Biofungicides: A Credible ‘Residue-free’ Pesticide

The impact of ‘organic’, ‘clean label’, and ‘residue-free’-- consumer preferences that have induced tectonic shifts across a range of sectors—is noticeable in the agriculture sector as well. It has influenced farmers around the world to incorporate sustainable products and services. Ranging from growing adoption of traditional seeds to biological crop protection methods, sustainable farming has become a key focus area for the agriculture sector. The onus has also shifted to using naturally-derived pest-control materials, creating increased demand for biofungicides and bioinsecticides.

The developments influencing better crop production to sustain the needs of a growing populace, and the biofungicides market in particular, warrant an in-depth understanding and unbiased analysis of this market. Transparency Market Research, in its new research study, unveils compelling insights to assist key stakeholders in the biofungicides market with value-creation and data-driven decision-making.

Biofungicides Demand Bolstered by Shift to More Sustainable Agriculture

The use of biofungicides, now gaining increasing attention in the view of the rising demand for organic and residue-free foods, has come a long way since it started in the 17th century before the advent of synthetic pesticides. The global sales of biofungicides closed in on US$ 220 million in 2018, and the number of players competing for a share of the pie of this lucrative market continues to rise with each passing year.

Since the intensive and frequent excessive use of chemical pesticides has increased, the resistance strength of plant pathogens has also increased. This has become a threat to public health and environment; hence, focus has shifted back to R&D activities and introduction of biofungicides and other bio-based substitutes. With increased attention being paid toward sustainable agriculture and the boom in the organic farming industry, especially in developed regions, biofungicide companies should be looking at a period of sustained demand.

However, it is pertinent to note that, most farmers, particularly in developing regions, are familiar with chemical-based agro-products, and are reluctant to adopt advanced products on account of financial barriers; this continues to be a challenge for biofungicide suppliers. Further, biofungicides are widely regarded for their heat-resistant properties, however, biologicals have a tendency to be washed away by rain or irrigation systems, and these perceptions have meant that a significant section of farmers have stayed away from them.

Trends Reforming the Biofungicides Landscape

Biofungicides are used as a pest-control in the cultivation of cereals, grains, fruits & vegetables, oilseeds & pulses. However, it has been the tectonic shift in consumer preference for organic fruits and vegetables that has led to a spike in their demand in the recent past. In the biofungicides market, product development and innovation strategies are underpinned by the rising demand for bio-based agro-products that not only increase agricultural yield but also ensure food security.

With regulatory agencies enforcing strict pesticide-residue-related regulations and conducting continuous revaluation of registered pesticides, biofungicides companies are likely to have a shot at capitalizing on the void. In addition, food-safety and other chemical-use regulations in various countries, along with pitfalls in the reregistration of synthetic fungicides with regulatory bodies, are likely to boost adoption of biofungicides.

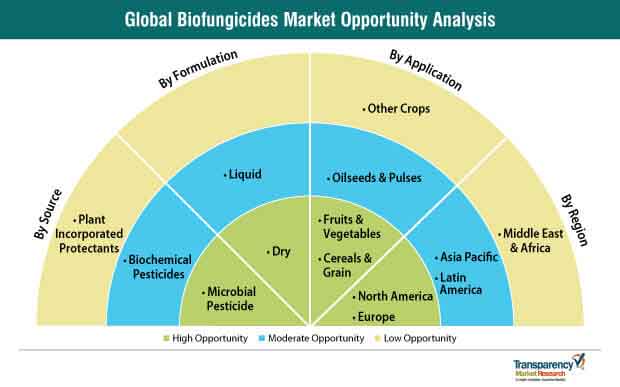

Microbial Pesticides: A Tool for Green Farming Practices

Microbial pesticides continue to experience higher demand as compared to biochemical pesticides and plant-incorporated protectants. As microbial pesticides account for nearly 60% share of the biofungicides market, manufacturers are specifically focusing on this category, providing broad-spectrum disease control and increased crop yield potential.

