial Banks

11.20.3. NBFCs

11.21. Asia Pacific Car Finance Market: PEST Analysis

12. Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, 2018?2030

12.1. Market Snapshot

12.2. Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Car Type

12.2.1. Used Car

12.2.2. New Car

12.3. Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Finance Type

12.3.1. Lease

12.3.2. Loan

12.4. Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Provider

12.4.1. OEM/ Captives

12.4.2. Commercial Banks

12.4.3. NBFCs

12.5. Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region

12.5.1. Turkey

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Turkey Car Finance Market Value (US$ Bn) Forecast, by Car Type

12.6.1. Used Car

12.6.2. New Car

12.7. Turkey Car Finance Market Value (US$ Bn) Forecast, by Finance Type

12.7.1. Lease

12.7.2. Loan

12.8. Turkey Car Finance Market Value (US$ Bn) Forecast, by Provider

12.8.1. OEM/ Captives

12.8.2. Commercial Banks

12.8.3. NBFCs

12.9. South Africa Car Finance Market Value (US$ Bn) Forecast, by Car Type

12.9.1. Used Car

12.9.2. New Car

12.10. South Africa Car Finance Market Value (US$ Bn) Forecast, by Finance Type

12.10.1. Lease

12.10.2. Loan

12.11. South Africa Car Finance Market Value (US$ Bn) Forecast, by Provider

12.11.1. OEM/ Captives

12.11.2. Commercial Banks

12.11.3. NBFCs

12.12. Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Car Type

12.12.1. Used Car

12.12.2. New Car

12.13. Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Finance Type

12.13.1. Lease

12.13.2. Loan

12.14. Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Provider

12.14.1. OEM/ Captives

12.14.2. Commercial Banks

12.14.3. NBFCs

12.15. Middle East & Africa Car Finance Market: PEST Analysis

13. Latin America Car Finance Market Value (US$ Bn) Forecast, 2018?2030

13.1. Market Snapshot

13.2. Latin America Car Finance Market Value (US$ Bn) Forecast, by Car Type

13.2.1. Used Car

13.2.2. New Car

13.3. Latin America Car Finance Market Value (US$ Bn) Forecast, by Finance Type

13.3.1. Lease

13.3.2. Loan

13.4. Latin America Car Finance Market Value (US$ Bn) Forecast, by Provider

13.4.1. OEM/ Captives

13.4.2. Commercial Banks

13.4.3. NBFCs

13.5. Latin America Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Brazil Car Finance Market Value (US$ Bn) Forecast, by Car Type

