Analysts’ Viewpoint

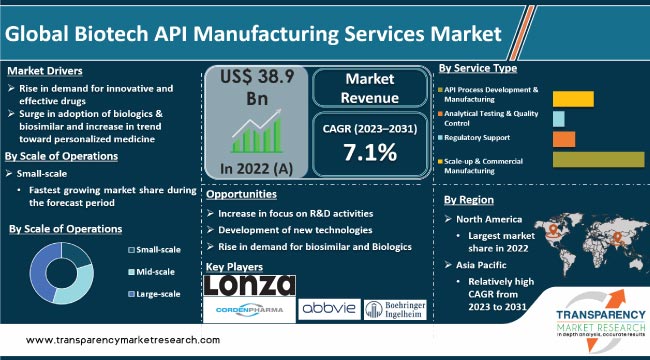

Increase in demand for innovative & effective drugs and rise in prevalence of chronic diseases are driving the global biotech API manufacturing services market. Surge in global geriatric population is another major factor propelling market expansion. Furthermore, increase in adoption of biologics & biosimilar and rise in trend toward personalized medicine are expected to augment the global biotech API manufacturing services market size in the next few years.

Post the COVID-19 pandemic, biotech API manufacturing services companies have witnessed surge in demand for biologics and biosimilars, particularly for the treatment of COVID-19 patients. This has created new opportunities for companies that provide biotech API manufacturing services Manufacturers are focusing on adoption of digital technologies, such as remote monitoring and virtual collaboration, post the COVID-19 pandemic in order to increase market share and presence.

Biotech API manufacturing services refer to production of active pharmaceutical ingredients (APIs) for use in the development of drugs and other pharmaceutical products. APIs are the primary components responsible for the therapeutic effect of a drug, and their manufacturing requires specialized knowledge and facilities.

Biotech API manufacturing services involve the use of biotechnology processes to develop and manufacture APIs, which may be derived from biological sources such as living cells or organisms. These services include design, development, optimization, and scale-up of bioprocesses for the production of APIs and the analytical testing & quality control of the final products. These services are typically provided by contract development and manufacturing organizations (CDMOs) that specialize in biotechnology and pharmaceutical production.

The major biotech API manufacturing services market trends are surge in demand for innovative & effective drugs, especially in the fields of oncology, immunology, and rare diseases. For instance, as per stats published by the Pharma Intelligence Drug Database in 2021, from 2016-2020, the U.S. Food and Drug Administration (FDA) approved more biologic new molecular entities (NMEs) in 2020 than in any other year in the previous decade. At the same time, sponsors increased the outsourcing of these biologics’ active pharmaceutical ingredient (API) manufacturing. This is likely to drive the biotech API manufacturing services industry.

Rise in prevalence of chronic diseases, aging population, and increase in healthcare spending are the other major drivers of the market. Rise in adoption of biologics & biosimilars and increase in trend of personalized medicine are projected to augment the market in the near future.

However, high cost of biotech API manufacturing services and stringent regulations are hampering market progress. Lack of skilled personnel is another factor restraining the market.

Based on future analysis of biotech API manufacturing services, increasing focus on R&D activities, development of new technologies, and growing demand for biosimilars are expected to propel biotech API manufacturing services market demand.

As per data published by the PharmaVentures in 2023, over 4,500 new drugs are being developed by a number of small and emerging biopharma businesses. That comes to 72% of all medications being developed globally, 65% of which are being developed independently from large pharmaceutical corporations.

Over 3,300 clinical trials that began in 2021 were supported by these corporations, which more than doubled from 2016. Moreover, outsourcing of biotech API manufacturing services to CDMOs is expected to provide significant opportunities in the market.

The COVID-19 pandemic had a negative impact on the global market development. The pandemic created both opportunities and challenges for the industry, affecting the demand and supply sides.

On the demand side, the pandemic led to a surge in demand for certain APIs, particularly those used in the production of vaccines, antivirals, and other treatments for COVID-19. This has created opportunities for biotech API manufacturing services providers to expand operations and increase production capacity. However, delays in clinical trials and decline in demand for other products have impacted the market negatively.

On the supply side, the pandemic disrupted global supply chains, leading to shortages of raw materials and other inputs for biotech API manufacturing. This led to delays and reduced production capacity for some biotech API manufacturing services. However, increase in focus on local production of pharmaceuticals has created opportunities for providers to expand their operations in certain regions.

