Blowout preventive (BoP) handling systems are increasingly being used in both, onshore as well as offshore applications in various industrial sectors, including marine, oil & gas, mining & construction, defense, and automotive. Technological advancements coupled with increasing demand for operational safety and higher efficiency have accelerated innovations in the BoP handling system market over the past few years– a trend that is projected to continue over the forthcoming decade. In addition, the growth of the BoP handling system market is anticipated due to the increase in the number of shale drilling activities around the world.

Moreover, strides taken by technology in wellhead systems continue to improve operational efficiency and safety due to which, BoP handling systems are expected to gain considerable traction during the forecast period. As shale drilling and completion operations continue to progress at a rapid pace, it is likely to have a direct impact on the BoP handling system market. As oil & gas production and marine activities around the world scale up at a staggering pace, with it, the demand for BoP handling systems is expected to grow at an impressive rate.

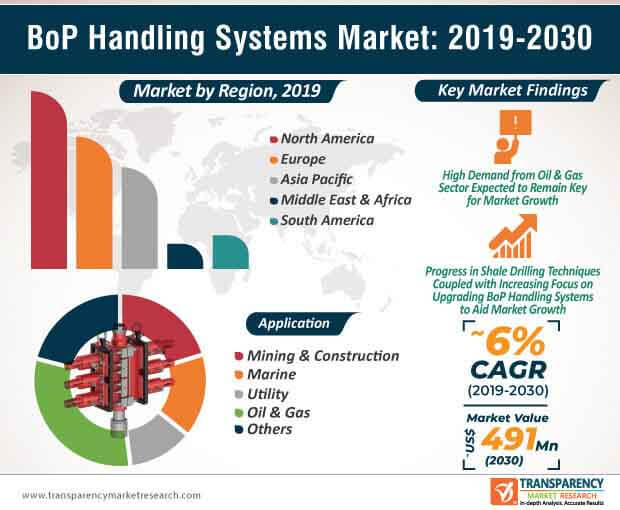

Presently, amid the ongoing COVID-19 pandemic, offshore and onshore drilling activities around the world are likely to face a steep decline due to an array of factors following which the growth of the BoP handling system market is likely to remain sluggish, particularly in 2020. However, in the long run, due to the ongoing pressure on various industries to minimize the depletion of conventional resources, several players operating in various end-use industries are primarily focusing on upgrading their BoP handling systems. At the back of these factors, the global BoP handling system market is expected to reach a value of ~US$ 491.3 Bn by the end of 2030.

For several decades, drilling operations across the oil & gas sector have proved to be hazardous due to which, considerable efforts are being made to minimize casualties and increase the overall safety. BoP handling systems are primarily deployed to ensure safety across drilling operations and as per current observations, the adoption is likely to remain consistent over the upcoming years. The growing demand for efficiency across the oil & gas sector has played a key role in improving the overall quality and performance of BoP handling systems. Market players involved in the current BoP handling system market are increasingly seeking novel ways to minimize the total time required to connect BoP handling systems with wellhead equipment. In addition, as regulators and operators continue to emphasize on well safety, innovations and new technologies across the BoP handling system market have entered the fray at a consistent pace.

Several key participants of the BoP handling system market are also expected to focus on the design aspects of their BoP handling systems to gain a competitive edge. Considerable attention has been given to offshore BoP handling systems over the past few years due to which, new technologies have been consistently introduced to address various challenges put forward by high-pressure, high-temperature, and deepwater reservoirs. These factors, along with growing emphasis on repair and maintenance of BoP handling systems, are driving the global BoP handling system market.

Over the past few years, participants operating in the BoP handling system market landscape have leaned toward organic as well as inorganic strategies to increase their market share and overall presence. While some companies are increasingly focusing on launching new BoP handling systems integrated with cutting-edge technologies, several other companies are focusing on collaborations, mergers, and other types of partnerships to establish a strong foothold in the market.

For instance, in 2018, Petrobas launched a campaign for novel BoP handling system technologies and well safety by tying up with the Brazilian aerospace company, Embraer S.A. Another noteworthy collaboration that made the headlines within the deepwater drilling sector was the contractual service agreement between Diamond Offshore Drilling, Inc., and GE Oil & Gas.

