Analyst Viewpoint

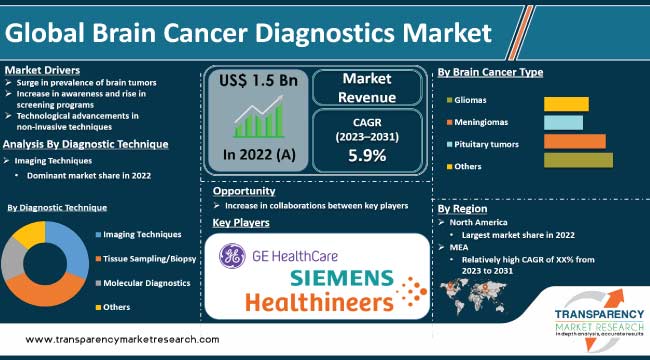

Surge in prevalence of neurological disorders & cancer owing to rise in number of individuals who smoke is driving the global brain cancer diagnostics industry. This escalating health concern necessitates the development and adoption of advanced diagnostic solutions to effectively address these challenges. Rise in awareness and increase in screening programs for brain cancer are the other factors propelling market expansion. Furthermore, technological advancements in non-invasive techniques are expected to bolster the global brain cancer diagnostics market size during the forecast period.

Development of more advanced, accurate, and efficient diagnostic technique offers lucrative opportunities to market players. Companies are focusing on development of non-invasive diagnostic tools that offer rapid and secure means to visualize the brain's internal structures.

Brain cancer diagnostics include a comprehensive array of medical procedures and tests designed to identify and assess the presence of brain tumors and other abnormalities within the brain. This diagnostic process is of paramount importance as it serves as the foundation for informed treatment decisions and ultimately influences patient outcomes.

Non-invasive techniques play a pivotal role in modern medicine, offering alternatives to invasive procedures such as brain biopsy. These techniques encompass both physical inspections of the body and advanced imaging modalities, particularly when it comes to the examination of the brain.

Computed tomography (CT) scans and magnetic resonance imaging (MRI) are the most widely used non-invasive imaging methods for brain cancer. These techniques provide rapid and secure means to visualize the brain's internal structures, enabling radiologists and healthcare professionals to identify various brain problems, track the progression of diseases, and plan surgical interventions.

Detecting and segmenting brain tumors is one of the most complex and critical tasks in medical imaging. Brain tumors are of diverse shapes and sizes, making it a challenging endeavor that often necessitates a substantial amount of data and information.

The global brain cancer diagnostics market demand has experienced robust growth in the past few years. This is ascribed to surge in prevalence of brain tumors, particularly malignant glioblastoma, and rise in awareness about early detection facilitated by government-backed screening programs.

Incidence of brain tumors is increasing as the global population continues to age. Moreover, persisting risk factors, such as smoking and environmental exposure, contribute to increase in demand for accurate diagnostic tools.

Glioblastoma, a particularly malignant form of brain tumor, exemplifies the urgency of early detection. This fast-growing and lethal condition underscores the critical need for swift diagnosis and intervention to enhance patient outcomes.

Increase in awareness about the importance of early detection and implementation of government-backed screening programs plays a pivotal role in bolstering global brain cancer diagnostics market growth.

Public awareness campaigns have shed light on the significance of identifying brain tumors at an early, more treatable stages. These initiatives encourage individuals to proactively seek regular check-ups and screenings, not only enhancing the chances of early diagnosis, but also promoting general health consciousness.

Increase in awareness has enabled more individuals to take proactive steps to include brain cancer diagnostics in their healthcare routines. This not only benefits individual patients but also leads to broader public health benefits by reducing the overall burden of advanced-stage brain cancers on healthcare systems.

Around 12,288 new cases of brain and CNS tumors are diagnosed in the U.K. each year, with brain tumor ranking as the ninth most common malignancy, accounting for 3% of all new cancer cases. Similar trends are observed in Australia, where thousands of new brain cancer cases are reported annually.

