Analysts’ Viewpoint

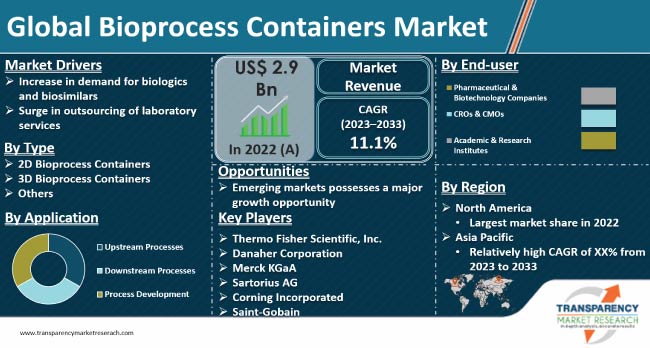

Rise in demand for biologics and biosimilars is expected to drive the global market during the forecast period. The shift toward single-use technologies to enable faster production timelines is further fueling market expansion. Surge in outsourcing of laboratory services is another major factor propelling global bioprocess containers market growth. Furthermore, newer materials, bag designs, and assembly techniques are being developed to improve the performance of bioprocess containers and enable higher product yields. This is expanding the capabilities of single-use technologies.

However, concerns around the sustainability of single-use technologies and increasing regulatory requirements could pose challenges for market players. Companies would need to work on improving the recyclability and reusability of their single-use products to alleviate sustainability concerns.

The bioprocess containers market includes single-use disposable bags used for the manufacturing of biopharmaceuticals and biological products. These bags are primarily made of plastics such as polyethylene, polypropylene, and polyvinyl chloride.

Increase in demand for biologic drugs and biosimilars is a major bioprocess containers market driver. Single-use bioprocess bags offer benefits such as lower cost, less risk of cross-contamination, and faster production timelines. These eliminate the need for expensive and cumbersome cleaning and sterilization of traditional stainless steel bioreactors.

The COVID-19 pandemic has bolstered market growth, as bioprocess bags help accelerate vaccine development and production using single-use technologies.

Increase in demand for biologics and biosimilars is fueling the global bioprocess containers market size. Biologics are large, complex medicinal products manufactured using biological processes.

Biosimilars are similar versions of original biologics that are developed after the patent on the original biologic expires. Hence, the cost-effectiveness of biosimilars compared to biologics is greater, which is propelling demand for biosimilars.

The global population aged 60 and over is projected to nearly double from 12% to 22% between 2015 and 2050. As people age, they become more prone to chronic diseases that can be treated with biologics. Hence, increase in incidence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, is a key factor boosting demand for biologics. These conditions often require long-term or life-long treatment, and biologics are increasingly used as effective therapies.

Several companies across industries are opting to outsource their laboratory services to specialized contract research organizations (CROs) and contract manufacturing organizations (CMOs). Outsourcing allows companies to focus on their core competencies while leveraging the expertise and infrastructure of these service providers.

Demand for bioprocess containers is rising in order to support outsourced research, development, and manufacturing processes. These include 2D bioprocess containers, 3D bioprocess containers, and tanker liners that are required by the CROs and CMOs to deliver their services.

Outsourcing laboratory services offer companies cost advantages. It eliminates the need for substantial investment in laboratory infrastructure, equipment, and skilled personnel. By outsourcing, companies can reduce operational costs, increase flexibility, and access cutting-edge technologies without incurring upfront capital expenditures. This cost-effectiveness drives the adoption of outsourcing, leading to a corresponding demand for bioprocess bags/containers by the service providers.

Based on type, the 2D bioprocess containers segment is projected to account for the largest global bioprocess containers market share from 2023 to 2033. This is ascribed to the simplicity, cost-effectiveness, and widespread commercial availability of 2D bioprocess containers. These factors make 2D bags the preferred choice for most lab-scale and medium-scale bioprocessing applications.

2D containers consist of a flat bottom and sides that are heat-sealed together, forming a simple envelope-like configuration that is easy to manufacture. The relatively low material input and simple design allow 2D bags to offer significant cost savings compared to more complex 3D bioprocess containers. Hence, 2D bags are commercially available in a wide range of sizes and materials to meet various bioprocessing needs.