The oil & gas sector that was gradually recovering from a setback in 2017 is expected to tread through a rough period in 2020 due to the onset of the novel COVID-19 pandemic. The demand for oil has declined at a rapid pace in the first two quarters of 2020 and its impact can be felt across the BoP handling system market. The imbalance between the supply and demand within the oil sector is expected to hinder market growth particularly in 2020. In addition, stringent lockdowns coupled with restrictions on cross-border trade and transportation are some of the other leading factors that are projected to affect the overall growth of the market for BoP handling systems. The market is likely to be the worst-hit across the Middle East & Africa where oil & gas operations are relatively higher.

Analysts’ Viewpoint

The global BoP handling system market is expected to grow at a CAGR of ~7%, in terms of volume, during the forecast period. The market growth can be primarily attributed to a host of factors, including high demand from the oil & gas sector, widening applications in other end-use industries, advancements in technology, growing emphasis on increasing operational safety across oilfields, and optimizing performance. Players operating in the current market landscape should focus on collaborating with stakeholders in the supply chain to increase their overall share in the current market landscape.

North America is a developed region and hence, innovation and new technologies are expected to be key trends to be witnessed in this region over the next few years. North America is expected to hold a significant share of the global BoP handling system market in 2020. For the same reason, North America is likely to see highest opportunity addition in the BoP handling system market globally, with Europe and Asia Pacific being the next closest key regions for the market.

Demand for oil & gas products is increasing at a significant rate; however, supply of the same is declining due to decrease in oil & gas reserves around the globe. The demand and supply gap has led various companies to invest their financial and technological resources in exploring new oil fields and improving oil & gas extraction efficiency. Governments of different countries such as India and China are investing in oil & gas companies. The Government of Dubai, as of 2017, owns 1,381 oil & gas companies. This, in turn, is expected to enhance the demand for BoP handling systems with the rising number of oil & gas plants.

BOP handling systems are used in construction, mining, metallurgy, and freight sectors. Rise in demand for BOP handling systems in heavy lifting of cargos in harbors and ships is anticipated to augment the global BoP handling system market.

For instance, 10.7 billion tons of goods were loaded across the globe in 2017 and Asia Pacific was the dominant region in this market. More than 6.5 billion tons was unloaded and 4.4 billion tons of goods were loaded in Asian seaports in 2017. This, in turn, is expected to enhance the growth of the BoP handling system market.

Established in 1859, Ingersoll Rand Inc. is located in Swords, Ireland. The company designs and manufactures reciprocating air compressors, BoP handling systems, oil-flooded rotary air compressors, oil-free rotary screw air compressors, centrifugal compressors, air compressor dryers / air compressor filters, air motors, and air starters. The company serves various industry segments such as aerospace, electronics, food & beverages, oil & gas, pharmaceutical, chemical, construction, mining, and pulp & paper. It also provides training and repair, maintenance, and installation services.

Incorporated in 1907, Baker Hughes is a provider of integrated oilfield products and services in 120 countries with approximately 68,000 employees. The company operates through four business segments that include Oilfield Services (OFS), Oilfield Equipment (OFE), Turbomachinery & Process Solutions (TPS), and Digital Solutions (DS). Under the Oilfield Equipment segment, Baker Hughes offers a drilling product line that includes blowout preventers (BoP), control systems, marine drilling risers, wellhead connectors, diverters, and related services for floaters, jack-ups, and land drilling rigs.

Incorporated in 1926, Schlumberger is an international oilfield services company employing approximately 100,000 people, representing more than 140 nationalities, and working in more than 120 countries. The company delivers a wide range of products and services including drilling fluids & drill bits, seismic data acquisition & processing, directional drilling & drilling services, well cementing & simulation, formation evaluation & well testing, well completions, well intervention, artificial lifts, and software & information management. Schlumberger has its principal executive offices located in London, Paris, Houston, and The Hague.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global BOP Handling System Market

4. Market Overview

4.1. Market Definition

4.2. Macroeconomic Factors

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Worldwide Industrial Production Index, by Top Countries

