Bulk Ferroalloys Market - Electrification of Vehicles to Add New Dimension

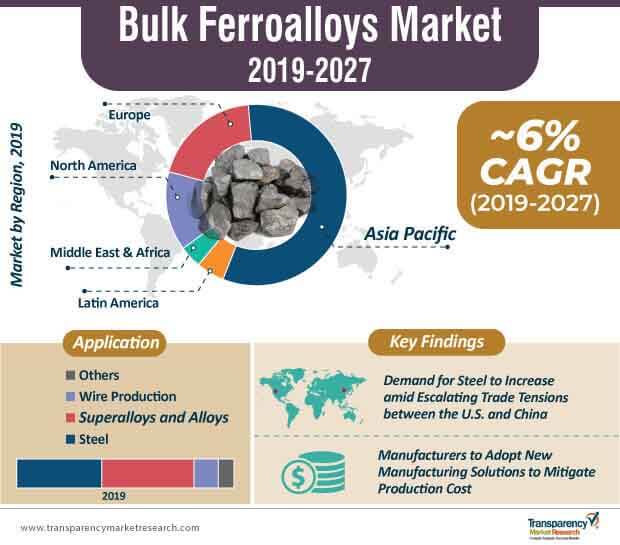

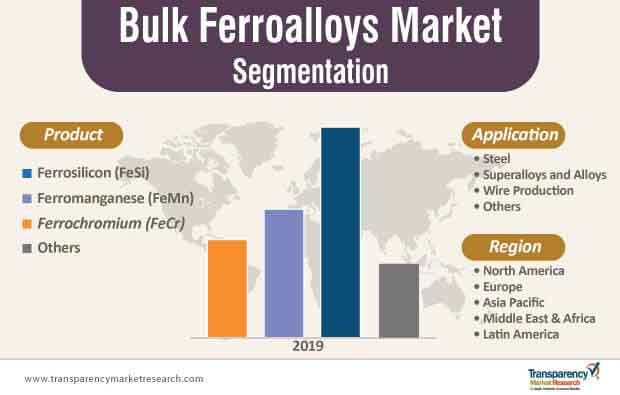

The global bulk ferroalloys market is projected to arrive at a value tantamount to ~US$ 79 Bn by 2027, as two distinct segments power growth: increasing opportunities for ferroalloys in construction activities across the globe and the use of steel to foster innovations in automotive designs. New opportunity is created for bulk ferroalloy manufacturers with the introduction of the Paris Agreement regarding the electrification of vehicles by 2030. Since automakers seek lightweight materials to improve the fuel efficiency of vehicles, the demand for steel is projected to intensify during the period of 2019-2027.

However, the depletion of reserves is bound to pose a serious challenge for the future production of these alloys. As the availability of raw materials for the ferroalloys industry is inadequate in numerous countries, the industry is highly reliant on imports, which is likely to influence the price of bulk ferroalloys during the forecast period. The high cost of producing bulk ferroalloys is yet another concern for manufacturers. Power requirements for the production of bulk ferroalloys are ~35%-40% of the total overhead cost, given the volatility in the prices of coking coal and electricity. Owing to the high cost of power generation, ferroalloy plants fails to utilize their full capacity, and this surges the prices of the end products.

Manufacturers Look at Asia Pacific as a Region with Measurable Growth Opportunities

As per the TMR study data for 2018, Asia Pacific accounted for ~57% of the market share, and will continue to remain relevant during the forecast period, given its favorable geographic location, coupled with the lead of China, India, and Japan in the production of steel. Propitious demand-supply dynamics in the steel industry in India, including the permission for 100% foreign direct investment (FDI) in the mining sector and high budget allocation to infrastructural activities, are projected to augur well for the regional market.

Besides construction, the bulk ferroalloys market also remains benefitted from the growth of the automotive sector of Asia Pacific, which enhances its lucrative quo. For instance, in October 2018, Mitsubishi Motors announced its plan to raise the production capacity of its steel plant, located at Bekasi, from 160,000 units to 220,000 units, annually, by 2020.