Based on application, the upstream processes segment dominated the global bioprocess containers industry in 2022. Upstream process includes cell culture and fermentation, which require more consumables such as media bags, feed bags and reservoirs. This drives demand for bioprocess containers in upstream processes compared to downstream processes. Moreover, upstream processes tend to be more variable and complex, involving multiple steps and container types. This leads to greater consumption of bioprocess containers.

As per bioprocess containers market trends, North America accounted for the largest share of more than 30% of the global market in 2022. This is ascribed to presence of leading biologics & biopharmaceutical companies and contract manufacturing organizations; and increase in investment in R&D activities by pharmaceutical companies in the region.

The U.S. dominated the market in North America in 2022. This is ascribed to high demand for single-use containers, as they minimize the risk of contamination and enable quicker production turnaround times. These factors help pharmaceutical companies reduce manufacturing costs and bring products to market more quickly.

Asia Pacific was the fastest growing market in 2022. The market in the region is expected to expand at a CAGR of 11.9% during the forecast period. Rise in investment by key players, increase in R&D expenditure by pharmaceutical companies, and growing biopharmaceutical industry offer lucrative bioprocess containers market opportunities in the region.

China and India are the primary markets in the region. Factors such as rising disposable income, growing healthcare awareness, and increasing government funding for biopharmaceutical research are fueling the growth of the biopharmaceutical industry in Asia Pacific. The region is also witnessing rapid increase in the number of CROs and CMOs, which require single-use bioprocess containers in their manufacturing processes.

China and India provide ample opportunities for outsourcing manufacturing operations due to the availability of affordable skilled labor, low production costs, and government initiatives to attract foreign investments in the pharmaceutical sector. Key players in the market are also focusing on expanding presence in Asia Pacific through partnerships, acquisitions, and contract manufacturing agreements with local companies.

The global market is consolidated, with the presence of small number of key players. New advancements in available products and merger & acquisition are the key strategies adopted by these players.

Sartorius AG, Thermo Fisher Scientific, Inc., Danaher Corporation, Merck KGaA, Corning Incorporated, Saint-Gobain, Avantor, Inc., Parker Hannifin Corporation, Entegris, Inc., Meissner Filtration Products, Inc., Lonza AG, Flexbiosys Inc., ABEC, Inc., and Cellexus are the prominent players in the market.

Each of these players has been profiled in the bioprocess containers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 2.9 Bn |

|

Forecast (Value) in 2033 |

US$ 9.3 Bn |

|

Growth Rate (CAGR) |

11.1% |

|

Forecast Period |

2023-2033 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Example: Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.9 Bn in 2022

It is projected to exceed US$ 9.3 Bn by 2033.

It expanded at a CAGR of 19.1% from 2017 to 2022

It is anticipated to advance at a CAGR of 11.1% from 2023 to 2033.

Increase in demand for biologics & biosimilars and surge in outsourcing of laboratory services.

The 2D bioprocess containers type segment held over 60.0% share in 2022.

North America is likely to account for leading share during the forecast period.

Sartorius AG, Thermo Fisher Scientific, Inc., Danaher Corporation, Merck KGaA, Corning Incorporated, Saint-Gobain, Avantor, Inc., Parker Hannifin Corporation, Entegris, Inc., Meissner Filtration Products, Inc., Lonza AG, Flexbiosys Inc., ABEC, Inc., and Cellexus.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Bioprocess Containers Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Bioprocess Containers Market Analysis and Forecast, 2017-2033

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Bioprocess Containers Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017-2033

6.3.1. 2D Bioprocess Containers

6.3.2. 3D Bioprocess Containers

6.3.3. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Bioprocess Containers Market Analysis and Forecast, by Capacity

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Capacity, 2017-2033

7.3.1. Small Volume

7.3.2. Large Volume

7.4. Market Attractiveness Analysis, by Capacity

8. Global Bioprocess Containers Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017-2033

8.3.1. Upstream Processes

8.3.2. Downstream Processes

8.3.3. Process Development

8.4. Market Attractiveness Analysis, by Application

9. Global Bioprocess Containers Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017-2033

9.3.1. Pharmaceutical & Biotechnology Companies

9.3.2. CROs & CMOs

9.3.3. Academic & Research Institutes

9.4. Market Attractiveness Analysis, by End-user

10. Global Bioprocess Containers Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Bioprocess Containers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2033