Technological advancements in non-invasive diagnostic techniques is driving the global brain cancer diagnostics industry. These innovations not only contribute to the ongoing demand for brain cancer diagnostics, but also hold great promise for the future of healthcare.

Development of noninvasive diagnostic techniques is a major factor bolstering the global brain cancer diagnostics market value. These techniques offer a patient-friendly approach that reduces the need for invasive procedures such as biopsies.

Non-invasive methods not only minimize patient discomfort, but also enhance safety, early detection, and diagnostic accuracy. These are becoming increasingly important in improving the patient experience and encouraging more individuals to undergo regular brain cancer screenings. Moreover, non-invasive techniques are instrumental in detecting tumors in the early, more treatable stages, leading to better patient outcomes.

In terms of diagnostic technique, the imaging techniques segment dominated the global brain cancer diagnostics market. This is ascribed to increase in reliance on imaging technologies in the diagnosis of a brain cancer. Magnetic Resonance Imaging (MRI) is a major medical imaging technique in radiology, contributing to the production of detailed anatomical images and insights into the body's physiological processes.

Rise in prevalence of brain cancer cases is also expected to propel demand for brain tumor diagnostics during the forecast period. In February 2023, Case Western Reserve University received a substantial grant of US$ 3 Mn to advance novel MRI technology and software specifically designed for brain tumor diagnosis. This development holds significant promise as it has the potential to revolutionize the field of brain cancer diagnostics.

Utilization of advanced MRI technology, along with specialized software, can provide highly detailed images and data that are essential for personalized treatment planning. This, in turn, can significantly improve patient outcomes by enabling healthcare providers to tailor treatments to the unique characteristics of each patient's brain tumor.

Integration of cutting-edge MRI technology and software advancements exemplifies the commitment of the healthcare and research community to continuously enhance the capabilities of diagnostic tools for brain cancer. This effort not only underscores the importance of MRI but also highlights the potential for innovative technologies to contribute to improved patient care.

Based on brain cancer type, the gliomas segment is expected to account for the largest global brain cancer diagnostics market share during the forecast period. This is ascribed to wide spectrum of subtypes of gliomas and their impact on brain health. Gliomas are characterized by their highly infiltrative nature, which affects the surrounding brain tissue, making their accurate diagnosis and monitoring crucial.

Glioblastoma is the most malignant subtype of glioma. This aggressive form of brain cancer grows rapidly and is associated with a poor prognosis, emphasizing the urgency of early and precise diagnosis.

High prevalence and diverse nature of gliomas necessitate advanced and specialized diagnostic approaches for accurate characterization and tailored treatment planning. The global brain cancer diagnostics market, therefore, continues to place strong emphasis on glioma diagnostics, given their clinical significance and their impact on the lives of patients.

This underscores the importance of ongoing research, technological advancements, and multidisciplinary collaboration in the field of brain cancer diagnostics to address the challenges posed by gliomas effectively.

In terms of end-user, the hospitals segment is likely to dominate the global brain cancer diagnostics market during the forecast period. Hospitals play a pivotal role in accurate and early diagnosis of brain cancer.

The healthcare landscape, characterized by increase in prevalence of brain tumors and the critical need for timely and precise diagnostics, places hospitals at the forefront of this essential endeavor.

Hospitals have state-of-the-art equipment, including MRI, CT, PET, various specialized imaging technologies; and a diverse team of healthcare professionals, such as radiologists, neurosurgeons, oncologists, and pathologists.

These facilities are crucial for providing detailed scans and expert interpretation, making them a primary destination for patients seeking accurate brain cancer assessment. This multidisciplinary approach ensures a comprehensive evaluation of brain cancer cases, allowing for individualized and accurate diagnoses.

According to brain cancer diagnostics market analysis, North America dominated the global industry in 2022. This is ascribed to increase in incidence of brain cancer cases across the region. High prevalence of brain cancer necessitates advanced diagnostic tools to improve early detection and treatment outcomes.

Ongoing clinical trials conducted by multiple companies in North America also contribute to market expansion. These trials aim to develop more effective treatments, emphasizing the importance of early and accurate diagnosis as the first step in the management of brain cancer.

