Canada Hosted PBX Market: Snapshot

Adoption of cloud and related services has elevated due to the competitive advantages offered by cloud in business communication, operations and other crucial organizational functions. Enterprises with higher employee size would require huge communication set up to work efficiently. Moreover, with hosted PBX the efforts required to set-up new equipment for business communication is drastically reduced. With the increasing enterprise size, need for robust communication tools has also increased. Such factors have led to increase in demand of hosted PBX market in Canada. The hosted PBX market in Canada is expected to experience higher demand during the forecast period 2017 to 2025.

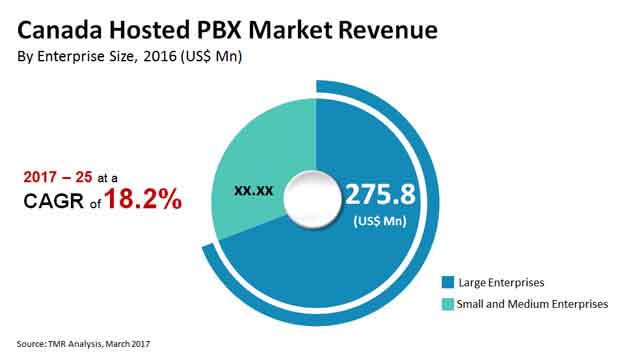

Canada’s hosted PBX market is driven by increasing demand for enterprise mobility and workforce as well as multiple benefits offered by hosted PBX services such as minimized operational expenses, elimination of additional set up costs among others. Growing adoption of wireless services in small, medium and large enterprises is also expected to fuel the demand for hosted PBX market in Canada. It is projected to generate US$459.6 mn in 2017. Furthermore, the market is projected to expand at a CAGR of 18.2% during the forecast period 2017 to 2025 reaching US$1.75 bn by 2025.

Large Enterprises to Account for Leading Share in Canada Hosted PBX Market

The hosted PBX market in Canada can be broadly classified on the basis of enterprise size and end-use application. Based on enterprise size, the market can be bifurcated into small and medium enterprises and large enterprises. Of these, large enterprises held dominance and is expected to continue boating the larger share through the course of the forecast period. By the end of 2017, overall shares held by the segment is expected to reach 68.7%. However, over the coming years, growth in the small and medium enterprises segment is expected to elevate as they exhibit a higher adoption of hosted PBX with an aim of minimizing operational expenses.

Telecom & IT to Continue Leading Market as Dominant Application Segment

Based on application, the key segments in the Canada hosted PBX market are include banking, financial services and insurance (BFSI), telecom and IT, healthcare, government, retail, hospitality, education and others such as manufacturing and transportation. As Canada holds the reputation of one of the earliest adopters of the latest technologies, it boasts a highly sophisticated telecom & IT infrastructure. Hence the country exhibits a rising adoption of advanced information technology. The companies located in Canada are mostly looking for cost-effective and advanced communication solutions. While this fuels the demand for hosted PBX, similarly given the scenario the telecom and IT sector has emerged as a key contributor to the market. In 2016, the telecom and IT sector held the dominant share of 20.1% in the market. It is expected to remain the market lead through the forecast period.

Besides this the Canada hosted PBX market is also expected to witness rising demand in government, BFSI, hospitality, and retail sectors. The rising demand for better enterprise and workforce mobility, besides the growing awareness about multiple benefits offered by PBX such as elimination of additional set-up cost and minimizing operational expected, will aid the market’s expansion in Canada.

Some of the key service providers engaged in Canada’s hosted PBX were, 3CX, Mitel Networks Corporation, Bell Canada, BroadConnect Technologies Inc., Cisco Systems Inc., Microsoft Corporation, Allstream, Inc., Alpha Telecom Services Inc., Birch Communications, AstraQom International, Voysis IP solution Inc.,Ringcentral and Telus Communications.

Growing Trend of Remote Working Mechanisms due to COVID-19 will strengthen the Growth Prospects across the Hosted PBX Market

The hosted PBX market expects a good growth-share across the assessment period of 2017-2025. The escalating adoption of cloud technology has significantly boosted the growth rate of the hosted PBX market. The increasing influence of hosted PBX across a large number of small and medium enterprises will bring good growth opportunities.

