Analysts’ Viewpoint

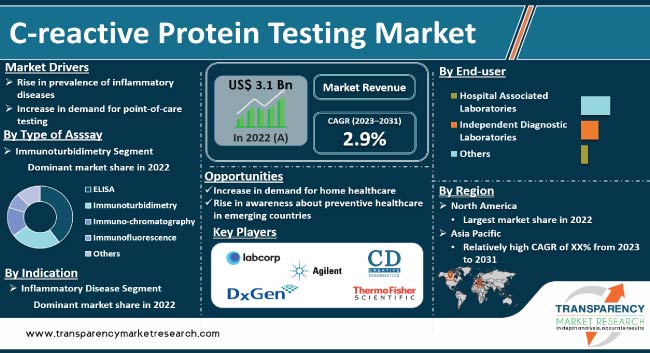

The global C-reactive protein (CRP) testing market is expected to experience significant growth in the next few years. Prevalence of chronic diseases such as cardiovascular diseases, cancer, and autoimmune diseases is increasing across the world. Surge in demand for CRP testing for diagnosis and management of these diseases is likely propel market expansion. Furthermore, rise in usage of CRP testing in development of personalized medicine is projected to bolster market progress.

Advances in technology, such as development of high-sensitivity CRP assays and point-of-care CRP testing devices, are projected to offer lucrative opportunities to market players. Companies are focusing on development of standardized and accurate CRP tests to increase market share.

However, lack of standardization in CRP testing, which could lead to variability in test results and affect the accuracy of diagnoses, is anticipated to restrain the global C-reactive protein testing market.

C-reactive protein (CRP) testing is a medical diagnostic tool that measures the level of CRP, a protein produced by the liver in response to inflammation, in a patient's blood. CRP testing is widely used in the diagnosis and management of various conditions such as infections, autoimmune diseases, and cardiovascular diseases. It is particularly useful in detecting inflammation in the body, as elevated CRP levels are a marker of inflammation.

One of the primary applications of CRP testing is in the diagnosis and management of cardiovascular diseases. Elevated CRP levels are associated with an increased risk of heart attack and stroke, and CRP testing is often used to monitor patients with a history of cardiovascular disease. CRP testing is also used in the diagnosis and management of infectious diseases, such as pneumonia and sepsis, as well as autoimmune diseases, including rheumatoid arthritis and lupus.

The global market has witnessed significant growth in the past few years owing to an increase in the prevalence of inflammatory diseases and a rise in demand for high-quality diagnostic tools. The market is expected to be driven by a surge in the need for accurate and efficient diagnostic tools in the next few years.

The rise in the prevalence of inflammatory diseases is likely to contribute to the growth of the global C-reactive protein testing market. CRP is an acute-phase protein that is produced by the liver in response to inflammation, infection, or tissue damage. Elevated levels of CRP in the blood could indicate the presence of inflammation in the body, which is associated with various diseases, including cardiovascular disease, rheumatoid arthritis, inflammatory bowel disease, and certain cancers. An increase in the incidence and prevalence of these diseases is projected to drive demand for CRP testing.

The surge in the adoption of point-of-care testing (POCT) for CRP, which enables rapid and convenient testing in primary care settings, is expected to propel market growth. Technological advancements in CRP testing methods, such as the development of high-sensitivity CRP assays, contribute to the growth of the market. These assays are more sensitive than traditional CRP tests and can detect lower levels of CRP in the blood, which could be useful in identifying patients who are at risk of developing inflammatory diseases or who may benefit from early intervention.

Overall, the rise in the prevalence of inflammatory diseases, the increase in the adoption of POCT for CRP, and technological advancements in CRP testing methods are likely to propel the market.

POCT is a type of medical testing that is performed near the patient, rather than in a centralized laboratory, and provides results in real time. POCT for CRP enables rapid and convenient testing in primary care settings, emergency departments, and other point-of-care locations, which is especially beneficial for patients who require immediate diagnosis and treatment.

POCT for CRP could help reduce healthcare costs by eliminating the need for laboratory testing and reducing the time and resources required for diagnosis and treatment. This could also help improve patient outcomes by enabling early detection and intervention of inflammatory diseases. The COVID-19 pandemic has highlighted the importance of POCT in healthcare, as it enables rapid and accurate testing in remote or high-risk locations. Consequently, demand for POCT for various diseases, including CRP testing, has increased.

Overall, a surge in demand for POCT for CRP is expected to drive the global C-reactive protein testing market, as it provides a convenient and cost-effective alternative to laboratory testing, which could help improve patient outcomes and reduce healthcare costs.