Aa per brain cancer diagnostics market forecast, the industry in Asia Pacific is driven by rise in incidence of brain cancer, improved diagnostic technologies, and growing awareness about early cerebral tumor detection. Moreover, presence of key players such as GE Healthcare and Siemens Healthineers offering innovative diagnostic solutions is expected to fuel the brain cancer diagnostics industry revenue in Asia Pacific during the forecast period. Furthermore, increase in healthcare investment, rise in research & development activities, and surge in elderly population are driving market growth in the region.

The global brain cancer diagnostics market is fragmented, with the presence of large number of players. Companies are focusing investing in R&D and merger & acquisition in order to increase market share and presence.

GE Healthcare, Siemens Healthineers, Philips Healthcare, Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, Illumina, Inc., Hologic, Inc., Agilent Technologies, and Bio-Rad Laboratories are the prominent players in the market.

Each of these players has been profiled in the brain cancer diagnostics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.5 Bn |

| Forecast (Value) in 2031 | More than US$ 2.5 Bn |

| Growth Rate (CAGR ) | 5.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

It was valued at US$ 1.5 Bn in 2022

It is projected to reach more than US$ 2.5 Bn by 2031

It is anticipated to grow at a CAGR of 5.9% from 2023 to 2031

Surge in prevalence of brain tumors and increase in awareness & rise in screening programs

North America is expected to account for largest share during the forecast period.

GE Healthcare, Siemens Healthineers, Philips Healthcare, Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, Illumina, Inc., Hologic, Inc., Agilent Technologies, and Bio-Rad Laboratories

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Brain Cancer Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Brain Cancer Diagnostics Market Analysis and Forecasts, 2023–2031

5. Key Insights

5.1. Brain Tumor Epidemiology

5.2. Current Trends in Diagnostic and Therapeutic Imaging of Brain Tumors

5.3. Technological advancements in cancer diagnostics

5.4. COVID-19 Impact Analysis

6. Global Brain Cancer Diagnostics Market Analysis and Forecasts, by Diagnostic Technique

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Diagnostic Technique, 2023–2031

6.3.1. Imaging Techniques

6.3.1.1. Magnetic Resonance Imaging (MRI)

6.3.1.2. Computed Tomography (CT) Scan

6.3.1.3. PET Scan or PET-CT Scan

6.3.1.4. (SPECT) Scan

6.3.2. Tissue Sampling/Biopsy

6.3.3. Molecular Diagnostics

6.3.4. Others

6.4. Market Attractiveness Analysis, by Diagnostic Technique

7. Global Brain Cancer Diagnostics Market Analysis and Forecasts, by Brain Cancer Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Brain Cancer Type, 2023–2031

7.3.1. Gliomas

7.3.2. Meningiomas

7.3.3. Pituitary Tumors

7.3.4. Others

7.4. Market Attractiveness Analysis, by Brain Cancer Type

8. Global Brain Cancer Diagnostics Market Analysis and Forecasts, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2023–2031

8.3.1. Hospitals

8.3.2. Diagnostic Laboratories

8.3.3. Cancer Hospitals/Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Brain Cancer Diagnostics Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Brain Cancer Diagnostics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Diagnostic Technique, 2023–2031

10.2.1. Imaging Techniques

10.2.1.1. Magnetic Resonance Imaging (MRI)

10.2.1.2. Computed Tomography (CT) Scan

10.2.1.3. PET Scan or PET-CT Scan

10.2.1.4. (SPECT) Scan

10.2.2. Tissue Sampling/Biopsy

10.2.3. Molecular Diagnostics

10.2.4. Others

10.3. Market Value Forecast, by Brain Cancer Type, 2023–2031

10.3.1. Gliomas

10.3.2. Meningiomas

10.3.3. Pituitary Tumors

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2023–2031

10.4.1. Hospitals

10.4.2. Diagnostic Laboratories

10.4.3. Cancer Hospitals/Centers

10.5. Market Value Forecast, by Country, 2023–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Diagnostic Technique

10.6.2. By Brain Cancer Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Brain Cancer Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Diagnostic Technique, 2023–2031

