Analysts’ Viewpoint on Cannabinoids Market Scenario

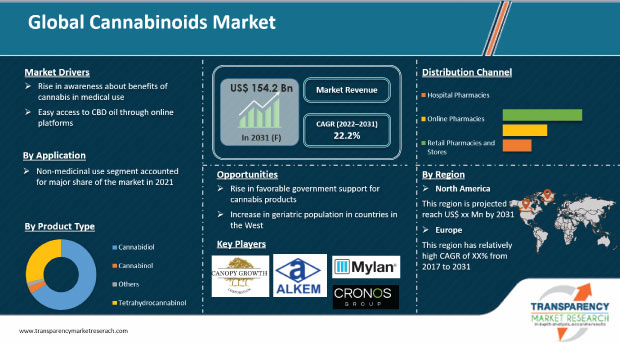

Supportive government policies and legalization of cannabinoid products in several countries are encouraging companies operating in the cannabinoids market. Canada became the first G20 nation to legalize the use of cannabis sativa for medicinal & recreational purposes. The global cannabinoid market is driven by product advancements. Awareness about health benefits of cannabinoids products is rising among consumers. However, the global cannabinoids market is experiencing a slight contraction due to the high costs of these products. Hence, governments and private players are focusing on capitalizing on cannabinoid products. For instance, Organigram Holdings, Inc. made additional investments in Hyasynth Biologicals, Inc., a renowned biotechnology company.

Cannabinoids are derived from phytocannabinoids, endocannabinoids, and synthetic cannabinoids; and are used for medical applications. Major cannabinoids and minor cannabinoids are the two types of cannabinoids. Major cannabinoids include tetrahydrocannabinol and cannabidiol. Minor cannabinoids include cannabinoids, cannabidivarin, and cannabigerol. Cannabinoid synthesis in plants in small amounts is termed as minor cannabinoids. Rise in interest in the potential usage of cannabis in various medical conditions as well as research on the adverse health effects from use of cannabis is encouraging governments of countries across the globe to support the sale of CBD oil at hospital pharmacies and physician offices. This is projected to drive the global cannabinoids market in the near future.

Technological advancements have led to the introduction of new plant cloning techniques in the market. GW Pharmaceuticals launched its lead cannabinoid product Epidiolex in 2018. It is a pharmaceutical formulation comprising highly purified plant derived cannabidiol, for which the company retains global commercial rights.

The medical cannabis industry is expanding with advances in the use of cannabidiol (CBD). Usage of cannabidiol has increased due to rise in legalization of cannabidiol in various countries. Additionally, the FDA approval for CBD products for epilepsy treatment is promoting their usage in the pharmaceutical industry. Therefore, companies would continue to come up with medical solutions with improved CBD-based medicines. For instance, SanSal Wellness is working on the research & development of improved hemp genetics and innovation, providing uncompromising high quality hemp products to the global community. In 2019, the Government of Australia declared investment of US$ 3 Mn for research in medical cannabis. Thus, rise in research & development and investment in medical cannabinoids are likely to drive the global market.

Medical hashish is a popular herbal treatment used to treat unusual ailments. Around 104 chemical compounds called cannabinoids have been discovered in a hashish or marijuana plant, which can play an important role in the remedy of one-of-a-kind diseases. Tetrahydrocannabinol (THC) is the leading psychoactive cannabinoid discovered in hashish, which offers greater alleviation from aches and different signs & symptoms without the mind-altering outcomes of marijuana. CBD is probably used to lessen persistent ache by means of impacting endocannabinoid receptor activity, decreasing inflammation, and interacting with neurotransmitters. For instance, Sativex, an oil spray, is an aggregate of tetrahydrocannabinol (THC) and cannabidiol (CBD); and is permitted in many countries to treat aches associated with multiple sclerosis.

