Analysts’ Viewpoint

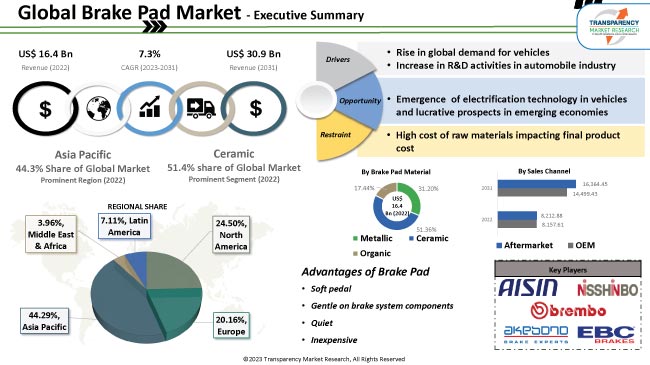

The global brake pad market size is expected to grow at a decent pace in the near future, led by government policies that promote better quality braking mechanism in order to minimize accidents. Availability of tailor-made finance options and decline in vehicle loan interest rates in emerging countries are also augmenting market development. Furthermore, rise in disposable income of consumers across the globe is fueling brake pad industry growth.

In line with the latest brake pad market trends, modern manufacturers are concentrating on producing innovative and high-durability brake pads to expand their customer base. Manufacturers of brake pads are also investing significantly in product development activities such as introduction of different types of organic brake pads for electric power sports vehicles.

Brake pads transform the kinetic energy of a vehicle into heat energy with the help of friction. Two brake pads are mounted inside the brake, with their friction sides facing the rotor. The caliper clamps the two brake pads against the rotating rotor upon the application of hydraulic brakes to slow down and halt the vehicle.

Brake disc retains a dull gray coating, as minute quantities of friction material from the brake pad are transferred onto the disc when it heats up upon contact with the rotor. The friction between the brake pad and brake disc, which is caused by the friction material, brings the vehicle to a halt.

According to the brake pad market analysis, rise in demand for lightweight and cutting-edge friction materials, such as ceramics and non-asbestos organic composites, is bolstering the global industry.

Growth in urbanization and development of smart cities are fueling the demand for passenger automobiles and light commercial vehicles. This, in turn, is augmenting brake pad market dynamics, as brake pad is a key elements of a vehicle.

Decrease in interest rates for vehicle loans and availability of customized finance options are some of the important factors driving the sales of vehicles. Production and sale of commercial vehicles has been rising across the globe, particularly in developing regions, due to rapid industrialization an urbanization. This growth in sales of vehicles is boosting market statistics.

Global regulatory organizations have enforced strict standards and guidelines for auto safety and vehicle control. Auto manufacturers, especially disc manufacturers, are investing substantially in R&D activities to create innovative and cutting-edge disc components. This is likely to boost the demand for various types of brake pads, such as metallic brake pads and carbon brake pads, in the near future.

Many end-users prefer high-end vehicles, since these are more secure and safe. Rise in awareness among the people to opt for safer vehicles in order to minimize accidents is driving the demand for high-quality and durable vehicle brake pads. The U.S. Department of Health & Human Services estimates that 1.35 million people across the globe pass away on roads each year. Accidents involving cars, buses, motorcycles, bicycles, lorries, or pedestrians claim the lives of about 3,700 people every day. More than half of all deaths involve motorcyclists, pedestrians, and cyclists.

Automobile emissions are anticipated to fuel brake pad industry trends in the near future. Demand for technology that reduces emissions is rising across the globe. Organic brake pads, which are also known as resin pads or semi-metallic pads, possess less metal content than metallic pads. These pads do not generate brake dust and are smoother in operation. Thus, demand for organic brake pads is increasing across the globe, thereby augmenting the global brake pad market growth.

Brake pads are made up of metallic, ceramic, and organic materials, as per brake pad market segmentation. The ceramic segment held significant market share in 2022, led by its greater stability and capacity to function amid temperature variations. High-performance cars typically employ ceramic brake pads, since they are quiet and emit less dust.

