Biodegradable chelating agents are increasingly replacing industry standard chelating agents such as EDTA and NTA, as EDTA is under scrutiny for poor biodegradability and accumulation in the ecosystem. Hence, companies in the biodegradable chelating agents market are introducing GLDA, which is natural and safe for the environment. For instance, Jarchem— a producer of high-quality specialty chemicals announced the launch of Jarchem Biopure™ GLDA, a novel biodegradable chelating agent, which is bio-based certified and possesses exceptional metal affinity.

GLDA is gaining popularity for hard surface cleaners, laundry detergents, and personal care products, among others. Advantageous qualities of GLDA are boosting the revenue for the global market, which is estimated to reach a value of US$ 1 Bn by the end of 2027. The preservative boosting properties of GLDA is one of the winning imperatives that is fueling the demand in various end markets. Manufacturers are tapping incremental opportunities in textiles and fertilizers with the help of GLDA.

Apart from the pulp & paper and the home care industry, companies in the biodegradable chelating agents market are tapping into opportunities in the cosmetics industry to capitalize on untapped business potentials. For instance, Kinetik Technologies— a provider of innovative raw materials to the personal care industry has gained efficacy in the production of biodegradable chelating agents such as their Dermofeel® PA-12 and Dermofeel® PA, which is ideal for cosmetics products in order to improve their shelf life.

The demand for biodegradable chelating agents is surging, as companies in the cosmetics industry are increasing efforts to prevent any adverse effects associated with the stability or appearance of the products. This is evident since manufacturers are increasing their R&D efforts to introduce organic and plant-based ingredients in cosmetics products. Since EDTA is not easily biodegradable, the demand for natural chelating agents is estimated to grow during the forecast period.

Biodegradable chelating agents hold promising potentials in the process of phytoremediation in order to remove metal pollutants from contaminated soils. Companies in the biodegradable chelating agents market are increasing their R&D activities to study the chemistry of natural chelating agents such as with uranium and cadmium contaminated soil. However, this practice leads to a decrease in plant biomass and inhibits the process of photosynthesis in plants. This is particularly observed in the case of chelating agents such as citric acid and oxalic acid. Hence, companies in the biodegradable chelating agents market are increasing the availability of EDDS that have significant effects on improving phytoremediation potential of sunflower plants.

Companies in the market for biodegradable chelating agents are adopting the biomass balance approach to innovate in chelating agents. For instance, in July 2019, world leader and marketer of chemicals BASF announced the launch of Trilon® M Max EcoBalanced— a novel biodegradable chelating agent that is produced using the biomass balance approach. Companies are making the use of renewable feedstock to replace the utilization of fossil feedstock for the production of natural chelating agents. Such innovative techniques are helping to reduce the volume of greenhouse emissions.

Ongoing developments in the coronavirus (COVID-19) outbreak have exposed the vulnerability of supply chains in the biodegradable chelating agents market. Negative ramifications of the novel virus have caused supply chain disruptions in the biodegradable chelating agents market. COVID-19 is expected to create a slowdown in revenue generation activities. Since consumers are increasingly focusing on purchasing essential commodities during the coronavirus pandemic, the business for biodegradable chelating agents is anticipated to tumble as chemical companies are channeling their production capabilities for the production of hand sanitizers and disinfectant products.

Analysts’ Viewpoint

The coronavirus outbreak has caused a slowdown in supply chain activities, but the demand for natural chelating agents is predicted to remain stable since these agents are ideal for surface cleaners and laundry detergents, which are a mandate for individuals amidst the pandemic.

Natural chelating agents are being used for phytoremediation of soil. However, citrics cause issues such as decreased biomass and inhibition of the photosynthesis process. Hence, companies in the biodegradable chelating agents market should increase the awareness for EDDS, which overcomes limitations of citrics. Chelating agents made with renewable feedstock is a novel concept in the global market landscape.

