The global population is increasingly becoming health-conscious and this has fueled the growth of the biotech flavor market since there has been a change in preferences from artificial flavors to natural flavors. Another factor benefiting the growth of the biotech flavor market is the increasing awareness about the advantages of the biotech flavors. The increasing health-conscious population has also caused a surge in demand for nutritional dairy items such as milkshake-style flavored milk, as well.

The biotech process primarily comprises microbial fermentation, bio-conversion, tissue culture, and plant tissue which helps in transforming fruit and vegetable ingredients to required flavors without having an impact on the nutritional aspect. The lack of nutritional value of artificially produced flavors has played an important role for customers to opt for biotech flavors.

The manufacturers in the biotech flavor market are developing fruity flavors and fragrances that are relatively less harvest dependent. Alternative methods to harvest-dependent processes are assisting market players to escape from the price and supply fluctuations of raw materials as well as agricultural disasters such as droughts and crop diseases. For example, manufacturers have developed valencene, an artificial substance which has taste and aroma similar to an orange. Manufacturers can work to develop similar products with grapefruit and bergamot, as well.

Customers nowadays are becoming aware about the nutritional aspects of fruits and vegetables. Increasing cases of obesity all around the world has been a crucial factor in the public moving away from consuming junk food and prefer biotech flavors, instead. It has helped in increasing biotech flavor sales.

The global biotech flavor market has gained substantial impetus because of rising awareness among customers, especially in developed countries due to the harmful effects caused by artificially-produced food flavors on the health of human beings.

Flavored milk is rising in popularity among consumers. Dairy and plant-based producers are emphasizing on producing thickened milk products that contain biotech flavors. Manufacturers in the biotech flavor market are also looking to use artificial intelligence (AI) and machine learning to develop new flavors.

The chemical properties of biotech flavors are being used to decide the right combination of edible ingredients required in several food and beverage products.

AI-based technology and analysis utilizes sensory sciences and aroma profiles of ingredients assist to develop the right combination in consumable food and beverages.

As a result, AI is playing an important role in discovering novel biotech flavors and assess the market value of the flavors to perform well among competitors. AI also assists in decoding data regarding customer preferences courtesy social media posts and reviews.

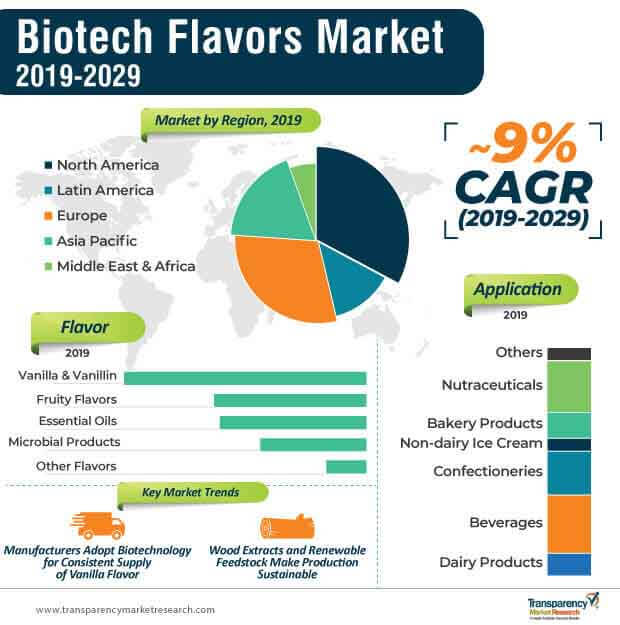

The biotech flavor market worldwide is anticipated to grow at a compound annual growth rate of approximately 9% during the forecast period 2019-2029. The expected valuation for the biotech flavor market is likely to be close to US$ 3 Bn by the end of the forecast period.

The food and beverages industry has always found it difficult to manufacture products that are both good to taste as well as have health and environmental benefits. Hence, biotech flavors are emerging as a solution to improve the flavor in food items without causing harm to the health and environment.

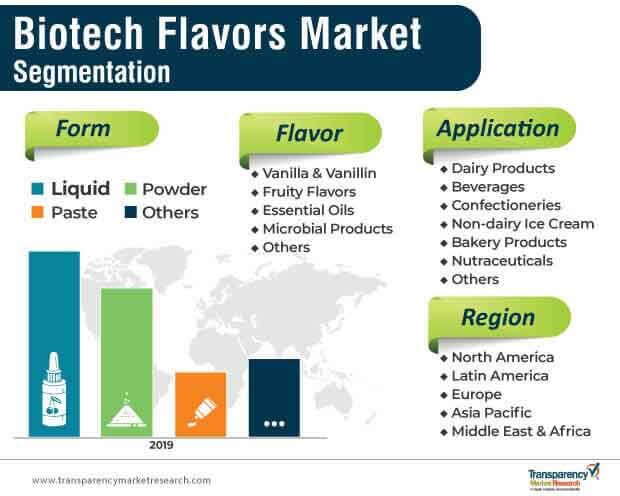

The global biotech flavor market has several types of flavors such as vanilla and vanillin, essential oil, microbial products, fruity, and others. Among them, fruity as well as vanilla and vanillin have been identified as the flavors in most demand. It is estimated that the demand for fruity flavor will increase because of the large demand for processed food and beverages worldwide.

