Analysts’ Viewpoint

High adoption of electric buses as cleaner and greener alternative is driving the global bus chassis market. Increase in government funding to drive the usage of electric buses is expected to propel market expansion. Embracing sustainability through the development of hybrid and electric bus chassis would allow players to cater to the growing demand for eco-friendly mobility solutions.

Technological innovation to enhance fuel efficiency, integrate smart features, and improve passenger safety & comfort offers lucrative opportunities to market players. Bus chassis market manufacturers prioritize research & development activities to stay at the forefront of technological advancements. This involves investing in new materials, manufacturing processes, and design methodologies to improve the performance, durability, and efficiency of bus chassis.

Bus chassis refers to the framework or structural foundation of a bus onto which various components are mounted. It serves as the base structure that supports the body, engine, transmission, suspension, and other essential systems of a bus. The chassis provides the necessary strength, stability, and durability required to carry passengers and withstand the rigors of road travel.

Bus chassis are typically designed to accommodate different types of bus bodies, such as city buses, intercity buses, coach buses, school buses, or specialized buses for specific purposes such as airport shuttles or tourist sightseeing. The chassis itself does not include the bus body, instead, it forms the underlying structure that holds the bus body in place.

The global industry is driven by factors such as increase in urbanization, rise in public transportation demands, and need for reliable and efficient bus transportation solutions.

Increase in emphasis on sustainable transportation solutions leads to growing demand for hybrid and electric bus chassis to reduce emissions and promote eco-friendly mobility, thus driving the bus chassis market demand. Expansion of public transportation infrastructure in developing regions and need for modernizing aging bus fleets positively influence market dynamics.

Demand for electric buses has increased significantly in the past few years, which in turn fuels market statistics. Electric buses offer a cleaner and greener alternative to traditional diesel buses, as they produce zero tailpipe emissions. This supports initiatives such as environmental sustainability and reduction in carbon emissions.

Governments and transportation authorities across the globe are increasingly promoting the adoption of electric buses as part of their efforts to combat air pollution and mitigate climate change. This has resulted in supportive policies, incentives, and funding programs that encourage the deployment of electric buses, thereby driving the demand for electric bus chassis. For instance, the electric bus sales increased by over 40% in 2022 compared to the previous years. This rise is specifically in the U.S., Europe, and China.

Advancements in battery technology have significantly improved the performance and range of electric buses. Modern electric bus chassis can accommodate large battery packs that provide long driving ranges and fast charging times. This has addressed the concern of limited range anxiety and enabled electric buses to operate on longer routes without compromising their operational efficiency.

Transit agencies and operators are more inclined to invest in electric bus chassis as a viable and sustainable solution for their transportation needs. Continuous innovation and development of battery technology are expected to improve electric bus chassis in the next few years.

Governments across the world are increasingly recognizing the importance of sustainable and efficient public transportation systems. As part of their efforts to reduce carbon emissions, improve air quality, and promote eco-friendly mobility, several governments are making significant investments in electric buses. These investments aim to maintain an easy and efficient public commute by providing clean and reliable transportation options.

Government investments in electric buses often come in the form of financial incentives, subsidies, and grants. These initiatives help transit agencies and operators offset the high upfront cost of electric buses and make them more financially viable. By providing financial support, governments encourage the adoption of electric buses, which in turn leads to significant market expansion.

Governments are investing in the development of charging infrastructure for electric buses. They recognize that a robust charging network is essential to support the widespread adoption of electric buses and ensure their operational efficiency.

Governments are establishing charging stations at strategic locations, such as bus depots, transit hubs, and major transportation corridors. This infrastructure investment aims to eliminate range anxiety for electric buses, enabling them to operate smoothly and seamlessly throughout their routes. By facilitating convenient charging options, governments contribute in making commute for citizens who rely on public transportation easy.

The global industry has witnessed significant advancements in manufacturing techniques, materials, and technology. Monocoque chassis benefit from these advancements, with innovations in lightweight materials such as high-strength steel, aluminum alloys, and composite materials. These advancements improve the strength-to-weight ratio of monocoque chassis, further enhancing their fuel efficiency and performance.

