Blood Group Typing Market: Contours of Evolution and Scope

A wide range of tests finds clinical application in blood group typing—there are as many as 33 blood group systems. Quite wide array of techniques and instruments have become popular in cross-matching tests in transfusion medicine. Transfusion-related problems have opened market for new tests for ABO and Rhesus system. These systems aside, a significant number of genetically-different BGs have been identified.

A growing body of research in blood group typing market has also put a slant emphasis on diseases RBC surface antigens can cause. Constant progress that blood transfusion medicine has witnessed world over is testimony to the growing application of conventional as well as some modern tests in blood group typing market. These comprise antibody screening, cross matching test, HLA typing, and antigen typing.

Unarguably, experts consider blood group-linked diseases to be at nascent stage but strikingly evolving. These has attract attention of clinicians in using blood group typing tests for understanding malignancies with chronic diseases. This is a key driver for growing clinical role of ABO blood groups in understanding the severity of infection in chronic diseases. Most importantly, industry players are putting stakes on instruments that are used in blood group typing market, and harness them for expanding the management avenue for cancer.

Blood Group Typing Market: Valuation and Projection

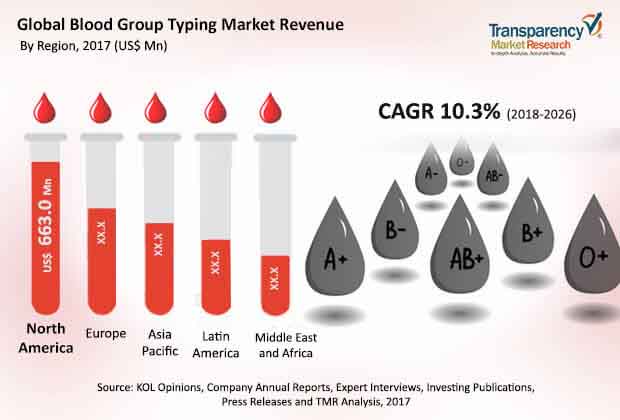

The global blood group typing market stood at US$ 1,500.0 Mn in 2017 and is anticipated to reach US$ 3,556.0 Mn by 2026, expanding at an impressive CAGR of 10.3% from 2018 to 2026.

Blood group typing tests and consumables have gained clinical acceptance due to rise in increase in blood transfusion rate across the world. To a great deal, the need for transfusion processes has risen at rapid pace due to its correlation with hospitalization caused due to various chronic diseases, such as kidney ailments.

The report segments the blood group typing market on the basis of product, technique, test, and end use.

Major end uses comprise instruments, consumables, and services.

PCR-based Techniques Gathered Steam for Blood Grouping for Chronic Diseases

Of all products, consumables accounted for the leading share in 2017 and is expected to retain its lead throughout the forecast period. Constant efforts by researchers to test advanced instruments and kits have helped boost the prominence of the segment. Advancements in analytical devices have bolstered the prospects. Further, rise in demand for molecular diagnostic test kits and reagents

Key techniques used in the blood are PCR-based, microarray-based, assay-based technique, and massively parallel techniques.

Of these, the PCR-based segment held the leading share in the global market in 2017. It is expected to retain its dominance in coming years as well. The segment is expected to clock a CAGR of 10.6% from 2018 to 2026.

PCR-based techniques have gathered steam for blood grouping for chronic diseases such as aplastic anemia, sickle cell anemia, traumatic injuries, and leukemia. The associated techniques are also useful in rare type of blood group. The second prominent share is held by microarray-based segment.

Assay-based technique and massively parallel techniques held an approximately 30.0% share of the global blood group typing market, vis-à-vis revenue, in 2017.

In coming years, portable blood typing methods will help save the lives of patients who need blood transfusion in emergency settings. Their capabilities have gone rapid advancements on the back of incorporation of sensor technology.

Serologic testing has been popularly used in the blood group typing market. However, in recent years, molecular typing methods are gaining preference due to their capability in advanced blood group typing, such as for predicting the probable antigen type.

