Analysts’ Viewpoint on Bearing Market Scenario

The global bearing market is growing at a notable pace due to rise in demand for lightweight automotive components, evolving regulatory landscape, extensive applications in different end-use industries, and advancements in bearing technology. Bearings are extensively used in various industries such as automotive, construction, aerospace, power transmission, oil & gas, agriculture, and others (industrial equipment, robotics, etc.). Companies operating in the bearing market are introducing lightweight bearings with high capacity to increase their revenue share in the market. Moreover, growing production of vehicles, globally, is directly influencing the demand for bearings used in automotive parts. Leading players in the bearing market are focusing on R&D in technological advancement, product innovations, and incremental opportunities in material and quality to broaden their revenue streams.

A bearing is a machine component that constrains relative motion and reduces friction between moving parts of a machine. Ball bearings, roller bearings, spherical bearings, and sleeve bearings are the different bearing types, used in automotive, construction, and aerospace applications. Bearings used in diverse machinery need to be monitored continuously to ensure the efficiency, reliability, and consistency of operations. Upcoming technologies, such as smart bearings, are likely to help manufacturers monitor bearing operations constantly. The opportunity for the bearing market to expand is influenced by an increase in the demand for bearings from the automobile industry. The various types of bearings used in automobiles include automotive mounted bearings, and air bearings, which comprise car hub unit bearings, truck hub units, belt tensioner units, water pump spindles, clutch release bearings, propeller shaft support bearings, propeller shaft centering bearings, suspension bearings, and free wheel clutches. Growth in demand for specialized bearing solutions that meet different industry-specific requirements is projected to boost the market during the forecast period.

In terms of application, the global bearing market has been classified into automotive, construction, aerospace, power transmission, oil & gas, agriculture, and others. The automotive segment held major share of the bearing market in 2021. This is due to increase in demand for bearings in automotive parts of the vehicle. Increase in production of vehicles across the globe is directly fueling the demand for bearings used in automotive parts. Thrust bearings or helical gears are the most common bearing utilized in modern automobile gearboxes (in cars) for forward gears, which improve smoothness and ensure noise reduction but produce axial forces that must be managed. Radio antenna masts may include thrust bearings to lighten the weight of an antenna rotator. Bearings are the most important part of machines to provide motion and to help run machines/vehicles smoothly and more efficiently, which is also encouraging the growth of the global bearing market. Increase in industrialization has been one of the major factors leading to rise in vehicle production, which has propelled the adoption of bearings. Globally, sales of electric vehicles have also boosted the demand for bearings in the automotive sector. Therefore, development of the automotive sector is expected to augment the global bearing market during the forecast period.

Various countries globally are revving up their defense infrastructure, which in turn is likely to increase the demand for bearings. Specialized bearings such as thrust bearings and linear bearings are needed for mission-critical uses in aerospace equipment. Companies such as SKF create specialist energy-efficient ball bearings with specific lubricants that decrease friction. These bearings have far lower bearing temperatures, longer grease life, and longer service intervals, besides using less energy. Smart bearings have in-built sensors to provide data about their surroundings, such as vibration, temperature, direction, speed, load, amounts of debris, and other elements. The data collected by smart bearings is sent to a control system that keeps track of the specific bearing activity; for instance, smart bearings used in automobile wheel applications to track speed information. The future of bearings is likely to depend on technologies that are expected to aid producers in continuously monitoring bearing functions, such as smart bearings, and magnetic bearings.

In terms of product, the bearing market has been segmented into ball bearing, roller bearing, plain bearing, and others (air bearings, magnetic bearings, etc.). The ball bearing segment held major share of the global bearing market in 2021, and it is expected to maintain its leading position in the market during the forecast period. Light vehicle and heavy vehicle manufacturers opt for ball bearings. This is expected to boost the segment during the forecast period. Production of light vehicles is projected to rise, globally, in the next few years due to demand for fuel-efficient vehicles. Ball bearings can handle lesser loads at a faster speed as compared to linear bearings. Under shock and impact loads, linear bearings function better. Typically, ball bearings are offered in assemblies, and they are easily replaced as single parts and available at a lower cost. Furthermore, the compact nature of ball bearings is enhancing their utility among end-users. All these factors are expected to boost the global bearing market during the forecast period.