Biodegradable Chelating Agents Market is expected to reach US$ 1 Bn By 2027

Biodegradable Chelating Agents Market is estimated to rise at a CAGR of 3% during forecast period

Demand for biodegradable chelating agents in the food & beverages industry are expected to drive the Biodegradable Chelating Agents Market during the forecast period

Asia Pacific is more attractive for vendors in the Biodegradable Chelating Agents Market

Key players of Biodegradable Chelating Agents Market are BASF SE, Nouryon, ADM, Cargill, Incorporated, Jungbunzlauer Suisse AG, Kemira, and Biesterfeld AG

1. Executive Summary

1.1. Market Snapshot

1.2. Demand-side Trends

1.3. Key Facts and Figures

1.4. Key Market Trends

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

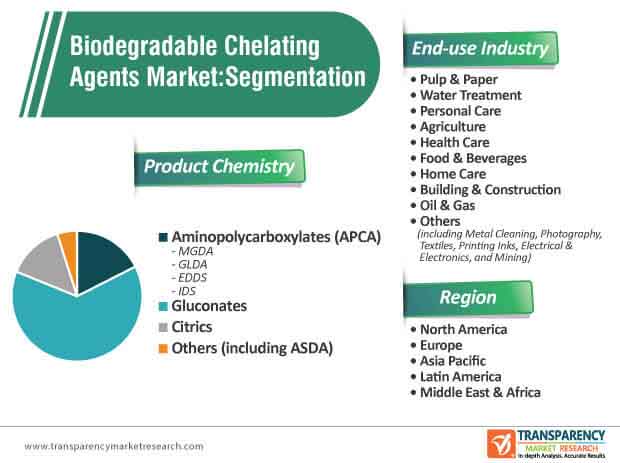

2.1. Market Segmentation

2.2. Key Developments/Product Timeline

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunity

2.5. Global Biodegradable Chelating Agents Market Analysis and Forecast, 2018

2.5.1. Global Biodegradable Chelating Agents Market Volume (Tons)

2.5.2. Global Biodegradable Chelating Agents Market Value (US$ Mn)

2.6. Porters Five Forces Analysis

2.7. Regulatory Landscape

2.8. Qualitative Analysis: Physical & Chemical Parameters of Chelating Agents

2.9. Value Chain Analysis

2.9.1. List of Key Manufacturers

2.9.2. List of Potential Customers

3. Global Biodegradable Chelating Agents Market, Production Output, by Region, 2018

4. Biodegradable Chelating Agents Price Trend Analysis, 2018–2027

4.1. By Product Chemistry

4.2. By Region

5. Global Biodegradable Chelating Agents Market Analysis and Forecast, by Product Chemistry

5.1. Key Findings, by Product Chemistry

5.2. Global Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

5.2.1. Aminopolycarboxylates (APCA)

5.2.1.1. MGDA

5.2.1.2. GLDA

5.2.1.3. EDDS

5.2.1.4. IDS

5.2.2. Gluconates

5.2.3. Citrics

5.2.4. Others

5.3. Global Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

6. Global Biodegradable Chelating Agents Market Analysis and Forecast, by End-use Industry

6.1. Key Findings, by End-use Industry

6.2. Global Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

6.2.1. Pulp & Paper

6.2.2. Water Treatment

6.2.3. Personal Care

6.2.4. Agriculture

6.2.5. Health Care

6.2.6. Food & Beverages

6.2.7. Home Care

6.2.8. Building & Construction

6.2.9. Oil & Gas

6.2.10. Others

6.3. Global Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

7. Regional Outlook - Global Biodegradable Chelating Agents Market Analysis and Forecast, by Region

7.1. Global Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Thousand), by Region, 2018–2027

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Latin America

7.1.5. Middle East & Africa

7.2. Global Biodegradable Chelating Agents Market Attractiveness Analysis, by Region

8. North America Biodegradable Chelating Agents Market Analysis and Forecast, by Product Chemistry

8.1. Key Findings, By Product Chemistry

8.2. North America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

8.2.1. Aminopolycarboxylates (APCA)

8.2.1.1. MGDA

8.2.1.2. GLDA

8.2.1.3. EDDS

8.2.1.4. IDS

8.2.2. Gluconates

8.2.3. Citrics

8.2.4. Others

8.3. North America Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

9. North America Biodegradable Chelating Agents Market Analysis and Forecast, by End-use Industry

9.1. Key Findings, By End-use Industry

9.2. North America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

9.2.1. Pulp & Paper

9.2.2. Water Treatment

9.2.3. Personal Care

9.2.4. Agriculture

