Rising Demand for Infrastructural Development Bolsters Growth in Bulk Handling Products and Technology Market

Incorporation and rapid integration of remote user connectivity as well as interface in equipment is one of the strongest driving forces behind the development of the global bulk handling products and technology market. Furthermore, increasing utilization of telematics based solutions by the OEMs or original equipment manufacturers is also expected to fuel the growth in the global bulk handling products and technology market in the next few years. The rising demand for infrastructural development as well as proper housing solutions is also expected to create new revenue generation opportunities in the global bulk handling products and technology market. Rise in the mining activities that trigger increased need for efficient handling as well as transportation of mined materials as well as mining equipment is also expected to fuel the demand in the global bulk handling products and technology market in coming years.

Players and manufacturers in the global bulk handling products and technology market are adopting latest and cutting edge technologies and modern techniques including automation as well as machine learning to gain a leading position in the global bulk handling products and technology market. The competitive landscape of the global bulk handling products and technology market is highly competitive, with a number of regional as well as international players functional within the industry. Usage of artificial intelligence technologies in solutions in the global bulk handling products and technology market is also projected to create new avenues for the market expansion in coming years.

Rapid urbanization and resulting increase in construction activities is yet another positive influencer for the development of the global bulk handling products and technology market in coming years. Furthermore, increasing environmental concerns pertaining to waste management are also expected to create new opportunities for revenue generation in the global bulk handling products and technology market in coming years. Players and manufacturers in the global bulk handling products and technology market are adopting various growth and expansion strategies, including mergers, partnerships, acquisitions, and collaborations in order to gain a leading position in the market.

The growth of the global market for bulk material handling products and technologies heavily relies on the rising industrial infrastructure and the movement in the construction sector, especially in the emerging economies. The increase in the automation in the manufacturing industry and the advent of the mass production methodology and the assembly line concept have been acting as the key driving factor behind this surge in this market in the recent times.

Furthermore, the rise in mining activities, progress in the agriculture industry, and the innovations and advancements in bulk material handling products and technologies are likely to propel this market over the forthcoming years.

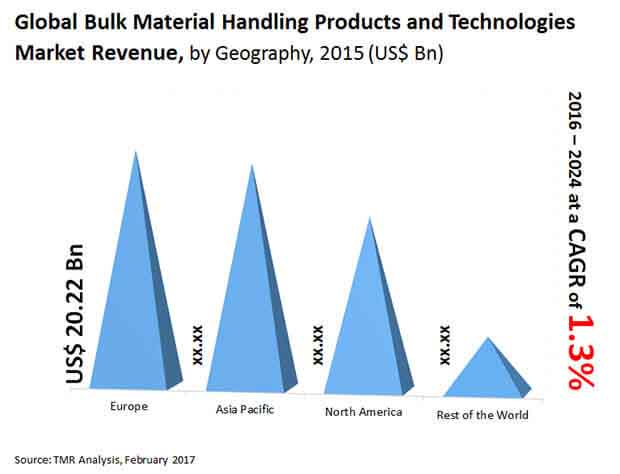

The global market for bulk material handling products and technologies offered an opportunity worth US$58.86 bn in 2015. Analysts project this market to expand at a CAGR of 1.30% between 2016 and 2024 and reach a value of US$65.74 bn by the end of 2024.

The worldwide bulk material handling products and technologies market is spread across North America, Asia Pacific, Europe, and the Rest of the World that includes the Middle East, Africa, and South America. Europe has been holding the lead in this market for quite some time and is expected to retain it over the next few years. In 2015, the Europe market for bulk material handling products and technologies accounted for a share of 34.4% in the overall market.

Germany, among all the European markets, has surfaced as the most attractive market for bulk material handling products and technologies. The increasing demand for industrial automation, which require extensive usage of bulk material handling equipment, rise in mass production methods, such as assembly line production, and the growing need for bulk equipment in the construction industry has boosted this domestic market substantially.

Among other regional markets, Asia Pacific is demonstrating signs of strong growth in the near future. The Asia Pacific market for bulk material handling products and technologies is largely acquired by China, which is one of the most prominent domestic bulk material handling products and technologies market across the world. Researchers expect the china market to expand considerably in the years to come and have a significant impact on the Asia Pacific market. The market in North America, on the other hand, is anticipated to experience sluggish rise over the forthcoming years.

The chemical, construction, food and beverages, energy, mining, oil and gas, metals, pharmaceuticals, and the plastics industries are the key end users of bulk material handling products and technologies across the world. The demand for these products and technologies has been most prominent from the mining industry, which has been closely followed by the construction and the chemical industries. According to analysts, the scenario is likely to remain so in the near future.

