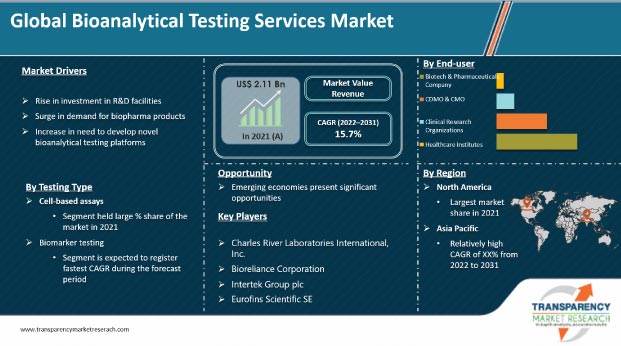

The global bioanalytical testing services industry was valued at US$ 2.11 Bn in 2021

The global market is projected to advance at a CAGR of 15.7% from 2022 to 2031

The global market is anticipated to reach more than US$ 8.95 Bn by 2031

Analysts’ Viewpoint on Bioanalytical Testing Services Market Scenario

Bioanalytical testing is used for quantitative determination of properties of drugs and metabolites in biological fluids, primarily blood, plasma, serum, urine, or tissue extracts. Rise in demand for biopharma products and growth in usage of biosimilars for different indications, especially diabetes and cancer, are key factors projected to drive the global market. Most of the pharmaceutical companies, bioanalytical laboratories, and CROs are scaling up their bioanalytical services and investing in bioanalytical testing laboratories.

Rise in demand for biopharma products and increase in need to develop novel bioanalytical assay platforms are the key factors driving investments in bioanalytical R&D and laboratories. Increase in trend of outsourcing laboratory testing services for quality check has encouraged companies to offer various types of services and solutions in the market. This is anticipated to propel the market. Growth in merger and acquisition activities across the globe is also augmenting the demand for bioanalytical assay services. For instance, in October 2021, BioAgilytix signed an agreement to acquire Australia-based 360biolabs.

Bioanalytical diagnostic technologies play a crucial role in containing the COVID-19 pandemic. They are likely to help contain the future waves of the pandemic and infectious disease outbreaks. In the event of a major pandemic such as COVID-19, a combination of different diagnostic technologies (centralized and point-of-care, and reliance on multiple biomarkers) is required for effective diagnosis, treatment selection, prognosis, patient monitoring, and epidemiological surveillance.

Several biotech and pharmaceutical companies have been focusing on developing effective technologies for rapid diagnosis of COVID-19. They have been concentrating on developing vaccines/therapeutics that can help mitigate the spread of the disease by ensuring appropriateness of care across all healthcare settings and achieving high-quality outcomes. This is driving the demand for bioanalytical assay services across the globe. For instance, CIRION BioPharma Research, Inc., a GLP-certified contract research laboratory based in the U.S., announced in July 2020 that it was expanding its bioanalytical testing services to support COVID-19 drug and vaccine development.

Immunogenicity testing is required throughout the development process to assess the immune response in preclinical models using clinical samples. Immunogenicity testing examines antibodies created against a treatment. It helps establish efficacy and safety with assurance in vaccine and biologics production or gene therapy. Hence, immunology bioanalytical tests are crucial in the clinical phase for practically all modern medicines, from monoclonal antibodies (mAbs) for oncology to vaccine programs and gene & cell therapies. Any therapy that provokes an immune response requires clinical immunological testing to ensure that the response does not jeopardize patient safety. In terms of application, immunology is likely to be the fastest growing segment of the global market during the forecast period. Therefore, increase in usage of immunogenicity and immune-based therapy is projected to boost the immunology segment during the forecast period.

The mass spectrometry segment is projected to account for major share of the global bioanalytical testing services market by 2031. R&D spending by pharmaceutical companies has increased significantly in the last two decades. Biopharmaceutical research is supported by investments in specialties such as biopharma and precision medicine. The study of large molecules is currently a hot topic of discussion in the bioanalytical community. Growing importance of peptides and proteins as therapeutic agents, combined with the significant opportunities provided by new MS-based technology, has opened up a whole new world for bioanalytical scientists. Rise in usage of mass spectrometers in pharmaceutical and biopharmaceutical industries and adoption of new applications in the bioanalytical testing services industry are the key factors driving the mass spectroscopy segment.