11.2.1. Imaging Techniques

11.2.1.1. Magnetic Resonance Imaging (MRI)

11.2.1.2. Computed Tomography (CT) Scan

11.2.1.3. PET Scan or PET-CT Scan

11.2.1.4. (SPECT) Scan

11.2.2. Tissue Sampling/Biopsy

11.2.3. Molecular Diagnostics

11.2.4. Others

11.3. Market Value Forecast, by Brain Cancer Type, 2023–2031

11.3.1. Gliomas

11.3.2. Meningiomas

11.3.3. Pituitary Tumors

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2023–2031

11.4.1. Hospitals

11.4.2. Diagnostic Laboratories

11.4.3. Cancer Hospitals/Centers

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Diagnostic Technique

11.6.2. By Brain Cancer Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Brain Cancer Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Diagnostic Technique, 2023–2031

12.2.1. Imaging Techniques

12.2.1.1. Magnetic Resonance Imaging (MRI)

12.2.1.2. Computed Tomography (CT) Scan

12.2.1.3. PET Scan or PET-CT Scan

12.2.1.4. (SPECT) Scan

12.2.2. Tissue Sampling/Biopsy

12.2.3. Molecular Diagnostics

12.2.4. Others

12.3. Market Value Forecast, by Brain Cancer Type, 2023–2031

12.3.1. Gliomas

12.3.2. Meningiomas

12.3.3. Pituitary Tumors

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2023–2031

12.4.1. Hospitals

12.4.2. Diagnostic Laboratories

12.4.3. Cancer Hospitals/Centers

12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Diagnostic Technique

12.6.2. By Brain Cancer Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Brain Cancer Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Diagnostic Technique, 2023–2031

13.2.1. Imaging Techniques

13.2.1.1. Magnetic Resonance Imaging (MRI)

13.2.1.2. Computed Tomography (CT) Scan

13.2.1.3. PET Scan or PET-CT Scan

13.2.1.4. (SPECT) Scan

13.2.2. Tissue Sampling/Biopsy

13.2.3. Molecular Diagnostics

13.2.4. Others

13.3. Market Value Forecast, by Brain Cancer Type, 2023–2031

13.3.1. Gliomas

13.3.2. Meningiomas

13.3.3. Pituitary Tumors

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2023–2031

13.4.1. Hospitals

13.4.2. Diagnostic Laboratories

13.4.3. Cancer Hospitals/Centers

13.5. Market Value Forecast, by Country/Sub-region, 2023–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Diagnostic Technique

13.6.2. By Brain Cancer Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Brain Cancer Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Diagnostic Technique, 2023–2031

14.2.1. Imaging Techniques

14.2.1.1. Magnetic Resonance Imaging (MRI)

14.2.1.2. Computed Tomography (CT) Scan

14.2.1.3. PET Scan or PET-CT Scan

14.2.1.4. (SPECT) Scan

14.2.2. Tissue Sampling/Biopsy

14.2.3. Molecular Diagnostics

14.2.4. Others

14.3. Market Value Forecast, by Brain Cancer Type, 2023–2031

14.3.1. Gliomas

14.3.2. Meningiomas

14.3.3. Pituitary Tumors

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2023–2031

14.4.1. Hospitals

14.4.2. Diagnostic Laboratories

14.4.3. Cancer Hospitals/Centers

14.5. Market Value Forecast, by Country/Sub-region, 2023–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Diagnostic Technique

14.6.2. By Brain Cancer Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2021)

15.3. Company Profiles

15.3.1. GE Healthcare

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Siemens Healthineers

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. Philips Healthcare

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Thermo Fisher Scientific

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. Roche Diagnostics

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Abbott Laboratories

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. Illumina, Inc.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. Hologic, Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Agilent Technologies

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

15.3.10. Bio-Rad Laboratories

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Strategic Overview

15.3.10.5. SWOT Analysis

List of Tables

Table 01: Global Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Diagnostic Technique, 2023–2031

