Analyst Viewpoint

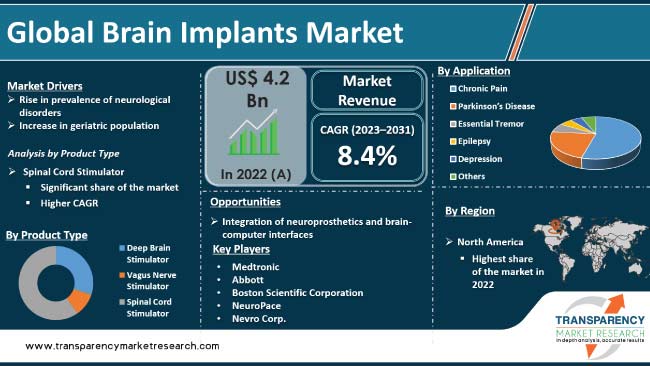

Rise in prevalence of neurological disorders such as Parkinson's disease, epilepsy, Alzheimer's disease, and movement disorders are driving the global brain implants industry. Brain implants are electronic devices implanted into the brain to provide therapeutic or prosthetic functions. Increase in geriatric population is another major factor propelling market expansion. Furthermore, surge in healthcare expenditure, rise in investments in healthcare infrastructure, and increase in awareness about neurological conditions & available treatments are expected to bolster the global brain implants market size during the forecast period.

Integration of neuroprosthetics and brain-computer interfaces offers lucrative opportunities to brain implants market players. Companies are focusing on refining brain implants in order to provide more efficient treatments, better patient outcomes, and improved quality of life.

Brain implants include medical devices created to interact with the brain's neural networks for therapeutic reasons. These are commonly termed as neural implants or neurostimulation devices.

These devices consist of deep brain stimulation (DBS) devices, spinal cord stimulators, and responsive neurostimulation (RNS) systems. These work by adjusting electrical signals within the brain or nervous system to alleviate symptoms linked to neurological disorders such as Parkinson's disease, epilepsy, chronic pain, and movement disorders.

Recent advancements in brain implants have concentrated on improving device accuracy, functionality, and patient results. Innovations encompass closed-loop systems capable of detecting and responding to real-time neural activity, offering tailored treatment.

Enhancements in device connectivity, size reduction, and battery life have increased patient comfort and broadened treatment choices. These advancements demonstrate the market's progression toward more efficient, less invasive, and patient-focused neurological therapies. These factors are likely to augment the global brain implants market demand.

Increase in individuals affected by neurological conditions such as Parkinson's disease, epilepsy, Alzheimer's disease, and various movement disorders is a significant driver of the global brain implants industry. These conditions cause severe symptoms that disrupt daily life.

As conventional treatments may have limitations in effectively managing these symptoms, there is a growing interest in innovative solutions such as brain implants. For instance, in 2021, nearly 5.8 million people in the U.S. lived with Alzheimer's dementia, a number projected to escalate to 14.3 million by 2060 (Alzheimer's Association, 2022). Similar trends are observed for other debilitating conditions, with over 1 million Americans affected by Parkinson's and 5.1 million by epilepsy.

Brain implants, also known as neural implants or neurostimulation devices, present promising avenues for therapy. These directly engage with the brain's neural circuits, modulating electrical signals to either stimulate or suppress specific brain activities.

For instance, deep brain stimulation (DBS) implants have demonstrated effectiveness in alleviating symptoms of Parkinson's disease and essential tremors by delivering electrical impulses to precise brain areas.

Limitations of conventional pharmaceutical methods in effectively managing neurological disorders is also boosting demand for brain implants. Patients and healthcare providers seek alternative approaches that promise better symptom control, improved quality of life, and reduced reliance on medications known to cause unwanted side effects.

Advancements in healthcare, life sciences, and improved public health measures have extended the average lifespan of elderly individuals across the globe. This increases age-related neurological conditions among older adults, including Parkinson's disease, Alzheimer's disease, and other cognitive disorders. These conditions often lead to cognitive decline, movement difficulties, and other challenging symptoms that impact the well-being of older individuals.