13.6.1. Used Car

13.6.2. New Car

13.7. Brazil Car Finance Market Value (US$ Bn) Forecast, by Finance Type

13.7.1. Lease

13.7.2. Loan

13.8. Brazil Car Finance Market Value (US$ Bn) Forecast, by Provider

13.8.1. OEM/ Captives

13.8.2. Commercial Banks

13.8.3. NBFCs

13.9. Mexico Car Finance Market Value (US$ Bn) Forecast, by Car Type

13.9.1. Used Car

13.9.2. New Car

13.10. Mexico Car Finance Market Value (US$ Bn) Forecast, by Finance Type

13.10.1. Lease

13.10.2. Loan

13.11. Mexico Car Finance Market Value (US$ Bn) Forecast, by Provider

13.11.1. OEM/ Captives

13.11.2. Commercial Banks

13.11.3. NBFCs

13.12. Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, by Car Type

13.12.1. Used Car

13.12.2. New Car

13.13. Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, by Finance Type

13.13.1. Lease

13.13.2. Loan

13.14. Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, by Provider

13.14.1. OEM/ Captives

13.14.2. Commercial Banks

13.14.3. NBFCs

13.15. Latin America Car Finance Market: PEST Analysis

14. Competition Landscape

14.1. Market Analysis By Company (2018)

14.2. Market Player – Competition Matrix (By Tier and Size of companies)

14.3. Key Market Players (Details – Overview, Recent Developments, Strategy)

14.3.1. Bank of China

14.3.1.1. Overview

14.3.1.2. Recent Developments

14.3.1.3. Strategy

14.3.2. BNP Paribas SA

14.3.2.1. Overview

14.3.2.2. Recent Developments

14.3.2.3. Strategy

14.3.3. Alley Financial Inc

14.3.3.1. Overview

14.3.3.2. Recent Developments

14.3.3.3. Strategy

14.3.4. Bank of America

14.3.4.1. Overview

14.3.4.2. Recent Developments

14.3.4.3. Strategy

14.3.5. Hitachi Capital Asia Pacific

14.3.5.1. Overview

14.3.5.2. Recent Developments

14.3.5.3. Strategy

14.3.6. ALD Automotive

14.3.6.1. Overview

14.3.6.2. Recent Developments

14.3.6.3. Strategy

14.3.7. LeasePlan

14.3.7.1. Overview

14.3.7.2. Recent Developments

14.3.7.3. Strategy

14.3.8. Ford Motor Credit

14.3.8.1. Overview

14.3.8.2. Recent Developments

14.3.8.3. Strategy

14.3.9. Volkswagen Financial Services

14.3.9.1. Overview

14.3.9.2. Recent Developments

14.3.9.3. Strategy

14.3.10. Standard Bank Group Ltd

14.3.10.1. Overview

14.3.10.2. Recent Developments

14.3.10.3. Strategy

List of Tables

Table 1: Global Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 2: Global Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 3: Global Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 4: Global Car Finance Market Value (US$ Bn) Forecast, by Region, 2018?2030

Table 5: North America Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 6: North America Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 7: North America Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 8: North America Car Finance Market Value (US$ Bn) Forecast, by Country, 2018?2030

Table 9: U.S. Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 10: U.S. Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 11: U.S. Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 12: Canada Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 13: Canada Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 14: Canada Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 15: Europe Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 16: Europe Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 17: Europe Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 18: Europe Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 19: Germany Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 20: Germany Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 21: Germany Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 22: U.K. Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 23: U.K. Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 24: U.K. Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 25: France Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 26: France Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 27: France Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 28: Italy Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 29: Italy Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 30: Italy Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 31: Spain Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 32: Spain Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 33: Spain Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 34: Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 35: Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 36: Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 37: Russia Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 38: Russia Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 39: Russia Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 40: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 41: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 42: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 43: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 44: China Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 45: China Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 46: China Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 47: India Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 48: India Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 49: India Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 50: Japan Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 51: Japan Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 52: Japan Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 53: ANZ Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 54: ANZ Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 55: ANZ Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 56: ASEAN Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 57: ASEAN Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 58 ASEAN Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 59: Latin America Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 60: Latin America Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 61: Latin America Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 62: Latin America Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 63: Brazil Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 64: Brazil Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 65: Brazil Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 66: Mexico Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 67: Mexico Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 68: Mexico Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 69: Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 70: Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 71: Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 72: Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 73: Turkey Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 74: Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 75: Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 76: Turkey Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 77: Turkey Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 78: Turkey Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 79: South Africa Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 80: South Africa Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 81: South Africa Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Table 82: Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Table 83: Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Table 84: Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

List of Figures

Figure 1: Global Car Finance Value (US$ Bn) Forecast, 2018?2030

Figure 2: Global Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Figure 3: Global Car Finance Market Attractiveness Analysis, by Car Type, 2018

Figure 4: Global Car Finance Market Share Analysis, by Car Type, 2018

Figure 5: Global Car Finance Market Share Analysis, by Car Type, 2030

Figure 6: Global Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Figure 7: Global Car Finance Market Attractiveness Analysis, by Finance Type, 2018

Figure 8: Global Car Finance Market Share Analysis, by Finance Type, 2018

Figure 9: Global Car Finance Market Share Analysis, by Finance Type, 2030

Figure 10: Global Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Figure 11: Global Car Finance Market Attractiveness Analysis, by Provider, 2018

Figure 12: Global Car Finance Market Share Analysis, by Provider, 2018

Figure 13: Global Car Finance Market Share Analysis, by Provider, 2030

Figure 14: Global Car Finance Market Share Analysis, by Region, 2018

Figure 15: Global Car Finance Market Share Analysis, by Region, 2030

Figure 16: Global Car Finance Market Attractiveness Analysis, by Region , 2018

Figure 17: North America Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 18: North America Car Finance Market Value (US$ Bn) Forecast, by Car Type, 2018?2030