Chapter 1 Preface

1.1 Market defination and Scope

1.2 Market Segmentation

1.3 Key Research Objectives

1.4 Research Highlights

Chapter 2 Assumptions and Research methodology

Chapter 3 Executive Summary: Canada Hosted PBX Market

Chapter 4 Market Overview

4.1 Introduction

4.1.1 Definition

4.1.2 Industry Developments

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunity

4.3 Canada Hosted PBX Market Analysis and Forecasts, 2015 – 2025

4.3.1 Market Revenue Projections (US$ Mn)

4.4 Pricing Model Analysis

4.4.1 PBX Provider Services and Pricing Overview

4.5 Value Chain Analysis

4.6 Porter’s Five Forces Analysis

4.7 Hosted PBX Market Outlook

Chapter 5 Canada Hosted PBX Market Analysis and Forecast by Enterprise Size

5.1 Introduction

5.2 Market Size (US$ Mn) Forecast By Enterprise Size

5.2.1 Small and Medium-sized Enterprises, 2015 – 2025 (US$ Mn)

5.2.2 Large Enterprises, 2015 – 2025 (US$ Mn)

5.3 Comparison Matrix

5.4 Market Attractiveness By Enterprise Size

Chapter 6 Canada Hosted PBX Market Analysis and Forecast by End-use Application

6.1 Introduction

6.2 Market Size (US$ Mn) Forecast By End-use Application

6.2.1 Banking, Financial services and Insurance (BFSI) , 2015 – 2025 (US$ Mn)

6.2.2 Telecom & IT, 2015 – 2025 (US$ Mn)

6.2.3 Healthcare, 2015 – 2025 (US$ Mn)

6.2.4 Retail, 2015 – 2025 (US$ Mn)

6.2.5 Media & Entertainment, 2015 – 2025 (US$ Mn)

6.2.6 Government, 2015 – 2025 (US$ Mn)

6.2.7 Hospitality, 2015 – 2025 (US$ Mn)

6.2.8 Education, 2015 – 2025 (US$ Mn)

6.2.9 Others (Transportation and Manufacturing) , 2015 – 2025 (US$ Mn)

6.3 Comparison Matrix

6.4 Market Attractiveness By End-use Application

Chapter 7 Competition Landscape

7.1 Market Player – Competition Matrix (By Tier and Size of companies)

7.2 Market Share Analysis By Company (2016)

7.3 Company Profiles

7.3.1 3CX Ltd.