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.4.1. By Capacity

4.4.2. By Application

4.5. Competitive Scenario and Trends

4.5.1. BOP Handling System Market Concentration Rate

4.5.1.1. List of Emerging, Prominent, and Leading Players

4.5.2. Mergers & Acquisitions, Expansions

4.6. Market Outlook

4.7. Impact Analysis of COVID -19 on BOP Handling System Market

5. Global BOP Handling System Market Analysis and Forecast

5.1.1. Market Revenue Analysis (US$ Mn), 2015-2030

5.1.1.1. Historic Growth Trends, 2015-2019

5.1.1.2. Forecast Trends, 2020-2030

5.1.2. Market Volume Analysis (Thousand Units), 2015-2030

5.1.2.1. Historic Growth Trends, 2015-2019

5.1.2.2. Forecast Trends, 2020-2030

5.1.3. Pricing Model Analysis/ Price Trend Analysis

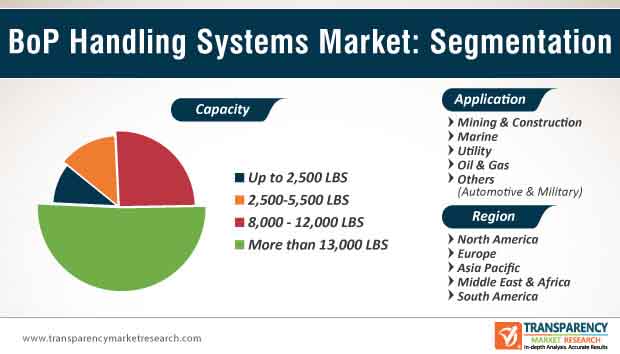

6. Global BOP Handling System Market Analysis, by Capacity

6.1. Overview

6.2. Key Segment Analysis

6.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Capacity, 2018 - 2030

6.3.1. Up to 2,500 LBS

6.3.2. 2,500-5,500 LBS

6.3.3. 8,000 - 12,000 LBS

6.3.4. More than 13,000 LBS

7. Global BOP Handling System Market Analysis, by Application

7.1. Overview

7.2. Key Segment Analysis

7.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Application, 2018 - 2030

7.3.1. Mining & Construction

7.3.2. Marine

7.3.3. Utility

7.3.4. Oil & Gas

7.3.5. Others (Automotive & Military)

8. Global BOP Handling System Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Region, 2018 - 2030

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America BOP Handling System Market Analysis

9.1. Regional Outlook

9.2. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Analysis and Forecast (2018 - 2030)

9.2.1. By Capacity

9.2.2. By Application

9.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Country & Sub-region, 2018 - 2030

9.3.1. U.S.

9.3.2. Canada

9.3.3. Rest of North America

10. Europe BOP Handling System Market Analysis and Forecast

10.1. Regional Outlook

10.2. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Analysis and Forecast (2018 - 2030)

10.2.1. By Capacity

10.2.2. By Application

10.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Country & Sub-region, 2018 - 2030

10.3.1. Germany

10.3.2. U.K.

10.3.3. Russia

10.3.4. Rest of Europe

11. APAC BOP Handling System Market Analysis and Forecast

11.1. Regional Outlook

11.2. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Analysis and Forecast (2018 - 2030)

11.2.1. By Capacity

11.2.2. By Application

11.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Country & Sub-region, 2018 - 2030

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. Rest of Asia Pacific

12. Middle East & Africa (MEA) BOP Handling System Market Analysis and Forecast

12.1. Regional Outlook

12.2. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Analysis and Forecast (2018 - 2030)

12.2.1. By Capacity

12.2.2. By Application

12.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Country & Sub-region, 2018 - 2030

12.3.1. Saudi Arabia

12.3.2. The United Arab Emirates

12.3.3. South Africa

12.3.4. Rest of Middle East & Africa (MEA)

13. South America BOP Handling System Market Analysis and Forecast

13.1. Regional Outlook

13.2. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Analysis and Forecast (2018 - 2030)

13.2.1. By Capacity

13.2.2. By Application

13.3. BOP Handling System Market Size (US$ Mn) and (Thousand Units) Forecast, by Country & Sub-region, 2018 - 2030

13.3.1. Brazil

13.3.2. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2019)