Ceramic brake pads need to be replaced less frequently and generate less pollution. They age more slowly and also make less noise. Therefore, most brake pad market players prefer ceramic pads despite the high production costs.

Based on vehicle type, the passenger vehicles segment constituted substantial market share in 2022. Launch of several models of passenger vehicles and introduction of various offers to improve sales are boosting the passenger vehicles segment. Rise in demand for fuel-efficient vehicles is also augmenting segment growth.

Demand for commercial vehicles is likely to increase significantly in the near future due to the expansion of e-commerce & logistics and industrial sectors. Heavy-duty trucks are primarily used for transportation of heavy goods and materials. Safe and efficient braking systems are therefore crucial in such vehicles.

Based on region, Asia Pacific accounted for major share of the global landscape in 2022. Availability of cheap labor and low-cost raw materials allows manufacturers in Asia Pacific to reduce the cost of vehicles, thus driving market expansion.

Key companies in the global automobile sector are focusing on increasing their presence in Asia by shifting their corporate offices or manufacturing facilities to countries such as China and India, which are the automotive hubs of the region.

In 2021, Porsche increased its footprint in Asia by opening a production facility in Malaysia and a research and development facility in Shanghai, China.

Several prominent players operate in the brake pad industry. Companies are establishing strong supply chain networks to increase their market share. Major players are also adopting strategies such as collaborations, mergers, acquisitions, and expansion of product lines to strengthen their position.

Leading companies operating in the global brake pad market are Aisin Seiki, ACDelco, Akebono Brake Corporation, ASIMCO, ASK Automotive Pvt. Ltd., Brake Parts Inc. LLC., Brembo S.p.A., Delphi Technologies, EBC Brakes, Federal-Mogul LLC, Japan Brake Industrial Co., Ltd., MACAS AUTOMOTIVE, Masu Brake, Nisshinbo Brake Inc., Robert Bosch GmbH, Super Circle Auto Limited., Tenneco, TMD FRICTION HOLDINGS GMBH, Toughla Brakelinings, and ZF Friedrichshafen AG.

The brake pad market report covers these prominent players based on parameters such as business strategies, business segments, financial overview, company overview, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 16.4 Bn |

|

Market Forecast Value in 2031 |

US$ 30.9 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Volume (Million Units) and US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Company Profiles |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 16.4 Bn in 2022

It is anticipated to expand at a CAGR of 7.3% by 2031

It would be worth US$ 30.9 Bn in 2031

Rise in focus on manufacture of new products with enhanced features, launch of new products with customized braking designs for trucks and SUVs, and growth in demand for passenger cars in developed countries

The ceramic material segment held the largest share in 2022

Asia Pacific is a highly lucrative region

Aisin Seiki, ACDelco, Akebono Brake Corporation, ASIMCO, ASK Automotive Pvt. Ltd., Brake Parts Inc. LLC., Brembo S.p.A., Delphi Technologies, EBC Brakes, Federal-Mogul LLC, Japan Brake Industrial Co., Ltd., MACAS AUTOMOTIVE, Masu Brake, Nisshinbo Brake Inc., Robert Bosch GmbH, Super Circle Auto Limited., Tenneco, TMD FRICTION HOLDINGS GMBH, Toughla Brakelinings, and ZF Friedrichshafen AG

