Analysts’ Viewpoint

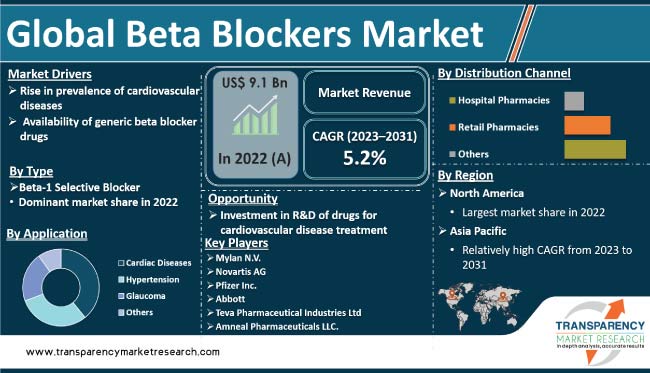

The global beta blockers market size is growing at a steady pace due to the increase in prevalence of cardiovascular diseases and rise in geriatric population. Beta blockers effectively reduce symptoms of anxiety and certain types of migraine headaches. This has led to a surge in interest and investment in beta blockers, thus driving market expansion.

Pharmaceutical companies are investing significantly in research and development activities to introduce new beta blockers with improved efficacy, safety, and tolerability. They are also launching combination therapies and novel drug delivery systems to increase their beta blockers market share.

Beta-blockers are a class of drugs that block the effects of adrenaline on the heart and blood vessels. These medications are used for the treatment of various cardiovascular conditions. They work by slowing the heart rate and reducing the force of contractions, which can help decrease blood pressure and improve blood flow.

Beta-blockers are widely employed in the treatment of hypertension, angina, heart failure, and arrhythmias. They also aid in preventing migraine and anxiety.

Cardiovascular diseases (CVDs) are a major cause of morbidity and mortality worldwide. Growth in the geriatric population and rise in sedentary lifestyles among the populace are major factors that increase the risk of CVDs. High blood pressure, diabetes, and obesity can also lead to CVDs.

According to the World Health Organization (WHO), CVDs are the leading cause of death globally, accounting for more than 17 million deaths each year. Thus, the surge in the incidence of CVDs is expected to spur beta blockers market growth in the near future.

Generic drugs are cheaper versions of brand-name drugs that have the same active ingredients, dosage form, strength, and intended use as the original drug. As a result, they are equally effective in the treatment of diseases and are increasingly prescribed by healthcare providers.

Generic beta blockers are significantly cheaper than brand-name drugs. This makes them more accessible to a wider range of patients, particularly those in developing countries who may not have access to expensive brand-name medications.

The approval process for generic beta blockers is faster and less expensive than that for brand-name drugs. Thus, generic drugs can be brought to market more quickly and at a lower cost. This increases the availability of these drugs. The availability of generic beta blockers is especially beneficial for patients who require long-term treatment as cost savings can be significant.

Governments, healthcare providers, and insurance companies are under pressure to reduce healthcare costs. The adoption of generic medications is one way to achieve this goal. Healthcare providers and insurance companies in many countries are offering incentives, such as lower copays or reduced out-of-pocket costs, to patients to use generic drugs. These initiatives are augmenting the beta blockers market development.

The beta-1 selective blocker segment is estimated to dominate the global landscape during the forecast period. Beta-1 selective blockers are less likely to cause side effects, as they offer a highly selective action.

Non-selective beta blockers affect certain parts of the body such as the lungs and blood vessels. This may lead to side effects such as bronchoconstriction and peripheral vasoconstriction.

The introduction of novel beta 1 selective blockers with improved pharmacokinetic properties has expanded the range of treatment options available to clinicians. Some of these newer beta 1 selective blockers have longer half-lives, which allow for once-daily dosing and may improve patient adherence to treatment.

Beta-blockers are often used in combination with other drugs such as angiotensin-converting enzyme inhibitors or angiotensin receptor blockers. The selectivity of beta-1 selective blockers makes them well-suited for usage in combination therapy.

