Breast cancer is one of the most common types of cancer found in women worldwide. However, breast cancer does not always show obvious symptoms in the early stages. Hence, companies in the breast cancer diagnostics market are increasing their R&D in AI technologies to identify unmet patient needs. For instance, Paragon Biosciences LLC announced the launch of its seventh portfolio company Qlarity Imaging LLC, to gain FDA clearance for their AI system used for breast cancer diagnostics in radiology.

Companies in the market are harnessing the advantages of AI to improve medical outcomes. The AI technology is being increasingly used in additional image modalities with the goal of lowering costs for hospitals as well as payers. Companies in the market for breast cancer diagnostics are directing their investments in developing AI systems with intuitive displays and machine learning (ML).

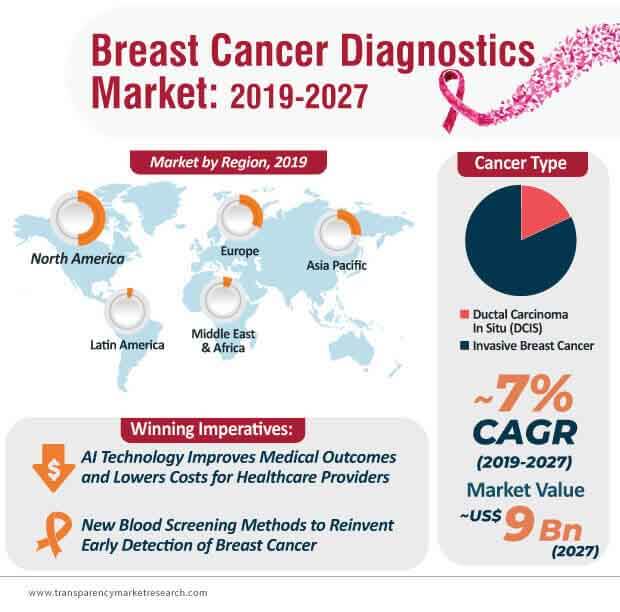

Most types of breast cancer are treatable and survival rates are high for patients that detect cancer at an early stage. Hence, researchers in the market for breast cancer diagnostics are increasing their focus in novel methods of blood screening that are reinventing techniques for early detection of breast cancer. For instance, researchers from the University of Nottingham are innovating in new blood screening methods that can help detect breast cancer years before it gets severe. Such discoveries are bolstering market growth, as the breast cancer diagnostics market is expected to reach a revenue of ~US$ 9 Bn by the end of 2027. Moreover, molecular testing is anticipated for exponential growth during the forecast period.

On the other hand, researchers are examining antigens and auto-antibodies to determine the presence of a tumor. Tumor-associated antigens (TAAs) are considered as a reliable indicator of breast cancer. Thus, companies in the market should collaborate with researchers to advance in clinical studies.

Nanotechnology holds promising potential for early detection of breast cancer. This technology is being highly publicized for its high sensitivity, specificity, and multiplexed measurement capacity in the breast cancer diagnostics market. However, translation of nanotechnology-based diagnostic methods into routine clinical applications poses as a challenge for healthcare providers.

The breast cancer diagnostics industry is consolidated with three major players accounting for ~66% of the global market share. This indicates that companies are increasing their research efforts in new diagnostic methods such as nanotechnology and deep learning to improve clinical numbers. However, the reliability of nanotechnology-based cancer diagnosis in regular clinical practices is still at the nascent stage in the market for breast cancer diagnostics. Moreover, high costs associated with the long-term storage of nanoprobes that are highly sensitive is another barrier for market growth. Hence, companies in the market for breast cancer diagnostics are simplifying the synthesis steps and nanoprobe functionalization and are increasing R&D to launch cost-efficient ways of introducing nanotechnology-based diagnosis in clinical practices.

Automated breast cancer diagnostics based on ML algorithms are bringing about a change in the market landscape. Soft computing techniques are being increasingly used to produce accurate and faster diagnosis of breast cancer amongst patients. Hence, healthcare companies in the breast cancer diagnostics market are collaborating with researchers to combine imaging techniques with ML algorithms to increase diagnosis accuracy. Preprocessing, feature extraction, and classification are becoming the key focus points for healthcare companies in order to advance in ML-based imaging techniques.

Several data mining and ML techniques are being used to facilitate careful interpretation and analysis of peripheral areas of the patient. As such, feature extraction plays a pivotal role in breast cancer detection using ML techniques. Such novel techniques are helping practitioners in the market to distinguish between benign and malignant tumors. Transform-based texture analysis techniques are being facilitated to convert the image into new analysis studies using spatial frequency properties.