Antibody Screening Test Segment to Rise From Demand in Low- and Middle-Income Countries

Of the various test types, the antibody screening test segment is anticipated to hold leading share of global blood group typing market by 2026-end. The segment is projected to clock a CAGR more than 10.0% during 2018 - 2026. In low- and middle-income countries, rise in incidence of transfusion transmitted infections (TTIs) has spurred the demand.

HLA typing and antigen segments jointly accounted for approximately 30.0% share of the global blood group typing market in 2017 in revenues.

Various end-use segments are hospitals, clinical laboratories, and blood bank. Of these, hospitals accounted for the top share. The segment is expected to rise at CAGR of 10% during 2018 - 2026. By the end of the period, it is expected to gain some market shares. Widespread demand for various test types makes the segment highly lucrative for market players.

North America Held the Top Share

The various regional markets for blood group typing are North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Of these, North America is the leading segment and is expected to gain share. A great deal of fillip for the uptick in demand for various types of blood group typing comes from active and voluntary blood donors in the U.S. Also, rapid strides have been made by life-saving transfusion medicine, paving way for new avenues for prenatal patients.

Rise in number of blood donors in Asia Pacific has spurred the demand for blood group typing. China is expected to a lucrative market and will rise at an impressive growth rate during 2018 – 2026.

Top players profiled in the report are Grifols, S.A., Bio-Red Laboratories, Inc., Merck KGaA, Ortho Clinical Diagnostics, QUOTIENT LIMITED, BAG Health Care GmbH, Immucor, Inc., eckman Coulter, Inc. (Danaher Corporation), Agena Bioscience, Inc., and Novacyt Group.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Market Definition

