Demand for RNA-based COVID-19 Vaccines Creates Revenue Opportunities for Contact Manufacturers

Epidemiological studies indicate that patients with asthma are not at an increased risk of severe COVID-19. Although the severity of coronavirus in patients with asthma is dependent on many factors, currently, there is scarce information on the risks associated with COVID-19 in patients with severe asthma that consume biologics. Nevertheless, companies in the biologics contract manufacturing market are tapping revenue opportunities in vaccine production in order to reduce incidences of the novel infection.

Companies in the global biologics contract manufacturing market are shifting their focus to RNA-based COVID-19 vaccines. In order to meet the demands of the patients, an increasing number of pharmaceutical and biotech companies are entering into mergers & agreements with contract manufacturers to develop COVID-19 vaccines.

Process Intensification Holds Promising Potentials to Accelerate Business of Life-altering Therapeutics

In order to leverage value-grab opportunities in biologic therapies, it has become imperative to eliminate manufacturing bottlenecks with the help of process intensification (PI). Sartorius AG - an international pharmaceutical and laboratory equipment supplier, covering the segments of bioprocess solutions and lab products & services, is offering solutions for process intensification to accelerate the business of life-altering therapeutics during the ongoing pandemic.

Biologics complexities and long production cycles are fueling the need for PI. Such trends are contributing to the expansion of the biologics contract manufacturing market. PI is helping contract manufacturers to meet key regulatory deadlines, which is crucial for staying ahead in competition. This trend is essential in the manufacturing of biosimilars that need to be produced in several successive batches in a compressed timeline.

Commercialization of Ublituximab for Blood Cancer Treatment

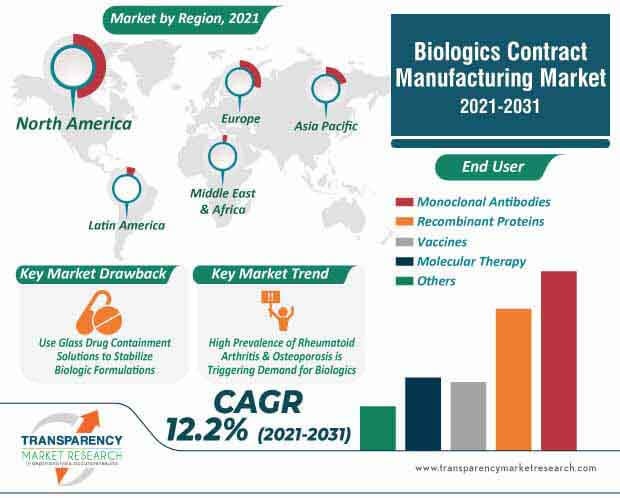

The biologics contract manufacturing market is expected surpass US$ 47.3 Bn by 2031. Monoclonal antibodies are emerging as an important therapeutic approach for blood cancer treatment. TG Therapeutics, Inc. - a clinical-stage biopharmaceutical company, has announced to expand its contract manufacturing deal with Samsung Biologics - a South Korean biotechnology company, to support the production of its investigational anti-CD20 monoclonal antibody, ublituximab.

Companies in the biologics contract manufacturing market are entering into multiple collaborations to increase the availability of ublituximab and enable its commercialization. Companies are re-evaluating their supply needs and securing long-term capacity to meet the global demand for ublituximab.

Glass Containment Solutions and Drug Delivery Devices Ideal for Next-gen Biologics

The biologics contract manufacturing market is projected to clock a CAGR of 12.2% during the forecast period. Stevanato Group - a specialist in world-class systems, processes, and services for pharmaceutical & healthcare industry, is providing novel glass drug containment solutions and drug delivery devices ideal for next-gen drugs.

With the help of state-of-the-art analytical services, reliable technology, and manufacturing equipment, companies in the biologics contract manufacturing market are able to capitalize on incremental opportunities. Biotech drugs such as recombinant proteins and monoclonal antibodies are fueling the demand for glass drug containment solutions and drug delivery devices. The high prevalence of rheumatoid arthritis and osteoporosis is triggering the demand for biologics.

Analysts’ Viewpoint

Due to very low margin for error in the production of life-altering therapeutics for COVID-19 treatment and prevention, companies in the biologics contract manufacturing market should adopt process intensification to avoid production failure. Companies are setting their collaboration wheels in motion to enable long-standing R&D activities involving monoclonal antibodies for blood cancer treatment. Since biologics are challenging to stabilize and administrate, especially in a syringe or a drug delivery device owing to their viscosity, complexity, and sensitivity, companies are using glass drug containment solutions to commercialize biologics. These solutions are necessary since biologics undergo stringent regulatory assessments as compared to generic drugs.