Manufacturers of bulk ferroalloys operating across the world are leveraging exports as a means to venture into the new as well as established market of Asia Pacific. However, the value proposition of the European bulk ferroalloys market is in stark contrast with the Asia Pacific market. Market players concentrated in Europe are seen leveraging electric arc furnaces (EAF) to gain improved production efficiency, reduced pollution, and decreased dependence on coking coal. EAFs account for two-thirds of the steel production in Europe, which significantly influences the total production cost, that too, by aligning with the concept of environmental sustainability.

In the future, easy availability of workforce and technological leaps that catapult production capacity, will, in turn, reflect on the regional production capacity. For instance, Nikopol Ferroalloy Plant, operating in Ukraine, supplies bulk ferroalloys to over 300 metallurgical enterprises across the world, owing to the technological prowess of the company that facilitates high output.

Analysts’ Viewpoint

Authors of the report infer that, the bulk ferroalloys market will rise from US$ 47 Bn in 2019 and advance at an above-average CAGR of 6% during the forecast period. Since establishing a production plant requires huge working capital, the cost-prohibitive feature of the industry reduces the threat of new market entrants; however, the competition is likely to remain intense during 2019-2027, given the growing interest of raw material suppliers in the production of bulk ferroalloys. Besides forward integration, leading end users of ferroalloys - steel producers - are seen forming joint ventures and acquisitions, which could lead to backward integration and further increase competition in the landscape.

Significant Growth of Electric Vehicles Industry to Boost Demand for Bulk Ferroalloys

