Analysts’ Viewpoint on Bio-based Bisphenol-A Market Scenario

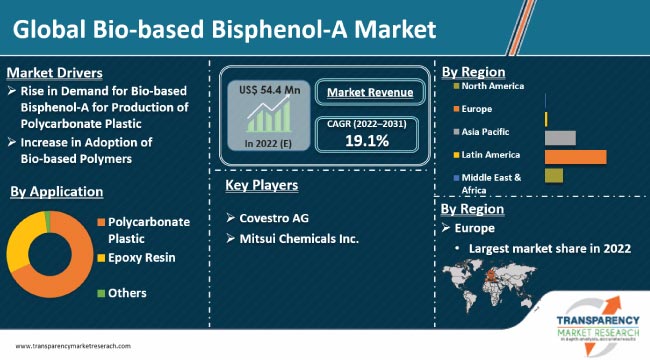

Rise in concern about harmful industrial processes and decrease in petroleum-based resources are driving the global bio-based bisphenol-A market. Bio-based bisphenol-A (BPA) is used in the production of polycarbonate plastics and epoxy resins. Polycarbonate plastic is employed in the manufacture of various consumer products such as food contact materials, toys, and medical devices. Increase in adoption of bio-based epoxy resins is expected to fuel the market during the forecast period. Bio-based epoxy resins are used in adhesives, paints & coatings, insulation, high-performance composites, and other industries. The market for bio-based BPA is still in the nascent stage, with a limited number of manufacturers operating worldwide. This is leading to high costs and limited availability of bio-based BPA. Thus, new companies are entering the market with significant investments in R&D activities.

Bio-based BPA is synthesized from lignin-derived aromatic compounds and bio-derived acetone in the presence of a catalyst. It is used in the production of bio-based polycarbonate plastics and novel bio-based epoxy resins with less fossil fuel-based carbon content. Bio-based BPA is largely incorporated as a monomer in a variety of polymers, namely polycarbonates, epoxy resins, polyethers, polysulfones, and polyesters. Polycarbonates are used to manufacture food & beverage containers, optical lenses, electronic & household appliances, safety helmets, telephones, automotive components, construction parts, medical equipment, and toys. Bio-based epoxy adhesives & sealants are primarily employed in the production of consumer and industrial coatings, paints, and adhesives.

Plastic is used to produce several personal care and daily life products. The widespread usage of plastics adversely impacts the environment. Plastics are hard to degrade and accumulate in the environment if discarded inappropriately. They may contain or release toxic components or volatile organic compounds that are harmful to human health and the habitat. Majority of plastics are manufactured from oil, which contributes to the rise in carbon footprint in the environment. Not all plastics can be recovered and reused, or have significant recycling economic value; therefore, they are liable to end up in landfills or oceans.

Governments and companies across the globe are striving to develop polycarbonate plastics from bio-derived phenol, acetone, and/or cumene to reduce plastic pollution. The United Nations Sustainable Development Goals (SDG 13 Climate Action, SDG 12 Responsible Consumption, and Production), the European Strategy for Plastics in a Circular Economy, and the EPA Sustainable Materials Management Program Strategic Plan are some of the transnational strategies focused on developing a smart, innovative and sustainable plastics industry.

Recent bio-based bisphenol-A market trends suggest increase in R&D of bio-based polymers due to the rise in carbon emissions and depletion of petrochemical resources across the globe. Biomass-derived chemicals, including bio-based phenol and acetone, are used in the manufacture of bio-based BPA. Manufacturers are striving to replace petroleum-based materials with polymers derived from naturally-occurring feedstock to achieve their sustainable development goals. BPA is an oil-derived, large market volume chemical with a wide spectrum of applications in plastics, adhesives, and thermal papers. However, it is not considered safe due to its endocrine-disrupting properties and reproductive toxicity. Thus, there is a need to shift the focus toward sustainable alternatives to BPA. The best bio-based alternative for BPA is isosorbide, which is marketed under the trade name POLYSORB.