Asia Pacific held major share of the global bearing market in 2021, and it is anticipated to maintain its share during the forecast period. This is due to rapid industrialization and the presence of key manufacturers in the region. Moreover, simple government rules and regulations for the establishment of small & medium manufacturing units are also expected to boost the market during the forecast period in the region. Asia Pacific is likely to be followed by North America in terms of share of the global bearing market due to adoption of new technologies and rapid growth in the automotive sector in the region.

The global bearing market is consolidated with a few large-scale vendors controlling majority of the share. Significant investment in R&D activities to develop customized products with advanced technologies is an efficient marketing strategy for bearing companies. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Manufacturers are focusing on technologically advanced and application-specific products that are likely to drive the revenue of the global bearing market. Additionally, manufacturers are offering customized bearings for different applications and upgrades to cater to the demands of customers. NSK Ltd., Schaeffler AG, JTEKT Corporation, SKF, The Timken Company, MinebeaMitsumi Inc., NTN Bearing Corporation, Dahler, RBC Bearings Incorporated, and Rexnord Corporation are the prominent players operating in the global bearing market.

Key players have been profiled in the bearing market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 123.6 Bn |

|

Market Forecast Value in 2031 |

US$ 216.7 Bn |

|

CAGR |

6.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2018–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

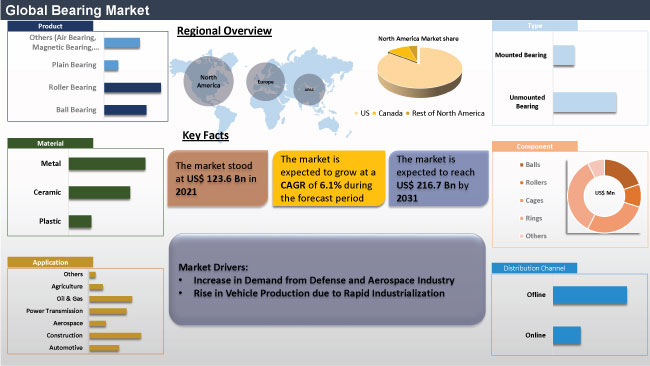

The bearing market stood at US$ 123.6 Bn in 2021

The bearing market is estimated to grow at a CAGR of 6.1%

The bearing market is projected to reach US$ 216.7 Bn by 2031

Increase in demand for bearings from automotive and aerospace industries

The ball bearing product segment accounted for largest share of the bearing market in 2021

Asia Pacific is a more attractive region for vendors in the bearing market

Brammer Plc, Daido Metal Company Ltd., Danaher Corp, GGB Bearing Technology, JTEKT Corporation, NSK Ltd., RBC Bearings, Rexnord Corporation, Schaeffler Group, and Thyssenkrupp AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Value Chain Analysis

5.6. Technology Overview

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Global. Bearing Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projections (US$ Mn)

5.9.2. Market Revenue Projections (Thousand Units)

6. Global Bearing Market Analysis and Forecast, by Product

6.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Product, 2017 - 2031

6.1.1. Ball Bearing

6.1.2. Roller Bearing

6.1.3. Plain Bearing

6.1.4. Others

6.2. Incremental Opportunity, by Product

7. Global Bearing Market Analysis and Forecast, by Material

7.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Material, 2017 - 2031

7.1.1. Plastic

7.1.2. Ceramic

7.1.3. Metal

7.2. Incremental Opportunity, by Material

8. Global Bearing Market Analysis and Forecast, by Type

8.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Type, 2017 - 2031

8.1.1. Unmounted Bearing

8.1.2. Mounted Bearing

8.2. Incremental Opportunity, by Type

9. Global Bearing Market Analysis and Forecast, by Component

9.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Component, 2017 - 2031

9.1.1. Balls

9.1.2. Rollers

9.1.3. Cages

9.1.4. Rings

9.1.5. Others

9.2. Incremental Opportunity, by Component

10. Global Bearing Market Analysis and Forecast, by Application

10.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Application, 2017 - 2031

10.1.1. Automotive

10.1.2. Construction

10.1.3. Aerospace

10.1.4. Power Transmission

10.1.5. Oil & Gas

10.1.6. Agriculture

10.1.7. Others

10.2. Incremental Opportunity, by Application

11. Global Bearing Market Analysis and Forecast, by Distribution Channel

11.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.2. Offline

11.1.2.1. Direct

11.1.2.2. Indirect

11.2. Incremental Opportunity, by Distribution Channel

12. Global Bearing Market Analysis and Forecast, by Region

12.1. Global Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Bearing Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trends Analysis