The demand for biotech flavors primarily witnesses demand from bakery products, nutraceuticals, dairy products, non-dairy ice creams, confectionaries, and beverages. Among them, it has been observed that biotech flavors have been used in beverages and the rise in demand for flavored beverages has propelled the biotech flavor market.

The global biotech flavor market has been divided into five regions: Asia Pacific, Europe, Latin America, North America, and Middle East and Africa. North America has held a major share in the global biotech flavor market due to the high awareness among the public in this region, about the benefits of biotech flavors.

As a result, this region is anticipated to dominate the biotech flavor market in future as well. Europe is second to North America in terms of accounting for the shares in the biotech flavor market.

Asia Pacific is expected to witness an increase in demand for biotech flavors in future, specifically in countries such as India and China, The surge in demand is likely to propel the biotech flavor market in this region.

Analysts believe that the biotech flavor market is estimated to grow at an exponential rate during the forecast period. Manufacturers are producing biotech flavor by fermenting stevia, which is a sweetener used in food and bakery products. They are also formulating biological methodologies to extract natural compounds which can be used as sweeteners from sugarcane and sugar beet.

Analysts also felt that biotech flavor market players should emphasize on developing effective chemical methods which help in decreasing the prices of end-use products that are usually high owing to the instability of raw materials and production variations.

The global biotech flavor market faces its own set of challenges too. One of them is the instability in ingredient supply owing to fluctuating seasonal conditions. Varying weather conditions can cause changes to prices, production, and quality of raw materials.

The other challenge for manufacturers in the biotech flavor market is the environmental damage that could be caused. As a result, manufacturers have started to adopt sustainable measures for biotech flavors production using wood extract and renewable feedstock.

Biotech Flavors Market is expected to reach US$ 3 Bn By 2029

Biotech Flavors Market is estimated to rise at a CAGR of 9% during forecast period

Increasing awareness about the advantages of the biotech flavors benefiting the growth of the biotech flavor market

North America is more attractive region for vendors in the Biotech Flavors Market

Some of the main players in the biotech flavors market include Givaudan, Sensient Technologies Corporation, Bell Flavors and Fragrances, Symrise AG, International Flavors & Fragrances, Inc., Takasago International Corporation, Frutarom Industries Ltd., Naturex group, Firmenich S.A., and Kerry Group Plc

1. Global Biotech Flavors Market - Executive Summary

1.1. Global Biotech Flavors Market Country Analysis

1.2. Application – Product Mapping

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Feed Products Across Globe

3.1.2. Business Environment Outlook

3.1.3. Regional Production Vs. Consumption Outlook

3.1.4. Feed Industry Growth

3.1.5. Global GDP Growth Outlook

3.1.6. Commodity Prices and Inflation

3.1.7. Global Trade Scenario

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.3.1. Rising Cost For Crop Protection

3.3.2. Lack Of Regulatory Harmonization

3.3.3. Adulteration of Feed Products

3.4. Market Trends

3.4.1. Increasing Awareness for Biotech Flavors

3.4.2. Technology Advancements

3.4.3. Adoption of RFID technology

3.5. Trend Analysis- Impact on Time Line (2019-2029)

3.6. Forecast Factors – Relevance and Impact

4. Supply Chain Analysis

4.1. Profitability and Gross Margin Analysis By Competition

4.2. List of Active Participants- By Region

4.2.1. Raw Material Suppliers

4.2.2. Key Manufacturers

4.2.3. Key Distributor/Retailers

4.2.4. Operating Margins

5. Global Biotech Flavors Market Pricing Analysis

5.1. Price Point Assessment by Flavor

5.2. Regional Average Pricing Analysis

5.2.1. North America

5.2.2. Latin America

5.2.3. Europe

5.2.4. Asia Pacific

5.2.5. Middle East and Africa

5.3. Price Forecast till 2029

5.4. Factors Influencing Pricing

6. Global Biotech Flavors Market Analysis and Forecast

6.1. Market Size Analysis (2014-2018) and Forecast (2019-2029)

6.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

6.1.2. Absolute $ Opportunity

7. Global Biotech Flavors Market Analysis By Flavor

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison By Flavor

7.1.2. Basis Point Share (BPS) Analysis By Flavor

7.2. Biotech Flavors Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Flavor

7.2.1. Liquid Extract

7.2.2. Vanilla & Vanillin

7.2.3. Fruity Flavors

7.2.4. Essential Oils

7.2.5. Microbial Products

7.3. Market Attractiveness Analysis By Flavor

8. Global Biotech Flavors Market Analysis By Form

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Form

8.1.2. Basis Point Share (BPS) Analysis By Form

8.2. Biotech Flavors Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Form

8.2.1. Liquid

8.2.2. Powder

8.2.3. Paste

8.2.4. Others

8.3. Market Attractiveness Analysis By Form

9. Global Biotech Flavors Market Analysis By Application

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Application

9.1.2. Basis Point Share (BPS) Analysis By Application

9.2. Biotech Flavors Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Application

9.2.1. Dairy Products

9.2.2. Beverages

9.2.3. Confectionery

9.2.4. Non Dairy Ice-cream

9.2.5. Bakery Products

9.2.6. Nutraceuticals

9.2.7. Others

10. Global Biotech Flavors Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Biotech Flavors Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2029) Analysis By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East and Africa

10.3. Market Attractiveness Analysis By Region

11. North America Biotech Flavors Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. Biotech Flavors Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2029)