Based on end-user, the biotech & pharmaceutical companies segment is projected to advance at a CAGR of 15.1% during the forecast period. Biotech and pharmaceutical companies are focusing on specialized testing services including gene expression analysis, liquid chromatography-mass spectrometry (LC/MS), raw material wet chemistry analysis, and metal analysis with inductive mass spectrometry (ICP-MS). Furthermore, pharmaceutical companies are increasing outsourcing of early-phase development, clinical, and laboratory testing services to boost revenue, avoid high capital spending, and decrease the time taken to validate processes and products.

North America is projected to be a highly attractive region of the global market during the forecast period. The region accounted for more than 45% share of the global market in 2021 due to the presence of large number of patients with various chronic diseases and rise in adoption of peptides and other large molecule therapeutics. According to the Centers for Disease Control and Prevention, more than 877,500 people in the U.S. succumb to heart disease or stroke every year (i.e., one-third of all deaths). These diseases take an economic toll, costing the health care system US$ 216 Bn per year.

Europe was the second largest bioanalytical testing services market in terms of revenue in 2021. High share of the region can be ascribed to the increase in investment in biotechnology and pharmaceutical R&D activities. Furthermore, rise in in cases of chronic diseases is driving the market in Europe. For instance, cardiovascular disease (CVD) accounted for 3.9 million deaths in Europe in 2017. Around 15% of CVD deaths in the region are due to high blood sugar. Prevalence of diabetes in the region is high. It has increased rapidly in the past 10 years, rising by more than 50% in several countries in the region. Hence, increase in incidence of diseases is propelling the market in Europe.

The market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Increase in clinical trial activities in emerging markets is primarily ascribed to factors such as cost savings, large treatment-naive population, retention of clinical trial participants, and constantly improving regulatory procedures. Furthermore, China's bioanalytical testing services have increased due to the growth in drug innovation and development activities in the last decade. This is expected to drive the market in the country during the forecast period.

This report includes vital information about the key players operating in the global bioanalytical testing services market. Companies are focusing on strategies such as new product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. Charles River Laboratories International, Inc., Bioreliance Corporation, Intertek Group plc, Eurofins Scientific SE, BioclinResearch Laboratories, Labcorp, Wuxi AppTec, Envigo, BioAgilytix Labs, Syneos Health, and Frontage Labs are the prominent players operating in the global market.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.11 Bn |

|

Market Forecast Value in 2031 |

More than US$ 8.95 Bn |

|

Compound Annual Growth Rate (CAGR) |

15.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.11 Bn in 2021.

The global market is projected to reach more than US$ 8.95 Bn by 2031.

The global market grew at a CAGR of 6% from 2017 to 2021.

The global market is anticipated to grow at a CAGR of 15.7% from 2022 to 2031.

Rise in investment in R&D facilities, surge in demand for biopharma products, and increase in need to develop novel bioanalytical testing platforms are the key factors driving the global market.

The cell-based bioassay segment accounted for more than 30% share of the global market in 2021.

North America is expected to account for major share of the global market during the forecast period.

Charles River Laboratories International Inc., Bioreliance Corporation, Intertek Group plc, Eurofins Scientific SE, BioclinResearch Laboratories, Labcorp, Wuxi AppTec, Envigo, BioAgilytix Labs, SyneosHealth, and Frontage Labs are the prominent players operating in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Bioanalytical Testing Services Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Bioanalytical Testing Services Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Pipeline Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemics Impact on Industry (value chain and short / mid / long term impact)

6. Global Bioanalytical Testing Services Market Analysis and Forecast, by Testing Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Testing Type, 2017–2031

