Analysts’ Viewpoint on Market Scenario

Modern building automation and control systems that utilize IoT, cloud computing, data analytics, and artificial intelligence technologies provide an innovative approach to improve energy efficiency, reduce costs, and ensure accessibility of the building's amenities.

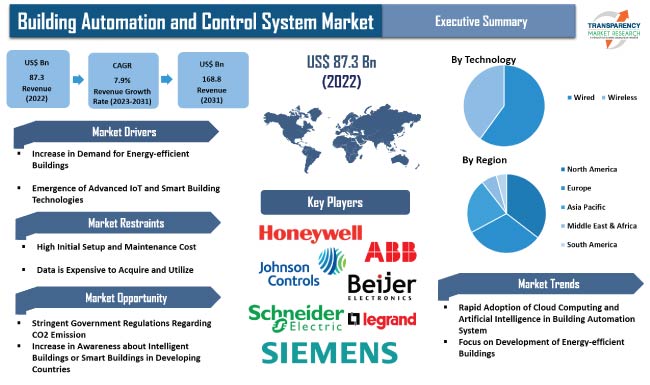

Significant rise in adoption of modern building automation and control system as well as the availability of newer IT and smart building technologies propel the global building automation and control system industry growth.

Key players are developing building automation and control systems and providing their clients with prompt and reliable services, with the integration of software, field controllers, network controllers, and communication devices.

The North America market has been growing at a rapid pace for the last few years due to growing consumer awareness about climate change and sustainability issues and enhanced building management systems. Additionally, growth of the construction industry in the region and rising investments in smart building technologies are further boosting the building automation and control system market in North America.

A network built to connect and automate specific building functions is known as a building automation and control system (BACS). One set of controls is used to operate every building control system, including the lighting, heating, ventilation & air conditioning (HVAC), fire, and security systems. An operator may access, control, and keep track of all connected building systems via a single interface owing to a building automation system. BACS is a critical tool for operating a building safely, efficiently, and reliably.

The market is expected to continue growing in the future, driven by factors such as the need for smart building systems, government regulations, and the adoption of Internet of Things (IoT) technology.

Buildings have a big impact on the environment, globally. When construction is considered, buildings are responsible for about 40% of all CO2 emissions worldwide. Energy usage is estimated to account for about one-third of all non-fixed operational costs. When both direct and indirect emissions are taken into account, the sector of buildings has a very substantial carbon footprint.

The International Energy Agency (IEA) estimates that in 2021, the use of fossil fuels in buildings attributed for about 8% of all energy- and process-related CO2 emissions worldwide. Another 19% of these emissions came from the production of electricity and heat used in buildings, and another 6% came from the production of cement, steel, and aluminum used in building construction.

Consequently, commercial real-estate companies and building owners are coming under increasing regulatory, monetary, and social pressure to reduce their energy usage and eventually decarbonize their building operations.

A building automation and control system, presently, must be able to monitor and operate all powered systems in the building in order to properly optimize energy use throughout the entire site. The tools needed to effectively optimize energy use, adhere to growing societal pressure, and meet legislative climate regulations are provided by a modern and next-generation building automation and control system.

Internet of Things (IoT) technology can be applied to building automation and control system to improve the monitoring and control of various building systems such as lighting, HVAC, security, and energy management. A BACS can collect data and provide real-time information about building conditions and resource usage by incorporating sensors, actuators, and connected devices.

Some examples of IoT applications in BACS include smart lighting systems, energy-efficient HVAC control, and predictive maintenance for building equipment. This is estimated to boost BACS market development.

For instance, in January 2021, ABB launched the FLXeon BACnet/IP automation control solutions to provide strong connectivity, visualization for intelligent buildings, and comprehensive control monitoring and analysis for the smart building space.

In terms of offerings, the global building automation and control system market segmentation comprises solutions and services. The heating, ventilation and air-conditioning (HVAC) control sub-segment under the solutions segment accounted for a largest market share in 2022. The segment is projected to expand at a CAGR of 8.2% during the forecast period.

Heating, ventilation, and air conditioning systems are critical components of any building. They are responsible for maintaining indoor air quality, temperature, and humidity levels. HVAC systems typically consist of heating equipment, air conditioning equipment, ductwork, and control systems.

The control system is where the BACS interfaces with the HVAC system, enabling the BACS to monitor and control the HVAC equipment in order to maintain the desired indoor conditions. The goal of a building automation and control system is to ensure the comfort and safety of building occupants, optimize energy consumption, and minimize maintenance costs.