Monocoque chassis designs have significantly improved, and their popularity has increased, leading to bus chassis industry growth. Additionally, advancements in computer-aided design (CAD) and engineering simulations enable precise optimization of monocoque structures, ensuring optimal strength and safety. As the industry continues to prioritize fuel efficiency, safety, and aesthetics, monocoque chassis are expected to have a high demand, thus boosting the bus chassis market share.

The market in Asia Pacific has experienced significant growth in the past few years. The trend is expected to continue during the forecast period. Rapid urbanization and growth in demand for public transportation are driving the need for efficient bus transportation systems.

Robust economic growth in the region has led to increase in consumer spending and surge in demand for transportation services, prompting bus operators and transportation companies to expand their fleets and invest in bus chassis.

Government initiatives promoting sustainable transportation, such as the adoption of electric buses and supportive policies, are driving the electric and hybrid bus chassis demand in the region. Technological advancements and ongoing infrastructure investments by governments also contribute to rise in bus chassis market size in Asia Pacific. With these bus chassis market insights, the regional industry is poised for continued expansion, as the demand for efficient and sustainable transportation solutions increase.

The global bus chassis market is highly competitive, with the presence of several key players. Market players adopt various strategies to gain a competitive edge and capture a large share of the industry.

According to bus chassis market analysis, players adopt strategies focused on sustainability, technological innovation, customization, regional focus, aftersales support, collaborations, and market diversification. Customization and flexibility in chassis offerings would enable players to cater to diverse customer needs and build strong relationships with bus bodybuilders and operators. Focus on regional strategies would help players understand and meet specific demands, while comprehensive aftersales support would ensure customer satisfaction.

Collaborations and partnerships across the industry value chain is likely to foster innovation and expand market reach. Exploring emerging markets and diversifying market presence is likely to contribute to sustained growth and reduced dependency on specific regions or segments.

Strong focus on customer-centric approach is essential. Understanding and anticipating customer needs, providing excellent pre- and post-sales support, and building long-term relationships would foster customer loyalty and drive business growth.

Some of the vendors in bus chassis market across the globe are Alexander Dennis Limited, Ashok Leyland Limited, BYD Company Limited, Daimler AG, Gillig LLC, Hino Motors, Ltd., Iveco S.p.A, King Long United Automotive Industry Co., Ltd., MAN Truck & Bus AG, New Flyer Industries, Inc., Scania AB, Solaris Bus & Coach S.A., Volvo Group, Yutong Group, and Zhongtong Bus Holding Co., Ltd.

Each of these players has been profiled in the bus chassis market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 1.8 Bn |

|

Market Forecast Value in 2031 |

US$ 2.3 Bn |

|

Growth Rate (CAGR) |

3.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

For Value (US$ Bn) & for Volume (Units) |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

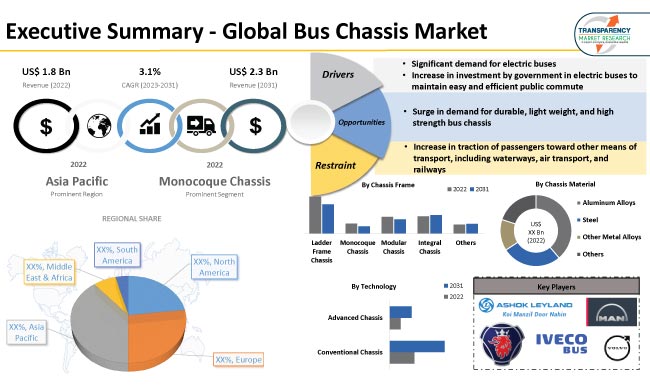

The global industry was valued at US$ 1.8 Bn in 2022

It is expected to expand at a CAGR of 3.1% from 2023 to 2031

The market is estimated to reach US$ 2.3 Bn in 2031

Significant demand for electric buses and increase in investment by governments in electric buses to maintain easy and efficient public commute are propelling the market

The monocoque chassis segment accounts for majority share

Asia Pacific is anticipated to be the highly lucrative region for vendors

Alexander Dennis Limited, Ashok Leyland Limited, BYD Company Limited, Daimler AG, Gillig LLC, Hino Motors, Ltd., Iveco S.p.A, King Long United Automotive Industry Co., Ltd., MAN Truck & Bus AG, New Flyer Industries Inc., Scania AB, Solaris Bus & Coach S.A., Volvo Group, Yutong Group, and Zhongtong Bus Holding are the prominent players in the market.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value (US$ Bn), 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage/Taxonomy

