Innovations and sustainable production techniques are the main focus in the cacao beans market. For instance, at the Chocoa 2020— a sustainable chocolate and cacao business event, it was acknowledged that the increasing use of smartphones has helped farmers understand that improved farming techniques can benefit their bottom line.

Digital innovations are gaining prominence in the cacao beans market. For instance, Farmerline— a company dedicated to create lasting wealth for smallholder farmers into successful entrepreneurs, is among the many initiatives that are bolstering market growth. Farm owners in the market for cacao beans are adopting pruning methods to increase their productivity and preserve the forests. Moreover, new product innovations in the confectionary category is one of the major key drivers contributing toward market growth. Plant-based chocolate innovations are at the forefront to meet needs of vegan consumers.

Plant based-chocolate innovations are increasingly grabbing the attention of consumers. For instance, Nestlé S.A.- a Swiss multinational food and drink processing conglomerate corporation, announced the launch of their one-of-its-kind Kitkat Chocolatory Cacao Fruit Chocolate in Japan, which is claimed to be made from cacao beans and pulp as its only ingredients. As such, companies in the cacao beans market are taking cues from leading market players to replace refined sugar in chocolate with dried fruit sugar sourced from cacao pulp.

Sugar reduction and sugar replacement are some of the megatrends observed in the domain of chocolate products in the market for cacao beans. Sugar obtained from cacao pulp is helping manufacturers to increase their customer base among vegan consumers. However, the calorie content of refined sugar and sugar obtained from cacao pulp is roughly the same. As such, sugar obtained from plant-based resources such as cacao are easy to break down in the body and hence, serve the purpose of health-conscious consumers.

The cacao beans market is estimated to reach a value of ~US$ 20 Bn by the end of 2030. However, excessive demand for cacao beans has led to the destruction of tropical rainforests. The practice of using herbicides and pesticides for faster growth of cacao trees is nearly damaging the natural and authentic quality of forest covers as well as soil. Hence, companies in the cacao beans market are launching developmental initiatives such as offering free seeds, fertilizers, and training to farm owners in order to maintain steady supply chains. As such, there is a need for more sustainable and economic solutions to protect the environment.

In order to reduce the amount of waste in the environment, manufacturers in the market for cacao beans are creating biomass from the waste generated after extracting cacao pulp. Such initiatives are boosting the credibility credentials of manufacturers in the market landscape.

The prices of cacao beans is anticipated to tumble due to the coronavirus (COVID-19) outbreak. Due to risk-off periods in markets, the prices of products tend to drop, thus creating challenges for companies in the cacao beans market. Moreover, the potential of supply disruptions is expected to be witnessed in the cacao beans market. As COVID-19 cases are surging worldwide, the situation in West Africa is under control as compared to other countries such as the U.S. and Italy, where there is a high prevalence of COVID-19 patients. This carries good news for manufacturers as large volumes of cacao beans are produced in Ghana and Côte d'Ivoire.

It has been found that Côte d'Ivoire cacao grinders have processed more seeds in February 2020 as compared to the last season. This is another good news for manufacturers and will help limit stress on supply chains.

Analysts’ Viewpoint

As consumers are focused on buying essential commodities amidst the coronavirus crisis, the demand for cacao bean products is anticipated to take a hit and create concerns for the global cacao beans market. Unique production methods and post-harvest practices such as fermentation and drying help to source antioxidants from cacao beans and in the production of nutritional chocolate bars.