In terms of product, the global cannabinoids market has been classified into cannabidiol, tetrahydrocannabinol, and others. The cannabidiol segment accounted for major share of the global market in 2021. The segment is expected to expand at a CAGR of around 22% from 2022 to 2031. Cannabidiol is less psychoactive to neutralize the reactive oxygen species, which makes it a crucial contributor to anti-inflammatory effects. Cannabidiol is derived from hemp and marijuana; hence, it helps patients overcome anxiety and pain. Cannabis-infused products are also popular among end-users across the globe. Companies in the global cannabinoid market are focusing on increasing the manufacture of cannabidiol products that are safe for consumption.

Based on application, the global cannabinoids market has been divided into medical

and non-medical use. The non-medical use segment accounted for the largest share of the global market in 2021. The segment is expected to expand at a CAGR of about 19% from 2022 to 2031 due to the increase in usage of cannabis in food, cosmetics, and textile industries. CBD edibles such as gummies and cannabis-infused chocolate bars are increasingly popular among end-users. They possess antioxidant properties and help relieve stress and depression.

In terms of distribution channel, the global cannabinoids market has been divided into hospitals, retail pharmacies & stores, and online stores. The retail pharmacies & stores segment accounted for the largest share of the global market in 2021. The segment is expected to expand at a high CAGR of about 22% from 2022 to 2031. The number of retail pharmacies and stores selling cannabinoids products is increasing due to the legalization of cannabinoids in many countries. Companies in the cannabinoids market are developing innovative products to meet consumer demand. Hospital pharmacies and retail pharmacies are focusing on offering innovative cannabinoid products.

North America dominated the global market in 2021. The market in the region is projected to expand at a CAGR of about 18% from 2022 to 2031. The U.S. and Canada have legalized recreational cannabis, which is driving the market in the region. Rise in chronic diseases such as cancer, Alzheimer’s, and multiple sclerosis has boosted the demand for synthetic cannabinoids in surgeries and chemotherapies. Government support has encouraged local cannabis traders to invest in indoor facilities for cultivation. This is likely to boost the market in North America.

The market in Europe is anticipated to expand at a CAGR of about 37% during the forecast period. Large economies in Europe are moving toward liberalization of cannabinoids. The Netherlands is the most mature medical cannabis market in the region. Germany is the economic powerhouse of Europe, with a geriatric population of over 19 million; of this, 80% to 90% is covered under statutory health insurance, which makes up for the cost of medical cannabis.

The global cannabinoids market is consolidated with a small number of large companies accounting for majority of the share. Most of the firms are making significant investments in research and development activities. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by key players. Prominent players operating in the market include Mylan N.V. (Viatris Inc.), Alkem Labs, GW Pharmaceuticals plc, Tilray, Inc., Aurora Cannabis, Inc., Canopy Growth Corporation, and The Cronos Group.

Each of these players has been profiled in the cannabinoids market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. In addition, the report focuses on demand analysis of cannabinoids products.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 22.1 Bn |

|

Market Forecast Value in 2031 |

US$ 154.2 Bn |

|

Growth Rate (CAGR) |

22.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global cannabinoids market was valued at US$ 22.1 Bn in 2021

The global cannabinoids market is projected to generate revenue of US$ 154.2 Bn by 2031

The global cannabinoids market expanded at a CAGR of 25.1% from 2017 to 2021

The global cannabinoids market is anticipated to expand at a CAGR 22.2% from 2022 to 2031

Rise in awareness about benefits of cannabis in medical use and easy access to CBD oil through online platforms

North America is expected to account for the largest share of the global market during the forecast period.