2.2. Market Definition/Scope/Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Bus Chassis Market, By Bus Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Bus Type

3.2.1. Coach/Motor Coach

3.2.2. School Bus

3.2.3. Shuttle Bus

3.2.4. Minibus

3.2.5. Mini Coach

3.2.6. Double-decker Bus

3.2.7. Low-floor Bus

3.2.8. Articulated Bus

3.2.9. Others

4. Global Bus Chassis Market, By Chassis Frame

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Frame

4.2.1. Ladder Frame Chassis

4.2.2. Monocoque Chassis

4.2.2.1. Semi-monocoque Chassis

4.2.2.2. Fully Monocoque Chassis

4.2.3. Modular Chassis

4.2.4. Integral Chassis

4.2.5. Others

5. Global Bus Chassis Market, By Chassis Material

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Material

5.2.1. Aluminum Alloys

5.2.2. Steel

5.2.2.1. Mild Steel

5.2.2.2. HSS Steel

5.2.2.3. Others

5.2.3. Other Metal Alloys

5.2.4. Others

6. Global Bus Chassis Market, By Technology

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Technology

6.2.1. Conventional Chassis

6.2.1.1. Mechanical Chassis

6.2.1.2. Pneumatic Chassis

6.2.1.3. Hydraulic Chassis

6.2.2. Advanced Chassis

6.2.2.1. Electronic Control Unit (ECU) Integrated Chassis

6.2.2.2. Telematics-enabled Chassis

6.2.2.3. Driver Assistance Systems Equipped Chassis

7. Global Bus Chassis Market, By Bus Axle

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Bus Axle

7.2.1. Single Axle

7.2.2. Multi-axle

8. Global Bus Chassis Market, By End-use

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By End-use

8.2.1. Public Transportation

8.2.1.1. City Transit Systems

8.2.1.2. State and Interstate Transit Systems

8.2.2. Private Transportation

8.2.2.1. Corporate Transport

8.2.2.2. School/College Buses

8.2.2.3. Tourism and Travel Companies

8.2.2.4. Others

9. Global Bus Chassis Market, By Seating Capacity

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Seating Capacity

9.2.1. Small Bus (Less than 20 Seats)

9.2.2. Medium Bus (20 Seats - 40 Seats)

9.2.3. Large Bus (More than 40 seats)

10. Global Bus Chassis Market, By Propulsion

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Propulsion

10.2.1. Diesel

10.2.2. Electric

10.2.3. Hybrid

11. Global Bus Chassis Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Bus Chassis Market Size & Forecast, 2017-2031, By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Bus Chassis Market