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.3. Restraints

5.4. Opportunity

6. The Global Blood Group Typing Market Analysis and Forecast, 2018-2026

6.1. Market Revenue Projections

6.2. Global Blood Group Typing Market Outlook

6.3. Strategies Adopted by Top 3 Players

6.4. Estimated Blood Donations By WHO – Region-wise (2013)

6.5. Key Mergers & Acquisitions in Blood Group Typing Market

7. Global Blood Group Typing Market Analysis, by Product

7.1. Introduction

7.2. Global Blood Group Typing Market Value Share Analysis, by Product

7.3. Global Blood Group Typing Market Forecast, by Product

7.3.1. Instrument

7.3.2. Consumables

7.3.3. Services

7.4. Global Blood Group Typing Market Analysis, by Product

7.5. Global Blood Group Typing Market Attractiveness Analysis, by Product

7.6. Key Trends

8. Global Blood Group Typing Market Analysis, by Technique

8.1. Introduction

8.2. Global Blood Group Typing Market Value Share Analysis, by Technique

8.3. Global Blood Group Typing Market Forecast, by Technique

8.3.1. PCR-based

8.3.2. Microarray-based

8.3.3. Assay-based Technique

8.3.4. Massively Parallel Technique

8.4. Global Blood Group Typing Market Analysis, by Technique

8.5. Global Blood Group Typing Market Attractiveness Analysis, by Technique

9. Global Blood Group Typing Market Analysis, by Test

9.1. Introduction

9.2. Global Blood Group Typing Market Value Share Analysis, by Test

9.3. Global Blood Group Typing Market Forecast, by Test

9.3.1. Antibody Screening

9.3.2. HLA Typing

9.3.3. ABO Blood Test

9.3.4. Cross Matching Test

9.3.5. Antigen Typing

9.4. Global Blood Group Typing Market Analysis, by Test

9.5. Global Blood Group Typing Market Attractiveness Analysis, by Test

9.6. Key Trend

10. Global Blood Group Typing Market Analysis, by End-user

10.1. Introduction

10.2. Global Blood Group Typing Market Value Share Analysis, by End-user

10.3. Global Blood Group Typing Market Forecast, by End-user

10.3.1. Hospitals

10.3.2. Clinical Laboratories

10.3.3. Blood Bank

10.3.4. Others

10.4. Global Blood Group Typing Market Analysis, by End-user

10.5. Global Blood Group Typing Market Attractiveness Analysis, by End-user

10.6. Key Trends

11. Global Blood Group Typing Market Analysis, by Region

11.1. Global Blood Group Typing Market Scenario, by Country/Sub-region

11.2. Global Blood Group Typing Market Value Share Analysis, by Region

11.3. Global Blood Group Typing Market Forecast, by Region

11.3.1. North America

11.3.2. Europe

11.3.3. Asia Pacific

11.3.4. Latin America

11.3.5. Middle East & Africa

11.4. Global Blood Group Typing Market Attractiveness Analysis, by Region

12. North America Blood Group Typing Market Analysis

12.1. North America Blood Group Typing Market: Regional Outlook

12.2. Key Findings

12.3. North America Blood Group Typing Market Overview

12.4. North America Blood Group Typing Market Value Share Analysis, by Country

12.5. North America Blood Group Typing Market Forecast, by Country

12.5.1. U.S.

12.5.2. Canada

12.6. North America Blood Group Typing Market Value Share Analysis, by Product

12.7. North America Blood Group Typing Market Forecast, by Product

12.7.1. Instrument

12.7.2. Consumables

12.7.3. Services

12.8. North America Blood Group Typing Market Value Share Analysis, by Technique

12.9. North America Blood Group Typing Market Forecast, by Technique

12.9.1. PCR-based

12.9.2. Microarray-based

12.9.3. Assay-based Technique

12.9.4. Massively Parallel Technique

12.10. North America Blood Group Typing Market Value Share Analysis, by Test

12.11. North America Blood Group Typing Market Forecast, by Test

12.11.1. Antibody Screening

12.11.2. HLA Typing

12.11.3. ABO Blood Test

12.11.4. Cross Matching Test

12.11.5. Antigen Typing

12.12. North America Blood Group Typing Market Value Share Analysis, by End-user

12.13. North America Blood Group Typing Market Forecast, by End-user

12.13.1. Hospitals

12.13.2. Clinical Laboratories

12.13.3. Blood Bank

12.13.4. Others

12.14. North America Blood Group Typing Market Attractiveness Analysis

13. Europe Blood Group Typing Market Analysis

13.1. Europe Blood Group Typing Market: Regional Outlook

13.2. Key Findings

