Analysts’ Viewpoint on Biobanking Market Scenario

Biobanking represents a new and innovative research field that involves international infrastructure and governmental organizations, which help in the adoption of best practices and provide scientific, ethical, and legal guidelines for the industry and public health. Imaging biobanks connected to biological samples and patients' clinical data is a new area in biobanking. Biobanks can help create multi-omics biobanks, where findings from genomics, proteomics, and metabolomics could be combined with radiomic data to create a novel and individualized method of treating a disease. Biobanking is becoming more sophisticated, akin to any industry in its early stages of development. Automation will play a significant role in biobanking storage, as the movement toward centralization and standardization continues. The global biobanking market size is expected to be driven by the growth in demand for personalized medicine, which will broaden the applications of biospecimen to facilitate ground-breaking treatments in areas of complex disease in the next few years.

The term 'biobanking' is often misused to refer to any collection of human biological specimens (biospecimens), regardless of the standards established for various tissue collection procedures or requirements pertaining to ethical and legal considerations. The process of collecting bodily fluids or tissue samples for usage in research to better understand health and disease is referred to as biobanking. Biobank is a sizable collection of biospecimens that are kept primarily for usage in health and medical research, and are linked to pertinent personal and health data (such as electronic medical record, family history, lifestyle, and genetic information).

The National Centre for Advanced Research and Excellence in Heart Failure (CARE-HF) at SCTIMST was established by ICMR to expand research in the field, as heart failure emerged as a significant health issue in India. One of the project's key components is the Heart Failure Biobank, which received funding of US$ 85,000 to build cutting-edge storage facilities.

In terms of usage and design (focused on populations or diseases), biobanks are diverse (epidemiology, translational, pharmaceutical research). Biobanks include information and samples from large-scale epidemiologic collections, family studies, patients with a particular disease, clinical trials of novel treatments, or patients with the disease in question. Data and samples are invariably gathered according to various guidelines, standards, and objectives.

According to the biobanking market analysis, little standardization has taken place across biobanks due to the challenges of data collection and sample storage within studies. The field of biome biobank research is rapidly evolving; however, the necessary biobanking infrastructure is currently fragmented and unprepared for microbiome biobanking. A number of international initiatives and protocols have recently been developed to address this issue. The goal of procedure standardization and harmonization is to facilitate data sharing among various resources, increasing effective sample size and statistical power, particularly for rare diseases.

Diversity of public participation in biobanking is a highlight of biobank success. Increase in number of biobanks across the world reflects their potential to improve the reproducibility and meaning of data generated by biomedical research. The fact that biospecimens are collected using strict and standardized methodologies ensures reproducibility, while meaningfulness is achieved by linking relevant information to biospecimens themselves as well as their donors. Biobanks' success is dependent on the participation of diverse groups of people.

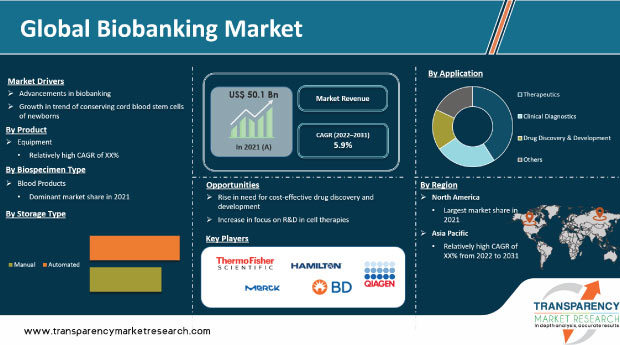

Increase in funding for biobanking from private and government organizations and expansion of application areas of bio-banked samples are the major factors driving the global biobanking market size. Availability of government funding for regenerative medicine, stem cell therapeutics, and cell & gene therapy is encouraging research in this area. Furthermore, growth in trend of cord blood banking is expected to contribute to the growth of the market.