In terms of technology, the global building automation and control system market segmentation comprises wired and wireless. The wireless segment accounted for a notable share of the market in 2022. It is projected to grow dramatically at a CAGR of the 8.5% during the forecast period.

Wired systems provide greater coverage, are incredibly reliable, and can handle massive amounts of data. Additionally, the cost of individual devices may be a little lower. However, installing wired devices is more expensive, less flexible, and frequently results in information not being accessible throughout the entire space.

Despite being slightly more expensive than their hard-wired counterparts, wireless solutions are currently far more reliable than they were a few years ago. Wireless building and automation control device installation is much simpler and more adaptable as needs change. Additionally, they enable transmission of constrained data packets and streamlined control commands from anywhere in the room or area, rather than only along the wires.

According to the regional analysis of the building automation and control system market forecast, North America held around 34% of the global market share in 2022. The building automation and control system industry in North America is expected to witness significant growth due to the presence of a large number of commercial and residential buildings and the adoption of smart technology.

North America witnesses a high demand for advanced and integrated building management solutions, which are expected to create significant market opportunities in the region. Moreover, high demand for advanced building automation systems in office buildings, shopping centers, and hotels, as well as increase in demand for smart homes and energy-efficient building systems further drives market demand in the region.

Europe and Asia Pacific are also prominent markets for building automation and control system. Carbon dioxide (CO2) emissions in Europe have been a major concern in the last few years due to their impact on the environment and climate change.

The European Union (EU) has set ambitious targets to reduce CO2 emissions in order to meet its commitment to the Paris Agreement on climate change. Building Automation Control Systems (BACS) must be installed in tertiary buildings by January 2025 as per a governmental decree in order to increase energy efficiency and lower CO2 emissions.

According to the EU Energy Performance of Buildings Directive (EPBD), this decree must be incorporated into national law by all EU member states by the year 2020. One of the most crucial tasks for the EU to mitigate the effects of climate change and global warming by improving energy performance in buildings.

The global building automation and control system industry is fragmented with a large number of large-medium scale vendors controlling the majority of share. A majority of the firms are spending significantly on comprehensive research and development activities and new product development.

Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by key players. Top building automation and control system companies include Honeywell International Inc., Beijer Electronics, ABB, Siemens AG, Johnson Controls International, Schneider Electric SE, General Electric Company, Legrand SA, Lutron Electronics Co., Inc., Control4 Corporation, and Hubbell Incorporated.

The building automation and control system market report comprises profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 87.3 Bn |

|

Market Forecast Value in 2031 |

US$ 168.8 Bn |

|

Growth Rate (CAGR) |

7.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The building automation and control system market was valued at US$ 87.3 Bn in 2022

The market is expected to expand at a CAGR of 7.9% from 2023 to 2031

Increase in demand for energy-efficient buildings and emergence of advanced IoT and smart building technologies

The commercial segment accounted for significant share of 32% in 2022

North America is a more attractive region for vendors in the building automation and control system business

Honeywell International Inc., Beijer Electronics, ABB, Siemens AG, Johnson Controls International, Schneider Electric SE, General Electric Company, Legrand SA, Lutron Electronics Co., Inc., Control4 Corporation, and Hubbell Incorporated

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Building Automation and Control System Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Building Technology Industry Overview

4.2. Ecosystem Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global Building Automation and Control System Market Analysis, by Offerings

5.1. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Offerings, 2017–2031

5.1.1. Solution

5.1.1.1. Heating, Ventilation and Air-conditioning (HVAC) Control

5.1.1.2. Lighting Control System

5.1.1.3. Security and Surveillance

5.1.1.4. Room Control System

5.1.1.5. Fire Control System

5.1.1.6. Access Control System

5.1.1.7. Energy Management System

5.1.1.8. Others

5.1.2. Services

5.1.2.1. Consultancy & Installation

5.1.2.2. Building Cybersecurity

5.1.2.3. Facility Management & Maintenance

5.2. Market Attractiveness Analysis, By Offerings

6. Global Building Automation and Control System Market Analysis, by Technology

6.1. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

6.1.1. Wired

6.1.2. Wireless

6.1.2.1. ZigBee

6.1.2.2. Wi-Fi

6.1.2.3. Bluetooth

6.1.2.4. Others

6.2. Market Attractiveness Analysis, By Technology

7. Global Building Automation and Control System Market Analysis, by End-use

7.1. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

7.1.1. Residential

7.1.2. Commercial

7.1.3. Industrial

7.2. Market Attractiveness Analysis, By End-use

8. Global Building Automation and Control System Market Analysis and Forecast, by Region

8.1. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Country, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Country

