The bioanalytical services market is expected to witness abundance of growth opportunities in the upcoming years. The increasing number of infectious diseases is anticipated to revive the growth of the bioanalytical services market. Many pharmaceutical companies are now collaborating with research institutes to provide necessary bioanalyical services. Bioanalytical services involve pre-clinical tests, fluid or specimen testing, analysis of clinical samples, investigation of infection of viruses in the body, etc. In the global pandemic, these services have created significant growth opportunities for market contributors. Bioanalytical services played a major role in COVID-19 drug investigation and vaccination programs. Ongoing assays, vaccine testing solutions, drug inspection procedures, and technological advancement in pharmaceutical companies are creating revenue opportunities amid pandemic in the bioanalytical services market.

Dearth of highly skilled and productive manpower is one of the major challenges faced by many market contributors of the bioanaytical services market. Bioanalytical laboratories and research centers require skilled and experienced professionals to study and develop innovative solutions to fulfill the increasing demand of bioanalytical testing services from medical industry. In order to overcome this, governments are investing on providing training, webinars for students and graduate-level scientists to educate and keep themselves updated with the latest trends, and recent technological advancements. Moreover, to minimize the complexities in bioanalytics, acceptance and investment in new technologies, making use of better tools, and equipment for accurate sample analysis are required.

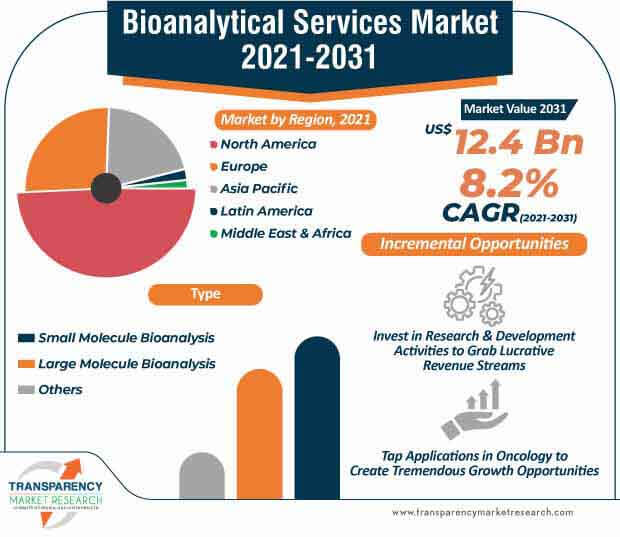

The bioanalytical services market is projected to reach US$ 12.34 Bn by 2031. Manufacturers are bolstering their R&D capabilities to experiment with new technologies and applications. Escalating complexity and number of standards are driving the bioanalytical services market. Pharmaceutical companies are establishing their foot in outsourcing R&D activities to various contact research organizations to stay ahead of the competition and generate more revenue opportunities. Increasing government expenditure on healthcare, research & development activities, and trending advances in bioinformatics also strengthen the scope and expansion of CROs. Oncology is also a highly demanding branch of medicine that deals in diagnosis and treatment of cancer. The introduction of Big Data and artificial intelligence in medical field also elevate the demand in the bioanalytical services market.