According to the latest beta blockers market trends, the cardiac diseases segment is anticipated to account for the largest share during the forecast period. Cardiac diseases are the leading cause of death worldwide. Beta-blockers are effective in the treatment of several cardiovascular conditions, including hypertension, angina, arrhythmias, and heart failure.

Angina, which is characterized by chest pain or discomfort caused by reduced blood flow to the heart, is a common cardiovascular condition. Beta-blockers are often prescribed to patients with stable angina, as they can reduce the heart's workload and oxygen. This helps mitigate the frequency and severity of angina episodes.

According to the latest beta blockers market analysis, the hospital pharmacies distribution channel segment is projected to dominate the industry during the forecast period. A hospital is a primary setting for the treatment of acute conditions such as heart attacks and arrhythmias. Beta-blockers are typically administered intravenously in a hospital setting and then continued orally after the patient is discharged. Hospital pharmacies play a crucial role in managing the supply of beta blockers for patients in this setting.

Hospital pharmacies are also involved in the management of patients with chronic conditions such as hypertension and heart failure, which also require long-term use of beta blockers. Hospital pharmacies provide medication management to patients which include monitoring drug interactions, ensuring treatment adherence, and adjusting doses as needed. This helps ensure that patients receive the appropriate level of care and support needed to manage their conditions.

According to the latest beta blockers market forecast, North America is expected to account for the largest share from 2023 to 2031. The high prevalence of cardiovascular diseases is driving the market dynamics of the region. According to the American Heart Association, cardiovascular disease is the leading cause of death in the U.S., accounting for approximately 840,000 deaths each year.

The business in the Asia Pacific region is estimated to grow at a significant pace during the forecast period. Growth in the geriatric population, rise in cases of CVDs, and R&D of new formulations that offer improved efficacy and safety profiles are boosting market statistics.

An increase in investment in research and development of beta blockers and the presence of a well-established healthcare system are augmenting the industry in Europe.

The global business is fragmented, with the presence of several players, including Mylan N.V., Novartis AG, Pfizer Inc., Abbott, Teva Pharmaceutical Industries Ltd., Amneal Pharmaceuticals LLC., Sun Pharmaceutical Industries Ltd., Lupin, ANI Pharmaceuticals, Inc., and Eagle Pharmaceuticals.

These vendors have been profiled in the beta blockers market report based on various factors such as company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

|

Attribute |

Detail |

|

Market Size in 2022 |

US$ 9.1 Bn |

|

Forecast Value in 2031 |

More than US$ 14.4 Bn |

|

CAGR |

5.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

It was valued at US$ 9.1 Bn in 2022.

It is projected to reach more than US$ 14.4 Bn by the end of 2031.

The CAGR is anticipated to be 5.2% from 2023 to 2031.

The cardiac diseases application segment held more than 65.0% share in 2022.

North America is expected to account for the largest share from 2023 to 2031.

Mylan N.V., Novartis AG, Pfizer Inc., Abbott, Teva Pharmaceutical Industries Ltd., Amneal Pharmaceuticals LLC., Sun Pharmaceutical Industries Ltd., Lupin, ANI Pharmaceuticals, Inc., and Eagle Pharmaceuticals.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Beta Blockers Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Beta Blockers Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario by Region/Globally

5.2. Overview: Applications of Beta Blockers

5.3. COVID-19 Impact Analysis

6. Global Beta Blockers Market Analysis and Forecast, By Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast By Type, 2017 - 2031

6.3.1. Beta-1 Selective Blocker

6.3.1.1. Bisoprolol

6.3.1.2. Atenolol

6.3.1.3. Acebutolol

6.3.1.4. Metoprolol

6.3.1.5. Others

6.3.2. Beta Non-selective Blocker

6.3.2.1. Labetalol

6.3.2.2. Pindolol

6.3.2.3. Penbutolol Sulfate

6.3.2.4. Sotalol Hydrochloride

6.3.2.5. Others

6.4. Market Attractiveness By Type

7. Global Beta Blockers Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast By Application, 2017 - 2031

7.3.1. Cardiac Diseases

7.3.1.1. Angina

7.3.1.2. Atrial Fibrillation

7.3.1.3. Heart Failure

7.3.1.4. Others

7.3.2. Hypertension

7.3.3. Glaucoma

7.3.4. Others

7.4. Market Attractiveness By Application

8. Global Beta Blockers Market Analysis and Forecast, By Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast By Distribution Channel, 2017 - 2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Others