Metso Corp., TRF Ltd., Tenova S.p.A, ThyssenKrupp AG, SENET, Voith GmbH, and FLSmidth & Co. are some of the prominent players in the global market for bulk material handling products and technologies.

The Bulk Material Handling Products and Technologies Market size is estimated to worth US$65.74 Bn by 2024

The rapid advances made in agricultural production over the last few decades have also generated significant demand for bulk material handling products

Asia Pacific is estimated to show prominent growth in the Bulk Material Handling Products and Technologies Market

Metso Corp., TRF Ltd., Tenova S.p.A, ThyssenKrupp AG, SENET, Voith GmbH, and FLSmidth & Co. are some of the prominent players in the global market for bulk material handling products and technologies.

The Bulk Material Handling Products and Technologies Market is studied from 2016 – 2024

Section 1 Preface

Section 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms used

2.2 Research Methodology

Section 3 Executive Summary : Global Bulk Material Handling Products and TechnologiesMarket

3.1 Executive Summary

Section 4 Global Bulk Material Handling Products and Technologies Market Overview

4.1 Introduction

4.1.1 Industry Evolution

4.2 Value Chain Analysis

4.3 Drivers & Restraints: Snapshot Analysis

4.3.1 Driver

4.3.2 Restraints

4.3.3 Opportunities

4.4 Porter’s Five Force Analysis

4.5 Global Market Attractiveness Analysis

4.6 List of Global Market Players (2015)

4.6.1 Market Positioning of Key Players , 2015

4.6.2 Competitive strategies adopted by leading players

4.7 Patent Analysis

Section 5 Global Bulk Material Handling Products and Technologies Market Analysis, ByTypes

5.1 Overview

5.1.1By Types: Definition

5.2 Global Bulk Material Handling Products and Technologies Market, By Types

Section 6 Global Bulk Material Handling Products and Technologies Market Analysis, By End Users

6.1 Overview

6.1.1 By End Users: Definition

6.2 Global Bulk Material Handling Products and Technologies Market, ByEnd Users

Section 7 Global Bulk Material Handling Products and Technologies Market Analysis, ByRegion

7.1 Geographical Scenario (By Revenue)

Section 8 North America Bulk Material Handling Products and Technologies Market Analysis

8.1 Overview

8.2 North America Bulk Material Handling Products and Technologies Market, ByTypes

8.3 North America Bulk Material Handling Products and Technologies Market, By End Users

8.4 North America Bulk Material Handling Products and Technologies Market, By Country

Section 9 Europe Bulk Material Handling Products and Technologies Market Analysis

9.1 Overview

9.2 Europe Bulk Material Handling Products and Technologies Market, ByTypes

9.3 Europe Bulk Material Handling Products and Technologies Market, By End Users

9.4 Europe Bulk Material Handling Products and Technologies Market, By Country

Section 10 Asia Pacific Bulk Material Handling Products and Technologies Market Analysis

10.1 Overview

10.2 Asia PacificBulk Material Handling Products and Technologies Market, ByTypes

10.3 Asia PacificBulk Material Handling Products and Technologies Market, By End Users

10.4 Asia Pacific Bulk Material Handling Products and Technologies Market, By Country

Section 11 Rest of the World Bulk Material Handling Products and Technologies Market Analysis

11.1 Overview

11.2 Rest of the WorldBulk Material Handling Products and Technologies Market, ByTypes

11.3 Rest of the WorldBulk Material Handling Products and Technologies Market, ByEnd Users

12.4 Rest of the WorldBulk Material Handling Products and Technologies Market, ByCountry

Section 12 Company Profiles

12.1 Metso Corporation

12.1.1 Company Details

12.1.2 Company Description

12.1.3 Business Overview

12.1.4 SWOT Analysis

12.1.5 Financial Overview

12.1.6 Strategic Overview

12.2TRF Ltd.

12.2.1 Company Details

12.2.2 Company Description

12.2.3 Business Overview

12.2.4 SWOT Analysis

12.2.5 Financial Overview

12.2.6 Strategic Overview

12.3Tenova S.p.A

12.3.1 Company Details

12.3.2 Company Description

12.3.3 Business Overview

12.3.4 SWOT Analysis

12.3.5 Financial Overview

12.3.6 Strategic Overview

12.4ThyssenKrupp AG

12.4.1 Company Details

12.4.2 Company Description

12.4.3 Business Overview

12.4.4 SWOT Analysis

12.4.5 Financial Overview

12.4.6 Strategic Overview

12.5SENET

12.5.1 Company Details

12.5.2 Company Description

12.5.3 Business Overview

12.5.4 SWOT Analysis

12.5.5 Financial Overview

12.5.6 Strategic Overview

12.6Voith GmbH

12.6.1 Company Details

12.6.2 Company Description

12.6.3 Business Overview

12.6.4 SWOT Analysis

12.6.5 Financial Overview

12.6.6 Strategic Overview

12.7FLSmidth & Co.