9. North America Building Automation and Control System Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Offerings, 2017–2031

9.3.1. Solution

9.3.1.1. Heating, Ventilation and Air-conditioning (HVAC) Control

9.3.1.2. Lighting Control System

9.3.1.3. Security and Surveillance

9.3.1.4. Room Control System

9.3.1.5. Fire Control System

9.3.1.6. Access Control System

9.3.1.7. Energy Management System

9.3.1.8. Others

9.3.2. Services

9.3.2.1. Consultancy & Installation

9.3.2.2. Building Cybersecurity

9.3.2.3. Facility Management & Maintenance

9.4. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

9.4.1. Wired

9.4.2. Wireless

9.4.2.1. ZigBee

9.4.2.2. Wi-Fi

9.4.2.3. Bluetooth

9.4.2.4. Others

9.5. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

9.5.1. Residential

9.5.2. Commercial

9.5.3. Industrial

9.6. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Offerings

9.7.2. By Technology

9.7.3. By End-use

9.7.4. By Country/Sub-region

10. Europe Building Automation and Control System Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Offerings, 2017–2031

10.3.1. Solution

10.3.1.1. Heating, Ventilation and Air-conditioning (HVAC) Control

10.3.1.2. Lighting Control System

10.3.1.3. Security and Surveillance

10.3.1.4. Room Control System

10.3.1.5. Fire Control System

10.3.1.6. Access Control System

10.3.1.7. Energy Management System

10.3.1.8. Others

10.3.2. Services

10.3.2.1. Consultancy & Installation

10.3.2.2. Building Cybersecurity

10.3.2.3. Facility Management & Maintenance

10.4. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

10.4.1. Wired

10.4.2. Wireless

10.4.2.1. ZigBee

10.4.2.2. Wi-Fi

10.4.2.3. Bluetooth

10.4.2.4. Others

10.5. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

10.5.1. Residential

10.5.2. Commercial

10.5.3. Industrial

10.6. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. Germany

10.6.2. The U.K.

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Offerings

10.7.2. By Technology

10.7.3. By End-use

10.7.4. By Country/Sub-region

11. Asia Pacific Building Automation and Control System Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Offerings, 2017–2031

11.3.1. Solution

11.3.1.1. Heating, Ventilation and Air-conditioning (HVAC) Control

11.3.1.2. Lighting Control System

11.3.1.3. Security and Surveillance

11.3.1.4. Room Control System

11.3.1.5. Fire Control System

11.3.1.6. Access Control System

11.3.1.7. Energy Management System

11.3.1.8. Others

11.3.2. Services

11.3.2.1. Consultancy & Installation

11.3.2.2. Building Cybersecurity

11.3.2.3. Facility Management & Maintenance

11.4. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

11.4.1. Wired

11.4.2. Wireless

11.4.2.1. ZigBee

11.4.2.2. Wi-Fi

11.4.2.3. Bluetooth

11.4.2.4. Others

11.5. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

11.5.1. Residential

11.5.2. Commercial

11.5.3. Industrial

11.6. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Offerings

11.7.2. By Technology

11.7.3. By End-use

11.7.4. By Country/Sub-region

12. Middle East & Africa Building Automation and Control System Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Offerings, 2017–2031

12.3.1. Solution

12.3.1.1. Heating, Ventilation and Air-conditioning (HVAC) Control

12.3.1.2. Lighting Control System

12.3.1.3. Security and Surveillance

12.3.1.4. Room Control System

12.3.1.5. Fire Control System

12.3.1.6. Access Control System

12.3.1.7. Energy Management System

12.3.1.8. Others

12.3.2. Services

12.3.2.1. Consultancy & Installation

12.3.2.2. Building Cybersecurity

12.3.2.3. Facility Management & Maintenance

12.4. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

12.4.1. Wired

12.4.2. Wireless

12.4.2.1. ZigBee

12.4.2.2. Wi-Fi

12.4.2.3. Bluetooth

12.4.2.4. Others

12.5. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

12.5.1. Residential

12.5.2. Commercial

12.5.3. Industrial

12.6. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Offerings

12.7.2. By Technology

12.7.3. By End-use

12.7.4. By Country/Sub-region

13. South America Building Automation and Control System Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Offerings, 2017–2031