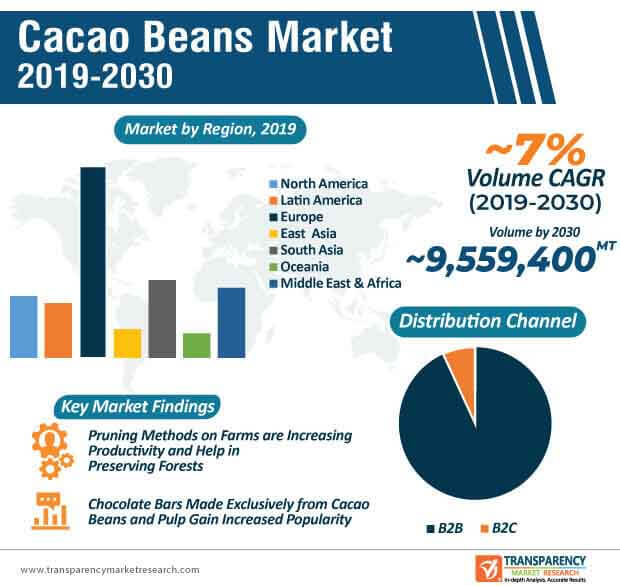

The market is estimated to progress at a favorable CAGR of ~7% during the forecast period. However, conventional processes such as the slash-and-burn approach are decimating tropical forests. Hence, companies should offer free training and other developmental initiatives with the help of digital innovations and smartphones to improve the yield of cacao beans and protect the environment.

Premium chocolate-based products such as chocolate coated fruits, chocolate cookies, and assorted and caramelized chocolates are available in attractive baskets, cans, hampers, and special wrapping for occasions such as Christmas, New Year’s Day, weddings, and birthdays. Gift giving on these days is predicted to be one of the biggest drivers in the cocoa market.

Raw chocolate bars, quinoa vegan bars, and ‘ruby’ chocolate are just some of the offerings made by companies trying to retain their health-conscious consumers. Mainstream chocolate sales have stagnated in developed countries with customers increasingly worried about heart disease and obesity. This shift in taste has compelled chocolate manufacturers to reformulate or rebrand their mass-market chocolates to present a healthier image– at a premium price. Chocolate protein bars, single origin chocolate, and sugar-free chocolate are launched in response to consumer demand for higher quality. It is quite difficult to persuade consumers to purchase more chocolate but they might be open to purchasing better quality chocolate. Natural and locally sourced ingredients are in greater demand in the industry.

The forecast period considered for the Cacao Beans Market is 2020-2030

Base year considered in the Cacao Beans Market is 2020

Cacao Beans Market is estimated to expand at a CAGR of 7% during the forecast period

Olam International Limited, Barry Callebaut AG, Theobroma B.V., Cargill Inc., Ciranda Inc., Edna Group, Dutch Cocoa B.V., Cocoa Processing Company are the top key players in the global Cacao Beans Market

Food & Beverages, Pharmaceuticals, Cosmetic & Personal Care, Pet Food, Household/Retail, HoReCa/Foodservices are the end-use segments in the Cacao Beans Market

1. Executive Summary

1.1. Global Cacao Beans Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Technology Timeline Mapping

1.4. Opportunity Assessment

1.5. FMI Analysis and Recommendations

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Key Trends Impacting the Market

4. Product Innovation / Development Trends

5. Product Oriented Market Buzz

6. Market Dynamics

6.1. Macro-economic Factors

6.2. Market Drivers

6.3. Market Restraints

6.4. Market Opportunities

6.5. Forecast Factors – Relevance and Impact

7. Consumer Behaviour Analysis

8. Global Cacao Beans Market- Trade Analysis

9. Cacao Beans Sector Background

9.1. Global Cacao Beans Production Volume (MT) Overview

9.2. Technology Roadmap

9.3. Policy and Regulatory Landscape

9.4. Industry Value and Supply Chain Analysis

9.4.1. Profit Margin Analysis at each sales point

9.4.2. List & role of key participants

9.4.2.1. Manufacturers

9.4.2.2. Distributors/Retailers

9.4.2.3. List of Key Exporter & Importer

9.4.2.4. List of Private Label Brands

10. Price Point Analysis

10.1. Price Point Assessment by Region

10.2. Price Point Assessment by Product Type

10.3. Price Forecast till 2029

10.4. Factors Influencing Pricing

11. Global Cacao Beans Market Analysis 2014–2018 and Forecast 2019–2029

11.1. Market Volume (MT) Projections

11.2. Market Size (US$ Mn) Projections

11.2.1. Y-o-Y Projections

11.2.2. Absolute $ Opportunity Analysis

12. Global Cacao Beans Market Analysis and Forecast, By Product Type

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume (MT) By Product Type, 2014–2018