12.1. Market Snapshot

12.2. North America Bus Chassis Market Size & Forecast, 2017-2031, By Bus Type

12.2.1. Coach/Motor Coach

12.2.2. School Bus

12.2.3. Shuttle Bus

12.2.4. Minibus

12.2.5. Mini Coach

12.2.6. Double-decker Bus

12.2.7. Low-floor Bus

12.2.8. Articulated Bus

12.2.9. Others

12.3. North America Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Frame

12.3.1. Ladder Frame Chassis

12.3.2. Monocoque Chassis

12.3.2.1. Semi-monocoque Chassis

12.3.2.2. Fully Monocoque Chassis

12.3.3. Modular Chassis

12.3.4. Integral Chassis

12.3.5. Others

12.4. North America Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Material

12.4.1. Aluminum Alloys

12.4.2. Steel

12.4.2.1. Mild Steel

12.4.2.2. HSS Steel

12.4.2.3. Others

12.4.3. Other Metal Alloys

12.4.4. Others

12.5. North America Bus Chassis Market Size & Forecast, 2017-2031, By Technology

12.5.1. Conventional Chassis

12.5.1.1. Mechanical Chassis

12.5.1.2. Pneumatic Chassis

12.5.1.3. Hydraulic Chassis

12.5.2. Advanced Chassis

12.5.2.1. Electronic Control Unit (ECU) Integrated Chassis

12.5.2.2. Telematics-enabled Chassis

12.5.2.3. Driver Assistance Systems Equipped Chassis

12.6. North America Bus Chassis Market Size & Forecast, 2017-2031, By Bus Axle

12.6.1. Single Axle

12.6.2. Multi-axle

12.7. North America Bus Chassis Market Size & Forecast, 2017-2031, By End-use

12.7.1. Public Transportation

12.7.1.1. City Transit Systems

12.7.1.2. State and Interstate Transit Systems

12.7.2. Private Transportation

12.7.2.1. Corporate Transport

12.7.2.2. School/College Buses

12.7.2.3. Tourism and Travel Companies

12.7.2.4. Others

12.8. North America Bus Chassis Market Size & Forecast, 2017-2031, By Seating Capacity

12.8.1. Small Bus (Less than 20 Seats)

12.8.2. Medium Bus (20 Seats - 40 Seats)

12.8.3. Large Bus (More than 40 seats)

12.9. North America Bus Chassis Market Size & Forecast, 2017-2031, By Propulsion

12.9.1. Diesel

12.9.2. Electric

12.9.3. Hybrid

12.10. North America Bus Chassis Market Size & Forecast, 2017-2031, By Country/Sub-region

12.10.1. U.S.

12.10.2. Canada

12.10.3. Mexico

13. Europe Bus Chassis Market

13.1. Market Snapshot

13.2. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Bus Type

13.2.1. Coach/Motor Coach

13.2.2. School Bus

13.2.3. Shuttle Bus

13.2.4. Minibus

13.2.5. Mini Coach

13.2.6. Double-decker Bus

13.2.7. Low-floor Bus

13.2.8. Articulated Bus

13.2.9. Others

13.3. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Frame

13.3.1. Ladder Frame Chassis

13.3.2. Monocoque Chassis

13.3.2.1. Semi-monocoque Chassis

13.3.2.2. Fully Monocoque Chassis

13.3.3. Modular Chassis

13.3.4. Integral Chassis

13.3.5. Others

13.4. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Material

13.4.1. Aluminum Alloys

13.4.2. Steel

13.4.2.1. Mild Steel

13.4.2.2. HSS Steel

13.4.2.3. Others

13.4.3. Other Metal Alloys

13.4.4. Others

13.5. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Technology

13.5.1. Conventional Chassis

13.5.1.1. Mechanical Chassis

13.5.1.2. Pneumatic Chassis

13.5.1.3. Hydraulic Chassis

13.5.2. Advanced Chassis

13.5.2.1. Electronic Control Unit (ECU) Integrated Chassis

13.5.2.2. Telematics-enabled Chassis

13.5.2.3. Driver Assistance Systems Equipped Chassis

13.6. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Bus Axle

13.6.1. Single Axle

13.6.2. Multi-axle

13.7. Europe Bus Chassis Market Size & Forecast, 2017-2031, By End-use

13.7.1. Public Transportation

13.7.1.1. City Transit Systems

13.7.1.2. State and Interstate Transit Systems

13.7.2. Private Transportation

13.7.2.1. Corporate Transport

13.7.2.2. School/College Buses

13.7.2.3. Tourism and Travel Companies

13.7.2.4. Others

13.8. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Seating Capacity

13.8.1. Small Bus (Less than 20 Seats)

13.8.2. Medium Bus (20 Seats - 40 Seats)

13.8.3. Large Bus (More than 40 seats)

13.9. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Propulsion