Figure 19: North America Car Finance Market Attractiveness Analysis, by Car Type, 2018

Figure 20: North America Car Finance Market Share Analysis, by Car Type, 2018

Figure 21: North America Car Finance Market Share Analysis, by Car Type ,2030

Figure 22: North America Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Figure 23: North America Car Finance Market Attractiveness Analysis, by Finance Type, 2018

Figure 24: North America Car Finance Market Share Analysis, by Finance Type, 2018

Figure 25: North America Car Finance Market Share Analysis, by Finance Type, 2030

Figure 26: North America Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Figure 27: North America Car Finance Market Attractiveness Analysis, by Provider, 2018

Figure 28: North America Car Finance Market Share Analysis, by Provider, 2018

Figure 29: North America Car Finance Market Share Analysis, by Provider, 2030

Figure 30: North America Car Finance Market Share Analysis, by Country, 2018

Figure 31: North America Car Finance Market Share Analysis, by Country, 2030

Figure 32: North America Car Finance Market Attractiveness Analysis, by Country, 2019

Figure 33: U.S. Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 34: U.S. Car Finance Market Share Analysis, by Car Type, 2018

Figure 35: U.S. Car Finance Market Share Analysis, by Finance Type, 2018

Figure 36: U.S. Car Finance Market Share Analysis, by Provider, 2018

Figure 37: Canada Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 38: Canada Car Finance Market Share Analysis, by Car Type, 2018

Figure 39:Canada Car Finance Market Share Analysis, by Finance Type, 2018

Figure 40: Canada Car Finance Market Share Analysis, by Provider, 2018

Figure 41: Europe Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 42: Europe Car Finance Market Vaue (US$ Bn) Forecast, by Car Type, 2018?2030

Figure 43: Europe Car Finance Market Attractiveness Analysis, by Car Type, 2018

Figure 44: Europe Car Finance Market Share Analysis, by Car Type, 2018

Figure 45: Europe Car Finance Market Share Analysis, by Car Type ,2030

Figure 46: Europe Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Figure 47: Europe Car Finance Market Attractiveness Analysis, by Finance Type, 2018

Figure 48: Europe Car Finance Market Share Analysis, by Finance Type, 2018

Figure 49: Europe Car Finance Market Share Analysis, by Finance Type, 2030

Figure 50: Europe Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Figure 51: Europe Car Finance Market Attractiveness Analysis, by Provider, 2018

Figure 52: Europe Car Finance Market Share Analysis, by Provider, 2018

Figure 53: Europe Car Finance Market Share Analysis, by Provider, 2030

Figure 54: Europe Car Finance Market Share Analysis, by Country, 2018

Figure 55: Europe Car Finance Market Share Analysis, by Country, 2030

Figure 56: Europe Car Finance Market Attractiveness Analysis, by Country/ Sub-region, 2019

Figure 57: Germany Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 58: Germany Car Finance Market Share Analysis, by Car Type, 2018

Figure 59: Germany Car Finance Market Share Analysis, by Finance Type, 2018

Figure 60: Germany Car Finance Market Share Analysis, by Provider, 2018

Figure 61: U.K. Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 62: U.K. Car Finance Market Share Analysis, by Car Type, 2018

Figure 63: U.K. Car Finance Market Share Analysis, by Finance Type, 2018

Figure 64: U.K. Car Finance Market Share Analysis, by Provider, 2018

Figure 65: France Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 65: France Car Finance Market Share Analysis, by Car Type, 2018

Figure 66: France Car Finance Market Share Analysis, by Finance Type, 2018

Figure 67: France Car Finance Market Share Analysis, by Provider, 2018

Figure 68: Italy Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 69: Italy Car Finance Market Share Analysis, by Car Type, 2018

Figure 70: Italy Car Finance Market Share Analysis, by Finance Type, 2018

Figure 71: Italy Car Finance Market Share Analysis, by Provider, 2018

Figure 72: Spain Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 73: Spain Car Finance Market Share Analysis, by Car Type, 2018