9.2.5. Health Care

9.2.6. Food & Beverages

9.2.7. Home Care

9.2.8. Building & Construction

9.2.9. Oil & Gas

9.2.10. Others

9.3. North America Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

10. North America Biodegradable Chelating Agents Market Analysis and Forecast, by Country

10.1. Key Findings, by Country

10.2. North America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2018–2027

10.3. U.S. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

10.3.1. Aminopolycarboxylates (APCA)

10.3.1.1. MGDA

10.3.1.2. GLDA

10.3.1.3. EDDS

10.3.1.4. IDS

10.3.2. Gluconates

10.3.3. Citrics

10.3.4. Others

10.4. U.S. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

10.4.1. Pulp & Paper

10.4.2. Water Treatment

10.4.3. Personal Care

10.4.4. Agriculture

10.4.5. Health Care

10.4.6. Food & Beverages

10.4.7. Home Care

10.4.8. Building & Construction

10.4.9. Oil & Gas

10.4.10. Others

10.5. Canada Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

10.5.1. Aminopolycarboxylates (APCA)

10.5.1.1. MGDA

10.5.1.2. GLDA

10.5.1.3. EDDS

10.5.1.4. IDS

10.5.2. Gluconates

10.5.3. Citrics

10.5.4. Others

10.6. Canada Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

10.6.1. Pulp & Paper

10.6.2. Water Treatment

10.6.3. Personal Care

10.6.4. Agriculture

10.6.5. Health Care

10.6.6. Food & Beverages

10.6.7. Home Care

10.6.8. Building & Construction

10.6.9. Oil & Gas

10.6.10. Others

10.7. North America Biodegradable Chelating Agents Market Attractiveness Analysis, by Country

11. Europe Biodegradable Chelating Agents Market Analysis and Forecast, by Product Chemistry

11.1. Key Findings, by Product Chemistry

11.2. Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

11.2.1. Aminopolycarboxylates (APCA)

11.2.1.1. MGDA

11.2.1.2. GLDA

11.2.1.3. EDDS

11.2.1.4. IDS

11.2.2. Gluconates

11.2.3. Citrics

11.2.4. Others

11.3. Europe Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

12. Europe Biodegradable Chelating Agents Market Analysis and Forecast, by End-use Industry

12.1. Key Findings, by End-use Industry

12.2. Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

12.2.1. Pulp & Paper

12.2.2. Water Treatment

12.2.3. Personal Care

12.2.4. Agriculture

12.2.5. Health Care

12.2.6. Food & Beverages

12.2.7. Home Care

12.2.8. Building & Construction

12.2.9. Oil & Gas

12.2.10. Others

12.3. Europe Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

13. Europe Biodegradable Chelating Agents Market Analysis and Forecast, by Country and Sub-region

13.1. Key Findings, by Country and Sub-region

13.2. Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

13.3. Germany Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.3.1. Aminopolycarboxylates (APCA)

13.3.1.1. MGDA

13.3.1.2. GLDA

13.3.1.3. EDDS

13.3.1.4. IDS

13.3.2. Gluconates

13.3.3. Citrics

13.3.4. Others

13.4. Germany Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.4.1. Pulp & Paper

13.4.2. Water Treatment

13.4.3. Personal Care

13.4.4. Agriculture

13.4.5. Health Care

13.4.6. Food & Beverages

13.4.7. Home Care

13.4.8. Building & Construction

13.4.9. Oil & Gas

13.4.10. Others

13.5. France Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.5.1. Aminopolycarboxylates (APCA)

13.5.1.1. MGDA

13.5.1.2. GLDA

13.5.1.3. EDDS

13.5.1.4. IDS

13.5.2. Gluconates

13.5.3. Citrics

13.5.4. Others

13.6. France Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.6.1. Pulp & Paper

13.6.2. Water Treatment

13.6.3. Personal Care

13.6.4. Agriculture

13.6.5. Health Care

13.6.6. Food & Beverages

13.6.7. Home Care