13.9.1. Diesel

13.9.2. Electric

13.9.3. Hybrid

13.10. Europe Bus Chassis Market Size & Forecast, 2017-2031, By Country/Sub-region

13.10.1. Germany

13.10.2. U.K.

13.10.3. France

13.10.4. Italy

13.10.5. Spain

13.10.6. Nordic Countries

13.10.7. Russia & CIS

13.10.8. Rest of Europe

14. Asia Pacific Bus Chassis Market

14.1. Market Snapshot

14.2. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Bus Type

14.2.1. Coach/Motor Coach

14.2.2. School Bus

14.2.3. Shuttle Bus

14.2.4. Minibus

14.2.5. Mini Coach

14.2.6. Double-decker Bus

14.2.7. Low-floor Bus

14.2.8. Articulated Bus

14.2.9. Others

14.3. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Frame

14.3.1. Ladder Frame Chassis

14.3.2. Monocoque Chassis

14.3.2.1. Semi-monocoque Chassis

14.3.2.2. Fully Monocoque Chassis

14.3.3. Modular Chassis

14.3.4. Integral Chassis

14.3.5. Others

14.4. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Material

14.4.1. Aluminum Alloys

14.4.2. Steel

14.4.2.1. Mild Steel

14.4.2.2. HSS Steel

14.4.2.3. Others

14.4.3. Other Metal Alloys

14.4.4. Others

14.5. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Technology

14.5.1. Conventional Chassis

14.5.1.1. Mechanical Chassis

14.5.1.2. Pneumatic Chassis

14.5.1.3. Hydraulic Chassis

14.5.2. Advanced Chassis

14.5.2.1. Electronic Control Unit (ECU) Integrated Chassis

14.5.2.2. Telematics-enabled Chassis

14.5.2.3. Driver Assistance Systems Equipped Chassis

14.6. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Bus Axle

14.6.1. Single Axle

14.6.2. Multi-axle

14.7. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By End-use

14.7.1. Public Transportation

14.7.1.1. City Transit Systems

14.7.1.2. State and Interstate Transit Systems

14.7.2. Private Transportation

14.7.2.1. Corporate Transport

14.7.2.2. School/College Buses

14.7.2.3. Tourism and Travel Companies

14.7.2.4. Others

14.8. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Seating Capacity

14.8.1. Small Bus (Less than 20 Seats)

14.8.2. Medium Bus (20 Seats - 40 Seats)

14.8.3. Large Bus (More than 40 seats)

14.9. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Propulsion

14.9.1. Diesel

14.9.2. Electric

14.9.3. Hybrid

14.10. Asia Pacific Bus Chassis Market Size & Forecast, 2017-2031, By Country/Sub-region

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. ASEAN Countries

14.10.5. South Korea

14.10.6. ANZ

14.10.7. Rest of Asia Pacific

15. Middle East & Africa Bus Chassis Market

15.1. Market Snapshot

15.2. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Bus Type

15.2.1. Coach/Motor Coach

15.2.2. School Bus

15.2.3. Shuttle Bus

15.2.4. Minibus

15.2.5. Mini Coach

15.2.6. Double-decker Bus

15.2.7. Low-floor Bus

15.2.8. Articulated Bus

15.2.9. Others

15.3. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Frame

15.3.1. Ladder Frame Chassis

15.3.2. Monocoque Chassis

15.3.2.1. Semi-monocoque Chassis

15.3.2.2. Fully Monocoque Chassis

15.3.3. Modular Chassis

15.3.4. Integral Chassis

15.3.5. Others

15.4. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Material

15.4.1. Aluminum Alloys

15.4.2. Steel

15.4.2.1. Mild Steel

15.4.2.2. HSS Steel

15.4.2.3. Others

15.4.3. Other Metal Alloys

15.4.4. Others

15.5. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Technology

15.5.1. Conventional Chassis

15.5.1.1. Mechanical Chassis

15.5.1.2. Pneumatic Chassis

15.5.1.3. Hydraulic Chassis

15.5.2. Advanced Chassis

15.5.2.1. Electronic Control Unit (ECU) Integrated Chassis

15.5.2.2. Telematics-enabled Chassis

15.5.2.3. Driver Assistance Systems Equipped Chassis

15.6. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Bus Axle

15.6.1. Single Axle

15.6.2. Multi-axle

15.7. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By End-use

15.7.1. Public Transportation

15.7.1.1. City Transit Systems

15.7.1.2. State and Interstate Transit Systems

15.7.2. Private Transportation

15.7.2.1. Corporate Transport