11.2.1. 2D Bioprocess Containers

11.2.2. 3D Bioprocess Containers

11.2.3. Others

11.3. Market Value Forecast, by Capacity, 2017-2033

11.3.1. Small Volume

11.3.2. Large Volume

11.4. Market Value Forecast, by Application, 2017-2033

11.4.1. Upstream Processes

11.4.2. Downstream Processes

11.4.3. Process Development

11.5. Market Value Forecast, by End-user, 2017-2033

11.5.1. Pharmaceutical & Biotechnology Companies

11.5.2. CROs & CMOs

11.5.3. Academic & Research Institutes

11.6. Market Value Forecast, by Country, 2017-2033

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Capacity

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Bioprocess Containers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2033

12.2.1. 2D Bioprocess Containers

12.2.2. 3D Bioprocess Containers

12.2.3. Others

12.3. Market Value Forecast, by Capacity, 2017-2033

12.3.1. Small Volume

12.3.2. Large Volume

12.4. Market Value Forecast, by Application, 2017-2033

12.4.1. Upstream Processes

12.4.2. Downstream Processes

12.4.3. Process Development

12.5. Market Value Forecast, by End-user, 2017-2033

12.5.1. Pharmaceutical & Biotechnology Companies

12.5.2. CROs & CMOs

12.5.3. Academic & Research Institutes

12.6. Market Value Forecast, by Country/Sub-region, 2017-2033

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Capacity

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Bioprocess Containers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2033

13.2.1. 2D Bioprocess Containers

13.2.2. 3D Bioprocess Containers

13.2.3. Others

13.3. Market Value Forecast, by Capacity, 2017-2033

13.3.1. Small Volume

13.3.2. Large Volume

13.4. Market Value Forecast, by Application, 2017-2033

13.4.1. Upstream Processes

13.4.2. Downstream Processes

13.4.3. Process Development

13.5. Market Value Forecast, by End-user, 2017-2033

13.5.1. Pharmaceutical & Biotechnology Companies

13.5.2. CROs & CMOs

13.5.3. Academic & Research Institutes

13.6. Market Value Forecast, by Country/Sub-region, 2017-2033

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Capacity

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Bioprocess Containers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017-2033

14.2.1. 2D Bioprocess Containers

14.2.2. 3D Bioprocess Containers

14.2.3. Others

14.3. Market Value Forecast, by Capacity, 2017-2033

14.3.1. Small Volume

14.3.2. Large Volume

14.4. Market Value Forecast, by Application, 2017-2033

14.4.1. Upstream Processes

14.4.2. Downstream Processes

14.4.3. Process Development

14.5. Market Value Forecast, by End-user, 2017-2033

14.5.1. Pharmaceutical & Biotechnology Companies

14.5.2. CROs & CMOs

14.5.3. Academic & Research Institutes

14.6. Market Value Forecast, by Country/Sub-region, 2017-2033

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Capacity

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Bioprocess Containers Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2017-2033

15.2.1. 2D Bioprocess Containers

15.2.2. 3D Bioprocess Containers

15.2.3. Others

15.3. Market Value Forecast, by Capacity, 2017-2033

15.3.1. Small Volume

15.3.2. Large Volume

15.4. Market Value Forecast, by Application, 2017-2033

15.4.1. Upstream Processes

15.4.2. Downstream Processes

15.4.3. Process Development

15.5. Market Value Forecast, by End-user, 2017-2033

15.5.1. Pharmaceutical & Biotechnology Companies

15.5.2. CROs & CMOs

15.5.3. Academic & Research Institutes

15.6. Market Value Forecast, by Country/Sub-region, 2017-2033

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Type

15.7.2. By Capacity

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2022)

16.3. Company Profiles

16.3.1. Sartorius AG

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Thermo Fisher Scientific Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Danaher Corporation

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Merck KGaA

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Corning Incorporated

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Saint-Gobain

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Avantor, Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Parker Hannifin Corporation

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Entegris, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Meissner Filtration Products, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Lonza AG

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. Flexbiosys Inc.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

