As the world gets closer and more connected, advancements in communication are being majorly witnessed. As broadcast businesses aim to provide seamless communication to consumers, worldwide, the broadcast and media technology (solutions and services) market is likely to witness major transformations in the coming years. Content consumption through next-gen connected devices continues to increase, offering content in an enhanced experience. Such changing content consumption patterns are being addressed with new broadcasting and media technologies.

Telling stories with technology is becoming mainstream, as companies continue to incorporate next-gen technologies in the process of offering broadcast and media solutions and services. Transparency Market Research (TMR), in its recent publication, analyzes the key dynamics of the broadcast and media technology industry, from changing consumer preference for faster networks, transformations in broadcasting and media channels, to continual developments made in a bid to offer quick-paced and seamless broadcasting.

The emerging broadcast and media technology ecosystem has an incremental growth cited deeper in history. The radio was the first media form, and had a huge impact on the history of the 20th century, and allowed the first-ever information broadcast without wires. Following this, the 1920s marked the beginning of the television era. As it combined the best attributes of radio and pictures, and changed media, television has captured the imagination of audiences ever since its inception.

The invention of cable TV in the 1980s along with the expansion of the Internet in the 2000s offered more alternatives for media consumers.

Technological revolutions became a nexus between historical broadcast and media and the changing communication expectations. With the evolution of technology, audiences’ needs and expectations continued to grow. Broadcasting has undergone a slew of transformations, with satellite, cable, and on-demand irreversibly altering consumer viewing habits. However, recently, the mobile is beginning to transform the face of broadcast and media. Another aspect driving the current broadcast and media technology business is the continued development and incorporation of technology to offer improved broadcasting to consumers. The broadcast and media technology (solutions and services) market is likely to generate a revenue of ~ US$ 6.3 Bn in 2019. Market growth is attributed to key trends, including the growing penetration of on-demand content, popularity of live video streaming, rise in digital advertisements, and emerging network infrastructure.

As consumers are becoming tech-savvy, broadcast and media technology (solutions and services) providers are leveraging cutting-edge technologies to improvise broadcast and media technology solutions and services. With the utilization of artificial intelligence and algorithms that offer better, more targeted recommendations, broadcasters would be able to offer a better user experience. Companies look to develop block-chain-based business models to solve potential issues pertaining to the industry, including combating piracy, securing royalty payments, and managing digital rights.

The era of well-designed data and voice packages along with enticing purchase offers have propelled the utilization of smartphones. Moreover, the increasing use of the Internet, and the growing access to media and video streaming have further accelerated the growth of the broadcast and media technology (solutions and services) business.

The latest 5G network infrastructure is likely to disrupt the broadcast and media technology (solutions and services) landscape. Users would be able to communicate in remote as well as crowded areas with high-speed broadband, promoting on-demand media from any device or location. 5G would maximize consumer experience, for both, indoor and outdoor connectivity.

Despite the positive influence of the aforementioned trends, the broadcast and media technology (solutions and services) market is likely to face challenges on account of the disparity in regulations of governments of different countries.

Competitors’ Success Strategies

Strategize on the OTT front

Over-the-top services are gaining center stage in broadcast and media technology (solutions and services) market. This is primarily attributed to the favorable high smartphone penetration rate, coupled with enhanced broadband services. Broadcast and media technology services competitors are strategizing their businesses towards this segment by introducing newer OTT services to address the robust demand.

Live broadcasting and video streaming is becoming popular among consumers, especially young consumers and millennials. Companies, in order to entice this consumer base, are launching free, ad-supported streaming services that include access to certain popular channels, and robust video on-demand collection and local channels featuring programming based on consumers’ regions. Technological advances further support the growth of live broadcasting.

Companies continue to adopt a consumer-centric approach while offering broadcast and media technology (solutions and services). The increasing demand for media and entertainment in motion or on mobile platforms has offered tremendous opportunities for broadcast and media technology (solutions and services) market competitors. They are concentrating on conquering mobile platforms to broaden their consumer reach. Moreover, in the era of autonomous driving, in-car media services are likely to gain major impetus, driving growth opportunities for market players.

In 2019, Quantum Corp. announced the launch of its flexible and efficient storage platform, designed for industrial IoT and surveillance applications. This new series is available in a wide-ranging server choices, and is ideal for deployments with less than ten cameras. With the use of this solution, security professionals can record and store surveillance footage, and efficiently run an entire security infrastructure on a single platform.