Table 02: Global Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Brain Cancer Type, 2023–2031

Table 03: Global Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 04: Global Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 05: North America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Diagnostic Technique, 2023–2031

Table 06: North America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Brain Cancer Type, 2023–2031

Table 07: North America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 08: North America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 09: Europe Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Diagnostic Technique, 2023–2031

Table 10: Europe Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Brain Cancer Type, 2023–2031

Table 11: Europe Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 12: Europe Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 13: Asia Pacific Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Diagnostic Technique, 2023–2031

Table 14: Asia Pacific Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Brain Cancer Type, 2023–2031

Table 15: Asia Pacific Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 16: Asia Pacific Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Latin America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Diagnostic Technique, 2023–2031

Table 18: Latin America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Brain Cancer Type, 2023–2031

Table 19: Latin America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 20: Latin America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 21: Middle East & Africa Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Diagnostic Technique, 2023–2031

Table 22: Middle East & Africa Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Brain Cancer Type, 2023–2031

Table 23: Middle East & Africa Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 24: Middle East & Africa Brain Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

List of Figures

Figure 01: Global Brain Cancer Diagnostics Market Value (US$ Mn) Forecast 2023–2031

Figure 02: Global Brain Cancer Diagnostics Market Value Share, by Diagnostic Technique 2023

Figure 03: Global Brain Cancer Diagnostics Market Value Share, by Brain Cancer Type 2023

Figure 04: Global Brain Cancer Diagnostics Market Value Share, by End-user 2023

Figure 05: Global Brain Cancer Diagnostics Market Value Share Analysis, by Diagnostic Technique 2023 and 2031

Figure 06: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Imaging Techniques 2023–2031

Figure 07: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Tissue Sampling/Biopsy 2023–2031

Figure 08: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Molecular Diagnostics 2023–2031

Figure 09: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Others 2023–2031

Figure 10: Global Brain Cancer Diagnostics Market Attractiveness Analysis, by Brain Cancer Type 2023–2031

Figure 11: Global Brain Cancer Diagnostics Market Value Share Analysis, by Brain Cancer Type 2023 and 2031

Figure 12: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Gliomas 2023–2031

Figure 13: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Meningiomas 2023–2031

Figure 14: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Pituitary Tumors 2023–2031

Figure 15: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Others 2023–2031

Figure 16: Global Brain Cancer Diagnostics Market Attractiveness Analysis, by End-user 2023–2031

Figure 17: Global Brain Cancer Diagnostics Market Value Share Analysis, by End-user 2023 and 2031

Figure 18: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Hospitals 2023–2031

Figure 19: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Diagnostic Laboratories 2023–2031

Figure 20: Global Brain Cancer Diagnostics Market Revenue (US$ Mn), by Cancer Hospitals/Centers 2017–2032

Figure 21: Global Brain Cancer Diagnostics Market Value Share Analysis, by Region 2023 and 2031

Figure 22: Global Brain Cancer Diagnostics Market Attractiveness Analysis, by Region 2023–2031

Figure 23: North America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast 2023–2031

Figure 24: North America Brain Cancer Diagnostics Market Value Share Analysis, by Country 2023 and 2031

Figure 25: North America Brain Cancer Diagnostics Market Attractiveness Analysis, by Country 2023–2031

Figure 26: North America Brain Cancer Diagnostics Market Value Share Analysis, by Diagnostic Technique 2023 and 2031

Figure 27: North America Brain Cancer Diagnostics Market Attractiveness Analysis, by Diagnostic Technique 2023–2031

Figure 28: North America Brain Cancer Diagnostics Market Value Share Analysis, by Brain Cancer Type 2023 and 2031

Figure 29: North America Brain Cancer Diagnostics Market Attractiveness Analysis, by Brain Cancer Type 2023–2031

Figure 30: North America Brain Cancer Diagnostics Market Value Share Analysis, by End-user 2023 and 2031

Figure 31: North America Brain Cancer Diagnostics Market Attractiveness Analysis, by End-user 2023–2031