In terms of test type, the standard C-reactive protein test segment held the largest global C-reactive protein testing market share in 2022. The standard C-reactive protein test is the most commonly used test for measuring CRP levels in the blood. CRP is a protein that is produced by the liver in response to inflammation in the body. The standard CRP test measures the level of CRP in the blood and is used to diagnose and monitor various conditions, such as infections, autoimmune disorders, and cardiovascular diseases. It is the most commonly used test in clinical practice, as it is widely available, relatively inexpensive, and provides accurate results in most cases.

The test is typically performed by drawing blood from a vein in the arm. The blood sample is then sent to a laboratory for analysis. Results are usually available within a few days. The standard CRP test measures CRP levels in the range of 1 to 10 milligrams per liter (mg/L). Higher levels of CRP in the blood indicate a greater level of inflammation in the body. However, the test is not specific to any particular disease or condition, so it is typically used in conjunction with other tests and clinical evaluations to diagnose and monitor various conditions.

Based on type of assay, the immunoturbidimetry segment dominated the global market in 2022. Immunoturbidimetry is a type of immunoassay used to measure the concentration of specific proteins or other molecules in a sample. The principle of immunoturbidimetry is based on the formation of a complex between the analyte of interest and a specific antibody, which leads to the formation of aggregates or complexes that scatter light, resulting in increased turbidity or opacity in the sample. This helps diagnose inflammatory conditions.

Immunoturbidimetry is a highly sensitive and specific method for measuring CRP levels and is widely used in clinical laboratories across the world. The technique involves mixing a sample of the patient's blood with a reagent that binds to CRP and then measuring the amount of light scattered by the resulting complex.

In terms of indication, the inflammatory diseases segment accounted for a significant global C-reactive protein testing market size in 2022. CRP test is commonly used to help diagnose and monitor inflammatory conditions such as rheumatoid arthritis, lupus, and inflammatory bowel disease. It can also be used to monitor the effectiveness of treatments for these conditions.

An increase in the prevalence and incidence of inflammatory diseases, such as inflammatory bowel disease (IBD), asthma, rheumatoid arthritis, and others, is anticipated to drive the inflammatory diseases segment during the forecast period.

The infectious diseases segment held the second-largest share of the global market in 2022. The rise in demand for CRP testing due to the rapid rise in the prevalence of infectious diseases globally and the increase in CRP testing rate for COVID-19 are propelling the segment.

Based on end-user, the independent diagnostic laboratories segment dominated the global market in 2022. The segment is projected to grow at a rapid pace during the forecast period due to an increase in the trend of home care diagnostics and testing. Independent diagnostic laboratories operate independently and can offer a wider range of services, such as direct-to-home testing, additional testing, and digital testing reports for the convenience of patients.

An increase in the number of independent diagnostic laboratories in the U.S. and Canada with advanced testing techniques and growing demand for direct-to-home testing services are anticipated to drive the independent diagnostic laboratories segment during the forecast period.

As per c-reactive protein testing market trends, North America accounted for the leading share of the global market in 2022. Point-of-care testing is becoming more popular in the region due to convenience and speed. POCT for CRP testing can provide rapid results, allowing for quicker diagnosis and treatment. Furthermore, advances in technology have made CRP testing more accurate, efficient, and affordable, which is expected to drive the market in North America during the forecast period.

The rise in the prevalence of inflammatory diseases, unhealthy lifestyles, and the development of new testing kits and solutions for early diagnosis of inflammatory conditions are anticipated to drive the market in North America during the forecast period. The strong presence of key players is another factor driving the market in the region.

The rise in the prevalence of chronic diseases, the increase in demand for early diagnosis & treatment, and the availability of advanced CRP testing technologies are likely to drive the CRP testing market in the Asia Pacific.

Leading players in the global market have adopted strategies such as the expansion of product portfolios and merger & acquisition in order to increase market presence and share. Agilent Technologies, Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Creative Diagnostics, DxGen Corp, CTK Biotech, Inc., Getein Biotech, Inc., Goldsite Diagnostics, Inc., OptiBio Co., Ltd., and Nanjing Vazyme Biotech Co., Ltd. are the prominent players in the global market.

The C-reactive protein testing market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 3.1 Bn |

|

Forecast (Value) in 2031 |

US$ 4.0 Bn |

|

Growth Rate (CAGR) |

2.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 3.1 Bn in 2022

It is projected to reach more than US$ 4.0 Bn by 2031

The CAGR is anticipated to be 2.9% from 2023 to 2031

Rise in prevalence of inflammatory diseases and increase in demand for point-of-care testing are driving the global market for C-reactive protein testing.