In 2019, WideOrbit and Mediaocean entered into a partnership to automate the buying and selling of local broadcast ad spots, which would it make it easier for media buyers to add local television inventory to brand campaigns. The collaboration between these companies focuses on improving processes and developing integrations that eradicate time-consuming tasks, which could make local TV buying expensive and inefficient for national media buying agencies.

With 40-45% market share held by leading players, the broadcast and media technology (solutions and services) market is a moderately consolidated market space. Companies operating in this market continue to focus on long-term contracts with publishing platforms to broadcast and monetize their digital content across all platforms. Investments centering the establishment of new broadcast centers are also witnessed.

Analysts’ Perspective

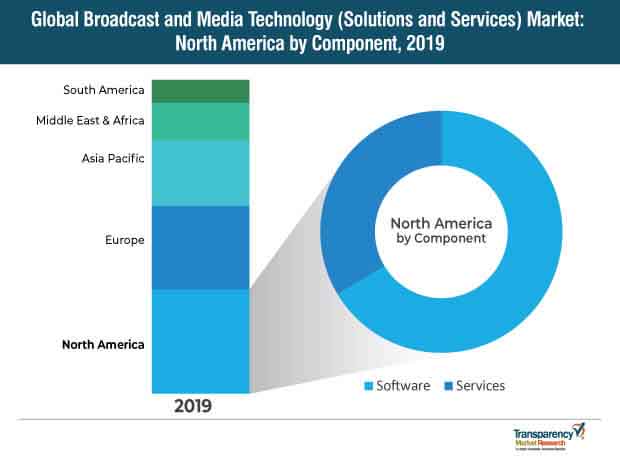

As network capabilities continue to expand, streaming will become more cost-effective and accessible for consumers, leading to rapid growth in video consumption, thereby strengthening the broadcast and media technology (solutions and services) market. Another aspect likely to drive market growth is the focus of various technology companies towards the media business, with a number of acquisitions witnessed recently. As the number of buyers are expected to rise in the coming years, the degree of competition continues to remain medium to high. Vendors need to innovate and cater to the constantly changing demands of customers, offering unique tools at competitive pricing to entice a larger consumer base. North America holds potential opportunities for broadcast and media technology (solutions and services), wherein, key players are strengthening their businesses in the U.S. Although not the leading market, Asia Pacific remains a high growth market for broadcast and media technology (solutions and services). New entrants can cash in on opportunities held by Asia Pacific on account of the rapid smartphone penetration witnessed in the region.

Global Broadcast and Media Technology (Solutions and Services) Market: Overview

Broadcast and Media Technology (Solutions and Services) Market Sees Growing Demand for Emerging Technologies

Broadcast and Media Technology (Solutions and Services) Market: Taxonomy

Broadcast and Media Technology (Solutions and Services) Market: Regional Outlook

The report provides in-depth segment analysis of the global broadcast and media technology (solutions and services) market, thereby providing valuable insights at macro as well as micro levels. Analysis of major countries that hold growth opportunities or account for significant shares has also been included as part of the geographic analysis for the broadcast and media technology (solutions and services) market.

Broadcast and Media Technology (Solutions and Services) Market: Competition Dynamics

The research study includes profiles of leading companies operating in the global broadcast and media technology (solutions and services) market. Key players profiled in the report include

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Broadcast and Media Technology (Solutions & Services) Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. GlobalICT Spending (US$ Mn), 2013, 2019, 2027