13.3. Europe Blood Group Typing Market Overview

13.4. Europe Blood Group Typing Market Value Share Analysis, by Country

13.5. Europe Blood Group Typing Market Forecast, by Country

13.5.1. Germany

13.5.2. France

13.5.3. Italy

13.5.4. Spain

13.5.5. U.K.

13.5.6. Rest of Europe

13.6. Europe Blood Group Typing Market Value Share Analysis, by Product

13.7. Europe Blood Group Typing Market Forecast, by Product

13.7.1. Instrument

13.7.2. Consumables

13.7.3. Services

13.8. Europe Blood Group Typing Market Value Share Analysis, by Technique

13.9. Europe Blood Group Typing Market Forecast, by Technique

13.9.1. PCR-based

13.9.2. Microarray-based

13.9.3. Assay-based Technique

13.9.4. Massively Parallel Technique

13.10. Europe Blood Group Typing Market Value Share Analysis, by Test

13.11. Europe Blood Group Typing Market Forecast, by Test

13.11.1. Antibody Screening

13.11.2. HLA Typing

13.11.3. ABO Blood Test

13.11.4. Cross Matching Test

13.11.5. Antigen Typing

13.12. Europe Blood Group Typing Market Value Share Analysis, by End-user

13.13. Europe Blood Group Typing Market Forecast, by End-user

13.13.1. Hospitals

13.13.2. Clinical Laboratories

13.13.3. Blood Bank

13.13.4. Others

13.14. Europe Blood Group Typing Market Attractiveness Analysis

14. Asia Pacific Blood Group Typing Market Analysis

14.1. Asia Pacific Blood Group Typing Market: Regional Outlook

14.2. Key Findings

14.3. Asia Pacific Blood Group Typing Market Overview

14.4. Asia Pacific Blood Group Typing Market Value Share Analysis, by Country

14.5. Asia Pacific Blood Group Typing Market Forecast, by Country

14.5.1. China

14.5.2. Japan

14.5.3. India

14.5.4. Australia & New Zealand

14.5.5. Rest of APAC

14.6. Asia Pacific Blood Group Typing Market Value Share Analysis, by Product

14.7. Asia Pacific Blood Group Typing Market Forecast, by Product

14.7.1. Instrument

14.7.2. Consumables

14.7.3. Services

14.8. Asia Pacific Blood Group Typing Market Value Share Analysis, by Technique

14.9. Asia Pacific Blood Group Typing Market Forecast, by Technique

14.9.1. PCR-based

14.9.2. Microarray-based

14.9.3. Assay-based Technique

14.9.4. Massively Parallel Technique

14.10. Asia Pacific Blood Group Typing Market Value Share Analysis, by Test

14.11. Asia Pacific Blood Group Typing Market Forecast, by Test

14.11.1. Antibody Screening

14.11.2. HLA Typing

14.11.3. ABO Blood Test

14.11.4. Cross Matching Test

14.11.5. Antigen Typing

14.12. Asia Pacific Blood Group Typing Market Value Share Analysis, by End-user

14.13. Asia Pacific Blood Group Typing Market Forecast, by End-user

14.13.1. Hospitals

14.13.2. Clinical Laboratories

14.13.3. Blood Bank

14.13.4. Others

14.14. Asia Pacific Blood Group Typing Market Attractiveness Analysis

15. Latin America Blood Group Typing Market Analysis

15.1. Latin America Blood Group Typing Market: Regional Outlook

15.2. Key Findings

15.3. Latin America Blood Group Typing Market Overview

15.4. Latin America Blood Group Typing Market Value Share Analysis, by Country

15.5. Latin America Blood Group Typing Market Forecast, by Country

15.5.1. Brazil

15.5.2. Mexico

15.5.3. Rest of LATAM

15.6. Latin America Blood Group Typing Market Value Share Analysis, by Product

15.7. Latin America Blood Group Typing Market Forecast, by Product

15.7.1. Instrument

15.7.2. Consumables

15.7.3. Services

15.8. Latin America Blood Group Typing Market Value Share Analysis, by Technique

15.9. Latin America Blood Group Typing Market Forecast, by Technique

15.9.1. PCR-based

15.9.2. Microarray-based

15.9.3. Assay-based Technique

15.9.4. Massively Parallel Technique

15.10. Latin America Blood Group Typing Market Value Share Analysis, by Test

15.11. Latin America Blood Group Typing Market Forecast, by Test

15.11.1. Antibody Screening

15.11.2. HLA Typing

15.11.3. ABO Blood Test

15.11.4. Cross Matching Test

15.11.5. Antigen Typing

15.12. Latin America Blood Group Typing Market Value Share Analysis, by End-user

15.13. Latin America Blood Group Typing Market Forecast, by End-user

15.13.1. Hospitals

15.13.2. Clinical Laboratories

15.13.3. Blood Bank

15.13.4. Others

15.14. Latin America Blood Group Typing Market Attractiveness Analysis