6.3.1. Cell-based Assays

6.3.2. Virology Testing

6.3.3. Serology, Immunogenicity, and Neutralizing Antibodies

6.3.4. Toxicology Services

6.3.5. Biomarker Testing

6.3.6. Pharmacokinetic Testing

6.3.7. Other services

6.4. Market Attractiveness Analysis, by Testing Type

7. Global Bioanalytical Testing Services Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Oncology

7.3.2. Metabolic Disorders

7.3.3. Neurology

7.3.4. Hematology

7.3.5. Orthopedics

7.3.6. Immunology

7.3.7. Other

7.4. Market Attractiveness Analysis, by Application

8. Global Bioanalytical Testing Services Market Analysis and Forecast, by Technology

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Technology, 2017–2031

8.3.1. Mass Spectrometry

8.3.2. Chromatography

8.3.3. Others

8.4. Market Attractiveness Analysis, by Technology

9. Global Bioanalytical Testing Services Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Healthcare Institutes

9.3.2. Biotech & Pharmaceuticals Company

9.3.3. CDMO & CMO

9.3.4. Clinical Research Organizations

9.4. Market Attractiveness Analysis, by End-user

10. Global Bioanalytical Testing Services Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Bioanalytical Testing Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Testing Type, 2017–2031

11.2.1. Cell-based Assays

11.2.2. Virology Testing

11.2.3. Serology, Immunogenicity, and Neutralizing Antibodies

11.2.4. Toxicology Services

11.2.5. Biomarker Testing

11.2.6. Pharmacokinetic Testing

11.2.7. Other services

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Oncology

11.3.2. Metabolic Disorders

11.3.3. Neurology

11.3.4. Hematology

11.3.5. Orthopedics

11.3.6. Immunology

11.3.7. Other

11.4. Market Value Forecast, by Technology, 2017–2031

11.4.1. Mass Spectrometry

11.4.2. Chromatography

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Healthcare Institutes

11.5.2. Biotech & Pharmaceuticals Company

11.5.3. CDMO & CMO

11.5.4. Clinical Research Organizations

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Testing Type

11.7.2. By Application

11.7.3. By Technology

11.7.4. By End-user

11.7.5. By Country

12. Europe Bioanalytical Testing Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Testing Type, 2017–2031

12.2.1. Cell-based Assays

12.2.2. Virology Testing

12.2.3. Serology, Immunogenicity, and Neutralizing Antibodies

12.2.4. Toxicology Services

12.2.5. Biomarker Testing

12.2.6. Pharmacokinetic Testing

12.2.7. Other Services

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Oncology

12.3.2. Metabolic Disorders

12.3.3. Neurology

12.3.4. Hematology

12.3.5. Orthopedics

12.3.6. Immunology

12.3.7. Other

12.4. Market Value Forecast, by Technology, 2017–2031

12.4.1. Mass Spectrometry

12.4.2. Chromatography

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Healthcare Institutes

12.5.2. Biotech & Pharmaceuticals Company

12.5.3. CDMO & CMO

12.5.4. Clinical Research Organizations

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Testing Type

12.7.2. By Application

12.7.3. By Technology

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Bioanalytical Testing Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Testing Type, 2017–2031

13.2.1. Cell-based Assays

13.2.2. Virology Testing

13.2.3. Serology, Immunogenicity, and Neutralizing Antibodies

13.2.4. Toxicology Services

13.2.5. Biomarker Testing

13.2.6. Pharmacokinetic Testing

13.2.7. Other Services

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Oncology

13.3.2. Metabolic Disorders

13.3.3. Neurology

13.3.4. Hematology

13.3.5. Orthopedics

13.3.6. Immunology

13.3.7. Other

13.4. Market Value Forecast, by Technology, 2017–2031

13.4.1. Mass Spectrometry

13.4.2. Chromatography

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Healthcare Institutes

13.5.2. Biotech & Pharmaceuticals Company

13.5.3. CDMO & CMO

13.5.4. Clinical Research Organizations

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Testing Type

13.7.2. By Application

13.7.3. By Technology

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Bioanalytical Testing Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Testing Type, 2017–2031

14.2.1. Cell-based Assays

14.2.2. Virology Testing

14.2.3. Serology, Immunogenicity, and Neutralizing Antibodies

14.2.4. Toxicology Services

14.2.5. Biomarker Testing

14.2.6. Pharmacokinetic Testing

14.2.7. Other Services

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Oncology

14.3.2. Metabolic Disorders

14.3.3. Neurology

14.3.4. Hematology

14.3.5. Orthopedics

14.3.6. Immunology

14.3.7. Other

14.4. Market Value Forecast, by Technology, 2017–2031

14.4.1. Mass Spectrometry

14.4.2. Chromatography

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Healthcare Institutes

14.5.2. Biotech & Pharmaceuticals Company

14.5.3. CDMO & CMO

14.5.4. Clinical Research Organizations

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Testing Type

14.7.2. By Application

14.7.3. By Technology

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Bioanalytical Testing Services Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Testing Type, 2017–2031

