Analysts’ Viewpoint on Cable Assembly Market Scenario

Cable assembly is primarily used to transmit power, signals, and information to the designated application and to provide protection to cables. The cable assembly is easy to install, repair, and maintain, which helps save time during replacement purposes. Presently, cable assembly companies are focusing on high-growth applications such as high performance computing (HPC), artificial intelligence (GPU to GPU), core routing, switching, and infotainment systems in order to grow post the COVID-19 pandemic. Consequently, the market is expected to grow at a notable pace during the forecast period, owing to the numerous advantages offered by cable assembly such as minimal wastage of cable, high performance, ease of set up, etc.

Cable assemblies are widely used in mass production and can save time in assembling an entire machine or piece of equipment, especially when used repeatedly for each manufactured unit. They are also referred to as wiring looms or harnesses. Cable assemblies are integral to the production of diverse products, ranging from wearables to home electronics equipment. Various types of cable assemblies are key to interconnecting electronic equipment, components, and systems for optimum functionality owing to their reliability, durability, and all-around high quality. For instance, the use of coaxial cable assembly to connect computers to Ethernet connections, receivers to antennas, or the use of cable harness assembly in the automotive industry. Most cable assemblies are made of environment-friendly recyclable materials, and they have an extensive range of connectors and terminals. This helps control output, input, data, and electrical current in an efficient and effective manner.

Production processes currently employed in the food and beverage industry are characterized by stringent hygiene regulations. When it comes to hygiene regulation, the most important part of hygiene are germs and impurities, which must not allowed to form and come into contact with foods. Moreover, in the food and beverage industry, highly corrosive cleaning agents and chemicals are used to clean and sanitize machines and equipment. Therefore, the cable assembly is extensively used owing to its ability to withstand mechanical stress, chemical stress, and thermal stress. Demand for cable assembly has increased in the food & beverage industry because cable assemblies are used in warming and heating equipment, slicers, mixers, etc.

Cable assemblies also help minimize downtime, increase productivity, ensure quality, and increase safety for employees. This is estimated to boosts the adoption of cable assemblies in the food and beverage industry and consequently drive the global cable assembly market during the forecast period.

Custom cables assemblies need a metallic conductor to carry electrical load throughout the product’s lifetime. Heavy duty connectors are required in custom cables to withstand high humidity, high temperature, or electromagnetic interference (EMI), water, saltwater, particles, or vibration. The conductor in custom cable assemblies plays a vital role because the large power needed for electronic equipment requires a larger conductor to protect the cable and electronic devices from damage. This boosts the demand for custom cable assemblies.

Electronic appliances such as home theater systems need custom cable assemblies to ensure optimum performance because custom cable assemblies are manufactured to operate multiple function such as power, signal, and voltages, etc.

Small and large manufacturers are focused on the development of custom cable assemblies to cater to the demands of advanced electronic equipment and compact devices as well. Thus, increased use of custom cable assembly in compact electronic devices is projected to propel the global cable assembly market during the forecast period.

In terms of type, the global cable assembly market can be segregated into discrete wire assemblies, fiber optic cable assemblies, RF cable assemblies, ribbon cable assemblies, custom cable assemblies, coaxial cable assemblies, and others. The custom cable assemblies segment dominated the global cable harness assembly market, as they help save space and reduce weight of cables. Moreover, custom cable assemblies saving of assembly time by eliminating cable ties and cable loops, while improving performance and safety. This helps propel the cable assembly market size.

Analysis of the global cable assembly market trends reveal that, presently, various cable assembly manufacturers offer custom industrial cables and assemblies, such as rectangular cable assemblies, circular cable assemblies, and printed circuit board (PCB) assemblies, for automotive, industrial control and instrumentation systems, radio frequency (RF), personal computers (PCs) and local area network (LAN), audio/video (AV), and telecommunication applications.