Prominent players in the global cannabinoids market include Mylan N.V. (Viatris, Inc.), Alkem Labs, GW Pharmaceuticals plc, Tilray, Inc., Aurora Cannabis, Inc., Canopy Growth Corporation, The Cronos Group, The Supreme Cannabis Company, Inc., and Elixinol Global Limited

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cannabinoids Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Cannabinoids Market Analysis and Forecast, 2017–2031

4.3.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Porter's Five Forces Analysis

5.2. PESTLE Analysis

5.3. Cannabis Genetics: Overview & Analysis

5.4. Regulatory Scenario, by Region/Globally

5.5. Pricing Analysis

5.6. List of key Competitors

5.7. COVID-19 Impact Analysis

5.8. Key Industry Development

6. Global Cannabinoids Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Cannabidiol

6.3.2. Tetrahydrocannabinol

6.3.3. Cannabinol

6.3.4. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Cannabinoids Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospitals Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Stores

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Cannabinoids Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Medicinal Use

8.3.1.1. Chronic Pain

8.3.1.2. Neurological Disorders Management

8.3.1.3. Oncology

8.3.1.4. Others

8.3.2. Non-medical Use

8.4. Market Attractiveness Analysis, by Application

9. Global Cannabinoids Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Cannabinoids Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Cannabidiol

10.2.2. Tetrahydrocannabinol

10.2.3. Cannabinol

10.2.4. Others

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospitals Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Stores

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Medicinal Use

10.4.1.1. Chronic Pain

10.4.1.2. Neurological Disorders Management

10.4.1.3. Oncology

10.4.1.4. Others

10.4.2. Non-medical Use

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Distribution Channel

10.6.3. By Application

10.6.4. By Country

11. Europe Cannabinoids Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Cannabidiol

11.2.2. Tetrahydrocannabinol

11.2.3. Cannabinol

11.2.4. Others

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospitals Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Stores

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Medicinal Use

11.4.1.1. Chronic Pain

11.4.1.2. Neurological Disorders Management

11.4.1.3. Oncology

11.4.1.4. Others

11.4.2. Non-medical Use

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Distribution Channel

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Cannabinoids Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Cannabidiol

12.2.2. Tetrahydrocannabinol

12.2.3. Cannabinol

12.2.4. Others

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospitals Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Online Stores

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Medicinal Use

12.4.1.1. Chronic Pain

12.4.1.2. Neurological Disorders Management

12.4.1.3. Oncology

12.4.1.4. Others

12.4.2. Non-medical Use

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Japan

12.5.2. India

12.5.3. Australia & New Zealand

12.5.4. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Distribution Channel

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Cannabinoids Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Cannabidiol

13.2.2. Tetrahydrocannabinol

13.2.3. Cannabinol

13.2.4. Others

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospitals Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Online Stores

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Medicinal Use

13.4.1.1. Chronic Pain

13.4.1.2. Neurological Disorders Management

13.4.1.3. Oncology

13.4.1.4. Others

13.4.2. Non-medical Use

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Distribution Channel

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Cannabinoids Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Cannabidiol