Analysts’ Viewpoint

AI-assisted technologies have become the frontrunner for innovations in the breast cancer diagnostics market. Thus, the market is expected to expand at a favorable CAGR of ~7% during the forecast period. Precision medicines and personalized therapies are helping to improve clinical numbers. Since ‘cancer’ is commonly associated as an ‘expensive disease’, healthcare companies are increasing their R&S activities to boost the availability of affordable tests and treatments.

ML techniques are gaining prominence in mammographic imaging of regions of interest (ROIs). However, there is a need for more confined approach toward the detection of cancerous lesions in conventional ML studies. Hence, companies should increase focus in architecture distortion and the detection of bilateral asymmetry to innovate in mammographic imaging.

The market to reach valuation of ~US$ 9 Bn by 2027

The market is expected to expand at a favorable CAGR of ~7% during 2019 - 2027

The market is driven by high prevalence and increase in incidence rate of breast cancer across the globe

North America accounted for a major share of the market in 2018 and the trend is projected to continue during the forecast period

Key players in the market include Abbott Laboratories, Koninklijke Philips N.V., C. R. Bard, Inc., F. Hoffmann-La Roche Ltd., Fujifilm Holding Corporation, Leica Biosystems Nussloch GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Breast Cancer Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Breast Cancer Diagnostics Introduction

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Breast Cancer Diagnostics Market Analysis and Forecast, 2018–2028

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Breast Cancer Epidemiology, by Key Countries/Region

5.3. Breast Cancer Epidemiology

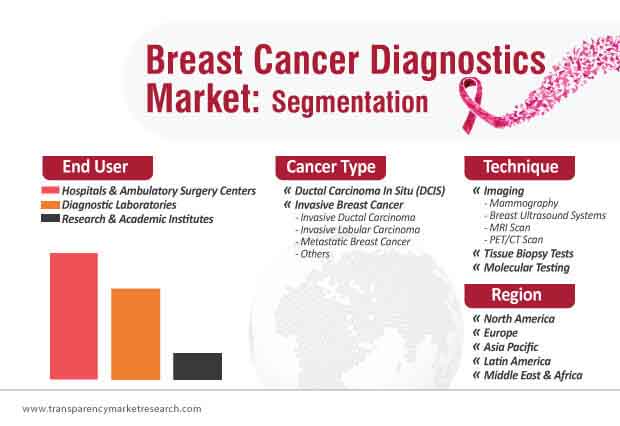

6. Global Breast Cancer Diagnostics Market Analysis and Forecast, by Technique

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Technique, 2018–2028

6.3.1. Imaging

6.3.1.1. Mammography

6.3.1.1.1. Analog Mammography

6.3.1.1.2. Digital Mammography

6.3.1.1.3. Breast Ultrasound System

6.3.1.1.4. MRI Scan

6.3.1.1.5. PET/CT Scan

6.3.2. Tissue Biopsy Tests

6.3.3. Molecular Testing

6.4. Market Attractiveness Analysis, by Technique

7. Global Breast Cancer Diagnostics Market Analysis and Forecast, by Cancer Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Cancer Type, 2018–2028

7.3.1. Ductal Carcinoma In Situ (DCIS)

7.3.2. Invasive Breast Cancer

7.3.2.1. Invasive Ductal Carcinoma

7.3.2.2. Invasive Lobular Carcinoma

7.3.2.3. Metastatic Breast Cancer

7.3.2.4. Others

7.4. Market Attractiveness Analysis, by Cancer Type

8. Global Breast Cancer Diagnostics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2018–2028

8.3.1. Hospitals & Ambulatory Surgery Center

8.3.2. Diagnostic Laboratories

8.3.3. Research & Academic Institutes

8.4. Market Attractiveness Analysis, by End-user

9. Global Breast Cancer Diagnostics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Country/Region

10. North America Global Breast Cancer Diagnostics Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Technique, 2018–2028