16. Middle East & Africa Blood Group Typing Market Analysis

16.1. Middle East & Africa Blood Group Typing Market: Regional Outlook

16.2. Key Findings

16.3. Middle East & Africa Blood Group Typing Market Overview

16.4. Middle East & Africa Blood Group Typing Market Value Share Analysis, by Country

16.5. Middle East & Africa Blood Group Typing Market Forecast, by Country

16.5.1. GCC Countries

16.5.2. South Africa

16.5.3. Rest of MEA

16.6. Middle East & Africa Blood Group Typing Market Value Share Analysis, by Product

16.7. Middle East & Africa Blood Group Typing Market Forecast, by Product

16.7.1. Instrument

16.7.2. Consumables

16.7.3. Services

16.8. Middle East & Africa Blood Group Typing Market Value Share Analysis, by Technique

16.9. Middle East & Africa Blood Group Typing Market Forecast, by Technique

16.9.1. PCR-based

16.9.2. Microarray-based

16.9.3. Assay-based Technique

16.9.4. Massively Parallel Technique

16.10. Middle East & Africa Blood Group Typing Market Value Share Analysis, by Test

16.11. Middle East & Africa Blood Group Typing Market Forecast, by Test

16.11.1. Antibody Screening

16.11.2. HLA Typing

16.11.3. ABO Blood Test

16.11.4. Cross Matching Test

16.11.5. Antigen Typing

16.12. Middle East & Africa Blood Group Typing Market Value Share Analysis, by End-user

16.13. Middle East & Africa Blood Group Typing Market Forecast, by End-user

16.13.1. Hospitals

16.13.2. Clinical Laboratories

16.13.3. Blood Bank

16.13.4. Others

16.14. Middle East & Africa Blood Group Typing Market Attractiveness Analysis

17. Competition Landscape

17.1. Blood Group Typing Market Share Analysis, by Company

17.2. Competition Matrix

17.3. Company Profiles

17.3.1. Grifols, S.A.

17.3.1.1. Company Profiles

17.3.1.2. Business Overview

17.3.1.3. Strategic Overview

17.3.1.4. SWOT Analysis

17.3.2. Bio-Red Laboratories, Inc.

17.3.2.1. Company Profiles

17.3.2.2. Business Overview

17.3.2.3. Strategic Overview

17.3.2.4. SWOT Analysis

17.3.3. Merck KGaA

17.3.3.1. Company Profiles

17.3.3.2. Business Overview

17.3.3.3. Strategic Overview

17.3.3.4. SWOT Analysis

17.3.4. Ortho Clinical Diagnostics

17.3.4.1. Company Profiles

17.3.4.2. Business Overview

17.3.4.3. Strategic Overview

17.3.4.4. SWOT Analysis

17.3.5. QUOTIENT LIMITED

17.3.5.1. Company Profiles

17.3.5.2. Business Overview

17.3.5.3. Strategic Overview

17.3.5.4. SWOT Analysis

17.3.6. BAG Health Care GmbH

17.3.6.1. Company Profiles

17.3.6.2. Business Overview

17.3.6.3. Strategic Overview

17.3.6.4. SWOT Analysis

17.3.7. Immucor, Inc.

17.3.7.1. Company Profiles

17.3.7.2. Business Overview

17.3.7.3. Strategic Overview

17.3.7.4. SWOT Analysis

17.3.8. Beckman Coulter, Inc. (Danaher Corporation)

17.3.8.1. Company Profiles

17.3.8.2. Business Overview

17.3.8.3. Strategic Overview

17.3.8.4. SWOT Analysis

17.3.9. Agena Bioscience, Inc.

17.3.9.1. Company Profiles

17.3.9.2. Business Overview

17.3.9.3. Strategic Overview

17.3.9.4. SWOT Analysis

17.3.10. Rapid Labs Ltd

17.3.10.1. Company Profiles

17.3.10.2. Business Overview

17.3.10.3. Strategic Overview

17.3.10.4. SWOT Analysis

17.3.11. Novacyt Group

17.3.11.1. Company Profiles

17.3.11.2. Business Overview

17.3.11.3. Strategic Overview

17.3.11.4. SWOT Analysis

List of Tables

Table 01: Global Blood Group Typing Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 02: Global Blood Group Typing market Size (US$ Mn) Forecast, by Instrument, 2016–2026

Table 03: Global Blood Group Typing market Size (US$ Mn) Forecast, by Consumables, 2016–2026

Table 04: Global Blood Group Typing Market Size (US$ Mn) Forecast, by Technique, 2016–2026

Table 05: Global Blood Group Typing Market Size (US$ Mn) Forecast, by Test, 2016–2026

Table 06: Global Blood Group Typing Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 07: Global Blood Group Typing Market Revenue (US$ Mn) Forecast, by Region, 2016-2026

Table 08: North America Blood Group Typing Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 09: North America Blood Group Typing Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 10: North America Blood Group Typing Market Size (US$ Mn) Forecast, by Instrument, 2016–2026