Global Bulk Ferroalloys Market: Highlights

Ferromanganese to Witness Significant Demand

Demand for Bulk Ferroalloys to Increase in Steel Application

Asia Pacific Expected to be Highly Lucrative Market

Global Bulk Ferroalloys Market: Competition Landscape

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Bulk Ferroalloys Market

4. Market Overview

4.1. Introduction

4.2. Market Outlook

4.3. Key Market Developments

4.4. Current Market and Future Potential/Emerging Applications

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunities

4.6. Global Bulk Ferroalloys Market Analysis and Forecast, 2018–2027

4.7. Global Bulk Ferroalloys Market Value Share Analysis

4.8. Regulatory Landscape

4.9. Porters Five Forces Analysis

4.10. Value Chain Analysis

4.10.1. List of Key Manufacturers

4.10.2. List of Potential Customers

5. Bulk Ferroalloys Price Comparison Analysis, 2018–2027

5.1. By Product

5.2. By Region

6. Bulk Ferroalloys Production Output Analysis, 2018

7. Import-Export Analysis of Global Bulk Ferroalloys Market, 2015–2018

8. Global Bulk Ferroalloys Market Analysis and Forecast, by Product

8.1. Key Findings

8.2. Global Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

8.2.1. Ferrosilicon (FeSi)

8.2.2. Ferromanganese (FeMn)

8.2.3. Ferrochromium (FeCr)

8.2.4. Others

8.3. Global Bulk Ferroalloys Market Attractiveness Analysis, by Product

9. Global Bulk Ferroalloys Market Analysis and Forecast, by Application

9.1. Key Findings

9.2. Global Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

9.2.1. Steel

9.2.2. Superalloys & Alloys (Excluding Steel)

9.2.3. Wire Production

9.2.4. Others

9.3. Global Bulk Ferroalloys Market Attractiveness Analysis, by Application

10. Global Bulk Ferroalloys Market Analysis and Forecast, by Region

10.1. Global Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Region, 2018–2027

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Latin America

10.1.5. Middle East & Africa

10.2. Global Bulk Ferroalloys Market Attractiveness Analysis, by Region

11. North America Bulk Ferroalloys Market Analysis and Forecast

11.1. Key Findings

11.2. North America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

11.2.1. Ferrosilicon (FeSi)

11.2.2. Ferromanganese (FeMn)

11.2.3. Ferrochromium (FeCr)

11.2.4. Others

11.3. North America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

11.3.1. Steel

11.3.2. Superalloys & Alloys (Excluding Steel)

11.3.3. Wire Production

11.3.4. Others

11.4. North America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Country, 2018–2027

11.5. U.S. Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

11.5.1. Ferrosilicon (FeSi)

11.5.2. Ferromanganese (FeMn)

11.5.3. Ferrochromium (FeCr)

11.5.4. Others

11.6. U.S. Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

11.6.1. Steel

11.6.2. Superalloys & Alloys (Excluding Steel)

11.6.3. Wire Production

11.6.4. Others

11.7. Canada Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

11.7.1. Ferrosilicon (FeSi)

11.7.2. Ferromanganese (FeMn)

11.7.3. Ferrochromium (FeCr)

11.7.4. Others

11.8. Canada Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

11.8.1. Steel

11.8.2. Superalloys & Alloys (Excluding Steel)

11.8.3. Wire Production

11.8.4. Others

11.9. North America Bulk Ferroalloys Market Attractiveness Analysis, 2018

11.9.1. By Product

11.9.2. By Application

11.9.3. By Country

12. Europe Bulk Ferroalloys Market Analysis and Forecast

12.1. Key Findings

12.2. Europe Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.2.1. Ferrosilicon (FeSi)

12.2.2. Ferromanganese (FeMn)

12.2.3. Ferrochromium (FeCr)

12.2.4. Others

12.3. Europe Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.3.1. Steel

12.3.2. Superalloys & Alloys (Excluding Steel)

12.3.3. Wire Production

12.3.4. Others

12.4. Europe Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Country and Sub-region, 2018–2027

12.5. Germany Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.5.1. Ferrosilicon (FeSi)

12.5.2. Ferromanganese (FeMn)

12.5.3. Ferrochromium (FeCr)

12.5.4. Others