11.2.1. Market Attractiveness By Country

11.2.1.1. U.S.

11.2.1.2. Canada

11.2.2. By Flavor

11.2.3. By Form

11.2.4. By Application

11.3. Market Attractiveness Analysis

11.3.1. By Country

11.3.2. By Flavor

11.3.3. By Form

11.3.4. By Application

12. Latin America Biotech Flavors Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.1.3. Key Regulations

12.2. Biotech Flavors Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2029)

12.2.1. By Country

12.2.1.1. Brazil

12.2.1.2. Mexico

12.2.1.3. Argentina

12.2.1.4. Rest of Latin America

12.2.2. By Flavor

12.2.3. By Form

12.2.4. By Application

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Flavor

12.3.3. By Form

12.3.4. By Application

13. Europe Biotech Flavors Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.1.3. Key Regulations

13.2. Biotech Flavors Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2029)

13.2.1. By Country

13.2.1.1. Germany

13.2.1.2. U.K.

13.2.1.3. France

13.2.1.4. Spain

13.2.1.5. Italy

13.2.1.6. NORDIC

13.2.1.7. BENELUX

13.2.1.8. Russia

13.2.1.9. Poland

13.2.1.10. Rest of Europe

13.2.2. By Flavor

13.2.3. By Form

13.2.4. By Application

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Flavor

13.3.3. By Form

13.3.4. By Application

14. Asia Pacific Biotech Flavors Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Biotech Flavors Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2029)

14.2.1. By Country

14.2.1.1. China

14.2.1.2. India

14.2.1.3. Japan

14.2.1.4. Australia & New Zealand

14.2.1.5. Rest of APAC

14.2.2. By Flavor

14.2.3. By Form

14.2.4. By Application

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Flavor

14.3.3. By Form

14.3.4. By Application

15. Middle East and Africa (MEA) Biotech Flavors Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Biotech Flavors Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2029)