In terms of end-use industry, the cable assembly market has been classified into automotive, IT and telecommunication, aerospace and defense, healthcare, industrial, and others. The automotive segment dominated the global cable assembly market owing to increased use of copper cable assemblies in motor vehicles such as gear boxes, door, side mirror, window, headlight, etc.

Use of RF cable assemblies and coaxial cable assemblies in infotainment systems, such as in-seat DVD players, global positioning systems, and Bluetooth connectivity, ensure systems work properly. However, low voltage differential signaling (LVDS) cable assemblies are also necessary for power in-car display units such as radio screens and backup cameras. All these factors boost the automotive segment of the cable assembly market.

Asia Pacific dominated the global cable assembly market owing to the presence of a large number of cable assembly manufacturers in countries, such as Japan, India, and China, in the region. Moreover, rise in industrialization, urbanization, and the demand for electric vehicles is driving the adoption of cable assembly in Asia Pacific.

The market in North America is expected to grow considerably in the next few years due to an increase of demand for cable assembly in military communications. Furthermore, a rise in need for cable assemblies in IT & telecommunication sector is also projected to propel the cable assembly market in the region.

The global cable assembly market is fragmented with a small number of large-scale vendors controlling the majority of the market share. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Prominent cable assembly manufacturers operating in the global market include 3M Company, AFCI, Amphenol Corporation, Cable Manufacturing & Assembly Co., Carlisle Interconnect Technologies, Carrio Cabling, DC Electronics, Epec LLC, Fischer Connectors SA, Infineon Technologies AG, Minnesota Wire Company, Molex, LLC, PSC Electronics, Samtec, Smith’s Interconnect Inc., TE Connectivity, TMB, TPC Wire & Cable Corp., W. L. Gore & Associates, Inc., and Walker Component Group, Inc.

Each of these players has been profiled in the cable assembly market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

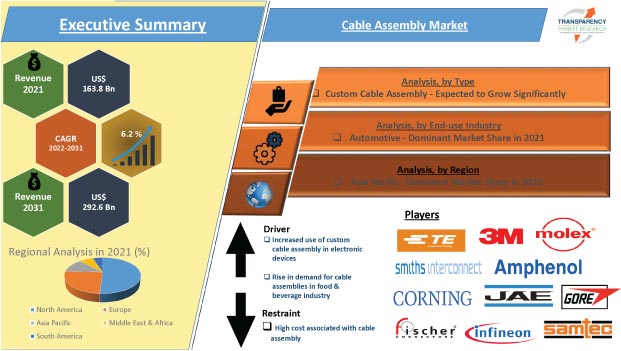

Market Size Value in 2021 |

US$ 163.8 Bn |

|

Market Forecast Value in 2031 |

US$ 292.6 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Billion for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The cable assembly market stood at US$ 163.8 Bn in 2021.

The cable assembly market is expected to rise at a CAGR of 6.2% from 2022 to 2031.

Increase in use of custom cable assembly in electronic devices and rise in demand for cable assembly from food & beverage industry.

The automotive segment accounted for major share of 28.6% of the cable assembly market in 2021.

Asia Pacific region accounted for major share of 43.5% of the global cable assembly market.

The U.S. accounted for 14.9% share of the cable assembly market.

3M Company, AFCI, Amphenol Corporation, Cable Manufacturing & Assembly Co., Carlisle Interconnect Technologies, Carrio Cabling, DC Electronics, Epec LLC, Fischer Connectors SA, Infineon Technologies AG, Minnesota Wire Company, Molex, LLC, PSC Electronics, Samtec, Smith’s Interconnect Inc., TE Connectivity, TMB, TPC Wire & Cable Corp., W. L. Gore & Associates, Inc., and Walker Component Group, Inc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Cable Assembly Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Electronic Component Industry

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global Cable Assembly Market Analysis, by Type

5.1. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Discrete Wire Assemblies