8.4. Market Attractiveness By Distribution Channel

9. Global Beta Blockers Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Beta Blockers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Type, 2017 - 2031

10.2.1. Beta-1 Selective Blocker

10.2.1.1. Bisoprolol

10.2.1.2. Atenolol

10.2.1.3. Acebutolol

10.2.1.4. Metoprolol

10.2.1.5. Others

10.2.2. Beta Non-selective Blocker

10.2.2.1. Labetalol

10.2.2.2. Pindolol

10.2.2.3. Penbutolol Sulfate

10.2.2.4. Sotalol Hydrochloride

10.2.2.5. Others

10.3. Market Value Forecast By Application, 2017 - 2031

10.3.1. Cardiac Diseases

10.3.1.1. Angina

10.3.1.2. Atrial Fibrillation

10.3.1.3. Heart Failure

10.3.1.4. Others

10.3.2. Hypertension

10.3.3. Glaucoma

10.3.4. Others

10.4. Market Value Forecast By Distribution Channel, 2017 - 2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Others

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Beta Blockers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Type, 2017 - 2031

11.2.1. Beta-1 Selective Blocker

11.2.1.1. Bisoprolol

11.2.1.2. Atenolol

11.2.1.3. Acebutolol

11.2.1.4. Metoprolol

11.2.1.5. Others

11.2.2. Beta Non-selective Blocker

11.2.2.1. Labetalol

11.2.2.2. Pindolol

11.2.2.3. Penbutolol Sulfate

11.2.2.4. Sotalol Hydrochloride

11.2.2.5. Others

11.3. Market Value Forecast By Application, 2017 - 2031

11.3.1. Cardiac Diseases

11.3.1.1. Angina

11.3.1.2. Atrial Fibrillation

11.3.1.3. Heart Failure

11.3.1.4. Others

11.3.2. Hypertension

11.3.3. Glaucoma

11.3.4. Others

11.4. Market Value Forecast By Distribution Channel, 2017 - 2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Others

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By Distribution Channel

11.6.4. By Country

12. Asia Pacific Beta Blockers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Type, 2017 - 2031

12.2.1. Beta-1 Selective Blocker

12.2.1.1. Bisoprolol

12.2.1.2. Atenolol

12.2.1.3. Acebutolol

12.2.1.4. Metoprolol

12.2.1.5. Others

12.2.2. Beta Non-selective Blocker

12.2.2.1. Labetalol

12.2.2.2. Pindolol

12.2.2.3. Penbutolol Sulfate

12.2.2.4. Sotalol Hydrochloride

12.2.2.5. Others

12.3. Market Value Forecast By Application, 2017 - 2031

12.3.1. Cardiac Diseases

12.3.1.1. Angina

12.3.1.2. Atrial Fibrillation

12.3.1.3. Heart Failure

12.3.1.4. Others

12.3.2. Hypertension

12.3.3. Glaucoma

12.3.4. Others

12.4. Market Value Forecast By Distribution Channel, 2017 - 2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Others

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By Distribution Channel

12.6.4. By Country

13. Latin America Beta Blockers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Type, 2017 - 2031

13.2.1. Beta-1 Selective Blocker

13.2.1.1. Bisoprolol

13.2.1.2. Atenolol

13.2.1.3. Acebutolol

13.2.1.4. Metoprolol

13.2.1.5. Others

13.2.2. Beta Non-selective Blocker

13.2.2.1. Labetalol

13.2.2.2. Pindolol

13.2.2.3. Penbutolol Sulfate

13.2.2.4. Sotalol Hydrochloride

13.2.2.5. Others

13.3. Market Value Forecast By Application, 2017 - 2031

13.3.1. Cardiac Diseases

13.3.1.1. Angina

13.3.1.2. Atrial Fibrillation

13.3.1.3. Heart Failure

13.3.1.4. Others

13.3.2. Hypertension

13.3.3. Glaucoma

13.3.4. Others

13.4. Market Value Forecast By Distribution Channel, 2017 - 2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Others

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By Distribution Channel

13.6.4. By Country

14. Middle East & Africa Beta Blockers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Type, 2017 - 2031

14.2.1. Beta-1 Selective Blocker

14.2.1.1. Bisoprolol

14.2.1.2. Atenolol

14.2.1.3. Acebutolol

14.2.1.4. Metoprolol

14.2.1.5. Others

14.2.2. Beta Non-selective Blocker

14.2.2.1. Labetalol

14.2.2.2. Pindolol

14.2.2.3. Penbutolol Sulfate

14.2.2.4. Sotalol Hydrochloride

14.2.2.5. Others

14.3. Market Value Forecast By Application, 2017 - 2031

14.3.1. Cardiac Diseases

14.3.1.1. Angina

14.3.1.2. Atrial Fibrillation

14.3.1.3. Heart Failure

14.3.1.4. Others