Future prospects, such as advancements in orthopedic procedures using stem cells, are expected to fuel the regenerative medicine market. Genomic research is a key driver of the global market. Government support for regenerative medicine research through various initiatives is also likely to increase biobanking market share.

Based on product, the equipment segment accounted for the largest share of the global biobanking market in 2021. Biobanking equipment is used in biorepositories to store biological samples for research purposes. Researchers use biobanking equipment to conduct tests or analyze specimens stored in a biobank. Along with equipment and consumables, software and services play an important role in assisting researchers in their studies of various diseases.

Surge in demand for personalized medicine, owing to high unmet medical requirements for developing effective therapies, is a key factor propelling the equipment segment. Increase in pharmaceutical R&D budgets by governments and private players is expected to support research activities. This is likely to augment the equipment segment.

In terms of biospecimen type, the blood products segment held significant market share in 2021. Blood is one of the most frequently used biospecimens in research. Depending on the downstream application and blood fraction required, it is collected in tubes containing preservatives and additives (serum, plasma, white blood cells, red cells). Serum samples are typically collected in tubes containing a clot accelerator such as thrombin or silica, while plasma samples can be collected in tubes containing various anticoagulant additives. Majority of biochemical analyses are performed on serum, while DNA and RNA analyses are performed on anticoagulated blood. These practices have the potential to introduce heterogeneity into basic data. Citrate-stabilized blood, for example, yields higher DNA and RNA quality and more lymphocytes for culture than other anti-coagulants, while EDTA-coated collection tubes would be preferred for protein assays and most DNA-molecule analyses.

Based on application, the therapeutics segment is projected to account for major share of the global biobanking market during the forecast period. Clinical trials and research-based innovative activities such as personalized medicine aim to broaden the applications of biospecimens in research. Demand for precision medicines is high, as these promise breakthrough treatments in the most complex disease areas. Biobanks stand to benefit significantly from the growth in trend of precision medicines due to the sample data they possess, which is critical to precision medicine applications in therapy areas such as oncology, psychiatry, infectious diseases, and cardiology.

Institutes are conducting studies on the usage of cord blood in various areas of science that could benefit human health. The Lund University in Sweden launched the world's largest biobank in 2020 to better understand and conduct research in the most common diseases such as Alzheimer's, Parkinson's, cardiovascular disease, and diabetes. Hence, surge in research activities has been observed in cord blood applications in the past few years. This is expected to increase the demand for cord blood, which in turn, is likely to augment the therapeutics segment.

In terms of storage type, the automated segment is anticipated to grow at a rapid pace during the forecast period. Increase in demand for biobanking has induced biobanks to turn to automation to help maintain sample integrity and uphold their stringent specimen tracking standards. Automation can be used to improve access, cost, and throughput at various stages of the biobanking process.

Automated transport of biological samples from clinics and pre-analytical labs to the biobank has several advantages over manual sample transport. The primary advantage is the ability to deliver specimens 24 hours a day, seven days a week, without the need for staff to be present at all times, resulting in lower personnel costs. Moving samples around the lab can be aided by automated workstations.

In order to ensure consistent quality, the collection, processing, storage, and retrieval of samples by biobanks and biorepositories should be standardized, harmonized, and quality controlled to the highest level possible. This can be accomplished by putting in place a quality management system (QMS) and standard operating procedures (SOPs). Implementing technical solutions, particularly the automation of critical biobanking process areas, could help support this process. Automation improves reproducibility and accuracy, while decreasing the incidence of mislabeled or misplaced samples by reducing or eliminating human handling steps.

North America accounted for the largest share of the global biobanking market in 2021. The region is projected to be a highly lucrative market during the forecast period, with high market attractiveness index. This can be ascribed to the increase in adoption of advanced technologies and rise in awareness about biobanking among healthcare professionals and individuals working in the research and development industry. Furthermore, increase in R&D activities in the healthcare sector to develop novel biobanking and presence of major players are anticipated to drive the biobanking market in the region during the forecast period.