Figure 32: Europe Brain Cancer Diagnostics Market Value (US$ Mn) Forecast 2023–2031

Figure 33: Europe Brain Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 34: Europe Brain Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 35: Europe Brain Cancer Diagnostics Market Value Share Analysis, by Diagnostic Technique 2023 and 2031

Figure 36: Europe Brain Cancer Diagnostics Market Attractiveness Analysis, by Diagnostic Technique 2023–2031

Figure 37: Europe Brain Cancer Diagnostics Market Value Share Analysis, by Brain Cancer Type 2023 and 2031

Figure 38: Europe Brain Cancer Diagnostics Market Attractiveness Analysis, by Brain Cancer Type 2023–2031

Figure 39: Europe Brain Cancer Diagnostics Market Value Share Analysis, by End-user 2023 and 2031

Figure 40: Europe Brain Cancer Diagnostics Market Attractiveness Analysis, by End-user 2023–2031

Figure 41: Asia Pacific Brain Cancer Diagnostics Market Value (US$ Mn) Forecast 2023–2031

Figure 42: Asia Pacific Brain Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 43: Asia Pacific Brain Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Asia Pacific Brain Cancer Diagnostics Market Value Share Analysis, by Diagnostic Technique 2023 and 2031

Figure 45: Asia Pacific Brain Cancer Diagnostics Market Attractiveness Analysis, by Diagnostic Technique 2023–2031

Figure 46: Asia Pacific Brain Cancer Diagnostics Market Value Share Analysis, by Brain Cancer Type 2023 and 2031

Figure 47: Asia Pacific Brain Cancer Diagnostics Market Attractiveness Analysis, by Brain Cancer Type 2023–2031

Figure 48: Asia Pacific Brain Cancer Diagnostics Market Value Share Analysis, by End-user 2023 and 2031

Figure 49: Asia Pacific Brain Cancer Diagnostics Market Attractiveness Analysis, by End-user 2023–2031

Figure 50: Latin America Brain Cancer Diagnostics Market Value (US$ Mn) Forecast 2023–2031

Figure 51: Latin America Brain Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 52: Latin America Brain Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 53: Latin America Brain Cancer Diagnostics Market Value Share Analysis, by Diagnostic Technique 2023 and 2031

Figure 54: Latin America Brain Cancer Diagnostics Market Attractiveness Analysis, by Diagnostic Technique 2023–2031

Figure 55: Latin America Brain Cancer Diagnostics Market Value Share Analysis, by Brain Cancer Type 2023 and 2031

Figure 56: Latin America Brain Cancer Diagnostics Market Attractiveness Analysis, by Brain Cancer Type 2023–2031

Figure 57: Latin America Brain Cancer Diagnostics Market Value Share Analysis, by End-user 2023 and 2031

Figure 58: Latin America Brain Cancer Diagnostics Market Attractiveness Analysis, by End-user 2023–2031

Figure 59: Middle East & Africa Brain Cancer Diagnostics Market Value (US$ Mn) 2023–2031

Figure 60: Middle East & Africa Brain Cancer Diagnostics Market Value Share Analysis, by Country 2023 and 2031

Figure 61: Middle East & Africa Brain Cancer Diagnostics Market Attractiveness , by Country 2023–2031

Figure 62: Middle East & Africa Brain Cancer Diagnostics Market Value Share Analysis, by Diagnostic Technique 2023 and 2031

Figure 63: Middle East & Africa Brain Cancer Diagnostics Market Attractiveness , by Diagnostic Technique 2023–2031

Figure 64: Middle East & Africa Brain Cancer Diagnostics Market Value Share Analysis, by Brain Cancer Type 2023 and 2031

Figure 65: Middle East & Africa Brain Cancer Diagnostics Market Attractiveness , by Brain Cancer Type 2023–2031

Figure 66: Middle East & Africa Brain Cancer Diagnostics Market Value Share Analysis, by End-user 2023 and 2031

Figure 67: Middle East & Africa Brain Cancer Diagnostics Market Attractiveness, by End-user 2023–2031