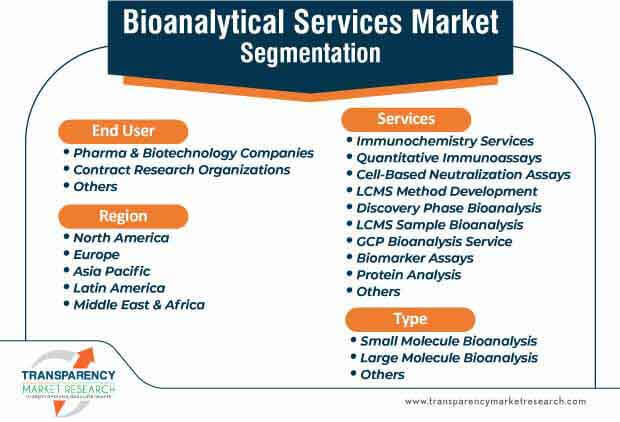

Research & development activities have gained momentum in the field of drug development life cycles, pharmaceuticals, biopharmaceuticals, vaccinating procedures, and biosimilars since the coronavirus pandemic outbreak. The bioanalytical services have played an important role in the mitigation of the COVID-19 pandemic. Prevention and control of future waves of the various other infectious diseases such as SARS-CoV-2, HIV, etc. is extremely necessary these days, and thus, bioanalytical testing services are advantageous in many ways. There is an increasing demand for small molecular and large molecular bioanalytical services such as electrophoresis, tissue bioanalysis, immunochemistry services, electrochemical and titrimetric assays, immunoassays, etc. The high demand for these services are translating into lucrative revenue opportunities for manufacturers in the bioanalyttical services market.

The bioanalytical services market is expected to advance at a CAGR of 8.2% during the forecast period. Pharmaceutical companies are increasing their output capacities in pre-clinical testing methods, drug safety, etc. with changing guidelines of international organizations. Thus, to understand the complex and changing standards in testing methods, clinical trials, and regulatory updates, governments are taking a step ahead to support manufacturers in the pharmaceutical companies, and investing in research and development activities. Bianalytical services are beneficial in early detection of coronavirus, and governments of various countries are supporting for the same. Increasing healthcare expenditure, outsourcing research activities by pharmaceutical companies in the bioanalytical services market help elevate the economy.

The increasing prevalence of infectious as well as chronic diseases such as diabetes all over the world demand for bioanalytical testing services. A large number of ongoing clinical trials, outsourcing services, research activities, and increasing investment by major pharmaceutical companies are some of the factors responsible for the growth of the bioanalytical services market in North America. The rapid increase in manufacturing of pharmaceuticals to fulfill consistently rising demand for healthcare services in the region is expected to propel the development of the bioanalytics services market in the region.

Manufacturers operating in the bioanalytical services market are shifting toward electronics medical devices to increase the performance of the services. Countries in the Asia Pacific market such as China, India, Japan, etc. are the fastest growing markets in providing and outsourcing bioanalytical services. Increasing investments on healthcare and highly efficient pharmaceutical outsourcing services are the two important factors that are boosting the market growth in Asia Pacific.

Analysts’ Viewpoint

Experienced scientists are developing innovative methods to detect drug metabolites, drug analysis, and validation requirements by considering various regulatory and non-regulatory guidelines and standardizations. Drug samples can be analyzed by ensuring the quality, stability, and accuracy. Technological advancements in healthcare and pharmaceutical industries have the potential to create more revenue opportunities post COVID-19 period. Although there are some challenges in the bioanalytical services market that we need to overcome in the upcoming years such as lack of skilled professionals, methods to deal with highly complex, unstable drug compounds, etc. Hence, companies in the bioanalytical services market should experiment with new techniques to improvise the testing processes. In addition, elemental bioanalysis, biosimilar analysis, and validation methods are also contributing toward market expansion.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 5.4 Bn |

|

Market Forecast Value in 2031 |

USD$ 12.4 Bn |

|

Growth Rate (CAGR) |

8.2% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Bioanalytical services market is projected to reach US$ 12.34 Bn by 2031

Bioanalytical services market is projected to expand at a CAGR of 8.2% from 2021 to 2031

Bioanalytical services market is driven by rise in prevalence of infectious diseases, HIV, and other diseases.

The small molecule bioanalysis segment dominated the global bioanalytical services market and the trend is likely to continue during the forecast period.