North America is projected to account for leading market share during the forecast period

Agilent Technologies, Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Creative Diagnostics, DxGen Corp, CTK Biotech, Inc., Getein Biotech, Inc., Goldsite Diagnostics, Inc., OptiBio Co., Ltd., and Nanjing Vazyme Biotech Co., Ltd. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global C-reactive Protein Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global C-reactive Protein Testing Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Overview of C-reactive Protein Testing Market

5.2. Key Product/ Brand Analysis

5.3. Pipeline Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global C-reactive Protein Testing Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Test Type, 2017–2031

6.3.1. Standard C-reactive Protein Test

6.3.2. High-sensitivity C-reactive Protein (hs-CRP) Test

6.4. Market Attractiveness Analysis, by Test Type

7. Global C-reactive Protein Testing Market Analysis and Forecast, by Type of Assay

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Type of Assay, 2017–2031

7.3.1. ELISA

7.3.2. Immunoturbidimetry

7.3.3. Immuno-chromatography

7.3.4. Immunofluorescence

7.3.5. Others

7.4. Market Attractiveness Analysis, by Type of Assay

8. Global C-reactive Protein Testing Market Analysis and Forecasts, by Indication

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Indication, 2017–2031

8.3.1. Heart Diseases

8.3.2. Inflammatory Diseases

8.3.3. Infectious Diseases

8.3.4. Others

8.4. Market Attractiveness Analysis, by Indication

9. Global C-reactive Protein Testing Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospital Associated Laboratories

9.3.2. Independent Diagnostic Laboratories

9.3.3. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global C-reactive Protein Testing Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America C-reactive Protein Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Test Type, 2017–2031

11.2.1. Standard C-reactive Protein Test

11.2.2. High-sensitivity C-reactive Protein (hs-CRP) Test

11.3. Market Value Forecast, by Type of Assay, 2017–2031

11.3.1. ELISA

11.3.2. Immunoturbidimetry

11.3.3. Immuno-chromatography

11.3.4. Immunofluorescence

11.3.5. Others

11.4. Market Value Forecast, by Indication, 2017–2031

11.4.1. Heart Diseases

11.4.2. Inflammatory Diseases

11.4.3. Infectious Diseases

11.4.4. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospital Associated Laboratories

11.5.2. Independent Diagnostic Laboratories

11.5.3. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Test Type

11.7.2. By Type of Assay

11.7.3. By Indication

11.7.4. By End-user

11.7.5. By Country

12. Europe C-reactive Protein Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Test Type, 2017–2031

12.2.1. Standard C-reactive Protein Test

12.2.2. High-sensitivity C-reactive Protein (hs-CRP) Test

12.3. Market Value Forecast, by Type of Assay, 2017–2031

12.3.1. ELISA

12.3.2. Immunoturbidimetry

12.3.3. Immuno-chromatography

12.3.4. Immunofluorescence

12.3.5. Others

12.4. Market Value Forecast, by Indication, 2017–2031

12.4.1. Heart Diseases

12.4.2. Inflammatory Diseases

12.4.3. Infectious Diseases

12.4.4. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospital Associated Laboratories

12.5.2. Independent Diagnostic Laboratories

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Test Type

12.7.2. By Type of Assay

12.7.3. By Indication

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific C-reactive Protein Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Test Type, 2017–2031

13.2.1. Standard C-reactive Protein Test

13.2.2. High-sensitivity C-reactive Protein (hs-CRP) Test

13.3. Market Value Forecast, by Type of Assay, 2017–2031

13.3.1. ELISA

13.3.2. Immunoturbidimetry

13.3.3. Immuno-chromatography

13.3.4. Immunofluorescence

13.3.5. Others

13.4. Market Value Forecast, by Indication, 2017–2031

13.4.1. Heart Diseases

13.4.2. Inflammatory Diseases

13.4.3. Infectious Diseases

13.4.4. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospital Associated Laboratories

13.5.2. Independent Diagnostic Laboratories

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Test Type

13.7.2. By Type of Assay

13.7.3. By Indication

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America C-reactive Protein Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Test Type, 2017–2031