12.3. Market Size (US$ Mn) and Volume (MT) Forecast By Product Type, 2019-2029

12.3.1. Forastero

12.3.2. Criollo

12.3.3. Trinitario

12.4. Market Attractiveness Analysis By Product Type

13. Global Cacao Beans Market Analysis and Forecast, By End Use Application

13.1. Introduction

13.2. Historical Market Size (US$ Mn) and Volume (MT) By End Use Application, 2014–2018

13.3. Market Size (US$ Mn) and Volume (MT) Forecast By End Use Application, 2019-2029

13.3.1. Food and Beverages

13.3.1.1. Bakery and Confectionery

13.3.1.2. Beverages

13.3.1.3. Dairy Products

13.3.1.4. Syrup, Toppings and Fillings

13.3.1.5. Other Applications

13.3.2. Pharmaceuticals

13.3.3. Cosmetic and Personal Care

13.3.4. Pet Food

13.3.5. Household/Retail

13.3.6. HoReCa/FoodService

13.4. Market Attractiveness Analysis By End Use Application

14. Global Cacao Beans Market Analysis and Forecast, By Distribution Channel

14.1. Introduction

14.2. Historical Market Size (US$ Mn) and Volume (MT) By Distribution Channel, 2014–2018

14.3. Market Size (US$ Mn) and Volume (MT) Forecast By Distribution Channel, 2019-2029

14.3.1. B2B

14.3.2. B2C

14.3.2.1. Hypermarkets/Supermarkets

14.3.2.2. Convenience Stores

14.3.2.3. Independent Grocery Retailers

14.3.2.4. Specialty Stores

14.3.2.5. Online Retail

14.4. Market Attractiveness Analysis By Distribution Channel

15. Global Cacao Beans Market Analysis and Forecast, By Region

15.1. Introduction

15.2. Historical Market Size (US$ Mn) and Volume (MT) By Region, 2014–2018

15.3. Market Size (US$ Mn) and Volume (MT) Forecast By Region, 2019-2029

15.3.1. North America

15.3.2. Latin America

15.3.3. Europe

15.3.4. East Asia

15.3.5. South Asia

15.3.6. Oceania

15.3.7. Middle East and Africa

15.4. Market Attractiveness Analysis By Region

16. North America Cacao Beans Market Analysis and Forecast 2014–2029

16.1. Introduction

16.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

16.2.1. By Country

16.2.1.1. U.S.

16.2.1.2. Canada

16.2.2. By Product Type

16.2.3. By End Use Application

16.2.4. By Distribution Channel

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Product Type

16.3.3. By End Use Application

16.3.4. By Distribution Channel

16.4. Key Takeaways

17. Latin America Cacao Beans Market Analysis and Forecast 2014–2029

17.1. Introduction

17.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

17.2.1. By Country

17.2.1.1. Brazil

17.2.1.2. Mexico

17.2.1.3. Argentina

17.2.1.4. Ecuador

17.2.1.5. Rest of Latin America

17.2.2. By Product Type

17.2.3. By End Use Application

17.2.4. By Distribution Channel

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Product Type

17.3.3. By End Use Application

17.3.4. By Distribution Channel

17.4. Key Takeaways

18. Europe Cacao Beans Market Analysis and Forecast 2014–2029

18.1. Introduction

18.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

18.2.1. By Country

18.2.1.1. EU-4

18.2.1.2. U.K.

18.2.1.3. Benelux

18.2.1.4. Nordic

18.2.1.5. Poland

18.2.1.6. Russia

18.2.1.7. Rest of Europe

18.2.2. By Product Type

18.2.3. By End Use Application

18.2.4. By Distribution Channel

18.3. Market Attractiveness Analysis

18.3.1. By Country

18.3.2. By Product Type

18.3.3. By End Use Application

18.3.4. By Distribution Channel

18.4. Key Takeaways

19. East Asia Cacao Beans Market Analysis and Forecast 2014–2029

19.1. Introduction

19.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

19.2.1. By Country

19.2.1.1. China

19.2.1.2. Japan

19.2.1.3. South Korea

19.2.2. By Product Type

19.2.3. By End Use Application

19.2.4. By Distribution Channel

19.3. Market Attractiveness Analysis

19.3.1. By Country

19.3.2. By Product Type

19.3.3. By End Use Application

19.3.4. By Distribution Channel

19.4. Key Takeaways

20. South Asia Cacao Beans Market Analysis and Forecast 2014–2029

20.1. Introduction

20.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

20.2.1. Market Size (US$ Mn) Forecast By Country

20.2.1.1. Indonesia

20.2.1.2. India

20.2.1.3. Malaysia

20.2.1.4. Singapore

20.2.1.5. Rest of South Asia

20.2.2. By Product Type

20.2.3. By End Use Application

20.2.4. By Distribution Channel

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Product Type

20.3.3. By End Use Application

20.3.4. By Distribution Channel

20.4. Key Takeaways

21. Oceania Cacao Beans Market Analysis and Forecast 2014–2029

21.1. Introduction

21.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

21.2.1. By Country

21.2.1.1. Australia

21.2.1.2. New Zealand

21.2.1.3. Papua New Guinea

21.2.1.4. Rest of Oceania

21.2.2. By Product Type

21.2.3. By End Use Application

21.2.4. By Distribution Channel

21.3. Market Attractiveness Analysis

21.3.1. By Country

21.3.2. By Product Type

21.3.3. By End Use Application

21.3.4. By Distribution Channel

21.4. Key Takeaways

22. Middle East and Africa Cacao Beans Market Analysis and Forecast 2014–2029

22.1. Introduction

22.2. Market Size (US$ Mn) Forecast By Market Taxonomy, 2019-2029

22.2.1. By Country

22.2.1.1. Turkey

22.2.1.2. Iran

22.2.1.3. North Africa

22.2.1.4. Cote d'lvoire

22.2.1.5. Rest of MEA

22.2.2. By Product Type

22.2.3. By End Use Application

22.2.4. By Distribution Channel