1. Global Brake Pad Market - Executive Summary

1.1. Market Size, Million Units, US$ Bn, 2017-2031

1.2. Market Analysis and Key Segment Analysis

1.3. Key Facts & Figures

1.4. TMR Analysis and Recommendations

2. Premium Insights

2.1. Market Attractiveness Opportunity

2.2. Key Trend Analysis

2.2.1. Technology/ Product Trend

2.2.2. Industry Trend

2.3. Supply-Demand Scenario

2.3.1. Supply Side Analysis

2.3.2. Demand Trend Analysis

2.4. Manufacturer’s Perspective

2.5. COVID-19 Impact Analysis

2.6. Impact Factors

2.6.1. Introduction of Electric Vehicles

2.6.2. Regenerative Braking

2.6.3. Advancement in Materials

3. Market Overview

3.1. Macro-economic Factors

3.1.1. Rise in warehouses across Globe

3.1.2. Per Capita Income

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. PESTEL Analysis

3.3.3. Value Chain Analysis

3.3.3.1. List of Key Manufacturers

3.3.3.2. List of Customers

3.3.3.3. Level of Integration

3.3.4. SWOT Analysis

3.4. Price Trend Analysis and Forecast, 2017-2031

3.5. Raw Material Availability & Pricing Analysis

3.6. COVID-19 Impact Analysis

3.7. Advancements in Friction Material

3.8. Introduction of Electric Vehicle Impact Analysis

4. Global Brake Pad Market, By Brake Pad Material

4.1. Market Snapshot

4.1.1. Introduction & Definition

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Brake Pad Material

4.2.1. Metallic

4.2.2. Ceramic

4.2.3. Organic

5. Global Brake Pad Market, By Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction & Definition

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

5.2.1. Two Wheeler Vehicles

5.2.2. Passenger Vehicles

5.2.2.1. Hatchbacks

5.2.2.2. Sedans

5.2.2.3. Utility Vehicles

5.2.3. Commercial Vehicles

5.2.3.1. Light Duty Vehicles

5.2.3.2. Heavy Trucks

5.2.3.3. Buses & Coaches

5.2.4. Off-road Vehicles

5.2.4.1. Agriculture Tractors & Equipment

5.2.4.2. Construction & Mining Equipment

5.2.4.3. Industrial Vehicles (Forklift, AGV, Etc.)

6. Global Brake Pad Market, By Sales Channel

6.1. Market Snapshot

6.1.1. Introduction & Definition

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

6.2.1. OEM

6.2.2. Aftermarket

7. Global Brake Pad Market, By Region

7.1. Market Snapshot

7.1.1. Introduction & Definition

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific

7.2.5. Middle East & Africa

8. North America Brake Pad Market

8.1. Market Snapshot

8.2. COVID-19 Impact Analysis

8.3. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Brake Pad Material

8.3.1. Metallic

8.3.2. Ceramic

8.3.3. Organic

8.4. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

8.4.1. Two Wheeler Vehicles

8.4.2. Passenger Vehicles

8.4.2.1. Hatchbacks

8.4.2.2. Sedans

8.4.2.3. Utility Vehicles

8.4.3. Commercial Vehicles

8.4.3.1. Light Duty Vehicles

8.4.3.2. Heavy Trucks

8.4.3.3. Buses & Coaches

8.4.4. Off-road Vehicles

8.4.4.1. Agriculture Tractors & Equipment

8.4.4.2. Construction & Mining Equipment

8.4.4.3. Industrial Vehicles (Forklift, AGV, Etc.)

8.5. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

8.5.1. OEM

8.5.2. Aftermarket

8.6. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

8.6.1. U. S.

8.6.2. Canada

9. Europe Brake Pad Market

9.1. Market Snapshot

9.2. COVID-19 Impact Analysis

9.3. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Brake Pad Material