12.6. Germany Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.6.1. Steel

12.6.2. Superalloys & Alloys (Excluding Steel)

12.6.3. Wire Production

12.6.4. Others

12.7. U.K. Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.7.1. Ferrosilicon (FeSi)

12.7.2. Ferromanganese (FeMn)

12.7.3. Ferrochromium (FeCr)

12.7.4. Others

12.8. U.K. Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.8.1. Steel

12.8.2. Superalloys & Alloys (Excluding Steel)

12.8.3. Wire Production

12.8.4. Others

12.9. France Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.9.1. Ferrosilicon (FeSi)

12.9.2. Ferromanganese (FeMn)

12.9.3. Ferrochromium (FeCr)

12.9.4. Others

12.10. France Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.10.1. Steel

12.10.2. Superalloys & Alloys (Excluding Steel)

12.10.3. Wire Production

12.10.4. Others

12.11. Spain Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.11.1. Ferrosilicon (FeSi)

12.11.2. Ferromanganese (FeMn)

12.11.3. Ferrochromium (FeCr)

12.11.4. Others

12.12. Spain Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.12.1. Steel

12.12.2. Superalloys & Alloys (Excluding Steel)

12.12.3. Wire Production

12.12.4. Others

12.13. Italy Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.13.1. Ferrosilicon (FeSi)

12.13.2. Ferromanganese (FeMn)

12.13.3. Ferrochromium (FeCr)

12.13.4. Others

12.14. Italy Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.14.1. Steel

12.14.2. Superalloys & Alloys (Excluding Steel)

12.14.3. Wire Production

12.14.4. Others

12.15. Russia & CIS Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.15.1. Ferrosilicon (FeSi)

12.15.2. Ferromanganese (FeMn)

12.15.3. Ferrochromium (FeCr)

12.15.4. Others

12.16. Russia & CIS Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.16.1. Steel

12.16.2. Superalloys & Alloys (Excluding Steel)

12.16.3. Wire Production

12.16.4. Others

12.17. Rest of Europe Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

12.17.1. Ferrosilicon (FeSi)

12.17.2. Ferromanganese (FeMn)

12.17.3. Ferrochromium (FeCr)

12.17.4. Others

12.18. Rest of Europe Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

12.18.1. Steel

12.18.2. Superalloys & Alloys (Excluding Steel)

12.18.3. Wire Production

12.18.4. Others

12.19. Europe Bulk Ferroalloys Market Attractiveness Analysis, 2018

12.19.1. By Product

12.19.2. By Application

12.19.3. By Country and Sub-region

13. Asia Pacific Bulk Ferroalloys Market Analysis and Forecast

13.1. Key Findings

13.2. Asia Pacific Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

13.2.1. Ferrosilicon (FeSi)

13.2.2. Ferromanganese (FeMn)

13.2.3. Ferrochromium (FeCr)

13.2.4. Others

13.3. Asia Pacific Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

13.3.1. Steel

13.3.2. Superalloys & Alloys (Excluding Steel)

13.3.3. Wire Production

13.3.4. Others

13.4. Asia Pacific Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Country and Sub-region, 2018–2027

13.5. China Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

13.5.1. Ferrosilicon (FeSi)

13.5.2. Ferromanganese (FeMn)

13.5.3. Ferrochromium (FeCr)

13.5.4. Others

13.6. China Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

13.6.1. Steel

13.6.2. Superalloys & Alloys (Excluding Steel)

13.6.3. Wire Production

13.6.4. Others

13.7. India Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

13.7.1. Ferrosilicon (FeSi)

13.7.2. Ferromanganese (FeMn)

13.7.3. Ferrochromium (FeCr)

13.7.4. Others

13.8. India Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

13.8.1. Steel

13.8.2. Superalloys & Alloys (Excluding Steel)

13.8.3. Wire Production

13.8.4. Others

13.9. Japan Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

13.9.1. Ferrosilicon (FeSi)

13.9.2. Ferromanganese (FeMn)

13.9.3. Ferrochromium (FeCr)

13.9.4. Others

13.10. Japan Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

13.10.1. Steel

13.10.2. Superalloys & Alloys (Excluding Steel)

13.10.3. Wire Production

13.10.4. Others

13.11. ASEAN Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

13.11.1. Ferrosilicon (FeSi)

13.11.2. Ferromanganese (FeMn)