Innovations have been witnessed in biofungicide seed treatment formulations and microbial fungicide technology. As the sales of microbial pesticides remain high, key manufacturers are wary about spending on other sources of biofungicides. These factors are further intensified when BioSafe Systems, a leading player in the biofungicides market, announced the launch of its PVent Biological Fungicide, an enhancement in microbial fungicide technology, which offers farmers with an easy-to-use, versatile integrated pest management (IPM) tool. PVent has a 93% Gliocladium catenulam strain J1446 as an active ingredient, allowing it to thrive across a wide range of temperatures and humidity. This strategic move by BioSafe Systems is likely to influence other developers to invest in microbial pesticides.

The Competitive Landscape

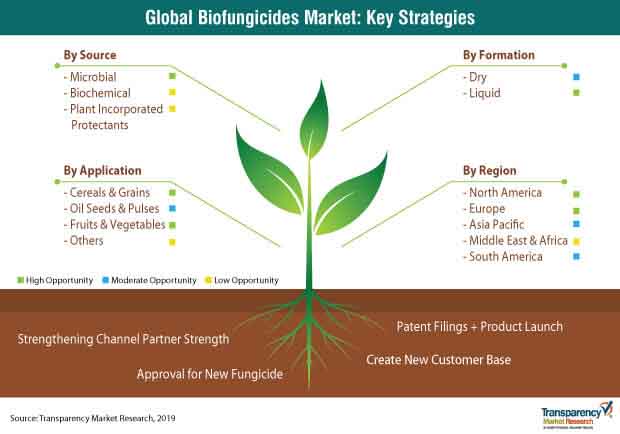

The biofungicides market shows a high level of fragmentation, with the significant presence of regional players and local players; the top five players collectively account for less than 10% share of the market.

Considering the nature of the product, registration from regulatory bodies and issuance of patents continue to be influencing aspects, and to stay competitive, a majority of developers have expanded their product portfolios that meet all the registration standards. Further, leading biofungicides market players are focusing on strengthening the product portfolios through new launches. For instance, in 2018, Maronne Bio Innovations, Inc. launched a series of biopesticides, including REGALIA CG, GRANDEVO CG, and VENERATE CG, in the United States, which are formulated to control highly destructive pests and diseases.

For companies to expand their business networks and strengthen their reach in different geographies, the appointment of new distributors also remains a key focus area. Government efforts to increase awareness regarding the beneficial application of biofungicides, especially in developing countries, has led to the realignment of strategies. Many leading players such as Marrone Bio Innovations, Inc. have entered into partnerships with regional distributors to push the sales of biofungicides and their other product lines in Vietnam, Cambodia, and other Southeast Asian countries.

The Analyst Viewpoint

Report authors maintain a positive outlook of the biofungicides market, with double digit growth estimated for the forecast period. As developed countries continue to emphasize on Integrated Pest Management (IPM) as an agriculture policy, manufacturers will need innovate their products that meet all registration standards and win approval sooner. In addition to expanding their business networks, manufactures will need to look at developing countries from a manufacturing perspective, as operating and labor costs are relatively low in these regions. China is focusing on 'zero growth' in the usage of chemical fertilizers and pesticides by 2020, to avoid contamination in farmlands. Therefore, manufacturers with a higher-risk appetite and who are willing to invest in strengthening their manufacturing capabilities are likely to gain their own eminence in the future.

Biofungicides - Product Introduction

Biofungicides Market Classification

Biofungicides Market Indicators

Biofungicides Market: Regional Outlook

Biofungicides Market: Competitive Landscape:

List of Tables

Table 1: Global Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 2: Global Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 3: Global Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 4: Global Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 5: Global Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 6: Global Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 7: Global Biofungicides Market Volume (Tons) Forecast, by Region, 2018–2027

Table 8: Global Biofungicides Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 9: North America Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 10: North America Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 11: North America Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 12: North America Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 13: North America Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 14: North America Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 15: North America Biofungicides Market Volume (Tons) Forecast, by Country, 2018–2027

Table 16: North America Biofungicides Value (US$ Mn) Forecast, by Country, 2018–2027