5.1.2. Optic Cable Assemblies

5.1.3. RF Cable Assemblies

5.1.4. Ribbon Cable Assemblies

5.1.5. Coaxial Cable Assemblies

5.1.6. Custom Cable Assemblies

5.1.7. Others

5.2. Market Attractiveness Analysis, by Type

6. Global Cable Assembly Market Analysis, by End-use Industry

6.1. Cable Assembly Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

6.1.1. Automotive

6.1.2. IT and Telecommunication

6.1.3. Aerospace and Defense

6.1.4. Healthcare

6.1.5. Industrial

6.1.6. Others

6.2. Market Attractiveness Analysis, by End-use Industry

7. Global Cable Assembly Market Analysis and Forecast, by Region

7.1. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America Cable Assembly Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017–2031

8.3.1. Discrete Wire Assemblies

8.3.2. Optic Cable Assemblies

8.3.3. RF Cable Assemblies

8.3.4. Ribbon Cable Assemblies

8.3.5. Coaxial Cable Assemblies

8.3.6. Custom Cable Assemblies

8.3.7. Others

8.4. Cable Assembly Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

8.4.1. Automotive

8.4.2. IT and Telecommunication

8.4.3. Aerospace and Defense

8.4.4. Healthcare

8.4.5. Industrial

8.4.6. Others

8.5. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By End-use Industry

8.6.3. By Country and Sub-region

9. Europe Cable Assembly Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017–2031

9.3.1. Discrete Wire Assemblies

9.3.2. Optic Cable Assemblies

9.3.3. RF Cable Assemblies

9.3.4. Ribbon Cable Assemblies

9.3.5. Coaxial Cable Assemblies

9.3.6. Custom Cable Assemblies

9.3.7. Others

9.4. Cable Assembly Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

9.4.1. Automotive

9.4.2. IT and Telecommunication

9.4.3. Aerospace and Defense

9.4.4. Healthcare

9.4.5. Industrial

9.4.6. Others

9.5. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By End-use Industry

9.6.3. By Country and Sub-region

10. Asia Pacific Cable Assembly Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Discrete Wire Assemblies

10.3.2. Optic Cable Assemblies

10.3.3. RF Cable Assemblies

10.3.4. Ribbon Cable Assemblies

10.3.5. Coaxial Cable Assemblies

10.3.6. Custom Cable Assemblies

10.3.7. Others

10.4. Cable Assembly Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.4.1. Automotive

10.4.2. IT and Telecommunication

10.4.3. Aerospace and Defense

10.4.4. Healthcare

10.4.5. Industrial

10.4.6. Others

10.5. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. South Korea

10.5.5. ASEAN

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By End-use Industry

10.6.3. By Country and Sub-region

11. Middle East & Africa Cable Assembly Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Discrete Wire Assemblies

11.3.2. Optic Cable Assemblies

11.3.3. RF Cable Assemblies

11.3.4. Ribbon Cable Assemblies

11.3.5. Coaxial Cable Assemblies

11.3.6. Custom Cable Assemblies

11.3.7. Others

11.4. Cable Assembly Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.4.1. Automotive

11.4.2. IT and Telecommunication

11.4.3. Aerospace and Defense

11.4.4. Healthcare

11.4.5. Industrial

11.4.6. Others

11.5. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of the Middle East & Africa

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By End-use Industry

11.6.3. By Country and Sub-region

12. South America Cable Assembly Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Discrete Wire Assemblies

12.3.2. Optic Cable Assemblies

12.3.3. RF Cable Assemblies

12.3.4. Ribbon Cable Assemblies

12.3.5. Coaxial Cable Assemblies

12.3.6. Custom Cable Assemblies

12.3.7. Others

12.4. Cable Assembly Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.4.1. Automotive

12.4.2. IT and Telecommunication

12.4.3. Aerospace and Defense

12.4.4. Healthcare

12.4.5. Industrial

12.4.6. Others

12.5. Cable Assembly Market Value (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By End-use Industry

12.6.3. By Country and Sub-region

13. Competition Assessment

13.1. Global Cable Assembly Market Competition Matrix - a Dashboard View

13.1.1. Global Cable Assembly Market Company Share Analysis, by Value (2021)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. 3M Company

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. AFCI

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Amphenol Corporation.