Table 11: North America Blood Group Typing Market Size (US$ Mn) Forecast, by Consumables, 2016–2026

Table 12: North America Blood Group Typing Market Size (US$ Mn) Forecast, by Technique, 2016–2026

Table 13: North America Blood Group Typing Market Size (US$ Mn) Forecast, by Test, 2016–2026

Table 14: North America Blood Group Typing Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 15: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 16: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 17: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by Instrument, 2016–2026

Table 18: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by Consumables, 2016–2026

Table 19: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by Technique, 2016–2026

Table 20: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by Test, 2016–2026

Table 21: Europe Blood Group Typing Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 22: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 23: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 24: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by Instrument, 2016–2026

Table 25: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by Consumables, 2016–2026

Table 26: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by Technique, 2016–2026

Table 27: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by Test, 2016–2026

Table 28: Latin America Blood Group Typing Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 29: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 30: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 31: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by Instrument, 2016–2026

Table 32: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by Consumables, 2016–2026

Table 33: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by Technique, 2016–2026

Table 34: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by Test, 2016–2026

Table 35: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast, by End-user, 2016–2026

List of Figures

Figure 01: Global Blood Group Typing Market Size (US$ Mn) Forecast, 2016–2026

Figure 02: Global Blood Group Typing Market Value Share, by Product (2017)

Figure 03: Global Blood Group Typing Market Value Share, by Technique (2017)

Figure 04: Global Blood Group Typing Market Value Share, by Test (2017)

Figure 05: Global Blood Group Typing Market Value Share, by End-user (2017)

Figure 06: Global Blood Group Typing Market Value Share Analysis, by Product, 2017 and 2026

Figure 07: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Instrument, 2016–2026

Figure 08: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Consumables, 2016–2026

Figure 09: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Services, 2016–2026

Figure 10: Global Blood Group Typing Market Attractiveness Analysis, by Product, 2016–2026

Figure 11: Global Blood Group Typing Market Value Share Analysis, by Technique, 2017 and 2026

Figure 12: Global Blood Group Typing Market Size (US$ Mn), by PCR-based, 2016–2026

Figure 13: Global Blood Group Typing Market Size (US$ Mn), by Microarray-based, 2016–2026

Figure 14: Global Blood Group Typing Market Size (US$ Mn), by Assay-based Technique, 2016–2026

Figure 15: Global Blood Group Typing Market Size (US$ Mn), by Others (Stretch Marks), 2016–2026

Figure 16: Global Blood Group Typing Market Attractiveness Analysis, by Technique, 2018–2026

Figure 17: Global Blood Group Typing Market Value Share Analysis, by Test, 2017 and 2026

Figure 18: Global Blood Group Typing Market Size (US$ Mn), by Antibody Screening, 2016–2026

Figure 19: Global Blood Group Typing Market Size (US$ Mn), by HLA Typing, 2016–2026

Figure 20: Global Blood Group Typing Market Size (US$ Mn), by ABO Blood Test, 2016–2026

Figure 21: Global Blood Group Typing Market Size (US$ Mn), by Cross Matching Test, 2016–2026

Figure 22: Global Blood Group Typing Market Size (US$ Mn), by Antigen Typing, 2016–2026

Figure 23: Global Blood Group Typing Market Attractiveness Analysis, by Test, 2018–2026

Figure 24: Global Blood Group Typing Market Value Share Analysis, by End-user, 2017 and 2026

Figure 25: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Hospitals, 2016–2026

Figure 26: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Clinical Laboratories, 2016–2026

Figure 27: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Blood Bank, 2016–2026

Figure 28: Global Blood Group Typing Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2016–2026

Figure 29: Global Blood Group Typing Market Attractiveness Analysis, by End-user, 2016–2026

Figure 30: Global Blood Group Typing Market Value Share, by Region, 2017 and 2026

Figure 31: Global Blood Group Typing Market Attractiveness, by Region, 2018–2026

Figure 32: North America Blood Group Typing Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 33: North America Blood Group Typing Market Attractiveness, by Country, 2018–2026