Table 17: U.S. Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 18: U.S. Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 19: U.S. Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 20: U.S. Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 21: U.S. Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 22: U.S. Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 23: Canada Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 24: Canada Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 25: Canada Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 26: Canada Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 27: Canada Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 28: Canada Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 29: Europe Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 30: Europe Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 31: Europe Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 32: Europe Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 33: Europe Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 34: Europe Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 35: Europe Biofungicides Market Volume (Tons) Forecast, by Country and Sub-region, 2018–2027

Table 36: Europe Biofungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 37: Germany Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 38: Germany Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 39: Germany Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 40: Germany Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 41: Germany Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 42: Germany Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 43: France Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 44: France Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 45: France Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 46: France Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 47: France Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 48: France Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 49: U.K. Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 50: U.K. Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 51: U.K. Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 52: U.K. Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 53: U.K. Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 54: Italy Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 55: Italy Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 56: Italy Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 57: Italy Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 58: Italy Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 59: Italy Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 60: Spain Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 61: Spain Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 62: Spain Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 63: Spain Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 64: Spain Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 65: Spain Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 66: Russia & CIS Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 67: Russia & CIS Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 68: Russia & CIS Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 69: Russia & CIS Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 70: Russia & CIS Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 71: Russia & CIS Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 72: Rest of Europe Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 73: Rest of Europe Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 74: Rest of Europe Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 75: Rest of Europe Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 76: Rest of Europe Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 77: Rest of Europe Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 78: Asia Pacific Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 79: Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 80: Asia Pacific Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 81: Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 82: Asia Pacific Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 83: Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 84: Asia Pacific Biofungicides Market Volume (Tons) Forecast, by Country and Sub-region, 2018–2027

Table 85: Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 86: China Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 87: China Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 88: China Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 89: China Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 90: China Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 91: China Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 92: Japan Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 93: Japan Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 94: Japan Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 95: Japan Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 96: Japan Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 97: Japan Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 98: India Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 99: India Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 100: India Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 101: India Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 102: India Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 103: India Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 104: ASEAN Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 105: ASEAN Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 106: ASEAN Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 107: ASEAN Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 108: ASEAN Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 109: ASEAN Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 110: Rest of Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 111: Rest of Asia Pacific Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 112: Rest of Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 113: Rest of Asia Pacific Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 114: Rest of Asia Pacific Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 115: Latin America Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 116: Latin America Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 117: Latin America Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 118: Latin America Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 119: Latin America Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 120: Latin America Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 121: Latin America Biofungicides Market Volume (Tons) Forecast, by Country and Sub-region, 2018–2027

Table 122: Latin America Biofungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 123: Brazil Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 124: Brazil Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 125: Brazil Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 126: Brazil Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 127: Brazil Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 128: Mexico Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 129: Mexico Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 130: Mexico Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 131: Mexico Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 132: Mexico Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 133: Mexico Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 134: Rest of Latin America Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 135: Rest of Latin America Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 136: Rest of Latin America Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 137: Rest of Latin America Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 138: Rest of Latin America Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 139: Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 140: Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 141: Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 142: Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 143: Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 144: Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 145: Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Country and Sub-region, 2018–2027

Table 146: Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 147: Egypt Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 148: Egypt Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 149: Egypt Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 150: Egypt Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 151: Egypt Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 152: Egypt Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 153: South Africa Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 154: South Africa Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 155: South Africa Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 156: South Africa Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 157: South Africa Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 158: South Africa Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 159: Rest of Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Source, 2018–2027

Table 160: Rest of Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Source, 2018–2027

Table 161: Rest of Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Formulation, 2018–2027

Table 162: Rest of Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Formulation, 2018–2027

Table 163: Rest of Middle East & Africa Biofungicides Market Volume (Tons) Forecast, by Application, 2018–2027

Table 164: Rest of Middle East & Africa Biofungicides Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 1: Summary: Global Biofungicides Market Value (US$ Mn), 2018–2027

Figure 2: Global Biofungicides Market Value Share Analysis, by Source, 2018 and 2027

Figure 3: Global Biofungicides Market Attractiveness Analysis 2019-2027, by Source

Figure 4: Global Biofungicides Market Value Share Analysis, by Formulation, 2018 and 2027

Figure 5: Global Biofungicides Market Attractiveness Analysis, by Formulation, 2019-2027

Figure 6: Global Biofungicides Market Value Share Analysis, by Application, 2018 and 2027

Figure 7: Global Biofungicides Market Attractiveness Analysis, by Application, 2018