15.2.1. By Country

15.2.1.1. GCC Countries

15.2.1.2. South Africa

15.2.1.3. North Africa

15.2.1.4. Rest of MEA

15.2.2. By Flavor

15.2.3. By Form

15.2.4. By Application

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Flavor

15.3.3. By Form

15.3.4. By Application

16. Competition Assessment

16.1. Global Biotech Flavors Market Competition - a Dashboard View

16.2. Global Biotech Flavors Market Structure Analysis

16.3. Global Biotech Flavors Market Company Share Analysis

16.3.1. For Tier 1 Market Players, 2017

16.3.2. Company Market Share Analysis of Top 10 Players, By Region

16.4. Key Participants Market Presence (Intensity Mapping) by Region

17. Brand Assessment

17.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

17.2. Biotech Flavors Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

17.3. Brand Strategy

18. Competition Deep-dive (Manufacturers/Suppliers)

18.1. Givaudan S.A.

18.1.1. Overview

18.1.2. Product Portfolio

18.1.3. Sales Footprint

18.1.4. Channel Footprint

18.1.4.1. Distributors List

18.1.4.2. Sales Channel (Clients)

18.1.5. Strategy Overview

18.1.5.1. Marketing Strategy

18.1.5.2. Culture Strategy

18.1.5.3. Channel Strategy

18.1.6. SWOT Analysis

18.1.7. Financial Analysis

18.1.8. Revenue Share

18.1.8.1. By Flavor

18.1.8.2. By Region

18.1.9. Key Clients

18.1.10. Analyst Comments

18.2. International Flavors & Fragrances Inc.

18.2.1. Overview

18.2.2. Product Portfolio

18.2.3. Sales Footprint

18.2.4. Channel Footprint

18.2.4.1. Distributors List

18.2.4.2. Sales Channel (Clients)

18.2.5. Strategy Overview

18.2.5.1. Marketing Strategy

18.2.5.2. Culture Strategy

18.2.5.3. Channel Strategy

18.2.6. SWOT Analysis

18.2.7. Financial Analysis

18.2.8. Revenue Share

18.2.8.1. By Flavor

18.2.8.2. By Region

18.2.9. Key Clients

18.2.10. Analyst Comments

18.3. Firmenich SA

18.3.1. Overview

18.3.2. Product Portfolio

18.3.3. Sales Footprint

18.3.4. Channel Footprint

18.3.4.1. Distributors List

18.3.4.2. Sales Channel (Clients)

18.3.5. Strategy Overview

18.3.5.1. Marketing Strategy

18.3.5.2. Culture Strategy

18.3.5.3. Channel Strategy

18.3.6. SWOT Analysis

18.3.7. Financial Analysis

18.3.8. Revenue Share

18.3.8.1. By Flavor

18.3.8.2. By Region

18.3.9. Key Clients

18.3.10. Analyst Comments

18.4. Symrise AG

18.4.1. Overview

18.4.2. Product Portfolio

18.4.3. Sales Footprint

18.4.4. Channel Footprint

18.4.4.1. Distributors List

18.4.4.2. Sales Channel (Clients)

18.4.5. Strategy Overview

18.4.5.1. Marketing Strategy

18.4.5.2. Culture Strategy

18.4.5.3. Channel Strategy

18.4.6. SWOT Analysis

18.4.7. Financial Analysis

18.4.8. Revenue Share

18.4.8.1. By Flavor

18.4.8.2. By Region

18.4.9. Key Clients

18.4.10. Analyst Comments

18.5. Takasago International Corporation

18.5.1. Overview

18.5.2. Product Portfolio

18.5.3. Sales Footprint

18.5.4. Channel Footprint

18.5.4.1. Distributors List

18.5.4.2. Sales Channel (Clients)

18.5.5. Strategy Overview

18.5.5.1. Marketing Strategy

18.5.5.2. Culture Strategy

18.5.5.3. Channel Strategy

18.5.6. SWOT Analysis

18.5.7. Financial Analysis

18.5.8. Revenue Share

18.5.8.1. By Flavor

18.5.8.2. By Region

18.5.9. Key Clients

18.5.10. Analyst Comments

18.6. Sensient Technologies Corporation

18.6.1. Overview

18.6.2. Product Portfolio

18.6.3. Sales Footprint

18.6.4. Channel Footprint

18.6.4.1. Distributors List

18.6.4.2. Sales Channel (Clients)

18.6.5. Strategy Overview

18.6.5.1. Marketing Strategy

18.6.5.2. Culture Strategy

18.6.5.3. Channel Strategy

18.6.6. SWOT Analysis

18.6.7. Financial Analysis

18.6.8. Revenue Share

18.6.8.1. By Flavor

18.6.8.2. By Region

18.6.9. Key Clients

18.6.10. Analyst Comments

18.7. Frutarom Industries Ltd.

18.7.1. Overview

18.7.2. Product Portfolio

18.7.3. Sales Footprint

18.7.4. Channel Footprint

18.7.4.1. Distributors List

18.7.4.2. Sales Channel (Clients)

18.7.5. Strategy Overview

18.7.5.1. Marketing Strategy

18.7.5.2. Culture Strategy

18.7.5.3. Channel Strategy

18.7.6. SWOT Analysis

18.7.7. Financial Analysis

18.7.8. Revenue Share

18.7.8.1. By Flavor

18.7.8.2. By Region

18.7.9. Key Clients

18.7.10. Analyst Comments

18.8. Bell Flavors and Fragrances

18.8.1. Overview

18.8.2. Product Portfolio

18.8.3. Sales Footprint

18.8.4. Channel Footprint

18.8.4.1. Distributors List

18.8.4.2. Sales Channel (Clients)

18.8.5. Strategy Overview

18.8.5.1. Marketing Strategy

18.8.5.2. Culture Strategy

18.8.5.3. Channel Strategy

18.8.6. SWOT Analysis

18.8.7. Financial Analysis

18.8.8. Revenue Share

18.8.8.1. By Flavor

18.8.8.2. By Region

18.8.9. Key Clients

18.8.10. Analyst Comments

18.9. Naturex

18.9.1. Overview

18.9.2. Product Portfolio

18.9.3. Sales Footprint

18.9.4. Channel Footprint

18.9.4.1. Distributors List

18.9.4.2. Sales Channel (Clients)

18.9.5. Strategy Overview

18.9.5.1. Marketing Strategy

18.9.5.2. Culture Strategy

18.9.5.3. Channel Strategy

18.9.6. SWOT Analysis

18.9.7. Financial Analysis

18.9.8. Revenue Share

18.9.8.1. By Flavor

18.9.8.2. By Region

18.9.9. Key Clients

18.9.10. Analyst Comments

18.10. Others (On Request)

18.10.1. Overview

18.10.2. Product Portfolio

18.10.3. Sales Footprint

18.10.4. Channel Footprint

18.10.4.1. Distributors List

18.10.4.2. Sales Channel (Clients)

18.10.5. Strategy Overview

18.10.5.1. Marketing Strategy

18.10.5.2. Culture Strategy

18.10.5.3. Channel Strategy

18.10.6. SWOT Analysis

18.10.7. Financial Analysis

18.10.8. Revenue Share

18.10.8.1. By Flavor

18.10.8.2. By Region

18.10.9. Key Clients

18.10.10. Analyst Comments

19. Recommendation- Critical Success Factors

20. Research Methodology

21. Assumptions & Acronyms Used

List of Tables

Table 1: Global Biotech Flavors Market Value (US$ Mn) Forecast By Form

Table 2: Global Biotech Flavors Market Volume (Tons) Forecast By Form

Table 3: Global Biotech Flavors Market Value (US$ Mn) Forecast By Flavor

Table 4: Global Biotech Flavors Market Volume (Tons) Forecast By Flavor

Table 5: Global Biotech Flavors Market Value (US$ Mn) Forecast By Application

Table 6: Global Biotech Flavors Market Volume (Tons) Forecast By Application

Table 7: Global Biotech Flavors Market Value (US$ Mn) Forecast By Region

Table 8: Global Biotech Flavors Market Volume (Tons) Forecast By Region

Table 9: North America Biotech Flavors Market Value (US$ Mn) Forecast By Form

Table 10: North America Biotech Flavors Market Volume (Tons) Forecast By Form

Table 11: North America Biotech Flavors Market Value (US$ Mn) Forecast By Flavor

Table 12: North America Biotech Flavors Market Volume (Tons) Forecast By Flavor

Table 13: North America Biotech Flavors Market Value (US$ Mn) Forecast By Application

Table 14: North America Biotech Flavors Market Volume (Tons) Forecast By Application

Table 15: North America Biotech Flavors Market Value (US$ Mn) Forecast By Country