In terms of service type, the API process development & manufacturing segment held the largest global biotech API manufacturing services market share in 2022. The trend is expected to continue during the forecast period. This is ascribed to increase in demand for complex APIs and the need for cost-efficient manufacturing processes.

Development of innovative drugs and personalized medicines has led to increase in demand for complex APIs that require specialized manufacturing processes. Furthermore, the need for cost-efficient manufacturing processes has led to the adoption of advanced technologies and automation in the manufacturing process. These factors are anticipated to propel the API process development & manufacturing segment.

Based on scale of operations, the large-scale segment held significant share of the global market in 2022. Presently, large scale companies are offering broad range of services, which include biologics manufacturing and drug product manufacturing APIs.

According to the Pharma Intelligence Centre Drug Database in 2021, mega and large-cap companies sponsored 52% of biologic FDA NME approvals in 2020. Thus, CMOs can benefit from investing in capabilities and expertise to produce and handle sensitive biologics, as the marketed drug APIs landscape will become increasingly flooded with these in the coming years.

As per biotech API manufacturing services market outlook, North America accounted for significant share of the global industry in 2022. This is ascribed to presence of major pharmaceutical companies in the region, increase in prevalence of chronic diseases, availability of highly skilled workforce, and advanced technological infrastructure.

The region is able to provide high-quality biotech API manufacturing services to support the drug development pipelines of pharmaceutical companies. Hence, the market in North America is expected to continue to grow during the forecast period.

Asia Pacific is likely to witness significant biotech API manufacturing services market expansion during the forecast period. This is ascribed to increase in demand for pharmaceutical products in the region, driven by factors such as population growth, increasing healthcare spending, and rising prevalence of chronic diseases.

The region has a large and growing biotech industry and manufacturing plants, with a focus on research & development, which has created a favorable environment for the growth of the biotech API manufacturing services market.

As per the PharmaVentures 2023, Asia has 45% more primary manufacturing facilities (API, ingredients, excipients etc.) than Europe and North America combined. Furthermore, favorable government policies supporting the growth of the biotech industry have contributed to the expansion of the biotech API manufacturing services in the region.

The biotech API manufacturing services market report concludes with the company profiles section that includes key information about the major players. Companies focus on strategies such as new product launches, mergers, and partnerships & collaborations to compete in the marketplace.

Lonza Group Ltd., WuXi AppTec Co., Ltd., Boehringer Ingelheim Biopharmaceuticals GmbH (Boehringer Ingelheim International GmbH), CordenPharma International, Sterling Pharma Solutions, AbbVie, Inc., Hikal Ltd., Almac Group, FUJIFILM Diosynth Biotechnologies, Abzena Ltd., Regis Technologies, Inc., Rentschler Biopharma SE, and Catalent, Inc. are the prominent players in the market.

Prominent players have been profiled in the biotech API manufacturing services market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments. The report also covers segments such as service type and scale of operations.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 38.9 Bn |

|

Forecast (Value) in 2031 |

More than US$ 73 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 38.9 Bn in 2022.

It is projected to reach more than US$ 73 Bn by 2031.

It is anticipated to grow at a CAGR of 7.1% from 2023 to 2031.

Rise in demand for innovative & effective drugs, surge in adoption of biologics & biosimilar, increase in trend toward personalized medicine, rise in chronic diseases, and surge in geriatric population.

The API process development & manufacturing segment accounted for more than 55.0% share in 2022.

North America is expected to account for the largest share from 2023 to 2031.

Lonza Group Ltd., WuXi AppTec Co., Ltd., Boehringer Ingelheim Biopharmaceuticals GmbH (Boehringer Ingelheim International GmbH), CordenPharma International, Sterling Pharma Solutions, AbbVie, Inc., Hikal Ltd., Almac Group, FUJIFILM Diosynth Biotechnologies, Abzena Ltd., Regis Technologies, Inc., Rentschler Biopharma SE, and Catalent, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Biotech API Manufacturing Services Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Biotech API Manufacturing Services Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Overview of API Manufacturing Services in Biotechnology Industry

5.2. Regulatory Scenario, by Region

5.3. Value Chain Analysis

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Biotech API Manufacturing Services Market Analysis and Forecast, by Service Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Service Type, 2017-2031