Figure 74: Spain Car Finance Market Share Analysis, by Finance Type, 2018

Figure 75: Spain Car Finance Market Share Analysis, by Provider, 2018

Figure 76: Nordic & Baltic Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 77: Nordic & Baltic Car Finance Market Share Analysis, by Car Type, 2018

Figure 78: Nordic & Baltic Car Finance Market Share Analysis, by Finance Type, 2018

Figure 79: Nordic & Baltic Car Finance Market Share Analysis, by Provider, 2018

Figure 80: Russia Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 81: Russia Car Finance Market Share Analysis, by Car Type, 2018

Figure 82: Russia Car Finance Market Share Analysis, by Finance Type, 2018

Figure 83: Russia Car Finance Market Share Analysis, by Provider, 2018

Figure 84: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 85: Asia Pacific Car Finance Market Vaue (US$ Bn) Forecast, by Car Type, 2018?2030

Figure 86: Asia Pacific Car Finance Market Attractiveness Analysis, by Car Type, 2018

Figure 87: Asia Pacific Car Finance Market Share Analysis, by Car Type, 2018

Figure 88: Asia Pacific Car Finance Market Share Analysis, by Car Type ,2030

Figure 89: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Figure 90: Asia Pacific Car Finance Market Attractiveness Analysis, by Finance Type, 2018

Figure 91: Asia Pacific Car Finance Market Share Analysis, by Finance Type, 2018

Figure 92: Asia Pacific Car Finance Market Share Analysis, by Finance Type, 2030

Figure 93: Asia Pacific Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Figure 94: Asia Pacific Car Finance Market Attractiveness Analysis, by Provider, 2018

Figure 95: Asia Pacific Car Finance Market Share Analysis, by Provider, 2018

Figure 96: Asia Pacific Car Finance Market Share Analysis, by Provider, 2030

Figure 97: Asia Pacific Car Finance Market Share Analysis, by Country, 2018

Figure 98: Asia Pacific Car Finance Market Share Analysis, by Country, 2030

Figure 99: Asia Pacific Car Finance Market Attractiveness Analysis, by Country/ Sub-region, 2019

Figure 100: China Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 101: China Car Finance Market Share Analysis, by Car Type, 2018

Figure 102: China Car Finance Market Share Analysis, by Finance Type, 2018

Figure 103: China Car Finance Market Share Analysis, by Provider, 2018

Figure 104: India Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 105: India Car Finance Market Share Analysis, by Car Type, 2018

Figure 106: India Car Finance Market Share Analysis, by Finance Type, 2018

Figure 107: India Car Finance Market Share Analysis, by Provider, 2018

Figure 108: Japan Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 109: Japan Car Finance Market Share Analysis, by Car Type, 2018

Figure 110: Japan Car Finance Market Share Analysis, by Finance Type, 2018

Figure 111: Japan Car Finance Market Share Analysis, by Provider, 2018

Figure 112: ANZ Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 113: ANZ Car Finance Market Share Analysis, by Car Type, 2018

Figure 114: ANZ Car Finance Market Share Analysis, by Finance Type, 2018

Figure 115: ANZ Car Finance Market Share Analysis, by Provider, 2018

Figure 116: ASEAN Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 117: ASEAN Car Finance Market Share Analysis, by Car Type, 2018

Figure 118: ASEAN Car Finance Market Share Analysis, by Finance Type, 2018

Figure 119: ASEAN Car Finance Market Share Analysis, by Provider, 2018

Figure 120: Latin America Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 121: Latin America Car Finance Market Vaue (US$ Bn) Forecast, by Car Type, 2018?2030

Figure 122: Latin America Car Finance Market Attractiveness Analysis, by Car Type, 2018

Figure 123: Latin America Car Finance Market Share Analysis, by Car Type, 2018

Figure 124: Latin America Car Finance Market Share Analysis, by Car Type ,2030

Figure 125: Latin America Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Figure 126: Latin America Car Finance Market Attractiveness Analysis, by Finance Type, 2018