Biologics Contract Manufacturing Market: Overview

Growth of Biopharmaceutical Industry and Promising Drug Pipeline: Key Drivers

Increase in Investment in Research & Development

High Cost of Treatment to Restrain Biologics Contract Manufacturing Market

Biologics Contract Manufacturing Market: Competition Landscape

Biologics Contract Manufacturing Market: Key Developments

Biologics Contract Manufacturing Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 13.3 Bn |

|

Market Forecast Value in 2031 |

US$ 47.3 Bn |

|

Growth Rate (CAGR) |

12.2% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Biologics contract manufacturing market is expected surpass US$ 47.3 Bn by 2031

Biologics contract manufacturing market is projected to expand at a CAGR of 12.2% from 2021 to 2031

Biologics contract manufacturing market is driven by increase in investment in research & development activities and rise in prevalence of chronic diseases.

North America accounted for a major share of the global biologics contract manufacturing market

Key players operating in the global market include Lonza Group, Samsung Biologics Co., Ltd., Patheon by Thermo Fisher Scientific, Inc., Cambrex Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Biologics Contract Manufacturing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Biologics Contract Manufacturing Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Biologics Contract Manufacturing: Overview

5.2. Trends in Biopharma Contract Manufacturing

5.3. Key Industry Events (mergers, acquisitions, collaborations, approvals, etc.)

5.4. COVID-19 Pandemic Impact on Industry

6. Global Biologics Contract Manufacturing Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value & Volume Forecast, by Type, 2017–2031

6.3.1. Monoclonal Antibodies

6.3.2. Recombinant Proteins

6.3.3. Vaccines

6.3.4. Molecular Therapy

6.3.5. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Biologics Contract Manufacturing Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Market Value & Volume Forecast, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis, by Country/Region

8. North America Biologics Contract Manufacturing Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value & Volume Forecast, by Type, 2017–2031

8.2.1. Monoclonal Antibodies

8.2.2. Recombinant Proteins

8.2.3. Vaccines

8.2.4. Molecular Therapy

8.2.5. Others

8.3. Market Value & Volume Forecast, by Country, 2017–2031

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.4.1. By Type

8.4.2. By Country

9. Europe Biologics Contract Manufacturing Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value & Volume Forecast, by Type, 2017–2031

9.2.1. Monoclonal Antibodies

9.2.2. Recombinant Proteins

9.2.3. Vaccines

9.2.4. Molecular Therapy

9.2.5. Others

9.3. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Spain

9.3.5. Italy

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Type

9.4.2. By Country/Sub-region

10. Asia Pacific Biologics Contract Manufacturing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value & Volume Forecast, by Type, 2017–2031

10.2.1. Monoclonal Antibodies

10.2.2. Recombinant Proteins

10.2.3. Vaccines

10.2.4. Molecular Therapy

10.2.5. Others

10.3. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. Australia & New Zealand

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Type

10.4.2. By Country/Sub-region

11. Latin America Biologics Contract Manufacturing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Type, 2017–2031

11.2.1. Monoclonal Antibodies

11.2.2. Recombinant Proteins

11.2.3. Vaccines

11.2.4. Molecular Therapy

11.2.5. Others

11.3. Market Value & Volume Forecast, by Country//Sub-region, 2017–2031

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Type

11.4.2. By Country/Sub-region

12. Middle East & Africa Biologics Contract Manufacturing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Type, 2017–2031

12.2.1. Monoclonal Antibodies

12.2.2. Recombinant Proteins

12.2.3. Vaccines

12.2.4. Molecular Therapy

12.2.5. Others

12.3. Market Value & Volume Forecast, by Country/Sub-region, 2017–2031

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Type

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. Company Profiles

13.1.1. Lonza Group

13.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.1.2. Product Portfolio

13.1.1.3. SWOT Analysis

13.1.1.4. Strategic Overview

13.1.2. Samsung Biologics Co., Ltd.

13.1.2.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.2.2. Product Portfolio

13.1.2.3. SWOT Analysis

13.1.2.4. Strategic Overview

13.1.3. Patheon by Thermo Fisher Scientific, Inc.

13.1.3.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.3.2. Product Portfolio

13.1.3.2. SWOT Analysis

13.1.3.3. Strategic Overview

13.1.4. Cambrex Corporation

13.1.4.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.4.2. Product Portfolio

13.1.4.3. SWOT Analysis

13.1.4.4. Strategic Overview

13.1.5. Siegfried Holding AG

13.1.5.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.5.2. Product Portfolio

13.1.5.3. SWOT Analysis

13.1.5.4. Strategic Overview

13.1.6. Fujifilm Holding Corporation

13.1.6.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.6.2. Product Portfolio