10.3.1. Imaging

10.3.1.1. Mammography

10.3.1.1.1. Analog Mammography

10.3.1.1.2. Digital Mammography

10.3.1.2. PET/CT Scan

10.3.2. Tissue Biopsy Tests

10.3.3. Molecular Testing

10.4. Market Value Forecast, by Cancer Type, 2018–2028

10.4.1. Ductal Carcinoma In Situ (DCIS)

10.4.2. Invasive Breast Cancer

10.4.2.1. Invasive Ductal Carcinoma

10.4.2.2. Invasive Lobular Carcinoma

10.4.2.3. Metastatic Breast Cancer

10.4.2.4. Others

10.5. Market Value Forecast, by End-user, 2018–2028

10.5.1. Hospitals & Ambulatory Surgery Center

10.5.2. Diagnostic Laboratories

10.5.3. Research & Academic Institutes

10.6. Market Value Forecast, by Country, 2018–2028

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Technique

10.7.2. By Cancer Type

10.7.3. By End-user

10.7.4. By Country

11. Europe Global Breast Cancer Diagnostics Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Technique, 2018–2028

11.3.1. Imaging

11.3.1.1. Mammography

11.3.1.1.1. Analog Mammography

11.3.1.1.2. Digital Mammography

11.3.1.2. PET/CT Scan

11.3.2. Tissue Biopsy Tests

11.3.3. Molecular Testing

11.4. Market Value Forecast, by Cancer Type, 2018–2028

11.4.1. Ductal Carcinoma In Situ (DCIS)

11.4.2. Invasive Breast Cancer

11.4.2.1. Invasive Ductal Carcinoma

11.4.2.2. Invasive Lobular Carcinoma

11.4.2.3. Metastatic Breast Cancer

11.4.2.4. Others

11.5. Market Value Forecast, by End-user, 2018–2028

11.5.1. Hospitals & Ambulatory Surgery Centers

11.5.2. Diagnostic Laboratories

11.5.3. Research & Academic Institutes

11.6. Market Value Forecast, by Country/Sub-region, 2018–2028

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Technique

11.7.2. By Cancer Type

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Asia Pacific Global Breast Cancer Diagnostics Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Technique, 2018–2028

12.3.1. Imaging

12.3.1.1. Mammography

12.3.1.1.1. Analog Mammography

12.3.1.1.2. Digital Mammography

12.3.1.2. PET/CT Scan

12.3.2. Tissue Biopsy Tests

12.3.3. Molecular Testing

12.4. Market Value Forecast, by Cancer Type, 2018–2028

12.4.1. Ductal Carcinoma In Situ (DCIS)

12.4.2. Invasive Breast Cancer

12.4.2.1. Invasive Ductal Carcinoma

12.4.2.2. Invasive Lobular Carcinoma

12.4.2.3. Metastatic Breast Cancer

12.4.2.4. Others

12.5. Market Value Forecast, by End-user, 2018–2028

12.5.1. Hospitals & Ambulatory Surgery Centers

12.5.2. Diagnostic Laboratories

12.5.3. Research & Academic Institutes

12.6. Market Value Forecast, by Country/Sub-region, 2018–2028

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Technique

12.7.2. By Cancer Type

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. Latin America Global Breast Cancer Diagnostics Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Technique, 2018–2028

13.3.1. Imaging

13.3.1.1. Mammography

13.3.1.1.1. Analog Mammography

13.3.1.1.2. Digital Mammography

13.3.1.2. PET/CT Scan

13.3.2. Tissue Biopsy Tests

13.3.3. Molecular Testing

13.4. Market Value Forecast, by Cancer Type, 2018–2028

13.4.1. Ductal Carcinoma In Situ (DCIS)

13.4.2. Invasive Breast Cancer

13.4.2.1. Invasive Ductal Carcinoma

13.4.2.2. Invasive Lobular Carcinoma

13.4.2.3. Metastatic Breast Cancer

13.4.2.4. Others

13.5. Market Value Forecast, by End-user, 2018–2028

13.5.1. Hospitals & Ambulatory Surgery Centers

13.5.2. Diagnostic Laboratories

13.5.3. Research & Academic Institutes

13.6. Market Value Forecast, by Country/Sub-region, 2018–2028

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Technique

13.7.2. By Cancer Type

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Middle East and Africa Global Breast Cancer Diagnostics Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Technique, 2018–2028