Key Players in bioanalytical services market include PPD, Inc., ICON plc, Laboratory Corporation of America, Charles River Laboratories International, Inc., Syneos Health, SGS SA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Bioanalytical Services Market

4. Market Overview

4.1. Introduction

4.1.1. Services Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Bioanalytical Services Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.2. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.3. Technological Advancements

6. Global Bioanalytical Services Market Analysis and Forecast, by Service

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Services, 2017–2031

6.3.1. Immunochemistry Service

6.3.2. Quantitative Immunoassays

6.3.3. Cell-Based Neutralization Assays

6.3.4. LCMS Method Development

6.3.5. Discovery Phase Bioanalysis

6.3.6. LCMS Sample Bioanalysis

6.3.7. GCP Bioanalysis Service

6.3.8. Biomarker Assays

6.3.9. Protein Analysis

6.3.10. Others

6.4. Market Attractiveness By Service

7. Global Bioanalytical Services Market Analysis and Forecast, by Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Type, 2017–2031

7.3.1. Small Molecule Bioanalysis

7.3.2. Large Molecule Bioanalysis

7.3.3. Others

7.4. Market Attractiveness Analysis, by Type

8. Global Bioanalytical Services Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Pharma & Biotechnology Companies

8.3.2. Contract Research Organizations

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Bioanalytical Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Country/Region

10. North America Bioanalytical Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Service, 2017–2031

10.2.1. Immunochemistry Service

10.2.2. Quantitative Immunoassays

10.2.3. Cell-Based Neutralization Assays

10.2.4. LCMS Method Development

10.2.5. Discovery Phase Bioanalysis

10.2.6. LCMS Sample Bioanalysis

10.2.7. GCP Bioanalysis Service

10.2.8. Biomarker Assays

10.2.9. Protein Analysis

10.2.10. Others

10.3. Market Value Forecast, by Type, 2017–2031

10.3.1. Small Molecule Bioanalysis

10.3.2. Large Molecule Bioanalysis

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Pharma & Biotechnology Companies

10.4.2. Contract Research Organizations

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Service

10.6.2. By Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Bioanalytical Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Service, 2017–2031

11.2.1. Immunochemistry Service

11.2.2. Quantitative Immunoassays

11.2.3. Cell-Based Neutralization Assays

11.2.4. LCMS Method Development

11.2.5. Discovery Phase Bioanalysis

11.2.6. LCMS Sample Bioanalysis

11.2.7. GCP Bioanalysis Service

11.2.8. Biomarker Assays

11.2.9. Protein Analysis

11.2.10. Others

11.3. Market Value Forecast, by Type, 2017–2031

11.3.1. Small Molecule Bioanalysis

11.3.2. Large Molecule Bioanalysis

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Pharma & Biotechnology Companies

11.4.2. Contract Research Organizations

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Service

11.6.2. By Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Bioanalytical Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Service, 2017–2031

12.2.1. Immunochemistry Service

12.2.2. Quantitative Immunoassays

12.2.3. Cell-Based Neutralization Assays

12.2.4. LCMS Method Development

12.2.5. Discovery Phase Bioanalysis

12.2.6. LCMS Sample Bioanalysis

12.2.7. GCP Bioanalysis Service

12.2.8. Biomarker Assays

12.2.9. Protein Analysis

12.2.10. Others

12.3. Market Value Forecast, by Type, 2017–2031

12.3.1. Small Molecule Bioanalysis

12.3.2. Large Molecule Bioanalysis

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Pharma & Biotechnology Companies

12.4.2. Contract Research Organizations

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Service

12.6.2. By Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Bioanalytical Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Service, 2017–2031

13.2.1. Immunochemistry Service

13.2.2. Quantitative Immunoassays

13.2.3. Cell-Based Neutralization Assays

13.2.4. LCMS Method Development

13.2.5. Discovery Phase Bioanalysis

13.2.6. LCMS Sample Bioanalysis

13.2.7. GCP Bioanalysis Service

13.2.8. Biomarker Assays

13.2.9. Protein Analysis

13.2.10. Others

13.3. Market Value Forecast, by Type, 2017–2031

13.3.1. Small Molecule Bioanalysis

13.3.2. Large Molecule Bioanalysis

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Pharma & Biotechnology Companies