Europe is expected to dominate the global bio-based bisphenol-A market in terms of value by the end of 2022. The region is expected to remain highly lucrative during the forecast period. Growth of the market can be ascribed to rapid industrialization and implementation of stringent environmental regulations in the region. Asia Pacific is likely to follow Europe in terms of market growth during the forecast period. Increase in demand for bio-based BPA in China for the manufacture of polycarbonate plastics and epoxy resins is fueling the market in Asia Pacific.

North America is projected to constitute 21.8% share of the global bio-based bisphenol-A market by the end of 2022. The market is driven by the rise in adoption of industrial automation and increase in technological reforms in the region. Latin America and Middle East & Africa are also likely to hold decent share of the global bio-based bisphenol-A market by the end of 2022.

The global bio-based bisphenol-A market is highly consolidated, with a small number of large-scale vendors controlling majority of the share. Most of the companies are investing significantly in comprehensive R&D activities to enhance their bio-based bisphenol-A market share. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by prominent players. Covestro AG and Mitsui Chemicals Inc. are the key entities operating in the market.

These players have been profiled in the bio-based bisphenol-A market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 54.4 Mn |

|

Market Forecast Value in 2031 |

US$ 262.1 Mn |

|

Growth Rate (CAGR) |

19.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

No historical data is available since the market is commercialized in 2022 |

|

Quantitative Units |

US$ Mn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The bio-based Bisphenol-A market stood at US$ 54.4 Mn in 2022

The bio-based bisphenol-A market is expected to advance at a CAGR of 19.1% from 2022 to 2031

Rise in demand for bio-based BPA for production of polycarbonate plastics and increase in adoption of bio-based polymers

Polycarbonate plastic was the largest application segment in 2022

Europe was the most lucrative region that held 68.0% share of the bio-based bisphenol-A market in 2022

Covestro AG and Mitsui Chemicals Inc. are the only manufacturers of bio-based BPA at present

1. Executive Summary

1.1. Bio-based Bisphenol-A Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Materials Providers

2.6.2. List of Bio-based Bisphenol-A Manufacturers

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customers

3. COVID-19 Impact Analysis

4. Bio-based Bisphenol-A Market Analysis and Forecast, by Application, 2022–2031

4.1. Introduction and Definitions

4.2. Global Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

4.2.1. Polycarbonate Plastic

4.2.2. Epoxy Resin

4.2.3. Others

4.3. Global Bio-based Bisphenol-A Market Attractiveness, by Application

5. Global Bio-based Bisphenol-A Market Analysis and Forecast, by Region, 2022–2031

5.1. Key Findings

5.2. Global Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Latin America

5.2.5. Middle East & Africa

5.3. Global Bio-based Bisphenol-A Market Attractiveness, by Region

6. North America Bio-based Bisphenol-A Market Analysis and Forecast, 2022–2031

6.1. Key Findings

6.2. North America Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

6.3. North America Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

6.3.1. U.S. Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

6.3.2. Canada Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

6.4. North America Bio-based Bisphenol-A Market Attractiveness Analysis

7. Europe Bio-based Bisphenol-A Market Analysis and Forecast, 2022–2031

7.1. Key Findings

7.2. Europe Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3. Europe Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

7.3.1. Germany Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.2. France Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.3. U.K. Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.4. Italy Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.5. Russia & CIS Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.6. Rest of Europe Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.4. Europe Bio-based Bisphenol-A Market Attractiveness Analysis

8. Asia Pacific Bio-based Bisphenol-A Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. Asia Pacific Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application

8.3. Asia Pacific Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

8.3.1. China Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.2. Japan Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.3. India Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.4. ASEAN Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.5. Rest of Asia Pacific Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.4. Asia Pacific Bio-based Bisphenol-A Market Attractiveness Analysis