12.7.1 Company Details

12.7.2 Company Description

12.7.3 Business Overview

12.7.4 SWOT Analysis

12.7.5 Financial Overview

12.7.6 Strategic Overvie

List of Tables

TABLE 1 Market Positioning of Key Players , 2015

TABLE 2 Number of Patents, by Region, 2010–2015

TABLE 3 Global Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Types, 2015–2024

TABLE 4 Global Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Powder Materials, 2015–2024

TABLE 5 Global Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By End Users, 2015–2024

TABLE 6 North America Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Types, 2015–2024

TABLE 7 North America Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Powder Materials, 2015–2024

TABLE 8 North America Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By End Users, 2015–2024

TABLE 9 North America Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Country, 2015–2024

TABLE 10 Europe Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Types, 2015–2024

TABLE 11 Europe Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Powder Materials, 2015–2024

TABLE 12 Europe Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By End Users, 2015–2024

TABLE 13 Europe Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Country, 2015–2024

TABLE 14 Asia Pacific Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Types, 2015–2024

TABLE 15 Asia Pacific Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Powder Materials, 2015–2024

TABLE 16 Asia Pacific Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By End Users, 2015–2024

TABLE 17 Asia Pacific Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Country, 2015–2024

TABLE 18 Rest of the World Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Types, 2015–2024

TABLE 19 Rest of the World Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Powder Materials, 2015–2024

TABLE 20 Rest of the World Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By End Users, 2015–2024

TABLE 21 Rest of the World Bulk Material Handling Products and Technologies Market Size (USD Bn) Forecast, By Region, 2015–2024

List of Figures

FIG. 1 Global Market Attractiveness Analysis (2015)

FIG. 2 Number of Patents Filed Globally, 2010–2016

FIG. 3 Global Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Types, 2015 and 2024

FIG. 4 Powder Materials Market Revenue Analysis, 2015 - 2024

FIG. 5 Others Market Revenue Analysis, 2015 - 2024

FIG. 6 Material Feeding Systems Market Revenue Analysis, 2015 - 2024

FIG. 7 Weighing Systems Market Revenue Analysis, 2015 - 2024

FIG. 8 Conveying Systems Market Revenue Analysis, 2015 - 2024

FIG. 9 Screening Systems Market Revenue Analysis, 2015 - 2024

FIG. 10 Global Bulk Material Handling Products and Technologies Market Revenue Share Analysis By End Users, 2015 and 2024

FIG. 11 Chemical Market Revenue Analysis, 2015 - 2024

FIG. 12 Construction Market Revenue Analysis, 2015 - 2024

FIG. 13 Energy Market Revenue Analysis, 2015 - 2024

FIG. 14 Food and Beverages Market Revenue Analysis, 2015 - 2024

FIG. 15 Mining Market Revenue Analysis, 2015 - 2024

FIG. 16 Metals Market Revenue Analysis, 2015 - 2024

FIG. 17 Oil and Gas Market Revenue Analysis, 2015 - 2024

FIG. 18 Pharmaceuticals Market Revenue Analysis, 2015 - 2024

FIG. 19 Plastics Market Revenue Analysis, 2015 - 2024

FIG. 20 Others Market Revenue Analysis, 2015 - 2024

FIG. 21 Global Bulk Material Handling Products and Technologies Market Value Share Analysis By Region Type, 2015 and 2024

FIG. 22 North America Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Types, 2015 and 2024

FIG. 23 North America Bulk Material Handling Products and Technologies Market Revenue Share Analysis By End Users, 2015 and 2024

FIG. 24 North America Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Country, 2015 and 2024

FIG. 25 Europe Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Types, 2015 and 2024

FIG. 26 Europe Bulk Material Handling Products and Technologies Market Revenue Share Analysis By End Users, 2015 and 2024

FIG. 27 Europe Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Country, 2015 and 2024

FIG. 28 Asia Pacific Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Types, 2015 and 2024

FIG. 29 Asia Pacific Bulk Material Handling Products and Technologies Market Revenue Share Analysis By End Users, 2015 and 2024

FIG. 30 Asia Pacific Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Country, 2015 and 2024

FIG. 31 Rest of the World Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Types, 2015 and 2024

FIG. 32 Rest of the World Bulk Material Handling Products and Technologies Market Revenue Share Analysis By End Users, 2015 and 2024

FIG. 33 Rest of the World Bulk Material Handling Products and Technologies Market Revenue Share Analysis By Region, 2015 and 2024