14.3.2. Hypertension

14.3.3. Glaucoma

14.3.4. Others

14.4. Market Value Forecast By Distribution Channel, 2017 - 2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Others

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By Distribution Channel

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2023)

15.3. Company Profiles

15.3.1. Mylan N.V.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Novartis AG

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Pfizer, Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Abbott

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Teva Pharmaceutical Industries Ltd.

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Amneal Pharmaceuticals LLC.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Sun Pharmaceuticals Industries Ltd.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Lupin

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. ANI Pharmaceuticals, Inc.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Eagle Pharmaceuticals

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Other Prominent Players

List of Tables

Table 01: Global Beta Blockers Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 02: Global Beta Blockers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Beta Blockers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Beta Blockers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Beta Blockers Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 07: North America Beta Blockers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 08: North America Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Beta Blockers Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 11: Europe Beta Blockers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 12: Europe Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Beta Blockers Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 15: Asia Pacific Beta Blockers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 16: Asia Pacific Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Beta Blockers Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 19: Latin America Beta Blockers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 20: Latin America Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Beta Blockers Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 23: Middle East & Africa Beta Blockers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 24: Middle East & Africa Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Beta Blockers Market Value Share, by Type, 2023

Figure 03: Beta Blockers Market Value Share, by Application, 2023

Figure 04: Beta Blockers Market Value Share, by Distribution Channel, 2023

Figure 05: Global Beta Blockers Market Value Share Analysis, by Type, 2022 and 2031

Figure 06: Global Beta Blockers Market Attractiveness Analysis, by Type, 2023–2031

Figure 07: Global Beta Blockers Market Value (US$ Mn), by Beta-1 Selective Blocker, 2017‒2031

Figure 08: Global Beta Blockers Market Value (US$ Mn), by Bisoprolol, 2017‒2031

Figure 09: Global Beta Blockers Market Value (US$ Mn), by Atenolol, 2017‒2031

Figure 10: Global Beta Blockers Market Value (US$ Mn), by Acebtolol, 2017‒2031

Figure 11: Global Beta Blockers Market Value (US$ Mn), by Metoprolol, 2017‒2031

Figure 12: Global Beta Blockers Market Value (US$ Mn), by Others, 2017‒2031

Figure 13: Global Beta Blockers Market Value (US$ Mn), by Beta Non-Selective Blocker, 2017‒2031

Figure 14: Global Beta Blockers Market Value (US$ Mn), by Labetalol, 2017‒2031

Figure 15: Global Beta Blockers Market Value (US$ Mn), by Pindolol, 2017‒2031

Figure 16: Global Beta Blockers Market Value (US$ Mn), by Penbutolol Sulfate, 2017‒2031

Figure 17: Global Beta Blockers Market Value (US$ Mn), by Sotalol Hydrochloride, 2017‒2031

Figure 18: Global Beta Blockers Market Value (US$ Mn), by Others, 2017‒2031

Figure 19: Global Beta Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 20: Global Beta Blockers Market Attractiveness Analysis, by Application, 2023–2031