14.2.2. Tetrahydrocannabinol

14.2.3. Cannabinol

14.2.4. Others

14.3. Market Value Forecast, by Distribution Channel, 2017–2031

14.3.1. Hospitals Pharmacies

14.3.2. Retail Pharmacies

14.3.3. Online Stores

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Medicinal Use

14.4.1.1. Chronic Pain

14.4.1.2. Neurological Disorders Management

14.4.1.3. Oncology

14.4.1.4. Others

14.4.2. Non-medical Use

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. South Africa

14.5.2. Israel

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Distribution Channel

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Profiles

15.2.1. Mylan N.V. (Viatris Inc.)

15.2.1.1. Company Overview

15.2.1.2. Financial Overview

15.2.1.3. Product Portfolio

15.2.1.4. Business Strategies

15.2.1.5. Recent Developments

15.2.2. Alkem Labs

15.2.2.1. Company Overview

15.2.2.2. Financial Overview

15.2.2.3. Product Portfolio

15.2.2.4. Business Strategies

15.2.2.5. Recent Developments

15.2.3. GW Pharmaceuticals plc

15.2.3.1. Company Overview

15.2.3.2. Financial Overview

15.2.3.3. Product Portfolio

15.2.3.4. Business Strategies

15.2.3.5. Recent Developments

15.2.4. Tilray, Inc.

15.2.4.1. Company Overview

15.2.4.2. Financial Overview

15.2.4.3. Product Portfolio

15.2.4.4. Business Strategies

15.2.4.5. Recent Developments

15.2.5. Aurora Cannabis, Inc.

15.2.5.1. Company Overview

15.2.5.2. Financial Overview

15.2.5.3. Product Portfolio

15.2.5.4. Business Strategies

15.2.5.5. Recent Developments

15.2.6. Canopy Growth Corporation

15.2.6.1. Company Overview

15.2.6.2. Financial Overview

15.2.6.3. Product Portfolio

15.2.6.4. Business Strategies

15.2.6.5. Recent Developments

15.2.7. The Cronos Group

15.2.7.1. Company Overview

15.2.7.2. Financial Overview

15.2.7.3. Product Portfolio

15.2.7.4. Business Strategies

15.2.7.5. Recent Developments

List of Tables

Table 01: Global Cannabinoids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Cannabinoids Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Cannabinoids Market Value (US$ Mn) Forecast, by Medicinal Use, 2017–2031

Table 04: Global Cannabinoids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 05: Global Cannabinoids Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Cannabinoids Market Analysis Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Cannabinoids Market Revenue (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: North America Cannabinoids Market Revenue (US$ Mn) Forecast, by Application, 2017–2031

Table 09: North America Cannabinoids Market Revenue (US$ Mn) Forecast, by Medicinal Use, 2017–2031

Table 10: North America Cannabinoids Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 11: Europe Cannabinoids Market Analysis Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Cannabinoids Market Revenue (US$ Mn) Forecast, by Product Type, 2017–2031

Table 13: Europe Cannabinoids Market Revenue (US$ Mn) Forecast, by Application, 2017–2031

Table 14: Europe Cannabinoids Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Asia Pacific Cannabinoids Market Analysis Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Asia Pacific Cannabinoids Market Revenue (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Asia Pacific Cannabinoids Market Revenue (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Asia Pacific Cannabinoids Market Revenue (US$ Mn) Forecast, by Application (Medicinal Use), 2017–2031

Table 19: Asia Pacific Cannabinoids Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 20: Latin America Cannabinoids Market Analysis Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Latin America Cannabinoids Market Revenue (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: Latin America Cannabinoids Market Revenue (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Latin America Cannabinoids Market Revenue (US$ Mn) Forecast, by Application (Medicinal Use), 2017–2031

Table 24: Latin America Cannabinoids Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 25: Middle East & Africa Cannabinoids Market Analysis Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Middle East & Africa Cannabinoids Market Revenue (US$ Mn) Forecast, by Product Type, 2017–2031

Table 27: Middle East & Africa Cannabinoids Market Revenue (US$ Mn) Forecast, by Application, 2017–2031

Table 28: Middle East & Africa Cannabinoids Market Revenue (US$ Mn) Forecast, by Application (Medicinal Use), 2017–2031

Table 29: Middle East & Africa Cannabinoids Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Cannabinoids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 02: Global Cannabinoids Market Value Share (%), by Region, 2020

Figure 03: Global Cannabinoids Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 04: Global Cannabinoids Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 05: Global Cannabinoids Market Value (US$ Mn), by Cannabidiol, 2017–2031

Figure 06: Global Cannabinoids Market Value (US$ Mn), by Tetrahydrocannabinol, 2017–2031

Figure 07: Global Cannabinoids Market Value (US$ Mn), by Cannabinol, 2017–2031

Figure 08: Global Cannabinoids Market Value (US$ Mn), by Others, 2017–2031

Figure 09: Global Cannabinoids Market Value Share Analysis, by Application, 2020 and 2031

Figure 10: Global Cannabinoids Market Attractiveness Analysis, by Application, 2021–2031

Figure 11: Global Cannabinoids Market Revenue (US$ Mn), by Medicinal Use, 2017–2031