Figure 127: Latin America Car Finance Market Share Analysis, by Finance Type, 2018

Figure 128: Latin America Car Finance Market Share Analysis, by Finance Type, 2030

Figure 129: Latin America Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Figure 130: Latin America Car Finance Market Attractiveness Analysis, by Provider, 2018

Figure 131: Latin America Car Finance Market Share Analysis, by Provider, 2018

Figure 132: Latin America Car Finance Market Share Analysis, by Provider, 2030

Figure 133: Latin America Car Finance Market Share Analysis, by Country, 2018

Figure 134: Latin America Car Finance Market Share Analysis, by Country, 2030

Figure 135: Latin America Car Finance Market Attractiveness Analysis, by Country/ Sub-region, 2019

Figure 136: Brazil Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 137: Brazil Car Finance Market Share Analysis, by Car Type, 2018

Figure 138: Brazil Car Finance Market Share Analysis, by Finance Type, 2018

Figure 139: Brazil Car Finance Market Share Analysis, by Provider, 2018

Figure 140: Mexico Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 141: Mexico Car Finance Market Share Analysis, by Car Type, 2018

Figure 142: Mexico Car Finance Market Share Analysis, by Finance Type, 2018

Figure 143: Mexico Car Finance Market Share Analysis, by Provider, 2018

Figure 144: Rest of Latin America Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 145: Rest of Latin America Car Finance Market Share Analysis, by Car Type, 2018

Figure 146: Rest of Latin America Car Finance Market Share Analysis, by Finance Type, 2018

Figure 147: Rest of Latin America Car Finance Market Share Analysis, by Provider, 2018

Figure 148: Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 149: Middle East & Africa Car Finance Market Vaue (US$ Bn) Forecast, by Car Type, 2018?2030

Figure 150: Middle East & Africa Car Finance Market Attractiveness Analysis, by Car Type, 2018

Figure 151: Middle East & Africa Car Finance Market Share Analysis, by Car Type, 2018

Figure 152: Middle East & Africa Car Finance Market Share Analysis, by Car Type ,2030

Figure 153: Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Finance Type, 2018?2030

Figure 154: Middle East & Africa Car Finance Market Attractiveness Analysis, by Finance Type, 2018

Figure 155: Middle East & Africa Car Finance Market Share Analysis, by Finance Type, 2018

Figure 156: Middle East & Africa Car Finance Market Share Analysis, by Finance Type, 2030

Figure 157: Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, by Provider, 2018?2030

Figure 158: Middle East & Africa Car Finance Market Attractiveness Analysis, by Provider, 2018

Figure 159: Middle East & Africa Car Finance Market Share Analysis, by Provider, 2018

Figure 160: Middle East & Africa Car Finance Market Share Analysis, by Provider, 2030

Figure 161: Middle East & Africa Car Finance Market Share Analysis, by Country, 2018

Figure 162: Middle East & Africa Car Finance Market Share Analysis, by Country, 2030

Figure 163: Middle East & Africa Car Finance Market Attractiveness Analysis, by Country and Sub-region, 2019

Figure 164: Turkey Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 165: Turkey Car Finance Market Share Analysis, by Car Type, 2018

Figure 166: Turkey Car Finance Market Share Analysis, by Finance Type, 2018

Figure 167: Turkey Car Finance Market Share Analysis, by Provider, 2018

Figure 168: South Africa Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 169: South Africa Car Finance Market Share Analysis, by Car Type, 2018

Figure 170: South Africa Car Finance Market Share Analysis, by Finance Type, 2018

Figure 171: South Africa Car Finance Market Share Analysis, by Provider, 2018

Figure 172: Rest of Middle East & Africa Car Finance Market Value (US$ Bn) Forecast, 2018?2030

Figure 173: Rest of Middle East & Africa Car Finance Market Share Analysis, by Car Type, 2018

Figure 174: Rest of Middle East & Africa Car Finance Market Share Analysis, by Finance Type, 2018

Figure 175: Rest of Middle East & Africa Car Finance Market Share Analysis, by Provider, 2018