Figure 21: Global Beta Blockers Market Revenue (US$ Mn), by Cardiac Diseases, 2017–2031

Figure 22: Global Beta Blockers Market Revenue (US$ Mn), by Angina, 2017–2031

Figure 23: Global Beta Blockers Market Revenue (US$ Mn), by Atrial Fibrillation, 2017–2031

Figure 24: Global Beta Blockers Market Revenue (US$ Mn), by Heart Failure, 2017–2031

Figure 25: Global Beta Blockers Market Revenue (US$ Mn), by Others, 2017–2031

Figure 26: Global Beta Blockers Market Revenue (US$ Mn), by Hypertension, 2017–2031

Figure 27: Global Beta Blockers Market Revenue (US$ Mn), by Glaucoma, 2017–2031

Figure 28: Global Beta Blockers Market Revenue (US$ Mn), by Others, 2017–2031

Figure 29: Global Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 30: Global Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 31: Global Beta Blockers Market Revenue (US$ Mn), by Hospitals Pharmacies, 2017–2031

Figure 32: Global Beta Blockers Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 33: Global Beta Blockers Market Revenue (US$ Mn), by Others, 2017–2031

Figure 34: Global Beta Blockers Market Value Share Analysis, by Region, 2022 and 2031

Figure 35: Global Beta Blockers Market Attractiveness Analysis, by Region, 2023–2031

Figure 36: North America Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: North America Beta Blockers Market Value Share Analysis, by Country, 2022 and 2031

Figure 38: North America Beta Blockers Market Attractiveness Analysis, by Country, 2023–2031

Figure 39: North America Beta Blockers Market Value Share Analysis, by Type, 2022 and 2031

Figure 40: North America Beta Blockers Market Attractiveness Analysis, by Type, 2023–2031

Figure 41: North America Beta Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 42: North America Beta Blockers Market Attractiveness Analysis, by Application, 2023–2031

Figure 43: North America Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 44: North America Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 45: Europe Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Europe Beta Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Europe Beta Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 48: Europe Beta Blockers Market Value Share Analysis, by Type, 2022 and 2031

Figure 49: Europe Beta Blockers Market Attractiveness Analysis, by Type, 2023–2031

Figure 50: Europe Beta Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 51: Europe Beta Blockers Market Attractiveness Analysis, by Application, 2023–2031

Figure 52: Europe Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 53: Europe Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 54: Asia Pacific Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Asia Pacific Beta Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 56: Asia Pacific Beta Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 57: Asia Pacific Beta Blockers Market Value Share Analysis, by Type, 2022 and 2031

Figure 58: Asia Pacific Beta Blockers Market Attractiveness Analysis, by Type, 2023–2031

Figure 59: Asia Pacific Beta Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 60: Asia Pacific Beta Blockers Market Attractiveness Analysis, by Application, 2023–2031

Figure 61: Asia Pacific Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 62: Asia Pacific Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 63: Latin America Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Latin America Beta Blockers Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 65: Latin America Beta Blockers Market Attractiveness Analysis, by Country/Sub-Region, 2023–2031

Figure 66: Latin America Beta Blockers Market Value Share Analysis, by Type, 2022 and 2031

Figure 67: Latin America Beta Blockers Market Attractiveness Analysis, by Type, 2023–2031

Figure 68: Latin America Beta Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 69: Latin America Beta Blockers Market Attractiveness Analysis, by Application, 2023–2031

Figure 70: Latin America Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 71: Latin America Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 72: Middle East & Africa Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 73: Middle East & Africa Beta Blockers Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 74: Middle East & Africa Beta Blockers Market Attractiveness Analysis, by Country/Sub-Region, 2023–2031

Figure 75: Middle East & Africa Beta Blockers Market Value Share Analysis, by Type, 2022 and 2031

Figure 76: Middle East & Africa Beta Blockers Market Attractiveness Analysis, by Type, 2023–2031

Figure 77: Middle East & Africa Beta Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 78: Middle East & Africa Beta Blockers Market Attractiveness Analysis, by Application, 2023–2031

Figure 79: Middle East & Africa Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 80: Middle East & Africa Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 81: Company Share Analysis, 2023