9.3.1. Metallic

9.3.2. Ceramic

9.3.3. Organic

9.4. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

9.4.1. Two Wheeler Vehicles

9.4.2. Passenger Vehicles

9.4.2.1. Hatchbacks

9.4.2.2. Sedans

9.4.2.3. Utility Vehicles

9.4.3. Commercial Vehicles

9.4.3.1. Light Duty Vehicles

9.4.3.2. Heavy Trucks

9.4.3.3. Buses & Coaches

9.4.4. Off-road Vehicles

9.4.4.1. Agriculture Tractors & Equipment

9.4.4.2. Construction & Mining Equipment

9.4.4.3. Industrial Vehicles (Forklift, AGV, Etc.)

9.5. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

9.5.1. OEM

9.5.2. Aftermarket

9.6. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

9.6.1. Germany

9.6.2. U. K.

9.6.3. France

9.6.4. Italy

9.6.5. Spain

9.6.6. East Europe

9.6.7. Rest of Europe

10. Asia Pacific Brake Pad Market

10.1. Market Snapshot

10.2. COVID-19 Impact Analysis

10.3. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Brake Pad Material

10.3.1. Metallic

10.3.2. Ceramic

10.3.3. Organic

10.4. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

10.4.1. Two Wheeler Vehicles

10.4.2. Passenger Vehicles

10.4.2.1. Hatchbacks

10.4.2.2. Sedans

10.4.2.3. Utility Vehicles

10.4.3. Commercial Vehicles

10.4.3.1. Light Duty Vehicles

10.4.3.2. Heavy Trucks

10.4.3.3. Buses & Coaches

10.4.4. Off-road Vehicles

10.4.4.1. Agriculture Tractors & Equipment

10.4.4.2. Construction & Mining Equipment

10.4.4.3. Industrial Vehicles (Forklift, AGV, Etc.)

10.5. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

10.6.1. China

10.6.2. India

10.6.3. Japan

10.6.4. South Korea

10.6.5. ASEAN

10.6.6. Rest of Asia Pacific

11. Middle East & Africa Brake Pad Market

11.1. Market Snapshot

11.2. COVID-19 Impact Analysis

11.3. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Brake Pad Material

11.3.1. Metallic

11.3.2. Ceramic

11.3.3. Organic

11.4. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

11.4.1. Two Wheeler Vehicles

11.4.2. Passenger Vehicles

11.4.2.1. Hatchbacks

11.4.2.2. Sedans

11.4.2.3. Utility Vehicles

11.4.3. Commercial Vehicles

11.4.3.1. Light Duty Vehicles

11.4.3.2. Heavy Trucks

11.4.3.3. Buses & Coaches

11.4.4. Off-road Vehicles

11.4.4.1. Agriculture Tractors & Equipment

11.4.4.2. Construction & Mining Equipment

11.4.4.3. Industrial Vehicles (Forklift, AGV, Etc.)

11.5. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

11.6.1. GCC

11.6.2. Turkey

11.6.3. South Africa

11.6.4. Rest of Middle East & Africa

12. Latin America Brake Pad Market

12.1. Market Snapshot

12.2. COVID-19 Impact Analysis

12.3. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Brake Pad Material

12.3.1. Metallic

12.3.2. Ceramic

12.3.3. Organic

12.4. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

12.4.1. Two Wheeler Vehicles

12.4.2. Passenger Vehicles

12.4.2.1. Hatchbacks

12.4.2.2. Sedans

12.4.2.3. Utility Vehicles

12.4.3. Commercial Vehicles

12.4.3.1. Light Duty Vehicles

12.4.3.2. Heavy Trucks

12.4.3.3. Buses & Coaches

12.4.4. Off-road Vehicles

12.4.4.1. Agriculture Tractors & Equipment

12.4.4.2. Construction & Mining Equipment

12.4.4.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.5. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Market Size (Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