16.3.13. ABEC, Inc.

16.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.13.2. Product Portfolio

16.3.13.3. Financial Overview

16.3.13.4. SWOT Analysis

16.3.13.5. Strategic Overview

16.3.14. Cellexus

16.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.14.2. Product Portfolio

16.3.14.3. Financial Overview

16.3.14.4. SWOT Analysis

16.3.14.5. Strategic Overview

List of Tables

Table 01: Global Bioprocess Containers Market Value (US$ Mn) Forecast, by Type, 2017-2033

Table 02: Global Bioprocess Containers Market Value (US$ Mn) Forecast, by Capacity, 2017-2033

Table 03: Global Bioprocess Containers Market Value (US$ Mn) Forecast, by Application, 2017-2033

Table 04: Global Bioprocess Containers Market Value (US$ Mn) Forecast, by End-user, 2017-2033

Table 05: Global Bioprocess Containers Market Value (US$ Mn) Forecast, by Region, 2017-2033

Table 06: North America Bioprocess Containers Market Value (US$ Mn) Forecast, by Type, 2017-2033

Table 07: North America Bioprocess Containers Market Value (US$ Mn) Forecast, by Capacity, 2017-2033

Table 08: North America Bioprocess Containers Market Value (US$ Mn) Forecast, by Application, 2017-2033

Table 09: North America Bioprocess Containers Market Value (US$ Mn) Forecast, by End-user, 2017-2033

Table 10: North America Bioprocess Containers Market Value (US$ Mn) Forecast, by Country, 2017-2033

Table 11: Europe Bioprocess Containers Market Value (US$ Mn) Forecast, by Type, 2017-2033

Table 12: Europe Bioprocess Containers Market Value (US$ Mn) Forecast, by Capacity, 2017-2033

Table 13: Europe Bioprocess Containers Market Value (US$ Mn) Forecast, by Application, 2017-2033

Table 14: Europe Bioprocess Containers Market Value (US$ Mn) Forecast, by End-user, 2017-2033

Table 15: Europe Bioprocess Containers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2033

Table 16: Asia Pacific Bioprocess Containers Market Value (US$ Mn) Forecast, by Type, 2017-2033

Table 17: Asia Pacific Bioprocess Containers Market Value (US$ Mn) Forecast, by Capacity, 2017-2033

Table 18: Asia Pacific Bioprocess Containers Market Value (US$ Mn) Forecast, by Application, 2017-2033

Table 19: Asia Pacific Bioprocess Containers Market Value (US$ Mn) Forecast, by End-user, 2017-2033

Table 20: Asia Pacific Bioprocess Containers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2033

Table 21: Latin America Bioprocess Containers Market Value (US$ Mn) Forecast, by Type, 2017-2033

Table 22: Latin America Bioprocess Containers Market Value (US$ Mn) Forecast, by Capacity, 2017-2033

Table 23: Latin America Bioprocess Containers Market Value (US$ Mn) Forecast, by Application, 2017-2033

Table 24: Latin America Bioprocess Containers Market Value (US$ Mn) Forecast, by End-user, 2017-2033

Table 25: Latin America Bioprocess Containers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2033

Table 26: Middle East & Africa Bioprocess Containers Market Value (US$ Mn) Forecast, by Type, 2017-2033

Table 27: Middle East & Africa Bioprocess Containers Market Value (US$ Mn) Forecast, by Capacity, 2017-2033

Table 28: Middle East & Africa Bioprocess Containers Market Value (US$ Mn) Forecast, by Application, 2017-2033

Table 29: Middle East & Africa Bioprocess Containers Market Value (US$ Mn) Forecast, by End-user, 2017-2033

Table 30: Middle East & Africa Bioprocess Containers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2033

List of Figures

Figure 01: Global Bioprocess Containers Market Value (US$ Mn) Forecast, 2017-2033

Figure 02: Bioprocess Containers Market Value Share, by Type, 2022

Figure 03: Bioprocess Containers Market Value Share, by Capacity, 2022

Figure 04: Bioprocess Containers Market Value Share, by Application, 2022

Figure 05: Bioprocess Containers Market Value Share, by End-user, 2022

Figure 06: Bioprocess Containers Market Value Share, by Region, 2022

Figure 07: Global Bioprocess Containers Market Value Share Analysis, by Type, 2022 and 2033