13.2.1. Demand Side Analysis

13.2.2. Supply Side Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price

13.4. COVID-19 Impact Analysis

13.5. Key Supplier Analysis

13.6. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Product, 2017 - 2031

13.6.1. Ball Bearing

13.6.2. Roller Bearing

13.6.3. Plain Bearing

13.6.4. Others

13.7. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Material, 2017 - 2031

13.7.1. Plastic

13.7.2. Ceramic

13.7.3. Metal

13.8. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Type, 2017 - 2031

13.8.1. Unmounted Bearing

13.8.2. Mounted Bearing

13.9. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Component, 2017 - 2031

13.9.1. Balls

13.9.2. Rollers

13.9.3. Cages

13.9.4. Rings

13.9.5. Others

13.10. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Application, 2017 - 2031

13.10.1. Automotive

13.10.2. Construction

13.10.3. Aerospace

13.10.4. Power Transmission

13.10.5. Oil & Gas

13.10.6. Agriculture

13.10.7. Others

13.11. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.11.1. Online

13.11.2. Offline

13.11.2.1. Direct

13.11.2.2. Indirect

13.12. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Country & Sub-region, 2017 - 2031

13.12.1. U.S.

13.12.2. Canada

13.12.3. Rest of North America

13.13. Incremental Opportunity Analysis

14. Europe Bearing Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trends Analysis

14.2.1. Demand Side Analysis

14.2.2. Supply Side Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price

14.4. COVID-19 Impact Analysis

14.5. Key Supplier Analysis

14.6. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Product, 2017 - 2031

14.6.1. Ball Bearing

14.6.2. Roller Bearing

14.6.3. Plain Bearing

14.6.4. Others

14.7. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Material, 2017 - 2031

14.7.1. Plastic

14.7.2. Ceramic

14.7.3. Metal

14.8. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Type, 2017 - 2031

14.8.1. Unmounted Bearing

14.8.2. Mounted Bearing

14.9. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Component, 2017 - 2031

14.9.1. Balls

14.9.2. Rollers

14.9.3. Cages

14.9.4. Rings

14.9.5. Others

14.10. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Application, 2017 - 2031

14.10.1. Automotive

14.10.2. Construction

14.10.3. Aerospace

14.10.4. Power Transmission

14.10.5. Oil & Gas

14.10.6. Agriculture

14.10.7. Others

14.11. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.11.1. Online

14.11.2. Offline

14.11.2.1. Direct

14.11.2.2. Indirect

14.12. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Country & Sub-region, 2017 - 2031

14.12.1. U.K.

14.12.2. Germany

14.12.3. France

14.12.4. Rest of Europe

14.13. Incremental Opportunity Analysis

15. Asia Pacific Bearing Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.2.1. Demand Side Analysis

15.2.2. Supply Side Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price

15.4. COVID-19 Impact Analysis

15.5. Key Supplier Analysis

15.6. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Product, 2017 - 2031

15.6.1. Ball Bearing

15.6.2. Roller Bearing

15.6.3. Plain Bearing

15.6.4. Others

15.7. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Material, 2017 - 2031

15.7.1. Plastic

15.7.2. Ceramic

15.7.3. Metal

15.8. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Type, 2017 - 2031

15.8.1. Unmounted Bearing

15.8.2. Mounted Bearing

15.9. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Component, 2017 - 2031

15.9.1. Balls

15.9.2. Rollers

15.9.3. Cages

15.9.4. Rings

15.9.5. Others

15.10. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Application, 2017 - 2031

15.10.1. Automotive

15.10.2. Construction

15.10.3. Aerospace

15.10.4. Power Transmission

15.10.5. Oil & Gas

15.10.6. Agriculture

15.10.7. Others

15.11. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.11.1. Online

15.11.2. Offline

15.11.2.1. Direct

15.11.2.2. Indirect

15.12. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Country & Sub-region, 2017 - 2031