6.3.1. API Process Development & Manufacturing

6.3.2. Analytical Testing & Quality Control

6.3.3. Regulatory Support

6.3.4. Scale-up & Commercial Manufacturing

6.4. Market Attractiveness Analysis, by Service Type

7. Global Biotech API Manufacturing Services Market Analysis and Forecast, by Scale of Operations

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Scale of Operations, 2017-2031

7.3.1. Small-scale

7.3.2. Mid-scale

7.3.3. Large-scale

7.4. Market Attractiveness Analysis, by Scale of Operations

8. Global Biotech API Manufacturing Services Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Biotech API Manufacturing Services Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Service Type, 2017-2031

9.2.1. API Process Development & Manufacturing

9.2.2. Analytical Testing & Quality Control

9.2.3. Regulatory Support

9.2.4. Scale-up & Commercial Manufacturing

9.3. Market Value Forecast, by Scale of Operations, 2017-2031

9.3.1. Small-scale

9.3.2. Mid-scale

9.3.3. Large-scale

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Service Type

9.5.2. By Scale of Operations

9.5.3. By Country

10. Europe Biotech API Manufacturing Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Service Type, 2017-2031

10.2.1. API Process Development & Manufacturing

10.2.2. Analytical Testing & Quality Control

10.2.3. Regulatory Support

10.2.4. Scale-up & Commercial Manufacturing

10.3. Market Value Forecast, by Scale of Operations, 2017-2031

10.3.1. Small-scale

10.3.2. Mid-scale

10.3.3. Large-scale

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Service Type

10.5.2. By Scale of Operations

10.5.3. By Country/Sub-region

11. Asia Pacific Biotech API Manufacturing Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Service Type, 2017-2031

11.2.1. API Process Development & Manufacturing

11.2.2. Analytical Testing & Quality Control

11.2.3. Regulatory Support

11.2.4. Scale-up & Commercial Manufacturing

11.3. Market Value Forecast, by Scale of Operations, 2017-2031

11.3.1. Small-scale

11.3.2. Mid-scale

11.3.3. Large-scale

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Service Type

11.5.2. By Scale of Operations

11.5.3. By Country/Sub-region

12. Latin America Biotech API Manufacturing Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Service Type, 2017-2031

12.2.1. API Process Development & Manufacturing

12.2.2. Analytical Testing & Quality Control

12.2.3. Regulatory Support

12.2.4. Scale-up & Commercial Manufacturing

12.3. Market Value Forecast, by Scale of Operations, 2017-2031

12.3.1. Small-scale

12.3.2. Mid-scale

12.3.3. Large-scale

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Service Type

12.5.2. By Scale of Operations

12.5.3. By Country/Sub-region

13. Middle East & Africa Biotech API Manufacturing Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Service Type, 2017-2031

13.2.1. API Process Development & Manufacturing

13.2.2. Analytical Testing & Quality Control

13.2.3. Regulatory Support

13.2.4. Scale-up & Commercial Manufacturing

13.3. Market Value Forecast, by Scale of Operations, 2017-2031

13.3.1. Small-scale

13.3.2. Mid-scale

13.3.3. Large-scale

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Service Type

13.5.2. By Scale of Operations

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. Lonza Group Ltd.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. WuXi AppTec Co., Ltd.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Boehringer Ingelheim Biopharmaceuticals GmbH (Boehringer Ingelheim International GmbH)

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. CordenPharma International

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Sterling Pharma Solutions

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. AbbVie, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Hikal Ltd.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Almac Group

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. FUJIFILM Diosynth Biotechnologies

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Abzena Ltd

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Regis Technologies, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Rentschler Biopharma SE

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Catalent, Inc.

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

List of Tables

Table 01: Global Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Service Type, 2017-2031

Table 02: Global Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Scale of Operations, 2017-2031

Table 03: Global Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Service Type, 2017-2031

Table 05: North America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Scale of Operations, 2017-2031

Table 06: North America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: Europe Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Service Type, 2017-2031

Table 08: Europe Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Scale of Operations, 2017-2031

Table 09: Europe Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Asia Pacific Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Service Type, 2017-2031

Table 11: Asia Pacific Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Scale of Operations, 2017-2031

Table 12: Asia Pacific Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Latin America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Service Type, 2017-2031

Table 14: Latin America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Scale of Operations, 2017-2031

Table 15: Latin America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Middle East & Africa Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Service Type, 2017-2031

Table 17: Middle East & Africa Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Scale of Operations, 2017-2031