The market in Asia Pacific is expected to grow at a rapid pace from 2022 to 2031. This can be ascribed to the increase in geriatric population, which is more susceptible to chronic diseases; better health care infrastructure; and rise in demand for biospecimen products in the region.

The global biobanking market is consolidated, with the presence of small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players in the global biobanking market. Thermo Fisher Scientific, Inc., PHC Holdings Corporation (Panasonic Healthcare), Hamilton Company, Chart Industries, Inc., VWR International, LLC, QIAGEN N.V., Greiner AG, Brooks Automation, Inc., Merck KGaA, and Tecan Trading AG are the prominent players operating in the global biobanking market.

Each of these players has been profiled in the biobanking market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 50.1 Bn |

| Market Forecast Value in 2031 | More than US$ 87.4 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global biobanking market was valued at US$ 50.1 Bn in 2021

The global market is projected to reach more than US$ 87.4 Bn by 2031

The global biobanking market is anticipated to grow at a CAGR of 5.9% from 2022 to 2031

Advancements in biobanking and growth in trend of conserving cord blood stem cells of newborns are driving the global biobanking market

North America is expected to account for major share of the global biobanking market during the forecast period

Thermo Fisher Scientific, Inc., Tecan Group Ltd., Qiagen N.V., Hamilton Company, Brooks Automation, TTP Labtech Ltd., VWR Corporation, Promega Corporation, Worthington Industries, Chart Industries, Becton, Dickinson and Company, and Merck KGaA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Biobanking Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Biobanking Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancement

5.2. List of Major Biobanks, by Region

5.3. List of Vendors Supporting Automated Biobanking

5.4. COVID-19 Impact Analysis

5.5. Regulatory Scenario by Region/globally

6. Global Biobanking Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Equipment

6.3.1.1. Temperature Control Systems

6.3.1.2. Incubators & Centrifuges

6.3.1.3. Alarms & Monitoring Systems

6.3.1.4. Accessories & Other equipment

6.3.2. Consumables

6.3.2.1. Cryovials & Cryomolds

6.3.2.2. Tubes

6.3.2.3. Others

6.3.3. Software & Services

6.4. Market Attractiveness Analysis, by Product

7. Global Biobanking Market Analysis and Forecast, by Biospecimen Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Biospecimen Type, 2017-2031

7.3.1. Blood Products

7.3.2. Human Tissues

7.3.3. Cell Lines

7.3.4. Nucleic Acids

7.3.5. Others

7.4. Market Attractiveness Analysis, by Biospecimen Type

8. Global Biobanking Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Therapeutics

8.3.2. Clinical Diagnostics

8.3.3. Drug Discovery & Development

8.3.4. Others

8.3.5. Neuropathic Pain

8.3.6. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Biobanking Market Analysis and Forecast, by Storage Product

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Storage Product, 2017-2031

9.3.1. Manual

9.3.2. Automated

9.4. Market Attractiveness Analysis, by Storage Product

10. Global Biobanking Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Biobanking Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Equipment