Figure 08: Global Bioprocess Containers Market Attractiveness Analysis, by Type, 2023-2033

Figure 09: Global Bioprocess Containers Market Value (US$ Mn), by 2D Bioprocess Containers, 2017-2033

Figure 10: Global Bioprocess Containers Market Value (US$ Mn), by 3D Bioprocess Containers, 2017-2033

Figure 11: Global Bioprocess Containers Market Value (US$ Mn), by Others, 2017-2033

Figure 12: Global Bioprocess Containers Market Value Share Analysis, by Capacity, 2022 and 2033

Figure 13: Global Bioprocess Containers Market Attractiveness Analysis, by Capacity, 2023-2033

Figure 14: Global Bioprocess Containers Market Value (US$ Mn), by Small Volume, 2017-2033

Figure 15: Global Bioprocess Containers Market Value (US$ Mn), by Large Volume, 2017-2033

Figure 16: Global Bioprocess Containers Market Value Share Analysis, by Application, 2022 and 2033

Figure 17: Global Bioprocess Containers Market Attractiveness Analysis, by Application, 2023-2033

Figure 18: Global Bioprocess Containers Market Revenue (US$ Mn), by Upstream Processes, 2017-2033

Figure 19: Global Bioprocess Containers Market Revenue (US$ Mn), by Downstream Processes, 2017-2033

Figure 20: Global Bioprocess Containers Market Revenue (US$ Mn), by Process Development, 2017-2033

Figure 21: Global Bioprocess Containers Market Value Share Analysis, by End-user, 2022 and 2033

Figure 22: Global Bioprocess Containers Market Attractiveness Analysis, by End-user, 2023-2033

Figure 23: Global Bioprocess Containers Market Revenue (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017-2033

Figure 24: Global Bioprocess Containers Market Revenue (US$ Mn), by CROs & CMOs, 2017-2033

Figure 25: Global Bioprocess Containers Market Revenue (US$ Mn), by Academic & Research Institutes, 2017-2033

Figure 26: Global Bioprocess Containers Market Value Share Analysis, by Region, 2022 and 2033

Figure 27: Global Bioprocess Containers Market Attractiveness Analysis, by Region, 2023-2033

Figure 28: North America Bioprocess Containers Market Value (US$ Mn) Forecast, 2017-2033

Figure 29: North America Bioprocess Containers Value Share Analysis, by Type, 2022 and 2033

Figure 30: North America Bioprocess Containers Attractiveness Analysis, by Type, 2023-2033

Figure 31: North America Bioprocess Containers Market Value Share Analysis, by Capacity, 2022 and 2033

Figure 32: North America Bioprocess Containers Market Attractiveness Analysis, by Capacity, 2023-2033

Figure 33: North America Bioprocess Containers Market Value Share Analysis, by Application, 2022 and 2033

Figure 34: North America Bioprocess Containers Market Attractiveness Analysis, by Application, 2023-2033

Figure 35: North America Bioprocess Containers Value Share Analysis, by End-user, 2022 and 2033

Figure 36: North America Bioprocess Containers Attractiveness Analysis, by End-user, 2023-2033

Figure 37: North America Bioprocess Containers Value Share Analysis, by Country, 2022 and 2033

Figure 38: North America Bioprocess Containers Attractiveness Analysis, by Country, 2023-2033

Figure 39: Europe Bioprocess Containers Market Value (US$ Mn) Forecast, 2017-2033

Figure 40: Europe Bioprocess Containers Value Share Analysis, by Type, 2022 and 2033

Figure 41: Europe Bioprocess Containers Attractiveness Analysis, by Type, 2023-2033

Figure 42: Europe Bioprocess Containers Market Value Share Analysis, by Capacity, 2022 and 2033

Figure 43: Europe Bioprocess Containers Market Attractiveness Analysis, by Capacity, 2023-2033

Figure 44: Europe Bioprocess Containers Market Value Share Analysis, by Application, 2022 and 2033

Figure 45: Europe Bioprocess Containers Market Attractiveness Analysis, by Application, 2023-2033

Figure 46: Europe Bioprocess Containers Value Share Analysis, by End-user, 2022 and 2033