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Cable Manufacturing & Assembly Co.

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Carlisle Interconnect Technologies

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Carrio Cabling

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. DC Electronics

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Epec, LLC.

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Fischer Connectors SA

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Infineon Technologies AG

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Minnesota Wire Company

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. Molex, LLC

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

14.13. PSC Electronics

14.13.1. Overview

14.13.2. Product Portfolio

14.13.3. Sales Footprint

14.13.4. Key Subsidiaries or Distributors

14.13.5. Strategy and Recent Developments

14.13.6. Key Financials

14.14. Samtec

14.14.1. Overview

14.14.2. Product Portfolio

14.14.3. Sales Footprint

14.14.4. Key Subsidiaries or Distributors

14.14.5. Strategy and Recent Developments

14.14.6. Key Financials

14.15. Smith’s Interconnect Inc.

14.15.1. Overview

14.15.2. Product Portfolio

14.15.3. Sales Footprint

14.15.4. Key Subsidiaries or Distributors

14.15.5. Strategy and Recent Developments

14.15.6. Key Financials

14.16. TE Connectivity

14.16.1. Overview

14.16.2. Product Portfolio

14.16.3. Sales Footprint

14.16.4. Key Subsidiaries or Distributors

14.16.5. Strategy and Recent Developments

14.16.6. Key Financials

14.17. TMB

14.17.1. Overview

14.17.2. Product Portfolio

14.17.3. Sales Footprint

14.17.4. Key Subsidiaries or Distributors

14.17.5. Strategy and Recent Developments

14.17.6. Key Financials

14.18. TPC Wire & Cable Corp.

14.18.1. Overview

14.18.2. Product Portfolio

14.18.3. Sales Footprint

14.18.4. Key Subsidiaries or Distributors

14.18.5. Strategy and Recent Developments

14.18.6. Key Financials

14.19. W. L. Gore & Associates, Inc.

14.19.1. Overview

14.19.2. Product Portfolio

14.19.3. Sales Footprint

14.19.4. Key Subsidiaries or Distributors

14.19.5. Strategy and Recent Developments

14.19.6. Key Financials

14.20. Walker Component Group, Inc

14.20.1. Overview

14.20.2. Product Portfolio

14.20.3. Sales Footprint

14.20.4. Key Subsidiaries or Distributors

14.20.5. Strategy and Recent Developments

14.20.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1. By Type

15.1.2. By End-use Industry

15.1.3. By Region

List of Tables

Table 01: Global Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 02: Global Cable Assembly Market Size & Forecast, by Type, Volume (Billion Units), 2017‒2031

Table 03: Global Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 04: Global Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 05: Global Cable Assembly Market Size & Forecast, by Region, Volume (Billion Units), 2017‒2031

Table 06: North America Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 07: North America Cable Assembly Market Size & Forecast, by Type, Volume (Billion Units), 2017‒2031

Table 08: North America Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 09: North America Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 10: North America Cable Assembly Market Size & Forecast, by Country & Sub-region, Volume (Billion Units), 2017‒2031

Table 11: Europe Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 12: Europe Cable Assembly Market Size & Forecast, by Type, Volume (Billion Units), 2017‒2031

Table 13: Europe Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 14: Europe Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 15: Europe Cable Assembly Market Size & Forecast, by Country & Sub-region, Volume (Billion Units), 2017‒2031

Table 16: Asia Pacific Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 17: Asia Pacific Cable Assembly Market Size & Forecast, by Type, Volume (Billion Units), 2017‒2031

Table 18: Asia Pacific Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 19: Asia Pacific Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 20: Asia Pacific Cable Assembly Market Size & Forecast, by Country & Sub-region, Volume (Billion Units), 2017‒2031