13.4.2. Contract Research Organizations

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Service

13.6.2. By Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Bioanalytical Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Service, 2017–2031

14.2.1. Immunochemistry Service

14.2.2. Quantitative Immunoassays

14.2.3. Cell-Based Neutralization Assays

14.2.4. LCMS Method Development

14.2.5. Discovery Phase Bioanalysis

14.2.6. LCMS Sample Bioanalysis

14.2.7. GCP Bioanalysis Service

14.2.8. Biomarker Assays

14.2.9. Protein Analysis

14.2.10. Others

14.3. Market Value Forecast, by Type, 2017–2031

14.3.1. Small Molecule Bioanalysis

14.3.2. Large Molecule Bioanalysis

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Pharma & Biotechnology Companies

14.4.2. Contract Research Organizations

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Service

14.6.2. By Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix

15.2. Market Share Analysis, by Company, 2020

15.3. Competitive Business Strategies

15.4. Company Profiles

15.4.1. PPD, Inc.

15.4.1.1. Company Description

15.4.1.2. Business Overview

15.4.1.3. Financial Overview

15.4.1.4. SWOT Analysis

15.4.2. ICON plc

15.4.2.1. Company Description

15.4.2.2. Business Overview

15.4.2.3. Financial Overview

15.4.2.4. SWOT Analysis

15.4.3. Laboratory Corporation of America

15.4.3.1. Company Description

15.4.3.2. Business Overview

15.4.3.3. Financial Overview

15.4.3.4. SWOT Analysis

15.4.4. Charles River Laboratories International, Inc.

15.4.4.1. Company Description

15.4.4.2. Business Overview

15.4.4.3. Financial Overview

15.4.4.4. SWOT Analysis

15.4.5. Syneos Health

15.4.5.1. Company Description

15.4.5.2. Business Overview

15.4.5.3. Financial Overview

15.4.5.4. SWOT Analysis

15.4.6. SGS SA

15.4.6.1. Company Description

15.4.6.2. Business Overview

15.4.6.3. SWOT Analysis

15.4.7. Toxikon, Inc.

15.4.7.1. Company Description

15.4.7.2. Business Overview

15.4.7.3. SWOT Analysis

15.4.8. Intertek Group

15.4.8.1. Company Description

15.4.8.2. Business Overview

15.4.8.3. Financial Overview

15.4.8.4. SWOT Analysis

15.4.9. Pace Analytical Services

15.4.9.1. Company Description

15.4.9.2. Business Overview

15.4.9.3. SWOT Analysis

15.4.10. Medpace

15.4.10.1. Company Description

15.4.10.2. Business Overview

15.4.10.3. Financial Overview

15.4.10.4. SWOT Analysis

15.4.11. PRA HEALTH SCIENCES

15.4.11.1. Company Description

15.4.11.2. Business Overview

15.4.11.3. Financial Overview

15.4.11.4. SWOT Analysis

15.4.12. WuXi AppTec

15.4.12.1. Company Description

15.4.12.2. Business Overview

15.4.12.3. Financial Overview

15.4.12.4. SWOT Analysis

15.4.13. IQVIA

15.4.13.1. Company Description

15.4.13.2. Business Overview

15.4.13.3. Financial Overview

15.4.13.4. SWOT Analysis

15.4.14. Eurofins Scientific

15.4.14.1. Company Description

15.4.14.2. Business Overview

15.4.14.3. Financial Overview

15.4.14.4. SWOT Analysis

List of Tables

Table 01: Global Bioanalytical Services Market Value (US$ Mn) Forecast, by Service, 2017–2031

Table 02: Global Bioanalytical Services Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 03: Global Bioanalytical Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Bioanalytical Services Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Bioanalytical Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Bioanalytical Services Market Value (US$ Mn) Forecast, by Service, 2017–2031