15.12.1. China

15.12.2. Japan

15.12.3. India

15.12.4. Rest of Asia Pacific

15.13. Incremental Opportunity Analysis

16. Middle East & Africa Bearing Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trends Analysis

16.2.1. Demand Side Analysis

16.2.2. Supply Side Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Selling Price

16.4. COVID-19 Impact Analysis

16.5. Key Supplier Analysis

16.6. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Product, 2017 - 2031

16.6.1. Ball Bearing

16.6.2. Roller Bearing

16.6.3. Plain Bearing

16.6.4. Others

16.7. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Material, 2017 - 2031

16.7.1. Plastic

16.7.2. Ceramic

16.7.3. Metal

16.8. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Type, 2017 - 2031

16.8.1. Unmounted Bearing

16.8.2. Mounted Bearing

16.9. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Component, 2017 - 2031

16.9.1. Balls

16.9.2. Rollers

16.9.3. Cages

16.9.4. Rings

16.9.5. Others

16.10. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Application, 2017 - 2031

16.10.1. Automotive

16.10.2. Construction

16.10.3. Aerospace

16.10.4. Power Transmission

16.10.5. Oil & Gas

16.10.6. Agriculture

16.10.7. Others

16.11. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.2. Offline

16.11.2.1. Direct

16.11.2.2. Indirect

16.12. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Country & Sub-region, 2017 - 2031

16.12.1. GCC

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Incremental Opportunity Analysis

17. South America Bearing Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Trends Analysis

17.2.1. Demand Side Analysis

17.2.2. Supply Side Analysis

17.3. Price Trend Analysis

17.3.1. Weighted Average Selling Price

17.4. COVID-19 Impact Analysis

17.5. Key Supplier Analysis

17.6. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Product, 2017 - 2031

17.6.1. Ball Bearing

17.6.2. Unmounted Bearing

17.6.3. Mounted Bearing

17.7. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Component, 2017 - 2031

17.7.1. Balls

17.7.2. Rollers

17.7.3. Cages

17.7.4. Rings

17.7.5. Others

17.8. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Application, 2017 - 2031

17.8.1. Automotive

17.8.2. Construction

17.8.3. Aerospace

17.8.4. Power Transmission

17.8.5. Oil & Gas

17.8.6. Agriculture

17.8.7. Others

17.9. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

17.9.1. Online

17.9.2. Offline

17.9.2.1. Direct

17.9.2.2. Indirect

17.10. Bearing Market Size (US$ Mn & Thousand Units) Forecast, by Country & Sub-region, 2017 - 2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player – Competition Dashboard

18.2. Market Share Analysis % (2021)

18.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

18.3.1. Brammer PLC

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.1.5. Go-To-Market Strategy

18.3.2. Daido Metal Company Ltd.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.2.5. Go-To-Market Strategy

18.3.3. Danaher Corp

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.3.5. Go-To-Market Strategy

18.3.4. GGB Bearing Technology

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.4.5. Go-To-Market Strategy

18.3.5. JTEKT Corporation

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.5.5. Go-To-Market Strategy

18.3.6. NSK Ltd.

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.6.5. Go-To-Market Strategy

18.3.7. RBC Bearings

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.7.5. Go-To-Market Strategy

18.3.8. Rexnord Corporation

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.8.5. Go-To-Market Strategy

18.3.9. Schaeffler Group

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.9.5. Go-To-Market Strategy

18.3.10. ThyssenKrupp AG

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.10.5. Go-To-Market Strategy

19. Key Takeaway

19.1. Identification of Potential Market Spaces

19.1.1. By Product

19.1.2. By Material

19.1.3. By Type

19.1.4. By Component

19.1.5. By Application

19.1.6. By Distribution Channel

19.1.7. By Region

19.2. Preferred Sales & Marketing Strategy

19.3. Prevailing Market Risks

List of Tables

Table 1: Global Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Table 2: Global Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Table 3: Global Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Table 4: Global Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Table 5: Global Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Table 6: Global Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Table 7: Global Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Table 8: Global Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Table 9: Global Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Table 10: Global Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Table 11: Global Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Table 12: Global Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Table 13: Global Bearing Market Value (US$ Mn) Projection, by Region 2017-2031