15.2.1. Cell-based Assays

15.2.2. Virology Testing

15.2.3. Serology, Immunogenicity, and Neutralizing Antibodies

15.2.4. Toxicology Services

15.2.5. Biomarker Testing

15.2.6. Pharmacokinetic Testing

15.2.7. Other Services

15.3. Market Value Forecast, by Application, 2017–2031

15.3.1. Oncology

15.3.2. Metabolic Disorders

15.3.3. Neurology

15.3.4. Hematology

15.3.5. Orthopedics

15.3.6. Immunology

15.3.7. Other

15.4. Market Value Forecast, by Technology, 2017–2031

15.4.1. Mass Spectrometry

15.4.2. Chromatography

15.4.3. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Healthcare Institutes

15.5.2. Biotech & Pharmaceuticals Company

15.5.3. CDMO & CMO

15.5.4. Clinical Research Organizations

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Testing Type

15.7.2. By Application

15.7.3. By Technology

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Company Profiles

16.3. Company Profiles

16.3.1. Charles River Laboratories International, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. SWOT Analysis

16.3.1.4. Strategic Overview

16.3.2. Bioreliance Corporation

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Intertek Group plc

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. SWOT Analysis

16.3.3.4. Strategic Overview

16.3.4. Eurofins Scientific SE

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. BioclinResearch Laboratories

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Labcorp

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. SWOT Analysis

16.3.6.4. Strategic Overview

16.3.7. Wuxi AppTec

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Envigo

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. BioAgilytix Labs

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. SWOT Analysis

16.3.9.4. Strategic Overview

16.3.10. SyneosHealth

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. SWOT Analysis

16.3.10.4. Strategic Overview

16.3.11. Frontage Labs

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. SWOT Analysis

16.3.11.4. Strategic Overview

List of Tables

Table 01: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 02: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 03: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 04: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 05: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by technology, 2017‒2031

Table 06: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by technology, 2017‒2031

Table 07: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 09: North America Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 10: North America Pericardial Patches Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 11: North America Bioanalytical Testing Services Market (US$ Mn) Forecast, by Application, 2017–2031

Table 12: North America Bioanalytical Testing Services Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 15: Europe Pericardial Patches Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 16: Europe Bioanalytical Testing Services Market (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Europe Bioanalytical Testing Services Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Asia Pacific Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 19: Asia Pacific Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 20: Asia Pacific Pericardial Patches Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 21: Asia Pacific Bioanalytical Testing Services Market (US$ Mn) Forecast, by Application, 2017–2031

Table 22: Asia Pacific Bioanalytical Testing Services Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 23: Latin America Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Latin America Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 25: Latin America Pericardial Patches Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 26: Latin America Bioanalytical Testing Services Market (US$ Mn) Forecast, by Application, 2017–2031

Table 27: Latin America Bioanalytical Testing Services Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 28: Middle-East & Africa Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 29: Middle-East & Africa Bioanalytical Testing Services Market Value (US$ Mn) Forecast, by Testing Type, 2017–2031

Table 30: Middle-East & Africa Pericardial Patches Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 31: Middle-East & Africa Bioanalytical Testing Services Market (US$ Mn) Forecast, by Application, 2017–2031

Table 32: Middle-East & Africa Bioanalytical Testing Services Market (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Bioanalytical Testing Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Bioanalytical Testing Services Market Value Share, by Testing Type, 2021

Figure 03: Global Bioanalytical Testing Services Market Value Share, by Technology, 2021

Figure 04: Global Bioanalytical Testing Services Market Value Share, by Application, 2021

Figure 05: Global Bioanalytical Testing Services Market Value Share, by End-user, 2021

Figure 06: Global Bioanalytical Testing Services Market Value Share, by Region, 2021

Figure 07: Global Bioanalytical Testing Services Market, by Testing Type, 2021 and 2031

Figure 08: Global Bioanalytical Testing Services Market Attractiveness Analysis, by Testing Type, 2022–2031