15. Company Profiles

15.1. Ingersoll Rand Inc.

15.1.1. Business Overview

15.1.2. Product Portfolio

15.1.3. Geographical Footprint

15.1.4. Revenue and Strategy

15.2. Baker Hughes Company

15.2.1. Business Overview

15.2.2. Product Portfolio

15.2.3. Geographical Footprint

15.2.4. Revenue and Strategy

15.3. EFC Group

15.3.1. Business Overview

15.3.2. Product Portfolio

15.3.3. Geographical Footprint

15.3.4. Revenue and Strategy

15.4. Fukushima Ltd

15.4.1. Business Overview

15.4.2. Product Portfolio

15.4.3. Geographical Footprint

15.4.4. Revenue and Strategy

15.5. J.D. NEUHAUS

15.5.1. Business Overview

15.5.2. Product Portfolio

15.5.3. Geographical Footprint

15.5.4. Revenue and Strategy

15.6. James Fisher and Sons plc

15.6.1. Business Overview

15.6.2. Product Portfolio

15.6.3. Geographical Footprint

15.6.4. Revenue and Strategy

15.7. Markey Machinery Co Inc

15.7.1. Business Overview

15.7.2. Product Portfolio

15.7.3. Geographical Footprint

15.7.4. Revenue and Strategy

15.8. Mile Marker Industries LLC

15.8.1. Business Overview

15.8.2. Product Portfolio

15.8.3. Geographical Footprint

15.8.4. Revenue and Strategy

15.9. National Oilwell Varco

15.9.1. Business Overview

15.9.2. Product Portfolio

15.9.3. Geographical Footprint

15.9.4. Revenue and Strategy

15.10. RAM Winch & Hoist

15.10.1. Business Overview

15.10.2. Product Portfolio

15.10.3. Geographical Footprint

15.10.4. Revenue and Strategy

15.11. Ramsey Winch

15.11.1. Business Overview

15.11.2. Product Portfolio

15.11.3. Geographical Footprint

15.11.4. Revenue and Strategy

15.12. Schlumberger Limited.

15.12.1. Business Overview

15.12.2. Product Portfolio

15.12.3. Geographical Footprint

15.12.4. Revenue and Strategy

15.13. Superwinch

15.13.1. Business Overview

15.13.2. Product Portfolio

15.13.3. Geographical Footprint

15.13.4. Revenue and Strategy

15.14. TWG, Inc,

15.14.1. Business Overview

15.14.2. Product Portfolio

15.14.3. Geographical Footprint

15.14.4. Revenue and Strategy

15.15. WARN Industries, Inc.

15.15.1. Business Overview

15.15.2. Product Portfolio

15.15.3. Geographical Footprint

15.15.4. Revenue and Strategy

16. Key Takeaways

List of Tables

Table 1: List of Vendors

Table 2: Mergers & Acquisitions, Expansions / Launch

Table 3: Global BoP Handling System Market Volume (Thousand Units) Forecast, by Capacity, 2018-2030

Table 4: Global BoP Handling System Market Revenue (US$ Mn) Forecast, by Capacity, 2018-2030

Table 5: Global BoP Handling System Market Volume (Thousand Units) and Forecast, by Application 2018 – 2030

Table 6: Global BoP Handling System Market Revenue (US$ Mn) and Forecast, by Application 2018 – 2030

Table 7: Global BoP Handling System Market Volume (Thousand Units) and Forecast, by Region 2018 – 2030

Table 8: Global BoP Handling System Market Revenue (US$ Mn) and Forecast, by Region 2018 – 2030

Table 9: North America BoP Handling System Market Volume (Thousand Units) Forecast, by Capacity, 2018-2030

Table 10: North America BoP Handling System Market Revenue (US$ Mn) Forecast, by Capacity, 2018-2030

Table 11: North America BoP Handling System Market Volume (Thousand Units) and Forecast, by Application 2018 – 2030

Table 12: North America BoP Handling System Market Revenue (US$ Mn) and Forecast, by Application 2018 – 2030

Table 13: North America Mobile Application and Testing Solutions Market Volume (Thousand Units) and Forecast, by Country 2018 – 2030

Table 14: North America Mobile Application and Testing Solutions Market Revenue (US$ Mn) and Forecast, by Country 2018 – 2030

Table 15: Europe BoP Handling System Market Volume (Thousand Units) Forecast, by Capacity, 2018-2030

Table 16: Europe BoP Handling System Market Revenue (US$ Mn) Forecast, by Capacity, 2018-2030

Table 17: Europe BoP Handling System Market Volume (Thousand Units) and Forecast, by Application 2018 – 2030

Table :18 Europe BoP Handling System Market Revenue (US$ Mn) and Forecast, by Application 2018 – 2030