Table 16: North America Biotech Flavors Market Volume (Tons) Forecast By Country

Table 17: Latin America Biotech Flavors Market Value (US$ Mn) Forecast By Form

Table 18: Latin America Biotech Flavors Market Volume (Tons) Forecast By Form

Table 19: Latin America Biotech Flavors Market Value (US$ Mn) Forecast By Flavor

Table 20: Latin America Biotech Flavors Market Volume (Tons) Forecast By Flavor

Table 21: Latin America Biotech Flavors Market Value (US$ Mn) Forecast By Application

Table 22: Latin America Biotech Flavors Market Volume (Tons) Forecast By Application

Table 23: Latin America Biotech Flavors Market Value (US$ Mn) Forecast By Country

Table 24: Latin America Biotech Flavors Market Volume (Tons) Forecast By Country

Table 25: Europe Biotech Flavors Market Value (US$ Mn) Forecast By Form

Table 26: Europe Biotech Flavors Market Volume (Tons) Forecast By Form

Table 27: Europe Biotech Flavors Market Value (US$ Mn) Forecast By Flavor

Table 28: Europe Biotech Flavors Market Volume (Tons) Forecast By Flavor

Table 29: Europe Biotech Flavors Market Value (US$ Mn) Forecast By Application

Table 30: Europe Biotech Flavors Market Volume (Tons) Forecast By Application

Table 31: Europe Biotech Flavors Market Value (US$ Mn) Forecast By Country

Table 32: Europe Biotech Flavors Market Volume (Tons) Forecast By Country

Table 33: Asia Pacific Biotech Flavors Market Value (US$ Mn) Forecast By Form

Table 34: Asia Pacific Biotech Flavors Market Volume (Tons) Forecast By Form

Table 35: Asia Pacific Biotech Flavors Market Value (US$ Mn) Forecast By Flavor

Table 36: Asia Pacific Biotech Flavors Market Volume (Tons) Forecast By Flavor

Table 37: Asia Pacific Biotech Flavors Market Value (US$ Mn) Forecast By Application

Table 38: Asia Pacific Biotech Flavors Market Volume (Tons) Forecast By Application

Table 39: Asia Pacific Biotech Flavors Market Value (US$ Mn) Forecast By Country

Table 40: Asia Pacific Biotech Flavors Market Volume (Tons) Forecast By Country

Table 41: Middle East & Africa Biotech Flavors Market Value (US$ Mn) Forecast By Form

Table 42: Middle East & Africa Biotech Flavors Market Volume (Tons) Forecast By Form

Table 43: Middle East & Africa Biotech Flavors Market Value (US$ Mn) Forecast By Flavor

Table 44: Middle East & Africa Biotech Flavors Market Volume (Tons) Forecast By Flavor

Table 45: Middle East & Africa Biotech Flavors Market Value (US$ Mn) Forecast By Application

Table 46: Middle East & Africa Biotech Flavors Market Volume (Tons) Forecast By Application

Table 47: Middle East & Africa Biotech Flavors Market Value (US$ Mn) Forecast By Country

Table 48: Middle East & Africa Biotech Flavors Market Volume (Tons) Forecast By Country

List of Figure

Figure 1: Global Biotech Flavors Market Y-o-Y Growth by Form, 2019-2029

Figure 2: Global Biotech Flavors Market Value Share and BPS Analysis, by Form, 2016 & 2024

Figure 3: Global Biotech Flavors Market Value (US$ Mn) & Volume (Tons), by Liquid Segment, 2018-2029

Figure 4: Global Biotech Flavors Market Absolute $ Opportunity, by Liquid Segment, 2019-2029

Figure 5: Global Biotech Flavors Market Value (US$ Mn) & Volume (Tons), by Powder Segment, 2018-2029

Figure 6: Global Biotech Flavors Market Absolute $ Opportunity, by Powder Segment, 2019-2029

Figure 7: Global Biotech Flavors Market Value (US$ Mn) & Volume (Tons), by Paste Segment, 2018-2029

Figure 8: Global Biotech Flavors Market Absolute $ Opportunity, by Paste Segment, 2019-2029

Figure 9: Global Biotech Flavors Market Attractiveness Analysis by Form, 2019-2029

Figure 10: Global Biotech Flavors Market Y-o-Y Growth by Flavor, 2019-2029

Figure 11: Global Biotech Flavors Market Value Share and BPS Analysis, by Flavor, 2016 & 2024

Figure 12: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Vanilla & Vanillin Segment, 2018-2029

Figure 13: Global Biotech Flavors Market Absolute $ Opportunity, by Vanilla & Vanillin Segment, 2019-2029

Figure 14: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Fruity Flavor Segment, 2018-2029

Figure 15: Global Biotech Flavors Market Absolute $ Opportunity, by Fruity Flavor Segment, 2019-2029

Figure 16: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Other Flavors Segment, 2018-2029

Figure 17: Global Biotech Flavors Market Absolute $ Opportunity, by Other Flavors Segment, 2019-2029

Figure 18: Global Biotech Flavors Market Attractiveness Analysis By Flavors, 2019-2029

Figure 19: Global Biotech Flavors Market Y-o-Y Growth by Application, 2019-2029

Figure 20: Global Biotech Flavors Market Value Share and BPS Analysis, by Application, 2016 & 2024

Figure 21: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Dairy Products Segment, 2018-2029

Figure 22: Global Biotech Flavors Market Absolute $ Opportunity, by Dairy Products Segment, 2019-2029

Figure 23: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Beverages Segment, 2018-2029

Figure 24: Global Biotech Flavors Market Absolute $ Opportunity, by Beverages Segment, 2019-2029