11.2.1.1. Temperature Control Systems

11.2.1.2. Incubators & Centrifuges

11.2.1.3. Alarms & Monitoring Systems

11.2.1.4. Accessories & Other equipment

11.2.2. Consumables

11.2.2.1. Cryovials & Cryomolds

11.2.2.2. Tubes

11.2.2.3. Others

11.2.3. Software & Services

11.3. Market Value Forecast, by Biospecimen Type, 2017-2031

11.3.1. Blood Products

11.3.2. Human Tissues

11.3.3. Cell Lines

11.3.4. Nucleic Acids

11.3.5. Others

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Therapeutics

11.4.2. Clinical Diagnostics

11.4.3. Drug Discovery & Development

11.4.4. Others

11.4.5. Neuropathic Pain

11.4.6. Others

11.5. Market Value Forecast, by Storage Product, 2017-2031

11.5.1. Manual

11.5.2. Automated

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Biospecimen Type

11.7.3. By Application

11.7.4. By Storage Product

11.7.5. By Country

12. Europe Biobanking Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Equipment

12.2.1.1. Temperature Control Systems

12.2.1.2. Incubators & Centrifuges

12.2.1.3. Alarms & Monitoring Systems

12.2.1.4. Accessories & Other equipment

12.2.2. Consumables

12.2.2.1. Cryovials & Cryomolds

12.2.2.2. Tubes

12.2.2.3. Others

12.2.3. Software & Services

12.3. Market Value Forecast, by Biospecimen Type, 2017-2031

12.3.1. Blood Products

12.3.2. Human Tissues

12.3.3. Cell Lines

12.3.4. Nucleic Acids

12.3.5. Others

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Therapeutics

12.4.2. Clinical Diagnostics

12.4.3. Drug Discovery & Development

12.4.4. Others

12.4.5. Neuropathic Pain

12.4.6. Others

12.5. Market Value Forecast, by Storage Product, 2017-2031

12.5.1. Manual

12.5.2. Automated

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Biospecimen Type

12.7.3. By Application

12.7.4. By Storage Product

12.7.5. By Country/Sub-region

13. Asia Pacific Biobanking Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Equipment

13.2.1.1. Temperature Control Systems

13.2.1.2. Incubators & Centrifuges

13.2.1.3. Alarms & Monitoring Systems

13.2.1.4. Accessories & Other equipment

13.2.2. Consumables

13.2.2.1. Cryovials & Cryomolds

13.2.2.2. Tubes

13.2.2.3. Others

13.2.3. Software & Services

13.3. Market Value Forecast, by Biospecimen Type, 2017-2031

13.3.1. Blood Products

13.3.2. Human Tissues

13.3.3. Cell Lines

13.3.4. Nucleic Acids

13.3.5. Others

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Therapeutics

13.4.2. Clinical Diagnostics

13.4.3. Drug Discovery & Development

13.4.4. Others

13.4.5. Neuropathic Pain

13.4.6. Others

13.5. Market Value Forecast, by Storage Product, 2017-2031

13.5.1. Manual

13.5.2. Automated

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Biospecimen Type

13.7.3. By Application

13.7.4. By Storage Product

13.7.5. By Country/Sub-region

14. Latin America Biobanking Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017-2031

14.2.1. Equipment

14.2.1.1. Temperature Control Systems

14.2.1.2. Incubators & Centrifuges

14.2.1.3. Alarms & Monitoring Systems

14.2.1.4. Accessories & Other equipment

14.2.2. Consumables

14.2.2.1. Cryovials & Cryomolds

14.2.2.2. Tubes

14.2.2.3. Others

14.2.3. Software & Services

14.3. Market Value Forecast, by Biospecimen Type, 2017-2031

14.3.1. Blood Products

14.3.2. Human Tissues

14.3.3. Cell Lines

14.3.4. Nucleic Acids

14.3.5. Others

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Therapeutics

14.4.2. Clinical Diagnostics

14.4.3. Drug Discovery & Development

14.4.4. Others

14.4.5. Neuropathic Pain

14.4.6. Others

14.5. Market Value Forecast, by Storage Product, 2017-2031

14.5.1. Manual

14.5.2. Automated

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Biospecimen Type

14.7.3. By Application

14.7.4. By Storage Product

14.7.5. By Country/Sub-region

15. Middle East & Africa Biobanking Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017-2031