Table 07: North America Bioanalytical Services Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 08: North America Bioanalytical Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Bioanalytical Services Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Bioanalytical Services Market Value (US$ Mn) Forecast, by Service, 2017–2031

Table 11: Europe Bioanalytical Services Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 12: Europe Bioanalytical Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Bioanalytical Services Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Bioanalytical Services Market Value (US$ Mn) Forecast, by Service, 2017–2031

Table 15: Asia Pacific Bioanalytical Services Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 16: Asia Pacific Bioanalytical Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Bioanalytical Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Bioanalytical Services Market Value (US$ Mn) Forecast, by Service, 2017–2031

Table 19: Latin America Bioanalytical Services Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 20: Latin America Bioanalytical Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Bioanalytical Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Bioanalytical Services Market Value (US$ Mn) Forecast, by Service, 2017–2031

Table 23: Middle East & Africa Bioanalytical Services Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 24: Middle East & Africa Bioanalytical Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Bioanalytical Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Bioanalytical Services Market Value Share, by Type, 2020

Figure 03: Global Bioanalytical Services Market Value Share, by Region, 2020

Figure 04: Global Bioanalytical Services Market Value Share, by Service, 2020

Figure 05: Global Bioanalytical Services Market Value Share, by End-user, 2020

Figure 06: Global Bioanalytical Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 07: Global Bioanalytical Services Market Value Share Analysis, by Service, 2020 and 2031

Figure 08: Global Bioanalytical Services Market Revenue (US$ Mn), by Immunochemistry Services, 2017–2031

Figure 09: Global Bioanalytical Services Market Revenue (US$ Mn), by Quantitative Immunoassays, 2017–2031

Figure 10: Global Bioanalytical Services Market Revenue (US$ Mn), by Cell-Based Neutralization Assays, 2017–2031

Figure 11: Global Bioanalytical Services Market Revenue (US$ Mn), by LCMS Method Development, 2017–2031

Figure 12: Global Bioanalytical Services Market Revenue (US$ Mn), by Discovery Phase Bioanalysis, 2017–2031

Figure 13: Global Bioanalytical Services Market Revenue (US$ Mn), by LCMS Sample Bioanalysis, 2017–2031

Figure 14: Global Bioanalytical Services Market Revenue (US$ Mn), by GCP Bioanalysis Service, 2017–2031

Figure 15: Global Bioanalytical Services Market Revenue (US$ Mn), by Biomarker Assays, 2017–2031

Figure 16: Global Bioanalytical Services Market Revenue (US$ Mn), by Protein Analysis, 2017–2031

Figure 17: Global Bioanalytical Services Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: Global Bioanalytical Services Market Value Share Analysis, by Type, 2020 and 2031

Figure 19: Global Bioanalytical Services Market Attractiveness Analysis, by Type, 2021–2031

Figure 20: Global Bioanalytical Services Market Revenue (US$ Mn), by Small Molecule Bioanalysis, 2017–2031

Figure 21: Global Bioanalytical Services Market Revenue (US$ Mn), by Large Molecule Bioanalysis, 2017–2031

Figure 22: Global Bioanalytical Services Market Revenue (US$ Mn), by Others, 2017–2031

Figure 23: Global Bioanalytical Services Market Value Share Analysis, by End-user, 2020 and 2031

Figure 24: Global Bioanalytical Services Market Attractiveness Analysis, by End-user, 2021–2031

Figure 25: Global Bioanalytical Services Market Value (US$ Mn), by Pharma & Biotechnology Companies, 2017–2031

Figure 26: Global Bioanalytical Services Market Value (US$ Mn), by Contract Research Organizations, 2017–2031

Figure 27: Global Bioanalytical Services Market Revenue (US$ Mn), by Others, 2017–2031

Figure 28: Global Bioanalytical Services Market Value Share Analysis, by Region, 2020 and 2031

Figure 29: Global Bioanalytical Services Market Attractiveness Analysis, by Region, 2021–2031