13.11.3. Ferrochromium (FeCr)

13.11.4. Others

13.12. ASEAN Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

13.12.1. Steel

13.12.2. Superalloys & Alloys (Excluding Steel)

13.12.3. Wire Production

13.12.4. Others

13.13. Rest of Asia Pacific Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

13.13.1. Ferrosilicon (FeSi)

13.13.2. Ferromanganese (FeMn)

13.13.3. Ferrochromium (FeCr)

13.13.4. Others

13.14. Rest of Asia Pacific Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

13.14.1. Steel

13.14.2. Superalloys & Alloys (Excluding Steel)

13.14.3. Wire Production

13.14.4. Others

13.15. Asia Pacific Bulk Ferroalloys Market Attractiveness Analysis, 2018

13.15.1. By Product

13.15.2. By Application

13.15.3. By Country and Sub-region

14. Latin America Bulk Ferroalloys Market Analysis and Forecast

14.1. Key Findings

14.2. Latin America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

14.2.1. Ferrosilicon (FeSi)

14.2.2. Ferromanganese (FeMn)

14.2.3. Ferrochromium (FeCr)

14.2.4. Others

14.3. Latin America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

14.3.1. Steel

14.3.2. Superalloys & Alloys (Excluding Steel)

14.3.3. Wire Production

14.3.4. Others

14.4. Latin America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Country and Sub-region, 2018–2027

14.5. Brazil Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

14.5.1. Ferrosilicon (FeSi)

14.5.2. Ferromanganese (FeMn)

14.5.3. Ferrochromium (FeCr)

14.5.4. Others

14.6. Brazil Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

14.6.1. Steel

14.6.2. Superalloys & Alloys (Excluding Steel)

14.6.3. Wire Production

14.6.4. Others

14.7. Mexico Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

14.7.1. Ferrosilicon (FeSi)

14.7.2. Ferromanganese (FeMn)

14.7.3. Ferrochromium (FeCr)

14.7.4. Others

14.8. Mexico Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

14.8.1. Steel

14.8.2. Superalloys & Alloys (Excluding Steel)

14.8.3. Wire Production

14.8.4. Others

14.9. Rest of Latin America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

14.9.1. Ferrosilicon (FeSi)

14.9.2. Ferromanganese (FeMn)

14.9.3. Ferrochromium (FeCr)

14.9.4. Others

14.10. Rest of Latin America Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

14.10.1. Steel

14.10.2. Superalloys & Alloys (Excluding Steel)

14.10.3. Wire Production

14.10.4. Others

14.11. Latin America Bulk Ferroalloys Market Attractiveness Analysis, 2018

14.11.1. By Product

14.11.2. By Application

14.11.3. By Country and Sub-region

15. Middle East & Africa Bulk Ferroalloys Market Analysis and Forecast

15.1. Key Findings

15.2. Middle East & Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

15.2.1. Ferrosilicon (FeSi)

15.2.2. Ferromanganese (FeMn)

15.2.3. Ferrochromium (FeCr)

15.2.4. Others

15.3. Middle East & Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

15.3.1. Steel

15.3.2. Superalloys & Alloys (Excluding Steel)

15.3.3. Wire Production

15.3.4. Others

15.4. Middle East & Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Country and Sub-region, 2018–2027

15.5. GCC Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

15.5.1. Ferrosilicon (FeSi)

15.5.2. Ferromanganese (FeMn)

15.5.3. Ferrochromium (FeCr)

15.5.4. Others

15.6. GCC Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

15.6.1. Steel

15.6.2. Superalloys & Alloys (Excluding Steel)

15.6.3. Wire Production

15.6.4. Others

15.7. South Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

15.7.1. Ferrosilicon (FeSi)

15.7.2. Ferromanganese (FeMn)

15.7.3. Ferrochromium (FeCr)

15.7.4. Others

15.8. South Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

15.8.1. Steel

15.8.2. Superalloys & Alloys (Excluding Steel)

15.8.3. Wire Production

15.8.4. Others

15.9. Rest of Middle East & Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Product, 2018–2027

15.9.1. Ferrosilicon (FeSi)

15.9.2. Ferromanganese (FeMn)

15.9.3. Ferrochromium (FeCr)

15.9.4. Others

15.10. Rest of Middle East & Africa Bulk Ferroalloys Market Size (Kilo Tons & US$ Mn) Forecast, by Application, 2018–2027