Table 19: Europe Mobile Application and Testing Solutions Market Volume (Thousand Units) and Forecast, by Country 2018 – 2030

Table 20: Europe Mobile Application and Testing Solutions Market Revenue (US$ Mn) and Forecast, by Country 2018 – 2030

Table 21: Asia Pacific BoP Handling System Market Volume (Thousand Units) Forecast, by Capacity, 2018-2030

Table 22: Asia Pacific BoP Handling System Market Revenue (US$ Mn) Forecast, by Capacity, 2018-2030

Table 23: Asia Pacific BoP Handling System Market Volume (Thousand Units) and Forecast, by Application 2018 – 2030

Table 24: Asia Pacific BoP Handling System Market Revenue (US$ Mn) and Forecast, by Application 2018 – 2030

Table 25: Asia Pacific Mobile Application and Testing Solutions Market Volume (Thousand Units) and Forecast, by Country 2018 – 2030

Table 26: Asia Pacific Mobile Application and Testing Solutions Market Revenue (US$ Mn) and Forecast, by Country 2018 – 2030

Table 27: Middle East & Africa BoP Handling System Market Volume (Thousand Units) Forecast, by Capacity, 2018-2030

Table 28: Middle East & Africa BoP Handling System Market Revenue (US$ Mn) Forecast, by Capacity, 2018-2030

Table 29: Middle East & Africa BoP Handling System Market Volume (Thousand Units) and Forecast, by Application 2018 – 2030

Table 30: Middle East & Africa BoP Handling System Market Revenue (US$ Mn) and Forecast, by Application 2018 – 2030

Table 31: Middle East & Africa Mobile Application and Testing Solutions Market Volume (Thousand Units) and Forecast, by Country 2018 – 2030

Table 32: Middle East & Africa Mobile Application and Testing Solutions Market Revenue (US$ Mn) and Forecast, by Country 2018 – 2030

Table 33: South America BoP Handling System Market Volume (Thousand Units) Forecast, by Capacity, 2018-2030

Table 34: South America BoP Handling System Market Revenue (US$ Mn) Forecast, by Capacity, 2018-2030

Table 35: South America BoP Handling System Market Volume (Thousand Units) and Forecast, by Application 2018 – 2030

Table 36: South America BoP Handling System Market Revenue (US$ Mn) and Forecast, by Application 2018 – 2030

Table 37: South America BoP Handling System Market Volume (Thousand Units) and Forecast, by Country 2018 – 2030

Table 38: South America BoP Handling System Market Revenue (US$ Mn) and Forecast, by Country 2018 – 2030

List of Figures

Figure 01: Global BoP Handling System Market Volume (Thousand Units ) Forecast, 2018- 2030

Figure 02: Global BoP Handling System Market Revenue (US$ Mn) Forecast, 2018- 2030

Figure 03: Global Market Value & Volume (US$ Mn) and (Thousand Units)

Figure 4: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 5: Top Economies GDP Landscape, 2018

Figure 6: Global BoP Handling System Market Attractiveness Assessment, by Capacity

Figure 7: Global BoP Handling System Market Relative Attractiveness Assessment, by Capacity

Figure 8: Global BoP Handling System Market Attractiveness Assessment, by Application

Figure 9: Global BoP Handling System Market Relative Attractiveness Assessment, by Application

Figure 10: Global BoP Handling System Market Attractiveness Assessment, by Region

Figure 11: Global BoP Handling System Market Relative Attractiveness Assessment, by Region

Figure 12: Global BoP Handling System Market, by Capacity CAGR (%) (2020 – 2030)

Figure 13: Global BoP Handling System Market, by Application CAGR (%) (2020 – 2030)

Figure 14: Global BoP Handling System Market, by Region CAGR (%) (2020 – 2030)

Figure 15: Global BoP Handling System Market Historic Growth Trends (Thousand Units), 2015 – 2019

Figure 16: Global BoP Handling System Market Y-o-Y Growth (Volume %), 2015 – 2019

Figure 17: Global BoP Handling System Market Historic Growth Trends (Thousand Units), 2020 - 2030

Figure 18: Global BoP Handling System Market Y-o-Y Growth (Volume %), 2020 - 2030

Figure 19: Global BoP Handling System Market Historic Growth Trends (US$ Mn), 2015 – 2019