15.2.1. Equipment

15.2.1.1. Temperature Control Systems

15.2.1.2. Incubators & Centrifuges

15.2.1.3. Alarms & Monitoring Systems

15.2.1.4. Accessories & Other equipment

15.2.2. Consumables

15.2.2.1. Cryovials & Cryomolds

15.2.2.2. Tubes

15.2.2.3. Others

15.2.3. Software & Services

15.3. Market Value Forecast, by Biospecimen Type, 2017-2031

15.3.1. Blood Products

15.3.2. Human Tissues

15.3.3. Cell Lines

15.3.4. Nucleic Acids

15.3.5. Others

15.4. Market Value Forecast, by Application, 2017-2031

15.4.1. Therapeutics

15.4.2. Clinical Diagnostics

15.4.3. Drug Discovery & Development

15.4.4. Others

15.4.5. Neuropathic Pain

15.4.6. Others

15.5. Market Value Forecast, by Storage Product, 2017-2031

15.5.1. Manual

15.5.2. Automated

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Biospecimen Type

15.7.3. By Application

15.7.4. By Storage Product

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competitive Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2021)

16.3. Company Profiles

16.3.1. Thermo Fisher Scientific, Inc.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. SWOT Analysis

16.3.1.4. Financial Overview

16.3.1.5. Strategic Overview

16.3.2. PHC Holdings Corporation (Panasonic Healthcare)

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. SWOT Analysis

16.3.2.4. Financial Overview

16.3.2.5. Strategic Overview

16.3.3. Hamilton Company

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. SWOT Analysis

16.3.3.4. Financial Overview

16.3.3.5. Strategic Overview

16.3.4. Chart Industries, Inc.

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. SWOT Analysis

16.3.4.4. Financial Overview

16.3.4.5. Strategic Overview

16.3.5. VWR International

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. SWOT Analysis

16.3.5.4. Financial Overview

16.3.5.5. Strategic Overview

16.3.6. LLC (Avantor, Inc.)

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. SWOT Analysis

16.3.6.4. Financial Overview

16.3.6.5. Strategic Overview

16.3.7. QIAGEN N.V.

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. SWOT Analysis

16.3.7.4. Financial Overview

16.3.7.5. Strategic Overview

16.3.8. Greiner AG

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. SWOT Analysis

16.3.8.4. Financial Overview

16.3.8.5. Strategic Overview

16.3.9. Brooks Automation, Inc.

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. SWOT Analysis

16.3.9.4. Financial Overview

16.3.9.5. Strategic Overview

16.3.10. Merck KGaA

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. SWOT Analysis

16.3.10.4. Financial Overview

16.3.10.5. Strategic Overview

16.3.11. Tecan Trading AG.

16.3.11.1. Company Overview

16.3.11.2. Product Portfolio

16.3.11.3. SWOT Analysis

16.3.11.4. Financial Overview

16.3.11.5. Strategic Overview

16.3.12. Micronic

16.3.12.1. Company Overview

16.3.12.2. Product Portfolio

16.3.12.3. SWOT Analysis

16.3.12.4. Financial Overview

16.3.12.5. Strategic Overview

16.3.13. Greiner Bio One

16.3.13.1. Company Overview

16.3.13.2. Product Portfolio

16.3.13.3. SWOT Analysis

16.3.13.4. Financial Overview

16.3.13.5. Strategic Overview

16.3.14. Biobank AS

16.3.14.1. Company Overview

16.3.14.2. Product Portfolio

16.3.14.3. SWOT Analysis

16.3.14.4. Financial Overview

16.3.14.5. Strategic Overview

16.3.15. Biokryo GmbH

16.3.15.1. Company Overview

16.3.15.2. Product Portfolio

16.3.15.3. SWOT Analysis

16.3.15.4. Financial Overview

16.3.15.5. Strategic Overview

List of Tables

Table 01: Global Biobanking Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Biobanking Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Biobanking Market Size (US$ Mn) Forecast, by Biospecimen Type, 2017-2031

Table 04: Global Biobanking Market Size (US$ Mn) Forecast, by Storage Type, 2017-2031