15.10.1. Steel

15.10.2. Superalloys & Alloys (Excluding Steel)

15.10.3. Wire Production

15.10.4. Others

15.11. Middle East & Africa Bulk Ferroalloys Market Attractiveness Analysis, 2018

15.11.1. By Product

15.11.2. By Application

15.11.3. By Country and Sub-region

16. Competition Landscape

16.1. Competition Matrix, by Key Players

16.2. Product Mapping

16.3. Global Bulk Ferroalloys Market Share Analysis, by Company (2018)

16.4. Company Profiles

16.4.1. ArcelorMittal

16.4.1.1. Company Description

16.4.1.2. Business Overview

16.4.1.3. Financial Overview

16.4.1.4. Strategic Overview

16.4.2. Om Holdings Ltd

16.4.2.1. Company Description

16.4.2.2. Business Overview

16.4.2.3. Financial Overview

16.4.2.4. Strategic Overview

16.4.3. Sakura Ferroalloys Sdn Bhd

16.4.3.1. Company Description

16.4.3.2. Business Overview

16.4.3.3. Financial Overview

16.4.3.4. Strategic Overview

16.4.4. Pertama Ferroalloys Sdn. Bhd.

16.4.4.1. Company Description

16.4.4.2. Business Overview

16.4.4.3. Financial Overview

16.4.4.4. Strategic Overview

16.4.5. Jai Balaji Industries Limited

16.4.5.1. Company Description

16.4.5.2. Business Overview

16.4.5.3. Financial Overview

16.4.5.4. Strategic Overview

16.4.6. Tata Steel Ltd

16.4.6.1. Company Description

16.4.6.2. Business Overview

16.4.6.3. Financial Overview

16.4.6.4. Strategic Overview

16.4.7. Nikopol Ferroalloy Plant

16.4.7.1. Company Description

16.4.7.2. Business Overview

16.4.7.3. Financial Overview

16.4.7.4. Strategic Overview

16.4.8. Gulf Ferro Alloys Company (SABAYEK)

16.4.8.1. Company Description

16.4.8.2. Business Overview

16.4.8.3. Financial Overview

16.4.8.4. Strategic Overview

16.4.9. BAFA Bahrain

16.4.9.1. Company Description

16.4.9.2. Business Overview

16.4.9.3. Financial Overview

16.4.9.4. Strategic Overview

16.4.10. Brahm Group

16.4.10.1. Company Description

16.4.10.2. Business Overview

16.4.10.3. Financial Overview

16.4.10.4. Strategic Overview

16.4.11. China Minmetals Corporation

16.4.11.1. Company Description

16.4.11.2. Business Overview

16.4.11.3. Financial Overview

16.4.11.4. Strategic Overview

16.4.12. Shanghai Shenjia Ferroalloys Co. Ltd.

16.4.12.1. Company Description

16.4.12.2. Business Overview

16.4.12.3. Financial Overview

16.4.12.4. Strategic Overview

16.4.13. Ferroalloy Corporation Limited

16.4.13.1. Company Description

16.4.13.2. Business Overview

16.4.13.3. Financial Overview

16.4.13.4. Strategic Overview

16.4.14. Mortex Group

16.4.14.1. Company Description

16.4.14.2. Business Overview

16.4.14.3. Financial Overview

16.4.14.4. Strategic Overview

16.4.15. Georgian American Alloys

16.4.15.1. Company Description

16.4.15.2. Business Overview

16.4.15.3. Financial Overview

16.4.15.4. Strategic Overview

16.4.16. SAIL

16.4.16.1. Company Description

16.4.16.2. Business Overview

16.4.16.3. Financial Overview

16.4.16.4. Strategic Overview

16.4.17. OFZ, a. s.

16.4.17.1. Company Description

16.4.17.2. Business Overview

16.4.17.3. Financial Overview

16.4.17.4. Strategic Overview

16.4.18. Vale S.A.

16.4.18.1. Company Description

16.4.18.2. Business Overview

16.4.18.3. Financial Overview

16.4.18.4. Strategic Overview

17. Primary Research: Key Insights

List of Tables

Table 1 Global Bulk Ferroalloys Market Volume (Kilo Tons) Analysis and Forecast, by Product, 2018–2027

Table 2 Global Bulk Ferroalloys Market Value (US$ Mn) Analysis and Forecast, by Product, 2018–2027

Table 3 Global Bulk Ferroalloys Market Volume (Kilo Tons) Analysis and Forecast, by Application, 2018–2027

Table 4 Global Bulk Ferroalloys Market Value (US$ Mn) Analysis and Forecast, by Application, 2018–2027

Table 5 Global Bulk Ferroalloys Market Volume (Kilo Tons) Analysis and Forecast, by Region, 2018–2027

Table 6 Global Bulk Ferroalloys Market Value (US$ Mn) Analysis and Forecast, by Region, 2018–2027

Table 7 North America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 8 North America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 9 North America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 10 North America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 11 North America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Country, 2018–2027

Table 12 North America Bulk Ferroalloys Value (US$ Mn) Forecast, by Country, 2018–2027

Table 13 U.S. Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 14 U.S. Bulk Ferroalloys Market Value(US$ Mn) Forecast, by Product, 2018–2027

Table 15 U.S. Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 16 U.S. Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 17 Canada Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 18 Canada Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 19 Canada Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 20 Canada Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 21 Europe Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 22 Europe Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 23 Europe Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 24 Europe Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 25 Europe Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region,

Table 26 Europe Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 27 Germany Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 28 Germany Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 29 Germany Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 30 Germany Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 31 U.K. Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 32 U.K. Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 33 U.K. Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 34 U.K. Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 35 France Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 36 France Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 37 France Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 38 France Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 39 Spain Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 40 Spain Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 41 Spain Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 42 Spain Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 43 Italy Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 44 Italy Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 45 Italy Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 46 Italy Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 47 Russia & CIS Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 48 Russia & CIS Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 49 Russia & CIS Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 50 Russia & CIS Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 51 Rest of Europe Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 52 Rest of Europe Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 53 Rest of Europe Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 54 Rest of Europe Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 55 Asia Pacific Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 56 Asia Pacific Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 57 Asia Pacific Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 58 Asia Pacific Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 59 Asia Pacific Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 60 Asia Pacific Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 61 China Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 62 China Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 63 China Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 64 China Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 65 India Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 66 India Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 67 India Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 68 India Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 69 Japan Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 70 Japan Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 71 Japan Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 72 Japan Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 73 ASEAN Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 74 ASEAN Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 75 ASEAN Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 76 ASEAN Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 77 Rest of Asia Pacific Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 78 Rest of Asia Pacific Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 79 Rest of Asia Pacific Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 80 Rest of Asia Pacific Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 81 Latin America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 82 Latin America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 83 Latin America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 84 Latin America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 85 Latin America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 86 Latin America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 87 Brazil Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 88 Brazil Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 89 Brazil Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 90 Brazil Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 91 Mexico Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 92 Mexico Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 93 Mexico Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 94 Mexico Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 95 Rest of Latin America Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 96 Rest of Latin America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 97 Rest of Latin America Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 98 Rest of Latin America Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 99 Middle East & Africa Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 100 Middle East & Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 101 Middle East & Africa Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 102 Middle East & Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 103 Middle East & Africa Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 104 Middle East & Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 105 GCC Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 106 GCC Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 107 GCC Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 108 GCC Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 109 South Africa Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 110 South Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 111 South Africa Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 112 South Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 113 Rest of Middle East & Africa Bulk Ferroalloys Volume Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 114 Rest of Middle East & Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 115 Rest of Middle East & Africa Bulk Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 116 Rest of Middle East & Africa Bulk Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 1 Global Bulk Ferroalloys Market Value Share Analysis, by Product, 2018 and 2027