22.3. Market Attractiveness Analysis

22.3.1. By Country

22.3.2. By Product Type

22.3.3. By End Use Application

22.3.4. By Distribution Channel

22.4. Key Takeaways

23. Competition Landscape

23.1. Competition Dashboard

23.2. Competitive Benchmarking

23.3. Profitability and Gross Margin Analysis By Competition

23.4. Competition Developments (Mergers, Acquisitions and Expansions)

23.5. Competition Deep-dive

23.5.1. Cargill Inc.

23.5.1.1. Overview

23.5.1.2. Product Portfolio

23.5.1.3. Strategy Overview

23.5.1.4. Marketing Strategy

23.5.1.5. Product Strategy

23.5.1.6. Channel Strategy

23.5.2. Theobroma B.V.

23.5.2.1. Overview

23.5.2.2. Product Portfolio

23.5.2.3. Strategy Overview

23.5.2.4. Marketing Strategy

23.5.2.5. Product Strategy

23.5.2.6. Channel Strategy

23.5.3. Olam International Limited

23.5.3.1. Overview

23.5.3.2. Product Portfolio

23.5.3.3. Strategy Overview

23.5.3.4. Marketing Strategy

23.5.3.5. Product Strategy

23.5.3.6. Channel Strategy

23.5.4. Ciranda Inc.

23.5.4.1. Overview

23.5.4.2. Product Portfolio

23.5.4.3. Strategy Overview

23.5.4.4. Marketing Strategy

23.5.4.5. Product Strategy

23.5.4.6. Channel Strategy

23.5.5. Barry Callebaut AG

23.5.5.1. Overview

23.5.5.2. Product Portfolio

23.5.5.3. Strategy Overview

23.5.5.4. Marketing Strategy

23.5.5.5. Product Strategy

23.5.5.6. Channel Strategy

23.5.6. Dutch Cocoa B.V.

23.5.6.1. Overview

23.5.6.2. Product Portfolio

23.5.6.3. Strategy Overview

23.5.6.4. Marketing Strategy

23.5.6.5. Product Strategy

23.5.6.6. Channel Strategy

23.5.7. Niche Cocoa Industry Ltd.

23.5.7.1. Overview

23.5.7.2. Product Portfolio

23.5.7.3. Strategy Overview

23.5.7.4. Marketing Strategy

23.5.7.5. Product Strategy

23.5.7.6. Channel Strategy

23.5.8. PT. Danora Agro Prima

23.5.8.1. Overview

23.5.8.2. Product Portfolio

23.5.8.3. Strategy Overview

23.5.8.4. Marketing Strategy

23.5.8.5. Product Strategy

23.5.8.6. Channel Strategy

23.5.9. United Cocoa Processors Inc.

23.5.9.1. Overview

23.5.9.2. Product Portfolio

23.5.9.3. Strategy Overview

23.5.9.4. Marketing Strategy

23.5.9.5. Product Strategy

23.5.9.6. Channel Strategy

23.5.10. Cocoa Processing Company

23.5.10.1. Overview

23.5.10.2. Product Portfolio

23.5.10.3. Strategy Overview

23.5.10.4. Marketing Strategy

23.5.10.5. Product Strategy

23.5.10.6. Channel Strategy

23.5.11. Kakao Berlin

23.5.11.1. Overview

23.5.11.2. Product Portfolio

23.5.11.3. Strategy Overview

23.5.11.4. Marketing Strategy

23.5.11.5. Product Strategy

23.5.11.6. Channel Strategy

23.5.12. India Cocoa Pvt Ltd.

23.5.12.1. Overview

23.5.12.2. Product Portfolio

23.5.12.3. Strategy Overview

23.5.12.4. Marketing Strategy

23.5.12.5. Product Strategy

23.5.12.6. Channel Strategy

24. Assumptions and Acronyms Used

25. Research Methodology

List of Tables

Table 01: Global Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 02: Global Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 03: Global Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 04: Global Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 05: Global Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 06: Global Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 07: Global Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 08: Global Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 09: Global Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 10: Global Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 11: Global Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 12: Global Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 13: Global Cacao Beans Market Value (US$ Mn) Historical by Region 2015–2019

Table 14: Global Cacao Beans Market Value (US$ Mn) Forecast by Region2020–2030

Table 15: Global Cacao Beans Market Volume (MT) Historical by Region 2015–2019

Table 16: Global Cacao Beans Market Volume (MT) Forecast by Region2020–2030

Table 17: North America Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 18: North America Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 19: North America Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 20: North America Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 21: North America Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 22: North America Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 23: North America Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 24: North America Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 25: North America Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 26: North America Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 27: North America Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 28: North America Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 29: North America Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 30: North America Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 31: North America Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 32: North America Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 33: Latin America Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 34: Latin America Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 35: Latin America Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 36: Latin America Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 37: Latin America Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 38: Latin America Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 39: Latin America Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 40: Latin America Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 41: Latin America Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 42: Latin America Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 43: Latin America Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 44: Latin America Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 45: Latin America Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 46: Latin America Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 47: Latin America Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 48: Latin America Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 49: Europe Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 50: Europe Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 51: Europe Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 52: Europe Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 53: Europe Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 54: Europe Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 55: Europe Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 56: Europe Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 57: Europe Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 58: Europe Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 59: Europe Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 60: Europe Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 61: Europe Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 62: Europe Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 63: Europe Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 64: Europe Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 65: East Asia Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 66: East Asia Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 67: East Asia Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 68: East Asia Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 69: East Asia Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 70: East Asia Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 71: East Asia Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 72: East Asia Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 73: East Asia Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 74: East Asia Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 75: East Asia Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 76: East Asia Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 77: East Asia Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 78: East Asia Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 79: East Asia Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 80: East Asia Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 81: South Asia Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 82: South Asia Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 83: South Asia Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 84: South Asia Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 85: South Asia Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 86: South Asia Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 87: South Asia Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 88: South Asia Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 89: South Asia Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 90: South Asia Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 91: South Asia Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 92: South Asia Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 93: South Asia Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 94: South Asia Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 95: South Asia Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 96: South Asia Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 97: Oceania Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 98: Oceania Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 99: Oceania Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 100: Oceania Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 101: Oceania Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 102: Oceania Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 103: Oceania Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 104: Oceania Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 105: Oceania Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 106: Oceania Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 107: Oceania Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 108: Oceania Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 109: Oceania Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 110: Oceania Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 111: Oceania Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 112: Oceania Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