Figure 20: Global BoP Handling System Market Y-o-Y Growth (Value %), 2015 – 2019

Figure 21: Global BoP Handling System Market Forecast Trends (US$ Mn), 2020 - 2030

Figure 22: Global BoP Handling System Market Y-o-Y Growth (Value %), 2020 - 2030

Figure 23: Global BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2020

Figure 24: Global BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2030

Figure 25: Global BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2020

Figure 26: Global BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2030

Figure 27: Global BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2020

Figure 28: Global BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2030

Figure 29: Global BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2020

Figure 30: Global BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2030

Figure 31: Global BoP Handling System Market Volume Share Analysis, (Volume %) by Region, 2020

Figure 32: Global BoP Handling System Market Volume Share Analysis, (Volume %) by Region, 2030

Figure 33: Global BoP Handling System Market Revenue Share Analysis, (Value %) by Region, 2020

Figure 34: Global BoP Handling System Market Revenue Share Analysis, (Value %) by Region, 2030

Figure 35: North America BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2020

Figure 36: North America BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2030

Figure 37: North America BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2020

Figure 38: North America BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2030

Figure 39: North America BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2020

Figure 40: North America BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2030

Figure 41: North America BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2020

Figure 42: North America BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2030

Figure 43: North America Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2020

Figure 44: North America Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2030

Figure 45: North America Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country , 2020

Figure 46: North America Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2030

Figure 47: Europe BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2020

Figure 48: Europe BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2030

Figure 49: Europe BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2020

Figure 50: Europe BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2030

Figure 51: Europe BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2020

Figure 52: Europe BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2030

Figure 53: Europe BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2020

Figure 54: Europe BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2030

Figure 55: Europe Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2020

Figure 56: Europe Mobile Application and Testing Solutions Market Revenue Share Analysis, (Volume %) by Country, 2030

Figure 57: Europe Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2020

Figure 58: Europe Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2030

Figure 59: Asia Pacific BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2020

Figure 60: Asia Pacific BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2030

Figure 61: Asia Pacific BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2020

Figure 62: Asia Pacific BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2030

Figure 63: Asia Pacific BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2020

Figure 64: Asia Pacific BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2030

Figure 65: Asia Pacific BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2020

Figure 66: Asia Pacific BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2030

Figure 67: Asia Pacific Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2020

Figure 68: Asia Pacific Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2030

Figure 69: Asia Pacific Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2020

Figure 70: Asia Pacific Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2030

Figure 71: Middle East & Africa BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2020

Figure 72: Middle East & Africa BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2030

Figure 73: Middle East & Africa BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2020

Figure 74: Middle East & Africa BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2030

Figure 75: Middle East & Africa BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2020

Figure 76: Middle East & Africa BoP Handling System Market Volume Share Analysis, (Volume %) by Application, 2030

Figure 77: Middle East & Africa BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2020

Figure 78: Middle East & Africa BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2030

Figure 79: Middle East & Africa Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2020

Figure 80: Middle East & Africa Mobile Application and Testing Solutions Market Volume Share Analysis, (Volume %) by Country, 2030

Figure 81: Middle East & Africa Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2020

Figure 82: Middle East & Africa Mobile Application and Testing Solutions Market Revenue Share Analysis, (Value %) by Country, 2030

Figure 83: South America BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2020

Figure 84: South America BoP Handling System Market Volume Share Analysis, (Volume %) by Capacity, 2030

Figure 85: South America BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2020

Figure 86: South America BoP Handling System Market Revenue Share Analysis, (Value %) by Capacity, 2030

Figure 87: South America BoP Handling System Market Volume Share Analysis, (Volume %) by Application , 2020

Figure 88: South America BoP Handling System Market Volume Share Analysis, (Volume %) by Application , 2030

Figure 89: South America BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2020

Figure 90: South America BoP Handling System Market Revenue Share Analysis, (Value %) by Application, 2030

Figure 91: South America BoP Handling System Market Revenue Share Analysis, (Volume %) by Country, 2020

Figure 92: South America BoP Handling System Market Revenue Share Analysis, (Volume %) by Country, 2030

Figure 93: South America BoP Handling System Market Revenue Share Analysis, (Value %) by Country, 2020

Figure 94: South America BoP Handling System Market Revenue Share Analysis, (Value %) by Country, 2030