Table 18: Middle East & Africa Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Biotech API Manufacturing Services Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 03: Global Biotech API Manufacturing Services Market Attractiveness Analysis, by Service Type, 2022-2031

Figure 04: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by API Process Development & Manufacturing, 2017-2031

Figure 05: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by Analytical Testing & Quality Control, 2017-2031

Figure 06: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by Regulatory Support, 2017-2031

Figure 07: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by Scale-up & Commercial Manufacturing, 2017-2031

Figure 08: Global Biotech API Manufacturing Services Market Value Share Analysis, by Scale of Operations, 2022 and 2031

Figure 09: Global Biotech API Manufacturing Services Market Attractiveness Analysis, by Scale of Operations, 2022-2031

Figure 10: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by Small-scale, 2017-2031

Figure 11: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by Mid-scale, 2017-2031

Figure 12: Global Biotech API Manufacturing Services Market Revenue (US$ Mn), by Large-scale, 2017-2031

Figure 13: Global Biotech API Manufacturing Services Market Value Share Analysis, by Region, 2022 and 2031

Figure 14: Global Biotech API Manufacturing Services Market Attractiveness Analysis, by Region, 2022-2031

Figure 15: North America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031

Figure 16: North America Biotech API Manufacturing Services Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 17: North America Biotech API Manufacturing Services Market Attractiveness Analysis, by Service Type, 2022-2031

Figure 18: North America Biotech API Manufacturing Services Market Value Share Analysis, by Scale of Operations, 2022 and 2031

Figure 19: North America Biotech API Manufacturing Services Market Attractiveness Analysis, by Scale of Operations, 2022-2031

Figure 20: North America Biotech API Manufacturing Services Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Biotech API Manufacturing Services Market Attractiveness Analysis, by Country, 2022-2031

Figure 22: North America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031

Figure 23: Europe Biotech API Manufacturing Services Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 24: Europe Biotech API Manufacturing Services Market Attractiveness Analysis, by Service Type, 2022-2031

Figure 25: Europe Biotech API Manufacturing Services Market Value Share Analysis, by Scale of Operations, 2022 and 2031

Figure 26: Europe Biotech API Manufacturing Services Market Attractiveness Analysis, by Scale of Operations, 2022-2031

Figure 27: Europe Biotech API Manufacturing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Europe Biotech API Manufacturing Services Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 29: Europe Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031

Figure 30: Asia Pacific Biotech API Manufacturing Services Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 31: Asia Pacific Biotech API Manufacturing Services Market Attractiveness Analysis, by Service Type, 2022-2031

Figure 32: Asia Pacific Biotech API Manufacturing Services Market Value Share Analysis, by Scale of Operations, 2022 and 2031

Figure 33: Asia Pacific Biotech API Manufacturing Services Market Attractiveness Analysis, by Scale of Operations, 2022-2031

Figure 34: Asia Pacific Biotech API Manufacturing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Asia Pacific Biotech API Manufacturing Services Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 36: Asia Pacific Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031

Figure 37: Latin America Biotech API Manufacturing Services Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 38: Latin America Biotech API Manufacturing Services Market Attractiveness Analysis, by Service Type, 2022-2031

Figure 39: Latin America Biotech API Manufacturing Services Market Value Share Analysis, by Scale of Operations, 2022 and 2031

Figure 40: Latin America Biotech API Manufacturing Services Market Attractiveness Analysis, by Scale of Operations, 2022-2031

Figure 41: Latin America Biotech API Manufacturing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Latin America Biotech API Manufacturing Services Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 43: Latin America Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031

Figure 44: Middle East & Africa Biotech API Manufacturing Services Market Value Share Analysis, by Service Type, 2022 and 2031

Figure 45: Middle East & Africa Biotech API Manufacturing Services Market Attractiveness Analysis, by Service Type, 2022-2031

Figure 46: Middle East & Africa Biotech API Manufacturing Services Market Value Share Analysis, by Scale of Operations, 2022 and 2031

Figure 47: Middle East & Africa Biotech API Manufacturing Services Market Attractiveness Analysis, by Scale of Operations, 2022-2031

Figure 48: Middle East & Africa Biotech API Manufacturing Services Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 49: Middle East & Africa Biotech API Manufacturing Services Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 50: Middle East & Africa Biotech API Manufacturing Services Market Value (US$ Mn) Forecast, 2017-2031