4.3. Total Number of subscriber, by Platform

4.3.1. Terrestrial

4.3.2. Satellite

4.3.3. Cable

4.3.4. OTT

4.3.5. IPTV

4.4. Media and Entertainment Industry Overview

4.5. Regulations and Policies

4.6. Market Factor Analysis

4.6.1. Porter’s Five Forces Analysis

4.6.2. PESTEL Analysis

4.6.3. Ecosystem Analysis

4.6.4. Market Dynamics (Growth Influencers)

4.6.4.1. Drivers

4.6.4.2. Restraints

4.6.4.3. Opportunities

4.6.4.4. Trends

4.6.4.5. Impact Analysis of Drivers & Restraints

4.7. Global Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast, 2012 - 2027

4.7.1. Market Revenue Analysis (US$ Mn)

4.7.1.1. Historic Growth Trends, 2012-2018

4.7.1.2. Forecast Trends, 2019-2027

4.8. Market Attractiveness Analysis– By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.8.1. By Component

4.8.2. By Solution

4.8.3. By Hosting Model

4.8.4. By Service Provider/End-user

4.9. Market Outlook

4.10. Competitive Scenario and Trends

4.10.1. Broadcast and Media Technology (Solutions & Services) Market Concentration Rate

4.10.1.1. List of New Entrants

4.10.2. Mergers & Acquisitions, Expansions

5. Global Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecasts, By Component

5.1. Overview& Definitions

5.2. Broadcast and Media Technology (Solutions & Services)Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

5.2.1. Software

5.2.1.1. On-Premise

5.2.1.2. Cloud

5.2.2. Services

5.2.2.1. Consulting

5.2.2.2. Support & Maintenance

5.2.2.3. Managed Services

6. Global Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast, By Solution

6.1. Overview& Definitions

6.2. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

6.2.1. Web Content Management

6.2.2. Content Storage Solutions

6.2.3. Editorial & Print Workflow

6.2.4. Media/Digital Asset Management

6.2.5. Revenue Management

6.2.6. Ad & Data Management

6.2.7. User Management

7. Global Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast, By Hosting Model

7.1. Overview& Definitions

7.2. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Hosting Model, 2017 - 2027

7.2.1. Integrated

7.2.2. Standalone

7.2.2.1. Content Creation/Storage

7.2.2.2. Content Distribution

8. Global Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast, By Service Provider/End-user

8.1. Overview& Definitions

8.2. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Service Provider/End-user, 2017 - 2027

8.2.1. Broadcaster

8.2.1.1. Terrestrial

8.2.1.2. Satellite

8.2.1.3. Cable

8.2.2. Studios & Creators

8.2.3. Distributors

8.2.4. OTT

8.2.5. IPTV

9. Global Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast, by Region

9.1. Overview

9.2. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast

10.1. Key Findings

10.2. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

10.2.1. Software

10.2.1.1. On-Premise

10.2.1.2. Cloud

10.2.2. Services

10.2.2.1. Consulting

10.2.2.2. Support & Maintenance

10.2.2.3. Managed Services

10.3. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

10.3.1. Web Content Management

10.3.2. Content Storage Solutions

10.3.3. Editorial & Print Workflow

10.3.4. Media/Digital Asset Management

10.3.5. Revenue Management

10.3.6. Ad & Data Management

10.3.7. User Management

10.4. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Hosting Model, 2017 - 2027

10.4.1. Integrated

10.4.2. Standalone

10.4.2.1. Content Creation/Storage

10.4.2.2. Content Distribution

10.5. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Service Provider/End-user, 2017 - 2027

10.5.1. Broadcaster

10.5.1.1. Terrestrial

10.5.1.2. Satellite

10.5.1.3. Cable

10.5.2. Studios & Creators

10.5.3. Distributors

10.5.4. OTT

10.5.5. IPTV

10.6. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

11. Europe Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast

11.1. Key Findings

11.2. Broadcast and Media Technology (Solutions & Services)Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

11.2.1. Software

11.2.1.1. On-Premise

11.2.1.2. Cloud

11.2.2. Services

11.2.2.1. Consulting

11.2.2.2. Support & Maintenance

11.2.2.3. Managed Services

11.3. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

11.3.1. Web Content Management

11.3.2. Content Storage Solutions

11.3.3. Editorial & Print Workflow

11.3.4. Media/Digital Asset Management

11.3.5. Revenue Management

11.3.6. Ad & Data Management

11.3.7. User Management

11.4. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Hosting Model, 2017 - 2027

11.4.1. Integrated

11.4.2. Standalone

11.4.2.1. Content Creation/Storage

11.4.2.2. Content Distribution

11.5. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Service Provider/End-user, 2017 - 2027

11.5.1. Broadcaster

11.5.1.1. Terrestrial

11.5.1.2. Satellite

11.5.1.3. Cable

11.5.2. Studios & Creators

11.5.3. Distributors

11.5.4. OTT

11.5.5. IPTV

11.6. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

11.6.1. Germany

11.6.2. The UK

11.6.3. France

11.6.4. Rest of Europe

12. Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast

12.1. Key Findings

12.2. Broadcast and Media Technology (Solutions & Services)Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

12.2.1. Software

12.2.1.1. On-Premise

12.2.1.2. Cloud

12.2.2. Services

12.2.2.1. Consulting

12.2.2.2. Support & Maintenance

12.2.2.3. Managed Services

12.3. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

12.3.1. Web Content Management

12.3.2. Content Storage Solutions

12.3.3. Editorial & Print Workflow

12.3.4. Media/Digital Asset Management

12.3.5. Revenue Management

12.3.6. Ad & Data Management

12.3.7. User Management

12.4. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Hosting Model, 2017 - 2027