Figure 25: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Confectionery Products Segment, 2018-2029

Figure 26: Global Biotech Flavors Market Absolute $ Opportunity, by Confectionery Products Segment, 2019-2029

Figure 27: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Non-dairy Ice Cream Segment, 2018-2029

Figure 28: Global Biotech Flavors Market Absolute $ Opportunity, by Non-dairy Ice Cream Segment, 2019-2029

Figure 29: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Bakery Products Segment, 2018-2029

Figure 30: Global Biotech Flavors Market Absolute $ Opportunity, by Bakery Products Segment, 2019-2029

Figure 31: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Nutraceuticals Segment, 2018-2029

Figure 32: Global Biotech Flavors Market Absolute $ Opportunity, by Nutraceuticals Segment, 2019-2029

Figure 33: Global Biotech Flavors Market Value (US$ Mn) and Volume (Tons), by Others Segment, 2018-2029

Figure 34: Global Biotech Flavors Market Absolute $ Opportunity, by Others Segment, 2019-2029

Figure 35: Global Biotech Flavors Market Attractiveness Analysis By Application, 2019-2029

Figure 36: Global Biotech Flavors Market Y-o-Y Growth, by Region, 2019-2029

Figure 37: Global Biotech Flavors Market Value Share and BPS Analysis, by Region, 2016 & 2024

Figure 38: Global Biotech Flavors Market Attractiveness Analysis By Region, 2019-2029

Figure 39: North America Biotech Flavors Market Value (US$ Mn) and Volume (Tons), 2018-2029

Figure 40: North America Biotech Flavors Market Absolute $ Opportunity, 2019-2029

Figure 41: North America Biotech Flavors Market Y-o-Y Growth, by Country, 2018-2029

Figure 42: North America Biotech Flavors Market Value Share and BPS Analysis, by Country, 2016 & 2024

Figure 43: North America Biotech Flavors Market Attractiveness Analysis By Country, 2019-2029

Figure 44: North America Biotech Flavors Market Y-o-Y Growth By Form, 2019-2029

Figure 45: North America Biotech Flavors Market Value Share and BPS Analysis, by Form, 2016 & 2024

Figure 46: North America Biotech Flavors Market Absolute $ Opportunity, by Liquid Segment, 2018-2029

Figure 47: North America Biotech Flavors Market Absolute $ Opportunity, by Powder Segment, 2018-2029

Figure 48: North America Biotech Flavors Market Absolute $ Opportunity, by Paste Segment, 2018-2029

Figure 49: North America Biotech Flavors Market Attractiveness Analysis, by Form, 2019-2029

Figure 50: North America Biotech Flavors Market Y-o-Y Growth By Flavor, 2019-2029

Figure 51: North America Biotech Flavors Market Value Share and BPS Analysis, by Flavor, 2016 & 2024

Figure 52: North America Biotech Flavors Market Absolute $ Opportunity, by Vanilla & Vanillin Segment, 2018-2029

Figure 53: North America Biotech Flavors Market Absolute $ Opportunity, by Fruity Flavor Segment, 2018-2029

Figure 54: North America Biotech Flavors Market Absolute $ Opportunity, by Other Flavors Segment, 2018-2029

Figure 55: North America Biotech Flavors Market Attractiveness Analysis, by Flavor, 2019-2029

Figure 56: North America Biotech Flavors Market Y-o-Y Growth by Application, 2019-2029

Figure 57: North America Biotech Flavors Market Value Share and BPS Analysis, by Application, 2016 & 2024

Figure 58: North America Biotech Flavors Market Absolute $ Opportunity, by Dairy Products Segment, 2018-2029

Figure 59: North America Biotech Flavors Market Absolute $ Opportunity, by Beverages Segment, 2018-2029

Figure 60: North America Biotech Flavors Market Absolute $ Opportunity, by Confectionery Products Segment, 2018-2029

Figure 61: North America Biotech Flavors Market Absolute $ Opportunity, by Non Dairy Ice Cream Segment, 2018-2029

Figure 62: North America Biotech Flavors Market Absolute $ Opportunity, by Bakery Products Segment, 2018-2029

Figure 63: North America Biotech Flavors Market Absolute $ Opportunity, by Nutraceuticals Segment, 2018-2029

Figure 64: North America Biotech Flavors Market Absolute $ Opportunity, by Others Flavors Segment, 2018-2029

Figure 65: North America Biotech Flavors Market Attractiveness Analysis By Application, 2019-2029

Figure 66: Latin America Biotech Flavors Market Value (US$ Mn) and Volume (Tons), 2018-2029

Figure 67: Latin America Biotech Flavors Market Absolute $ Opportunity, 2019-2029

Figure 68: Latin America Biotech Flavors Market Y-o-Y Growth, by Country, 2018-2029

Figure 69: Latin America Biotech Flavors Market Value Share and BPS Analysis, by Country, 2016 & 2024

Figure 70: Latin America Biotech Flavors Market Attractiveness Analysis By Country, 2019-2029

Figure 71: Latin America Biotech Flavors Market Y-o-Y Growth By Form, 2019-2029

Figure 72: Latin America Biotech Flavors Market Value Share and BPS Analysis, by Form, 2016 & 2024

Figure 73: Latin America Biotech Flavors Market Absolute $ Opportunity, by Liquid Segment, 2018-2029

Figure 74: Latin America Biotech Flavors Market Absolute $ Opportunity, by Powder Segment, 2018-2029