Table 14: Global Bearing Market Volume (Thousand Units) Projection, by Region 2017-2031

Table 15: North America Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Table 16: North America Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Table 17: North America Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Table 18: North America Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Table 19: North America Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Table 20: North America Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Table 21: North America Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Table 22: North America Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Table 23: North America Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Table 24: North America Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Table 25: North America Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Table 26: North America Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Table 27: North America Bearing Market Value (US$ Mn) Projection, by Country 2017-2031

Table 28: North America Bearing Market Volume (Thousand Units) Projection, by Country 2017-2031

Table 29: Europe Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Table 30: Europe Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Table 31: Europe Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Table 32: Europe Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Table 33: Europe Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Table 34: Europe Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Table 35: Europe Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Table 36: Europe Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Table 37: Europe Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Table 38: Europe Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Table 39: Europe Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Table 40: Europe Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Table 41: Europe Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2017-2031

Table 42: Europe Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2017-2031

Table 43: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Table 44: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Table 45: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Table 46: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Table 47: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Table 48: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Table 49: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Table 50: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Table 51: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Table 52: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Table 53: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Table 54: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Table 55: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2017-2031

Table 56: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2017-2031

Table 57: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Table 58: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Table 59: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Table 60: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Table 61: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Table 62: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Table 63: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Table 64: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Table 65: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Table 66: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Table 67: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Table 68: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Table 69: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2017-2031

Table 70: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2017-2031

Table 71: South America Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Table 72: South America Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Table 73: South America Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Table 74: South America Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Table 75: South America Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Table 76: South America Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Table 77: South America Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Table 78: South America Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Table 79: South America Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Table 80: South America Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Table 81: South America Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Table 82: South America Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Table 83: South America Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2017-2031

Table 84: South America Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2017-2031

List of Figures

Figure 1: Global Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Figure 2: Global Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Figure 3: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Product 2022-2031

Figure 4: Global Bearing Market Value (US$ Mn) Projection, by Material 2022-2031

Figure 5: Global Bearing Market Volume (Thousand Units) Projection, by Material 2022-2031

Figure 6: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Material 2022-2031

Figure 7: Global Bearing Market Value (US$ Mn) Projection, by Type 2022-2031

Figure 8: Global Bearing Market Volume (Thousand Units) Projection, by Type 2022-2031

Figure 9: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Type 2022-2031

Figure 10: Global Bearing Market Value (US$ Mn) Projection, by Component 2022-2031

Figure 11: Global Bearing Market Volume (Thousand Units) Projection, by Component 2022-2031

Figure 12: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Component 2022-2031

Figure 13: Global Bearing Market Value (US$ Mn) Projection, by Application 2022-2031

Figure 14: Global Bearing Market Volume (Thousand Units) Projection, by Application 2022-2031

Figure 15: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Application 2022-2031

Figure 16: Global Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Figure 17: Global Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Figure 18: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Distribution Channel 2022-2031

Figure 19: Global Bearing Market Value (US$ Mn) Projection, by Region 2017-2031

Figure 20: Global Bearing Market Volume (Thousand Units) Projection, by Region 2017-2031

Figure 21: Global Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Region 2022-2031

Figure 22: North America Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Figure 23: North America Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Figure 24: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Product 2022-2031

Figure 25: North America Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Figure 26: North America Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Figure 27: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Material 2022-2031

Figure 28: North America Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Figure 29: North America Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Figure 30: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Type 2022-2031

Figure 31: North America Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Figure 32: North America Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Figure 33: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Component 2022-2031

Figure 34: North America Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Figure 35: North America Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Figure 36: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Application 2022-2031

Figure 37: North America Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Figure 38: North America Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Figure 39: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Distribution Channel 2022-2031

Figure 40: North America Bearing Market Value (US$ Mn) Projection, by Country 2017-2031

Figure 41: North America Bearing Market Volume (Thousand Units) Projection, by Country 2017-2031

Figure 42: North America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Country 2022-2031

Figure 43: Europe Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Figure 44: Europe Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Figure 45: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Product 2022-2031

Figure 46: Europe Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Figure 47: Europe Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Figure 48: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Material 2022-2031

Figure 49: Europe Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Figure 50: Europe Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Figure 51: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Type 2022-2031