Figure 2 Global Bulk Ferroalloys Market Attractiveness Analysis, by Product

Figure 3 Global Bulk Ferroalloys Market Value Share Analysis, by Application, 2018 and 2027

Figure 4 Global Bulk Ferroalloys Market Attractiveness Analysis, by Application

Figure 5 Global Bulk Ferroalloys Market Value Share Analysis, by Region, 2018 and 2027

Figure 6 Global Bulk Ferroalloys Market Attractiveness Analysis, by Region

Figure 7 North America Bulk Ferroalloys Market Value Share, by Product, 2018 and 2027

Figure 8 North America Bulk Ferroalloys Market Value Share, by Application, 2018 and 2027

Figure 9 North America Bulk Ferroalloys Market Value Share, by Country, 2018 and 2027

Figure 10 North America Bulk Ferroalloys Market Attractiveness, by Product

Figure 11 North America Bulk Ferroalloys Market Attractiveness, by Application

Figure 12 North America Bulk Ferroalloys Market Attractiveness, by Country

Figure 13 Europe Bulk Ferroalloys Market Value Share, by Product, 2018 and 2027

Figure 14 Europe Bulk Ferroalloys Market Value Share, by Application, 2018 and 2027

Figure 15 Europe Bulk Ferroalloys Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 16 Europe Bulk Ferroalloys Market Attractiveness, by Product

Figure 17 Europe Bulk Ferroalloys Market Attractiveness, by Application

Figure 18 Europe Bulk Ferroalloys Market Attractiveness, by Country and Sub-region

Figure 19 Asia Pacific Bulk Ferroalloys Market Value Share, by Product, 2018 and 2027

Figure 20 Asia Pacific Bulk Ferroalloys Market Value Share, by Application, 2018 and 2027

Figure 21 Asia Pacific Bulk Ferroalloys Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 22 Asia Pacific Bulk Ferroalloys Market Attractiveness, by Product

Figure 23 Asia Pacific Bulk Ferroalloys Market Attractiveness, by Application

Figure 24 Asia Pacific Bulk Ferroalloys Market Attractiveness, by Country and Sub-region

Figure 25 Latin America Bulk Ferroalloys Market Value Share, by Product, 2018 and 2027

Figure 26 Latin America Bulk Ferroalloys Market Value Share, by Application, 2018 and 2027

Figure 27 Latin America Bulk Ferroalloys Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 28 Latin America Bulk Ferroalloys Market Attractiveness Analysis, by Product

Figure 29 Latin America Bulk Ferroalloys Market Attractiveness Analysis, by Application

Figure 30 Latin America Bulk Ferroalloys Market Attractiveness Analysis, by Country and Sub-region

Figure 31 Middle East & Africa Bulk Ferroalloys Market Value Share Analysis, by Product, 2018 and 2027

Figure 32 Middle East & Africa Bulk Ferroalloys Market Value Share Analysis, by Application, 2018 and 2027

Figure 33 Middle East & Africa Bulk Ferroalloys Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 34 Middle East & Africa Bulk Ferroalloys Market Attractiveness Analysis, by Product

Figure 35 Middle East & Africa Bulk Ferroalloys Market Attractiveness Analysis, by Application

Figure 36 Middle East & Africa Bulk Ferroalloys Market Attractiveness Analysis, by Country and Sub-region