Table 113: MEA Cacao Beans Market Value (US$ Mn) Historical by Country 2015–2019

Table 114: MEA Cacao Beans Market Value (US$ Mn) Forecast by Country2020–2030

Table 115: MEA Cacao Beans Market Volume (MT) Historical by Country 2015–2019

Table 116: MEA Cacao Beans Market Volume (MT) Forecast by Country2020–2030

Table 117: MEA Cacao Beans Market Value (US$ Mn) Historical by Product Type 2015–2019

Table 118: MEA Cacao Beans Market Value (US$ Mn) Forecast by Product Type2020–2030

Table 119: MEA Cacao Beans Market Volume (MT) Historical by Product Type 2015–2019

Table 120: MEA Cacao Beans Market Volume (MT) Forecast by Product Type2020–2030

Table 121: MEA Cacao Beans Market Value (US$ Mn) Historical by End Use Application 2015–2019

Table 122: MEA Cacao Beans Market Value (US$ Mn) Forecast by End Use Application2020–2030

Table 123: MEA Cacao Beans Market Volume (MT) Historical by End Use Application 2015–2019

Table 124: MEA Cacao Beans Market Volume (MT) Forecast by End Use Application2020–2030

Table 125: MEA Cacao Beans Market Value (US$ Mn) Historical by Distribution Channel 2015–2019

Table 126: MEA Cacao Beans Market Value (US$ Mn) Forecast by Distribution Channel2020–2030

Table 127: MEA Cacao Beans Market Volume (MT) Historical by Distribution Channel 2015–2019

Table 128: MEA Cacao Beans Market Volume (MT) Forecast by Distribution Channel2020–2030

List of Figures

Figure 01: Global Cacao Beans Historic Market Value (US$ Mn) Forecast, 2015–2030

Figure 02: Global Cacao Beans Market Absolute Incremental Opportunity Forecast, 2020–2030

Figure 03: Global Cacao Beans Market Value Share (%) and BPS Analysis by Region, 2015, 2020 & 2030

Figure 04: Global Cacao Beans Market Y-o-Y Growth (%) Projections by Region, 2020-2030

Figure 05: North America Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 06: Latin America Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 07: Europe Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 08: East Asia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 09: South Asia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 10: Oceania Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 11: Middle East and Africa Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 12: Global Cacao Beans Market Attractiveness Analysis by Region, 2020-2030

Figure 13: Global Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015, 2020 & 2030

Figure 14: Global Cacao Beans Market Value (US$ Mn) Analysis by Product Type, 2020 & 2030

Figure 15: Global Cacao Beans Market Incremental Value (US$ Mn) by Product Type, 2015 to 2030

Figure 16: Global Cacao Beans Market Attractiveness by Product Type, 2020 to 2030

Figure 17: Global Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015,2020 & 2030

Figure 18: Global Cacao Beans Market Value (US$ Mn) Analysis by End Use Application, 2020 & 2030

Figure 19: Global Cacao Beans Market Incremental Value (US$ Mn) by End Use Application, 2015 to 2030

Figure 20: Global Cacao Beans Market Attractiveness by End Use Application, 2020 to 2030

Figure 21: Global Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015, 2020 & 2030

Figure 22: Global Cacao Beans Market Value (US$ Mn) Analysis by Distribution Channel, 2020 & 2030

Figure 23: Global Cacao Beans Market Incremental Value (US$ Mn) by Distribution Channel, 2015 to 2030

Figure 24: Global Cacao Beans Market Attractiveness by Distribution Channel, 2020 to 2030

Figure 25: North America Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 26: U.S. Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 27: Canada Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 28: U.S. Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 29: Canada Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 30: North America Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015,2020 & 2030

Figure 31: North America Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 32: North America Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 33: North America Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015,2020 & 2030