Figure 75: Latin America Biotech Flavors Market Absolute $ Opportunity, by Paste Segment, 2018-2029

Figure 76: Latin America Biotech Flavors Market Attractiveness Analysis, by Form, 2019-2029

Figure 77: Latin America Biotech Flavors Market Y-o-Y Growth By Flavor, 2019-2029

Figure 78: Latin America Biotech Flavors Market Value Share and BPS Analysis, by Flavor, 2016 & 2024

Figure 79: Latin America Biotech Flavors Market Absolute $ Opportunity, by Vanilla & Vanillin Segment, 2018-2029

Figure 80: Latin America Biotech Flavors Market Absolute $ Opportunity, by Fruity Flavor Segment, 2018-2029

Figure 81: Latin America Biotech Flavors Market Absolute $ Opportunity, by Other Flavors Segment, 2018-2029

Figure 82: Latin America Biotech Flavors Market Attractiveness Analysis, by Flavor, 2019-2029

Figure 83: Latin America Biotech Flavors Market Y-o-Y Growth by Application, 2019-2029

Figure 84: Latin America Biotech Flavors Market Value Share and BPS Analysis, by Application, 2016 & 2024

Figure 85: Latin America Biotech Flavors Market Absolute $ Opportunity, by Dairy Products Segment, 2018-2029

Figure 86: Latin America Biotech Flavors Market Absolute $ Opportunity, by Beverages Segment, 2018-2029

Figure 87: Latin America Biotech Flavors Market Absolute $ Opportunity, by Confectionery Products Segment, 2018-2029

Figure 88: Latin America Biotech Flavors Market Absolute $ Opportunity, by Non Dairy Ice-cream Segment, 2018-2029

Figure 89: Latin America Biotech Flavors Market Absolute $ Opportunity, by Bakery Products Segment, 2018-2029

Figure 90: Latin America Biotech Flavors Market Absolute $ Opportunity, by Nutraceuticals Segment, 2018-2029

Figure 91: Latin America Biotech Flavors Market Absolute $ Opportunity, by Others Flavors Segment, 2018-2029

Figure 92: Latin America Biotech Flavors Market Attractiveness Analysis By Application, 2019-2029

Figure 93: Europe Biotech Flavors Market Value (US$ Mn) and Volume (Tons), 2018-2029

Figure 94: Europe Biotech Flavors Market Absolute $ Opportunity, 2019-2029

Figure 95: Europe Biotech Flavors Market Y-o-Y Growth, by Country, 2018-2029

Figure 96: Europe Biotech Flavors Market Value Share and BPS Analysis, by Country, 2016 & 2024

Figure 97: Europe Biotech Flavors Market Attractiveness Analysis By Region, 2019-2029

Figure 98: Europe Biotech Flavors Market Y-o-Y Growth By Form, 2019-2029

Figure 99: Europe Biotech Flavors Market Value Share and BPS Analysis, by Form, 2016 & 2024

Figure 100: Europe Biotech Flavors Market Absolute $ Opportunity, by Liquid Segment, 2018-2029

Figure 101: Europe Biotech Flavors Market Absolute $ Opportunity, by Powder Segment, 2018-2029

Figure 102: Europe Biotech Flavors Market Absolute $ Opportunity, by Paste Segment, 2018-2029

Figure 103: Europe Biotech Flavors Market Attractiveness Analysis, by Form, 2019-2029

Figure 104: Europe Biotech Flavors Market Y-o-Y Growth By Flavor, 2019-2029

Figure 105: Europe Biotech Flavors Market Value Share and BPS Analysis, by Flavor, 2016 & 2024

Figure 106: Europe Biotech Flavors Market Absolute $ Opportunity, by Vanilla & Vanillin Segment, 2018-2029

Figure 107: Europe Biotech Flavors Market Absolute $ Opportunity, by Fruity Flavor Segment, 2018-2029

Figure 108: Europe Biotech Flavors Market Absolute $ Opportunity, by Other flavors Segment, 2018-2029

Figure 109: Europe Biotech Flavors Market Attractiveness Analysis, by Flavor, 2019-2029

Figure 110: Europe Biotech Flavors Market Y-o-Y Growth By Application, 2019-2029

Figure 111: Europe Biotech Flavors Market Value Share and BPS Analysis, by Application, 2016 & 2024

Figure 112: Europe Biotech Flavors Market Absolute $ Opportunity, by Dairy Products Segment, 2018-2029

Figure 113: Europe Biotech Flavors Market Absolute $ Opportunity, by Beverages Segment, 2018-2029

Figure 114: Europe Biotech Flavors Market Absolute $ Opportunity, by Confectionary Products Segment, 2018-2029

Figure 115: Europe Biotech Flavors Market Absolute $ Opportunity, by Non-dairy Ice cream Segment, 2018-2029

Figure 116: Europe Biotech Flavors Market Absolute $ Opportunity, by Bakery Products Segment, 2018-2029

Figure 117: Europe Biotech Flavors Market Absolute $ Opportunity, by Nutraceuticals Segment, 2018-2029

Figure 118: Europe Biotech Flavors Market Absolute $ Opportunity, by Others Segment, 2018-2029

Figure 119: Global Biotech Flavors Market Attractiveness Analysis By Applications, 2019-2029

Figure 120: Asia Pacific Biotech Flavors Market Value (US$ Mn) and Volume (Tons), 2018-2029