14.3.1. Imaging

14.3.1.1. Mammography

14.3.1.1.1. Analog Mammography

14.3.1.1.2. Digital Mammography

14.3.1.2. PET/CT Scan

14.3.2. Tissue Biopsy Tests

14.3.3. Molecular Testing

14.4. Market Value Forecast, by Cancer Type, 2018–2028

14.4.1. Ductal Carcinoma In Situ (DCIS)

14.4.2. Invasive Breast Cancer

14.4.2.1. Invasive Ductal Carcinoma

14.4.2.2. Invasive Lobular Carcinoma

14.4.2.3. Metastatic Breast Cancer

14.4.2.4. Others

14.5. Market Value Forecast, by End-user, 2018–2028

14.5.1. Hospitals & Ambulatory Surgery Centers

14.5.2. Diagnostic Laboratories

14.5.3. Research & Academic Institutes

14.6. Market Value Forecast, by Country/Sub-region, 2018–2028

14.6.1. GCC

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Technique

14.7.2. By Cancer Type

14.7.3. By End-user

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company, 2018

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.1.2. Product Portfolio

15.3.1.1.3. SWOT Analysis

15.3.1.1.4. Strategic Overview

15.3.2. GE Healthcare (General Electric Company)

15.3.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.1.2. Product Portfolio

15.3.2.1.3. SWOT Analysis

15.3.2.1.4. Strategic Overview

15.3.3. Koninklijke Philips N.V.

15.3.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.1.2. Product Portfolio

15.3.3.1.3. SWOT Analysis

15.3.3.1.4. Strategic Overview

15.3.4. Hologic, Inc.

15.3.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.1.2. Product Portfolio

15.3.4.1.3. SWOT Analysis

15.3.4.1.4. Strategic Overview

15.3.5. C. R. Bard, Inc. (Becton, Dickinson and Company)

15.3.5.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.1.2. Product Portfolio

15.3.5.1.3. SWOT Analysis

15.3.5.1.4. Strategic Overview

15.3.6. Siemens Healthineers (Siemens AG)

15.3.6.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.1.2. Product Portfolio

15.3.6.1.3. SWOT Analysis

15.3.6.1.4. Strategic Overview

15.3.7. F. Hoffmann-La Roche Ltd.

15.3.7.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.1.2. Product Portfolio

15.3.7.1.3. SWOT Analysis

15.3.7.1.4. Strategic Overview

15.3.8. Fujifilm Holding Corporation

15.3.8.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.1.2. Product Portfolio

15.3.8.1.3. SWOT Analysis

15.3.8.1.4. Strategic Overview

15.3.9. Leica Biosystems Nussloch GmbH (Danaher)

15.3.9.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.1.2. Product Portfolio

15.3.9.1.3. SWOT Analysis

15.3.9.1.4. Strategic Overview

15.3.10. bioTheranostics, Inc.

15.3.10.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.1.2. Product Portfolio

15.3.10.1.3. SWOT Analysis

15.3.10.1.4. Strategic Overview

15.3.11. Myriad Genetics, Inc.

15.3.11.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.1.2. Product Portfolio

15.3.11.1.3. SWOT Analysis

15.3.11.1.4. Strategic Overview

List of Tables

Table 01: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Technique, 2017–2027

Table 02: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Imaging, 2017–2027

Table 03: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Mammography, 2017–2027

Table 04: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Cancer Type, 2017–2027

Table 05: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Invasive Breast Cancer, 2017–2027

Table 06: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 07: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 09: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Technique, 2017–2027

Table 10: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Imaging, 2017–2027

Table 11: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Mammography, 2017–2027

Table 12: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Cancer Type, 2017–2027

Table 13: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Invasive Breast Cancer, 2017–2027

Table 14: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 15: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 16: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Technique, 2017–2027

Table 17: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Imaging, 2017–2027

Table 18: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Mammography, 2017–2027

Table 19: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Cancer Type, 2017–2027

Table 20: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Invasive Breast Cancer, 2017–2027

Table 21: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 22: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 23: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Technique, 2017–2027

Table 24: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Imaging, 2017–2027

Table 25: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Mammography, 2017–2027

Table 26: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Cancer Type, 2017–2027

Table 27: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Invasive Breast Cancer, 2017–2027

Table 28: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 29: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 30: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Technique, 2017–2027

Table 31: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Imaging, 2017–2027

Table 32: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Mammography, 2017–2027

Table 33: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Cancer Type, 2017–2027

Table 34: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Invasive Breast Cancer, 2017–2027

Table 35: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 36: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 37: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Technique, 2017–2027

Table 38: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Imaging, 2017–2027

Table 39: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Mammography, 2017–2027

Table 40: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Cancer Type, 2017–2027

Table 41: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by Invasive Breast Cancer, 2017–2027

Table 42: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01 Global Breast Cancer Diagnostics Market Value (US$ Mn), 2018 and 2027

Figure 02 Global Breast Cancer Diagnostics Market, Market Snapshot

Figure 03: Global Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 04: Global Breast Cancer Diagnostics Market Value Share, by Technique, 2018