12.4.1. Integrated

12.4.2. Standalone

12.4.2.1. Content Creation/Storage

12.4.2.2. Content Distribution

12.5. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Service Provider/End-user, 2017 - 2027

12.5.1. Broadcaster

12.5.1.1. Terrestrial

12.5.1.2. Satellite

12.5.1.3. Cable

12.5.2. Studios & Creators

12.5.3. Distributors

12.5.4. OTT

12.5.5. IPTV

12.6. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Australia

12.6.5. Rest of Asia Pacific

13. Middle East & Africa (MEA) Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast

13.1. Key Findings

13.2. Broadcast and Media Technology (Solutions & Services)Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

13.2.1. Software

13.2.1.1. On-Premise

13.2.1.2. Cloud

13.2.2. Services

13.2.2.1. Consulting

13.2.2.2. Support & Maintenance

13.2.2.3. Managed Services

13.3. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

13.3.1. Web Content Management

13.3.2. Content Storage Solutions

13.3.3. Editorial & Print Workflow

13.3.4. Media/Digital Asset Management

13.3.5. Revenue Management

13.3.6. Ad & Data Management

13.3.7. User Management

13.4. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Hosting Model, 2017 - 2027

13.4.1. Integrated

13.4.2. Standalone

13.4.2.1. Content Creation/Storage

13.4.2.2. Content Distribution

13.5. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Service Provider/End-user, 2017 - 2027

13.5.1. Broadcaster

13.5.1.1. Terrestrial

13.5.1.2. Satellite

13.5.1.3. Cable

13.5.2. Studios & Creators

13.5.3. Distributors

13.5.4. OTT

13.5.5. IPTV

13.6. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of MEA

14. South America Broadcast and Media Technology (Solutions & Services) Market Analysis and Forecast

14.1. Key Findings

14.2. Broadcast and Media Technology (Solutions & Services)Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

14.2.1. Software

14.2.1.1. On-Premise

14.2.1.2. Cloud

14.2.2. Services

14.2.2.1. Consulting

14.2.2.2. Support & Maintenance

14.2.2.3. Managed Services

14.3. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Solution, 2017 - 2027

14.3.1. Web Content Management

14.3.2. Content Storage Solutions

14.3.3. Editorial & Print Workflow

14.3.4. Media/Digital Asset Management

14.3.5. Revenue Management

14.3.6. Ad & Data Management

14.3.7. User Management

14.4. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Hosting Model, 2017 - 2027

14.4.1. Integrated

14.4.2. Standalone

14.4.2.1. Content Creation/Storage

14.4.2.2. Content Distribution

14.5. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Service Provider/End-user, 2017 - 2027

14.5.1. Broadcaster

14.5.1.1. Terrestrial

14.5.1.2. Satellite

14.5.1.3. Cable

14.5.2. Studios & Creators

14.5.3. Distributors

14.5.4. OTT

14.5.5. IPTV

14.6. Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

14.6.1. Brazil

14.6.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), By Company (2018)

16. Company Profiles(Details – Business Overview, Sales Area/Geographical Presence, Revenue and Strategy)

16.1. Evertz Technologies Limited

16.1.1. Business Overview

16.1.2. Revenue

16.1.3. Strategy

16.2. IBM Corporation

16.2.1. Business Overview

16.2.2. Revenue

16.2.3. Strategy

16.3. Quantum Corporation

16.3.1. Business Overview

16.3.2. Revenue

16.3.3. Strategy

16.4. ROHDE & SCHWARZ GmbH & Co. KG

16.4.1. Business Overview

16.4.2. Revenue

16.4.3. Strategy

16.5. Dell Inc. (EMC Corporation)

16.5.1. Business Overview

16.5.2. Revenue

16.5.3. Strategy

16.6. Grass Valley USA, LLC

16.6.1. Business Overview

16.6.2. Revenue

16.6.3. Strategy

16.7. AVI Systems

16.7.1. Business Overview

16.7.2. Revenue

16.7.3. Strategy

16.8. Video Stream Networks S.L.

16.8.1. Business Overview

16.8.2. Revenue

16.8.3. Strategy

16.9. WideOrbit Inc.

16.9.1. Business Overview

16.9.2. Revenue

16.9.3. Strategy

16.10. Harmonic Inc.

16.10.1. Business Overview

16.10.2. Revenue

16.10.3. Strategy

17. Key Takeaways

List of Tables

Table 1: North America ICT Spending (US$ Mn)