12.6.1. Brazil

12.6.2. Mexico

12.6.3. Rest of Latin America

13. Competition Assessment

13.1. Global Target Market Competition - a Dashboard View

13.2. Global Target Market Structure Analysis

13.3. Global Target Market Company Share Analysis

13.3.1. For Tier 1 Market Players, 2021

14. Company Profile

14.1. Aisin Seiki

14.1.1. Company Overview

14.1.2. Product Portfolio

14.1.3. Strategy Overview

14.1.4. Recent Developments

14.1.5. Financial Analysis

14.1.6. Revenue Share

14.1.7. Executive Bios

14.2. ACDelco

14.2.1. Company Overview

14.2.2. Product Portfolio

14.2.3. Strategy Overview

14.2.4. Recent Developments

14.2.5. Financial Analysis

14.2.6. Revenue Share

14.2.7. Executive Bios

14.3. Akebono Brake Corporation

14.3.1. Company Overview

14.3.2. Product Portfolio

14.3.3. Strategy Overview

14.3.4. Recent Developments

14.3.5. Financial Analysis

14.3.6. Revenue Share

14.3.7. Executive Bios

14.4. ASIMCO

14.4.1. Company Overview

14.4.2. Product Portfolio

14.4.3. Strategy Overview

14.4.4. Recent Developments

14.4.5. Financial Analysis

14.4.6. Revenue Share

14.4.7. Executive Bios

14.5. ASK Automotive Pvt. Ltd.

14.5.1. Company Overview

14.5.2. Product Portfolio

14.5.3. Strategy Overview

14.5.4. Recent Developments

14.5.5. Financial Analysis

14.5.6. Revenue Share

14.5.7. Executive Bios

14.6. Brake Parts Inc. LLC.

14.6.1. Company Overview

14.6.2. Product Portfolio

14.6.3. Strategy Overview

14.6.4. Recent Developments

14.6.5. Financial Analysis

14.6.6. Revenue Share

14.6.7. Executive Bios

14.7. Brembo S.p.A.

14.7.1. Company Overview

14.7.2. Product Portfolio

14.7.3. Strategy Overview

14.7.4. Recent Developments

14.7.5. Financial Analysis

14.7.6. Revenue Share

14.7.7. Executive Bios

14.8. Delphi Technologies

14.8.1. Company Overview

14.8.2. Product Portfolio

14.8.3. Strategy Overview

14.8.4. Recent Developments

14.8.5. Financial Analysis

14.8.6. Revenue Share

14.8.7. Executive Bios

14.9. EBC Brakes

14.9.1. Company Overview

14.9.2. Product Portfolio

14.9.3. Strategy Overview

14.9.4. Recent Developments

14.9.5. Financial Analysis

14.9.6. Revenue Share

14.9.7. Executive Bios

14.10. Federal-Mogul LLC

14.10.1. Company Overview

14.10.2. Product Portfolio

14.10.3. Strategy Overview

14.10.4. Recent Developments

14.10.5. Financial Analysis

14.10.6. Revenue Share

14.10.7. Executive Bios

14.11. Japan Brake Industrial Co., Ltd.

14.11.1. Company Overview

14.11.2. Product Portfolio

14.11.3. Strategy Overview

14.11.4. Recent Developments

14.11.5. Financial Analysis

14.11.6. Revenue Share

14.11.7. Executive Bios

14.12. MACAS AUTOMOTIVE

14.12.1. Company Overview

14.12.2. Product Portfolio

14.12.3. Strategy Overview

14.12.4. Recent Developments

14.12.5. Financial Analysis

14.12.6. Revenue Share

14.12.7. Executive Bios

14.13. Masu Brake

14.13.1. Company Overview

14.13.2. Product Portfolio

14.13.3. Strategy Overview

14.13.4. Recent Developments

14.13.5. Financial Analysis

14.13.6. Revenue Share

14.13.7. Executive Bios

14.14. Nisshinbo Brake Inc.

14.14.1. Company Overview

14.14.2. Product Portfolio

14.14.3. Strategy Overview

14.14.4. Recent Developments

14.14.5. Financial Analysis

14.14.6. Revenue Share

14.14.7. Executive Bios

14.15. Robert Bosch GmbH

14.15.1. Company Overview

14.15.2. Product Portfolio

14.15.3. Strategy Overview

14.15.4. Recent Developments

14.15.5. Financial Analysis

14.15.6. Revenue Share

14.15.7. Executive Bios

14.16. Super Circle Auto Limited.

14.16.1. Company Overview

14.16.2. Product Portfolio

14.16.3. Strategy Overview

14.16.4. Recent Developments

14.16.5. Financial Analysis

14.16.6. Revenue Share

14.16.7. Executive Bios

14.17. Tenneco

14.17.1. Company Overview

14.17.2. Product Portfolio

14.17.3. Strategy Overview

14.17.4. Recent Developments

14.17.5. Financial Analysis

14.17.6. Revenue Share

14.17.7. Executive Bios

14.18. TMD FRICTION HOLDINGS GMBH

14.18.1. Company Overview

14.18.2. Product Portfolio

14.18.3. Strategy Overview

14.18.4. Recent Developments

14.18.5. Financial Analysis

14.18.6. Revenue Share

14.18.7. Executive Bios

14.19. Toughla Brakelinings

14.19.1. Company Overview

14.19.2. Product Portfolio

14.19.3. Strategy Overview

14.19.4. Recent Developments

14.19.5. Financial Analysis

14.19.6. Revenue Share

14.19.7. Executive Bios

14.20. ZF Friedrichshafen AG

14.20.1. Company Overview

14.20.2. Product Portfolio

14.20.3. Strategy Overview

14.20.4. Recent Developments

14.20.5. Financial Analysis

14.20.6. Revenue Share

14.20.7. Executive Bios

List of Tables

Table 1: Global Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Table 2: Global Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017‒2031

Table 3: Global Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 5: Global Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 6: Global Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 7: Global Brake Pad Market Volume (Million Units) Forecast, by Region, 2017-2031

Table 8: Global Brake Pad Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Table 10: North America Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017‒2031

Table 11: North America Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 12: North America Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 13: North America Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 14: North America Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 15: North America Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 16: North America Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Table 18: Europe Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017‒2031