Figure 09: Global Bioanalytical Testing Services Market (US$ Mn), by Cell-based Assays, 2017–2031

Figure 10: Global Bioanalytical Testing Services Market (US$ Mn), by Virology Testing, 2017–2031

Figure 11: Global Bioanalytical Testing Services Market (US$ Mn), by Serology, Immunogenicity, and Neutralizing Antibodies, 2017–2031

Figure 12: Global Bioanalytical Testing Services Market (US$ Mn), by Toxicology Services, 2017–2031

Figure 13: Bioanalytical Testing Services Market (US$ Mn), by Biomarker Testing, 2017–2031

Figure 14: Global Bioanalytical Testing Services Market (US$ Mn), by Pharmacokinetic Testing, 2017–2031

Figure 15: Global Bioanalytical Testing Services Market (US$ Mn), by Other services, 2017–2031

Figure 16: Global Bioanalytical Testing Services Market, by Application, 2021 and 2031

Figure 17: Global Bioanalytical Testing Services Market Attractiveness Analysis, by Application, 2022–2031

Figure 18: Global Bioanalytical Testing Services Market (US$ Mn), by Oncology, 2017–2031

Figure 19: Global Bioanalytical Testing Services Market (US$ Mn), by Metabolic Disorders, 2017–2031

Figure 20: Global Bioanalytical Testing Services Market (US$ Mn), by Neurology, 2017–2031

Figure 21: Global Bioanalytical Testing Services Market (US$ Mn), by Hematology, 2017–2031

Figure 22: Global Bioanalytical Testing Services Market (US$ Mn), by Orthopedics, 2017–2031

Figure 23: Global Bioanalytical Testing Services Market (US$ Mn), by Immunology, 2017–2031

Figure 24: Global Bioanalytical Testing Services Market (US$ Mn), by Other, 2017–2031

Figure 25: Global Bioanalytical Testing Services Market, by Technology 2021 and 2031

Figure 26: Global Bioanalytical Testing Services Market Attractiveness Analysis, Technology, 2022–2031

Figure 27: Global Bioanalytical Testing Services Market (US$ Mn), by Mass Spectrometry, 2017–2031

Figure 28: Global Bioanalytical Testing Services Market (US$ Mn), by Chromatography, 2017–2031

Figure 29: Global Bioanalytical Testing Services Market (US$ Mn), by Others, 2017–2031

Figure 30: Global Bioanalytical Testing Services Market, by End-user 2021 and 2031

Figure 31: Global Bioanalytical Testing Services Market Attractiveness Analysis, End-user, 2022–2031

Figure 32: Global Bioanalytical Testing Services Market (US$ Mn), by Healthcare Institutes, 2017–2031

Figure 33: Global Bioanalytical Testing Services Market (US$ Mn), by Biotech & Pharmaceuticals Company, 2017–2031

Figure 34: Global Bioanalytical Testing Services Market (US$ Mn), by CDMO & CMO, 2017–2031

Figure 35: Global Bioanalytical Testing Services Market (US$ Mn), by Clinical Research Organizations, 2017–2031

Figure 36: Global Bioanalytical Testing Services Market Value Share Analysis, by Region, 2021 and 2031

Figure 37: Global Bioanalytical Testing Services Market Attractiveness Analysis, by Region, 2022–2031

Figure 38: North America Bioanalytical Testing Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: North America Bioanalytical Testing Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 40: North America Bioanalytical Testing Services Market Attractiveness Analysis, by Country, 2022–2031

Figure 41: North America Bioanalytical Testing Services Market, by Testing Type, 2021 and 2031

Figure 42: North America Bioanalytical Testing Services Market Attractiveness Analysis, by Testing Type, 2022–2031

Figure 43: North America Bioanalytical Testing Services Market, Technology, 2021 and 2031

Figure 44: North America Bioanalytical Testing Services Market Attractiveness Analysis, by Technology, 2022–2031

Figure 45: North America Bioanalytical Testing Services Market, by Application, 2021 and 2031

Figure 46: North America Bioanalytical Testing Services Market Attractiveness Analysis, Application, 2022–2031

Figure 47: North America Bioanalytical Testing Services Market, by End-user, 2021 and 2031