13.6.8. Building & Construction

13.6.9. Oil & Gas

13.6.10. Others

13.7. U.K. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.7.1. Aminopolycarboxylates (APCA)

13.7.1.1. MGDA

13.7.1.2. GLDA

13.7.1.3. EDDS

13.7.1.4. IDS

13.7.2. Gluconates

13.7.3. Citrics

13.7.4. Others

13.8. U.K. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.8.1. Pulp & Paper

13.8.2. Water Treatment

13.8.3. Personal Care

13.8.4. Agriculture

13.8.5. Health Care

13.8.6. Food & Beverages

13.8.7. Home Care

13.8.8. Building & Construction

13.8.9. Oil & Gas

13.8.10. Others

13.9. Italy Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.9.1. Aminopolycarboxylates (APCA)

13.9.1.1. MGDA

13.9.1.2. GLDA

13.9.1.3. EDDS

13.9.1.4. IDS

13.9.2. Gluconates

13.9.3. Citrics

13.9.4. Others

13.10. Italy Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.10.1. Pulp & Paper

13.10.2. Water Treatment

13.10.3. Personal Care

13.10.4. Agriculture

13.10.5. Health Care

13.10.6. Food & Beverages

13.10.7. Home Care

13.10.8. Building & Construction

13.10.9. Oil & Gas

13.10.10. Others

13.11. Spain Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.11.1. Aminopolycarboxylates (APCA)

13.11.1.1. MGDA

13.11.1.2. GLDA

13.11.1.3. EDDS

13.11.1.4. IDS

13.11.2. Gluconates

13.11.3. Citrics

13.11.4. Others

13.12. Spain Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.12.1. Pulp & Paper

13.12.2. Water Treatment

13.12.3. Personal Care

13.12.4. Agriculture

13.12.5. Health Care

13.12.6. Food & Beverages

13.12.7. Home Care

13.12.8. Building & Construction

13.12.9. Oil & Gas

13.12.10. Others

13.13. Russia & CIS Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.13.1. Aminopolycarboxylates (APCA)

13.13.1.1. MGDA

13.13.1.2. GLDA

13.13.1.3. EDDS

13.13.1.4. IDS

13.13.2. Gluconates

13.13.3. Citrics

13.13.4. Others

13.14. Russia & CIS Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.14.1. Pulp & Paper

13.14.2. Water Treatment

13.14.3. Personal Care

13.14.4. Agriculture

13.14.5. Health Care

13.14.6. Food & Beverages

13.14.7. Home Care

13.14.8. Building & Construction

13.14.9. Oil & Gas

13.14.10. Others

13.15. Rest of Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

13.15.1. Aminopolycarboxylates (APCA)

13.15.1.1. MGDA

13.15.1.2. GLDA

13.15.1.3. EDDS

13.15.1.4. IDS

13.15.2. Gluconates

13.15.3. Citrics

13.15.4. Others

13.16. Rest of Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

13.16.1. Pulp & Paper

13.16.2. Water Treatment

13.16.3. Personal Care

13.16.4. Agriculture

13.16.5. Health Care

13.16.6. Food & Beverages

13.16.7. Home Care

13.16.8. Building & Construction

13.16.9. Oil & Gas

13.16.10. Others

13.17. Europe Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

14. Asia Pacific Biodegradable Chelating Agents Market Analysis and Forecast, by Product Chemistry

14.1. Key Findings, by Product Chemistry

14.2. Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

14.2.1. Aminopolycarboxylates (APCA)

14.2.1.1. MGDA

14.2.1.2. GLDA

14.2.1.3. EDDS

14.2.1.4. IDS

14.2.2. Gluconates

14.2.3. Citrics

14.2.4. Others

14.3. Asia Pacific Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

15. Asia Pacific Biodegradable Chelating Agents Market Analysis and Forecast, by End-use Industry

15.1. Key Findings, By End-use Industry

15.2. Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

15.2.1. Pulp & Paper

15.2.2. Water Treatment

15.2.3. Personal Care

15.2.4. Agriculture

15.2.5. Health Care

15.2.6. Food & Beverages

15.2.7. Home Care

15.2.8. Building & Construction

15.2.9. Oil & Gas

15.2.10. Others