14.2.1. Standard C-reactive Protein Test

14.2.2. High-sensitivity C-reactive Protein (hs-CRP) Test

14.3. Market Value Forecast, by Type of Assay, 2017–2031

14.3.1. ELISA

14.3.2. Immunoturbidimetry

14.3.3. Immuno-chromatography

14.3.4. Immunofluorescence

14.3.5. Others

14.4. Market Value Forecast, by Indication, 2017–2031

14.4.1. Heart Diseases

14.4.2. Inflammatory Diseases

14.4.3. Infectious Diseases

14.4.4. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospital Associated Laboratories

14.5.2. Independent Diagnostic Laboratories

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Test Type

14.7.2. By Type of Assay

14.7.3. By Indication

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa C-reactive Protein Testing Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Test Type, 2017–2031

15.2.1. Standard C-reactive Protein Test

15.2.2. High-sensitivity C-reactive Protein (hs-CRP) Test

15.3. Market Value Forecast, by Type of Assay, 2017–2031

15.3.1. ELISA

15.3.2. Immunoturbidimetry

15.3.3. Immuno-chromatography

15.3.4. Immunofluorescence

15.3.5. Others

15.4. Market Value Forecast, by Indication, 2017–2031

15.4.1. Heart Diseases

15.4.2. Inflammatory Diseases

15.4.3. Infectious Diseases

15.4.4. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospital Associated Laboratories

15.5.2. Independent Diagnostic Laboratories

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Test Type

15.7.2. By Type of Assay

15.7.3. By Indication

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Agilent Technologies, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Laboratory Corporation of America Holdings

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Thermo Fisher Scientific

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Abbott Laboratories

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. F. Hoffmann-La Roche Ltd.

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Creative Diagnostics

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. DxGen Corp

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. CTK Biotech, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Getein Biotech, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Goldsite Diagnostics, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. OptiBio Co., Ltd.

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. Nanjing Vazyme Biotech Co., Ltd.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

List of Tables

Table 01: Global C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 02: Global C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Type of Assay, 2017‒2031

Table 03: Global C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 04: Global C-reactive Protein Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 08: North America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Type of Assay, 2017‒2031

Table 09: North America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 10: North America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 13: Europe C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Type of Assay, 2017‒2031

Table 14: Europe C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Europe C-reactive Protein Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 18: Asia Pacific C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Type of Assay, 2017‒2031

Table 19: Asia Pacific C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 20: Asia Pacific C-reactive Protein Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 23: Latin America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Type of Assay, 2017‒2031

Table 24: Latin America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 25: Latin America C-reactive Protein Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 28: Middle East & Africa C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Type of Assay, 2017‒2031

Table 29: Middle East & Africa C-reactive Protein Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 30: Middle East & Africa C-reactive Protein Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global C-reactive Protein Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global C-reactive Protein Testing Market Value Share, by Test Type, 2022

Figure 03: Global C-reactive Protein Testing Market Value Share, by Types of Assay, 2022

Figure 04: Global C-reactive Protein Testing Market Value Share, by Indication, 2022

Figure 05: Global C-reactive Protein Testing Market Value Share, by End-user, 2022

Figure 06: Global C-reactive Protein Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 07: Global C-reactive Protein Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 08: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Standard C-reactive Protein Test , 2017–2031

Figure 09: Global C-reactive Protein Testing Market Revenue (US$ Mn), by High-sensitivity C-reactive Protein (hs-CRP) Test, 2017–2031

Figure 10: Global C-reactive Protein Testing Market Value Share Analysis, by Type of Assay, 2022 and 2031

Figure 11: Global C-reactive Protein Testing Market Attractiveness Analysis, by Type of Assay, 2023–2031

Figure 12: Global C-reactive Protein Testing Market Value (US$ Mn), by ELISA, 2017‒2031

Figure 13: Global C-reactive Protein Testing Market Value (US$ Mn), by Immunoturbidimetry, 2017‒2031

Figure 14: Global C-reactive Protein Testing Market Value (US$ Mn), by Irreversible Immuno-chromatography, 2017‒2031

Figure 15: Global C-reactive Protein Testing Market Value (US$ Mn), by Immunofluorescence, 2017‒2031

Figure 16: Global C-reactive Protein Testing Market Value (US$ Mn), by Others, 2017‒2031

Figure 17: Global C-reactive Protein Testing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 18: Global C-reactive Protein Testing Market Attractiveness Analysis, Indication, 2023–2031

Figure 19: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Heart Diseases, 2017–2031

Figure 20: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Inflammatory Diseases, 2017–2031

Figure 21: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Infectious Diseases, 2017–2031

Figure 22: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Others, 2017–2031

Figure 23: Global C-reactive Protein Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: Global C-reactive Protein Testing Market Attractiveness Analysis, by End-user, 2023–2031