Figure 34: North America Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 35: North America Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 36: North America Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015,2020 & 2030

Figure 37: North America Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 38: North America Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030

Figure 39: Latin America Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 40: Mexico Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 41: Brazil Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 42: Argentina Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 43: Ecuador Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 44: Rest of LA Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 45: Mexico Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 46: Brazil Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 47: Argentina Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 48: Ecuador Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 49: Rest of LA Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 50: Latin America Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015,2020 & 2030

Figure 51: Latin America Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 52: Latin America Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 53: Latin America Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015,2020 & 2030

Figure 54: Latin America Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 55: Latin America Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 56: Latin America Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015,2020 & 2030

Figure 57: Latin America Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 58: Latin America Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030

Figure 59: Europe Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 60: EU-4 Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 61: U.K. Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 62: Nordic Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 63: Benelux Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 64: Poland Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 65: Russia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 66: Rest of Europe Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 67: EU-4 Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 68: U.K. Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 69: Nordic Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 70: Benelux Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 71: Poland Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 72: Russia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 73: Rest of Europe Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 74: Europe Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015, 2020 & 2030

Figure 75: Europe Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 76: Europe Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 77: Europe Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015, 2020 & 2030

Figure 78: Europe Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 79: Europe Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 80: Europe Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015, 2020 & 2030

Figure 81: Europe Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 82: Europe Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030

Figure 83: East Asia Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 84: China Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 85: Japan Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 86: South Korea Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 87: China Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 88: Japan Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 89: South Korea Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 90: East Asia Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015,2020 & 2030

Figure 91: East Asia Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 92: East Asia Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 93: East Asia Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015,2020 & 2030

Figure 94: East Asia Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 95: East Asia Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 96: East Asia Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015,2020 & 2030

Figure 97: East Asia Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 98: East Asia Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030

Figure 99: South Asia Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 100: India Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 101: Singapore Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 102: Indonesia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 103: Malaysia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 104: Rest of SA Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 105: India Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 106: Singapore Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 107: Indonesia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 108: Malaysia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 109: Rest of SA Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 110: South Asia Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015, 2020 & 2030

Figure 111: South Asia Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 112: South Asia Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 113: South Asia Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015,2020 & 2030

Figure 114: South Asia Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 115: South Asia Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 116: South Asia Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015,2020 & 2030

Figure 117: South Asia Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 118: South Asia Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030

Figure 119: Oceania Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 120: Australia Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 121: New Zealand Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 122: Australia Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 123: New Zealand Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 124: Oceania Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015, 2020 & 2030

Figure 125: Oceania Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 126: Oceania Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 127: Oceania Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015, 2020 & 2030

Figure 128: Oceania Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 129: Oceania Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 130: Oceania Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015, 2020 & 2030

Figure 131: Oceania Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 132: Oceania Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030

Figure 133: MEA Cacao Beans Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 134: Turkey Cacao Beans Market Value and Volume Analysis, 2015 -2030

Figure 135: Iran Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 136: North Africa Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 137: Cote d'lvoire Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 138: Rest of MEA Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 139: Turkey Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 140: Iran Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 141: North Africa Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 142: Cote d'lvoire Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 143: Rest of MEA Cacao Beans Absolute $ Opportunity Analysis, 2020-2030

Figure 144: MEA Cacao Beans Market Value Share (%) and BPS Analysis by Product Type, 2015, 2020 & 2030

Figure 145: MEA Cacao Beans Market Y-o-Y Growth (%) Projections by Product Type, 2020-2030

Figure 146: MEA Cacao Beans Market Attractiveness, by Product Type, 2020-2030

Figure 147: MEA Cacao Beans Market Value Share (%) and BPS Analysis by End Use Application, 2015, 2020 & 2030

Figure 148: MEA Cacao Beans Market Y-o-Y Growth (%) Projections by End Use Application, 2020-2030

Figure 149: MEA Cacao Beans Market Attractiveness, by End Use Application, 2020-2030

Figure 150: MEA Cacao Beans Market Value Share (%) and BPS Analysis by Distribution Channel, 2015, 2020 & 2030

Figure 151: MEA Cacao Beans Market Y-o-Y Growth (%) Projections by Distribution Channel, 2020-2030

Figure 152: MEA Cacao Beans Market Attractiveness, by Distribution Channel, 2020-2030