Table 05: Global Biobanking Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Biobanking Market Size (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Biobanking Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 08: North America Biobanking Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 09: North America Biobanking Market Size (US$ Mn) Forecast, by Biospecimen Type, 2017-2031

Table 10: North America Biobanking Market Size (US$ Mn) Forecast, by Storage Type, 2017-2031

Table 11: Europe Biobanking Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Biobanking Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 13: Europe Biobanking Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 14: Europe Biobanking Market Size (US$ Mn) Forecast, by Biospecimen Type, 2017-2031

Table 15: Europe Biobanking Market Size (US$ Mn) Forecast, by Storage Type, 2017-2031

Table 16: Asia Pacific Biobanking Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Biobanking Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 18: Asia Pacific Biobanking Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Asia Pacific Biobanking Market Size (US$ Mn) Forecast, by Biospecimen Type, 2017-2031

Table 20: Asia Pacific Biobanking Market Size (US$ Mn) Forecast, by Storage Type, 2017-2031

Table 21: Latin America Biobanking Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Biobanking Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 23: Latin America Biobanking Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Latin America Biobanking Market Size (US$ Mn) Forecast, by Biospecimen Type, 2017-2031

Table 25: Latin America Biobanking Market Size (US$ Mn) Forecast, by Storage Type, 2017-2031

Table 26: Middle East & Africa Biobanking Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Biobanking Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 28: Middle East & Africa Biobanking Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 29: Middle East & Africa Biobanking Market Size (US$ Mn) Forecast, by Biospecimen Type, 2017-2031

Table 30: Middle East & Africa Biobanking Market Size (US$ Mn) Forecast, by Storage Type, 2017-2031

List of Figures

Figure 01: Global Biobanking Market Size (US$ Mn) and Distribution (%), by Region, 2021 and 2031

Figure 02: Global Biobanking Market Revenue (US$ Mn), by Product, 2021

Figure 03: Global Biobanking Market Value Share, by Product, 2021

Figure 04: Global Biobanking Market Value Share, by Application, 2021

Figure 05: Global Biobanking Market Value Share, by Biospecimen Type, 2021

Figure 06: Global Biobanking Market Value Share, by Storage Type, 2021

Figure 07: Global Biobanking Market Value Share, by Region, 2021

Figure 08: Global Biobanking Market Value (US$ Mn) Forecast, 2017-2031

Figure 09: Global Biobanking Market Value Share Analysis, by Product, 2017 and 2031

Figure 10: Global Biobanking Market Attractiveness Analysis, by Product, 2022-2031

Figure 11: Global Biobanking Market Value Share Analysis, by Application, 2017 and 2031

Figure 12: Global Biobanking Market Attractiveness Analysis, by Application, 2022-2031

Figure 13: Global Biobanking Market Value Share Analysis, by Biospecimen Type, 2017 and 2031

Figure 14: Global Biobanking Market Attractiveness Analysis, by Storage type, 2022-2031

Figure 15: Global Biobanking Market Value Share Analysis, by Storage Type, 2017 and 2031

Figure 16: Global Biobanking Market Value Share Analysis, by Region, 2017 and 2031

Figure 17: Global Biobanking Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Biobanking Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 19: North America Biobanking Market Attractiveness Analysis, by Country, 2017-2031

Figure 20: North America Biobanking Market Value Share Analysis, by Country, 2017 and 2031

Figure 21: North America Biobanking Market Value Share Analysis, by Product, 2017 and 2031

Figure 22: North America Biobanking Market Value Share Analysis, by Application, 2017 and 2031

Figure 23: North America Biobanking Market Value Share Analysis, by Biospecimen Type, 2017 and 2031

Figure 24: North America Biobanking Market Value Share Analysis, by Storage Type, 2017 and 2031

Figure 25: North America Biobanking Market Attractiveness Analysis, by Product, 2022-2031

Figure 26: North America Biobanking Market Attractiveness Analysis, by Application, 2022-2031

Figure 27: North America Biobanking Market Attractiveness Analysis, by Biospecimen Type, 2022-2031