15.3. Asia Pacific Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

16. Asia Pacific Biodegradable Chelating Agents Market Analysis and Forecast, by Country and Sub-region

16.1. Key Findings, by Country and Sub-region

16.2. Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

16.3. China Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

16.3.1. Aminopolycarboxylates (APCA)

16.3.1.1. MGDA

16.3.1.2. GLDA

16.3.1.3. EDDS

16.3.1.4. IDS

16.3.2. Gluconates

16.3.3. Citrics

16.3.4. Others

16.4. China Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

16.4.1. Pulp & Paper

16.4.2. Water Treatment

16.4.3. Personal Care

16.4.4. Agriculture

16.4.5. Health Care

16.4.6. Food & Beverages

16.4.7. Home Care

16.4.8. Building & Construction

16.4.9. Oil & Gas

16.4.10. Others

16.5. Japan Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

16.5.1. Aminopolycarboxylates (APCA)

16.5.1.1. MGDA

16.5.1.2. GLDA

16.5.1.3. EDDS

16.5.1.4. IDS

16.5.2. Gluconates

16.5.3. Citrics

16.5.4. Others

16.6. Japan Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

16.6.1. Pulp & Paper

16.6.2. Water Treatment

16.6.3. Personal Care

16.6.4. Agriculture

16.6.5. Health Care

16.6.6. Food & Beverages

16.6.7. Home Care

16.6.8. Building & Construction

16.6.9. Oil & Gas

16.6.10. Others

16.7. India Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

16.7.1. Aminopolycarboxylates (APCA)

16.7.1.1. MGDA

16.7.1.2. GLDA

16.7.1.3. EDDS

16.7.1.4. IDS

16.7.2. Gluconates

16.7.3. Citrics

16.7.4. Others

16.8. India Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

16.8.1. Pulp & Paper

16.8.2. Water Treatment

16.8.3. Personal Care

16.8.4. Agriculture

16.8.5. Health Care

16.8.6. Food & Beverages

16.8.7. Home Care

16.8.8. Building & Construction

16.8.9. Oil & Gas

16.8.10. Others

16.9. ASEAN Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

16.9.1. Aminopolycarboxylates (APCA)

16.9.1.1. MGDA

16.9.1.2. GLDA

16.9.1.3. EDDS

16.9.1.4. IDS

16.9.2. Gluconates

16.9.3. Citrics

16.9.4. Others

16.10. ASEAN Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

16.10.1. Pulp & Paper

16.10.2. Water Treatment

16.10.3. Personal Care

16.10.4. Agriculture

16.10.5. Health Care

16.10.6. Food & Beverages

16.10.7. Home Care

16.10.8. Building & Construction

16.10.9. Oil & Gas

16.10.10. Others

16.11. Rest of Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

16.11.1. Aminopolycarboxylates (APCA)

16.11.1.1. MGDA

16.11.1.2. GLDA

16.11.1.3. EDDS

16.11.1.4. IDS

16.11.2. Gluconates

16.11.3. Citrics

16.11.4. Others

16.12. Rest of Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

16.12.1. Pulp & Paper

16.12.2. Water Treatment

16.12.3. Personal Care

16.12.4. Agriculture

16.12.5. Health Care

16.12.6. Food & Beverages

16.12.7. Home Care

16.12.8. Building & Construction

16.12.9. Oil & Gas

16.12.10. Others

16.13. Asia Pacific Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

17. Latin America Biodegradable Chelating Agents Market Analysis and Forecast, by Product Chemistry

17.1. Key Findings, by Product Chemistry

17.2. Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

17.2.1. Aminopolycarboxylates (APCA)

17.2.1.1. MGDA

17.2.1.2. GLDA

17.2.1.3. EDDS

17.2.1.4. IDS

17.2.2. Gluconates

17.2.3. Citrics

17.2.4. Others

17.3. Latin America Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

18. Latin America Biodegradable Chelating Agents Market Analysis and Forecast, by End-use Industry

18.1. Key Findings, by End-use Industry

18.2. Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