In the past few years, around 524 million individuals, constituting 8% of the global population, were aged 65 and above. Projections from the National Institute on Aging suggest that by 2050, the number would rise to around 1.5 billion, accounting for nearly 16% of the world's population, with much of this growth expected in developing nations.

Several developing countries in Asia Pacific and South America are anticipated to witness a threefold increase in the geriatric population in the next decade. As individuals age, the likelihood of developing neurological disorders also increases. Presently, approximately 1% of people aged 60 or above globally are estimated to have Parkinson's disease, but this rate jumps to 5% among those aged 85 and older.

In terms of product type, the spinal cord stimulator segment accounted for the largest global brain implants market share in 2022. This is ascribed to broad application range, established track record, and ongoing advancements.

Companies such as Nevro are integrating AI into their spinal cord stimulator systems, enabling real-time adjustments based on individual pain patterns and optimizing pain relief while potentially minimizing side effects.

Based on application, the chronic pain segment is expected to grow at a rapid pace during the forecast period. Chronic pain is a global epidemic, affecting over 500 million people worldwide. The sheer number creates significant demand for effective treatment solutions.

Existing treatments for chronic pain often fall short, offering inadequate relief or carrying unwanted side effects. Brain implants, such as spinal cord stimulators (SCS), offer hope with their non-invasive nature and promising pain reduction. The race for innovative pain management solutions is on, and brain implants are poised to play a leading role in offering millions a life free from chronic pain's grip.

In terms of end-user, the hospitals segment to anticipated to dominate the global brain implants market during the forecast period. Hospitals offer a complete package, from pre-operative consultations and surgery to post-operative monitoring and rehabilitation, streamlining the brain implant journey for patients.

Hospitals continuously invest in cutting-edge equipment and technology, such as MRI-compatible DBS systems and robotic arms for precise implant placement, making them desirable destinations for patients seeking advanced options. Remote consultations and monitoring facilitate patient access to specialist care, potentially expanding the reach of brain implant surgeries beyond major center.

As per brain implants market analysis, North America accounted for the largest share in 2022. This is ascribed to combination of advanced technology, favorable healthcare factors, and supportive environment for research and development in the region.

North America is a hub for cutting-edge brain implant solutions, offering hope to millions suffering from neurological disorders. Leading universities and private companies in the region are investing in brain implant research, leading to technological advancements such as AI-powered simulation algorithms and new application explorations for chronic pain and other conditions.

European countries, with their established public healthcare systems and emphasis on universal access, often provide coverage for brain implant procedures, increasing affordability for patients. This fosters a larger market compared to regions with limited healthcare access.

In November 2023, the EU Commission announced a EUR 1 Bn investment in the Human Brain Project 2, focusing on advancing the understanding of the brain and developing new technologies for treating neurological disorders, potentially benefiting the development of future brain implants.

According to brain implants market forecast, Asia Pacific is likely to witness rapid growth during the forecast period. The region's large population, increasing healthcare accessibility, and focus on technological advancements position it to play a major role in shaping this transformative field.

The global brain implants market is fragmented, with the presence of large number of players. Manufacturers are adopting strategies such as investment in R&D and collaborations in order to increase market presence.

Medtronic, Abbott, Boston Scientific Corporation, NeuroPace, Renishaw plc, LivaNova plc, and Nevro Corp. are the prominent players in the brain implants market.

Key players in the brain implants market report have been profiled based on parameters such as company overview, latest developments, business strategies, application portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 4.2 Bn |

| Forecast Value in 2031 | More than US$ 8.8 Bn |

| Growth Rate (CAGR) | 8.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.2 Bn in 2022

It is projected to reach more than US$ 8.8 Bn by 2031

The CAGR is anticipated to be 8.4% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

Medtronic, Abbott, Boston Scientific Corporation, NeuroPace, Renishaw plc, LivaNova plc, and Nevro Corp.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Brain Implants Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Brain Implants Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. egulatory Scenario