15.7.2.2. School/College Buses

15.7.2.3. Tourism and Travel Companies

15.7.2.4. Others

15.8. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Seating Capacity

15.8.1. Small Bus (Less than 20 Seats)

15.8.2. Medium Bus (20 Seats - 40 Seats)

15.8.3. Large Bus (More than 40 seats)

15.9. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Propulsion

15.9.1. Diesel

15.9.2. Electric

15.9.3. Hybrid

15.10. Middle East & Africa Bus Chassis Market Size & Forecast, 2017-2031, By Country/Sub-region

15.10.1. GCC

15.10.2. South Africa

15.10.3. Turkey

15.10.4. Rest of Middle East & Africa

16. South America Bus Chassis Market

16.1. Market Snapshot

16.2. South America Bus Chassis Market Size & Forecast, 2017-2031, By Bus Type

16.2.1. Coach/Motor Coach

16.2.2. School Bus

16.2.3. Shuttle Bus

16.2.4. Minibus

16.2.5. Mini Coach

16.2.6. Double-decker Bus

16.2.7. Low-floor Bus

16.2.8. Articulated Bus

16.2.9. Others

16.3. South America Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Frame

16.3.1. Ladder Frame Chassis

16.3.2. Monocoque Chassis

16.3.2.1. Semi-monocoque Chassis

16.3.2.2. Fully Monocoque Chassis

16.3.3. Modular Chassis

16.3.4. Integral Chassis

16.3.5. Others

16.4. South America Bus Chassis Market Size & Forecast, 2017-2031, By Chassis Material

16.4.1. Aluminum Alloys

16.4.2. Steel

16.4.2.1. Mild Steel

16.4.2.2. HSS Steel

16.4.2.3. Others

16.4.3. Other Metal Alloys

16.4.4. Others

16.5. South America Bus Chassis Market Size & Forecast, 2017-2031, By Technology

16.5.1. Conventional Chassis

16.5.1.1. Mechanical Chassis

16.5.1.2. Pneumatic Chassis

16.5.1.3. Hydraulic Chassis

16.5.2. Advanced Chassis

16.5.2.1. Electronic Control Unit (ECU) Integrated Chassis

16.5.2.2. Telematics-enabled Chassis

16.5.2.3. Driver Assistance Systems Equipped Chassis

16.6. South America Bus Chassis Market Size & Forecast, 2017-2031, By Bus Axle

16.6.1. Single Axle

16.6.2. Multi-axle

16.7. South America Bus Chassis Market Size & Forecast, 2017-2031, By End-use

16.7.1. Public Transportation

16.7.1.1. City Transit Systems

16.7.1.2. State and Interstate Transit Systems

16.7.2. Private Transportation

16.7.2.1. Corporate Transport

16.7.2.2. School/College Buses

16.7.2.3. Tourism and Travel Companies

16.7.2.4. Others

16.8. South America Bus Chassis Market Size & Forecast, 2017-2031, By Seating Capacity

16.8.1. Small Bus (Less than 20 Seats)

16.8.2. Medium Bus (20 Seats - 40 Seats)

16.8.3. Large Bus (More than 40 seats)

16.9. South America Bus Chassis Market Size & Forecast, 2017-2031, By Propulsion

16.9.1. Diesel

16.9.2. Electric

16.9.3. Hybrid

16.10. South America Bus Chassis Market Size & Forecast, 2017-2031, By Country/Sub-region

16.10.1. Brazil

16.10.2. Argentina

16.10.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/Brand Share Analysis, 2022

17.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/Key Players

18.1. Alexander Dennis Limited

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Ashok Leyland Limited

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. BYD Company Limited

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. Daimler AG

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. Gillig LLC

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Hino Motors, Ltd.

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Iveco S.p.A

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. King Long United Automotive Industry Co., Ltd.

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. MAN Truck & Bus AG

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. New Flyer Industries Inc.

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Scania AB

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Solaris Bus & Coach S.A.

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. Volvo Group

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. Yutong Group

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. Zhongtong Bus Holding Co., Ltd.