Figure 30: North America Bioanalytical Services Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 31: North America Bioanalytical Services Market Value Share, by Country, 2020–2031

Figure 32: North America Bioanalytical Services Market Attractiveness Analysis, by Country, 2021–2031

Figure 33: North America Bioanalytical Services Market Value Share Analysis, by Service, 2020 and 2031

Figure 34: North America Bioanalytical Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 35: North America Bioanalytical Services Market Value Share Analysis, by Type, 2020 and 2031

Figure 36: North America Bioanalytical Services Market Attractiveness Analysis, by Type, 2021–2031

Figure 37: North America Bioanalytical Services Market Value Share Analysis, by End-user, 2020 and 2031

Figure 38: North America Bioanalytical Services Market Attractiveness Analysis, by End-user, 2021–2031

Figure 39: Europe Bioanalytical Services Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 40: Europe Bioanalytical Services Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 41: Europe Bioanalytical Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 42: Europe Bioanalytical Services Market Value Share Analysis, by Service, 2020 and 2031

Figure 43: Europe Bioanalytical Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 44: Europe Bioanalytical Services Market Value Share Analysis, by Type, 2020 and 2031

Figure 45: Europe Bioanalytical Services Market Attractiveness Analysis, by Type, 2021–2031

Figure 46: Europe Bioanalytical Services Market Value Share Analysis, by End-user, 2020 and 2031

Figure 47: Europe Bioanalytical Services Market Attractiveness Analysis, by End-user, 2021–2031

Figure 48: Asia Pacific Bioanalytical Services Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 49: Asia Pacific Bioanalytical Services Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 50: Asia Pacific Bioanalytical Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 51: Asia Pacific Bioanalytical Services Market Value Share Analysis, by Service, 2020 and 2031

Figure 52: Asia Pacific Bioanalytical Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 53: Asia Pacific Bioanalytical Services Market Value Share Analysis, by Type, 2020 and 2031

Figure 54: Asia Pacific Bioanalytical Services Market Attractiveness Analysis, by Type, 2021–2031

Figure 55: Asia Pacific Bioanalytical Services Market Value Share Analysis, by End-user, 2020 and 2031

Figure 56: Asia Pacific Bioanalytical Services Market Attractiveness Analysis, by End-user, 2021–2031

Figure 57: Latin America Bioanalytical Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 58: Latin America Bioanalytical Services Market Value Share, by Country/Sub-region, 2020–2031

Figure 59: Latin America Bioanalytical Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 60: Latin America Bioanalytical Services Market Value Share Analysis, by Service, 2020 and 2031

Figure 61: Latin America Bioanalytical Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 62: Latin America Bioanalytical Services Market Value Share Analysis, by Type, 2020 and 2031

Figure 63: Latin America Bioanalytical Services Market Attractiveness Analysis, by Type, 2021–2031

Figure 64: Latin America Bioanalytical Services Market Value Share Analysis, by End-user, 2020 and 2031

Figure 65: Latin America Bioanalytical Services Market Attractiveness Analysis, by End-user, 2021–2031

Figure 66: Middle East & Africa Bioanalytical Services Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 67: Middle East & Africa Bioanalytical Services Market Value Share, by Country/Sub-region, 2020–2031

Figure 68: Middle East & Africa Bioanalytical Services Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 69: Middle East & Africa Bioanalytical Services Market Value Share Analysis, by Service, 2020 and 2031

Figure 70: Middle East & Africa Bioanalytical Services Market Attractiveness Analysis, by Service, 2021–2031

Figure 71: Middle East & Africa Bioanalytical Services Market Value Share Analysis, by Type, 2020 and 2031

Figure 72: Middle East & Africa Bioanalytical Services Market Attractiveness Analysis, by Type, 2021–2031

Figure 73: Middle East & Africa Bioanalytical Services Market Value Share Analysis, by End-user, 2020 and 2031

Figure 74: Middle East & Africa Bioanalytical Services Market Attractiveness Analysis, by End-user, 2021–2031