13.3.1. Solution

13.3.1.1. Heating, Ventilation and Air-conditioning (HVAC) Control

13.3.1.2. Lighting Control System

13.3.1.3. Security and Surveillance

13.3.1.4. Room Control System

13.3.1.5. Fire Control System

13.3.1.6. Access Control System

13.3.1.7. Energy Management System

13.3.1.8. Others

13.3.2. Services

13.3.2.1. Consultancy & Installation

13.3.2.2. Building Cybersecurity

13.3.2.3. Facility Management & Maintenance

13.4. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

13.4.1. Wired

13.4.2. Wireless

13.4.2.1. ZigBee

13.4.2.2. Wi-Fi

13.4.2.3. Bluetooth

13.4.2.4. Others

13.5. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

13.5.1. Residential

13.5.2. Commercial

13.5.3. Industrial

13.6. Building Automation and Control System Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Offerings

13.7.2. By Technology

13.7.3. By End-use

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Building Automation and Control System Market Competition Matrix - a Dashboard View

14.1.1. Global Building Automation and Control System Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Beijer Electronics

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Control4 Corporation

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. General Electric Company

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Honeywell International Inc.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Hubbell Incorporated

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Johnson Controls International

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Legrand SA

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Lutron Electronics Co., Inc

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Schneider Electric SE

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Siemens AG

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Offerings

16.1.2. By Technology

16.1.3. By End-use

16.1.4. By Region

List of Tables

Table 1: Global Building Automation and Control System Market Size & Forecast, by Offerings, Value (US$ Bn), 2017-2031

Table 2: Global Building Automation and Control System Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 3: Global Building Automation and Control System Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 4: Global Building Automation and Control System Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 5: North America Building Automation and Control System Market Size & Forecast, by Offerings, Value (US$ Bn), 2017-2031

Table 6: North America Building Automation and Control System Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 7: North America Building Automation and Control System Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 8: North America Building Automation and Control System Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 9: Europe Building Automation and Control System Market Size & Forecast, by Offerings, Value (US$ Bn), 2017-2031

Table 10: Europe Building Automation and Control System Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 11: Europe Building Automation and Control System Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 12: Europe Building Automation and Control System Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 13: Asia Pacific Building Automation and Control System Market Size & Forecast, by Offerings, Value (US$ Bn), 2017-2031

Table 14: Asia Pacific Building Automation and Control System Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 15: Asia Pacific Building Automation and Control System Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 16: Asia Pacific Building Automation and Control System Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 17: Middle East & Africa Building Automation and Control System Market Size & Forecast, by Offerings, Value (US$ Bn), 2017-2031

Table 18: Middle East & Africa Building Automation and Control System Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 19: Middle East & Africa Building Automation and Control System Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 20: Middle East & Africa Building Automation and Control System Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 21: South America Building Automation and Control System Market Size & Forecast, by Offerings, Value (US$ Bn), 2017-2031

Table 22: South America Building Automation and Control System Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 23: South America Building Automation and Control System Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 24: South America Building Automation and Control System Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

List of Figures

Figure 1: Global Building Automation and Control System Market Share Analysis, by Region

Figure 2: Global Building Automation and Control System Price Trend Analysis (Average Price, US$)

Figure 3: Global Building Automation and Control System Market, Value (US$ Bn), 2017-2031

Figure 4: Global Building Automation and Control System Market Size & Forecast, by Offerings, Revenue (US$ Bn), 2017-2031

Figure 5: Global Building Automation and Control System Market Share Analysis, by Offerings, 2023 and 2031

Figure 6: Global Building Automation and Control System Market Attractiveness, By Offerings, Value (US$ Bn), 2023-2031

Figure 7: Global Building Automation and Control System Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 8: Global Building Automation and Control System Market Share Analysis, by Technology, 2023 and 2031

Figure 9: Global Building Automation and Control System Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 10: Global Building Automation and Control System Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 11: Global Building Automation and Control System Market Share Analysis, by End-use, 2023 and 2031

Figure 12: Global Building Automation and Control System Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 13: Global Building Automation and Control System Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 14: Global Building Automation and Control System Market Share Analysis, by Region, 2023 and 2031

Figure 15: Global Building Automation and Control System Market Attractiveness, By Region, Value (US$ Bn), 2023-2031

Figure 16: North America Building Automation and Control System Market Size & Forecast, by Offerings, Revenue (US$ Bn), 2017-2031