Table 2: Europe ICT Spending (US$ Mn)

Table 3: Asia Pacific ICT Spending (US$ Mn)

Table 4: MEA ICT Spending (US$ Mn)

Table 5: South America ICT Spending (US$ Mn)

Table 6: Global Broadcast and Media Technology (Solutions & Services) Market Size, by Component , 2017–2027

Table 7: Global Broadcast and Media Technology (Solutions & Services) Market Size, by Solutions, 2017–2027

Table 8: Global Broadcast and Media Technology (Solutions & Services) Market Size, by Hosting Model, 2017–2027

Table 9: Global Broadcast and Media Technology (Solutions & Services) Market Size, by Service Provider/End-User, 2017–2027

Table 10: Global Broadcast and Media Technology (Solutions & Services) Market Size, by Regions, 2017–2027

Table 11: North America Broadcast and Media Technology (Solutions & Services) Market Size, by Component , 2017–2027

Table 12: North America Broadcast and Media Technology (Solutions & Services) Market Size, by Solutions , 2017–2027

Table 13: North America Broadcast and Media Technology (Solutions & Services) Market Size, by Hosting Model, 2017–2027

Table 14: North America Broadcast and Media Technology (Solutions & Services) Market Size, by Service Provider/End-User, 2017–2027

Table 15: North America Broadcast and Media Technology (Solutions & Services) Market Size, by Country, 2017–2027

Table 16: Europe Broadcast and Media Technology (Solutions & Services) Market Size, by Component, 2017–2027

Table 17: Europe Broadcast and Media Technology (Solutions & Services) Market Size, by Solutions, 2017–2027

Table 18: Europe Broadcast and Media Technology (Solutions & Services) Market Size, by Hosting Model, 2017–2027

Table 19: Europe Broadcast and Media Technology (Solutions & Services) Market Size, by Service Provider/End-User, 2017–2027

Table 20: Europe Broadcast and Media Technology (Solutions & Services) Market Size, by Country, 2017–2027

Table 21: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Size, by Component, 2017–2027

Table 22: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Size, by Solutions, 2017–2027

Table 23: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Size, by Hosting Model, 2017–2027

Table 24: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Size, by Service Provider/End-User, 2017–2027

Table 25: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Size, by Country, 2017–2027

Table 26: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Size, by Component, 2017–2027

Table 27: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Size, by Solutions, 2017–2027

Table 28: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Size, by Hosting Model, 2017–2027

Table 29: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Size, by Service Provider/End-User, 2017–2027

Table 30: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Size, by Country, 2017–2027

Table 31: South America Broadcast and Media Technology (Solutions & Services) Market Size, by Component, 2017–2027

Table 32: South America Broadcast and Media Technology (Solutions & Services) Market Size, by Solutions, 2017–2027

Table 33: South America Broadcast and Media Technology (Solutions & Services) Market Size, by Hosting Model, 2017–2027

Table 34: South America Broadcast and Media Technology (Solutions & Services) Market Size, by Service Provider/End-User, 2017–2027

Table 35: South America Broadcast and Media Technology (Solutions & Services) Market Size, by Country, 2017–2027

List of Figures

Figure 1. Global Broadcast and Media Technology (Solutions & Services) Market Size (US$ Mn) and Forecast, 2017–2027

Figure 2: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 3: Top Economies GDP Landscape, 2018

Figure 4: Major Countries Average GDP Contribution, by Industry, 2018

Figure 5: Top Economies GDP Landscape

Figure 6: Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Tn), By Major Countries, 2012-2017

Figure 7: Growth rates are expected to remain steady, even as the industry is being transformed

Figure 8: Digital revenues will continue to make up more and more of the industry’s income

Figure 9: Total Number of Subscriber, by Platform (Mn)

Figure 10: Global Broadcast and Media Technology (Solutions & Services) Market Historic Growth Trends (US$ Mn), 2012 – 2017