Figure 8: Global Biofungicides Market Value Share Analysis, by Region, 2018 and 2027

Figure 9: Global Biofungicides Market Attractiveness Analysis, by Region, 2019-2027

Figure 10: North America Biofungicides Market Value Share Analysis, by Source, 2018 and 2027

Figure 11: North America Biofungicides Market Value Share Analysis, by Formulation, 2018 and 2027

Figure 12: North America Biofungicides Market Value Share Analysis, by Application, 2018 and 2027

Figure 13: North America Biofungicides Market Value Share Analysis, by Country, 2018 and 2027

Figure 14: North America Biofungicides Market attractiveness Analysis, by Source, 2018 and 2027

Figure 15: North America Biofungicides Market attractiveness Analysis, by Formulation, 2018

Figure 16: North America Biofungicides Market attractiveness Analysis, by Application, 2018 and 2027

Figure 17: North America Biofungicides Market attractiveness Analysis, by Country, 2018 and 2027

Figure 18: Europe Biofungicides Market Value Share Analysis, by Source, 2018 and 2027

Figure 19: Europe Biofungicides Market Value Share Analysis, by Formulation, 2018 and 2027

Figure 20: Europe Biofungicides Market Value Share Analysis, by Application, 2018 and 2027

Figure 21: Europe Biofungicides Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 22: Europe Biofungicides Market Attractiveness Analysis, by Source, 2018-2027

Figure 23: Europe Biofungicides Market Attractiveness Analysis, by Formulation, 2018-2027

Figure 24: Europe Biofungicides Market Attractiveness Analysis, by Application, 2018 and 2027

Figure 25: Europe Biofungicides Market Attractiveness Analysis, by Country, 2018 and 2027

Figure 26: Asia Pacific Biofungicides Market Value Share Analysis, by Source, 2018 and 2027

Figure 27: Asia Pacific Biofungicides Market Value Share Analysis, by Formulation, 2018 and 2027

Figure 28: Asia Pacific Biofungicides Market Value Share Analysis, by Application, 2018 and 2027

Figure 29: Asia Pacific Biofungicides Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 30: Asia Pacific Biofungicides Market attractiveness Analysis, by Source, 2018 and 2027

Figure 31: Asia Pacific Biofungicides Market attractiveness Analysis, by Formulation, 2018

Figure 32: Asia Pacific Biofungicides Market attractiveness Analysis, by Application, 2018 and 2027

Figure 33: Asia Pacific Biofungicides Market attractiveness Analysis, by Country, 2018 and 2027

Figure 34: Latin America Biofungicides Market Value Share Analysis, by Source, 2018 and 2027

Figure 35: Latin America Biofungicides Market Value Share Analysis, by Formulation, 2018 and 2027

Figure 36: Latin America Biofungicides Market Value Share Analysis, by Application, 2018 and 2027

Figure 37: Latin America Biofungicides Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 38: Latin America Biofungicides Market attractiveness Analysis, by Source, 2018 and 2027

Figure 39: Latin America Biofungicides Market attractiveness Analysis, by Formulation, 2018

Figure 40: Latin America Biofungicides Market attractiveness Analysis, by Application, 2018 and 2027

Figure 41: Latin America Biofungicides Market attractiveness Analysis, by Country, 2018 and 2027

Figure 42: Middle East & Africa Biofungicides Market Value Share, by Source, 2018 and 2027

Figure 43: Middle East & Africa Biofungicides Market Value Share, by Formulation, 2018 and 2027

Figure 44: Middle East & Africa Biofungicides Market Value Share, by Application, 2018 and 2027

Figure 45: Middle East & Africa Biofungicides Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 46: Middle East & Africa Biofungicides Market attractiveness Analysis, by Source, 2018 and 2027

Figure 47: Middle East & Africa Biofungicides Market attractiveness Analysis, by Formulation, 2018

Figure 48: Middle East & Africa Biofungicides Market attractiveness Analysis, by Application, 2018 and 2027

Figure 49: Middle East & Africa Biofungicides Market attractiveness Analysis, by Country and Sub-region, 2018 and 2027