Table 21: Middle East & Africa Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 22: Middle East & Africa Cable Assembly Market Size & Forecast, by Type, Volume (Billion Units), 2017‒2031

Table 23: Middle East & Africa Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 24: Middle East & Africa Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 25: Middle East & Africa Cable Assembly Market Size & Forecast, by Country & Sub-region, Volume (Billion Units), 2017‒2031

Table 26: South America Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 27: South America Cable Assembly Market Size & Forecast, by Type, Volume (Billion Units), 2017‒2031

Table 28: South America Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 29: South America Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 30: South America Cable Assembly Market Size & Forecast, by Country & Sub-region, Volume (Billion Units), 2017‒2031

List of Figures

Figure 01: Global Cable Assembly Price Trend Analysis (Average Price, US$)

Figure 02: Global Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 03: Global Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 04: Global Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 05: Global Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 06: Global Cable Assembly Market Size & Forecast, by Type, Revenue (US$ Bn), 2017‒2031

Figure 07: Global Cable Assembly Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 08: Global Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 09: Global Cable Assembly Market Attractiveness, by End-use Industry, Revenue (US$ Bn), 2022‒2031

Figure 10: Global Cable Assembly Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 11: Global Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 12: Global Cable Assembly Market Size & Forecast, by Region, Revenue (US$ Bn), 2022‒2031

Figure 13: Global Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 14: Global Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 15: North America Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 16: North America Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 17: North America Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 18: North America Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 19: North America Cable Assembly Market Size & Forecast, by Type, Revenue (US$ Bn), 2017‒2031

Figure 20: North America Cable Assembly Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 21: North America Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 22: North America Cable Assembly Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017‒2031

Figure 23: North America Cable Assembly Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 24: North America Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 25: North America Cable Assembly Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2022‒2031

Figure 26: North America Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 27: North America Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 28: Europe Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 29: Europe Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 30: Europe Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 31: Europe Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 32: Europe Cable Assembly Market Size & Forecast, by Type, Revenue (US$ Bn), 2017‒2031

Figure 33: Europe Cable Assembly Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 34: Europe Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 35: Europe Cable Assembly Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017‒2031

Figure 36: Europe Cable Assembly Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 37: Europe Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 38: Europe Cable Assembly Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 39: Europe Cable Assembly Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 40: Europe Cable Assembly Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2022‒2031

Figure 41: Europe Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 42: Europe Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 43: Asia Pacific Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 44: Asia Pacific Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 45: Asia Pacific Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 46: Asia Pacific Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 47: Asia Pacific Cable Assembly Market Size & Forecast, by Type, Revenue (US$ Bn), 2017‒2031

Figure 48: Asia Pacific Cable Assembly Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 49: Asia Pacific Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 50: Asia Pacific Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 51: Asia Pacific Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 52: Asia Pacific Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 53: Asia Pacific Cable Assembly Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 54: Asia Pacific Cable Assembly Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 55: Asia Pacific Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 56: Middle East & Africa Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 57: Middle East & Africa Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 58: Middle East & Africa Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 59: Middle East & Africa Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 60: Middle East & Africa Cable Assembly Market Size & Forecast, by Type, Revenue (US$ Bn), 2017‒2031

Figure 61: Middle East & Africa Cable Assembly Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 62: Middle East & Africa Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 63: Middle East & Africa Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 64: Middle East & Africa Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 65: Middle East & Africa Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 66: Middle East & Africa Cable Assembly Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 67: Middle East & Africa Cable Assembly Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 68: Middle East & Africa Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 69: South America Cable Assembly Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 70: South America Cable Assembly Market, Value (US$ Bn), 2017‒2031

Figure 71: South America Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 72: South America Cable Assembly Market, Volume (Billion Units), 2017‒2031

Figure 73: South America Cable Assembly Market Size & Forecast, by Type, Revenue (US$ Bn), 2017‒2031

Figure 74: South America Cable Assembly Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 75: South America Cable Assembly Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 76: South America Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 77: South America Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 78: South America Cable Assembly Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 79: South America Cable Assembly Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 80: South America Cable Assembly Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 81: South America Cable Assembly Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 82: Global Cable Assembly Market Share Analysis, by Company