Figure 17: North America Building Automation and Control System Market Share Analysis, by Offerings, 2023 and 2031

Figure 18: North America Building Automation and Control System Market Attractiveness, By Offerings, Value (US$ Bn), 2023-2031

Figure 19: North America Building Automation and Control System Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 20: North America Building Automation and Control System Market Share Analysis, by Technology, 2023 and 2031

Figure 21: North America Building Automation and Control System Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 22: North America Building Automation and Control System Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 23: North America Building Automation and Control System Market Share Analysis, by End-use, 2023 and 2031

Figure 24: North America Building Automation and Control System Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 25: North America Building Automation and Control System Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 26: North America Building Automation and Control System Market Share Analysis, by Country 2023 and 2031

Figure 27: North America Building Automation and Control System Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 28: Europe Building Automation and Control System Market Size & Forecast, by Offerings, Revenue (US$ Bn), 2017-2031

Figure 29: Europe Building Automation and Control System Market Share Analysis, by Offerings, 2023 and 2031

Figure 30: Europe Building Automation and Control System Market Attractiveness, By Offerings, Value (US$ Bn), 2023-2031

Figure 31: Europe Building Automation and Control System Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 32: Europe Building Automation and Control System Market Share Analysis, by Technology, 2023 and 2031

Figure 33: Europe Building Automation and Control System Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 34: Europe Building Automation and Control System Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 35: Europe Building Automation and Control System Market Share Analysis, by End-use, 2023 and 2031

Figure 36: Europe Building Automation and Control System Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 37: Europe Building Automation and Control System Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 38: Europe Building Automation and Control System Market Share Analysis, by Country 2023 and 2031

Figure 39: Europe Building Automation and Control System Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Building Automation and Control System Market Size & Forecast, by Offerings, Revenue (US$ Bn), 2017-2031

Figure 41: Asia Pacific Building Automation and Control System Market Share Analysis, by Offerings, 2023 and 2031

Figure 42: Asia Pacific Building Automation and Control System Market Attractiveness, By Offerings, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Building Automation and Control System Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 44: Asia Pacific Building Automation and Control System Market Share Analysis, by Technology, 2023 and 2031

Figure 45: Asia Pacific Building Automation and Control System Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Building Automation and Control System Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 47: Asia Pacific Building Automation and Control System Market Share Analysis, by End-use, 2023 and 2031

Figure 48: Asia Pacific Building Automation and Control System Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Building Automation and Control System Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 50: Asia Pacific Building Automation and Control System Market Share Analysis, by Country 2023 and 2031

Figure 51: Asia Pacific Building Automation and Control System Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Building Automation and Control System Market Size & Forecast, by Offerings, Revenue (US$ Bn), 2017-2031

Figure 53: Middle East & Africa Building Automation and Control System Market Share Analysis, by Offerings, 2023 and 2031

Figure 54: Middle East & Africa Building Automation and Control System Market Attractiveness, By Offerings, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Building Automation and Control System Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 56: Middle East & Africa Building Automation and Control System Market Share Analysis, by Technology, 2023 and 2031

Figure 57: Middle East & Africa Building Automation and Control System Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Building Automation and Control System Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 59: Middle East & Africa Building Automation and Control System Market Share Analysis, by End-use, 2023 and 2031

Figure 60: Middle East & Africa Building Automation and Control System Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Building Automation and Control System Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 62: Middle East & Africa Building Automation and Control System Market Share Analysis, by Country 2023 and 2031

Figure 63: Middle East & Africa Building Automation and Control System Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 64: South America Building Automation and Control System Market Size & Forecast, by Offerings, Revenue (US$ Bn), 2017-2031

Figure 65: South America Building Automation and Control System Market Share Analysis, by Offerings, 2023 and 2031

Figure 66: South America Building Automation and Control System Market Attractiveness, By Offerings, Value (US$ Bn), 2023-2031

Figure 67: South America Building Automation and Control System Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 68: South America Building Automation and Control System Market Share Analysis, by Technology, 2023 and 2031

Figure 69: South America Building Automation and Control System Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 70: South America Building Automation and Control System Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 71: South America Building Automation and Control System Market Share Analysis, by End-use, 2023 and 2031

Figure 72: South America Building Automation and Control System Market Attractiveness, By End-use, Value (US$ Bn), 2023-2031

Figure 73: South America Building Automation and Control System Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 74: South America Building Automation and Control System Market Share Analysis, by Country 2023 and 2031

Figure 75: South America Building Automation and Control System Market Attractiveness, By Country Value (US$ Bn), 2023-2031