Figure 25: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Hospital Associated Laboratories, 2017–2031

Figure 26: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Independent Diagnostic Laboratories, 2017–2031

Figure 27: Global C-reactive Protein Testing Market Revenue (US$ Mn), by Others, 2017–2031

Figure 28: Global C-reactive Protein Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global C-reactive Protein Testing Market Attractiveness Analysis, by Region, 2023–2031

Figure 30: North America C-reactive Protein Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 31: North America C-reactive Protein Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: North America C-reactive Protein Testing Market Attractiveness Analysis, by Country, 2023–2031

Figure 33: North America C-reactive Protein Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 34: North America C-reactive Protein Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 35: North America C-reactive Protein Testing Market Value Share Analysis, by Type of Assay, 2022 and 2031

Figure 36: North America C-reactive Protein Testing Market Attractiveness Analysis, by Type of Assay, 2023–2031

Figure 37: North America C-reactive Protein Testing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 38: North America C-reactive Protein Testing Market Attractiveness Analysis, Indication, 2023–2031

Figure 39: North America C-reactive Protein Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: North America C-reactive Protein Testing Market Attractiveness Analysis, by End-user, 2023–2031

Figure 41: Europe C-reactive Protein Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 42: Europe C-reactive Protein Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 43: Europe C-reactive Protein Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Europe C-reactive Protein Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 45: Europe C-reactive Protein Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 46: Europe C-reactive Protein Testing Market Value Share Analysis, by Type of Assay, 2022 and 2031

Figure 47: Europe C-reactive Protein Testing Market Attractiveness Analysis, by Type of Assay, 2023–2031

Figure 48: Europe C-reactive Protein Testing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 49: Europe C-reactive Protein Testing Market Attractiveness Analysis, Indication, 2023–2031

Figure 50: Europe C-reactive Protein Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Europe C-reactive Protein Testing Market Attractiveness Analysis, by End-user, 2023–2031

Figure 52: Asia Pacific C-reactive Protein Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 53: Asia Pacific C-reactive Protein Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Asia Pacific C-reactive Protein Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 55: Asia Pacific C-reactive Protein Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 56: Asia Pacific C-reactive Protein Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 57: Asia Pacific C-reactive Protein Testing Market Value Share Analysis, by Type of Assay, 2022 and 2031

Figure 58: Asia Pacific C-reactive Protein Testing Market Attractiveness Analysis, by Type of Assay, 2023–2031

Figure 59: Asia Pacific C-reactive Protein Testing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 60: Asia Pacific C-reactive Protein Testing Market Attractiveness Analysis, Indication, 2023–2031

Figure 61: Asia Pacific C-reactive Protein Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Asia Pacific C-reactive Protein Testing Market Attractiveness Analysis, by End-user, 2023–2031

Figure 63: Latin America C-reactive Protein Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Latin America C-reactive Protein Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 65: Latin America C-reactive Protein Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 66: Latin America C-reactive Protein Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 67: Latin America C-reactive Protein Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 68: Latin America C-reactive Protein Testing Market Value Share Analysis, by Type of Assay, 2022 and 2031

Figure 69: Latin America C-reactive Protein Testing Market Attractiveness Analysis, by Type of Assay, 2023–2031

Figure 70: Latin America C-reactive Protein Testing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 71: Latin America C-reactive Protein Testing Market Attractiveness Analysis, Indication, 2023–2031

Figure 72: Latin America C-reactive Protein Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Latin America C-reactive Protein Testing Market Attractiveness Analysis, by End-user, 2023–2031

Figure 74: Middle East & Africa C-reactive Protein Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 75: Middle East & Africa C-reactive Protein Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 76: Middle East & Africa C-reactive Protein Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 77: Middle East & Africa C-reactive Protein Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 78: Middle East & Africa C-reactive Protein Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 79: Middle East & Africa C-reactive Protein Testing Market Value Share Analysis, by Type of Assay, 2022 and 2031

Figure 80: Middle East & Africa C-reactive Protein Testing Market Attractiveness Analysis, by Type of Assay 2023–2031

Figure 81: Middle East & Africa C-reactive Protein Testing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 82: Middle East & Africa C-reactive Protein Testing Market Attractiveness Analysis, by Indication, 2023–2031

Figure 83: Middle East & Africa C-reactive Protein Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 84: Middle East & Africa C-reactive Protein Testing Market Attractiveness Analysis, by End-user, 2023–2031

Figure 85: Global C-reactive Protein Testing Market Share Analysis By Company (2022)