Figure 34: North America Blood Group Typing Market Value Share, by Country, 2017 and 2026

Figure 35: North America Blood Group Typing Market Value Share, by Product, 2017 and 2026

Figure 36: North America Blood Group Typing Market Value Share, by Technique, 2017 and 2026

Figure 37: North America Blood Group Typing Market Value Share, by Test, 2017 and 2026

Figure 38: North America Blood Group Typing Market Value Share, by End-user, 2017 and 2026

Figure 39: North America Blood Group Typing Market Attractiveness, by Product, 2018–2026

Figure 40: North America Blood Group Typing Market Attractiveness, by Technique, 2018–2026

Figure 41: North America Blood Group Typing Market Attractiveness, by Test, 2018–2026

Figure 42: North America Blood Group Typing Market Attractiveness, by End-user, 2018–2026

Figure 43: Europe Blood Group Typing Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 44: Europe Blood Group Typing Market Attractiveness, by Country, 2018–2026

Figure 45: Europe Blood Group Typing Market Value Share, by Country, 2017 and 2026

Figure 46: Europe Blood Group Typing Market Value Share, by Product, 2017 and 2026

Figure 47: Europe Blood Group Typing Market Value Share, by Technique, 2017 and 2026

Figure 48: Europe Blood Group Typing Market Value Share, by Test, 2017 and 2026

Figure 49: Europe Blood Group Typing Market Value Share, by End-user, 2017 and 2026

Figure 50: Europe Blood Group Typing Market Attractiveness, by Product, 2018–2026

Figure 51: Europe Blood Group Typing Market Attractiveness, by Technique, 2018–2026

Figure 52: Europe Blood Group Typing Market Attractiveness, by Test, 2018–2026

Figure 53: Europe Blood Group Typing Market Attractiveness, by End-user, 2018–2026

Figure 54: Latin America Blood Group Typing Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 55: Latin America Blood Group Typing Market Attractiveness, by Country, 2018–2026

Figure 56: Latin America Blood Group Typing Market Value Share, by Country, 2017 and 2026

Figure 57: Latin America Blood Group Typing Market Value Share, by Product, 2017 and 2026

Figure 58: Latin America Blood Group Typing Market Value Share, by Technique, 2017 and 2026

Figure 59: Latin America Blood Group Typing Market Value Share, by Test, 2017 and 2026

Figure 60: Latin America Blood Group Typing Market Value Share, by End-user, 2017 and 2026

Figure 61: Latin America Blood Group Typing Market Attractiveness, by Product, 2018–2026

Figure 62: Latin America Blood Group Typing Market Attractiveness, by Technique, 2018–2026

Figure 63: Latin America Blood Group Typing Market Attractiveness, by Test, 2018–2026

Figure 64: Latin America Blood Group Typing Market Attractiveness, by End-user, 2018–2026

Figure 65: Middle East & Africa Blood Group Typing Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 66: Middle East & Africa Blood Group Typing Market Attractiveness, by Country, 2018–2026

Figure 67: Middle East & Africa Blood Group Typing Market Value Share, by Country, 2017 and 2026

Figure 68: Middle East & Africa Blood Group Typing Market Value Share, by Product Type, 2017 and 2026

Figure 69: Middle East & Africa Blood Group Typing Market Value Share, by Technique, 2017 and 2026

Figure 70: Middle East & Africa Blood Group Typing Market Value Share, by Test, 2017 and 2026

Figure 71: Middle East & Africa Blood Group Typing Market Value Share, by End-user, 2017 and 2026

Figure 72: Middle East & Africa Blood Group Typing Market Attractiveness, by Product, 2018–2026

Figure 73: Middle East & Africa Blood Group Typing Market Attractiveness, by Technique, 2018–2026

Figure 74: Middle East & Africa Blood Group Typing Market Attractiveness, by Test, 2018–2026

Figure 75: Middle East & Africa Blood Group Typing Market Attractiveness, by End-user, 2018–2026

Figure 76: Global Blood Group Typing Market Share (%), by Company, 2017 (Estimated)