Figure 11: Global Broadcast and Media Technology (Solutions & Services) Market Y-o-Y Growth (Value %), 2013 – 2017

Figure 12: Global Broadcast and Media Technology (Solutions & Services) Market Forecast Trends (US$ Mn), 2017 - 2026

Figure 13: Global Broadcast and Media Technology (Solutions & Services) Market Y-o-Y Growth (Value %), 2017 - 2026

Figure 14: Global Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Component (2019)

Figure 15: Global Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Solutions (2019)

Figure 16: Global Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Hosting Model (2019)

Figure 17: Global Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Service Provider/End-User (2019)

Figure 18: Global Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Region (2019)

Figure 19: North America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Component (2019)

Figure 20: North America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Solutions (2019)

Figure 21: North America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Hosting Model (2019)

Figure 22: North America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Service Provider/End-User (2019)

Figure 23: North America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Country (2019)

Figure 24: Europe Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Component (2019)

Figure 25: Europe Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Solutions (2019)

Figure 26: Europe Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Hosting Model (2019)

Figure 27: Europe Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Service Provider/End-User (2019)

Figure 28: Europe Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Country (2019)

Figure 29: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Component (2019)

Figure 30: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Solutions (2019)

Figure 31: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Hosting Model (2019)

Figure 32: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Service Provider/End-User (2019)

Figure 33: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Country (2019)

Figure 34: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Component (2019)

Figure 35: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Solutions (2019)

Figure 36: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Hosting Model (2019)

Figure 37: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Service Provider/End-User (2019)

Figure 38: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Country (2019)

Figure 39: South America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Component (2019)

Figure 40: South America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Solutions (2019)

Figure 41: South America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Hosting Model (2019)

Figure 42: South America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Service Provider/End-User (2019)

Figure 43: South America Broadcast and Media Technology (Solutions & Services) Market Attractiveness Analysis, by Country (2019)

Figure 44: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Component (2019)

Figure 45: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Component (2027)

Figure 46: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Broadcaster Type (2019)

Figure 47: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Broadcaster Type (2027)

Figure 48: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Hosting Model (2019)

Figure 49: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Hosting Model (2027)

Figure 50: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Service Provider/End-User (2019)

Figure 51: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Service Provider/End-User (2027)

Figure 52: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Region (2019)

Figure 53: Global Broadcast and Media Technology (Solutions & Services) Market Value Share, by Region (2027)

Figure 54: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2019)

Figure 55: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2027)

Figure 56: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2019)

Figure 57: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2027)

Figure 58: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2019)

Figure 59: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2027)

Figure 60: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2019)

Figure 61: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2027)

Figure 62: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Regions (2019)

Figure 63: Global Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Regions (2027)

Figure 64: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2019)

Figure 65: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2027)

Figure 66: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2019)

Figure 67: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2027)

Figure 68: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2019)

Figure 69: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2027)

Figure 70: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2019)

Figure 71: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2027)

Figure 72: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country (2019)

Figure 73: North America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country(2027)

Figure 74: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2019)

Figure 75: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2027)

Figure 76: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2019)

Figure 77: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2027)

Figure 78: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2019)

Figure 79: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2027)

Figure 80: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2019)

Figure 81: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2027)

Figure 82: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country (2019)

Figure 83: Europe Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country(2027)

Figure 84: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2019)

Figure 85: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2027)

Figure 86: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2019)

Figure 87: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2027)

Figure 88: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2019)

Figure 89: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2027)

Figure 90: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2019)

Figure 91: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2027)

Figure 92: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country (2019)

Figure 93: Asia Pacific Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country(2027)

Figure 94: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2019)

Figure 95: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2027)

Figure 96: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2019)

Figure 97: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2027)

Figure 98: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2019)

Figure 99: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2027)

Figure 100: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2019)

Figure 101: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2027)

Figure 102: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country (2019)

Figure 103: Middle East & Africa Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country(2027)

Figure 104: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2019)

Figure 105: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Component (2027)

Figure 106: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2019)

Figure 107: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Solutions (2027)

Figure 108: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2019)

Figure 109: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Hosting Model (2027)

Figure 110: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2019)

Figure 111: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Service Provider/End-User (2027)

Figure 112: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country (2019)

Figure 113: South America Broadcast and Media Technology (Solutions & Services) Market Share Analysis, by Country(2027)