Figure 28: North America Biobanking Market Attractiveness Analysis, by Storage Type, 2022-2031

Figure 29: Europe Biobanking Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 30: Europe Biobanking Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 31: Europe Biobanking Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 32: Europe Biobanking Market Value Share Analysis, by Product, 2017 and 2031

Figure 33: Europe Biobanking Market Value Share Analysis, by Application, 2017 and 2031

Figure 34: Europe Biobanking Market Value Share Analysis, by Biospecimen Type, 2017 and 2031

Figure 35: Europe Biobanking Market Value Share Analysis, by Storage Type, 2022-2031

Figure 36: Europe Biobanking Market Attractiveness Analysis, by Product, 2022-2031

Figure 37: Europe Biobanking Market Attractiveness Analysis, by Application, 2022-2031

Figure 38: Europe Biobanking Market Attractiveness Analysis, by Biospecimen Type, 2022-2031

Figure 39: Europe Biobanking Market Attractiveness Analysis, by Storage Type, 2022-2031

Figure 40: Asia Pacific Biobanking Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 41: Asia Pacific Biobanking Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 42: Asia Pacific Biobanking Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 43: Asia Pacific Biobanking Market Value Share Analysis, by Product, 2017 and 2031

Figure 44: Asia Pacific Biobanking Market Value Share Analysis, by Application, 2017 and 2031

Figure 45: Asia Pacific Biobanking Market Value Share Analysis, by Biospecimen Type, 2017 and 2031

Figure 46: Asia Pacific Biobanking Market Value Share Analysis, by Storage Type, 2022-2031

Figure 47: Asia Pacific Biobanking Market Attractiveness Analysis, by Product, 2022-2031

Figure 48: Asia Pacific Biobanking Market Attractiveness Analysis, by Application, 2022-2031

Figure 49: Asia Pacific Biobanking Market Attractiveness Analysis, by Biospecimen Type, 2022-2031

Figure 50: Asia Pacific Biobanking Market Attractiveness Analysis, by Storage Type, 2022-2031

Figure 51: Latin America Biobanking Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 52: Latin America Biobanking Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 53: Latin America Biobanking Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 54: Latin America Biobanking Market Value Share Analysis, by Product, 2017 and 2031

Figure 55: Latin America Biobanking Market Value Share Analysis, by Application, 2017 and 2031

Figure 56: Latin America Biobanking Market Value Share Analysis, by Biospecimen Type, 2017 and 2031

Figure 57: Latin America Biobanking Market Value Share Analysis, by Storage Type, 2022-2031

Figure 58: Latin America Biobanking Market Attractiveness Analysis, by Product, 2022-2031

Figure 59: Latin America Biobanking Market Attractiveness Analysis, by Application, 2022-2031

Figure 60: Latin America Biobanking Market Attractiveness Analysis, by Biospecimen Type, 2022-2031

Figure 61: Latin America Biobanking Market Attractiveness Analysis, by Storage Type, 2022-2031

Figure 62: Middle East & Africa Biobanking Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 63: Middle East & Africa Biobanking Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 64: Middle East & Africa Biobanking Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 65: Middle East & Africa Biobanking Market Value Share Analysis, by Product, 2017 and 2031

Figure 66: Middle East & Africa Biobanking Market Value Share Analysis, by Application, 2017 and 2031

Figure 67: Middle East & Africa Biobanking Market Value Share Analysis, by Storage Type, 2017 and 2031

Figure 68: Middle East & Africa Biobanking Market Attractiveness Analysis, by Product, 2022-2031

Figure 69: Middle East & Africa Biobanking Market Attractiveness Analysis, by Application, 2022-2031

Figure 70: Middle East & Africa Biobanking Market Attractiveness Analysis, by Biospecimen Type, 2022-2031

Figure 71: Middle East & Africa Biobanking Market Attractiveness Analysis, by Storage Type, 2022-2031