Table 19: Europe Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 20: Europe Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: Europe Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 22: Europe Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: Europe Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 24: Europe Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Table 26: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017‒2031

Table 27: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 28: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 29: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 30: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 31: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Table 34: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017‒2031

Table 35: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 37: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 38: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 39: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Latin America Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Table 42: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017‒2031

Table 43: Latin America Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Latin America Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 46: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Latin America Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 48: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Figure 2: Global Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017-2031

Figure 3: Global Brake Pad Market, Incremental Opportunity, by Brake Pad Material, Value (US$ Bn), 2023-2031

Figure 4: Global Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 5: Global Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Brake Pad Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 7: Global Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 8: Global Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 9: Global Brake Pad Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 10: Global Brake Pad Market Volume (Million Units) Forecast, by Region, 2017-2031

Figure 11: Global Brake Pad Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Brake Pad Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Figure 14: North America Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017-2031

Figure 15: North America Brake Pad Market, Incremental Opportunity, by Brake Pad Material, Value (US$ Bn), 2023-2031

Figure 16: North America Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 17: North America Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 18: North America Brake Pad Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 19: North America Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 20: North America Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 21: North America Brake Pad Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 22: North America Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 23: North America Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Brake Pad Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Figure 26: Europe Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017-2031

Figure 27: Europe Brake Pad Market, Incremental Opportunity, by Brake Pad Material, Value (US$ Bn), 2023-2031

Figure 28: Europe Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: Europe Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: Europe Brake Pad Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 32: Europe Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: Europe Brake Pad Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 34: Europe Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 35: Europe Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Brake Pad Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Figure 38: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017-2031

Figure 39: Asia Pacific Brake Pad Market, Incremental Opportunity, by Brake Pad Material, Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 41: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Asia Pacific Brake Pad Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 44: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 45: Asia Pacific Brake Pad Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Brake Pad Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Figure 50: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017-2031

Figure 51: Middle East & Africa Brake Pad Market, Incremental Opportunity, by Brake Pad Material, Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Middle East & Africa Brake Pad Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Middle East & Africa Brake Pad Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Brake Pad Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Latin America Brake Pad Market Volume (Million Units) Forecast, by Brake Pad Material, 2017-2031

Figure 62: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Brake Pad Material, 2017-2031

Figure 63: Latin America Brake Pad Market, Incremental Opportunity, by Brake Pad Material, Value (US$ Bn), 2023-2031

Figure 64: Latin America Brake Pad Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Latin America Brake Pad Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 67: Latin America Brake Pad Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Latin America Brake Pad Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 70: Latin America Brake Pad Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 71: Latin America Brake Pad Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Latin America Brake Pad Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031