Figure 47: Europe Bioprocess Containers Attractiveness Analysis, by End-user, 2023-2033

Figure 48: Europe Bioprocess Containers Value Share Analysis, by Country/Sub-region, 2022 and 2033

Figure 49: Europe Bioprocess Containers Attractiveness Analysis, by Country/Sub-region, 2023-2033

Figure 50: Asia Pacific Bioprocess Containers Market Value (US$ Mn) Forecast, 2017-2033

Figure 51: Asia Pacific Bioprocess Containers Value Share Analysis, by Type, 2022 and 2033

Figure 52: Asia Pacific Bioprocess Containers Attractiveness Analysis, by Type, 2023-2033

Figure 53: Asia Pacific Bioprocess Containers Market Value Share Analysis, by Capacity, 2022 and 2033

Figure 54: Asia Pacific Bioprocess Containers Market Attractiveness Analysis, by Capacity, 2023-2033

Figure 55: Asia Pacific Bioprocess Containers Market Value Share Analysis, by Application, 2022 and 2033

Figure 56: Asia Pacific Bioprocess Containers Market Attractiveness Analysis, by Application, 2023-2033

Figure 57: Asia Pacific Bioprocess Containers Value Share Analysis, by End-user, 2022 and 2033

Figure 58: Asia Pacific Bioprocess Containers Attractiveness Analysis, by End-user, 2023-2033

Figure 59: Asia Pacific Bioprocess Containers Value Share Analysis, by Country/Sub-region, 2022 and 2033

Figure 60: Asia Pacific Bioprocess Containers Attractiveness Analysis, by Country/Sub-region, 2023-2033

Figure 61: Latin America Bioprocess Containers Market Value (US$ Mn) Forecast, 2017-2033

Figure 62: Latin America Bioprocess Containers Value Share Analysis, by Type, 2022 and 2033

Figure 63: Latin America Bioprocess Containers Attractiveness Analysis, by Type, 2023-2033

Figure 64: Latin America Bioprocess Containers Market Value Share Analysis, by Capacity, 2022 and 2033

Figure 65: Latin America Bioprocess Containers Market Attractiveness Analysis, by Capacity, 2023-2033

Figure 66: Latin America Bioprocess Containers Market Value Share Analysis, by Application, 2022 and 2033

Figure 67: Latin America Bioprocess Containers Market Attractiveness Analysis, by Application, 2023-2033

Figure 68: Latin America Bioprocess Containers Value Share Analysis, by End-user, 2022 and 2033

Figure 69: Latin America Bioprocess Containers Attractiveness Analysis, by End-user, 2023-2033

Figure 70: Latin America Bioprocess Containers Value Share Analysis, by Country/Sub-region, 2022 and 2033

Figure 71: Latin America Bioprocess Containers Attractiveness Analysis, by Country/Sub-region, 2023-2033

Figure 72: Middle East & Africa Bioprocess Containers Market Value (US$ Mn) Forecast, 2017-2033

Figure 73: Middle East & Africa Bioprocess Containers Value Share Analysis, by Type, 2022 and 2033

Figure 74: Middle East & Africa Bioprocess Containers Attractiveness Analysis, by Type, 2023-2033

Figure 75: Middle East & Africa Bioprocess Containers Market Value Share Analysis, by Capacity, 2022 and 2033

Figure 76: Middle East & Africa Bioprocess Containers Market Attractiveness Analysis, by Capacity, 2023-2033

Figure 77: Middle East & Africa Bioprocess Containers Market Value Share Analysis, by Application, 2022 and 2033

Figure 78: Middle East & Africa Bioprocess Containers Market Attractiveness Analysis, by Application, 2023-2033

Figure 79: Middle East & Africa Bioprocess Containers Value Share Analysis, by End-user, 2022 and 2033

Figure 80: Middle East & Africa Bioprocess Containers Attractiveness Analysis, by End-user, 2023-2033

Figure 81: Middle East & Africa Bioprocess Containers Value Share Analysis, by Country/Sub-region, 2022 and 2033

Figure 82: Middle East & Africa Bioprocess Containers Attractiveness Analysis, by Country/Sub-region, 2023-2033

Figure 83: Company Share Analysis, 2022