Figure 52: Europe Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Figure 53: Europe Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Figure 54: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Component 2022-2031

Figure 55: Europe Bearing Market Value (US$ Mn) Projection, by Application 2017-2031

Figure 56: Europe Bearing Market Volume (Thousand Units) Projection, by Application 2017-2031

Figure 57: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Application 2022-2031

Figure 58: Europe Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2017-2031

Figure 59: Europe Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2017-2031

Figure 60: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Distribution Channel 2022-2031

Figure 61: Europe Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2017-2031

Figure 62: Europe Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2017-2031

Figure 63: Europe Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Country & Sub-region, 2022-2031

Figure 64: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Product 2017-2031

Figure 65: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Product 2017-2031

Figure 66: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Product 2022-2031

Figure 67: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Material 2017-2031

Figure 68: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Material 2017-2031

Figure 69: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Material 2022-2031

Figure 70: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Type 2017-2031

Figure 71: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Type 2017-2031

Figure 72: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Type 2022-2031

Figure 73: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Component 2017-2031

Figure 74: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Component 2017-2031

Figure 75: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Component 2022-2031

Figure 76: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Application 2022-2031

Figure 77: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Application 2022-2031

Figure 78: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Application 2022-2031

Figure 79: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2022-2031

Figure 80: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2022-2031

Figure 81: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Distribution Channel 2022-2031

Figure 82: Asia Pacific Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2022-2031

Figure 83: Asia Pacific Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2022-2031

Figure 84: Asia Pacific Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Country & Sub-region, 2022-2031

Figure 85: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Product 2022-2031

Figure 86: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Product 2022-2031

Figure 87: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Product 2022-2031

Figure 88: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Material 2022-2031

Figure 89: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Material 2022-2031

Figure 90: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Material 2022-2031

Figure 91: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Type 2022-2031

Figure 92: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Type 2022-2031

Figure 93: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Type 2022-2031

Figure 94: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Component 2022-2031

Figure 95: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Component 2022-2031

Figure 96: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Component 2022-2031

Figure 97: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Application 2022-2031

Figure 98: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Application 2022-2031

Figure 99: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Application 2022-2031

Figure 100: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2022-2031

Figure 101: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2022-2031

Figure 102: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Distribution Channel 2022-2031

Figure 103: Middle East & Africa Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2022-2031

Figure 104: Middle East & Africa Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2022-2031

Figure 105: Middle East & Africa Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Country & Sub-region, 2022-2031

Figure 106: South America Bearing Market Value (US$ Mn) Projection, by Product 2022-2031

Figure 107: South America Bearing Market Volume (Thousand Units) Projection, by Product 2022-2031

Figure 108: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Product 2022-2031

Figure 109: South America Bearing Market Value (US$ Mn) Projection, by Material 2022-2031

Figure 110: South America Bearing Market Volume (Thousand Units) Projection, by Material 2022-2031

Figure 111: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Material 2022-2031

Figure 112: South America Bearing Market Value (US$ Mn) Projection, by Type 2022-2031

Figure 113: South America Bearing Market Volume (Thousand Units) Projection, by Type 2022-2031

Figure 114: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Type 2022-2031

Figure 115: South America Bearing Market Value (US$ Mn) Projection, by Component 2022-2031

Figure 116: South America Bearing Market Volume (Thousand Units) Projection, by Component 2022-2031

Figure 117: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Component 2022-2031

Figure 118: South America Bearing Market Value (US$ Mn) Projection, by Application 2022-2031

Figure 119: South America Bearing Market Volume (Thousand Units) Projection, by Application 2022-2031

Figure 120: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Application 2022-2031

Figure 121: South America Bearing Market Value (US$ Mn) Projection, by Distribution Channel 2022-2031

Figure 122: South America Bearing Market Volume (Thousand Units) Projection, by Distribution Channel 2022-2031

Figure 123: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Distribution Channel 2022-2031

Figure 124: South America Bearing Market Value (US$ Mn) Projection, by Country & Sub-region, 2022-2031

Figure 125: South America Bearing Market Volume (Thousand Units) Projection, by Country & Sub-region, 2022-2031

Figure 126: South America Bearing Market, Incremental Opportunities (US$ Mn), Forecast, by Country & Sub-region, 2022-2031