Figure 121: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, 2019-2029

Figure 122: Asia Pacific Biotech Flavors Market Y-o-Y Growth, by Country, 2019-2029

Figure 123: Asia Pacific Biotech Flavors Market Value Share and BPS Analysis, by Country, 2015 & 2024

Figure 124: Asia Pacific Biotech Flavors Market Attractiveness Analysis By Country, 2019-2029

Figure 125: Asia Pacific Biotech Flavors Market Y-o-Y Growth By Form, 2019-2029

Figure 126: Asia Pacific Biotech Flavors Market Value Share and BPS Analysis, by Form, 2016 & 2024

Figure 127: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Liquid Segment, 2018-2029

Figure 128: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Powder Segment, 2018-2029

Figure 129: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Paste Segment, 2018-2029

Figure 130: Asia Pacific Biotech Flavors Market Attractiveness Analysis, by Form, 2019-2029

Figure 131: Asia Pacific Biotech Flavors Market Y-o-Y Growth By Flavor, 2019-2029

Figure 132: Asia Pacific Biotech Flavors Market Value Share and BPS Analysis, by Flavor, 2016 & 2024

Figure 133: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Vanilla & Vanillin Segment, 2018-2029

Figure 134: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Fruity Flavor Segment, 2018-2029

Figure 135: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Other Flavors Segment, 2018-2029

Figure 136: Asia Pacific Biotech Flavors Market Attractiveness Analysis, by Flavor, 2019-2029

Figure 137: Asia Pacific Biotech Flavors Market Y-o-Y Growth By Application, 2019-2029

Figure 138: Asia Pacific Biotech Flavors Market Value Share and BPS Analysis, by Application, 2016 & 2024

Figure 139: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Dairy Products Segment, 2018-2029

Figure 140: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Beverages Segment, 2018-2029

Figure 141: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Confectionary Products Segment, 2018-2029

Figure 142: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Non-dairy Ice cream Segment, 2018-2029

Figure 143: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Bakery Products Segment, 2018-2029

Figure 144: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Nutraceuticals Segment, 2018-2029

Figure 145: Asia Pacific Biotech Flavors Market Absolute $ Opportunity, by Others Segment, 2018-2029

Figure 146: Asia Pacific Biotech Flavors Market Attractiveness Analysis By Flavors, 2019-2029

Figure 147: MEA Biotech Flavors Market Value (US$ Mn) and Volume (Tons), 2018-2029

Figure 148: MEA Biotech Flavors Market Absolute $ Opportunity, 2019-2029

Figure 149: MEA Biotech Flavors Market Y-o-Y Growth, by Country, 2018-2029

Figure 150: MEA Biotech Flavors Market Value Share and BPS Analysis, by Country, 2016 & 2024

Figure 151: MEA Biotech Flavors Market Attractiveness Analysis By Region, 2019-2029

Figure 152: MEA Biotech Flavors Market Y-o-Y Growth By Form, 2019-2029

Figure 153: MEA Biotech Flavors Market Value Share and BPS Analysis, by Form, 2016 & 2024

Figure 154: MEA Biotech Flavors Market Absolute $ Opportunity, by Liquid Segment, 2018-2029

Figure 155: MEA Biotech Flavors Market Absolute $ Opportunity, by Powder Segment, 2018-2029

Figure 156: MEA Biotech Flavors Market Absolute $ Opportunity, by Paste Segment, 2018-2029

Figure 157: MEA Biotech Flavors Market Attractiveness Analysis, by Form, 2019-2029

Figure 158: MEA Biotech Flavors Market Y-o-Y Growth By Flavor, 2019-2029

Figure 159: MEA Biotech Flavors Market Value Share and BPS Analysis, by Flavor, 2016 & 2024

Figure 160: MEA Biotech Flavors Market Absolute $ Opportunity, by Vanilla & Vanillin Segment, 2018-2029

Figure 161: MEA Biotech Flavors Market Absolute $ Opportunity, by Fruity Flavor Segment, 2018-2029

Figure 162: MEA Biotech Flavors Market Absolute $ Opportunity, by Other Flavors Segment, 2018-2029

Figure 163: MEA Biotech Flavors Market Attractiveness Analysis, by Flavor, 2019-2029

Figure 164: MEA Biotech Flavors Market Y-o-Y Growth By Application, 2019-2029

Figure 165: MEA Biotech Flavors Market Value Share and BPS Analysis, by Application, 2016 & 2024

Figure 166: MEA Biotech Flavors Market Absolute $ Opportunity, by Dairy Products Segment, 2018-2029

Figure 167: MEA Biotech Flavors Market Absolute $ Opportunity, by Beverages Segment, 2018-2029

Figure 168: MEA Biotech Flavors Market Absolute $ Opportunity, by Confectionary Products Segment, 2018-2029

Figure 169: MEA Biotech Flavors Market Absolute $ Opportunity, by Non-dairy Ice cream Segment, 2018-2029

Figure 170: MEA Biotech Flavors Market Absolute $ Opportunity, by Bakery Products Segment, 2018-2029

Figure 171: MEA Biotech Flavors Market Absolute $ Opportunity, by Nutraceuticals Segment, 2018-2029

Figure 172: MEA Biotech Flavors Market Absolute $ Opportunity, by Others Segment, 2018-2029

Figure 173: MEA Biotech Flavors Market Attractiveness Analysis By Application, 2019-2029