Figure 48: North America Bioanalytical Testing Services Market Attractiveness Analysis, End-user, 2022–2031

Figure 49: Europe Bioanalytical Testing Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Europe Bioanalytical Testing Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Europe Bioanalytical Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Europe Bioanalytical Testing Services Market, by Testing Type, 2021 and 2031

Figure 53: Europe Bioanalytical Testing Services Market Attractiveness Analysis, by Testing Type, 2022–2031

Figure 54: Europe Bioanalytical Testing Services Market, Technology, 2021 and 2031

Figure 55: Europe Bioanalytical Testing Services Market Attractiveness Analysis, by Technology, 2022–2031

Figure 56: Europe Bioanalytical Testing Services Market, by Application, 2021 and 2031

Figure 57: Europe Bioanalytical Testing Services Market Attractiveness Analysis, Application, 2022–2031

Figure 58: Europe Bioanalytical Testing Services Market, by End-user, 2021 and 2031

Figure 59: Europe Bioanalytical Testing Services Market Attractiveness Analysis, End-user, 2022–2031

Figure 60: Asia Pacific Bioanalytical Testing Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Asia Pacific Bioanalytical Testing Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 62: Asia Pacific Bioanalytical Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 63: Asia Pacific Bioanalytical Testing Services Market, by Testing Type, 2021 and 2031

Figure 64: Asia Pacific Bioanalytical Testing Services Market Attractiveness Analysis, by Testing Type, 2022–2031

Figure 65: Asia Pacific Bioanalytical Testing Services Market, Technology, 2021 and 2031

Figure 66: Asia Pacific Bioanalytical Testing Services Market Attractiveness Analysis, by Technology, 2022–2031

Figure 67: Asia Pacific Bioanalytical Testing Services Market, by Application, 2021 and 2031

Figure 68: Asia Pacific Bioanalytical Testing Services Market Attractiveness Analysis, Application, 2022–2031

Figure 69: Asia Pacific Bioanalytical Testing Services Market, by End-user, 2021 and 2031

Figure 70: Asia Pacific Bioanalytical Testing Services Market Attractiveness Analysis, End-user, 2022–2031

Figure 71: Latin America Bioanalytical Testing Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 72: Latin America Bioanalytical Testing Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 73: Latin America Bioanalytical Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 74: Latin America Bioanalytical Testing Services Market, by Testing Type, 2021 and 2031

Figure 75: Latin America Bioanalytical Testing Services Market Attractiveness Analysis, by Testing Type, 2022–2031

Figure 76: Latin America Bioanalytical Testing Services Market, Technology, 2021 and 2031

Figure 77: Latin America Bioanalytical Testing Services Market Attractiveness Analysis, by Technology, 2022–2031

Figure 78: Latin America Bioanalytical Testing Services Market Attractiveness Analysis, by Application, 2021 and 2031

Figure 79: Latin America Bioanalytical Testing Services Market, Application, 2022–2031

Figure 80: Latin America Bioanalytical Testing Services Market Attractiveness Analysis, by End-user, 2021 and 2031

Figure 81: Latin America Bioanalytical Testing Services Market, End-user, 2022–2031

Figure 82: Middle-East & Africa Bioanalytical Testing Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 83: Middle-East & Africa Bioanalytical Testing Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 84: Middle-East & Africa Bioanalytical Testing Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 85: Middle-East & Africa Bioanalytical Testing Services Market, by Testing Type, 2021 and 2031

Figure 86: Middle-East & Africa Bioanalytical Testing Services Market Attractiveness Analysis, by Testing Type, 2022–2031

Figure 87: Middle-East & Africa Bioanalytical Testing Services Market, Technology, 2021 and 2031

Figure 88: Middle-East & Africa Bioanalytical Testing Services Market Attractiveness Analysis, by Technology, 2022–2031

Figure 89: Middle-East & Africa Bioanalytical Testing Services Market Attractiveness Analysis, by Application, 2021 and 2031

Figure 90: Middle-East & Africa Bioanalytical Testing Services Market, Application, 2022–2031

Figure 91: Middle-East & Africa Bioanalytical Testing Services Market Attractiveness Analysis, by End-user, 2021 and 2031

Figure 92: Middle-East & Africa Bioanalytical Testing Services Market, End-user, 2022–2031