5.2. Prevalence and Incidence rate of various Neurological Disorders

5.3. Technological Advancements

6. Global Brain Implants Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Deep Brain Stimulator

6.3.2. Vagus Nerve Stimulator

6.3.3. Spinal Cord Stimulator

6.4. Market Attractiveness Analysis, by Product Type

7. Global Brain Implants Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Chronic Pain

7.3.2. Parkinson’s Disease

7.3.3. Essential Tremor

7.3.4. Epilepsy

7.3.5. Depression

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Brain Implants Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Specialty Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Brain Implants Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Brain Implants Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Deep Brain Stimulator

10.2.2. Vagus Nerve Stimulator

10.2.3. Spinal Cord Stimulator

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Chronic Pain

10.3.2. Parkinson’s Disease

10.3.3. Essential Tremor

10.3.4. Epilepsy

10.3.5. Depression

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Specialty Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Brain Implants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Deep Brain Stimulator

11.2.2. Vagus Nerve Stimulator

11.2.3. Spinal Cord Stimulator

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Chronic Pain

11.3.2. Parkinson’s Disease

11.3.3. Essential Tremor

11.3.4. Epilepsy

11.3.5. Depression

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Specialty Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Brain Implants Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Deep Brain Stimulator

12.2.2. Vagus Nerve Stimulator

12.2.3. Spinal Cord Stimulator

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Chronic Pain

12.3.2. Parkinson’s Disease

12.3.3. Essential Tremor

12.3.4. Epilepsy

12.3.5. Depression

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Specialty Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of APAC

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Brain Implants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Deep Brain Stimulator

13.2.2. Vagus Nerve Stimulator

13.2.3. Spinal Cord Stimulator

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Chronic Pain

13.3.2. Parkinson’s Disease

13.3.3. Essential Tremor

13.3.4. Epilepsy

13.3.5. Depression

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Specialty Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. rest of LATAM

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Brain Implants Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Deep Brain Stimulator

14.2.2. Vagus Nerve Stimulator

14.2.3. Spinal Cord Stimulator

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Chronic Pain

14.3.2. Parkinson’s Disease

14.3.3. Essential Tremor

14.3.4. Epilepsy

14.3.5. Depression

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Specialty Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Profiles

15.2.1. Medtronic

15.2.1.1. Company Overview

15.2.1.2. Financial Overview

15.2.1.3. Product Portfolio

15.2.1.4. Business Strategies

15.2.1.5. Recent Developments

15.2.2. Abbott

15.2.2.1. Company Overview

15.2.2.2. Financial Overview

15.2.2.3. Product Portfolio

15.2.2.4. Business Strategies

15.2.2.5. Recent Developments

15.2.3. Boston Scientific Corporation

15.2.3.1. Company Overview

15.2.3.2. Financial Overview

15.2.3.3. Product Portfolio

15.2.3.4. Business Strategies

15.2.3.5. Recent Developments

15.2.4. NeuroPace

15.2.4.1. Company Overview

15.2.4.2. Financial Overview

15.2.4.3. Product Portfolio

15.2.4.4. Business Strategies

15.2.4.5. Recent Developments

15.2.5. Renishaw plc

15.2.5.1. Company Overview

15.2.5.2. Financial Overview

15.2.5.3. Product Portfolio

15.2.5.4. Business Strategies

15.2.5.5. Recent Developments

15.2.6. LivaNova plc

15.2.6.1. Company Overview

15.2.6.2. Financial Overview

15.2.6.3. Product Portfolio

15.2.6.4. Business Strategies

15.2.6.5. Recent Developments

15.2.7. Nevro Corp.

15.2.7.1. Company Overview

15.2.7.2. Financial Overview

15.2.7.3. Product Portfolio

15.2.7.4. Business Strategies

15.2.7.5. Recent Developments

List of Tables

Table 01: Global Brain Implants Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Brain Implants Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Brain Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Brain Implants Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Brain Implants Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 06: North America Brain Implants Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: North America Brain Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: North America Brain Implants Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Brain Implants Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 10: Europe Brain Implants Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Brain Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Brain Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Brain Implants Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Asia Pacific Brain Implants Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Asia Pacific Brain Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Brain Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Brain Implants Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Latin America Brain Implants Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Latin America Brain Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Brain Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Brain Implants Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: Middle East & Africa Brain Implants Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Middle East & Africa Brain Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Brain Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Brain Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Brain Implants Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 03: Global Brain Implants Market Value Share Analysis, by Deep Brain Stimulator, 2022 and 2031