7.3.1.1 Company Detail

7.3.1.2 Company Description

7.3.1.3 Financial Overview

7.3.1.4 SWOT Analysis

7.3.1.5 Strategic Overview

7.3.2 Alpha Telecom Services Inc.

7.3.2.1 Company Detail

7.3.2.2 Company Description

7.3.2.3 Financial Overview

7.3.2.4 SWOT Analysis

7.3.2.5 Strategic Overview

7.3.3 Mitel Networks Corporation

7.3.3.1 Company Detail

7.3.3.2 Company Description

7.3.3.3 Financial Overview

7.3.3.4 SWOT Analysis

7.3.3.5 Strategic Overview

7.3.4 Bell Canada

7.3.4.1 Company Detail

7.3.4.2 Company Description

7.3.4.3 Financial Overview

7.3.4.4 SWOT Analysis

7.3.4.5 Strategic Overview

7.3.5 Cisco Systems Inc.

7.3.5.1 Company Detail

7.3.5.2 Company Description

7.3.5.3 Financial Overview

7.3.5.4 SWOT Analysis

7.3.5.5 Strategic Overview

7.3.6 Microsoft Corporation

7.3.6.1 Company Detail

7.3.6.2 Company Description

7.3.6.3 Financial Overview

7.3.6.4 SWOT Analysis

7.3.6.5 Strategic Overview

7.3.7 AllStream, Inc.

7.3.7.1 Company Detail

7.3.7.2 Company Description

7.3.7.3 Financial Overview

7.3.7.4 SWOT Analysis

7.3.7.5 Strategic Overview

7.3.8 AstraQomInternational

7.3.8.1 Company Detail

7.3.8.2 Company Description

7.3.8.3 Financial Overview

7.3.8.4 SWOT Analysis

7.3.8.5 Strategic Overview

7.3.9 Birch Communications

7.3.9.1 Company Detail

7.3.9.2 Company Description

7.3.9.3 Financial Overview

7.3.9.4 SWOT Analysis

7.3.9.5 Strategic Overview

7.3.10 BroadConnect Telecom Inc.

7.3.10.1 Company Detail

7.3.10.2 Company Description

7.3.10.3 Financial Overview

7.3.10.4 SWOT Analysis

7.3.10.5 Strategic Overview

7.3.11 Broadsoft, Inc.

7.3.11.1 Company Detail

7.3.11.2 Company Description

7.3.11.3 Financial Overview

7.3.11.4 SWOT Analysis

7.3.11.5 Strategic Overview

7.3.12 Digitcom Canada (Hosted PBX)

7.3.12.1 Company Detail

7.3.12.2 Company Description

7.3.12.3 Financial Overview

7.3.12.4 SWOT Analysis

7.3.12.5 Strategic Overview

7.3.13 Nurango Networks

7.3.13.1 Company Detail

7.3.13.2 Company Description

7.3.13.3 Financial Overview

7.3.13.4 SWOT Analysis

7.3.13.5 Strategic Overview

7.3.14 Ringcentral, Inc.

7.3.14.1 Company Detail

7.3.14.2 Company Description

7.3.14.3 Financial Overview

7.3.14.4 SWOT Analysis

7.3.14.5 Strategic Overview

7.3.15 Telus Communications

7.3.15.1 Company Detail

7.3.15.2 Company Description

7.3.15.3 Financial Overview

7.3.15.4 SWOT Analysis

7.3.15.5 Strategic Overview

7.3.16 Introtel Communications Inc.

7.3.16.1 Company Detail

7.3.16.2 Company Description

7.3.16.3 Financial Overview

7.3.16.4 SWOT Analysis

7.3.16.5 Strategic Overview

7.3.17 Rogers Communications Inc.

7.3.17.1 Company Detail

7.3.17.2 Company Description

7.3.17.3 Financial Overview

7.3.17.4 SWOT Analysis

7.3.17.5 Strategic Overview

7.3.18 Voysis IP Solutions Inc.

7.3.18.1 Company Detail

7.3.18.2 Company Description

7.3.18.3 Financial Overview

7.3.18.4 SWOT Analysis

7.3.18.5 Strategic Overview

7.3.19 TeraGo Networks Inc.

7.3.19.1 Company Detail

7.3.19.2 Company Description

7.3.19.3 Financial Overview

7.3.19.4 SWOT Analysis

7.3.19.5 Strategic Overview

Chapter 8 Key Takeaways

List of Tables

Table 1: PBX hardware pricing

Table 2: PBX license/subscription pricing

Table 3: Canada Hosted PBX Market Forecast, By Enterprise Size, 2015–2025 (US$ Mn)

Table 4: Canada Hosted PBX Market Forecast, By End-use Application, 2015–2025 (US$ Mn)

List of Figures

Figure 1: Canada Hosted PBX Market Revenue Projections, 2015 - 2025 (US$ Mn)

Figure 2: Canada Hosted PBX Market – Porter’s Five Forces Analysis

Figure 3: Canada Hosted PBX Market – Porter’s Five Forces Analysis

Figure 4: Canada Market Value Share (Revenue) By Enterprise Size (2017)

Figure 5: Canada Market Value Share (Revenue) By End-use Application (2017)

Figure 6: Canada Hosted PBX Market Value Share Analysis, By Enterprise Size, 2017 and 2025

Figure 7: Canada Hosted PBX Market Revenue, By Enterprise Size, SME

Figure 8: Canada Hosted PBX Market Revenue, By Enterprise Size, Large Enterprise

Figure 9: Canada Hosted PBX Comparison Matrix, By Enterprise Size

Figure 10: Canada Hosted PBX Market Attractiveness Analysis, By Enterprise Size

Figure 11: Canada Hosted PBX Market Value Share Analysis, By End-use Application, 2017 and 2025

Figure 12: Canada Hosted PBX Market Revenue, By End-use Application, BFSI

Figure 13: Canada Hosted PBX Market Revenue, By End-use Application, Telecom & IT

Figure 14: Canada Hosted PBX Market Revenue, By End-use Application, Healthcare

Figure 15: Canada Hosted PBX Market Revenue, By End-use Application, Retail

Figure 16: Canada Hosted PBX Market Revenue, By End-use Application, Media and Entertainment

Figure 17: Canada Hosted PBX Market Revenue, By End-use Application, Government

Figure 18: Canada Hosted PBX Market Revenue, By End-use Application, Hospitality

Figure 19: Canada Hosted PBX Market Revenue, By End-use Application, Education

Figure 20: Canada Hosted PBX Market Revenue, By End-use Application, Others

Figure 21: Canada Hosted PBX Comparison Matrix, By End-use Application

Figure 22: Canada Hosted PBX Market Attractiveness Analysis, By End-use Application

Figure 23: Canada Hosted PBX Market Share Analysis (2016)