18.2.1. Pulp & Paper

18.2.2. Water Treatment

18.2.3. Personal Care

18.2.4. Agriculture

18.2.5. Health Care

18.2.6. Food & Beverages

18.2.7. Home Care

18.2.8. Building & Construction

18.2.9. Oil & Gas

18.2.10. Others

18.3. Latin America Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

19. Latin America Biodegradable Chelating Agents Market Analysis and Forecast, by Country and Sub-region

19.1. Key Findings, by Country and Sub-region

19.2. Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

19.3. Brazil Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

19.3.1. Aminopolycarboxylates (APCA)

19.3.1.1. MGDA

19.3.1.2. GLDA

19.3.1.3. EDDS

19.3.1.4. IDS

19.3.2. Gluconates

19.3.3. Citrics

19.3.4. Others

19.4. Brazil Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

19.4.1. Pulp & Paper

19.4.2. Water Treatment

19.4.3. Personal Care

19.4.4. Agriculture

19.4.5. Health Care

19.4.6. Food & Beverages

19.4.7. Home Care

19.4.8. Building & Construction

19.4.9. Oil & Gas

19.4.10. Others

19.5. Mexico Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

19.5.1. Aminopolycarboxylates (APCA)

19.5.1.1. MGDA

19.5.1.2. GLDA

19.5.1.3. EDDS

19.5.1.4. IDS

19.5.2. Gluconates

19.5.3. Citrics

19.5.4. Others

19.6. Mexico Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

19.6.1. Pulp & Paper

19.6.2. Water Treatment

19.6.3. Personal Care

19.6.4. Agriculture

19.6.5. Health Care

19.6.6. Food & Beverages

19.6.7. Home Care

19.6.8. Building & Construction

19.6.9. Oil & Gas

19.6.10. Others

19.7. Rest of Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

19.7.1. Aminopolycarboxylates (APCA)

19.7.1.1. MGDA

19.7.1.2. GLDA

19.7.1.3. EDDS

19.7.1.4. IDS

19.7.2. Gluconates

19.7.3. Citrics

19.7.4. Others

19.8. Rest of Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

19.8.1. Pulp & Paper

19.8.2. Water Treatment

19.8.3. Personal Care

19.8.4. Agriculture

19.8.5. Health Care

19.8.6. Food & Beverages

19.8.7. Home Care

19.8.8. Building & Construction

19.8.9. Oil & Gas

19.8.10. Others

19.9. Latin America Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

20. Middle East & Africa Biodegradable Chelating Agents Market Analysis and Forecast, by Product Chemistry

20.1. Key Findings, by Product Chemistry

20.2. Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

20.2.1. Aminopolycarboxylates (APCA)

20.2.1.1. MGDA

20.2.1.2. GLDA

20.2.1.3. EDDS

20.2.1.4. IDS

20.2.2. Gluconates

20.2.3. Citrics

20.2.4. Others

20.3. Middle East & Africa Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

21. Middle East & Africa Biodegradable Chelating Agents Market Analysis and Forecast, by End-use Industry

21.1. Key Findings, by End-use Industry

21.2. Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

21.2.1. Pulp & Paper

21.2.2. Water Treatment

21.2.3. Personal Care

21.2.4. Agriculture

21.2.5. Health Care

21.2.6. Food & Beverages

21.2.7. Home Care

21.2.8. Building & Construction

21.2.9. Oil & Gas

21.2.10. Others

21.3. Middle East & Africa Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

22. Middle East & Africa Biodegradable Chelating Agents Market Analysis and Forecast, by Country and Sub-region

22.1. Key Findings, by Country and Sub-region

22.2. Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

22.3. GCC Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

22.3.1. Aminopolycarboxylates (APCA)

22.3.1.1. MGDA

22.3.1.2. GLDA

22.3.1.3. EDDS

22.3.1.4. IDS

22.3.2. Gluconates

22.3.3. Citrics

22.3.4. Others

22.4. GCC Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