Figure 12: Global Cannabinoids Market Revenue (US$ Mn), by Non-medical Use, 2017–2031

Figure 13: Global Cannabinoids Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 14: Global Cannabinoids Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 15: Global Cannabinoids Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 16: Global Cannabinoids Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 17: Global Cannabinoids Market Revenue (US$ Mn), by Online Stores, 2017–2031

Figure 18: Global Cannabinoids Market Value Share Analysis, by Region, 2020 and 2031

Figure 19: Global Cannabinoids Market Attractiveness Analysis, by Region, 2021–2031

Figure 20: North America Cannabinoids Market Analysis Value (US$ Mn) Forecast, 2017–2031

Figure 21: North America Cannabinoids Market Analysis Value Share Analysis, by Country, 2020 and 2031

Figure 22: North America Cannabinoids Market Analysis Attractiveness Analysis, by Country 2021–2031

Figure 23: North America Cannabinoids Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 24: North America Cannabinoids Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 25: North America Cannabinoids Market Value Share Analysis, by Application, 2020 and 2031

Figure 26: North America Cannabinoids Market Attractiveness Analysis, by Application, 2021–2031

Figure 27: North America Cannabinoids Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 28: North America Cannabinoids Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 29: Europe Cannabinoids Market Analysis Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe Cannabinoids Market Analysis Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 31: Europe Cannabinoids Market Analysis Attractiveness Analysis, by Country/Sub-region 2021–2031

Figure 32: Europe Cannabinoids Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 33: Europe Cannabinoids Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 34: Europe Cannabinoids Market Value Share Analysis, by Application, 2020 and 2031

Figure 35: Europe Cannabinoids Market Attractiveness Analysis, by Application, 2021–2031

Figure 36: Europe Cannabinoids Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 37: Europe Cannabinoids Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 38: Asia Pacific Cannabinoids Market Analysis Value (US$ Mn) Forecast, 2017–2031

Figure 39: Asia Pacific Cannabinoids Market Analysis Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 40: Asia Pacific Cannabinoids Market Analysis Attractiveness Analysis, by Country/Sub-region 2021–2031

Figure 41: Asia Pacific Cannabinoids Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 42: Asia Pacific Cannabinoids Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 43: Asia Pacific Cannabinoids Market Value Share Analysis, by Application, 2020 and 2031

Figure 44: Asia Pacific Cannabinoids Market Attractiveness Analysis, by Application, 2021–2031

Figure 45: Asia Pacific Cannabinoids Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 46: Asia Pacific Cannabinoids Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 47: Latin America Cannabinoids Market Analysis Value (US$ Mn) Forecast, 2017–2031

Figure 48: Latin America Cannabinoids Market Analysis Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 49: Latin America Cannabinoids Market Analysis Attractiveness Analysis, by Country/Sub-region 2021–2031

Figure 50: Latin America Cannabinoids Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 51: Latin America Cannabinoids Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 52: Latin America Cannabinoids Market Value Share Analysis, by Application, 2020 and 2031

Figure 53: Latin America Cannabinoids Market Attractiveness Analysis, by Application, 2021–2031

Figure 54: Latin America Cannabinoids Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 55: Latin America Cannabinoids Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 56: Middle East & Africa Cannabinoids Market Analysis Value (US$ Mn) Forecast, 2017–2031

Figure 57: Middle East & Africa Cannabinoids Market Analysis Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 58: Middle East & Africa Cannabinoids Market Analysis Attractiveness Analysis, by Country/Sub-region 2021–2031

Figure 59: Middle East & Africa Cannabinoids Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 60: Middle East & Africa Cannabinoids Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 61: Middle East & Africa Cannabinoids Market Value Share Analysis, by Application, 2020 and 2031

Figure 62: Middle East & Africa Cannabinoids Market Attractiveness Analysis, by Application, 2021–2031

Figure 63: Middle East & Africa Cannabinoids Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 64: Middle East & Africa Cannabinoids Market Attractiveness Analysis, by Distribution Channel, 2021–2031