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Other Key Players

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

List of Tables

Table 1: Global Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Table 2: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Table 3: Global Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Table 4: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Table 5: Global Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 6: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Table 7: Global Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Table 8: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 9: Global Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Table 10: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Table 11: Global Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Table 12: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 13: Global Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Table 14: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Table 15: Global Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 16: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 17: Global Bus Chassis Market Volume (Units) Forecast, by Region, 2017-2031

Table 18: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 19: North America Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Table 20: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Table 21: North America Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Table 22: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Table 23: North America Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 24: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Table 25: North America Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Table 26: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 27: North America Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Table 28: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Table 29: North America Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Table 30: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 31: North America Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Table 32: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Table 33: North America Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 34: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 35: North America Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Table 36: North America Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Table 37: Europe Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Table 38: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Table 39: Europe Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Table 40: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Table 41: Europe Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 42: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Table 43: Europe Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Table 44: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 45: Europe Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Table 46: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Table 47: Europe Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Table 48: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 49: Europe Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Table 50: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Table 51: Europe Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 52: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 53: Europe Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Table 54: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Table 55: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Table 56: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Table 57: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Table 58: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Table 59: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 60: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Table 61: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Table 62: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 63: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Table 64: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Table 65: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Table 66: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 67: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Table 68: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Table 69: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 70: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 71: Asia Pacific Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Table 72: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Table 73: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Table 74: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Table 75: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Table 76: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Table 77: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 78: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Table 79: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Table 80: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 81: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Table 82: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Table 83: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Table 84: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 85: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Table 86: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Table 87: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 88: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 89: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Table 90: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Table 91: South America Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Table 92: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Table 93: South America Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Table 94: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Table 95: South America Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 96: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Table 97: South America Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Table 98: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 99: South America Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Table 100: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Table 101: South America Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Table 102: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Table 103: South America Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Table 104: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Table 105: South America Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 106: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 107: South America Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Table 108: South America Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

List of Figures

Figure 1: Global Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Figure 2: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Figure 3: Global Bus Chassis Market, Incremental Opportunity, by Bus Type, Value (US$ Bn), 2023-2031

Figure 4: Global Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Figure 5: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Figure 6: Global Bus Chassis Market, Incremental Opportunity, by Chassis Frame, Value (US$ Bn), 2023-2031

Figure 7: Global Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 8: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 9: Global Bus Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2023-2031

Figure 10: Global Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 11: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 12: Global Bus Chassis Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 13: Global Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Figure 14: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Figure 15: Global Bus Chassis Market, Incremental Opportunity, by Bus Axle, Value (US$ Bn), 2023-2031

Figure 16: Global Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Figure 17: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 18: Global Bus Chassis Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 19: Global Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Figure 20: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Figure 21: Global Bus Chassis Market, Incremental Opportunity, by Seating Capacity, Value (US$ Bn), 2023-2031

Figure 22: Global Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 23: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 24: Global Bus Chassis Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 25: Global Bus Chassis Market Volume (Units) Forecast, by Region, 2017-2031

Figure 26: Global Bus Chassis Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 27: Global Bus Chassis Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 28: North America Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Figure 29: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Figure 30: North America Bus Chassis Market, Incremental Opportunity, by Bus Type, Value (US$ Bn), 2023-2031

Figure 31: North America Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Figure 32: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Figure 33: North America Bus Chassis Market, Incremental Opportunity, by Chassis Frame, Value (US$ Bn), 2023-2031

Figure 34: North America Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 35: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 36: North America Bus Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2023-2031

Figure 37: North America Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 38: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 39: North America Bus Chassis Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 40: North America Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Figure 41: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Figure 42: North America Bus Chassis Market, Incremental Opportunity, by Bus Axle, Value (US$ Bn), 2023-2031

Figure 43: North America Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Figure 44: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 45: North America Bus Chassis Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 46: North America Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Figure 47: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Figure 48: North America Bus Chassis Market, Incremental Opportunity, by Seating Capacity, Value (US$ Bn), 2023-2031

Figure 49: North America Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 50: North America Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 51: North America Bus Chassis Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 52: North America Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Figure 53: North America Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Figure 54: North America Bus Chassis Market, Incremental Opportunity, By Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 55: Europe Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Figure 56: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Figure 57: Europe Bus Chassis Market, Incremental Opportunity, by Bus Type, Value (US$ Bn), 2023-2031

Figure 58: Europe Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Figure 59: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Figure 60: Europe Bus Chassis Market, Incremental Opportunity, by Chassis Frame, Value (US$ Bn), 2023-2031

Figure 61: Europe Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 62: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 63: Europe Bus Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2023-2031

Figure 64: Europe Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 65: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 66: Europe Bus Chassis Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 67: Europe Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Figure 68: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Figure 69: Europe Bus Chassis Market, Incremental Opportunity, by Bus Axle, Value (US$ Bn), 2023-2031