22.4.1. Pulp & Paper

22.4.2. Water Treatment

22.4.3. Personal Care

22.4.4. Agriculture

22.4.5. Health Care

22.4.6. Food & Beverages

22.4.7. Home Care

22.4.8. Building & Construction

22.4.9. Oil & Gas

22.4.10. Others

22.5. South Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

22.5.1. Aminopolycarboxylates (APCA)

22.5.1.1. MGDA

22.5.1.2. GLDA

22.5.1.3. EDDS

22.5.1.4. IDS

22.5.2. Gluconates

22.5.3. Citrics

22.5.4. Others

22.6. South Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

22.6.1. Pulp & Paper

22.6.2. Water Treatment

22.6.3. Personal Care

22.6.4. Agriculture

22.6.5. Health Care

22.6.6. Food & Beverages

22.6.7. Home Care

22.6.8. Building & Construction

22.6.9. Oil & Gas

22.6.10. Others

22.7. Rest of Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

22.7.1. Aminopolycarboxylates (APCA)

22.7.1.1. MGDA

22.7.1.2. GLDA

22.7.1.3. EDDS

22.7.1.4. IDS

22.7.2. Gluconates

22.7.3. Citrics

22.7.4. Others

22.8. Rest of Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

22.8.1. Pulp & Paper

22.8.2. Water Treatment

22.8.3. Personal Care

22.8.4. Agriculture

22.8.5. Health Care

22.8.6. Food & Beverages

22.8.7. Home Care

22.8.8. Building & Construction

22.8.9. Oil & Gas

22.8.10. Others

22.9. Middle East & Africa Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

23. Competition Landscape

23.1. Competition Matrix, by Key Players

23.2. Global Biodegradable Chelating Agents Market Share Analysis, by Company (2018)

23.3. Market Footprint Analysis

23.3.1. By Product Chemistry

23.4. Competitive Business Strategies

23.5. Company Profiles

23.5.1. BASF SE

23.5.1.1. Company Description

23.5.1.2. Business Overview

23.5.1.3. Financial Overview

23.5.1.4. Strategic Overview

23.5.2. Dow

23.5.2.1. Company Description

23.5.2.2. Business Overview

23.5.2.3. Financial Overview

23.5.2.4. Strategic Overview

23.5.3. Innospec

23.5.3.1. Company Description

23.5.3.2. Business Overview

23.5.3.3. Financial Overview

23.5.3.4. Strategic Overview

23.5.4. Kemira

23.5.4.1. Company Description

23.5.4.2. Business Overview

23.5.4.3. Financial Overview

23.5.5. Roquette Frères

23.5.5.1. Company Description

23.5.5.2. Business Overview

23.5.5.3. Financial Overview

23.5.5.4. Strategic Overview

23.5.6. ADM

23.5.6.1. Company Description

23.5.6.2. Business Overview

23.5.6.3. Financial Overview

23.5.7. Jungbunzlauer Suisse AG

23.5.7.1. Company Description

23.5.7.2. Business Overview

23.5.8. Biesterfeld AG

23.5.8.1. Company Description

23.5.8.2. Business Overview

23.5.9. Mitsubishi Chemical Corporation

23.5.9.1. Company Description

23.5.9.2. Business Overview

23.5.9.3. Financial Overview

23.5.10. AVA Chemicals

23.5.10.1. Company Description

23.5.10.2. Business Overview

23.5.11. Nouryon

23.5.11.1. Company Description

23.5.11.2. Business Overview

23.5.11.3. Strategic Overview

23.5.12. NIPPON SHOKUBAI CO., LTD

23.5.12.1. Company Description

23.5.12.2. Business Overview

23.5.12.3. Financial Overview

23.5.13. Aquapharm Chemical Pvt. Ltd.

23.5.13.1. Company Description

23.5.13.2. Business Overview

23.5.14. Tate & Lyle PLC

23.5.14.1. Company Description

23.5.14.2. Business Overview

23.5.14.3. Financial Overview

23.5.15. Cargill, Incorporated

23.5.15.1. Company Description

23.5.15.2. Business Overview

23.5.15.3. Financial Overview

24. Key Primary Insights

List of Tables

Table 01: Global Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 02: Global Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 03: Global Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