Figure 05: Global Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018

Figure 06: Global Breast Cancer Diagnostics Market Value Share, by End-user, 2018

Figure 07: Global Breast Cancer Diagnostics Market Value Share, by Region, 2018

Figure 08: Global Breast Cancer Diagnostics Market Value Share, by Technique, 2018 and 2027

Figure 09: Global Breast Cancer Diagnostics Market Attractiveness Analysis, by Technique, 2019–2027

Figure 10: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Imaging, 2017–2027

Figure 11: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Tissue Biopsy Tests, 2017–2027

Figure 12: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Molecular Testing, 2017–2027

Figure 13: Global Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 14: Global Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 15: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ductal Carcinoma In Situ (DCIS), 2017–2027

Figure 16: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Invasive Breast Cancer, 2017–2027

Figure 17: Global Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 18: Global Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 19: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals & Ambulatory Surgery Center, 2017–2027

Figure 20: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diagnostic Laboratories, 2017–2027

Figure 21: Global Breast Cancer Diagnostics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Research & Academic Institutes, 2017–2027

Figure 22: Global Breast Cancer Diagnostics Market Value Share, by Region, 2018 and 2027

Figure 23: Global Breast Cancer Diagnostics Market Attractiveness Analysis, by Region, 2019–2027

Figure 24: North America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 25: North America Breast Cancer Diagnostics Market Value Share Analysis, by Country, 2018 and 2027

Figure 26: North America Breast Cancer Diagnostics Market Attractiveness Analysis, by Country, 2019-2027

Figure 27: North America Breast Cancer Diagnostics Market Value Share Analysis, by Technique, 2018 and 2027

Figure 28: North America Breast Cancer Diagnostics Market Attractiveness Analysis, by Technique, 2019–2027

Figure 29: North America Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 30: North America Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 31: North America Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 32: North America Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 33: Europe Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 34: Europe Breast Cancer Diagnostics Market Value Share Analysis, by Country, 2018 and 2027

Figure 35: Europe Breast Cancer Diagnostics Market Attractiveness Analysis, by Country, 2019-2027

Figure 36: Europe Breast Cancer Diagnostics Market Value Share Analysis, by Technique, 2018 and 2027

Figure 37: Europe Breast Cancer Diagnostics Market Attractiveness Analysis, by Technique, 2019–2027

Figure 38: Europe Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 39: Europe Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 40: Europe Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 41: Europe Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 42: Asia Pacific Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 43: Asia Pacific Breast Cancer Diagnostics Market Value Share Analysis, by Country, 2018 and 2027

Figure 44: Asia Pacific Breast Cancer Diagnostics Market Attractiveness Analysis, by Country, 2019-2027

Figure 45: Asia Pacific Breast Cancer Diagnostics Market Value Share Analysis, by Technique, 2018 and 2027

Figure 46: Asia Pacific Breast Cancer Diagnostics Market Attractiveness Analysis, by Technique, 2019–2027

Figure 47: Asia Pacific Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 48: Asia Pacific Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 49: Asia Pacific Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 50: Asia Pacific Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 51: Latin America Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 52: Latin America Breast Cancer Diagnostics Market Value Share Analysis, by Country, 2018 and 2027

Figure 53: Latin America Breast Cancer Diagnostics Market Attractiveness Analysis, by Country, 2019-2027

Figure 54: Latin America Breast Cancer Diagnostics Market Value Share Analysis, by Technique, 2018 and 2027

Figure 55: Latin America Breast Cancer Diagnostics Market Attractiveness Analysis, by Technique, 2019–2027

Figure 56: Latin America Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 57: Latin America Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 58: Latin America Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 59: Latin America Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 60: Middle East & Africa Breast Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 61: Middle East & Africa Breast Cancer Diagnostics Market Value Share Analysis, by Country, 2018 and 2027

Figure 62: Middle East & Africa Breast Cancer Diagnostics Market Attractiveness Analysis, by Country, 2019-2027

Figure 63: Middle East & Africa Breast Cancer Diagnostics Market Value Share Analysis, by Technique, 2018 and 2027

Figure 64: Middle East & Africa Breast Cancer Diagnostics Market Attractiveness Analysis, by Technique, 2019–2027

Figure 65: Middle East & Africa Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 66: Middle East & Africa Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 67: Middle East & Africa Breast Cancer Diagnostics Market Value Share, by Cancer Type, 2018 and 2027

Figure 68: Middle East & Africa Breast Cancer Diagnostics Market Attractiveness Analysis, by Cancer Type, 2019–2027

Figure 69: Global Breast Cancer Diagnostics Market Share Analysis, by Company, 2018