13.1.6.3. SWOT Analysis

13.1.6.4. Strategic Overview

13.1.7. AbbVie, Inc.

13.1.7.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.7.2. Product Portfolio

13.1.7.3. SWOT Analysis

13.1.7.4. Strategic Overview

13.1.8. Boehringer Ingelheim

13.1.8.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.8.2. Product Portfolio

13.1.8.3. SWOT Analysis

13.1.8.4. Strategic Overview

13.1.9. Recipharm Pharmaceuticals

13.1.9.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.9.2. Product Portfolio

13.1.9.3. SWOT Analysis

13.1.9.4. Strategic Overview

13.1.10. WuXi Biologics

13.1.10.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.10.2. Product Portfolio

13.1.10.3. SWOT Analysis

13.1.10.4. Strategic Overview

13.1.11. Catalent, Inc.

13.1.11.1. Company Overview (HQ, Business Segments, Employee Strength)

13.1.11.2. Product Portfolio

13.1.11.3. SWOT Analysis

13.1.11.4. Strategic Overview

List of Tables

Table 01: Global Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 02: Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 03: North America Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 04: North America Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 05: Europe Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 06: Europe Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 07: Asia Pacific Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 08: Asia Pacific Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 09: Latin America Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Latin America Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 11: Middle East & Africa Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 12: Middle East & Africa Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, by Type, 2017–2031

List of Figures

Figure 01: Global Biologics Contract Manufacturing Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Biologics Contract Manufacturing Market Value Share, by Type, 2020

Figure 03: Biologics Contract Manufacturing Market Value Share, by Region, 2020

Figure 04: Global Biologics Contract Manufacturing Market Value Share Analysis, by Type, 2020 and 2031

Figure 05: Global Biologics Contract Manufacturing Market Attractiveness Analysis, by Type, 2021–2031

Figure 06: Global Biologics Contract Manufacturing Market Value (US$ Mn), by Monoclonal Antibodies, 2017‒2031

Figure 07: Global Biologics Contract Manufacturing Market Value (US$ Mn), by Recombinant Proteins, 2017‒2031

Figure 08: Global Biologics Contract Manufacturing Market Value (US$ Mn), by Vaccines, 2017‒2031

Figure 09: Global Biologics Contract Manufacturing Market Value (US$ Mn), by Molecular Therapy, 2017‒2031

Figure 10: Global Biologics Contract Manufacturing Market Value (US$ Mn), by Others, 2017–2031

Figure 11: Global Biologics Contract Manufacturing Market Value Share Analysis, by Region, 2020 and 2031

Figure 12: Global Biologics Contract Manufacturing Market Attractiveness Analysis, by Region, 2021–2031

Figure 13: North America Biologics Contract Manufacturing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 14: North America Biologics Contract Manufacturing Market Value Share Analysis, by Country, 2020 and 2031

Figure 15: North America Biologics Contract Manufacturing Market Attractiveness Analysis, by Country, 2021–2031

Figure 16: North America Biologics Contract Manufacturing Market Value Share (%), by Type, 2020 and 2031

Figure 17: North America Biologics Contract Manufacturing Market Attractiveness Analysis, by Type, 2021–2031

Figure 18: Europe Biologics Contract Manufacturing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 19: Europe Biologics Contract Manufacturing Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 20: Europe Biologics Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 21: Europe Biologics Contract Manufacturing Market Value Share (%), by Type, 2020 and 2031

Figure 22: Europe Biologics Contract Manufacturing Market Attractiveness Analysis, by Type, 2021–2031

Figure 23: Asia Pacific Biologics Contract Manufacturing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 24: Asia Pacific Biologics Contract Manufacturing Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 25: Asia Pacific Biologics Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 26: Asia Pacific Biologics Contract Manufacturing Market Value Share (%), by Type, 2020 and 2031

Figure 27: Asia Pacific Biologics Contract Manufacturing Market Attractiveness Analysis, by Type, 2021–2031

Figure 28: Latin America Biologics Contract Manufacturing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 29: Latin America Biologics Contract Manufacturing Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 30: Latin America Biologics Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 31: Latin America Biologics Contract Manufacturing Market Value Share (%), by Type, 2020 and 2031

Figure 32: Latin America Biologics Contract Manufacturing Market Attractiveness Analysis, by Type, 2021–2031

Figure 33: Middle East & Africa Biologics Contract Manufacturing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 34: Middle East & Africa Biologics Contract Manufacturing Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 35: Middle East & Africa Biologics Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-Region, 2021–2031

Figure 36: Middle East & Africa Biologics Contract Manufacturing Market Value Share (%), by Type, 2020 and 2031

Figure 37: Middle East & Africa Biologics Contract Manufacturing Market Attractiveness Analysis, by Type, 2021–2031