Figure 70: Europe Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Figure 71: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 72: Europe Bus Chassis Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 73: Europe Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Figure 74: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Figure 75: Europe Bus Chassis Market, Incremental Opportunity, by Seating Capacity, Value (US$ Bn), 2023-2031

Figure 76: Europe Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 77: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 78: Europe Bus Chassis Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 79: Europe Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Figure 80: Europe Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Figure 81: Europe Bus Chassis Market, Incremental Opportunity, By Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 82: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Figure 83: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Figure 84: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Bus Type, Value (US$ Bn), 2023-2031

Figure 85: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Figure 86: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Figure 87: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Chassis Frame, Value (US$ Bn), 2023-2031

Figure 88: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 89: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 90: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2023-2031

Figure 91: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 92: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 93: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 94: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Figure 95: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Figure 96: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Bus Axle, Value (US$ Bn), 2023-2031

Figure 97: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Figure 98: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 99: Asia Pacific Bus Chassis Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 100: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Figure 101: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Figure 102: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Seating Capacity, Value (US$ Bn), 2023-2031

Figure 103: Asia Pacific Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 104: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 105: Asia Pacific Bus Chassis Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 106: Asia Pacific Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Figure 107: Asia Pacific Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Figure 108: Asia Pacific Bus Chassis Market, Incremental Opportunity, By Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 109: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Figure 110: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Figure 111: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Bus Type, Value (US$ Bn), 2023-2031

Figure 112: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Figure 113: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Figure 114: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Chassis Frame, Value (US$ Bn), 2023-2031

Figure 115: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 116: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 117: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2023-2031

Figure 118: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 119: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 120: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 121: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Figure 122: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Figure 123: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Bus Axle, Value (US$ Bn), 2023-2031

Figure 124: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Figure 125: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 126: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 127: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Figure 128: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Figure 129: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Seating Capacity, Value (US$ Bn), 2023-2031

Figure 130: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 131: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 132: Middle East & Africa Bus Chassis Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 133: Middle East & Africa Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Figure 134: Middle East & Africa Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Figure 135: Middle East & Africa Bus Chassis Market, Incremental Opportunity, By Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 136: South America Bus Chassis Market Volume (Units) Forecast, by Bus Type, 2017-2031

Figure 137: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Type, 2017-2031

Figure 138: South America Bus Chassis Market, Incremental Opportunity, by Bus Type, Value (US$ Bn), 2023-2031

Figure 139: South America Bus Chassis Market Volume (Units) Forecast, by Chassis Frame, 2017-2031

Figure 140: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Frame, 2017-2031

Figure 141: South America Bus Chassis Market, Incremental Opportunity, by Chassis Frame, Value (US$ Bn), 2023-2031

Figure 142: South America Bus Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 143: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Chassis Material, 2017-2031

Figure 144: South America Bus Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Bn), 2023-2031

Figure 145: South America Bus Chassis Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 146: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 147: South America Bus Chassis Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 148: South America Bus Chassis Market Volume (Units) Forecast, by Bus Axle, 2017-2031

Figure 149: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Bus Axle, 2017-2031

Figure 150: South America Bus Chassis Market, Incremental Opportunity, by Bus Axle, Value (US$ Bn), 2023-2031

Figure 151: South America Bus Chassis Market Volume (Units) Forecast, by End-use, 2017-2031

Figure 152: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by End-use, 2017-2031

Figure 153: South America Bus Chassis Market, Incremental Opportunity, by End-use, Value (US$ Bn), 2023-2031

Figure 154: South America Bus Chassis Market Volume (Units) Forecast, by Seating Capacity, 2017-2031

Figure 155: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Seating Capacity, 2017-2031

Figure 156: South America Bus Chassis Market, Incremental Opportunity, by Seating Capacity, Value (US$ Bn), 2023-2031

Figure 157: South America Bus Chassis Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 158: South America Bus Chassis Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 159: South America Bus Chassis Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 160: South America Bus Chassis Market Volume (Units) Forecast, By Country/Sub-region, 2017-2031

Figure 161: South America Bus Chassis Market Revenue (US$ Bn) Forecast, By Country/Sub-region, 2017-2031

Figure 162: South America Bus Chassis Market, Incremental Opportunity, By Country/Sub-region, Value (US$ Bn), 2023-2031