9. Latin America Bio-based Bisphenol-A Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Latin America Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.3. Latin America Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

9.3.1. Brazil Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.3.2. Mexico Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.3.3. Rest of Latin America Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.4. Latin America Bio-based Bisphenol-A Market Attractiveness Analysis

10. Middle East & Africa Bio-based Bisphenol-A Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Middle East & Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.3. Middle East & Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

10.3.1. GCC Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.3.2. South Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.3.3. Rest of Middle East & Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. Middle East & Africa Bio-based Bisphenol-A Market Attractiveness Analysis

11. Competition Landscape

11.1. Global Bio-based Bisphenol-A Company Market Share Analysis, 2022

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. Covestro AG

11.2.1.1. Company Description

11.2.1.2. Business Overview

11.2.1.3. Financial Overview

11.2.1.4. Strategic Overview

11.2.2. Mitsui Chemicals Inc.

11.2.2.1. Company Description

11.2.2.2. Business Overview

11.2.2.3. Financial Overview

11.2.2.4. Strategic Overview

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Global Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 2: Global Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 3: Global Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 4: Global Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 5: North America Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 6: North America Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 7: North America Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Country, 2022–2031

Table 8: North America Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 9: U.S. Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 10: U.S. Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: Canada Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 12: Canada Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 13: Europe Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 14: Europe Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 15: Europe Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 16: Europe Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 17: Germany Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 18: Germany Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 19: France Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 20: France Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 21: U.K. Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 22: U.K. Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 23: Italy Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 24: Italy Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 25: Spain Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 26: Spain Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 27: Russia & CIS Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 28: Russia & CIS Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 29: Rest of Europe Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 30: Rest of Europe Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 31: Asia Pacific Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 32: Asia Pacific Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 33: Asia Pacific Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 34: Asia Pacific Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 35: China Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 36: China Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 37: Japan Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 38: Japan Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 39: India Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 40: India Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 41: ASEAN Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 42: ASEAN Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 43: Rest of Asia Pacific Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 44: Rest of Asia Pacific Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 45: Latin America Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 46: Latin America Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 47: Latin America Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 48: Latin America Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 49: Brazil Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 50: Brazil Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 51: Mexico Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 52: Mexico Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 53: Rest of Latin America Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Latin America Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 55: Middle East & Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 56: Middle East & Africa Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 57: Middle East & Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 58: Middle East & Africa Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 59: GCC Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 60: GCC Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 61: South Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 62: South Africa Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 63: Rest of Middle East & Africa Bio-based Bisphenol-A Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 64: Rest of Middle East & Africa Bio-based Bisphenol-A Market Value (US$ Mn) Forecast, by Application, 2022–2031

List of Figures

Figure 1: Global Bio-based Bisphenol-A Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 2: Global Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 3: Global Bio-based Bisphenol-A Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 4: Global Bio-based Bisphenol-A Market Attractiveness, by Region

Figure 5: North America Bio-based Bisphenol-A Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 6: North America Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 7: North America Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 8: North America Bio-based Bisphenol-A Market Attractiveness, by Country and Sub-region

Figure 9: Europe Bio-based Bisphenol-A Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 10: Europe Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 11: Europe Bio-based Bisphenol-A Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 12: Europe Bio-based Bisphenol-A Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Bio-based Bisphenol-A Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 14: Asia Pacific Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 15: Asia Pacific Bio-based Bisphenol-A Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 16: Asia Pacific Bio-based Bisphenol-A Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Bio-based Bisphenol-A Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 18: Latin America Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 19: Latin America Bio-based Bisphenol-A Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 20: Latin America Bio-based Bisphenol-A Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Bio-based Bisphenol-A Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 22: Middle East & Africa Bio-based Bisphenol-A Market Attractiveness, by Application

Figure 23: Middle East & Africa Bio-based Bisphenol-A Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Middle East & Africa Bio-based Bisphenol-A Market Attractiveness, by Country and Sub-region