Table 04: North America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 05: North America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 06: North America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2018–2027

Table 07: U.S. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 08: U.S. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 09: Canada Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 10: Canada Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 11: Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 12: Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 13: Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 14: Germany Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 15: Germany Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 16: France Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 17: France Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 18: U.K. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 19: U.K. Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 20: Italy Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 21: Italy Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 22: Spain Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 23: Spain Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 24: Russia & CIS Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 25: Russia & CIS Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 26: Rest of Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 27: Rest of Europe Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 28: Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 29: Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 30: Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 31: China Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 32: China Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 33: Japan Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 34: Japan Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 35: India Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 36: India Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 37: ASEAN Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 38: ASEAN Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 39: Rest of Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 40: Rest of Asia Pacific Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 41: Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 42: Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 43: Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 44: Brazil Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 45: Brazil Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 46: Mexico Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 47: Mexico Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 48: Rest of Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 49: Rest of Latin America Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 50: Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 51: Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 52: Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 53: GCC Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 54: GCC Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 55: South Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 56: South Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

Table 57: Rest of Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Chemistry, 2018–2027

Table 58: Rest of Middle East & Africa Biodegradable Chelating Agents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2018–2027

List of Figures

Figure 1 Global Biodegradable Chelating Agents Market Share Analysis, by Product Chemistry

Figure 2 Global Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

Figure 3 Global Biodegradable Chelating Agents Market Share Analysis, by End-use Industry

Figure 4 Global Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

Figure 5 Global Biodegradable Chelating Agents Market Share Analysis, by Region

Figure 6 Global Biodegradable Chelating Agents Market Attractiveness Analysis, by Region

Figure 7 North America Biodegradable Chelating Agents Market Share Analysis, by Product Chemistry

Figure 8 North America Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

Figure 9 North America Biodegradable Chelating Agents Market Share Analysis, by End-use Industry

Figure 10 North America Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

Figure 11 North America Biodegradable Chelating Agents Market Share Analysis, by Country and Sub-region

Figure 12 North America Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

Figure 13 Europe Biodegradable Chelating Agents Market Share Analysis, by Product Chemistry

Figure 14 Europe Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

Figure 15 Europe Biodegradable Chelating Agents Market Share Analysis, by End-use Industry

Figure 16 Europe Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

Figure 17 Europe Biodegradable Chelating Agents Market Share Analysis, by Country and Sub-region

Figure 18 Europe Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

Figure 19 Asia Pacific Biodegradable Chelating Agents Market Share Analysis, by Product Chemistry

Figure 20 Asia Pacific Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

Figure 21 Asia Pacific Biodegradable Chelating Agents Market Share Analysis, by End-use Industry

Figure 22 Asia Pacific Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

Figure 23 Asia Pacific Biodegradable Chelating Agents Market Share Analysis, by Country and Sub-region

Figure 24 Asia Pacific Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

Figure 25 Latin America Biodegradable Chelating Agents Market Share Analysis, by Product Chemistry

Figure 26 Latin America Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

Figure 27 Latin America Biodegradable Chelating Agents Market Share Analysis, by End-use Industry

Figure 28 Latin America Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

Figure 29 Latin America Biodegradable Chelating Agents Market Share Analysis, by Country and Sub-region

Figure 30 Latin America Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region

Figure 31 Middle East & Africa Biodegradable Chelating Agents Market Share Analysis, by Product Chemistry

Figure 32 Middle East & Africa Biodegradable Chelating Agents Market Attractiveness Analysis, by Product Chemistry

Figure 33 Middle East & Africa Biodegradable Chelating Agents Market Share Analysis, by End-use Industry

Figure 34 Middle East & Africa Biodegradable Chelating Agents Market Attractiveness Analysis, by End-use Industry

Figure 35 Middle East & Africa Biodegradable Chelating Agents Market Share Analysis, by Country and Sub-region

Figure 36 Middle East & Africa Biodegradable Chelating Agents Market Attractiveness Analysis, by Country and Sub-region