Figure 04: Global Brain Implants Market Value Share Analysis, by Vagus Nerve Stimulator, 2022 and 2031

Figure 05: Global Brain Implants Market Value Share Analysis, by Spinal Cord Stimulator, 2022 and 2031

Figure 06: Global Brain Implants Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 07: Global Brain Implants Market Value Share Analysis, by Application 2022 and 2031

Figure 08: Global Brain Implants Market Value Share Analysis, by Chronic Pain, 2022 and 2031

Figure 09: Global Brain Implants Market Value Share Analysis, by Parkinson’s Disease, 2022 and 2031

Figure 10: Global Brain Implants Market Value Share Analysis, by Essential Tremor, 2022 and 2031

Figure 11: Global Brain Implants Market Value Share Analysis, by Epilepsy, 2022 and 2031

Figure 12: Global Brain Implants Market Value Share Analysis, by Depression, 2022 and 2031

Figure 13: Global Brain Implants Market Value Share Analysis, by Others, 2022 and 2031

Figure 14: Global Brain Implants Market Attractiveness Analysis, by Application, 2023–2031

Figure 15: Global Brain Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 16: Global Brain Implants Market Value Share Analysis, by Hospitals, 2022 and 2031

Figure 17: Global Brain Implants Market Value Share Analysis, by Specialty Centers, 2022 and 2031

Figure 18: Global Brain Implants Market Value Share Analysis, by Others, 2022 and 2031

Figure 19: Global Brain Implants Market Attractiveness Analysis, by End-user, 2023–2031

Figure 20: Global Brain Implants Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Brain Implants Market Attractiveness Analysis, by Region, 2023–2031

Figure 22: North America Brain Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: North America Brain Implants Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 24: North America Brain Implants Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 25: North America Brain Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 26: North America Brain Implants Market Attractiveness Analysis, by Application, 2023–2031

Figure 27: North America Brain Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 28: North America Brain Implants Market Attractiveness Analysis, by End-user, 2023–2031

Figure 29: North America Brain Implants Market Value Share Analysis, by Country, 2022 and 2031

Figure 30: North America Brain Implants Market Attractiveness Analysis, by Country, 2023–2031

Figure 31: Europe Brain Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Europe Brain Implants Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 33: Europe Brain Implants Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 34: Europe Brain Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 35: Europe Brain Implants Market Attractiveness Analysis, by Application, 2023–2031

Figure 36: Europe Brain Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 37: Europe Brain Implants Market Attractiveness Analysis, by End-user, 2023–2031

Figure 38: Europe Brain Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Europe Brain Implants Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 40: Asia Pacific Brain Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Asia Pacific Brain Implants Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 42: Asia Pacific Brain Implants Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 43: Asia Pacific Brain Implants Market Value Share Analysis, by Application 2022 and 2031

Figure 44: Asia Pacific Brain Implants Market Attractiveness Analysis, by Application, 2023–2031

Figure 45: Asia Pacific Brain Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 46: Asia Pacific Brain Implants Market Attractiveness Analysis, by End-user, 2023–2031

Figure 47: Asia Pacific Brain Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Asia Pacific Brain Implants Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 49: Latin America Brain Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America Brain Implants Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 51: Latin America Brain Implants Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 52: Latin America Brain Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 53: Latin America Brain Implants Market Attractiveness Analysis, by Application, 2023–2031

Figure 54: Latin America Brain Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 55: Latin America Brain Implants Market Attractiveness Analysis, by End-user, 2023–2031

Figure 56: Latin America Brain Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Latin America Brain Implants Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 58: Middle East & Africa Brain Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East & Africa Brain Implants Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 60: Middle East & Africa Brain Implants Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 61: Middle East & Africa Brain Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 62: Middle East & Africa Brain Implants Market Attractiveness Analysis, by Application, 2023–2031

Figure 63: Middle East & Africa Brain Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 64: Middle East & Africa Brain Implants Market Attractiveness Analysis, by End-user, 2023–2031

Figure 65: Middle East & Africa Brain Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 66: Middle East & Africa Brain Implants Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 67: Global Brain Implants Market Share Analysis, by Company, 2022